Everyone knows how to pay off a mortgage as usual, but we’ll tell you in a detailed review right now how to pay off a VTB mortgage early and why it’s profitable.

VTB Bank offers its clients modern offline and online services, a large selection of various loan products, and a convenient calculator for preliminary loan calculations.

Numerous bank clients with a mortgage are concerned about the question: how to repay a mortgage from VTB correctly (early)?

Let's consider the types of early repayment, their pros and cons, conditions and features.

How to save on your mortgage

Until the borrower pays off the mortgage loan in full, the apartment or other borrowed property will be pledged to the bank (). It cannot be sold, donated, or exchanged without the consent of the bank. This depresses any person, so at the slightest opportunity it is better to pay off your mortgage early at VTB in order to pay off quickly.

Russian legislation provides for early repayment of a mortgage without any fees or penalties ().

We will find out how to repay your mortgage early at VTB, when and under what conditions. This can be done right from the first day after the conclusion of the agreement, but only if the relevant requirements of the bank are met. The main requirement is to submit an application to the bank for early repayment of the loan, indicating all the necessary parameters.

Early repayment of a mortgage at VTB may be partial. That is, a certain amount is paid, the balance of the mortgage debt is distributed in accordance with the new payment schedule. Or complete - the entire debt is extinguished, the mortgage is closed, and the encumbrance on the object of the contract is removed.

Let's take a closer look at how to repay a mortgage early at VTB, look at typical mistakes during early repayment (EP), and find out the conditions for early repayment of a mortgage at VTB.

Early repayment calculator

Software for calculating loan payments is available on many websites dedicated to financial topics. To obtain reliable results, the client must fill in the following fields:

- Amount of credit. In this line you need to enter the loan amount minus the down payment and government subsidies (if any);

- Type of contribution (annuity or differentiated). The annuity system allows you to pay off the principal and accrued interest in equal installments. A differentiated scheme involves a gradual reduction in the monthly amount (in modern commercial practice this approach is rarely used);

- Mortgage interest. The amount of the bet depends on a combination of various factors. The discount is received by clients who insure their lives and use the electronic transaction registration service. The interest rate is reduced for young parents, state employees and some other categories of the population;

- One-time and regular commissions. The cell specifies the bank's commission for maintaining an account, depositing funds and other services;

- The date the mortgage loan was issued. In this column you should record the day you received the funds;

- Credit term. The value of this field is indicated in the years and months remaining until the debt is completely closed;

- Availability of maternity capital (you must answer “yes” or “no”). One of the options for financial support for young families. The subsidy is received by women who have given birth to or adopted a second and subsequent children;

After entering all the data, you need to click on the “Calculate repayment” button. The computer will make arithmetic calculations and produce a final table, which will detail the procedure for repaying credit debt. You can also calculate the amount of monthly contributions that the borrower must make given the given parameters. The bank client finds out the total amount of interest that must be paid if the loan is repaid early.

The table displays not only regular payments, but also the balance of the loan debt. Each borrower can build a graph that clearly demonstrates the process of repaying the debt. The program makes it possible to save the calculations made (the user will be provided with a link to a web page or file for downloading). The software can be used by both current and potential bank clients. In the latter case, the citizen will be able to soberly assess his capabilities and outline a plan for repaying the mortgage loan before concluding an agreement.

To avoid common mistakes, the borrower needs to take into account some details. Money deposited in the current payment period will be taken into account only in a month. If the payment date is considered to be the twelfth of March, then it is better to make incomplete early repayment on the 11th. In this case, the calculation of the new annuity amount will be made on April 12. If the date of the contribution coincides with the time of payment provided for in the debt repayment schedule, then the new amount will be calculated only after 2 months (May 12).

Independently performed calculations may not coincide with the real state of affairs. The reasons for the discrepancy between practical and theoretical calculations may be incorrect information entry, software errors and changes in credit conditions. To clarify operational issues, it is better to contact bank employees.

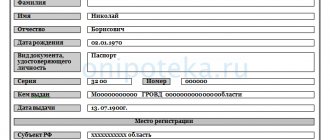

Documents for DP mortgage

Let's look at what documents will be required to correctly repay your mortgage early at VTB. The main document for partial early repayment (PAR) is a new payment schedule. Having received an application from the borrower, the bank specialist must recalculate the remaining debt and interest, draw up a new payment schedule and hand it over to the client. The old schedule loses its validity. After each partial repayment, the payment schedule is drawn up anew; other documents are not required by law.

