Buying an apartment: how much money will be returned if you submit 3-NDFL?

An individual who has spent funds on the purchase of an apartment has the right to expect a return of part of the funds spent in the amount of personal income tax paid (Article 220 of the Tax Code of the Russian Federation).

But there is a limitation - only those individuals who work officially and pay income tax can take advantage of this opportunity. The amount of personal income tax refunded depends on:

- the amount of expenses for purchasing an apartment;

- income tax paid on income earned by an individual.

You can return up to 13% of the cost of the apartment, but not more than the amount calculated from the maximum deduction allowed by the Tax Code of the Russian Federation (2 million rubles). Thus, the buyer of the apartment, who spent 2 million rubles on its payment. and more, 260 thousand rubles will be returned from the budget. (RUB 2 million × 13%).

If the apartment was purchased with a mortgage, the buyer has an additional right to receive a deduction for the amount of interest paid (in addition, personal income tax is returned in the amount of up to 390 thousand rubles).

To receive this money, you will need to report to the tax authorities using the 3-NDFL declaration and a package of supporting documents (more on this in subsequent sections).

Sample of filling out the 3-NDFL declaration for 2014 for property deduction (with mortgage interest)

Description of the example: In 2014, Yuryev S.S. bought an apartment for 4,000,000 rubles, of which 2 million rubles. he took out a mortgage loan. In 2014, he paid interest on a loan in the amount of 200,000 rubles. In the same year, Yuriev S.S. worked at JSC Bank and received an income of 3 million rubles. (390 thousand rubles in tax were paid). Based on the results of the declaration to Yuryev S.S. 286 thousand rubles must be returned from the budget. (260 thousand rubles of the main deduction and 26 thousand rubles of interest deduction). In subsequent years, he will be able to continue to receive a credit interest deduction.

What documents should I attach to 3-NDFL?

The package of documentation attached to 3-NDFL includes the following documents:

1. Proof of identity (copies of passport pages with personal data and registration).

2. Containing data on income received (original 2-NDFL certificate received from the employer).

3. Of an application-informational nature (an application for a personal income tax refund, including the payment details of the applicant’s account, to which the inspectors will transfer the tax).

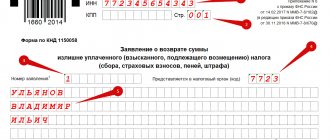

You can view and download a sample application for refund of overpayment of personal income tax when receiving a property deduction for the purchase of housing in ConsultantPlus, having received trial access to the system for free.

4. Certified copies confirming the fact of purchase of the apartment and payment of its cost:

- purchase and sale agreement (or equity participation in the construction of a house);

- act of acceptance and transfer of housing;

- certificates of state registration of ownership of the acquired property;

- bills, payment receipts or receipts.

What documents confirm the right to housing in different situations - see the diagram:

For additional useful information about 3-NDFL, see the material “Property tax deduction when purchasing an apartment (nuances)” .

Find out how to fill out the 3-NDFL declaration to receive a property deduction when buying an apartment with a mortgage in ConsultantPlus by getting trial access to the system.

Help fill out 3-NDFL: where to start compiling

You can fill out 3-NDFL in several ways:

- use the electronic program on the Federal Tax Service website - the program itself will calculate the personal income tax based on the input data and check the correctness of filling out the declaration;

- turn to the services of special consultants - in this situation, you will not have to enter information into the cells yourself and count nothing, you just need to collect and make available to the consultant all supporting documents, as well as pay for his services;

- independently prepare all the papers for the tax office - our material will help you cope with this process.

NOTE! The declaration for 2021 must be submitted using the new form from the Federal Tax Service order dated August 28, 2020 No. ED-7-11/ [email protected] you can here.

To confirm your right to a personal income tax refund when purchasing a home, you must fill out several sections in the 3-NDFL declaration:

- title page;

- 2 sections (1st - containing information about tax, 2nd - with calculation of the tax base and personal income tax);

- 3 sheets (Appendix 1 - information on income received, Appendix 5 and 7 - calculation of standard, social and property deductions).

Let's consider the scheme for filling out 3-NDFL when buying an apartment using the following example.

Example

Vasiliev Nikolay Antonovich in 2021 purchased an apartment for 2,750,000 rubles using accumulated funds. The 2-NDFL certificate received from his employer indicates taxable personal income tax (13%) income for 2021 in the amount of 484,000 rubles. (Personal income tax withheld by the employer - 57,720 rubles).

