What is shared ownership

According to the provisions of the Civil Code of the Russian Federation, common property is divided into two categories, differing in the essence of ownership:

- Shared – certain shares are allocated in the ownership of property.

- Joint, in which the shares are not established in advance.

When a residential area comes into the possession of several persons and the shares are allocated in advance, shared ownership occurs. You can dispose of a real estate property only with the consent of the remaining owners, regardless of the size of the share. When all the owners live in the same living space, it is impossible to divide it among all in proportion to their shares. The co-owners must resolve this issue among themselves and divide the apartment, determining the procedure for use. If the problem cannot be resolved peacefully, they turn to the judiciary.

The Civil Code of the Russian Federation, in the first part of Chapter 16, covers issues of regulation of common property rights. When we are talking about shares, it is worth focusing on the provisions of a number of articles:

- Article 245 When the shares are not agreed upon in advance, they are considered equal. If money is invested in improving the condition of the living space, the size of the share increases in proportion to the financial investment.

- 246. Any of the owners can sell, donate or bequeath their share.

- 247. Each co-owner has the right to receive his share for use. If this is not actually feasible, compensation can be claimed.

- 248. Income received as a result of the exploitation of shared property is distributed among the owners by agreement. If it is not there, it is proportional to the shares.

Shared property is recognized when each owner is allocated a part of it. The apartment will be equally shared in the following cases:

- This is regulated by current legislation.

- The co-owners made this decision by mutual consent.

- Shares cannot be determined due to the impossibility of establishing the size of the share for each co-owner.

The Family Code of the Russian Federation (Article 39) regulates equal shares in property acquired jointly by spouses, provided that a marriage contract has not been concluded.

The legislation does not provide grounds for the emergence of shares in the right to real estate. There are no restrictions regarding subjective rights.

When married persons purchase residential space, it is considered joint property. The apartment is registered in the name of both spouses or one of them.

If real estate is purchased in shares, special attention is paid to the method of payment.

When each spouse contributes money for their part, this will not cause misunderstandings and questions from government authorities and the tax service in the event that citizens apply for a property tax deduction when purchasing an apartment in shared ownership.

Tax deduction when purchasing a share in an apartment

When purchasing a share in an apartment, you already incur expenses. The state compensates them by returning 13% of the purchase price, but not more than 260 thousand rubles per person. This rule applies to real estate purchased in 2014 and later. If your apartment was purchased before 2014, then the deduction is given for the apartment itself, regardless of the number of shared owners. To understand the difference, let's look at an example.

Citizen Vladimir Aleksenko decided to buy himself an apartment in 2016. Since he does not yet have money for the full cost of housing, he buys a “kopeck piece” with his brother Boris. A shared ownership agreement is drawn up - 1/2 share for each brother. The cost of the purchased 2-room apartment is 4.1 million rubles.

Since there is an agreement on shared ownership and the shares are determined, the expenses, as a general rule, are distributed in accordance with the shares: 2 million 50 thousand rubles were spent by each of the Aleksenko brothers. Moreover, everyone can apply a maximum tax deduction of 2 million rubles to the cost of their share in the apartment. Both Vladimir and Boris will receive 260 thousand rubles each.

But if they had bought an apartment in shared ownership in 2013, the state would have provided a deduction not to each shared owner, but for the entire property. That is, the Aleksenko brothers would have received only 260 thousand rubles for two, and not 260 thousand rubles each.

