General provisions

The first chapter of the Federal Law on mortgage collateral of real estate consists of 7 articles. The first describes under what circumstances and on what conditions a mortgage arises, as well as legislative methods of regulation. The same chapter states that property pledged for mortgage lending remains for the use of the borrower and is not transferred to the lender. And not only the owner, but also other persons who have the appropriate documents and permits for this can provide property as collateral.

The text of the law clearly states that the amount for the mortgaged property that the client receives from the lender cannot exceed its value. The loan may be equal to or less than the collateral. Special situations are also prescribed when the lender bears the costs of maintaining the mortgaged property. In this case, the credit institution has the right to compensate for its own costs by selling the collateral.

Article 5 of Federal Law 102 clearly defines the property categories that can be used as collateral:

- plots of land, except for those that belong to the state or municipal, there are separate rules for such plots;

- buildings, enterprises, individual structures;

- apartments in high-rise buildings and private houses or parts thereof, which can be separately allocated;

- garages, outbuildings, garden houses;

- parking spaces;

- water and air transport.

Article 6 stipulates the right to transfer real estate as collateral. And the 7th talks about living space that is in common or joint ownership. If such real estate is pledged, then it is necessary to collect papers on the consent of all shareholders. But if it is possible to allocate a share of the common property to a potential borrower, then he has the right to independently dispose of personal property.

The owner of the share has the right to use it as collateral, but it is rare that a creditor will agree to such conditions. Such property is difficult to sell; it is considered an illiquid option. But such property can be used for additional collateral for a loan. In this case, the lender will pay more attention to the borrower’s solvency and credit history. Such data can better inform the client’s financial discipline, income and performance.

What are the differences between a legal mortgage and a contractual loan?

Mortgage by law and by contract have a number of very important and significant differences, which are shown in the table.

| By force of law | By virtue of the contract | |

| Emergence | arises automatically according to the current legislation of the Russian Federation | arises if a separate agreement is drawn up |

| Subject of collateral | real estate for the purchase of which a targeted loan is issued | any real estate owned by the borrower |

| Registration | 1) Simultaneously at the time of registration of ownership. 2) at the request of one of the parties to the transaction (lender, borrower) | 1) After the purchase and sale agreement is registered. The basis will be a separate mortgage agreement. 2) By joint application of the borrower and lender |

| Payment of state duty | not charged | charged |

About the mortgage and state registration of mortgages

A description of the mortgage is given in the third chapter of Federal Law-102. This section describes the basic provisions, conditions of registration and work with the electronic version of the document.

Essentially, a mortgage is a registered security. But its registration is not necessary for a mortgage. No one obliges you to draw up such paper for this type of lending. If a mortgage is issued, then the right to it can be assigned. A separate article is devoted to how to do this.

When the borrower repays the loan, the lender returns the mortgage. The owner independently removes the encumbrance on the property from the government agency.

The fourth chapter describes the stages of state registration of collateral. Here it is indicated how the mortgage record is entered, edited, corrected, corrected or removed from the state register. The articles also talk about the actions of the property owner during the liquidation of the mortgagee. For example, in case of bankruptcy of a creditor.

The same chapter states that the state fee for state registration is paid when making an entry or when making adjustments. The tax is:

| Content | Individuals | Legal entities |

| Making an entry | 1,000 rubles | 4,000 rubles |

| Correcting a record | 200 rubles | 600 rubles |

When drawing up an agreement between an individual and a legal entity, the amount of payment is established as for an individual. Taxes and fees are not constant. They depend on the legislation currently in force, so the current cost should be looked at on the day of state registration.

In Art. 25 of the Federal Law “On Mortgage” describes the procedure for repaying an entry in the State Register about the pledge of property. It also indicates which persons and in what composition can submit an application for repayment and a list of securities.

When does such a mortgage arise?

A mortgage, by operation of law, occurs when an individual obtains title to any real property as a result of the signing and execution of a contract of sale, rent, exchange, or any other agreement where borrowed money is used. It follows from this that the transaction becomes completed after registration with Rosreestr, but not before this stage.

In general, the term “mortgage by force of law” is rarely used, because its main purpose is to secure encumbrances on certain real estate. This concept is mainly used by Rosreestr employees, and less often by bank employees.

Depending on which method of obtaining a mortgage was chosen, a specific piece of real estate is established, on which an encumbrance (collateral obligation) is then placed.