Let us dwell in detail on filling out the 3-NDFL declaration when purchasing an apartment using the example data in the following sections.

How to fill out 3-NDFL if housing was purchased using maternity capital? The answer to this question is in ConsultantPlus. If you do not yet have access to the system, get trial online access for free and proceed to the material.

Filling out Section 1 3-NDFL. Sample

010 – total amount of income from line 080 of sheet A.

030 – the total amount of income on which tax should be calculated.

040 – the total amount of expenses and deductions, it turns out as (line 220 of sheet G1 + line 210 of sheet I + line 220 of sheet I + line 240 of sheet I + line 250 of sheet I).

050 – tax base = line 030 minus line 040 of this section.

070 – amount of tax withheld from sheet A, line 110.

100 – tax to be refunded from the budget is equal to line 070.

The figure below shows a sample of filling out section 1 of the declaration.

Sample of filling out section 1 of the tax return

Preparation of 3-NDFL declaration sheets for the purchase of an apartment

Filling out 3-NDFL begins with special sheets - appendices 1, 6 and 7. The data reflected in these sheets is for informational purposes only:

- sources of income of the taxpayer (Appendix 1);

- the amount of property deductions (Appendix 6 and 7).

Appendix 1 contains a number of identical blocks (lines 010–080). For Vasiliev N.A. from our example, it is enough to fill out only 1 block, since last year he received income from 1 employer. If the taxpayer received income from several sources, for each of them it would be necessary to fill out a separate block 010–080 of Appendix 1.

To fill out the sheet, all data is taken from the 2-NDFL certificate, but you need to enter one more code correctly:

| Line name | Meaning | Regulatory document |

| Income type code (line 020 of application 1) | 07 | Appendix No. 3 to the Procedure approved by Order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] |

Code “07” means income received under an employment contract, tax on which is withheld by the employer.

Filling out Appendix 7 begins by indicating the encoded information (in the table, the codes are given based on the conditions of the example):

| Sub-clause name and line number | Meaning | Explanation |

| Clause 1.1 - object name code (line 010 of application 7) | 2 (apartment) | Appendix No. 6 of the Procedure, approved. by order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] |

| Clause 1.2 - taxpayer attribute code (line 020 of application 7) | 01 (apartment owner) | Appendix No. 7 of the Procedure, approved. by order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] |

| P. 1.3 - information about the object - line 030 of Appendix 7 method of purchasing a residential building — line 031 of application 7 object number code | dash 1 (cadastral number) | When buying a house, indicate code 2, if the house is built - code 1 When buying an apartment, put a dash The code is selected from the list located to the right of the cell to be filled in |

Further filling out Appendix 7:

- pp. 032-033 - reflection of the cadastral number and address of the purchased apartment;

- subp. 1.4–1.6 - entering information about the date of the document (deed of transfer of the apartment, certificate of state registration of ownership of the property);

- subp. 1.7 - share in ownership;

- subp. 1.8 - when filling out this line, Vasiliev N.A. must keep in mind that the amount of his expenses for purchasing an apartment (2,750,000 rubles) exceeded the allowable tax deduction of the Russian Federation (2 million rubles), therefore, in the cells of this line he you must indicate the number 2,000,000.

Of all the subsequent subparagraphs of the application, Vasilyev N.A. filled out subparagraph. 2.5, 2.8 and 2.10 (see table below):

| Sub-clause name and line number | Meaning (for this example) | Calculation algorithm |

| P. 2.5 - the size of the tax base in relation to income, taxed at a rate of 13%, minus tax deductions (line 140 of Appendix 7) | 484 000 | Data is taken from certificate 2-NDFL |

| Clause 2.6 - the amount of documented expenses for the purchase of an apartment, accepted for the purposes of property deduction for the tax period (line 150 of appendix 7) | 484 000 | The amount indicated in this line cannot exceed the calculated tax base specified in clause 2.5 |

| Clause 2.8 - the balance of the property deduction carried over to the next tax period (line 170 of appendix 7) | 1 516 000 | The figure for this line is calculated using the formula: page 080 – page 150 = 2,000,000 – 484,000 = 1,516,000 rub. |

N.A. Vasiliev did not fill out Appendix 5, since he did not receive standard and social deductions in 2021.

