Limits on most tax deductions (for education, for treatment, etc.) are established only within one calendar year: each calendar year the “limit” is reset, and the deduction can be received again. In contrast, the property deduction for the purchase of a home contains more serious restrictions: both the maximum deduction amount and the number of times it can be used during one’s lifetime are legally limited .

Until 2014, there were restrictions according to which tax deductions for housing purchase expenses and loan interest could be obtained only once in a lifetime and only for one housing property. Since 2014, the deduction was allowed to be received for several residential properties, but the new rules were allowed to be applied only to new transactions (concluded after the entry into force of the new law). In this regard, many questions arose: in what cases what deduction restrictions apply? If you used the deduction earlier, in what cases can you “receive” it when purchasing a new home? Is it possible to get a deduction for credit interest if you previously only used the deduction for the purchase of housing?

In this article we will try to answer all these questions.

Please note: The key factor on which the property deduction limits depend is the date of purchase of the home for which you receive (or want to receive) the deduction. The “date of purchase of housing” for the purposes of this article should be considered: - the date of registration of ownership of housing according to an extract from the Unified State Register of Real Estate when purchasing under a sales contract; — the date of the transfer deed when purchasing housing under an agreement of shared participation in construction.

Deduction limits for housing purchased before January 1, 2014

If you purchased housing before 2014 and received (or plan to receive) a property deduction for it, then the “old” rules apply to you, according to which the deduction can be obtained strictly only for one property (paragraph 27, paragraph 2, paragraph 1, art. 220 of the Tax Code of the Russian Federation as amended, valid until 01/01/2014) and in an amount of no more than 2 million rubles. (260 thousand rubles to be returned). Moreover, even if you received a deduction less than the maximum amount, you will not be able to receive it additionally when purchasing another home.

Example: In 2008, Levashov I.I. bought an apartment for 500 thousand rubles. and received a tax deduction for it (returned 65 thousand rubles of taxes paid). When purchasing an apartment in 2021, Levashov I.I. will not be able to use the deduction again, since until 2014 the property deduction was provided only once for one housing property

The credit interest deduction for housing purchased before January 1, 2014 had no restrictions on the amount (you could return 13% of all mortgage interest paid), but it could only be received on the same property for which you received the principal deduction (deduction for purchase expenses). This is due to the fact that until 2014, the main property deduction and the interest deduction were not separated and constituted a single type of deduction (Article 220 of the Tax Code of the Russian Federation, as amended, valid until 01/01/2014).

Example: In 2012, Ivanchenko A.A. I bought an apartment and received a tax deduction for it. In 2013, Ivanchenko bought another apartment with a mortgage and wanted to get a deduction on loan interest. The tax office legally denied him the deduction, since for housing purchased before January 1, 2014, the main deduction and interest deduction could only be received for a single housing property.

However, it is worth noting that if you purchased a home before January 1, 2014 and only took advantage of the deduction for purchase expenses, then you can receive a deduction for credit interest on other housing, but only if it was purchased after January 1, 2014. We will look at this situation in detail below in the section - Is it possible to get a deduction for credit interest if you previously only used a deduction for purchase expenses?

Types of tax deductions

All citizens know about the need to pay taxes, but many do not even realize that the final amount can be reduced.

A tax deduction is an amount for which a citizen does not have to pay tax.

Many people think that this amount will be deducted from the total payment, but they are mistaken: you will not have to pay tax on this money.

It is important to know: if the deduction is 1,400 rubles, then the debt to the state will be reduced not by 1,400, but by only 182 rubles: 1,400 * 13%.

There are several types of deductions.

Standard. Determined by Article 218 of the Tax Code. This includes:

- 500 rubles every month for Heroes of the USSR and Russia, disabled people of groups 1 and 2, disabled people from childhood and those who participated in battles.

- 1,400 rubles for the first and second minor children.

- 3,000 rubles for the third and subsequent children. For example, if there are 3 children in a family, the deduction will be 5.8 thousand: twice 1400 and another 3000.