What should I present to the borrower? If the application is submitted online, there is no need to enter data into the system; everything is already in the database. To receive information via the hotline through the operator, you will need to indicate the contract number and passport details. When visiting a bank office in person, you will need to present your passport.

To resolve the issue of partial return of the insured amount, the entire set of mortgage documents may be required. To remove the encumbrance, you will additionally need the originals of the mortgage and pledge agreements, a certificate from the bank, and the original mortgage note.

Under what conditions is partial DP of a mortgage loan at VTB possible?

At any time, you can deposit the borrower’s available funds to repay the loan ahead of schedule. To do this, submit an application about the desire to make an early repayment, and it is registered with the bank no later than one day before the day of depositing the funds. The application can be submitted literally the next day after the mortgage is issued.

Information on early repayment is indicated in.

The application must indicate the main parameters - the amount of early payments on the mortgage at VTB, the date of these payments, the method of paying the balance. If the application arrives late, or the account does not have the required amount, the bank will cancel the application and you will have to start all over again.

Recommended article: Is it possible to change the mortgage payment date?

Features of obtaining a mortgage at VTB

You can get a mortgage under the following conditions:

- Funds from maternity capital and military certificates can be used to pay for mortgage loans at VTB.

- The amount of initial capital usually ranges from 10-20% of the cost of the purchased object (depending on the chosen program and the client’s status).

- Review of applications takes 4-5 business days. After approval, a positive decision is valid for 122 days. This period is spent on selecting a property and conducting a transaction.

- Despite the presence of special conditions, the standard mortgage rate at VTB starts at 8.4%.

- Any collateral property must be insured throughout the entire loan period. Life and health insurance is also offered. It is voluntary, but if you have it, you can get a discount on the interest rate.

- Early and partially early repayment of mortgage loans is allowed. There are no fees or restrictions for this. All the client needs is to call the call center in advance.

Important! Mortgage loans at VTB are provided exclusively in Russian currency - rubles. There are no currency programs.

What other nuances and conditions are there for partial early repayment of a mortgage from VTB?

If at the time of submitting the application there is a mortgage debt, you must first close it, otherwise the bank itself will close the delay with your funds from the amount intended for partial repayment.

It is better to make an early payment on the day designated for payment according to the schedule. Then you will not have to pay interest on this amount; on any other day you will have to pay it for all days after the last payment according to the schedule.

Partial early repayment of a mortgage at VTB can be made multiple times, but not more often than once a month. After each such repayment, the bank must recalculate and present a new payment schedule to the client.

There are two options for NPV; let’s look at the advantages and disadvantages of each in more detail.

About early repayment in Sberbank

Some borrowers seek to redeem their home from the loan collateral as early as possible - this is due to the unstable economic situation in the country and the constant fear of breaking the mortgage payment schedule.

Conditions for partial early repayment of a mortgage

Today, Sberbank has no restrictions on making partial payments, and there is also no specific minimum payment amount. When making a payment ahead of schedule, it is required that the borrower have a sufficient amount of funds in the account. The required amount must first be transferred to the card or deposited through the terminal. Then write an application to Sberbank to repay the debt ahead of schedule, or write off the required amount through a bank terminal.

When depositing money at a bank branch, it is best to ask in your application that this amount be included in the monthly payment schedule. Then they will calculate the early repayment for you, and this payment will be written off, and the reduced payment will be recorded on the next date.

Early repayment of a mortgage at Sberbank can be done without contacting the bank in your Sberbank online account. For this function to be available, you must contact the bank branch and activate it through the administrator.

Partial early repayment from Sberbank is available only with the possibility of reducing the monthly payment. It is not possible to shorten the term of the existing mortgage after early repayment. Our early repayment mortgage calculator allows you to make two types of calculations:

- One-time repayment or on a specific date will create a payment schedule taking into account one-time early mortgage payments on the required dates.

- Monthly for a certain amount. Allows you to build a schedule taking into account the monthly transfer of a certain additional amount for payment according to the schedule.

Full repayment of the mortgage

This type of debt repayment relieves the borrower of mortgage obligations, and all restrictions are also removed from his home, and it becomes the property of the borrower. To repay the loan in full before the due date:

- Call the bank or come to the branch in person to clarify the remaining amount on the loan.

- The required amount is transferred to the specified account. It is better to make payments not through online services, but in person at Sberbank - this speeds up the process of crediting the borrower’s money.