Preservation of real estate

The pledged property must be properly used and preserved. This is included in the text of the agreement. And from the fifth chapter of Law 102 on mortgages, you can learn in more detail the nuances about the duties and responsibilities of the parties in relation to the collateral:

- How can a property owner use the mortgaged property? The lender has no right to set any restrictions. Moreover, the homeowner can even derive additional income from personal property registered as collateral. For example, renting out to tenants daily or for a longer period.

- Who carries out repairs of mortgaged real estate. All costs for home repairs are borne by the owner, unless otherwise specified in additional agreements. In addition, the lender has the right to demand early repayment of the loan if the pledged property loses its original value due to the owner’s negligence.

- How is the insurance of the property provided as collateral carried out? Housing insurance is a mandatory condition for mortgage lending. It is paid by the borrower. However, it cannot be less than 10% of the value of the property, but cannot exceed 50% of the principal amount of the debt. Some credit institutions offer their borrowers to also pay for personal insurance. But banks do not have the right to force the client to purchase such a policy. Refusal of personal insurance may serve as a reason for revising the interest rate on the loan upward.

- What measures are permissible to use to protect collateral from damage and loss. And also from the actions of third parties. If a real threat arises, the owner is obliged to notify the bank of everything that he knows that may lead to the loss of the collateral.

- On the rights of the creditor to inspect the property registered as collateral.

- What are the consequences of loss or damage to mortgaged real estate for the owner and the lender?

If the property owner neglects responsibilities, untimely repairs or intentional damage, the lender may ask to close the loan agreement early.

Transfer of property rights

The sixth chapter of Federal Law-102 “On Pledge” describes the transfer of rights to real estate in a mortgage. The articles in this section describe:

- procedure for alienation of real estate;

- preservation of the mortgage when transferring rights to real estate as collateral to a third party;

- consequences of violation of the procedure for alienation of property rights;

- consequences of seizure of mortgaged property by the state, including under renovation programs.

The same section specifies the lender’s right to demand repayment of the loan funds ahead of schedule in a situation where the collateral housing is seized through vindication. That is, when the real owner is another citizen, and not the mortgagor. The procedure takes place when a court decision on the seizure of housing has been made, which has entered into force.

A mortgage, by its legal nature, is a form of pledge of real estate, in which the property is the property of the debtor, but at the same time, its creditor, in the event of the debtor’s failure to fulfill its obligations to pay funds, receives the right to sell the real estate pledged to him in order to return the funds transferred to the debtor. In other words, the debtor’s obligation is to repay the loan, and the real estate pledge is a form of security for the fulfillment of the debtor’s financial obligations to his creditor.

