What is an encumbrance

The term "encumbrance" means any restriction on the owner's rights to use real estate. For example, such an encumbrance could be a ban on changing data on an apartment in the Unified State Register of Real Estate - in Russia, all transactions must be registered in this database. Therefore, sometimes the encumbrance is also called a “prohibition on registration actions.”

All encumbrances can be divided into two types:

- Forced. For example, when an apartment is seized for debts.

- Voluntary. For example, when a person himself pledges property in order to borrow money.

Encumbrances associated with a mortgage are regulated by several articles of Federal Law No. 102 “On mortgage (real estate pledge).” It spells out all the rights and obligations of both the apartment owner and the mortgagee, that is, the bank. For example, according to Art. 29 of this law, you can “derive fruits and income from the property pledged under a mortgage agreement.” And in Art. 40 states that you can rent out encumbered real estate, unless otherwise provided in the agreement with the bank.

In the case of a mortgage, the encumbrances must be removed when you pay off the entire loan, whether on time or early.

Lifehack

When you repay your mortgage early, ask the bank employee to calculate the payment with interest not on the repayment day, but on the next day.

This way you will protect yourself from possible problems. For example, a month after repayment, it may turn out that you have not repaid the loan in full, and only one banking day’s interest remains.

Therefore, it is better to overpay for an extra day, but definitely close all debts.

What to do with insurance

Actions after repaying a mortgage loan from Sberbank usually include problems with insurance. However, they are only relevant if the debt was closed ahead of schedule. In a normal situation, an insurance policy is issued strictly before the date of full repayment of the debt. As a result, after closing the loan, no problems arise with it. But if the debt was closed ahead of schedule and the policy is still valid, you can try to contact the insurance company and demand to close the policy ahead of schedule, returning at least part of the money.

In practice, the impossibility of such actions is usually stated in advance in the insurance contract, so such requirements will lead to nothing. And even if for some reason there is no such clause in the contract, you can wait a very long time for your money and the closure of the policy. And can't wait. Insurance companies are very reluctant to part with the funds received.

How can you remove the burden?

In short, there are three ways to get rid of the burden.

The bank will do everything itself.

There are credit institutions that remove the encumbrance themselves; the borrower only needs to pay off the debt. The bank manager himself will collect the documents and send them to Rosreestr, and then officials will change the data in the apartment card in the database. Then you can order an extract from the Unified State Register of Real Estate to ensure that the process is completed.

On average, removing the encumbrance in this case takes about two months - a month and a half for collecting documents, another 10 days for the work of Rosreestr.

Banks are not obliged to remove the encumbrance themselves - check with the mortgage manager to see how things are going at the institution. If there is no such service, you will have to do everything yourself.

Through the Internet.

The method is suitable if you have a qualified enhanced electronic signature - now this costs about 4-7 thousand rubles.

You need to collect all the documents, send them to Rosreestr through a special service and wait for the encumbrance to be lifted.

At the MFC.

You can submit documents and write an application at the multifunctional public services center in your region.

Procedure for issuing a mortgage

A mortgage is a document, a security issued by the bank when signing a loan agreement, which confirms the pledge of your property. When registering a transaction at the MFC, the mortgage, as well as the purchase and sale agreement, is submitted for registration, but only a bank employee can receive it. And it is stored in the bank until the debt under the loan agreement is fully repaid.

The procedure for obtaining a mortgage after repaying the mortgage

:

- The client will find out the balance that must be paid if he plans to pay off the debt early. This can be done at a bank branch, by phone or via SMS, online banking. Or the last payment is made according to the payment schedule.

- To issue a mortgage after repaying the mortgage, the client contacts the bank.

We also recommend that you order a certificate confirming the absence of debt under the loan agreement. The certificate and mortgage are issued free of charge. A note is made in the mortgage about the fulfillment of the obligation in full.

Recommended article: Where is the best place to get a mortgage for a secondary home?

The certificate itself consists of the following details:

- Loan repayment date, loan agreement number;

- Date of filling out the certificate;

- Full name of the borrower and the bank employee who issued the certificate;

- Record of debt repayment.

How to remove a burden yourself

If the bank does not remove the encumbrance itself, you can do it yourself. Here are the step-by-step instructions.

Step 1: Gather your documents

You need to obtain two documents from the bank.

Request a certificate of full repayment of the loan.

The application is written according to the bank's form. The easiest way is to submit your request on the same day you make your final payment. The law does not establish specific deadlines for issuing such certificates, so you should be guided by the general principles of civil law - the bank must respond within 30 days. If the bank does not want to issue such a receipt, you can write an appeal to the prosecutor’s office to restore your rights under Art. 408 of the Civil Code of the Russian Federation, or go to court.

Usually a certificate is issued within a week at most, usually 3 working days.

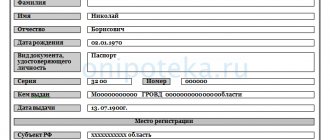

This is what a mortgage repayment certificate looks like from Sberbank

Get a mortgage for your apartment.

This is a document confirming a mortgage on real estate. The bank also has a maximum of a month to transfer the mortgage, so write an application for issuance as early as possible. Usually a mortgage is issued within a couple of weeks, but, for example, due to the pandemic in the spring of 2021, the process was delayed for several months.

Problems with delays occur due to the loss of the document by the bank. Then managers order a mortgage from Rosreestr or prepare a copy themselves.

A duplicate of the mortgage note must be attached to the loan agreement - if the bank does not issue the document, you can use this copy.