- 3,000 rubles per disabled child of groups 1 and 2.

- 3,000 rubles every month for disabled participants in combat operations and participants in the liquidation of nuclear accidents.

It is worth noting: if a citizen is entitled to several refunds (for example, for a disabled child), he can receive only one of them, the largest.

Social. This includes money spent during the year on:

- Education: This can be the education of the child or the parents themselves. In the first case, only full-time forms of education are taken into account (up to 24 years of age, if payment was made by parents, and up to 18 years of age, if by guardians), and you can receive no more than 50 thousand rubles for each. In the second, any options are accepted (day, evening, correspondence), but the amount grows to 120 thousand.

- Treatment: You can also get money back for providing medical care to your spouse, parents or minor children. The maximum amount is 120 thousand rubles, but in some cases, when receiving expensive treatment, the amount may be increased.

- Donations: Citizens' charity is not taxable, but the deduction amount should not exceed 25% of the total taxable income.

- Increasing a future pension: if a citizen decides to increase his own pension, he can put money into a savings account. It is not taxed, but you can return no more than 120 thousand rubles in this way.

Please note: if maternity capital was spent on training, there is no tax deduction.

Other options. These include:

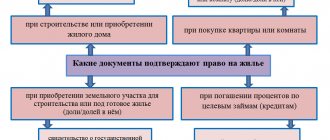

- Property: can amount to up to 2 million rubles. They are provided to people when purchasing real estate or land for future development, as well as when paying off a mortgage loan or interest on it.

- Investment: can only be used by citizens “playing” on the stock exchange. They are offered when selling securities, depositing money into an account and other situations.

- Professional: refer to individual entrepreneurs, lawyers and notaries, persons receiving royalties and some others.

Please note: older people do not have the right to relief, since they do not pay income tax of 13 percent to the treasury - in order to return the funds, it is necessary that able-bodied children or grandchildren “pay” for them.

You can only receive deductions for the last 3 years: that is, if your studies last for 5 years, the first 2 years will not be refunded.

If you didn’t already know, we recommend reading the article on how to get a 13% income tax refund for medical services.

Deduction limits for housing purchased after 2014

Since January 1, 2014, significant changes have been made to the Tax Code of the Russian Federation, according to which, if the tax deduction for the purchase of an apartment/house is not received in the maximum amount (i.e. from an amount less than 2 million rubles), then the remainder can be received when purchasing other housing properties (paragraph 2, paragraph 1, paragraph 3, article 220 of the Tax Code of the Russian Federation).

Example: In 2021 Ukladova T.I. I bought a room for 500 thousand rubles. and received a property deduction (returned 65 thousand rubles). In 2021, she bought an apartment for 3 million rubles. Ukladova T.I. will be able to receive an additional property deduction for the purchase of an apartment in the amount of 1.5 million rubles. (to be returned 195 thousand rubles).

New rules also began to apply to the deduction for credit interest on housing purchased after January 1, 2014:

- the deduction for credit interest is not related to the deduction for expenses for the purchase of housing and can be obtained for a separate object;

- The maximum deduction for credit interest is 3 million rubles. (to be returned 390 thousand rubles);

- unlike the deduction for expenses for the purchase of housing, the deduction for credit interest can be received only once in a lifetime for one property;

Example: In 2021 Panyukov E.I. bought an apartment worth 8 million rubles. To buy an apartment, he took out a mortgage in the amount of 6 million rubles. (on which he will pay interest in the amount of 3.5 million rubles) Panyukov E.I. will be able to receive a basic property deduction in the amount of 2 million rubles. (to be returned 260 thousand rubles), as well as an interest deduction in the amount of 3 million rubles. (to be returned - 390 thousand rubles).

Example: In 2014, Epifanova T.K. I bought an apartment and received a property deduction for purchase costs. In 2017, she bought a new apartment with a mortgage and will be able to receive a deduction for the loan interest paid.

