Owners of private houses, land plots and other real estate are required to pay taxes. This obligation does not depend on the age of the owner or the period of ownership of the property. There is no such concept as a “private house tax” in Russian legislation: we are talking about a property tax. Payers receive receipts with a fixed amount annually from the Federal Tax Service. But it’s not difficult to calculate the payment amount yourself, and here’s how you can do it.

Features of taxation of private houses in [year]

The procedure for calculating and paying tax on private houses is regulated by the norms of Chapter 32 of the Tax Code of the Russian Federation. In accordance with this document, tax payers are individuals who own such property. Tenants, including persons renting premises on a long-term lease, are not subject to taxation.

Taxation of private houses has the following features:

- Property tax is classified as local. The money collected from home owners goes to the municipal budget and is distributed within the region.

- If a building belongs to several owners, a single tax is charged on it. Each homeowner calculates the budget in proportion to the size of the share.

- Owners of houses with an area of less than 50 sq.m. are exempt from mandatory payments. But there is a condition: the territory on which the house is built must be intended for gardening or dacha farming.

The basis for calculating such a tax is primarily the cadastral value. True, the law also allows for linking the tax to the inventory value. For this reason, some municipalities still use BTI data in their calculations. But in most regions cadastral valuation is still practiced

Tax on non-residential dacha buildings

Real estate objects - apartments, houses, garages and others - that have a foundation are subject to taxation. However, the tax authority, if there is no information about the object in the Unified State Register, will in no way be able to guess about its existence.

At least, this will last until the citizen needs to contact government agencies, the reason for which will be inextricably linked with the unaccounted for object. If the Federal Tax Service finds out about hidden real estate, then the tax for the last three periods will be calculated, as well as penalties for late payment.

Article 407 of the Tax Code of the Russian Federation indicates a list of beneficiaries for the payment of property tax for individuals. These include citizens who own garden houses, houses for economic activities, gardening, etc., if the object has an area of no more than 50 square meters. m.

If the property has a large area, then the tax will be calculated for payment. However, this does not mean that a citizen cannot be included in the preferential category of payers for other reasons. For example, being a pensioner, a war veteran, etc.

The legislator also exempted from paying property tax for individuals who are the owners of objects with any area, but the purpose of the buildings is designated as an atelier, workshop, etc. If you do not want to pay the tax, you can try to change the category of the property.

If a person does not qualify on any of the preferential grounds, then the tax for a non-residential dacha building will be calculated in the generally accepted manner, based on the cost, the rate for a non-residential building and the coefficient.

What factors influence the amount of house tax?

In addition to the inventory or cadastral price of the building, the following factors influence the amount of tax:

- The region in which the private house is located.

- A type of territorial zone.

- Type of item subject to taxation.

- Area, number of floors and other characteristics of the building.

The basement floors of houses used for garages are not taken into account when calculating the total area. After all, according to the law, this is no longer considered a house, but a parking space. In most municipalities, such properties are exempt from taxes.

Sometimes owners of private houses equip gyms, dressing rooms and even swimming pools in their basements. Such premises are considered non-residential, but they are noted in the technical plans. Accordingly, these square meters are included in the tax base, although they are unlikely to greatly affect the amount on the receipt.

Even the foundation of a private house is subject to property tax. True, the owners of unfinished construction projects are in no hurry to make payments. But if this violation is discovered, the tax will be charged in full, and even with fines.

Do pensioners pay tax on a country house?

Starting from 2015, pensioners have the right to be exempt from paying property tax for individuals for one property among similar ones. That is, if a pensioner has two country houses, then he may not pay tax for one of them, but only after submitting an appropriate application to the territorial tax authority.

Typically, exemption is given for the object for which the tax is calculated in a larger amount, but the citizen is not deprived of the right to choose. Please note that the application for the benefit must be submitted before November 1 of the current year in order to receive an exemption from payment for the previous tax period.

The application is free in nature, no documents are attached to it, but details of a passport, pension certificate, etc. are indicated. A person can submit an application through their Personal Account in order not to visit the inspection.

Do not forget! The country house is located on a plot of land, which is also subject to taxation. From 2021, pensioners do not pay land tax, provided that the plot has an area of no more than 600 square meters. m.

More information about tax benefits for pensioners can be found on the official website of the Federal Tax Service of Russia. For this you need:

- on the Internet resource of the Federal Tax Service, go to the “Taxation” section;

- select the “current taxes and fees” subsection;

- go to the “local taxes” section, select the type of interest;

- scroll the page to the point where benefits are described;

- select “local benefits”;

- set the required search parameters;

- after this, the service will issue a regulatory act of local government bodies, which must be carefully studied in order to have an idea of the benefits available to various categories of citizens.

Real estate tax rates in [year] for individuals

Tax rates established by law depend on the type of building and look like this:

- 0.1% of the inventory and cadastral value of private houses, parking spaces and garages.

- 2% is charged in cases where the price in accordance with the cadastre exceeds 300 million rubles, and the property is used for an office or for other commercial purposes.

- 0.5% of the cost is charged for other types of objects.

The law gives regions the right to adjust tax rates down or up. In this case, the percentage may be increased no more than three times.

Tax calculation procedure

We recommend that you read:

Tax on the sale of an apartment owned for less than 3 years

As noted above, when a house is built or received by agreement, a person immediately acquires the obligation to pay property tax. For citizens in such situations, a very important question is how much they will have to pay annually for owning one or another real estate option. To calculate each specific type of tax, its own calculation scheme has been established, and payments on property are no exception.