- Obtain from bank employees a certificate confirming that loan obligations have been fulfilled and that they have no claims regarding credit debt.

- After this, the borrower should terminate contractual obligations with Sberbank.

- Then you need to close the mortgage account so that you are not charged for its maintenance and documentation.

- Remove restrictions from your home and close the insurance drawn up when drawing up the insurance contract.

Sberbank mortgages are discussed in more detail in a separate post. To find out what documents are needed for a mortgage at Sberbank, go to another post.

We are waiting for your questions about the operation of the calculator. We would be grateful for your assessment of his work and repost on social networks.

We are looking for a profitable option for private insurance

After paying some amount towards early repayment, the remaining balance on the mortgage becomes smaller. And here the question arises - how to continue to pay off the mortgage.

The legislation provides for the following options for further debt payments after partial repayment of the NDP:

- reducing the repayment period of the mortgage loan while maintaining the same amount of monthly payments;

- maintaining the same payment term with decreasing monthly payments.

Each borrower chooses when it is more profitable to pay off a mortgage early at VTB. Let's look at the pros and cons of both options.

Advantages of NPV with a lower monthly amount:

- the financial burden on the family is reduced, money is freed up for other purposes;

- An interesting possibility is to put this money in the bank in the form of a deposit, and use the interest from it to pay off the mortgage.

The advantages of the 2nd option are observed when the loan terms are reduced - the savings will be greater than in the first option.

Which repayment option should you choose for the annuity type of payments:

- if the financial situation is stable now and in the future, you can choose any option;

- there is a risk of a deterioration in your financial situation - it is better to choose a reduction in the monthly payment.

What to do if you have a mortgage with graduated payments? In this case, DP should be carried out in the first five years, but reducing the payment will do little. But shortening the loan term will allow you to save a lot.

We close the mortgage completely

If the borrower has sufficient funds to fully repay the mortgage on an unscheduled basis, it will allow him to relieve himself of the burden of the mortgage and gain full 100% ownership of his property. This is the best option; it involves closing the mortgage agreement completely.

Strict rules govern this banking operation as well.

We will describe all the stages of full early repayment of a mortgage from VTB:

- To do this, submit an application indicating the date of deposit (at least one day before payment), it must indicate that the balance of the loan will be repaid in full;

- the full amount of the balance calculated by the bank is paid;

- Next, you should close your mortgage early at VTB. You must obtain a certificate from the bank confirming that the loan has been fully repaid and that the bank has no claims against the borrower (the response from the bank must be within 14 days);

- to obtain such a certificate, you must submit an application in which you must request the closure (cancellation) of the account, agreement and card, and the return of the mortgage to the client;

- A bank employee must render the plastic card unusable in front of the borrower by breaking the magnetic tape on it;

- Having received a certificate from the bank and paid the state fee, you can submit the documents to Rosreestr or the MFC to remove the encumbrance from this property (the deadline is 5 days).

Recommended article: Mortgage for employees of the Ministry of Internal Affairs

VTB 24 mortgage calculator with early repayment (reducing the loan term)

Rating: 5.0 /5. From 7 votes.

Please wait…

Voting is currently disabled, data maintenance in progress.

The VTB 24 mortgage calculator on the website allows you to calculate your mortgage payment online, as well as take into account early repayment of your mortgage at VTB-24 while saving the results in Excel.

The calculator is used both for mortgage calculations on the primary market and for housing on the secondary market. It is possible to specify maternity capital as a down payment on a mortgage.

Next, the calculator itself and the rules for early repayment at the bank.

Calculator:

It is possible to use Excel calculation directly on the website or. Substitution of parameters is carried out in yellow fields (editable cells) . The schedule is calculated using the annuity payment method based on instructions from the Central Bank of Russia. The model allows you to plan early repayment of your mortgage with a shorter repayment period.

Mortgage early repayment calculator VTB 24

You can download the calculation model in MS Excel format by clicking on

The model allows you to plan early repayment of your mortgage while maintaining the same monthly payment amount (annuity), but reducing the loan term. This repayment method is now used in VTB 24 and some other banks at the request of the client. An alternative method of calculation with early repayment involves reducing the monthly payment - the mortgage repayment model of Sberbank of Russia.

This repayment method is also available to clients of VTB 24 Bank - here the choice is up to the clients (unlike Sberbank, where there is only one scheme). The Sberbank model can be used for calculations, because it is based on the Bank of Russia methodology.

When making full early repayment, read a review of the practice about the possibility of returning part of the interest paid on the loan.

