A two-document mortgage is a simplified application process that requires you to spend a minimum of time on preparation. The system is convenient, but there are some nuances. Of course, this is a logical choice for those who are not able to confirm their income with a standard certificate and a copy of the work book. And for other borrowers, this is the only opportunity to acquire housing with bank money. Almost everyone always has the necessary two documents at hand.

In this article we will describe in detail the entire lending process from collecting papers to financial settlements with the real estate seller. We will provide a list of banks that provide mortgages based on two documents, indicate their interest rates and key lending conditions. But first, let's give some general information.

Differences between a mortgage based on two documents and a regular one

Applicants for a classic mortgage must confirm income with personal income tax certificate 2 and a copy of the work record book. But some banks agree to exclude this requirement in order, for example, to increase the number of clients. They are ready to issue money for housing with just two documents, the first of which is a passport. Second choice:

- SNILS,

- TIN,

- International passport,

- Driver's license.

In some cases, a military ID will be considered. If the borrower is married, the bank may be interested in the spouse’s passport or marriage contract. Of course, to get a mortgage loan, you will need papers for the selected property.

As a rule, the mortgage interest rate for two documents is 1–3 percentage points higher than similar banking products. There is also a high down payment, about 40%. The bank puts forward such conditions in order to minimize financial risks, because the borrower does not prove his solvency. The credit institution is interested in issuing simplified mortgages for real estate from partner companies, and by reducing the rate it motivates borrowers to choose such properties.

Pros and cons of a mortgage based on two documents:

- There is no need to waste time collecting a voluminous package of papers,

- Relatively fast processing of the application,

- Increased interest rate and down payment,

- It is possible to reduce the maximum amount and term of the loan agreement.

Features of a mortgage without proof of income

This lending program from VTB has many positive aspects. First of all, it allows you to get your own housing in the shortest possible time. At the same time, lending applies not only to finished apartments, but also to those that are under construction. The amounts that the bank issues on credit allow you to purchase even luxury housing.

To apply for a loan, VTB requires a minimum package of documents. Therefore, clients do not need to spend a lot of time collecting all the papers and issuing a certificate of income. The client's application is reviewed in a short time. Usually the borrower receives a response the very next day.

VTB compensates for its risks from a mortgage without proof of income with a large down payment. The client thus buys an impressive part of the apartment, and also confirms his future solvency.

When a borrower does not have the funds for a down payment, he can also rely on obtaining a mortgage without confirming his financial status. When posting collateral, such as a car, or issuing a guarantee. VTB will also give a positive answer.

Main disadvantages

The main disadvantage of a mortgage without proof of income is, as mentioned above, a large down payment, which not everyone can make. In addition, borrowers who do not have a certificate of income should understand that the interest rate for them will be comparatively higher than for persons who can document their income.

Another disadvantage is that difficulties may arise in obtaining a property tax deduction. This is due to the fact that its calculation is carried out on the basis of data that is displayed in the 2-personal income tax certificate. This certificate contains information about the source of income, salary and withholding taxes.

A mortgage based on two documents will be profitable if you...

- If you have almost half of the apartment or house in cash equivalent, in this case the inflated interest rate will not become a problem for you, because it will initially be charged on approximately 50% of the housing price.

- You receive your salary in an envelope, partially or completely.

- Unofficially employed.

- You work for a company whose head office is located abroad, which makes the process of collecting certificates difficult.

- Hurry up to buy real estate from a specific seller who is not willing to wait long.

Recommended article: Mortgage without guarantors and co-borrowers - conditions for registration

Conditions

Common requirements for borrowers: citizenship of the Russian Federation and appropriate registration, age from 21 to 65 years. Work experience at the last place of work is at least six months, total - at least one year.

Attention: these are standard requirements; some banks increase the competitiveness of their products by expanding the age limit or easing other conditions.

The unspoken rule for issuing a mortgage on two documents without proof of income is a good credit history. Without receiving evidence of your current solvency, the bank wants to be sure that it is placing its funds in safe hands. However, some organizations consider applications with a bad credit history, and some of them even approve. Often, a mandatory condition is the division of financial responsibility with the co-borrower, the spouse of the main recipient of the loan.

The credit institution is interested in the borrower insuring not only the purchased property, but also himself against loss of ability to work. Clients who prefer comprehensive insurance have every reason to expect more favorable lending conditions. The interest rate can be reduced by an average of 2 percentage points.

Important information

Therefore, the banking organization includes its risks in the loan rate, which affects it upward, and, due to the large down payment, selects solvent borrowers.

Usually, to obtain a mortgage, you need a certificate of income, as it proves the client’s solvency.

However, you can apply for a mortgage without this certificate, but then the bank may charge you increased interest.