Return the right to a share in privatization

QUESTION :

asked by Minaeva Inna Anatolyevna (November 28, 2007) Hello. Please tell me. Several years ago, my husband notarized his share in the privatization, out of stupidity, according to his mother’s instructions. As a result, the mother-in-law became the sole owner of a 3-room apartment. Now my husband and I live in this apartment, since he is registered there. The relationship with my mother-in-law is very difficult; she threatens to force us out, without the right of inheritance, since she wrote a will for her daughter. The daughter is registered and lives in another place and has nothing to do with this apartment. Tell me, is it possible to return or revoke my husband’s refusal of his share in the privatization? Restore his rights to a share in this apartment? If yes, tell me where to start. Thank you

This is interesting: If the Pension Fund Does Not Transfer Maternity Capital Money Due to the Cessation of CPC Operation

ANSWER :

gives by "Premier" JSC Hello Inna Anatolyevna! Citizens who do not participate in the privatization of the occupied residential premises and who have expressed their consent to the acquisition of ownership of the residential premises by other persons living with them, retain the right to free acquisition of ownership, in the manner of privatization, of another subsequently acquired residential premises. Minors living together with the tenant and being members of his family or former family members, on the same basis as adult users, have the right to become participants in the common ownership of this premises. Refusal to include minors in the number of participants in the common ownership of privatized residential premises can be carried out by guardians and trustees, including parents and adoptive parents of minors, only with permission from the guardianship and trusteeship authorities. This transaction may be declared voidable or invalid by the court. In this case, it is necessary to prove that no more than 1 year has passed from the moment you learned or should have learned about the violation of your rights and interests, or the transaction was concluded with misleading and deceptive behavior. If necessary, we are ready to review your documents, give them a legal assessment and represent your interests in court.

Rules for obtaining a property deduction for shared ownership

To receive a tax deduction when purchasing an apartment in shared ownership, you must comply with a number of conditions. Algorithms for obtaining property deductions for shared ownership vary depending on the year the home was purchased.

The date of purchase of housing is the date indicated in the certificate of registration of ownership when purchasing under a purchase and sale agreement, or the date from the transfer documentation when purchasing real estate under an agreement of shared participation in construction.

| Home purchase date | Until January 1, 2014 | From January 1, 2014 onwards |

| Who can receive a tax deduction? | Tax resident of the Russian Federation, officially employed. An individual entrepreneur can also receive a deduction, but only on the OSN. Imputators, simplifiers, individual entrepreneurs on a patent or agricultural tax do not pay personal income tax and do not have the right to deduction. | |

| How many times can you get a deduction? | Once in a lifetime, one apartment at a time | Several times on different properties, but not more than the limit |

| When can you not get a deduction? | • housing was purchased from a dependent person (relative, guardian); • the taxpayer did not pay for the housing himself - his employer bought the apartment for him and provided it to him from the state. • if government subsidies were spent on housing or the employer helped, a deduction is provided for amounts spent in excess of the financial assistance of the state/employer; | |

| Income tax refund limit for purchasing an apartment | 260 thousand rubles. | |

| Income tax refund limit on mortgage interest | Absent | 390 thousand rubles. |

| What expenses are taken into account when calculating the property deduction? | • for the purchase of housing itself; • on interest on a mortgage loan; • for completion and finishing; | |

| What income is taken into account when determining the amount of tax refund? | • salary; • rental of property; • sale of property; • payments under the contract; | |

| What income cannot be taken into account for a tax refund? | • pensions; • state and regional benefits for child care, pregnancy and childbirth, etc. • dividends; | |

| How much tax refund can I get? | In one calendar year, you will be refunded no more than the amount of income tax paid by your employers for the calendar year (or the last 3 calendar years following the year you purchased the home). If the deduction amount cannot be exhausted in one calendar year, the balance is carried over to the next year. | |

| Tax deduction for shared ownership | Given in the amount of a maximum of 2 million rubles. for the entire property | Given in the amount of expenses of each share owner, but not more than 2 million rubles. to each share owner |

| Tax deduction for mortgage interest in shared ownership | No limit set | Limit of 3 million rubles. applies to the entire property |

| Where can I get a deduction? | At the tax office at the end of the calendar year of purchase | At the tax office at the end of the calendar year of purchase. Since 2015 – with an employer (or several employers). |

Who can take advantage of the deduction

Only the following citizens can apply for a personal income tax refund:

- Income tax payers. Those who do not work, do not pay personal income tax to the treasury, cannot have tax benefits.