Can a bank charge a fee for early repayment of a mortgage?

The entry into force of the Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 N 102-FZ has made the mortgage lending market more client-oriented.

If previously the bank that provided the borrower with a mortgage loan had the right to refuse the possibility of early repayment (or even impose penalties for such), then after the adoption of the law, all that is required of the borrower who wants to repay the entire loan (or part of it) ahead of schedule is to warn bank 30 days before the planned transfer of funds.

If you want to find out which collateral and life insurance contracts are required for a mortgage, read our article

The law also sets the maximum period within which it is necessary to write an application - 30 days. Moreover, the bank can change this period downwards. Obviously, the banks were not happy with what was happening, because early repayment of even part of the debt leads to a discrepancy between the planned and actual profit on the loan.

Some of the banks, having lost part of their income, resorted to a last resort - the introduction of additional fees for early repayment. The accrual of such commissions is unlawful, but borrowers in some cases have to resort to the help of professional lawyers to return personal funds illegally obtained by the bank. It should be immediately emphasized that this practice does not apply to VTB 24.

What are the mortgage payment plans?

Today, banks offer two payment schemes for mortgage loans - differentiated and annuity.

- Differentiated scheme , as its name suggests, assumes that the amount of payments varies, decreasing from month to month. Payment under a differentiated scheme consists of two parts - the part that goes to repay the main body of the debt and the part that goes to cover the interest accrued on the loan. At the same time, repayment of the principal debt is carried out evenly - every month an equal part of the loan body is repaid, which ultimately leads to a high burden on the borrower in the first half of the term, when interest payments are high.

- An annuity scheme is an artificial calculation of the repayment amount in such a way that the borrower deposits the same amount every month, up to the full repayment of the debt with interest. At the same time, at the very beginning of the term, to compensate for the payment of high interest payments on the amount of the debt, the client repays the loan body itself very minimally, and only at the end of the term does he begin to repay the principal debt more actively.

Obviously , partial early repayment of a mortgage loan leads to a recalculation of the previously fixed monthly payment amount or an adjustment of the term.

Early repayment of a mortgage at VTB 24 Bank

VTB 24 Bank strictly fulfills the requirements for banks prescribed in the Federal Law “On Mortgage”. The borrower may exercise the legal right to repay the mortgage loan early, either in full or in part.

Important: the period within which you must notify the bank of your intention to repay the debt early is 15 days. In this case, the bank sets a minimum payment of 15 thousand rubles.

You can make early repayment of your VTB 24 mortgage in the following ways:

- Personally deposit funds through a bank cash desk.

- Send money via Telebank online banking.

- Use a VTB 24 ATM equipped with a cash acceptance function.

- Take advantage.

- Through an ATM, using a bank card, from which funds will be debited.

How to submit an application for early repayment of a mortgage loan

Different banks have different requirements for the format of the notice of intent to make early repayment. Some banks, including Sberbank, offer to draw up and send an application via Internet banking.

Until recently, VTB 24 Bank accepted such statements exclusively in writing. Some time ago, the bank announced the possibility of notification by telephone. According to the data provided on the bank’s official website, the application-obligation for full or partial early repayment must, among other things, include information on the amount of early payment (excluding accrued interest), in addition, it must be submitted no later than one day in advance before the next payment period.

You can read about mortgage refinancing at VTB Bank in our article

Partial early repayment - reduce the term or amount of the loan?

In the application for partial early repayment, the borrower may indicate how he wishes to change the loan repayment scheme.

Banks provide two options.

- Reducing the loan term.

- Reducing the monthly payment amount.

Both options have both advantages and disadvantages. The VTB 24 mortgage calculator, offered by the bank on the official website, does not provide for the possibility of recalculating payments for partial early repayment.

If the annuity method of repaying the loan is chosen, then, obviously, the benefit is directly related to the amount of funds already spent on repaying the loan.

- If you decide to resort to early repayment after, say, 10 years after taking out a mortgage, then almost all the interest has already been paid. And in this case, it will be more profitable to reduce the size of the monthly payment, thereby reducing the financial burden.

- If the bank has not yet managed to “take its toll” on the accrued interest, then reducing the payment period in all cases will be more profitable, since you are reducing the lending period.

But you can’t give universal advice - it’s worth considering how significant the mortgage payment is for you and how stable your job is.

For example, if you are currently earning well, but you have doubts that the situation will not change, it is wiser to first reduce the monthly payment to a comfortable level, and then resort to recalculating the loan term.

