Who can claim a property deduction and when?

Property deduction is a taxpayer’s ability, established by tax legislation, to:

- return part of the personal income tax previously transferred to the budget;

- not pay tax at all or reduce its amount.

A person who has committed certain manipulations with personal property can receive a property deduction, such as:

- sale of property;

- buying a home;

- acquisition of land for housing construction and (or) implementation of this construction;

- concluding a contract for the purchase of property for state or municipal needs.

A person can count on a property deduction:

- having legal sources of income subject to personal income tax at a rate of 13%;

- being the owner of property (bought or sold);

- who paid for the purchased housing using their own or borrowed money;

- who has completed and sent the 3-NDFL declaration to the tax authorities (with supporting documents and an application for tax refund attached to it).

What personal income tax deductions can you get if you have no income? The answer to this question can be studied in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The following sections will reveal the subtleties and nuances of filling out 3-NDFL and calculating tax in the situation of receiving a property deduction.

IMPORTANT! The declaration for 2021 must be submitted using the new form from the Federal Tax Service order dated August 28, 2020 No. ED-7-11/ [email protected] you can here.

On our forum you can consult on any question you have when filling out the 3-NDFL declaration. For example, in this thread we share our experience on how to independently fill out the 3-NDFL declaration for treatment.

To find out the amount carried over from the previous year in the 3-NDFL declaration, you need

Complete the following arithmetic problem. 1,450,000 (cost of housing) - 450,000 (deduction for previous years) = 1,000,000 rubles. This will be the amount carried over from the previous year.

So, you can find out the deduction for previous years in four ways:

- Contact the tax office, they should provide you with the information you are looking for, but do not forget to take the documents with you.

- Ask your employer to print you 2-NDFL certificates for the years for which you received a deduction and add up the tax base amounts from them.

They say that the response from the tax service comes no later than 14 days from the date of application.It is necessary to subtract the “deduction for previous years” from the “total cost of all objects” previously entered in the program (taking into account deduction restrictions).

Sale of property and 3-NDFL (filling example)

The need to prepare a 3-NDFL declaration arises for an individual if he:

- received income from the sale of property owned by him;

- owned the sold property less than established in Art. 217.1 and clause 17.1 of Art. 217 of the Tax Code of the Russian Federation MSVI (minimum period of ownership of property).

The Tax Code provides for 2 types of property deductions when selling property:

- 1 million rub. (when selling real estate);

- 250,000 rub. (when selling other property).

Registration of the 3-NDFL declaration:

- mandatory if the period of ownership of the property was less than the MSVI (regardless of the amount of income received from its sale);

- is not required if more than the MSVI has passed from the beginning of ownership of the property to its sale (clause 17.1 of Article 217, subclause 2 of clause 1 of Article 228, clause 4 of Article 229 of the Tax Code of the Russian Federation).

Features of the definition of MSVI are shown in the diagram:

Examples will help you figure out whether to apply for 3-NDFL or not.

Example 1

Tumanov A.A. purchased an apartment in 2013. In 2021, he sold it for RUB 5,243,000. Dates:

- acquisitions - before 01/01/2016;

- ownership - more than 3 years.

Conclusion: filing 3-NDFL and paying personal income tax to Tumanov A.A. is not required.

Example 2

Sidorova G. E. in September 2021 sold an apartment privatized in December 2021 for RUB 3,200,000.

Deadlines:

- acquisition of property rights - after 01/01/2016;

- ownership - less than 5 years.

Conclusion: Sidorova G.E. needs to file 3-NDFL and pay tax.

Example 3

Tokarev S.G. purchased a car in December 2021, which he sold in September 2021 for 240,000 rubles.

Calculation of terms: the car was owned for 10 months. (less than 3 years).

Conclusion: Tokarev S.G. is obliged to report on the income received using the 3-NDFL declaration. There will be no need to pay personal income tax if he exercises his right to a property deduction (240,000 rubles < 250,000 rubles → personal income tax = 0 rubles).

We will tell you how Tokarev S.G. fill out 3-personal income tax in the next section.

Filling out 3-NDFL when selling a car

We use the data from example 3 of the previous section to fill out the 3-NDFL declaration with a property deduction.

Example 3 (continued).

Tokarev S.G. studied the structure of 3-NDFL and came to the conclusion that he will need to fill out the following declaration sheets:

- title page;

- section 1;

- section 2;

- Annex 1;

- Appendix 6.