- Tax residents of the Russian Federation. Art. 207 of the Tax Code of the Russian Federation covers the circle of persons who can receive a tax deduction. Resident status gives a stay on the territory of the state of 183 days within 12 months . In addition, the recipient of the deduction must be a personal income tax payer in accordance with Part 1 of Art. 224 Tax Code of the Russian Federation. By law, income tax is withheld from non-residents in the amount of 30% of earnings, however, after acquiring the status of a tax resident, the rate is reduced to 13% , and the deduction is applied to the reduced tax.

- Owners of purchased housing. If the shares in the new apartment are registered in the name of third parties, the buyer who made the payment will not be able to apply the deduction to his income. He will have to provide a document confirming the ownership of the housing (extract from the Unified State Register of Real Estate).

This is important to know: Allocation of a share in kind from the common property of a private house

Tax deduction when purchasing an apartment in shared ownership

If spouses purchase an apartment, one or more purchase and sale agreements are concluded.

The agreement must indicate the buyers, the share of each of them in the common property, but the cost can only be indicated for the entire object - without dividing the expenses of the husband and wife. Then it is considered that the expenses of each of the shareholders are proportional to their shares.

The amount of deduction will be limited to the amount of expenses of each co-shareholder.

If the receipt indicates one payer

A common situation is when one co-owner can document expenses (for example, a husband), paying the entire amount for the apartment, but the other co-owners cannot, although they also took part in the payment. The solution is to issue a power of attorney to the main payer.

According to the tax service (Letter of the Federal Tax Service dated May 17, 2012 No. ED-4-3/8135, Article 26 of the Tax Code of the Russian Federation), the payer can not only personally take part in transactions regulated by the legislation on taxes and fees, but also through his representative To do this, you need to issue a power of attorney.

It should be noted that a “trusted person” cannot be a tax official, a customs official, a representative of the internal affairs department, a judge, a prosecutor or a person engaged in investigative activities (Article 29 of the Tax Code of the Russian Federation).

Tax deduction and movable property, cost of repairs

When indicating the price of real estate in the purchase and sale agreement, you should specify whether the price of furniture, household appliances and other things transferred into ownership along with the apartment is included in it.

Trying to maximize benefits, owners add repair costs to the cost of housing. This is legal only if the sales documents (transfer deed) indicate that the apartment is being sold without renovation. You can compensate personal income tax from the amount spent on finishing the apartment after receiving a certificate of registration of ownership (Letter of the Ministry of the Russian Federation for Taxes and Duties dated December 16, 2004 No. 27-08 / [email protected] ).

Maximum amount of personal income tax “return” for the year

If a citizen has the right to property tax, its maximum amount for the year is equal to the amount of all income tax deductions made, but not more than 260 thousand rubles. (RUR 2 million X 13%). If the amount of annual contributions is not enough, the remainder of the deduction is transferred to the next calendar year.

Deduction when purchasing real estate in shared ownership

In general, the maximum amount of deduction that a co-owner of a residential property can claim is 2,000,000 rubles. Thus, the maximum amount of funds that will not be withheld from the owner’s income (will be returned by the tax authorities to the citizen’s account) can be 260,000 rubles. (RUB 2,000,000 * 13%).

1. You can use the property deduction for the purchase of real estate only once in your life. At the same time, the state allows the unused balance of the INV to be transferred to subsequent years without any restrictions. In addition, if the deduction amount is not completely exhausted when purchasing one object, the citizen has the right to use the balance of the INV when concluding a new transaction.

2. The benefit applies to property objects located on the territory of the Russian Federation.

3. The right to deduction arises from the year in which the ownership right is registered in the Unified State Register of Real Estate (the deed of transfer of real estate is signed between the developer and the buyer).

In what cases can you not take advantage of the deduction?