Thus, Article of the Federal Law of July 16, 1998 N 102-FZ “On Mortgage (Pledge of Real Estate)” (hereinafter referred to as the Mortgage Law) establishes that under an agreement on the pledge of real estate (mortgage agreement), one party is the mortgagee, who is the creditor of the obligation secured by a mortgage has the right to receive satisfaction of its monetary claims against the debtor under this obligation from the value of the pledged real estate of the other party - the mortgagor, preferentially before other creditors of the mortgagor, with exceptions established by federal law. The property on which the mortgage is established remains with the mortgagor in his possession and use. In the theory of civil law, it is customary to distinguish between two types of mortgage: mortgage by force of law and mortgage by force of contract. A mortgage by force of law is a form of mortgage that arises under circumstances specified by law, regardless of the will and desire of the parties. An example of a mortgage by force of law may be clause 5 of Art. 488 of the Civil Code of the Russian Federation, according to which, unless otherwise provided by the purchase and sale agreement, from the moment the goods are transferred to the buyer and until payment, goods sold on credit are recognized as being pledged by the seller to ensure the buyer fulfills his obligation to pay for the goods. A similar rule applies to an agreement for the sale of goods on credit with the condition of payment in installments (clause 3 of Article 489 of the Civil Code of the Russian Federation). When transferring a plot of land or other real estate for payment of rent, the recipient of the rent, as security for the obligation of the rent payer, acquires the right of pledge over this property (Article 587 of the Civil Code of the Russian Federation). Also, securing the fulfillment of obligations under the contract with a pledge by force of law is established for the developer (mortgagor) under the contract from the moment of state registration of the contract with the participants in shared construction (mortgagors), taking into account the features provided for in Part 2.1 of Art. 13 of the Federal Law of December 30, 2004 N 214-FZ “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation” (hereinafter referred to as the Law on shared participation in construction), except in cases of involvement by the developer funds of participants in shared construction when placing such funds in escrow accounts (Article 13, Part 4 of Article 15.4 of the Law on Shared Participation in Construction), as well as to ensure the buyer’s obligation to pay for state or municipal property purchased in installments (Clause 6 Article 35 of the Federal Law of December 21, 2001 N 178-FZ “On the privatization of state and municipal property”). Mortgage, by force of law, is also applied when purchasing a plot of land, residential buildings or apartments using credit (borrowed) funds (Articles 64.1, 77 of the Mortgage Law). Unlike a mortgage by law, a mortgage by contract is a pledge of real estate arising on the basis of an agreement entered into by the parties. A mortgage by virtue of an agreement is concluded in order to ensure that the debtor fulfills his obligations under a loan agreement or credit agreement. In this case, the mortgage is not an independent obligation, but only performs a security function under the original loan agreement or credit agreement. Ownership rights and other proprietary rights to real estate and transactions with it are subject to state registration in the Unified State Register of Real Estate. Restrictions (encumbrances) of rights to real estate, including mortgages, are also subject to state registration (Article 131 of the Civil Code of the Russian Federation, paragraph 6 of Article 1, paragraph 2 of Article 14 of the Federal Law of July 13, 2015 N 218-FZ “On State Registration of Real Estate "). It should be noted that a mortgage by virtue of a contract differs from a mortgage by force of law in that a contractual mortgage is subject to state registration only upon the joint application of both parties to the contract. State registration of a mortgage arising by virtue of a notarized mortgage agreement may also be carried out on the basis of an application from a notary who certified the mortgage agreement. If there is a collateral manager, state registration of the mortgage is carried out on the basis of a joint application of the mortgagor and the collateral manager, acting on the basis of a collateral management agreement concluded with the mortgagee. Together with the said joint application, the agreement on the basis of which the obligation secured by the mortgage arose, as well as a collateral management agreement or a syndicated loan agreement, if such an agreement contains provisions on collateral management (Part 1, Article 20 of the Mortgage Law), is submitted. In turn, state registration of a mortgage by force of law is carried out on the basis of an application from the mortgagee or mortgagor or a notary who certified the agreement giving rise to a mortgage by force of law, without paying a state fee. State registration of a mortgage by force of law is carried out simultaneously with the state registration of the property rights of the person whose rights are encumbered by the mortgage, unless otherwise established by federal law. The rights of the mortgagee under a mortgage may by force of law be certified by a mortgage.

Subsequent mortgages

The seventh chapter introduces the concept of subsequent mortgage and the situation when it is allowed to be used. The articles explain under what conditions the same collateral can be used as security for different loans of the same citizen or different individuals. If the text of the first mortgage prohibits the property from being re-mortgaged, then no subsequent mortgages can arise.

This section also describes the state registration procedure when registering property as collateral for the second or third time. And in what sequence will debts be collected from borrowers in case of non-payment of loans.

Assignment of rights and foreclosure

The creditor may transfer his rights to the pledge unless this is prohibited by the terms of the contract. At the same time, the obligation to repay the loan may or may not be transferred. Such details can be specified separately when drawing up the agreement. Rights can also be transferred to a mortgage. An entry about the new copyright holder is made on the security.

Law 102 expressly prohibits the making of inscriptions that would indicate that the mortgage is prohibited from transferring the mortgage to other creditors. If such inscriptions were made, they have no legal force and are invalid.

Some clients do not fulfill their obligations on time, then the lender may sue the borrower. This is stated in Chapter 9 of Federal Law-102. Under such circumstances, the credit institution has the right to sell the collateral. The bank uses funds received from the sale of real estate to compensate for its own costs.

It happens that the money received from the sale of collateral may not be enough to compensate for all losses incurred. Then the lender can legally demand compensation from the borrower for the remaining difference.

Sale of mortgaged real estate

Chapter 10 of the Law “On Mortgage” describes the procedure for the sale of mortgaged property. When the lender has the right to sell the property, he can obtain the consent of the borrower, or he can start the process without it. When choosing the first option, the parties can come to an amicable agreement and sell the collateral on the most favorable terms for all participants. If the bank initiates the sale of real estate without the client’s consent, then it goes through an auction.

At an auction, the collateral is assigned the minimum acceptable value. If the object is not sold, the auction is declared invalid. At the next auction, the price of the collateral is set even lower. The lender publishes information about the auction in official publications. Participants who want to take part in the auction make a deposit of up to 5% of the value of the lot. The one who gives the highest price buys the property. The remaining participants will receive their deposits immediately back.

