Filling out 3-NDFL when purchasing an apartment is a mandatory step when a taxpayer applies to the Federal Tax Service for a property deduction (more details about the property deduction are described in the article on the website). The document is drawn up according to the template approved by the Federal Tax Service Order No. ММВ-7-11/ [email protected] dated December 24, 2014 (as amended on October 25, 2017), that is, a new declaration form is in force in 2018. Registration of 3-NDFL when purchasing an apartment can be done using the free Declaration software, electronic services of your personal account on the Federal Tax Service website, or manually filling out a paper form. A declaration is submitted to the tax authority via the Internet or in person.

Deduction when buying an apartment

The amount of the deduction in the case of the purchase of real estate depends on the amount of funds spent on the purchase and the amount of personal income tax paid by the applicant (or on his behalf by the employer) for the reporting period. An example of filling out 3-NDFL would be relevant when purchasing an apartment, repaying a mortgage loan (to reimburse repaid loan interest) or implementing a residential construction project.

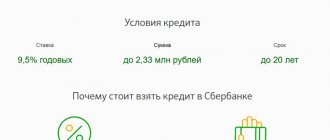

When applying for a deduction, you can offset the costs of several purchased objects within the established limits. The total maximum amount to which the property benefit applies is RUB 2 million. When repaying interest on targeted loans related to the acquisition of real estate, the limit is approved at the level of 3 million rubles. You can return 13% of these amounts, that is, 260 thousand and 390 thousand rubles. respectively.

3-NDFL new form 2021: sample filling

Regardless of the purpose of submitting the declaration to the tax authorities, it must contain:

- title page,

- section 1 - total personal income tax amounts to be paid or refunded,

- Section 2 – calculation of the tax base and personal income tax for each tax rate.

The remaining sheets and a new appendix to the 3-NDFL declaration are filled out if necessary, depending on the type of declared income and declared deductions.

The sample form 3-NDFL 2021 we present is filled out for an individual to receive social deductions for personal income tax for treatment and education. In addition to the mandatory sections of the declaration 1 and 2, in this case it was necessary to fill out sheet “E1” with the calculation of such deductions.

Form 3-NDFL in 2021 - sample

How to fill out 3-NDFL when buying an apartment

Filling out form 3-NDFL when purchasing an apartment is voluntary - it is required only when applying for compensation for a property deduction. In these cases, the composition of the document will vary.

Read also: 3-NDFL when buying an apartment - new form 2019

A sample of filling out 3-NDFL when purchasing an apartment will contain the following blocks:

- A title page presenting generalized information about the taxpayer (individual - applicant for the deduction).

- Sheet A, in the columns of which information about income received for the period under review is entered.

- Sheet D1 – calculation of the amount of tax benefit (deduction).

- Form 3-NDFL (purchase of an apartment) must contain information about the amount of income tax paid - Section 2.

- Section 1, which provides systematic summary data from the previous pages, on the basis of which the value of the tax to be reimbursed in favor of the taxpayer is derived.

Step-by-step filling out 3-NDFL (purchase of an apartment) must be done in the specified sequence. If there are income receipts from a source outside the Russian Federation or applied tax deductions of other categories in the reporting period, it is necessary to supplement the declaration with the appropriate pages. The rules for filling out 3-NDFL when purchasing an apartment are established by law. All empty columns in the document must contain dashes. Numerical values for personal income tax are rounded to whole rubles, other indicators are given to the nearest kopeck.

If filling out 3-NDFL when purchasing an apartment is done manually, then you can only use blue or black ink. When printing an electronic form yourself, a two-sided format is not allowed. Each completed page is numbered; the first number is always the title page. On each sheet, at the top of the form, the taxpayer’s full name and the TIN number assigned to him are repeated.

How to fill out 3-NDFL when buying an apartment:

- Information is entered into the cells of the title page in strict accordance with passport data and tax registration certificate (TIN). The information will be verified against copies of the passport and TIN.

- Income receipts are given for each place of work (if there are several). All numerical values must have documentary evidence. For this purpose, a certificate in form 2-NDFL is obtained from employers. This will ensure that 3-NDFL is correctly filled out when purchasing an apartment in part of Sheet A.

- At the next stage, payment documents related to the real estate purchase transaction are collected. In 3-NDFL (purchase of an apartment), the sample filling requires entering information about the purchased object - its location, cadastral or inventory number, data on registration of property rights. All this is entered into Sheet D1 along with the actual costs incurred to purchase the property or pay interest on the loan. If the object does not have a cadastral or inventory code, then code 4 is entered in cell 050, and the full address in columns 052. If you indicate the number assigned to the property, then you do not need to enter address data.

Read also: Certificate 2-NDFL for an employee 2019

How to fill out 3-NDFL when buying an apartment - all codes must be selected from the tables in the appendices to Order No. ММВ-7-11 / [email protected] When purchasing several objects and filing a deduction for them, sheets D1 are compiled separately for each object. If it is impossible to repay the entire amount of the deduction in one year, the balance can be carried over to the next tax period. A personal income tax refund when purchasing an apartment (the 2021 form can be found here) in this situation will be processed next year according to a similar scheme with the obligatory submission of a new declaration form.

3-NDFL: return for apartment

To fill out the report, use the form that is approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] dated 10/03/2018.

Let's look at filling with an example.

Ivanov I. I. purchased an apartment under a purchase and sale agreement on January 1, 2018. Its cost was 5 million rubles. The apartment was purchased using personal savings.