Step 1. Tokarev began filling out the declaration with the title page. Here he indicated the correction number (for the primary declaration - 0), full name, data on the date and place of birth, citizenship and passport of S. G. Tokarev and other required information in the fields proposed for filling out.

Step 2. Next, he filled out Appendix 1 “Income from sources in the Russian Federation”

To further enter data, Tokarev S.G. used information about the buyer of the car from the sales contract:

- Entered information about the source of income payment on page 060 - the buyer of the vehicle. Since the buyer is an individual, Tokarev S.G. indicated only his full name.

- Information about income received:

- on page 020, the value 03 is the income code, meaning the sale of other property;

- on page 070 - 240,000 - the amount received from the sale of the vehicle.

Step 3. Next, Tokarev proceeded to filling out Appendix 6 “Calculation of property and tax deductions.” To do this, in p. 070, clause 3.1, he indicated the amount of property deduction in the amount of 240,000 rubles.

Step 4. In this step, Tokarev filled out section 2, indicating on page 010 the amount received for the car, and on page 040 - the amount of property deduction.

Step 5. Since the amount of tax payable is zero, in section 1 Tokarev indicated the value 0 on page 050, and on pages 020 and 030 KBK and OKTMO.

What documents are needed for property deduction?

For Tokarev S.G. from the example considered, the list of documents attached to 3-NDFL for obtaining a property deduction consists of 3 points:

- copy of passport (pages with personal data and registration);

- a copy of the car purchase and sale agreement;

- copies of payment documents.

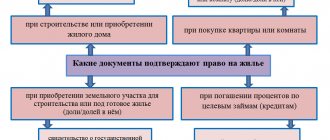

When an individual applies for a property deduction when purchasing real estate, the list of documents for the 3-NDFL declaration will differ depending on the type of real estate and the form of its acquisition (see example in the diagram):

The taxpayer may need an additional document - a special notification from the tax authorities confirming the right of an individual to a property deduction (the notification form was approved by Order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11 / [email protected] ), if:

- expenses have been incurred for the purchase or new construction of real estate (including the payment of interest on repayment of targeted loans) - a property deduction for such situations is provided for in subclause. 3–4 p. 1 tbsp. 220 Tax Code of the Russian Federation;

- the individual intends to receive a property deduction at his place of work (clause 8 of Article 220 of the Tax Code of the Russian Federation).

To receive a notification, you must contact the inspectorate at your place of residence with an application and supporting documents.

What documents will be needed to receive notification, from what month and in what volume a property deduction will be provided at the taxpayer’s place of work, see here.

Formulas for calculating personal income tax when buying and selling property

Calculation of personal income tax when purchasing property

When purchasing real estate, the taxpayer can return part of the personal income tax from the budget. Standard formulas for calculating tax refunded from the budget (NDFLreturn) are as follows:

1. Property acquired without borrowing:

Personal income tax return = RN × 13%, if RN ≤ 2 million rubles,

Personal income tax return = 2,000,000 rub. × 13% = 260,000 rubles, if pH > 2 million rubles,

where РН – taxpayer’s expenses for new construction or purchase of housing;

2 million rub. – maximum property deduction when purchasing property.

2. A targeted loan (credit) was used to purchase real estate:

Personal income tax% = RP × 13%, if RP ≤ 3 million rubles,

Personal income tax% = 3,000,000 rubles. × 13% = 390,000 rubles, RP > 3 million rubles,

where personal income tax% is the amount of personal income tax refunded when paying interest on a target loan (credit);

RP - interest expenses paid;

3 million rub. – maximum property deduction for interest (if the target loan was received before 2014, the property deduction for interest is not legally limited by an upper limit).

3. The property was partially paid for with maternity capital funds:

Personal income tax return = (RN - MK) × 13%, if (RN - MK) ≤ 2 million rubles,

Personal income tax return = 2,000,000 rub. × 13% = 260,000 rubles, if (RN - MK) > 2 million rubles,

where MK is maternity capital funds spent on the purchase of real estate.

A similar formula is used to calculate tax if the property is paid for using funds:

- employers;

- budget;

- other persons.