We recommend calculating the VTB 24 mortgage, initially taking into account that the mortgage payment should not hit the family budget too significantly.

Some nuances of early repayment of a mortgage at VTB 24

Changing the date of monthly mortgage payment at VTB 24

To change the calendar date of a monthly payment, you must write a written application at a bank branch. But we draw your attention to the fact that clients of VTB 24 Bank periodically become dissatisfied with the time this procedure may take. Therefore, we recommend that you arrange for a change in the payment date in advance and obtain a new payment schedule agreed upon by the parties.

Receiving a payment schedule after partial early repayment

After the bank receives additional funds for partial early repayment of the mortgage, a recalculation is made, based on the results of which the bank manager offers possible options for further payments. Once agreed, the new payment schedule comes into force.

Preferential mortgage lending programs VTB 24

VTB 24 Bank participates in all government housing programs and accepts any certificates (for maternity capital, for military mortgages) for the purchase of real estate.

It is important to take into account that a number of borrowers expressed dissatisfaction with the fact that maternity capital cannot be used to reduce the loan term. But the mortgage rate for a young family will be only 11%, the maximum amount is limited to 8 million rubles.

Read about using maternity capital as a down payment on a mortgage

The procedure for removing encumbrances from an apartment

After paying off the entire mortgage loan, a number of procedures will need to be carried out, which will result in the release of the property from the encumbrance. For this you will need:

- Certificate of full repayment of the loan.

- Originals and copies of owners' passports.

- An application for lifting restrictions certified by bank employees.

- Loan agreement.

- A mortgage note with a maturity note.

- Certificate of ownership (now not required, as it has been replaced by an extract).

- Confirmation of payment of state duty

- Contract of sale.

The collected documents must be submitted to Rosreestr (via the MFC), and after five days you must pick up a document confirming the fact that the encumbrance has been removed from the apartment.

By the way , you can also submit an application through the Rosreestr website, if you have an electronic digital signature, which is purchased at the MFC

Congratulations, you are now the full owner of the purchased home!

This may be useful:

- Rosselkhozbank mortgage calculator with early repayment

- Defrauded shareholders and new protection mechanisms under law 214-FZ

- Mortgage restructuring at Sberbank. Does the state bank’s program for unsuccessful borrowers work?

- Difficult cases of selling a share in an apartment: minor owners, mortgaged apartment, no consent of other owners

- Apply for a mortgage to all major banks simultaneously and online

We are trying to return part of the interest and insurance

In case of early repayment of the loan, the bank is obliged to return part of the interest taken from the borrower. But this is not profitable for the bank, and it is unlikely that its employees will advise this to the client.

When a mortgage agreement is concluded, first of all, the bank usually writes off its interest and only then begins to write off the principal amount. As a result, somewhere in the middle of the loan term, the bank had already collected all its interest from the client (for the entire mortgage term and for the entire amount). And early repayment reduces the mortgage term, and the client can apply for a refund of interest (ground -).

If the bank refuses this, you will have to collect documents and file a lawsuit. Usually the court decides such cases in favor of the borrower, so do not lose hope. The issue of returning part of the insurance is resolved in the same way.

Extinguishing DP with maternity capital

One of the pressing questions is whether it is possible to repay a mortgage early at VTB using maternity capital. Yes, it can be a source of funds for early repayment (). Its use must be agreed with the pension fund. To do this, you must provide a certificate of the remaining debt on the loan to the Pension Fund.

If the Pension Fund approves the use of maternal capital for these purposes, the funds are transferred to the borrower’s account. It is allowed to use these funds only to repay the principal and interest, but it is prohibited to use them to pay penalties, fines and penalties.

Important. If maternity capital is involved in the mortgage, by law it is necessary to allocate shares in this real estate for children and the second spouse after the encumbrance is removed. The notary will formalize the division of shares, then this document must be registered through the MFC, for example.

DP extinguishing online

Many banks have online services for their products, VTB is no exception. The convenient VTB online service allows clients to perform all necessary banking transactions. Each client can go to the site, register and work in his personal account.

In it you can get any information on current loans, submit an application, make a payment, and control all operations. It is convenient to pay off your mortgage early at VTB online in your personal account; you should fill out a special application form in the section on early repayment. In advance, you can make the necessary calculations and view the new payment schedule, indicate the option of partial repayment (reducing the term or monthly payment) and make the repayment on the appointed day without any fees.