Property deduction does not apply:

1. If the parties to the transaction for the purchase and sale of a share in real estate are interdependent persons: husband and wife, parents (adoptive parents) and children; brothers and sisters; trustee and ward; ward and guardian;

2. If the payment for the share was made with the money of the employer or another person, at the expense of maternity capital or budget funds.

Distribution of the deduction amount between co-owners

The amount of the deduction directly depends on the date of purchase of the shared property. Until January 1, 2014, the deduction was tied to a specific property and was divided between co-owners in proportion to their shares. Therefore, if the property was acquired before the above date, then the INV is calculated as follows:

Amount of deduction = Total expenses for the purchase of housing (≤ 2,000,000 rubles) * Amount of the owner’s share.

If the share was acquired before 01/01/2014 in a separate transaction (not as part of a general agreement for the entire property), then the deduction is not distributed among the shares, and the owner has the right to receive it in full (in the amount of actual expenses, but not more than 2,000 000 rub.).

For example: An apartment purchased in 2013 under a common agreement for shared ownership for 3,000,000 rubles is owned by 2 citizens: the first owns 3/4 of the apartment, and the second – 1/4.

Until now, co-owners have not enjoyed the right to receive a deduction. The amount from which the size of the INV will be calculated for each of them is 2,000,000 rubles, since the cost of the apartment exceeds the established limit.

The first owner has the right to a deduction in the amount of RUB 1,500,000. (RUB 2,000,000 * 3/4). That is, he will be able to return 195,000 rubles from the budget. (RUB 1,500,000 * 13%).

2nd owner - in the amount of 500,000 rubles. (RUB 2,000,000 * 1/4). And he will be able to reimburse 65,000 rubles. (RUB 500,000 * 13%).

After 01/01/2014, the limit is 2,000,000 rubles. began to apply not to a real estate object, but to a person. That is, each co-owner can receive a deduction in the amount of expenses incurred, but not more than the INV limit.

If the amount of expenses of each individual co-owner of the property cannot be determined (the contract only indicates the total cost of the property), then the amount of the deduction is calculated as follows:

Amount of deduction = Total amount of expenses * Amount of co-owner's share,

but not > 2,000,000 rub.

Let's use the data from the previous example, but change the only condition: the apartment was purchased in 2021. Thus:

The first owner will receive a deduction in the amount of: RUB 2,000,000. (3,000,000 rubles * 3/4 = 2,250,000 rubles, which is > the maximum permissible amount, therefore the established limit is taken as the basis for calculating the tax). That is, a citizen will be able to receive 260,000 rubles. (RUB 2,000,000 * 13%).

The 2nd co-owner will receive an INV in the amount of: RUB 750,000. (RUB 3,000,000 * 1/4). And he will be able to return 97,500 rubles. (750,000 * 13%).

Distribution of deductions when purchasing a home by spouses

Spouses can purchase housing either in common ownership or in joint ownership.

In the first case, the specific share of each spouse is recorded in the Unified State Register of Real Estate, and the amount of the deduction also depends on the date of purchase of the property:

- before 01/01/2014 – INV is calculated in the same manner as for ordinary co-owners of shared ownership (in accordance with the size of the shares, example above);

- after 01/01/2014 – the size of the INV depends on certain circumstances:

1. Each of the spouses paid their share independently and has documents confirming the expenses - the deduction is distributed between the spouses in accordance with the expenses incurred.

For example: Semenov R.L. and Semenova K.D. bought an apartment in 2021 for 3,900,000 rubles. into shared ownership (each person's share is 1/2). At the same time, both husband and wife have documents in their hands confirming the costs of paying their share. The amount of deduction for each spouse will be 1,950,000 rubles, and the amount of tax refund will be 253,500 rubles. (RUB 1,950,000 * 13%).

2. The contract indicates the total cost of housing , and payment in full was made by one of the spouses - the amount of the deduction is distributed by the parties independently in any proportions, since in accordance with the RF IC, all expenses of the spouses are considered common.