The bank must issue a mortgage note and a loan repayment certificate free of charge.

This is what a mortgage from a bank looks like

If you took out a mortgage after July 1, 2021

, the process of removing the encumbrance is simplified for you - paper mortgages are no longer relevant for new borrowers, they have become electronic. Such documents are signed with an electronic signature, and data about this is entered into the Unified State Register of Real Estate.

In this case, there is no need to request a mortgage - the encumbrance is terminated after a joint application by the bank and the ex-debtor, plus the provision of an account statement to Rosreestr. Usually, in this case, the bank does everything itself, through online services.

Step 2. Submit documents

The certificate and mortgage must be sent to Rosreestr - it’s free and the easiest way to do this is through the MFC in your area. They sign up there in advance - for example, here is a time booking service for Moscow, and here for the Moscow region.

At the branch you need to fill out an application - a form with explanations and a sample will be issued by MFC specialists. Take your passport with you.

Give the certificate, mortgage and passport to the specialist at the MFC. Receive an inventory of the documents received.

Removal of the encumbrance occurs within 10 working days.

If the bank has not issued you a mortgage, then you need to go to the MFC with a representative of the bank - you and the manager write a joint application to remove the encumbrance. This is also free, but you need to arrange a time in advance with a consultant from the mortgage center of your lending institution.

Step 3. Receive documents

The result of the removal of the encumbrance will be a certificate “Notification of repayment of the restriction (encumbrances) of the right.” You will be notified of readiness either by SMS or by call. You can also check the status of your application yourself by calling the MFC hotline in your region.

If there are long queues at the public services center in your area, it is also better to sign up for a certificate in advance - by phone or through the reservation service of the MFC in your area.

FAQ

List of popular questions related to closing a loan at Sberbank:

I didn’t receive an SMS stating that the encumbrance has been lifted, what should I do? You can still wait, but it is better to immediately contact bank representatives and clarify why the delay occurred. You should also check your phone number. Perhaps the account was linked to another number.

Do I need to pay anything to remove the encumbrance? No, this is a completely free procedure that the bank performs independently.

If I do not receive a certificate of no debt, is this critical? Yes, critical. In case of any claims from the bank, you will have nothing to counter-argument with and prove that you are right.

Will the bank tell me what to do and when? Most likely no. Unless you come across a good manager. In fact, after the debt is repaid, the bank no longer cares about the client. Therefore, it is recommended to independently control the procedure for removing the burden.

How to remove a burden via the Internet

The algorithm is approximately the same, only instead of two trips to the MFC, you submit documents through the Rosreestr service - you need to select the section “Registration of termination of rights, restrictions (encumbrances) of rights”, and then “Repayment of the mortgage registration record”.

This is what the required item looks like

Then you need to attach copies of documents - mortgage and loan repayment certificate. At the end, sign the application with an electronic signature, and then send all the information to Rosreestr.

The deadline for registering the removal of encumbrance is the same - 10 days.

Insurance return

If you pay off your mortgage early, it makes sense to contact the bank with an application for the return of insurance. The fact is that the insurance premium is calculated for the entire term of the mortgage agreement. If it expired before the date specified on it, then part of the unused money can be returned. This again requires an application. In addition, you must attach a certificate of debt repayment. If the insurance company refuses to return the unused portion of the insurance premium, you should go to court.

How to check that the encumbrance has really been removed

The easiest way is to use the free online service of Rosreestr. You can search for an apartment by address or cadastral number.

The service shows that there are no restrictions

You can also order an extract from the Unified State Register of Real Estate - it will contain all the information about the transfer of rights to the apartment, including restrictions. Please note that the data in the database is not updated immediately, so it is better to receive the certificate 10–15 days after the encumbrance is lifted.

Briefly - how to remove an encumbrance from an apartment

Now banks often do this themselves, 30–45 days after the mortgage is repaid. You can do everything yourself, for example, if the credit institution does not provide such a service or the deadlines are delayed.

- Order a certificate from the bank stating that you have paid off your mortgage in full.

- Get a mortgage from the bank. If you bought an apartment after July 2018, you can skip this step; the mortgage is issued electronically, and the bank itself will pay it off. If the bank does not issue a mortgage, you can use a duplicate from your copy of the loan agreement.

- Please submit your documents to the MFC in your area. There, fill out the application using the template - the form will be issued by the center’s specialists. If the mortgage is electronic, you need to contact the MFC together with the bank manager - a joint statement is written.

- Wait 10 working days and pick up a completed notice of removal of the encumbrance from the apartment from the MFC.

Deadlines, documents and results

Up to 30 days are required to prepare a complete package of documents. After notification of the completion of the encumbrance removal process, you can check the result in 3 ways:

- Through the Rosreestr reference service.

- On the State portal class=”aligncenter” width=”1310″ height=”767″[/img]

- In an extract from the Unified State Register of Rosreestr.

The Rosreestr service allows you to obtain free data on the cadastral number of a real estate property. The “Rights and Restrictions” column must be empty. The State Services portal also provides access to information free of charge through the “My objects” menu in the personal account of Rosreestr. To confirm the removal of the encumbrance, an extract from the Unified State Register can be obtained only on a paid basis.

30 days from the moment the mortgage is repaid, the bank is obliged to return the mortgage. It states that there are no claims against the borrower from the bank. To obtain a document, you must make a written request. If the bank does not return it longer than the specified period, then you can file a complaint with the Central Bank of the Russian Federation. If the bank loses the mortgage, it is obliged to issue a duplicate.