For 2021, Ivanov I.I. received 900 thousand rubles. as wages. From it, the tax agent (employer) paid personal income tax in the amount of 117 thousand rubles. in a year. Consequently, Ivanov I.I. is entitled to a property tax deduction in the amount of 117 thousand rubles for 2021. The balance of the property deduction that carries over to the next tax period is 110 thousand rubles. This amount is obtained by subtracting RUB 2 million from the maximum deduction amount. the amount of the taxpayer's salary for the year.

The following sections must be completed in the declaration:

- Title page;

- Sections 1 and 2;

- Appendices 1 and 7.

On the title page

We indicate the taxpayer's information. At the top we write down his TIN. Next, enter the adjustment number 3-NDFL. If we submit the primary report, we enter “0”. If we submit a clarifying one - “1”, “2”, “3” and so on (depending on the number of corrective declarations already submitted).

Then we enter the tax period code. In our example, this is a year. It corresponds to the code “34”. We indicate the tax period - 2018.

Fill in the section “Taxpayer Information”:

- country code - 643;

- taxpayer category code - 760 (other individual);

- FULL NAME;

- date and place of birth.

In the “Information about identity document” section, indicate the document code. In our case, this is a passport of a citizen of the Russian Federation. It corresponds to the code “21”. We write down its details: series, number, by whom and when it was issued.

Next, we indicate the taxpayer status code - 1. Contact phone number. The number of declaration sheets must be entered after all necessary sections and annexes have been compiled. In our example there are 5 of them. Then we indicate who exactly submits the declaration: the taxpayer personally or his representative.

Section 1

is intended to reflect the amounts of tax that need to be paid, paid additionally to the budget or returned from it. We fill in the following terms:

- 010 - code 2 (refund from the budget);

- 020 - KBK (budget classification code for 3-NDFL);

- 030 - OKTMO code;

- 040 - zero value;

- 050 - the amount of tax that needs to be returned (117 thousand rubles)

Since in our example one apartment was purchased, we leave the remaining fields empty.

In Section 2

We calculate the tax base and the amount of income tax. We indicate the information in the following lines:

- 001 — tax rate (13% for citizens of the Russian Federation);

- 002 - type of income (code 3 - other income);

- 010 - total amount of income (900 thousand rubles)

- 030 - total amount of income (900 thousand rubles)

- 080 - total amount of tax withheld from income (117 thousand rubles)

- 160 - total tax amount (117 thousand rubles)

Lines 010 and 030 indicate the total amount of income excluding the amount of profit of controlled foreign companies.

In Appendix 1

We reflect information about sources of income that are located on the territory of the Russian Federation.

We fill in the following lines:

- 010 — tax rate (13%);

- 020 - code of type of income (07 - wages);

- 030 — TIN of the source of payments (employer);

- 040 - gearbox;

- 050 - OKTMO.

In line 060 we write the name of the employer. In line 070 - the amount of income received in the reporting period - 900 thousand rubles. In line 080 - the amount of income tax paid from it - 117 thousand rubles. Since in our example the taxpayer works for one employer, we leave the remaining fields blank.

In Appendix 7

We calculate the property deduction. We fill in the following terms:

- 010 — object name code (2 — apartment);

- 020—taxpayer attribute code (01).

In line 030 we indicate the code of the object number. We know the cadastral number. Therefore, we enter the code “1” in the line. In line 031 we write down the cadastral number of the object. In line 032 - the address of the location of the property.

Line 040 is filled out if both parties to the agreement have entered into a deed of transfer of the property. In our case, the apartment was purchased under a purchase and sale agreement dated January 1, 2018. We enter this date in line 050.

In line 080 we indicate the maximum amount of costs (according to the law - 2 million rubles). Even if an apartment was purchased from us for 5 million rubles, we put down exactly 2 million rubles.

In lines 140 and 150 we indicate the tax base in respect of which personal income tax is calculated at the appropriate rate. In our example, this is 900 thousand rubles. In line 110 we enter the amount of the tax deduction, which goes over to the next tax period - 110 thousand rubles.

We sign each sheet of the declaration and indicate on it the date of creation of the document. Then we indicate the number of sheets in the declaration.

An example of filling out 3-NDFL when buying an apartment

The submitted declaration 3-NDFL (purchase of an apartment) - sample filling 2021 - is compiled according to the following data:

- Full name of the taxpayer – Sergey Vitalievich Mokhov;

- the purpose of filing a declaration with a set of documents is to formalize a property deduction when purchasing a home with a mortgage;

- declaration period – 2021;

- during the interval under review, he was employed at Luch LLC, the total annual income accruals amounted to 787,506 rubles;

- personal income tax paid by the employer is equal to 102,376 rubles. at a rate of 13%, there were no tax deductions;

- the purchase of the apartment cost 1,985,500 rubles, ownership rights were received on 02/05/2017;

- mortgage interest – 200,000 rubles.

Sample of filling out the declaration

What is needed to fill out the 3-NDFL declaration

First, you need to download the 3-NDFL 2021 declaration form, print it if filling it out manually, or fill out the form on a computer. The declaration using the new form can also be filled out using a special program already posted ]]>on the Federal Tax Service website]]>.

You can download form 3-NDFL 2021, current in 2021, below.

Data should be entered into the declaration after all necessary supporting documents have been collected. Information to be filled out is obtained from “2-NDFL” income certificates issued by the tax agent, from payment, settlement and other supporting documents, as well as from calculations that are made on the basis of these documents.