The main indicator for determining the amount of tax is the value of the property according to the cadastre. However, until 2021, both cadastral and inventory prices are taken into account in order to reduce the financial burden on citizens.

The basis of any tax is the tax rate, which is determined and established only by legislative acts, namely the Tax Code.

Speaking about tax rates on property ownership, the law defines several options, since the cost of such real estate can be different:

- 0.1% of the cadastral and inventory value of a house, apartment, garage, unfinished objects and parking spaces;

- 3% if the price according to the cadastre is above three hundred million rubles, and the objects are premises for offices, business or trade;

- 0.5% of the value of other objects that are recognized as real estate and fall under the tax law.

Regional authorities can change rates, reducing or increasing them. Moreover, the percentage can be reduced without restrictions, and increased no more than three times.

Regarding the procedure for calculating the tax, it has a certain action plan, which is based on new rules on the cadastral and inventory price of property and the reduction factor:

- First, the amount of deductions is determined, that is, the tax is calculated based on the cadastral price.

- Next, the amount of tax is determined taking into account old indicators, namely inventory value.

- After this, the second result is subtracted from the first result, which results in a difference, and a significant one, since the cadastral price is always higher than the inventory price. After this, the amount must be multiplied by a reduction factor, which today is 0.4.

- The tax at the inventory price is added to the result obtained and, as a result, the total amount is displayed, which is presented for payment.

For understanding, consider an example. The cadastral price is 1.2 million rubles, and the inventory price is 200 thousand rubles. The tax rate is 0.1, the same for each option. 1.2 million rubles * 0.1 = 1,200 rubles and 200 thousand rubles * 0.1 = 200 rubles. After this, 200 rubles are subtracted from 1,200, which is equal to 1,000 rubles. This indicator is multiplied by a coefficient, and the inventory price indicator is added to the total: 1 thousand rubles * 0.4 = 400 + 200 = 600 rubles of apartment tax.

To independently determine the amount of tax, you must go to the official website of the Federal Tax Service (Federal Tax Service), where a special “Calculator” application is available.

When calculating, you should pay attention to the possibility of receiving benefits. For example, no matter how many people live in a house, only the area that exceeds 50 square meters will be taxed. That is, when a house has an area of 100 m2, the tax will be charged on only half. A house with a smaller area is not subject to taxes. Other benefits for certain categories of persons, tax deductions and even complete exemption from tax obligations are also possible.

Procedure for calculating tax on a private house

The tax on a private home can be calculated using the following formula:

- The cadastral value of the property must be multiplied by the tax rate.

- The next step is to multiply the inventory price by the same rate.

- You need to subtract the second from the first result.

- The resulting amount must be multiplied by a reduction factor.

- The amount of tax payment calculated based on the inventory value is added to the final indicator.

The reduction factor is an indicator by which the final tax amount can be reduced. Each region sets its own coefficient of 0.2, 0.4 or 0.6.

The interactive personal property tax calculator [year] will help you quickly calculate the cost of the upcoming payment. Such a service is available on the website of the Federal Tax Service of the Russian Federation. To obtain information, you need to enter the cadastral number, type of object, and its area. If the owner owns a share in a private house, it is necessary to indicate its size and period of ownership.

How to calculate the amount

To calculate property tax for individuals, in particular for a country house, it is necessary to take into account the following criteria, which form the final amount payable:

- taxable base – inventory or cadastral value of the object;

- tax rate - in accordance with the Tax Code of the Russian Federation and regulations at the regional and local levels;

- coefficients that help adjust the tax amount.

The tax rate is always directly dependent on the value of the object of taxation.

How can I calculate property tax for individuals?

- by personally contacting the territorial tax authority, where the inspector will explain how the calculation is made in the corresponding tax period;

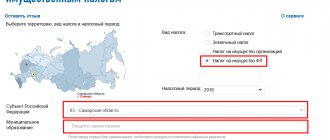

- on the official website of the Federal Tax Service of Russia, where a calculator is presented with which you can perform calculations online. To do this, you will need to select the desired type of tax, select your region of residence, and also set the required parameters (cost of the object, area). The user can find the cost on the Public Cadastral Map by entering the object number;

- refer to the current legislation and independently make the calculation, taking into account the cost and area of the object, tax rate, coefficient and formula.

Article 406 of the Tax Code establishes all-Russian tax rates depending on the inventory or cadastral value of a real estate property.

| Inventory value | Tax rate |

| Up to 300 thousand rubles. | Up to 0.1% |

| From 300 to 500 thousand rubles. | More than 0.1%, but up to 0.3% |

| More than 500 thousand rubles. | More than 0.3%, but up to 2% |

As for the calculation of the cadastral value, the rate will be 0.1%, provided that the area of the object is no more than fifty square meters. In this case, the house must be located on the plots of SNT, individual housing construction, private household plots. In other cases, a rate of 0.5% will be taken into account.

At the regional level, property tax for individuals can be either reduced or increased, but not more than three times.

On a note! If a citizen owns a country house, located geographically on a SNT land plot, and the area does not reach 50 square meters. m., then the tax amount will be zero. However, we should not forget that this has nothing to do with the calculation of land tax.

Real estate gift tax.

What to do if you haven’t received a tax notice to pay your tax, read here.

How to reduce property taxes for individuals, read the link: