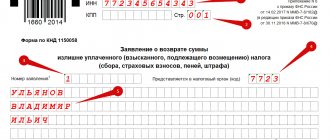

Sample application to an employer for a property deduction

An example of filling out an application to an employer for a property deduction. The application is submitted to the employer's accounting department along with a notice confirming the deduction received from the tax office. Microsoft Word version 2003 or higher (or similar program) is required to open.

Note: There is no single standard application form established by law, therefore some organizations have introduced their own application form. In this case, you may be asked to rewrite it according to the internal form.

Instructions for filling out 3-NDFL when buying an apartment - for 2021

The program contains several sections and tabs; not all need to be filled out.

In order to receive a property deduction when purchasing an apartment and an income tax refund, you should fill out the following tabs:

- setting conditions;

- information about the declarant;

- income received in the Russian Federation - indicate the annual earnings withheld by personal income tax (if a person received payments in foreign currency from foreign companies, then the “income outside the Russian Federation” tab is additionally filled in;

- deductions - indicate the amount of the required property deduction and information about the purchased apartment;

- tax offset/refund - an application for the tax office for a personal income tax refund (you don’t have to write it separately).

Below is a sequential step-by-step instruction that will help you independently fill out the indicated tabs of the Declaration 2020 program, check the entered data and generate a ready-made 3-NDFL.

To fill out, you will need a 2-NDFL income certificate, which must be taken from your employer. It reflects the details of the tax agent’s organization, monthly earnings indicating the deductions provided and the tax withheld. All this information will be needed when filling out form 3-NDFL.

Setting conditions

For the case of filling out 3-NDFL for a tax refund on expenses for purchasing an apartment, in this tab of the Declaration 2021 program, you need to indicate:

| Declaration type | 3-NDFL |

| general information | Inspection No. – the Federal Tax Service number, where 3-personal income tax is submitted for property deduction, can be found on the tax website via the link. By entering your address, you can see the number of the branch to which this address belongs. To indicate the number, click on the ellipses, a list of all branches of the Federal Tax Service will open, if you start entering the desired number, it will quickly be found - the choice should be confirmed by clicking on “Yes”. Correction No. – if 3-NDFL in relation to a given apartment is filled out for the first time in 2021, then “0” is entered; when making clarifications, a serial number of changes is entered, starting from 1, etc. OKTMO - the code can be viewed on the Federal Tax Service website by following the link by entering your address. |

| Taxpayer attribute | Select the item “Other individual”. |

| Income available | A. If in 2021 there were income from foreign sources of payments, then you should also fill out the “income outside the Russian Federation” program tab. |

| Statement data | Check this box, thereby activating the last new tab of the “tax offset/refund” program, which allows you to generate an application for a personal income tax refund in connection with the purchase of an apartment. Previously, this application had to be drawn up separately and submitted along with the 3-NDFL declaration. |

| Reliability is confirmed | If the taxpayer personally brings the completed declaration form to the Federal Tax Service, then Fr. If a trusted person submits 3-NDFL, then the second point is marked “Representative” and his full name and details of the document giving the right to represent interests in the tax office when filing a return (usually a power of attorney) are indicated. |

An example of filling out the first tab of the “Set Conditions” program:

Information about the declarant

The second tab is information about the individual filing the 3-NDFL declaration (the taxpayer who paid the costs of purchasing the apartment).

On this tab of the program you should fill out:

| Full Name | Full name as in passport |

| TIN | Enter your taxpayer number. If you don’t know, you can look it up on the Federal Tax Service website using the link. You must provide information about yourself, send a request, and your Taxpayer Identification Number will appear. |

| Date and place of birth | The date and locality must clearly match the passport. |

| Citizenship data | For Russians, the field has already been filled in. |

| Information about the identity document | Select document code 21 - passport and fill in its details. |

| Contact details | Taxpayer's personal telephone number for communication. |

An example of filling out the second tab of the program:

Income received in the Russian Federation

On this tab of the program, payments from employers should be reflected based on the 2-NDFL income certificate, and a rate of 13 percent should be selected at the top (the first digit is 13).

If there were several employers in 2021, then each should receive a 2-NDFL. Each source of payment is indicated separately.

The result of filling out will be the total amount of income received for 2020 and personal income tax paid, which limits the amount of income tax that can be returned in 2021.

Adding a new employer:

In the first field “Source of payments” you need to click on the green plus, in the tab that opens, based on clause 1 of the 2-NDFL certificate, fill in:

- name of company;

- TIN;

- checkpoint;

- OKTMO;

- The calculation of standard deductions should be carried out using this source only if the employer has not fully provided standard deductions and the taxpayer wants to receive them through the Federal Tax Service on his own; in other cases, the field is not marked.

If the payments were made by the employer of the individual entrepreneur, then you need to enter his full name, tax identification number and OKTMO.

After entering the employer details, you need to click “Yes”.

Reflection of payments:

By clicking on the plus, a new payment is added, the amounts are taken from clause 3 of form 2-NDFL, where income codes and amounts by month are indicated. If a deduction is indicated for any income, then its code and amount must also be transferred.

For each amount you must fill out:

- income code - click on the ellipsis and select the desired one;

- sum;

- deduction code and amount - if there is a deduction for this amount in 2-NDFL;

- serial number of the month of receipt of income.

Next, click on “Yes” to confirm the entered data. You need to sequentially transfer all payments for 2021 from the 2-NDFL certificate. The result will be the total value, which is automatically calculated in the “total income” field.

Deductions:

From clause 4 of the 2-NDFL certificate, you should transfer the deductions provided by the employer in 2021 - code and amount. There is no need to make deductions already indicated when indicating monthly payments.

Withheld tax:

The amount of income tax that the employer withheld from payments for 2021 is entered in the “tax amount withheld” field - taken from paragraph 5 of the 2-NDFL certificate.

An example of filling out a tab on income received in the Russian Federation, if there was one employer in 2021:

Property deduction

On the “Deductions” tab, you need to fill out the “Property” section, which shows data about the purchased apartment and the amount of deduction for a tax refund on the purchase.

By clicking on the green plus you need to add a new property purchased by the taxpayer, fill in the field that opens:

- purchase method - select a purchase and sale agreement;

- name of the object - select an apartment (or other type of real estate depending on what was purchased) from the list;

- taxpayer sign - if the owner of the apartment, who paid its cost, claims to deduct and refund the tax, then you need to select “owner of the property”;

- object number code - indicate the type of number that is known to the taxpayer (you can see it in the purchase and sale agreement) or in an extract from the Unified State Register of Real Estate, usually a cadastral number;

- object number - enter directly the number stated in the previous paragraph;

- location - if a number is indicated, then the address does not need to be filled in;

- date of registration of rights to real estate;

- if the individual is a pensioner, then you need o;

- when purchasing an apartment with shares, you need to indicate the size of the share;

- cost of the object - the amount under the purchase and sale agreement;

- interest on loans - must be indicated if the apartment was purchased with a mortgage, taken from a bank certificate of interest paid. You can first return the personal income tax on the cost of paying for the apartment, and then return all the interest on the mortgage.

After entering all the data, click “Yes”.

In this case, below in the “Calculation of property deduction” field will be reflected the amount of deduction that is provided to an individual in connection with expenses, from which personal income tax will be returned. Limited to 2 million rubles.

The deduction for previous years is filled out if a person submits 3-NDFL for an apartment purchased before 2021, and he has already applied to the Federal Tax Service and has already received part of the deduction. How can I find out the deduction received for previous years?

How to fill out 3-NDFL in the mortgage deduction program?

Application for income tax refund

In the last tab of the Declaration 2021 program, you need to click on the green plus in the “Refund of withheld tax” field and select “application for transfer to bank.”

In the “bank transfer details” field, you can check the “Transfer the entire refund amount” checkbox and fill in the bank details for the transfer.

How to save a declaration in xml, check and print?

After entering all the data into the tabs of the 3-NDFL program, you can see what happened in the end - to do this, you need to click on the “View” button, where you will see the completed declaration and the amount of tax that will be returned to the taxpayer - in section 1.

Next, click “save” and “check” on the top menu.

If there are no errors when filling out, then the declaration can be saved in xml format - click “xml file” and send through your personal account.

You can also immediately click “Print” and print out the 3-NDFL for submission in paper form.

How and when to submit to the Federal Tax Service?

The printed 3-NDFL declaration must be signed and attached to it the necessary documents confirming the purchase of the apartment (purchase and sale agreement), income for the reporting year (2-NDFL certificate).

The deadline for filing a tax return with the Federal Tax Service for 2021 is during 2021 at any time.

.

.

The procedure for filling out the 3-NDFL declaration without using the program - see here.

Sample list of documents

An example of filling out a list of documents for property deductions to be sent by mail to the tax office. Microsoft Word version 2003 or higher (or similar program) is required to open.

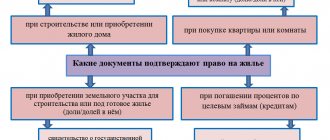

Please note: this listing is just an example. Your inventory must contain exactly all the documents that you send to the tax office. You can find a list of documents that you need to apply for a property tax deduction here: Documents for processing a property tax deduction