The buyer is required to pay the balance of the price for the purchased property within 5 days after the auction. And over the next 5 days they conclude a deal with him to sell the property.

In Art. 61 describes the conditions for how funds received from the sale of collateral will be distributed. Who is entitled to them and in what order the debts of all creditors are compensated. If the proceeds are greater than the debts owed to all creditors, then the remainder is returned to the former owner of the property.

How to conclude a contract for the purchase of real estate with a mortgage?

The law establishes that when including a mortgage agreement in the relevant agreement, the requirements established for the mortgage

(clause 3 of article 10 of the Mortgage Law).

A mortgage clause can be included in different types of contracts. This could be a contract of sale, exchange, rent, etc.

agreements using credit funds

.

Let's consider the features of a mortgage by force of law when purchasing a property using credit or borrowed funds.

When purchasing real estate using credit funds, a purchase and sale agreement for the property is concluded. The parties to such an agreement are the buyer, who is granted a loan on the basis of a credit agreement or loan agreement, and the seller - the owner of the property or his representative.

At the same time, the purchase and sale agreement specifies not only the essential terms of the purchase and sale agreement, but also the essential terms of the mortgage: the subject of the agreement, the source of payment for the purchased property, the procedure for settlements between the parties, the rights and obligations of the parties, the duration of the agreement and other conditions.

To conclude a purchase and sale agreement using credit funds, a number of steps should be taken sequentially:

- Step 1

- choose a bank by studying the mortgage programs of various banks and the terms of their loans (interest rate, payment procedure, mortgage term, monthly payment amount, early repayment conditions, etc.). - Step 2

— fill out a form and prepare documents to obtain a loan secured by real estate.More details

As a rule, banks require the following documents:

- application for a mortgage loan in the form of a bank;

- borrower's passport;

- marriage certificate (if you are married);

- birth certificate of minor children (if any);

- documents confirming your income;

- a copy of the work book certified by the employer (to confirm work experience), etc.

- Step 3

- submit documents to the bank and wait for approval for the loan. - Step 4

— after receiving preliminary approval from the bank, select one that suits your criteria

real estate

, which also meets the bank's requirements. To minimize the risks associated with the purchase of housing, we recommend entrusting the search and analysis of information about the specific property you have chosen to professionals. To do this, just order

object passport

.If necessary, at this stage a deposit agreement or a preliminary purchase and sale agreement can be signed (Article 380, paragraph 1 of Article 429 of the Civil Code of the Russian Federation).

- Step 5

— contact the bank again to issue a loan, adding the following documents:- a report from an independent appraiser on the market value of real estate (Clause 3, Article 9 of the Mortgage Law; Article 11 of Federal Law No. 135-FZ of July 29, 1998 “On Valuation Activities in the Russian Federation”);

- a copy of the agreement on the deposit (advance payment) or a copy of the preliminary purchase and sale agreement (at the request of the bank);

- risk insurance agreement (life and health of the borrower, purchased property, etc.).

- Step 6

— conclude a purchase and sale agreement using credit funds (can be drawn up by a bank or prepared by the parties to the agreement).As a rule, the following documents are drawn up and signed:

- a loan agreement on pre-agreed terms (Articles 819, 820 of the Civil Code of the Russian Federation; Article 9.1 of the Mortgage Law; Article 6.1 of the Federal Law of December 21, 2013 No. 353-FZ “On consumer credit (loan)).

agreement for the purchase and sale of an apartment using credit funds (Clause 1, Article 549 of the Civil Code of the Russian Federation);

- mortgage (prepared by the bank) (Clause 1, Article 13 of the Mortgage Law).

- Step 7

is to register the title to the property and the mortgage by law.

Features of mortgages with land plots

Owners have the right to mortgage land that exceeds the minimum established size in a given subject of the Russian Federation. In this case, it is possible to mortgage land from municipal property if:

- the site is allocated for individual construction within the framework of social programs;

- the loan is taken out for the improvement of this site;

- The decision on whether a given plot can be mortgaged is made by the municipality.

The owner of the land does not have to have permission from the lender to develop it. The principle of indivisibility comes into play: buildings on earth cannot exist separately from it.

Two features with this type of collateral:

- When registering a private house as collateral, the land plot underneath it is always registered along with the real estate.

- When a foreclosure occurs on the mortgage of agricultural land, they do not have the right to put the fields up for auction until the crop is harvested and sold.