Example: In 2014, A.A. Cherezov I bought an apartment worth 1 million rubles with a mortgage. Cherezov A.A. received a deduction for purchase expenses and a deduction for credit interest. In 2021, he purchased another apartment worth 3 million rubles. (also using credit funds). Cherezov A.A. will be able to receive an additional deduction for purchase expenses (since he did not use it in full), but will not be able to receive an additional deduction for credit interest, since it is provided only for one property.

How long does snus last?

How is nicotine absorbed and distributed in the body? The oral cavity contains a huge number of tiny capillaries into which nicotine enters. Snus usually contains soda, which is necessary for faster absorption of nicotine. It changes the acid-base balance in a person’s mouth, so within 10 minutes after consumption, nicotine from tobacco enters the human body. However, the brain suffers already in the first seconds after a person “throws in snus.”

How long does it take for snus to release?

How long snus stays in the blood depends on its ability to penetrate tissue and interact and bind to receptors. How long does it take for snus to leave the body? As a rule, the half-life is 2-3 hours, however, the rate of elimination of snus from the blood and urine is influenced by the state of a person’s health and the individual characteristics of his body. The time it takes for snus to disappear from the blood is influenced by the type of tobacco, the presence of a filter and other factors. It is important to know that the amount of nicotine that enters the body with chewing tobacco is enormous, much greater than when smoking regular cigarettes.

Receipt of deductions before January 1, 2001 is not taken into account

In conclusion of the article, we note that until 2001, the property deduction was provided on the basis of the Law of the Russian Federation of December 7, 1991 N 1998-1 “On personal income tax.” This law became invalid on January 1, 2001. Therefore, if you claimed a property deduction and all payments on it were made before January 1, 2001, then you can assume that you did not use the deduction . When purchasing another home (after January 1, 2001), you can again receive a property deduction (Letters of the Ministry of Finance of Russia dated February 13, 2014 N 03-04-05/5889, dated July 24, 2013 N 03-04-05/29229).

Example: In 1998, Klestova Y.F. I bought an apartment. In 1999 and 2000, she submitted 3-NDFL returns to the tax office and received a full property deduction. In 2013, Klestova Ya.F. I bought an apartment again. Since she received the full deduction before January 1, 2001, when purchasing an apartment in 2013, she will be able to take advantage of the property deduction again (according to the rules of Article 220 of the Tax Code of the Russian Federation).

Example: In 1999, Ezhov N.N. bought an apartment. In 2000, 2001, 2002 and 2003, he applied to the tax office to receive a property deduction. In 2021 Ezhov N.N. bought a second apartment. Since part of the deduction payments was made after January 1, 2001, N.N. Ezhov can receive a property deduction for an apartment purchased in 2021. can not.

If you have not yet purchased a home, we recommend our partner’s site-guide, APARTMENT-Bez-AGENTA.ru. This is an educational site for those who want to understand the rules for buying and selling apartments.

The legislative framework

The main regulatory document that controls taxation issues and the provision of the opportunity to use tax deductions is the Tax Code of the Russian Federation (document).

Information on the right and procedure for using this type of compensation is recorded in the following parts of the Tax Code of the Russian Federation:

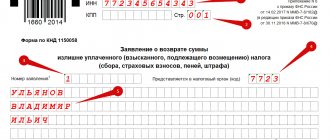

- Article 78 - contains step-by-step instructions that must be followed when receiving a deduction. As an example, paragraph 7 of this article indicates the deadlines for submitting documents that allow you to use a tax deduction;

- Article 219 defines the categories of all possible tax deductions that Russian citizens can take advantage of, and also fixes the nuances of receiving these payments.

In addition, the deduction algorithm, information on the tax agent, as well as the nuances of obtaining a tax deduction will be determined by Federal Law No. 85-FZ of April 18, 2018 “On Amendments to the Federal Law “On Basic Guarantees of the Rights of the Child in the Russian Federation.”