4. Real estate was purchased from interdependent persons - in this situation, it will not be possible to return personal income tax, regardless of the value of the real estate, since in this situation the taxpayer does not have the right to a property deduction. The following are recognized as interdependent persons with the taxpayer (Article 105.1 of the Tax Code of the Russian Federation):

- his parents (adoptive parents);

- his children (including adopted ones);

- his spouse;

- his brothers and sisters;

- his guardian (trustee) and ward.

Calculation of personal income tax when selling property

Personal income tax payable (NDFLupl) is determined by the following formulas:

1. Income is received from the sale of land plots, residential buildings, apartments, rooms, garden houses, dachas, as well as shares in the specified property:

NDFLupl = (DPT - 1,000,000 rub.) × 13%, if DPT > 1 million rub.,

NDFLupl = 0, if DPT ≤ 1 million rubles,

where DPN is income from the sale of real estate;

1 million rub. - the maximum property deduction allowed by the Tax Code of the Russian Federation when selling real estate.

Example 1

Soloviev A.P. sold an apartment in 2021 for RUB 1,220,000. In the 3-NDFL declaration, he reflected income in the amount of 1,220,000 rubles. and a property deduction in the amount of 1 million rubles. Personal income tax payable was calculated using the formula:

NDFLupl = (1,220,000 rub. – 1,000,000 rub.) × 13% = 28,600 rub.

Example 2

Vasilyeva T.N. received 643,000 rubles from the buyer in 2021. under the contract of sale and purchase of the dacha. I filed a 3-NDFL declaration, indicating the income received (RUB 643,000) and a property deduction in the same amount. She will not have to pay personal income tax on this transaction (643,000 rubles ≤ 1 million rubles).

2. Income received from the sale of other property (car, garage or other items):

NDFLupl = (DPI - 250,000 rub.) × 13%, if DPI > 250,000 rub.,

NDFLupl = 0, if DPI ≤ 250,000 rub.,

where DPI is income from the sale of other property;

250,000 rub. - the maximum property deduction allowed by the Tax Code of the Russian Federation when selling other property.

Example 3

Two brothers, Stepan and Andrey Tumanov, decided to upgrade their cars in 2021. Before buying new cars, they sold their old cars:

- for 523,000 rub. (Stepan),

- 182,000 rub. (Andrey).

When calculating personal income tax payable, they used the following formulas:

Stepan: Personal income tax = (RUB 523,000 – RUB 250,000) × 13% = RUB 35,490;

Andrey: Personal income tax = 0, since 182,000 rubles. < RUB 250,000

At the end of 2021, both brothers declared their income by filing 3-NDFL. Stepan paid tax in the amount of 35,490 rubles, but Andrey did not have to pay anything.

For calculation formulas used to determine tax liabilities and for financial analysis purposes, please visit our portal:

- “Calculation of the tax burden in 2020-2021 (formula)”;

- “Calculation of the break-even point (formula and graph)”.

How to fill out a declaration taking into account deductions for previous years?

Deduction for previous years of declaration and the amount carried over from the previous year.

These concepts raise many questions when filling out the 3-NDFL tax return for the return of a property tax deduction.

To understand once and for all, you need to answer the questions:

- What it is?

- Where does it come from?

- How is it calculated?

- How to fill out 3-NDFL?

- What exactly and where should I write in the declaration?

What is a deduction?

The phrase “deduction for previous years of declaration” refers to the topic of property deduction. This means that you can return income tax or personal income tax when purchasing any housing: a house, apartment, room, land.

And again new questions arise. What is income tax? And how can I return it?

Income tax is the portion of funds that individuals pay to the government on their income. It would be correct to call it the personal income tax, or personal income tax. The rate of this tax for Russian citizens is 13%.

As a rule, personal income tax is withheld by tax agents, who are employers. For example, if a citizen receives a salary of 10 thousand rubles, the employer will most likely withhold 13% tax from him, which is 1,300 rubles. And he will receive 8,700 rubles in his hands.

This income tax is refundable. Today there are five types of tax deductions:

- standard;

- social;

- property;

- professional;

- deductions for securities.

In order to take advantage of the property deduction and return the withheld income tax, you must fill out a 3-NDFL declaration.

Where does the deduction for previous years of declaration come from?

To date, the amount of property deduction is 2 million rubles. And 13% of this amount can be returned. And this is 260 thousand rubles.