Main concepts

What does a client need to know when applying for a mortgage? There are the concepts of “Mortgage” and “Mortgage lending”, what do they mean:

| Mortgage | A type of collateral under which the creditor (lender) has the right to “take away” the borrower’s real estate (house, apartment, car) if the debt has not been repaid in a timely manner under the terms of the loan agreement between the parties |

| Mortgage credit lending | A bank lending product used as collateral for real estate. The bank issues funds to the borrower for the purchase of housing, registration falls into the subcategory of long-term loans (from 5 to 50 years), with a full or minimum package of documents (two documents - a Russian passport and an additional identity document) |

Also, in case of failure to comply with the terms of the agreement by the borrower or late payments, the bank reserves the right to demand full or partial repayment of the debt in court.

It is quite possible to keep the property and subsequently resell it, thereby covering the debt from the previous borrower.

What should you know when entering into this type of loan? It is best to carry out registration in state currency, in this case in rubles; it is convenient because the client receives income in rubles.

Of course, you can apply in different currencies, but then your loan will also depend on changes in the exchange rate on the financial market.

The interest rate is selected individually for each product, depending on the mortgage product, loan term, and amount.

If the client agrees to purchase insurance as an additional product, the bank can reduce the rate by several points (from two to three). If a down payment is made, the rate is even lower.

The absence of a 2-NDFL certificate, on the contrary, increases the amount of interest, and the loan term is reduced (up to a maximum of 20 years).

To become a participant in the mortgage program, the bank must:

- be a citizen of the Russian Federation (with the exception of some programs where the client may not be a citizen and without registration, but when buying a home he must register in it);

- meet the age criteria - from 21 to 65 years; have a permanent residence permit;

- place of work, stable income, preferably having personal funds for a down payment, about 10-20% of the amount.

Bank selection

There is a special mortgage offer for this – “Victory over formalities”. Under this program you can buy real estate in both the primary and secondary housing markets.

The mortgage is provided according to two documents, without unnecessary information. You can get a mortgage from VTB Bank without a down payment:

- by contributing money towards the first contribution of maternity capital;

- taking out a loan secured by your own property;

- on-lending.

You can get a loan in any currency. The borrower may be a citizen who urgently needs a large amount of money to purchase housing and has reached 22 years of age. Mortgage loans are not issued to borrowers over 65 years of age.

The legislative framework

The mortgage agreement is regulated in accordance with Federal Law No. 102-FZ dated 03/07/2016, types of conclusion:

- the mortgage agreement is concluded only in writing;

- is necessarily subject to further state registration. If this is not done, then the mortgage agreement is considered false, that is, it is considered invalid.

Procedure for obtaining a mortgage

- First of all, you need to look for housing that meets banking requirements and collect documents for it.

- Then study and compare the profitability of various offers, apply for a mortgage using two documents to the selected bank. The papers will be checked by the credit committee and security service for several days.

- If your application is approved, you should come to the bank branch to sign a loan agreement.

- Having settled these formalities, the bank will transfer your down payment to the seller of the apartment or house.

- Next, you need to register the purchase and sale at the Registration Chamber (documents are submitted through the MFC). After which the real estate purchased on credit will become yours and acquire the status of collateral. You can pay your mortgage according to the schedule, or do it ahead of schedule, in full or in part. After repaying the debt under the loan agreement, it will be necessary to remove the encumbrance (mortgage by force of law) from the housing.

Attention! Some banks require that a down payment be placed in a current account to ensure the availability of money and to eliminate the possibility of inflating the price of real estate.

Mortgage conditions secured by property in VTB 24

The borrower is not always able to make a down payment. Moreover, a mortgage without certificates from VTB 24 involves paying 40% of the price, which is several hundred thousand rubles. In such a situation, the bank can issue borrowed money, but only if the client provides collateral.

The terms of such a mortgage remain standard. The loan amount can vary up to 30 million rubles, and the annual interest is 13.6% per annum. The loan term for each client is determined individually, but the maximum is 20 years.

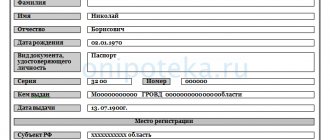

List of required documents

The standard package of documents for obtaining a mortgage without proof of income includes a passport of a citizen of the Russian Federation, as well as a second document confirming identity. If the application for a VTB mortgage has been approved, then within a few days the client must provide the bank with documents for the collateral. These include:

- cadastral passport;

- certificate of ownership;

- extract from the unified state register.

The client must also attach a completed banking application form.

Can maternity capital be used as a down payment?