We will tell you how N.A. Vasiliev prepared the remaining sheets of 3-NDFL in the next section.

For a sample of filling out Appendix 7, see here.

How to fill out 3-NDFL to receive a deduction when buying an apartment

If you want to submit a 3-NDFL declaration for an income tax refund when purchasing an apartment or other housing, you can do this at any time during the year. You can report for the previous 3 years. For example, if you bought an apartment, house, room or other housing in 2014, then you can fill out and submit 3-NDFL to receive a property deduction during 2015 in an amount not exceeding your income for the reporting year (in this example, 2014) .

Fill out the declaration form carefully, do not make mistakes, otherwise you will have to start all over again. Each cell contains one symbol, all letters must be large and printed. If there are empty cells left, put dashes in them.

If you enter data manually with a pen, use blue or black paste.

The declaration has 23 sheets, there is no need to fill out everything, there is no need to submit blank pages, only completed pages are submitted to the tax office.

Be responsible when preparing the document, because it is in it that the amount of income tax is calculated, which you can return from the state if the tax authority makes a positive decision.

These are the basic rules for filling out the declaration, now let’s move on to page-by-page registration of 3-NDFL to receive a deduction when buying an apartment.

3-NDFL when selling an apartment, personal income tax refund for treatment. Read about existing tax deductions for personal income tax here

There are few main changes in the income tax n/a for 2021: 6, let’s look at them in table form, compared with the n/a for 2015

| Note | ||

| Barcodes located in the upper left corner of each sheet | ||

| Title page – 0331 2018 , etc. | Title page – 0331 3015 , etc. | Using this barcode, you can always determine what form the N/A is in front of you, the main thing is to know the last 4 digits of the code of the current reporting for the given period* (see note) |

| Line "002" (Section 2) | ||

| No | There is | A new field “002” has been added, in which you must indicate the type of income for which the section is being filled out. |

| Reflection of the amount of expenses for paying the trade fee | ||

| According to page 123 of Section 2 | According to page 091 of Section 2 | |

| Information reflected on page 040 (Section 2) | ||

| Social deductions received at the place of work should not be included in this line. | In the new form on page 040 it is necessary to reflect social deductions received from the employer | |

| Number of income type codes in Sheet A | ||

| In total, in the data sheet for 2015, Sheet A provides for 8 types of arguments | Added new type of income “09” | The introduction of a new income code is due to a change in the procedure for calculating tax when selling an apartment. If its value under the purchase and sale agreement is thirty percent or more below the cadastral value, the tax must be calculated using the formula: Cadastral value x 0.7 The amount of income received is reflected on line 070, and the code for this type of income is indicated - “09” |

| Changing the income limit for social security (sheet E1 line 030) | ||

| 280 thousand rubles. | 350 thousand rubles. | |

Note: if a citizen submits a document without a barcode at all, the Federal Tax Service will not be able to refuse to accept this document if all other requirements are met.

The title page consists of 2 pages and contains general information about the taxpayer. Detailed line-by-line filling of these two pages is discussed in the article: “How to correctly fill out 3-NDFL when selling an apartment?” You can follow the link and use the recommendations presented there. The figure below shows an example of filling out the title page of the 3-NDFL declaration.

The costs of treatment and the purchase of medicines can be reimbursed as part of social benefits.

How to fill out 3 personal income taxes for tax deductions for treatment?

Example of filling out Form 3-NDFL reporting on treatment expenses

Briefly about this type of benefit:

- The maximum benefit amount (for all social deductions, except for education of children and expensive treatment) is 120,000 rubles . and in the full amount of costs if the treatment is classified as expensive .

- The maximum amount of funds returned to your hands is 15,600 rubles.

Features of this type of benefit

- The statute of limitations for reimbursement of expenses is 3 years from the date of their implementation;

- The benefit can only be obtained when paying for treatment in Russia;

- To apply for a deduction for expensive treatment, you need to check the presence of code “02” in the certificate; code “01” indicates ordinary treatment;

- The institution that provided medical services must have a license to conduct the specified activities;

- Recently, this type of social benefit can be obtained at the place of work.

This sheet is intended for the direct calculation of property deductions for the purchase and construction of residential real estate.

Paragraph 1 contains information about the constructed or purchased apartment, house and other residential real estate.

010 – object code, taken from Appendix 5 to the Procedure for filling out 3-NDFL: (click to expand)

| Object name | Object code |

| House | 1 |

| apartment | 2 |

| room | 3 |

| share | 4 |

| land plot | 5 |

| house with land | 6 |

020 – type of property, one of the proposed options is selected.

030 – taxpayer attribute, indicates who the taxpayer is, whose income is reflected in this declaration: the owner of the property or his (her) spouse.

040 – address of the purchased property.

050 – date of the act of transfer of housing.

060 – date of registration of ownership of housing.

070 – date of registration of ownership of the land plot.

080 – date of application for distribution of deductions if the apartment is in common ownership (without shares).

Algorithm for filling out sections 1 and 2 of the 3-NDFL declaration when purchasing an apartment

Vasiliev N.A. took the data for completing the title page of 3-NDFL from his passport, and found out the necessary codes at the tax office at his place of residence (see table):

| Field name | Meaning | Explanation | Link to regulatory document |

| Correction number | 0 | The declaration is submitted for the first time, therefore a zero value is entered | Order of the Federal Tax Service of Russia “On approval of the form of the tax return for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return for personal income tax in electronic form” dated 08/28/2020 No. ED-7 -11/ [email protected] |

| Tax period code | 34 | established by Federal Tax Service Order No. ED-7-11/ [email protected] for the 3-NDFL declaration | |

| Taxable period | 2020 | The year for which 3-NDFL is provided is indicated | |

| Tax authority code | 1838 | Code of the tax inspectorate at the place of residence of Vasiliev N.A. | |

| Code of the country | 643 | Digital code of the Russian Federation | |

| Taxpayer category code | 760 | Designation of an individual |

Next, Vasilyev N.A. proceeded to filling out section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate...”.

To the right of the section name, Vasiliev N.A put the number “13”, which means the personal income tax rate (13%), and in paragraph 1 “Type of income” he indicated the number “3”, selecting the appropriate option from the list next to this cell .

In lines 010, 030 (intended to reflect income) and 040 (dedicated to deductions), he entered the same values - the amount of income received in 2021 (information taken from the 2-NDFL certificate) and the amount of deduction equal to it. In line 060 I put “0”, which means there is no difference between the income indicated in line 010 and the tax deduction amount reflected in line 040:

Lines 080 (personal income tax withheld) and 160 (subject to return from the personal income tax budget) reflect the amount of income tax withheld by the employer (its amount is indicated in certificate 2-NDFL and in this example is equal to 57,720 rubles):

The same amount must be transferred to section 1 of the 3-NDFL declaration (line 050) - this amount will be returned to N.A. Vasiliev from the budget. In line 040 enter 0 (nothing needs to be paid to the budget based on the conditions of the example). To fill out lines 020 and 030 with codes, the taxpayer used the information about KBK posted on the Federal Tax Service website, and specified the OKTMO code in the classifier:

| Line name | Meaning | Regulatory document |

| Budget classification code (line 020 section 1) | 18210102010011000110 | List of BCCs approved by the Russian Ministry of Finance for the corresponding year |

| OKTMO (line 030 of section 1) | 94740000 | All-Russian classifier of municipal territories, approved by order of Rosstandart dated June 14, 2013 No. 159-st. |

When filling out section 1, you should pay attention to line 010 - it consists of only 1 cell and is lost against the background of multi-valued lines dedicated to KBK and OKTMO. In this line, Vasiliev N.A. placed the number “2”, selecting from the list offered next to the necessary action with personal income tax for his case - “refund from the budget”:

As a result of the calculations performed, it turned out that for 2021 Vasilyev N.A. can return the tax only on part of the deduction, and its unused amount is transferred to subsequent periods. Find out how this happens in the next section.

Sample of Filling out Repeated Declaration 3 Personal Income Tax for 2021 When Purchasing an Apartment

The amount of the refund is limited not only by the amount of taxes paid, but also by legislation. Based on the current code, a taxpayer can return 13% from the costs of purchasing real estate, and the same amount from the costs of servicing a housing loan. The maximum value is taken as follows:

- 2,000,000 – cost of purchasing a home;

- 3,000,000 – fee paid to the bank for using a mortgage loan (interest).

