Elena Mishchenko, head of the city real estate department of the northeastern branch, answers:

You can receive a tax deduction for the purchase of an apartment using deductions made over the last three years. In other words, a 2-NDFL certificate for the last three years is submitted to the tax office. You can return the tax deduction in the amount of 260 thousand rubles, provided that this amount was paid in the form of tax.

Tax refund when buying a home

How is the tax deduction calculated if I sell and buy an apartment?

Result: tax benefits on payment and sale

Tax deductions are benefits that a citizen of the Russian Federation who pays income tax on their profits can count on.

Accordingly, the possibility of receiving this payment is influenced by the availability of income on which a person pays personal income tax. If he does not work anywhere and does not receive any income, then he cannot receive a tax deduction. More details about who can apply for tax benefits are indicated in Art. 218 Tax Code of the Russian Federation. However, since those who deduct 13% personal income tax on income can receive a deduction, other profits subject to this tax rate should also be taken into account. Accordingly, you can get a tax deduction even if a person does not work anywhere, but has the means:

- from the delivery of real estate;

- income from the sale of some property;

- profit resulting from the provision of services under a civil contract;

- received additional taxable pensions or bonuses.

However, certain conditions apply to property deductions. That is, a non-working person who no longer has any other income cannot receive any tax benefits other than property ones.

The right to a property deduction is granted to the taxpayer within a certain limit. For the purchase of housing it is 2 million rubles. That is, a person can buy an apartment that is more expensive, but he will receive a return of 13% of the maximum 2 million (that’s 260,000 rubles). However, the amount of any deduction depends not only on the amount of spending, but also on the amount that the person contributed to the tax fund. The benefit cannot be higher than the latter.

An unemployed person can receive a deduction for the purchase of an apartment in three cases:

- He sold one apartment and bought another. In such situations, interchange is possible if both transactions were completed in the same year.

- A person recently lost his job and has had personal income tax deductions for the last 3 years.

- A man is about to get a job. In this case, he will not be given a deduction in cash, but simply will not have income tax deducted from his salary when he is employed. However, he has three years to find a job from the moment the right to the deduction arises.

This means that an unemployed person can receive a tax deduction for an apartment if he has had taxable income over the past three years or is planning to get a job in the near future. In this case, the amount of deduction should not exceed the amount of deducted income.

note

- The deduction for the apartment will be provided within the limit.

- If there were no personal income tax deductions, no deduction is allowed.

- If the income was not taxed, you will not be able to receive the benefit.

- If you are recently employed, you will be exempt from paying monthly personal income tax.

The procedure for receiving compensation is individual, depending on the type of deductions. To understand when the benefit does become available, let’s look at several standard situations:

- It is quite possible to apply for a tax deduction when purchasing an apartment while unemployed, if he is officially employed in the future. For example, in 2021 a person buys real estate, and from 2021 or another year he finds a job. Then you can use the benefit in full; it is transferred to future periods. On the other hand, if a person worked until 2015, retired, and bought an apartment in 2018, it will not be possible to return 13%;

- You won't be able to get a tax deduction for education if you don't work. The only way out is to get a job and pay personal income tax. The benefit does not transfer to other periods. That is, if you spent 60 thousand rubles on study in 2021 and 2018, and you have been working only since November 2021 and your salary is 20 thousand per month, then you can return only 13% of the 40 thousand earned in 2021. month: 2,600 * 2 = 5,200 rub.;

- With treatment, the situation is similar - it is important that personal income tax is paid in the calendar year when expenses for medical care are incurred. If you worked and quit in 2021, and had your teeth treated in 2021, you don’t have to wait for compensation.

Another way to receive benefits is to apply for it to an employed relative. This way you can get a property deduction for the purchase of a home in common ownership if your wife does not work, or pay for the costs of treatment or education for relatives.

Thus, tax benefits are not provided for unemployed citizens, although there are exceptions when compensation can be used in the future, and the right to receive it does not expire for a long period of time.

In addition, close relatives can return 13% of their wages, provided that they were the ones who incurred expenses, for example, for treatment or tuition fees.

Also, a non-working citizen can take advantage of tax offsets, for example, when selling and buying an apartment, as well as if he has other income on which 13% income tax is paid (for example, renting out an apartment).

Well, we should not forget that the discussion above was specifically about a cash refund, which you can receive to your current account.

All these rules also apply to the temporarily unemployed. To understand how they can get their taxes paid back, you need to pay attention to 2 points:

- The right to receive a property deduction arises from the year in which the ownership of the acquired housing was registered, i.e. It is not the date of purchase that is recorded, but the registration of ownership of the property. When purchasing under an equity participation agreement, this is the signing of an acceptance certificate; when building a house on a purchased plot, this is after registering the house. You can exercise your right to a refund at any time. The law does not establish term limits.

- But there are temporary restrictions on personal income tax returns. Compensation is possible only 3 years before filing the declaration. For pensioners and the unemployed - 3 years before retirement or leaving work. The money overpaid to the budget can only be returned for the time when the person was officially employed.

Based on this, an unemployed person needs to choose the right time to submit an application for a deduction:

- The employment relationship was interrupted for less than a year. The taxpayer submits the return as usual and gets a chance to get the funds back.

- When a citizen eventually gets a job officially and is able to make contributions to the tax treasury, he can submit applications for reimbursement. Or you won’t have to pay personal income tax under the terms of the offset until the limit is completely exhausted. During this time, you can even sell your home, the right to deduction will remain.

Unemployed citizens can take advantage of the right to compensation if they have income from which 13% is deducted:

- sale of real estate and movable property;

- renting out an apartment or other real estate

- provision of services under a civil contract.

In the absence of official employment, a citizen has the right to reimburse part of the taxes paid in two ways: through the Federal Tax Service or through a previous employer. In the first option, you will need to deal with this procedure yourself, and in the second, you will need to shift some of the responsibilities to your former employer. In the latter case, the procedure will be delayed in time.

We suggest you read: Taxes under a contract

Before submitting an application, you should develop a strategy that will benefit you:

- Assess the situation. You may find that your family is entitled to a double deduction. It may be more profitable if the second spouse submits the application. Or you will need to redistribute the deduction in a married couple. Pre-calculate the financial benefits of all options.

- Decide on the method of compensation - through the tax office or through the employer. It is allowed to alternate them until the entire amount is returned.

- Monitor deduction balances so that in the next reporting period you can return them in full or distribute them over several periods.

Through the Federal Tax Service

The procedure for tax refunds for the unemployed through the tax service is no different from the same procedure for officially employed Russians:

- you will need to take a certificate in form 2-NDFL from the organization where you were employed before or where you are now receiving additional income;

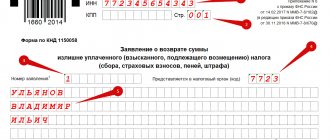

- write an application to the Federal Tax Service for a deduction, indicating the details for transferring money;

- prepare certified copies of documents (list below);

- fill out the 3-NDFL declaration for submission to the tax service, supplementing with the collected certificates;

- a maximum of 3 months is provided for checking the provided documentation according to the instructions, after which the taxpayer receives a response from the Federal Tax Service;

- If the answer is positive, compensation is transferred within 1 month to the account specified in the application.

This site offers a wide range of services to its clients

In addition to the completed declaration, income certificate, passport, TIN and application, the taxpayer provides:

- documents confirming the right to own real estate (purchase and sale agreement of an apartment, house, room, land plot for further construction);

- a certificate for maternity capital, if the funds from it were used to purchase housing (the same applies to other subsidies);

- equity participation agreement, if housing was purchased under such a scheme;

- bank statements, payment documents, checks confirming the fact of payment.

List of life situations that allow you to receive compensation for tax payments

In this option, the registration algorithm is similar to the previous one, but the former employer is responsible for issuing some certificates:

- certificate of income for previous periods;

- documents confirming the transfer of tax from the salary of the applying employee to the budget.

In order to simplify the procedure for reimbursement of paid tax payments, the bank, together with its partner, launched a special service.

Groups of expenses for which it is possible to return the money paid

With its help, you can return annual expenses associated with:

- Purchasing any real estate (apartment, house, plot, cottage), including mortgage. The maximum amount of compensation is 650 thousand rubles.

- Trading activities and receiving investment income from trading securities (maximum 1 million rubles).

- Opening an investment account, conducting transactions using an individual investment account (maximum 52 thousand rubles)

Property deduction for a non-working person

note

An unemployed citizen may be interested in the possibility of applying for a personal income tax deduction when buying or selling an apartment. The sale of living space before the expiration of the minimum ownership period (3 years or 5 years) necessitates the transfer of personal income tax on the income received by an individual from this sale.

As for the personal income tax deduction for a home buyer, in this case Article 220 of the Tax Code does not establish a specific statute of limitations for an individual to obtain the corresponding benefit. However, paragraph 7 of Article 78 of the Tax Code stipulates that the applicant has the right to apply for a credit (refund) of the tax amount paid in excess by a citizen within 3 years, counted from the moment of transfer of this amount. Thus, an apartment buyer who decided to apply for the due deduction in 2019 can implement any of the three available scenarios:

- Send three 3-NDFL declarations at once to the Federal Tax Service division for the past three years (2016, 2021, 2018), and draw up an application for personal income tax refund for 2021. The tax (maximum 260,000 rubles) will be returned for 2016-2018, the unused balance of the benefit (if any) will be carried over to 2021 and subsequent periods.

- The declaration and application must be submitted only for 2021. Personal income tax will be compensated for 2021 with the unused balance carried forward to subsequent periods.

- Compile 3-NDFL for 2021 and 2021, and submit an application for 2021. The tax payment will be reimbursed to the citizen for 2017-2018 with the balance carried over to the following periods.

If you have any questions, you can ask them free of charge to the company’s lawyers in the form provided below. An answer from a competent specialist will help you make the right decision.

Who is eligible for a tax refund?

Before demanding that the authorized bodies reimburse part of the costs of purchasing an apartment, carefully read the legislative framework that regulates the process of returning tax funds.

According to the law, any taxpayer of the Russian Federation can receive a tax deduction (hereinafter referred to as TD) (clause 3, article No. 220 of the Tax Code of the Russian Federation).

Tax refunds can be received by citizens who:

- They are citizens of the Russian Federation.

- They live on the territory of the Russian Federation most of the time, that is, they are residents of the Russian Federation.

- They pay personal income tax in the amount of 13% (from salary or other taxable income).

If a citizen does not receive (has not received) income subject to personal income tax or is simply exempt from paying it, then he cannot apply for an income tax.