Now you need to compare this with salary. Let it be 25 thousand rubles per month - or 300 thousand rubles per year. The withheld personal income tax for the year will be 39 thousand rubles. Now let's compare tax relief and income tax. The benefit is more than six times your actual income for the year. How to be?

For the past year, you can only get a refund on the real amount of income - three hundred thousand rubles. That is, 39 thousand is returned. What benefit will remain unspent? You need to subtract 2 million 300 thousand, and you get 1 million 700 thousand rubles.

How to fill out the 3-NDFL declaration when selling an apartment?

How to get a tax deduction for previous years, read here.

How to fill out the 3-NDFL declaration for the annual return of mortgage interest, read the link:

When can you use it again? Only next year, when new income appears and, accordingly, withheld personal income tax.

Now attention! 300 thousand rubles is a deduction for previous years of the declaration. One million 700 thousand rubles is the amount that carries over to the next year.

How to calculate the amount of deduction for previous years of declaration?

Where does the amount transferred from last year come from?

A simple example has already been discussed. You need to complicate the problem and make a calculation. So, we bought an apartment worth 3 million rubles. Accordingly, you can take advantage of a property deduction of 2 million rubles. In the first year, the year the apartment was purchased, the buyer’s salary was 300 thousand rubles. The next year he earned 400 thousand rubles. And a year later his income became 500 thousand rubles.

In the example, the declaration is submitted specifically for this third year, while it is assumed that a refund has already been received for all previous years.

You should add up the income for previous years. This amount will be a deduction for previous years of the declaration. It should be repeated that 500 thousand rubles were earned in the year for which the 3-NDFL declaration is now being submitted. That is, this is the current amount of income, and not for the previous period.

Well, another small problem, now for subtraction. From the 2 million tax credit, all income for three years must be deducted. The result will be 800 thousand rubles. This amount will be the balance carried over to the next year.

Here, income for the current year was taken into account, since it will be used in the current declaration when calculating the refund amount. Therefore, next year the deduction will decrease by the amount received. In the example, the deduction for previous years of the declaration is 700 thousand rubles. The amount carried over to the next year is 800 thousand rubles. You should remember the conditions of this problem.

Next, using a specific example, we will consider what exactly needs to be written down and on what lines, and what numbers should be reflected in the declaration form.

You should consider a living example of exactly which lines should be filled out in the 3-NDFL declaration. The conditions of the problem remain the same. Income for the previous three years was 300, 400 and 500 thousand, respectively.

So, the declaration for the first year is filled out.

An apartment was purchased last year, and this is the first time a deduction has been received for this period. In the column “Amount of actual expenses incurred for the purchase of housing”, write the amount of the tax deduction equal to the cost of the apartment - or 2 million if the cost exceeds this amount.

In the example, an apartment was bought for 3 million. Possible deduction – 2 million rubles.

The size of the tax base is income for the year - 300 thousand rubles.

The balance of the property tax deduction carried over to the next year is 1 million 700 thousand rubles.

What should the declaration look like for next year?

“The amount of expenses actually incurred for the purchase of housing” - the number from last year’s declaration is repeated here.

“The amount of property deduction accepted for accounting for the previous tax period” is a deduction for previous years of the declaration. Since last year the income was 300 thousand rubles, and they received a refund from it, then this number is written here too.

“The balance of the property tax deduction transferred from the previous year” is 1 million 700 thousand rubles.

The size of the tax base is 400 thousand rubles. This is income for the year.

Now all that remains is to calculate the balance of the property tax deduction that carries over to the next year. Income for previous years is subtracted from the tax deduction amount of 2 million rubles. In this case, it was only 300 thousand rubles. Income for the current year is also deducted - 400 thousand rubles. As a result, the balance carried over to the next year is 1 million 300 thousand rubles.

Now the declaration for the third year is being filled out. The amount of actual expenses incurred remains the same - 2 million rubles.

The amount of property deduction accepted for accounting for the previous tax period is a deduction for previous years of the declaration.

Since last year the income was 400 thousand rubles, and the year before 300 thousand rubles, then when these two figures are summed up, the result is 700 thousand rubles.

The balance of the property deduction transferred from the previous year is 1 million 300 thousand rubles.

The size of the tax base in the current year is the income received during the year - 500 thousand rubles.