It turns out that you can return 260,000 rubles for the property deduction, and 390,000 rubles for the mortgage interest. It is possible to submit a tax return for 3 personal income tax several times until all required amounts are received.

The next limitation is related to the size of the salary.

Important! The amount of possible compensation is calculated only from official income confirmed by certificate 2 of personal income tax. The part of the salary received “in an envelope” is not taken into account.

Let's look at a simple example of calculating compensation. Let’s say a person receives 100,000 rubles, income tax is paid only on 10,000, the rest is a gray salary. Reimbursement calculation:

- Official annual income – 10,000*12 = 120,000.

- Personal income tax paid – 120,000*0.13 = 15,600

- 15,600 – refundable. Submitting documents is possible until the total compensation reaches 260,000 and 390,000, respectively.

This is a rather exaggerated example that allows you to understand the principle of calculations. When filling out 3 personal income tax on mortgage interest, absolutely all taxable earnings are taken into account - bonuses, vacation pay, allowances.

If the purchase was made later than 2014, the taxpayer has the right to receive deductions not only for it, but also for subsequent purchased objects. Also, if the amount of expenses is less than 2,000,000, when calculating compensation it is possible to take into account the cost of finishing work, construction, etc. - if we are talking about a new apartment received in rough finishing. All these expenses will need to be confirmed.

In addition, compensation for interest on a mortgage taken before 2014 can be received without any restrictions - the maximum amount of 3 million does not apply in this case.

Make sure you have the latest declaration form for 2021. The tax authority approved the document by Order of the Federal Tax Service of Russia No. ММВ-7-11/ Changes are indicated in Order No. ММВ-7-11/ dated 10/07/2019. The easiest way to find a valid form is on the official website of the Federal Tax Service - tax.ru. There you can download the free program “Declaration 2019” and fill out the form in it. Both options are acceptable.

You can fill out 3NDFL using the “Declaration” program developed by the tax service. The program will tell you which fields need to be filled in. If you want to fill out a declaration this way, download and install the Declaration program on your computer.

You will see 6 tabs in the program, but not all of them are active. As they fill up, they are unlocked. First you need to select the “3NDFL” filling option. Next, move in order through the tabs: “Set conditions”, “Information about the declarant”, “Income received in the Russian Federation”, “Deductions - property deductions”.

After entering all the data, click on the “Check” button. The program will show you what data you forgot to enter. Correct the errors and save the document in xml format if you are going to submit the declaration electronically, or print it in duplicate if you are bringing a paper declaration to the Federal Tax Service.

For a property deduction, you will need to fill out the title page, the first and second sections, as well as appendices 1 and 7. The remaining sections and appendices are filled out if necessary.

If your annual income is less than 2 million rubles. per year, the deduction will be carried forward to the next tax period. Then you will have to fill out a return for the second and third years until you receive the full amount. If the value of the property is less than 2 million, the right to receive the balance is reserved for future purchases.

Before moving on to step-by-step instructions for filling out 3-NDFL, we will consider the key requirements for this tax reporting form. Let’s determine who, when and how is obliged to report to the Federal Tax Service:

- Private traders and individual entrepreneurs, that is, those citizens who do business independently or carry out private practice.

- Citizens recognized as tax residents in the reporting period and who received income outside the Russian Federation. That is, these are those individuals who stayed in Russia for at least 183 days a year.

- Persons who sold real estate, land plots or vehicles during the reporting period.

- Citizens who received income in the form of lottery winnings, valuable gifts and other income exceeding the maximum permissible limit established for such types of income.

- Persons who received income in the reporting period under work contracts or civil contracts.

- Individuals applying for tax deductions (property, professional, social or treatment).

Before you start preparing your tax return, please read the basic requirements and instructions for filling out 3-NDFL:

- Fill in the cells from left to right with blue or black ink, or using printing or computer technology.

- Place dashes in empty fields on your tax return. If the indicator value is missing, dashes should be placed in each cell of the indicator field.

- Indicate the amounts of income and expenses in rubles and kopecks, with the exception of personal income tax amounts.

- Specify tax amounts strictly in rubles, apply the rounding rule: up to 50 kopecks - discard, more - round up to the full ruble.

- Cash received in foreign currency and expenses incurred should be reflected in rubles. Recalculate amounts in foreign currency at the exchange rate of the Central Bank of the Russian Federation on the date of receiving the currency or making expenses.

Here are detailed step-by-step instructions for filling out the 3-NDFL declaration in 2021 for 2021 (2019 - last year).

Next, we move on to filling out the tax return sheets. Please note that the new KND report 1151020 consists of 13 sheets. The updated form has been significantly shortened; previously the declaration had more than 19 sheets.

The names of the ND pages have also been changed. Instead of the alphabetic and numerical designation of the sheet, sections and appendices have been introduced. Now the ND has only two sections and 8 appendices. Standard, social and investment deductions are combined in Appendix No. 5. Professional deductions are now reflected in Appendix No. 3 along with income from business, lawyer and private activities.

There is no need to fill out all the sheets. Indicate information only on those sheets of the tax return that are necessary to reflect income received, expenses incurred and tax deductions that are due to an individual in the reporting period.

IMPORTANT!

The title page, section No. 1 and section No. 2 are required to be completed, regardless of the grounds for drawing up the fiscal report.

Otherwise, the composition of the completed pages varies. For example, in order to receive a deduction for the purchase of housing, in addition to the title page and sections No. 1 and No. 2, you will have to fill out Appendix No. 1 and Appendix No. 7. And when selling real estate, Appendix No. 1 and No. 6 are filled out.

To apply for a social deduction for training, fill out the title page, sections No. 1 and No. 2 and Appendices No. 1 and No. 5.

Since you cannot count on a property deduction without submitting a declaration, you need to take its completion seriously. In general, it consists of a large number of sheets, but we only need a part.

Many taxpayers can cope with this task; you can also turn to professionals for help. Programs for filling out on the official website of the Federal Tax Service are also provided to help. Their interface is clear, the checking and printing function is available.

Sample of filling out an application for a 3-NDFL refund when purchasing an apartment for 2021 - 1 year:

Ivanova worked in 2021 at the Iskra enterprise and received an income of 350,400 rubles. In the same year, she purchased an apartment worth 2.3 million rubles.

In 2021, the maximum amount of expenses for the purchase of housing from which a property deduction will be received is 2 million rubles. The tax deduction from this amount is 260 thousand rubles. In this case, Ivanova for 2021 will be able to receive a deduction in the amount of:

350,400 - 13% = 45,552 rubles.

Repeated declaration 3-NDFL: will additional documents be needed?

The concept of “submission of a repeated declaration” is not used in tax legislation. From the taxpayer’s point of view, this may mean re-applying to the tax authorities for the balance of the unused deduction - a situation where several 3-NDFL declarations are filed for one-time expenses incurred related to the purchase of an apartment (primary and subsequent - for income received in the periods following for the first year of receiving the deduction).

Some information in each subsequent declaration will be repeated (data about the taxpayer and the purchased property), and information about the income received and personal income tax will change.

In this case, you will have to start collecting documents again - you need to:

- fill out an application for a personal income tax refund;

- request new 2-NDFL certificates;

- issue 3-NDFL.

Copies of other documents (for example, an apartment purchase and sale agreement) do not need to be provided again.

The video tutorial will help you correctly write an application for an income tax refund: “We are preparing an application for a personal income tax refund (sample, form) .

Can the 3-NDFL sample when buying an apartment be used when selling it?

The 3-NDFL declaration when selling an apartment is somewhat different in composition from the 3-NDFL when buying it. The example discussed above can be used in such a situation, but only partially:

- You can leave only the title page without adjustments (by specifying the tax period);

- in section 1, similar codes KBK and OKTMO are filled in (the rest of the information changes);

- section 2 and appendix 1 are drawn up in a different way;

- Instead of Appendix 7, the calculation for Appendix 1 is filled out.

To fill out a 3-NDFL declaration when selling an apartment, the same methods can be used as when filing a 3-NDFL in other situations (you can use a special program, fill out the declaration form yourself, etc.).

Find answers to your questions in the materials in the “Personal Income Tax for an Apartment” .

Results

Declaration 3-NDFL when purchasing an apartment is filled out according to algorithms regulated by order of the Federal Tax Service on the basis of supporting documents (acceptance certificate of the apartment, certificate of state registration of real estate rights, payment receipts, etc.).

The balance of the property deduction can be carried forward to subsequent periods. To do this, you need to collect the package of documents again, fill out a declaration and submit an application to the tax authority.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.