For example: Kotov P.I. and Kotova A.A. bought a house in shared ownership in 2017 for RUB 2,500,000. (the share of each of them is 1/2). Despite the fact that the payment for housing was made in full by the husband, the spouses submitted an application to the Federal Tax Service for the distribution of actual expenses between the parties: 1,250,000 rubles. – husband’s expenses, RUB 1,250,000. - wife's expenses. Thus, each spouse will be able to receive an amount in the amount of: 162,500 rubles. (RUB 1,250,000 * 13%).

If housing was purchased by spouses as joint property, each of them by default has the right to a deduction in the amount of 50% of the value of the property, but not more than 2,000,000 rubles. (no more than 1,000,000 rubles, if the property was purchased before 01/01/2014).

In this case, spouses have the right to apply the deduction to each other in any proportion (even 100% and 0%).

If the cost of real estate exceeds 4,000,000 rubles. (2,000,000 rubles, if the property was purchased before 01/01/2014) – an application for distribution of the deduction does not need to be submitted; the INV is automatically presented to each of the spouses in the maximum allowable amount.

Distribution of deductions when buying a home in the share with children

A parent (adoptive parent, foster parent, trustee, custodian) who buys housing in a share with a minor child (natural, adopted, adopted, ward, ward) has the right to receive an INV for both his share and the child’s share.

For example: Mironova T.A. bought an apartment in shared ownership with her minor daughter in 2021 for 1,800,000 rubles. Despite the fact that T.A. Mironova’s share is 1/2, she has the right to receive a deduction from the full cost of the apartment: both for herself and for her daughter.

In this case, the number of other persons participating in the transaction does not matter.

For example: Petrova I.O., her parents Petrova T.K. and Petrov O.B. and a minor son purchased an apartment in 2018 for 4,000,000 rubles. (the share of each co-owner is 1/4). The deduction will be distributed as follows:

- Petrova I. O. – 2,000,000 rubles. (for your share and the child’s share: 4,000,000 rubles * 2/4), to be returned 260,000 rubles. (RUB 2,000,000 * 13%).

- Petrova T.K. and Petrov O.B. - 1,000,000 rubles each. each (4,000,000 rubles * 1/4), to be returned at 130,000 rubles. (RUB 1,000,000 * 13%).

Spouses who bought a home in shared ownership with children must independently decide which of them will increase their INV for the child’s share and in what amount.

For example: the Ivanovs, a married couple with many children, bought a residential building in common shared ownership in 2018 with their 3 children (the share of each co-owner was 1/5) for RUB 3,340,000. The couple decided that the husband would receive a deduction for the shares of two children, and the wife – for the share of one child.

Thus, the husband’s deduction amount will be: RUB 2,000,000. (3,340,000 rubles * 3/5 = 2,004,000 rubles, which is > the maximum permissible amount, therefore the established limit is taken as the basis for calculating the tax), the amount of tax to be refunded is 260,000 rubles.

And the size of the wife’s INV will be equal to 1,336,000 (RUB 3,340,000 * 2/5), personal income tax return will be RUB 173,680.

In this case, the child, for whose share the parent previously received a deduction, does not lose the right to use the INV, but can use it when purchasing another residential property after reaching the age of majority (recognition of legal capacity).

Distribution of mortgage interest deduction

In the case of purchasing an apartment on a mortgage (or other housing loan), the interest deductions are available to the co-borrowers in any proportion at their discretion by submitting a corresponding written application to the tax authority (Letter of the Federal Tax Service of Russia dated May 23, 2016 No. BS-3-11 /2315).

Where should spouses go to receive a property tax deduction?

After familiarizing yourself with the legislation and calculating the amount of the benefit, a dilemma arises: how to return personal income tax when purchasing a share in an apartment? Spouses can use one of 2 methods:

- Contact the tax office at your place of residence. Based on the documents provided, the amount will be returned for the calendar year or several previous years.

- Provide information about the deduction to the employer. Accounting will stop deducting income tax from wages.

Learn more about each option.