Banks more often practice mortgages under two documents without a down payment in the form of maternity capital. That is, the first installment, of course, needs to be paid, but with funds received from other sources. It should also be remembered that the use of the certificate is unacceptable for beneficiaries. However, privileged categories of citizens can make the first payment using subsidies. The simultaneous use of state benefits and maternity capital is impossible due to the specifics of MK.

Recommended article: Buying a new building with a mortgage: instructions

Check with the managers in advance whether the bank will accept your certificate. If the answer is yes, use the two-document mortgage calculator to calculate the estimated amount of future payments. This option is available on the official websites of most banks.

Important: Do not delay clarifying the issue regarding maternity capital, otherwise you may waste your time receiving an extract from the Pension Fund.

The following is a list of banks that provide mortgages based on two documents, and specifically the most popular offers. The conditions, range of rates, payment terms, requirements for borrowers and specific restrictions are listed. The maximum loan amount indicated in most descriptions is relevant for residents of Moscow, the Moscow region, St. Petersburg and the Leningrad region. In the regions, this figure may be reduced due to the lower market value of real estate.

Please note: Almost all financial organizations offer bonuses to their salary clients. Therefore, first of all, find out the terms of the mortgage from the bank with which you have successfully cooperated or have done so in the past. You may receive a reduction in the interest rate or your application will be considered for one passport.

Read more about maternity capital as a down payment in another article.

Mortgage conditions without proof of income

Such a bank loan cannot be called profitable. In the process of repaying the mortgage, the client overpays a large amount. The terms of lending from VTB 24 are as follows:

| Amount of credit | The maximum loan amount for residents of Moscow and St. Petersburg is 30 million rubles. For residents of other Russian cities it is 15 million rubles. At the same time, the bank also set a minimum lending threshold of 600 thousand rubles. |

| Interest rate | Up to 13.6% per annum |

| Loan terms | 20 years |

| An initial fee | 40% of the market value of the apartment |

List of required documents

When receiving such a mortgage, the client must provide only two documents - a passport and another document of his choice that confirms his identity. For example, this could be a driver’s license, TIN, SNILS. They must be accompanied by a bank questionnaire, where the potential borrower must answer questions from VTB. Men of military age additionally need to bring a military ID to the bank branch.

If the bank client is legally married, VTB 24 also recommends taking the following documents to apply for a mortgage:

- Marriage certificate;

- spouse's passport.

In some cases, VTB may require documents from the client confirming the availability of funds to make a down payment on the mortgage. This could be, for example, a bank account statement.

VTB

The bank issues 0.6–30 million rubles for a period of up to 20 years. The standard rate is 10%, but when purchasing an apartment of 65 m² or more it is reduced to 9.5%. The down payment is 40% if you purchase secondary housing and 30% for a new building. Comprehensive insurance is required!

At VTB, a mortgage according to two documents is drawn up with the obligatory involvement of a guarantor, who becomes the spouse of the borrower. The procedure is optional for those whose family union is sealed by a marriage contract. The main advantage of a VTB home loan: even officially unemployed borrowers, as well as those on maternity leave, can apply for a mortgage.

Attention: Maternity capital cannot be used as a down payment.

Which banks issue simplified mortgages?

You may be surprised, but such offers come even from the country's leading banks. Under the same mortgage program, they issue both classic and simplified mortgages.

Here are popular offers you can apply for:

| Bank | Bid | Down payment | Term |

| Sberbank | from 8.5% | from 30% | up to 30 years old |

| VTB | 7,9-8,4% | from 20% | up to 20 years |

| Alfa Bank | 8,99% | from 10% | up to 30 years old |

| Rosbank | +1% to the base rate | from 15% | 3-25 years |

Interest rates are approximate. The above data is not a public offer.

You will only find out the exact interest rate after contacting the bank and reviewing the application. The above values are the base rate plus the added coefficient specified by the bank for applying for a mortgage without proof of income. And some banks, for example, Rosbank, do not even indicate a clear base rate.

What coefficients can be applied:

- many banks reduce the rate by 0.3-0.5% if the borrower submits an application online;

- the rate is significantly reduced if the application is submitted by a salary client. But since we are talking about a mortgage without certificates, this is unlikely;

- rates for new buildings are often much lower than for the purchase of secondary housing. It's all about the partnership between the bank and the developer;

- many banks reduce the rate if the borrower makes a down payment of 30-50%;

- the rate always increases if the borrower refuses insurance.

So, contact the bank, submit an application and wait for an answer. Only after reviewing you will find out what percentage will be relevant for you. But you definitely shouldn’t prepare for the minimum values: you don’t confirm your income, the bank will include its risks in the rate.

Sberbank

Get from 300 thousand to 15/8 million rubles for finished housing at 10.5% or an apartment in a new building at 11.2%. The down payment in both cases is 50%, and the maximum amount can be increased if you attract co-borrowers. Special offer for young families: rate reduction up to 10%. Sberbank mortgages based on two documents are issued to citizens of the Russian Federation under the age of 75! All salary clients will need a Russian passport to submit an application.

Attention: Sberbank gives 0.1% per annum subject to electronic registration of the transaction. In this case, bank managers remotely carry out document flow with Rosreestr. You receive an extract from the Unified State Register and the purchase and sale agreement by email.

Mortgage loans without income certificate throughout Russia from other banks

| Bank-yaya-a | Program and interest rate rate below rate above | Loan amount less more | Down payment less more | Other conditions | Apply onlineoffline |

| 6% monthly payment from 65,731 rub. | up to 12 million rubles | from 20%from 800,000 rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 7.8% monthly. payment from 68,614 rub. | up to 15 million rubles | from 10%from 400,000 rub. | Issuance to accountWork experience from 6 months. last | online | |

| All about mortgage | |||||

| from 7.9% monthly. payment from 68,777 rub. | up to 30 million rubles | from 20%from 800,000 rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 7.99% monthly. payment from 68,923 rub. | up to 30 million rubles | from 10%from 400,000 rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| 8% monthly payment from 68,939 rub. | up to 3.1 million rubles. | from 20%from 800,000 rub. | Issuance to account Work experience Participation in NIS for at least 3 years | online | |

| All about mortgage | |||||

| 8.1% monthly payment from 69,102 rub. | up to 45 million rubles | from 0%from rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 8.19% monthly. payment from 69,249 rub. | up to 1 million rubles | from 0%from rub. | It is possible to use maternity capital. Issuance to account. Work experience of 4 months. last | online | |

| All about mortgage | |||||

| from 8.4% monthly. payment from 69,592 rub. | up to 30 million rubles | from 10%from 400,000 rub. | It is possible to use maternity capital. Issuance to account. Work experience of 3 months. last | ||

| All about mortgage | |||||

| from 8.49% monthly. payment from 69,739 rub. | up to 30 million rubles | from 10%from 400,000 rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 8.7% monthly. payment from 70,084 rub. | up to 30 million rubles | from 20%from 800,000 rub. | It is possible to use maternity capital. Issuance to account. Work experience of 3 months. last | online | |

| All about mortgage | |||||

| from 8.7% monthly. payment from 70,084 rub. | up to 30 million rubles | from 15%from 600,000 rub. | It is possible to use maternity capital. Issuance to account. Work experience of 3 months. last | online | |

| All about mortgage | |||||

| from 8.7% monthly. payment from 70,084 rub. | up to 30 million rubles | from 30%from 1,200,000 rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 8.7% monthly. payment from 70,084 rub. | up to 30 million rubles | from 15%from 600,000 rub. | It is possible to use maternity capital. Issuance to account. Work experience of 3 months. last | online | |

| All about mortgage | |||||

| from 9.6% monthly. payment from RUB 71,572 | up to 8 million rubles | from 0%from rub. | Issuance to accountWork experience from 6 months. last | online | |

| All about mortgage | |||||

| from 10.4% monthly. payment from 72,910 rub. | up to 12 million rubles | from 0%from rub. | Issuance to/to an account in a third-party bankWork experience of 3 months or more. last | online | |

| All about mortgage | |||||

| from 10.5% monthly. payment from 73,079 rub. | up to 30 million rubles | from 0%from rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 10.99% monthly. payment from 73,907 rub. | up to 50 million rubles | from 0%from rub. | Issuance to accountWork experience from 6 months. last | online | |

| All about mortgage | |||||

| 11.89% monthly. payment from 75,442 rub. | up to 10 million rubles | from 0%from rub. | Issuance to accountWork experience from 6 months. last | online | |

| All about mortgage | |||||

| 12.25% monthly. payment from 76,061 rub. | up to 1 million rubles | from 20%from 800,000 rub. | Issuance to the accountWork experience from 3 months. last | online | |

| All about mortgage | |||||

| from 12.89% monthly. payment from 77,169 rub. | up to 10 million rubles | from 0%from rub. | Issuance to accountWork experience from 6 months. last | online | |

| All about mortgage |

Mortgage online using two documents

Financial institutions do not issue large sums without a personal meeting with the client, but it is indeed possible to obtain preliminary approval via the Internet. Fill out the form on the website of the selected bank, indicate your income, the required amount and a comfortable payment period. The credit committee will make an interim decision and schedule a meeting, to which you will need to bring the original documents.

Thank you for reading the article to the end, now you know which two documents are used to give a mortgage. If you find this option profitable and convenient, go for it. Buy your own home without proof of income while banks give you this opportunity!

Rate the author

(

2 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publication January 10, 2019 February 25, 2019