All that remains is to calculate the balance of the property tax deduction that carries over to the next year. Again you need to subtract. The income for previous years is subtracted from the tax deduction amount of 2 million rubles. This is 700 thousand rubles. And also for the current year - 500 thousand rubles. And the result is a number - 800 thousand rubles.

In all subsequent years, the 3-NDFL declaration is filled out according to the same scheme. And this continues from year to year until the due tax deduction is fully returned.

Was the Recording helpful? No 45 out of 64 readers found this post helpful.

Second year of application of the property deduction: repeated 3-NDFL declaration

The situation when a property deduction can be applied for several years is typical for real estate purchase situations. For example, if the amount of personal income tax withheld from the taxpayer’s income (taxed at 13% personal income tax) for the period of filing 3-personal income tax is less than 260,000 rubles, the right to the balance of the unused deduction does not expire, but is transferred to subsequent periods.

Example

In 2021, stamper E. B. Lakhtina bought an apartment on the secondary housing market for RUB 1,760,000. During the specified period, personal income tax = 81,120 rubles was transferred to the budget from her salary. Amount of personal income tax to be refunded from the budget:

- calculated from the purchase price: RUB 1,760,000. × 13% = RUB 228,800;

- possible return (for 2021): RUB 81,120.

The balance of personal income tax that can be returned from the budget in subsequent periods: 228,800 – 81,120 = 147,680 rubles.

In 2021, Lakhtina E.B. got an additional part-time job in another company. At the end of 2021, the personal income tax transferred to the budget from the salary she received from 2 employers amounted to 127,000 rubles. - Lakhtina E.B. can return this amount from the budget by again submitting 3-NDFL and other required documents to the inspection (2-NDFL certificate for 2021, application for personal income tax return, documents confirming the purchase of housing).

The balance of the deduction is 20,680 rubles. (147,680 – 127,000) Lakhtina E.B. will return based on the results of 2021 if she again provides the necessary documents to the tax office.

What is a deduction for previous years in 3-NDFL?

In the declaration program, in this column you must enter the amount with which you returned income tax on the purchase of housing for all the years that you contacted the tax office with this question. Let's look at this with a small example.

- For two years in a row, the citizen filed a tax return for 2021 and 2017 in order to return previously paid tax. In 2019, when filing a return for 2021, he will need to indicate the deduction for previous years. He bought housing for 1,450,000 rubles.

- First, he needs to find out his income for this period, which was subject to taxes and for which he received deductions. Let’s say in 2016 his income, from which he returned his 13%, was 200,000 rubles, in 2021 - 250,000 rubles, in 2021 - 300,000 rubles. The total for 2016-2017 is 450,000 rubles; this figure, 450,000, is a deduction for previous years.

- The amount for the reporting year 2021 (300,000 rubles) is not included here, since you will receive a deduction for it

Results

The use of a property deduction allows you to return personal income tax from the budget (when purchasing real estate) or reduce the income tax payable (when selling property).

When filling out a 3-NDFL declaration for a property deduction, an individual needs to take into account many nuances (tenure of ownership of property, maximum allowed amount of deduction, etc.), and also collect a package of supporting documents (2-NDFL certificates, real estate purchase and sale agreement, transfer and acceptance certificate completed housing construction, etc.).

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Availability of official income

If we talk specifically about the return of personal income tax when purchasing an apartment for the second year, then tax legislation does not directly regulate this situation. However, it is understood that this right exists in its own right. The law limits it only to the maximum amount of personal income tax deduction for the purchase of housing:

| 2,000,000 rub. × 13% = 260,000 rub. |

Let us clarify that you can receive a tax deduction for the second year when purchasing an apartment, as when registering the first part: through the Federal Tax Service at your place of residence or through the employer’s accounting department.

Also see “Application to the Federal Tax Service for the right to a property deduction for personal income tax: form and procedure.”

In order to receive a property deduction for the second year when purchasing an apartment, you must obtain from your employer a certificate of income in Form 2-NDFL for this particular past year. The data from it is reflected in Sheet A of the 3-NDFL declaration:

Many declarants, when returning tax on the purchase of an apartment for the second year, are faced with the following problem: the inspectorate hints that they need to re-submit documents confirming the right to deduction. However, such a requirement from inspectors is illegal. In case of a controversial situation, refer to numerous clarifications from the Ministry of Finance and the Federal Tax Service of Russia. For example, letter of the Ministry of Finance dated June 7, 2013 No. 03-04-05/21309.