To the tax office

The algorithm of actions is as follows:

- prepare documents;

- contact the Federal Tax Service;

- wait until the documents are thoroughly checked (up to 3 months );

- receive notification of the results of the inspection (will arrive within 10 days );

- submit an application for a tax refund;

- wait for the funds to be transferred to your account, up to 1 month .

If, when filing a declaration, you received a notification about the need to come to the tax office, you must appear, taking with you the originals of the documents provided. There is no need to worry, the task of civil service employees is to ensure the reliability of the data and clarify controversial issues.

To the employer

To receive a personal income tax deduction, an employee of an enterprise must:

- Prepare documents.

- Contact the tax office at your place of registration. A government agency employee must verify that the applicant is eligible to receive the deduction. Within 30 days, the taxpayer will receive a notification confirming the legality of the benefit.

- Contact the company's accountant with a request to reduce the personal income tax base.

The possibility of an early refund should be discussed with the management of the organization. Until 2021 , it was assumed that the termination of personal income tax withholding should begin from the month of submitting the application to the accounting department of the enterprise. Changes were subsequently made. According to Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated March 21, 2016 N 03-04-06/15541 for citizens who applied not from the first month of the tax period, the calculation is made for the months of income received from the beginning of the year on an accrual basis. The previously paid personal income tax amount must be returned as over-withheld.

Accounting staff may consider recalculation impossible or difficult and suggest filling out a declaration in Form 3-NDFL at the end of the year in order to return the amount of uncompensated tax for the months preceding the application to the enterprise. The employee himself is free to choose - to conflict and receive the entire deduction amount at work, or to contact the tax service at the end of the year.

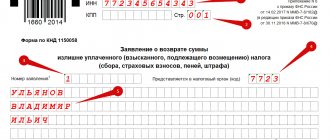

Documentation

To get a tax refund when spouses purchase a share of an apartment, you must provide:

- a statement reflecting the proportional distribution of taxes between husband and wife (if necessary, attach a statement on the distribution of benefits for mortgage interest);

- a document certifying the fact of transfer of funds from co-shareholders to the seller of the apartment (for mortgage lending - calculation of interest payable; loan agreement);

- declaration 3-NDFL (only if tax refund is made through the tax office);

- certificate 2-NDFL from the place of work of the husband and wife;

- Marriage certificate;

- a child’s birth certificate, if a share in the property of a minor is acquired and it is planned to use his property deduction;

- documents on ownership of the apartment;

- an application for receipt of a deduction indicating the details of the bank where the returned personal income tax will subsequently be received;

- application to notify the employer if the deduction is made at the place of work.

Documents can be submitted to the tax office in person or sent by mail with a list of attachments. The latter method does not require a visit to a government agency, but if any documents are missing, you can find out about this only after 2-3 months , when the inspection takes place. Therefore, it is better to immediately contact the service in person and make sure that the inspector has no questions.

Reasons for refusal

A desk audit may result in a refusal to provide a property tax deduction. The most common reasons:

- the couple acquired shares in the apartment through subsidies;

- spouses do not pay personal income tax to the budget;

- A woman on maternity leave contacted the tax office;

- the deduction was received earlier;

- shares were acquired from a related party;

- the property was purchased by the employer;

- the object is unfinished.

To avoid receiving a refusal, you must consult with a specialist before contacting the tax service. Buying an apartment by spouses is a responsible, costly process that requires knowledge of the law.

Maximum amount of tax refund

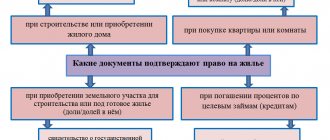

The state returns 13% of the deduction amount. The maximum deduction for the purchase of housing is 2 million rubles per person, not counting interest on the loan. This amount has been established since 2008. Previously, the maximum deduction amount was 1 million rubles. To determine the maximum amount of tax refundable, it is necessary to determine the moment when the right to this refund arises, namely:

– when purchasing an apartment in a building under construction (share participation agreement, assignment of rights agreement), this moment is the signing of the acceptance certificate for the finished apartment;

– when purchasing finished housing (purchase and sale agreement) – date of registration of ownership.