If the land is used under a lease agreement, the tenant has the right to mortgage it for a period that is shorter than the lease itself. In this case, the permission of the land owner is not necessary for the lender.

Features of a mortgage by force of law

When obtaining a home loan, borrowers should consider the important consequences of registering a transaction:

- If there are regular late payments, the bank may transfer the right to the collateral to third parties (for example, a collection agency) or sell it by court order. In this case, written notification to the borrower about upcoming procedures is required.

- Mortgage by force of law by minor owners is permitted by law, but under one condition. If children become the new owners of real estate, you must first obtain the consent of the guardianship and trusteeship authorities for the pledge. The fact is that such a transaction affects the interests of the child, so the state must assess its legality.

- The pledged property must be in an unchanged condition, and the borrower is obliged to take all possible measures to preserve it. It is for this reason that banks require collateral insurance during the repayment period of the mortgage loan. What happens if you don't get mortgage insurance?

- If a situation arises where there is a threat of damage or destruction of property, its owner is obliged to immediately notify the mortgagee.

- The bank has the right to check the condition of the collateral at any time. Although in practice, representatives of a credit institution rarely go to inspect it themselves. Is it possible to do redevelopment when the apartment is under mortgage?

- The owner of the property has no right to rent it out without the consent of the mortgagee. The fact is that tenants can damage the security deposit, which will affect its value. Is it possible to rent out an apartment purchased with a mortgage?

Recommended article: Gazprombank mortgage with maternity capital

Of course, according to the documents, the property belongs to the borrower and his family members. They can use it for personal residence and household needs, but not make transactions and not use it for earnings (with the exception of a commercial mortgage). In any case, the bank acts as a potential owner of this property. He has the right to take it away and put it under the hammer if the client does not comply with the essential terms of the loan agreement.

Features of collateral of non-residential property

Chapter 12 spells out the specifics when pledging non-residential premises:

- the enterprise is registered as collateral with all the property and land on which it is located;

- a non-residential building standing on a separate plot is also pledged along with a plot of land under it;

- the creditor does not prevent the owner of the property from using it, unless otherwise specified in the pledge agreement.

An exception to the transfer of land with buildings and structures along with the land arises if it is transferred to the owner on a lease basis. It is possible to collect mortgage debts from enterprises only after a court decision has been made.

Special conditions for pledging apartments and houses

There are also special requirements for the borrower’s living space, since not only the debtor himself, but also other persons can live on its territory. At the same time, it is prohibited to accept objects owned by the state or city as collateral. The following requirements are put forward for other apartments and residential buildings:

- when mortgaging housing where family members who have not reached the age of majority are registered, it is important to obtain permission from the guardianship authorities;

- during the period of self-construction, a pledge can be issued for materials and equipment, but after completion of construction, the residential building is pledged;

- housing purchased with a mortgage is registered as collateral simultaneously with the registration of the borrower’s right to the property;

- When using the mortgage program for military personnel, the living space is simultaneously pledged to the bank and to the government agency that makes payments to repay the loan.

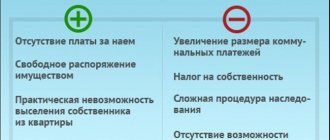

What is best for the borrower?

It cannot be summed up unequivocally that one format brings more benefits to the borrower, and another less. It all depends on the situation.

A mortgage loan is legally convenient and beneficial to all parties to the transaction if everything goes “on the beaten path,” i.e. there are no conditions and requirements, only upon the occurrence of which registration or transfer of funds must occur, there are no additional parties to the transaction, or any other difficulties.

When everything is standard - a loan is received, a down payment is made and property rights are immediately registered - there is nothing better than a mortgage by force of law, because it gives the greatest legal protection to both the bank, the seller, and the buyer.

But these advantages become irrelevant as soon as nuances appear in the transaction that are not regulated by the standard package of legal documents. Then, on the contrary, it is the mortgage loan that, by virtue of the contract, can provide the greatest protection to both the borrower and the other parties, because the agreement will further clarify and legitimize those very nuances not regulated by law.

Final part

Federal Law 102 was adopted in the Russian Federation in 1998. It applies in the current edition, which was carried out on August 2, 2021. In this case, a single rule is taken into account. All agreements executed with the pledge of real estate are drawn up taking into account the current edition. After additions and changes are made to the Federal Law, previously concluded agreements are not revised unless this is necessary for the parties.

All mortgage loans in the Russian Federation are concluded taking into account this federal law. What types of mortgages are common in Russia and other useful materials about mortgages can be found on the Brobank portal.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya