Hello, dear guests of the blog, today we will consider a topic such as a mortgage loan in Sberbank, since this information may be of interest to all our compatriots who are planning to take out a mortgage loan in the described banking structure.

If you are just planning to purchase your own home with borrowed funds, then it will be useful for you to know that when applying for a mortgage loan, in addition to the main agreement, you will have to sign an additional document, on the basis of which the property you purchased will act as collateral for the loan issued to you. This document is called a mortgage note and without signing it, you simply will not be given a loan.

What is a mortgage on an apartment

A mortgage for a bank is a security that gives the lender the right to recover costs associated with the borrower's insolvency by reselling the mortgaged property. In Russia, this registration procedure is optional only when working with banks that have good financial reserves.

The credit institution is interested in drawing up the document, because it serves as a guarantee of the return of funds on the housing loan. The borrower must be extremely careful when signing, because the collateral, in most cases, becomes the only home. In the event of a conflict between the parties, the court considers a case based not on the mortgage agreement, but on the mortgage.

| Mortgage debt, rub. | Monthly savings, rub. | Refinancing costs | ||

| — 1% | — 2% | — 3% | ||

| 1 million | 500 | 1000 | 1500 | 15500 |

| 1.5 million | 800 | 1600 | 2400 | 21000 |

| 2 million | 1050 | 1600 | 3100 | 26500 |

| 3 million | 1600 | 3200 | 4600 | 37500 |

| 4 million | 2150 | 4250 | 6300 | 48500 |

| 5 million | 2825 | 5560 | 8250 | 59500 |

| 6 million | 3500 | 6870 | 10200 | 70500 |

The mortgage comes in several forms:

- in the form of a paper document;

- electronic.

The document is valid only until the payer repays the loan in full. Before this, the lender does not have the right to sell the mortgage for his own purposes without the client’s permission.

Mortgage adjustment

When a client takes out a loan from a credit institution, the best guarantee that the bank will receive its money in full is the presence of collateral. Mortgages are no exception. According to it, the best guarantor of debt repayment is collateral in the form of the borrower’s valuable real estate.

You need to be very careful when taking out mortgages, as making subsequent adjustments can be a difficult process. You cannot change the data in it after it has been completed and signed by bank employees. If the client needs to enter a new piece of property as collateral or change any information, he will have to draw up a new document. It is worth remembering that if adjustments are made, the mortgaged property agreement, like any other document in such cases, will lose its force. And if any controversial issue arises, it simply will not have legal force.

In order to avoid difficulties with adjustments and controversial issues, it is better to carefully consider entering data into the mortgage from the very beginning. Check the document carefully before signing.

Description of the document

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

The requirements, registration and form of the mortgage note are set out in Federal Law No. 102-FZ dated July 16, 1998. The third chapter of the law is devoted to the execution of the document, its issuance, registration and restoration.

Functions

Main functions:

- The mortgage allows the borrower to live in the mortgaged apartment, but prohibits its sale, gift or exchange.

- The document confirms that after full payment of the debt, the payer becomes its full owner.

- The paper protects the rights of the mortgagor when it is resold to another beneficiary, since he cannot change the terms of the mortgage loan.

A mortgage is given legal force only after registration with Rosreestr; until this moment it is not considered an official document.

Requisites

List of details required by law:

- Information about the bank. It is important to indicate the name, payment details, contact information and license number.

- Payer information. The document contains the borrower’s personal data and email address for sending the web version of the mortgage.

- Information about the subject of the pledge. A complete description of the object, its estimated value, and all registration documents are indicated.

- Lending terms. It is important to specify the full loan amount, repayment period, payment procedure and interest rate.

- Date of execution and signature of the parties to the transaction.

Example document:

Since the beginning of last year, the state has obliged Sberbank to issue electronic mortgages through the Rosreestr portal.

What does a mortgage look like?

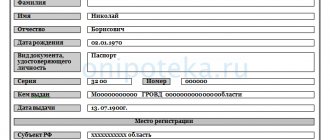

A sample mortgage for an apartment under a Sberbank mortgage is a form divided into 10 points:

- Pledger. This section is devoted to the borrower’s personal data.

- Debtor. The information is duplicated from the first paragraph if it is the same person. Otherwise, a separate form is drawn up for each debtor.

- Initial mortgagee. In most cases, it is a legal entity, so all the details and contact information of the company are written down.

- An obligation secured by a mortgage. This section includes mortgage loan information.

- Subject of mortgage. The paragraph is devoted to collateral and its description.

- Information about the time and place of notarization of the contract.

- Information about the right by virtue of which the subject of the mortgage belongs to the mortgagor. The block reveals the legal side of the transaction and explains why the borrower cannot dispose of the property until the mortgage is paid in full.

- Mortgage Loan Data. Information from the loan agreement is written down: payment, payment deadline, conditions for NPV and RAP.

- Information about the state registration of the mortgage in Rosreestr.

- The date a mortgage is issued to the primary mortgagee.

You can obtain a sample mortgage note from your bank for review.

You can study the first pages of the document from the photo:

How to apply for a mortgage at Sberbank

In most cases, the registration of a mortgage at Sberbank is entrusted to bank employees. Documentation is prepared after signing the transfer and acceptance agreement.

Documents for mortgage note

It is necessary to prepare the following documents for registration of a mortgage note:

- borrower's passport;

- act of acceptance and transfer of future collateral real estate;

- an extract from the Unified State Register for this house;

- registration certificate;

- mortgage agreement;

- appraiser's report on the purchased apartment;

- insurance contract;

- receipt for payment of state duty.

Based on the assessment results, in order to obtain a mortgage from Sberbank, the authorized person issues the borrower 2 copies of the report: the first remains with the credit manager for registration of the security, and the second is sent to Rosreestr.

Payment of state duty and signing of the contract

The mortgage is issued together with the title to the property. Therefore, the state duty depends on the form of the person receiving the title:

- For citizens – 2 thousand rubles.

- For legal entities persons – 220 thousand rubles.

After payment, you must hand over the receipt to the lender, and then sign the executed mortgage.

Mortgage registration

Having collected all the documents for registering a mortgage, you need to visit the territorial representative office of Rosreestr. Since 2021, borrowers have access to online registration using an electronic signature. The mortgage is drawn up in a special form and registered automatically.

Pros and cons of electronic mortgage

Any innovation must be tested before it becomes possible to draw a conclusion about its need and usefulness. The use of electronic mortgages in Rosreestr was supposed to lead to an improvement in the work of the government agency. A year after the introduction of the innovation, the following advantages can be noted:

- The waste of time and money on working with paper documents has been reduced. Previously, large resources were involved in the transmission, preparation for transfer to the archive and storage of documents.

- It is almost impossible to lose the electronic form of a security, which means there will be no problems with its restoration.

- The procedure for encumbering real estate has been significantly simplified, both for the mortgagee and for the registering authority.

- Electronic interaction between participants in a mortgage transaction saves a lot of time.

Recommended article: Which bank should a foreign citizen get a mortgage from?

The advantages of an electronic mortgage for a bank are obvious. He is sure that the property is encumbered with a mortgage immediately after signing the loan agreement. But the new method of registering a pledge also has disadvantages:

- Each participant in the transaction must receive an electronic digital signature (). Without it, it is impossible to submit documents for registration. Borrowers will have to pay for the production of digital signatures and the transfer of documents through a banking specialist. In particular, at Sberbank an electronic transaction will cost 7-8 thousand rubles (including the production of a digital signature);

- Despite the secure connection, there is a possibility of loss of transaction data.

Many banks still use a paper version of the mortgage note. It is too early to talk about the widespread implementation of remote document management.

Mortgage after debt repayment

Each borrower, after paying off the home loan in full, is required to withdraw the mortgage from Sberbank. The document can be obtained at the branch where the payer took out the mortgage.

How to get a mortgage from Sberbank after repaying the mortgage

The mortgage can only be returned when the final payment is made and the mortgage is closed. After this, the payer must contact the credit institution with an application to issue the document. The return period can take up to 30 days; the bank is obliged to check all receipts and mark the absence of claims.

To obtain a mortgage from Sberbank, you do not need to present an equity participation agreement, a loan contract or collect documents from the list. The bank will independently send the necessary documents to Rosreestr.

What to do with the mortgage after paying off the mortgage loan

As soon as the borrower receives a mortgage with a mark, he is obliged to visit Rosreestr to remove the encumbrance from his own home. The following documents must be collected:

- Payer's passport.

- Application for removal of encumbrance.

- Mortgage agreement.

- Mortgage note with a no-claims note.

- Document of ownership.

Removal of the encumbrance is carried out within 3 working days.

What operations can Sberbank perform with a mortgage?

Legal powers of the lender after receiving the mortgage:

- Assignment of rights to another bank. In this case, the terms of payment for the borrower remain the same, only the current account number changes.

- Mortgage exchange. The bank has the right to exchange the mortgage for a security of another bank with an additional payment.

- Partial implementation. For some time, the bank may transfer the right to receive monthly payments to another credit institution. In this case, the current account number does not change.

In rare situations, Sberbank uses mortgages to replenish working capital. It issues mortgage-backed securities and markets them as an investment product with good returns.

Can Sber sell a mortgage?

Based on the Civil Code of the Russian Federation, the bank is not obliged to agree with the borrower on the transfer/assignment of the right to claim the debt. The lender may notify the client of the upcoming mortgage sale. A banking organization has the right to resell the security of even the most disciplined payer.

What to do if you lose your mortgage

If a mortgage on a home was issued only in paper form, then there is a risk of losing it. There is no way to protect yourself from this, since the borrower does not have the right to keep the original.

If you are lost

In fact, it is impossible to lose the mortgage, since it is deposited with the bank, i.e., loss is possible only on the part of the creditor who received it. If an electronic version of the document was issued, then its loss is also unrealistic.

If you lost the bank

The fact that there is no mortgage on a mortgage with Sberbank is revealed after the debt has been fully repaid. Most often, a document is lost during interbank movements between departments and offices.

If the lender independently notices the loss of the document, then he is immediately obliged to inform the borrower about this, issue a duplicate and register it with Rosreestr.

The electronic form was created specifically for the bank in order to eliminate the possibility of loss of the document.

Mortgage concept

A mortgage in a bank is a document certifying the right of the mortgagee (in our case, the bank) to an object purchased using loan funds (). It confirms the registration of a mortgage on an apartment or other real estate. When situations defined by law occur, the bank has the right to use the mortgage to return the borrowed funds issued to the client (). It guarantees repayment of the loan regardless of the financial situation of the borrower through the sale of property.

✅It is worth noting that a mortgage without a mortgage is possible. The bank has the right not to register it, but, as a rule, the security is still registered when issuing a home loan.

A mortgage on an apartment under a bank mortgage can be issued in paper or electronic form. Legally, both formats of securities are equivalent (). Banks are increasingly switching to registering electronic mortgages, because this saves time and allows you to verify the fact that the loaned object is pledged.

Registration of a mortgage is completely under the control of the bank; the borrower does not participate in this process. He only needs to put his signature on the security and submit it for registration to government agencies. Or give consent to issue a mortgage via remote communication channels.

The document is signed by the bank issuing the loan when drawing up a loan agreement or after registering ownership of a new building. Where is the mortgage note kept after the mortgage is registered? The original mortgage remains with the lender, who places it in his own escrow for safekeeping. It can only be transferred to the client after the mortgage loan has been fully repaid. Without this copy of the mortgage note, it will be impossible to remove the mortgage on real estate.

The mortgage obligation fulfills the following functions:

- certifies the mortgagee's right to the property;

- allows you to attract fresh financing through the sale of mortgages.

Recommended article: Mortgage arrears - consequences and what to do

In the latter case, the mortgagee changes. The right to sell a security is usually provided for by banks (). Although mortgage clients do not pay any attention to this point when signing documents, and then they are surprised on what basis the lender transferred the mortgage to a third party.

✅Please note that the terms of the mortgage and loan agreement with the bank must match. Be sure to check their compliance when signing the documentation.

❗Important to know: What is an Electronic mortgage note

The bank sold the mortgage - what does this mean for the borrower?

What does a mortgage by force of law mean and when does it arise?

conclusions

A mortgage is a document that guarantees the bank that if the borrower fails to repay the housing loan, he will be able to sell the mortgaged property and cover his own costs. This security has priority over the mortgage agreement.

A mortgage on an apartment is issued in the bank that issued the housing loan, and is registered in Rosreestr. Afterwards it is transferred for storage to a credit institution or electronic depository.

You can make a mortgage at Sberbank in two weeks by paying the state fee.

The procedure for execution and registration of a mortgage

The mortgage registration procedure includes the following steps:

- Drawing up a document by Sberbank according to the form/example approved in 102-FZ (before the borrower signs, it is important to check all the details and conditions of the upcoming transaction).

- Payment of state duty.

- State registration in Rosreestr (the corresponding mark is affixed).

- Transfer for storage to the depository.

Important! If the loan agreement/mortgage agreement and the Sberbank mortgage have discrepancies or inaccuracies, then it is important to understand that it is the latter that has higher priority.