Since 2014, the deduction for mortgage interest has been limited to 3 million rubles; previously, the amount of deduction for interest was not limited.

How to get the maximum deduction quickly and easily?

The easiest way is to quickly prepare the correct documents for the maximum refund and submit these documents with the Tax Office. With the Tax Inspectorate, the documents will be approved and you will not have to redo them. You will receive the correct documents and expert advice. And then you can choose whether to take the documents to the inspectorate yourself or submit them online.

Can I return the share of the apartment that I gave up during privatization?

in 2006, group A and group T, a budgetary institution provided ownership of an apartment for social rent. During privatization, group T gave up its share of the property, there are documents for this. Gr.A concluded a purchase and sale agreement for this apartment with us, now Gr.T has filed a lawsuit to have her share in this apartment recognized, and wants our agreement to be declared invalid. What are her chances? and what do we have? Help

In accordance with Article 2 of the Law on Privatization, Citizens of the Russian Federation who have the right to use residential premises of the state or municipal housing stock on social rental terms have the right to purchase them on the terms provided for by this Law, other regulatory legal acts of the Russian Federation and regulatory legal acts of the constituent entities of the Russian Federation Federation, into common ownership or into the ownership of one person, including a minor, with the consent of all adults and minors aged 14 to 18 years who have the right to privatize these residential premises.

Deduction for the amount of interest on the loan

In general, a property deduction for repaying interest on a mortgage (refinancing a loan) is provided in the amount of expenses actually incurred, but not more than 3,000,000 rubles. The maximum amount of tax savings - funds that will not be withheld from the owner's income (will be returned by the tax authorities to the citizen's account) can be: 390,000 rubles (3,000,000 rubles * 13%). The above limit is valid from 01/01/2014. Interest on mortgage loans received before this date can be included in the deduction in full (without taking into account the limit of 3,000,000 rubles).

Note:

- The right to use this type of property deduction is also not limited by any time limits, but it can be used once throughout life and only in relation to one piece of real estate, even if the deduction amount has not been fully exhausted.

- INV on interest can be obtained only after the right to the main deduction for the purchase of housing has arisen.

The procedure for distributing the deduction between co-owners who are co-borrowers also depends on the date of acquisition of shared ownership:

1. Until 01/01/2014 . INV percentage is distributed in proportion to the shares of co-owners.

For example: spouses bought an apartment using a targeted loan in 2013 for 2,000,000 rubles (each spouse’s share is 1/2). The main deduction was fully repaid by the spouses in 2021. At the end of 2021, the spouses decided to declare an INV for interest paid for 2013-2018 in the amount of 1,140,000 rubles, 570,000 rubles each. for each of them (1,140,000 * 1/2). Consequently, both husband and wife will be able to return 74,100 rubles from the budget. (RUB 570,000 * 13%).

2. After 01/01/2014 . INV is distributed in any proportion at the request of the co-borrowers.

For example: Semenova M.L. and her adult son Semenov V.V. bought an apartment in common shared ownership in 2015 using borrowed funds. In 2021, the co-owners fully repaid the main INV for the purchase of an apartment, and at the end of 2018 they decided to claim a deduction for the interest paid for 2015-2018. Since in 2021 Semenova M.L. retired and no longer has taxable income, the owners decided that the interest deduction in full will be received by Semenov V.V. In 2021, the co-owners will attach an application for the distribution of INV to the package of documents for the Federal Tax Service : 100% – Semenov V.V., 0% – Semenova M.L.

The proportion of distribution of interest deductions between co-borrowers can be changed annually.

Sometimes one of the co-owners of the mortgaged property acts as the main borrower. Accordingly, all loan payments are received by the bank on its behalf.

In this case, the remaining co-borrowers can claim a deduction if they submit to the Federal Tax Service a written power of attorney to transfer funds to repay interest on the loan to the person who actually pays them (it is advisable to obtain additional advice on this issue from the tax office at your place of residence).

Is it possible to return a share of an apartment inherited after registering a relinquishment of it?

Hello, we have the following problem: my husband’s father died when he was a minor, his share was 1/2, after he came of age, out of his gullibility and at the insistence of his stepmother, he abandoned his father’s share. she promised to buy him an apartment in the future, but this did not happen. Is it possible to return the father’s share, which he refused out of trust.

This is interesting: Veteran of Labor of the Ministry of Internal Affairs turns 55 Benefits in Moscow Tagansky District

In this case, there are no grounds for recognizing the transaction as invalid unless you prove that the gift transaction was made by the husband in a state where he was not able to understand the meaning of his actions or manage them, and also if the transaction was made under the influence of a significant misconception.

If payment documents are issued for only one owner

In practice, a situation may arise when payment for the cost of an apartment occurs on behalf of only one of the owners (for example, from his bank account), but in fact all owners bear the costs. In this case, in order for other owners to receive a deduction, documents confirming their expenses must be provided to the tax office. Such a document may be a handwritten power of attorney to transfer funds to pay for an apartment to the person who made the payment (in addition to the main payment document). The power of attorney can be written by hand in free form and does not require notarization (Letter of the Federal Tax Service of Russia dated May 17, 2012 No. ED-4-3/8135).

Example: In 2021, Orlova E.V. with his sister T.V. Orlova We bought an apartment in common shared ownership for 4 million rubles (each sister’s share was 1/2). The cost of the apartment was paid from the account of E.V. Orlova. At the end of the calendar year (in 2021), each of them submitted documents to the tax office to receive a deduction in the amount of 2 million rubles (to be returned 260 thousand rubles). Orlova T.V. To the main package of documents she attached a copy of the power of attorney, which indicated that she gave it to her sister Orlova E.V. 2 million rubles to pay for your share of the apartment through a bank account.

The situation is similar with the deduction for credit interest. Even when payments under a loan agreement were actually made on behalf of one of the co-owners (for example, the main borrower), other co-borrowers can also receive a deduction by submitting documents to the tax office confirming their expenses for paying loan interest. Such confirmation may be a handwritten power of attorney to transfer funds to pay mortgage interest to the person who made the payment.

Example: Alushtin S.S. with his daughter Milova A.S. bought an apartment in common shared ownership for 4 million rubles (the share of each of them was 1/2). To purchase an apartment, they took out a mortgage loan in the amount of 3 million rubles, where Alushtin S.S. was the main borrower, and Milova A.S. - co-borrower. The father and daughter also paid the mortgage in equal shares, although virtually all payments on the loan were made by Alushtin S.S. from your bank account. Despite the fact that the mortgage payments were made by the father, Milova A.S. can count on a deduction for mortgage interest in the amount of her expenses by submitting to the tax office a handwritten power of attorney, according to which she transferred the money to father Alushtin S.S. to pay mortgage interest on the loan.

Legal refusal of a share in a privatized apartment - why is it needed and how to arrange everything correctly

This type of renunciation means a renunciation of all property rights to the apartment. This means that the citizen retains the right to live in the living space indefinitely, but when deciding to sell the apartment, his opinion will not be taken into account.

The procedure for privatization of real estate is carried out by municipal authorities. Therefore, the specified package of documents is submitted to the Housing Policy Department at the address of the privatization object. After submitting all the required documents, the process will be completed in a few months, after which you will become the owner of the property.

12 Jun 2021 uristlaw 873

Share this post

- Related Posts

- To Obtain Russian Citizenship What Lugoti Does Chernobil Participants Have?

- Where Can You Find Archive Documents About Deprivation of Parental Rights

- Benefits for participants in the liquidation of the accident at the Chernobyl nuclear power plant in 2021

- How Much Northern Experience Do Women Need to Retire?