Of course, repayment can be made in traditional ways - through a cash register, ATM, mail, but online payments and other operations are becoming increasingly popular. The time is not far off when all transactions will be carried out online through the bank, as the bank itself says.

Early repayment of a mortgage at VTB online is possible both on the VTB online website and in the mobile application downloaded to your smartphone. With its help, it is easy to make payments, control the receipt and debit of funds, receive loan information and bank news on your phone.

Using a Mortgage Calculator

A mortgage calculator is a tool that allows a client to calculate the amount of monthly payments and the total cost of debt in advance. The calculator can be found on the official website of VTB Bank. You can use it completely free.

Using the mortgage calculator is as simple as possible. The cost of the purchased object, the interest rate and the loan term are entered into a special form. The system itself will make the necessary calculations and display the monthly payment and final cost. The income required for a specific loan product will also be indicated.

We calculate DP on the VTB calculator ourselves

It will not be possible to calculate early repayment of a mortgage at VTB using an online calculator, but you can make a preliminary calculation of the DP as follows:

- full repayment amount = next monthly payment + balance of debt in the next monthly payment;

- partial repayment amount = next monthly payment + the amount you are willing to pay as partial repayment.

After this, the partial early repayment of the mortgage at VTB is calculated using the calculator. After early repayment, that is, the actual payment, only a bank employee can provide an exact schedule.

Recommended article: How to calculate a mortgage in Pochta Bank using an online calculator

We discuss DP on the forums

Reviews about early repayment of a mortgage at VTB on the forums, as always, are different - depending on your luck.

They speak positively about the opportunity to use maternity capital; this saves on bank interest. Note the convenient calculator and online banking service. Everyone believes that with any option for a home loan, it is better to pay off the mortgage early at VTB and save the family budget.

A major discussion is taking place everywhere on the topic of bank interest with NPV. The bank assures that the entire NDP amount goes to repay only the principal debt (the body of the loan). And forum users report that the bank covers the interest with part of this amount and explains this by the fact that later (at the next monthly payment) the interest will be recalculated. Why is this done? The benefit of the bank is obvious. Let's take the conditional average numbers.

If 50 people apply for a private equity transaction, and the bank writes off 20,000 rubles for interest from each, then that’s already a million rubles. It is not profitable for the bank to wait for the next monthly payment if you can receive income 2-3 weeks earlier.

That's all the tricks.

How to calculate a mortgage payment schedule at Sberbank

The payment schedule for a mortgage issued by Sberbank is usually in the hands of the client. If it is lost, the loan is repaid faster; you can calculate the planned payments yourself or look at Sberbank Online.

A planned schedule is necessary to understand what part of the payment goes to repaying the principal debt and what part goes to interest. To find out how to pay a Sberbank mortgage and print out the exact payment schedule for it, you need to visit its branch with a passport or go to your personal account on the official website.

Advice from experienced borrowers

A negligent attitude towards the rules for early repayment of a mortgage at VTB, various mistakes can lead the client to the loss of significant money.

We offer tips to help avoid fatal mistakes:

- When preparing a DP, do not forget about the upcoming monthly payment. If there is not enough money for it, the bank will use part of the DP amount to close the monthly payment and early repayment will not occur;

- NDP is beneficial if its amount is greater than the monthly payment, and the repayment date coincides with the date of the next payment;

- a more profitable DP option is to reduce the loan repayment period, since the amount of bank interest will be less;

- You should not save a large amount for DP, as time works against the client. Any available amounts must be sent for repayment immediately, especially with annuity payments;

- provide yourself with a financial cushion, that is, reserve funds, for any possible force majeure circumstances. It is best if you have an amount of several monthly payments.

If you pay only scheduled payments according to the schedule, you will give the bank much more money in the form of interest than their amount if repaid early.

Mistakes that might not have happened

Failure to comply with the procedure for early repayment of a mortgage at VTB can lead to great disappointment and loss of a significant amount of money, as well as:

- insufficient knowledge of your own mortgage agreement;

- incorrect choice of NPV option;

- ignoring loan debt (along with penalties);

- lack of control over transactions and payments, as well as compliance with the entire procedure for full repayment of the mortgage.

How to pay off a mortgage early at Sberbank - step-by-step instructions

The process of early debt repayment at Sberbank is no different from what is required from clients at other institutions in 2021.

Borrowers will have to:

- submit an application indicating the exact date and amount of payment;

- deposit money on the specified day;

- wait for the debt to be recalculated and a new payment schedule to be received.

The situation is a little more complicated when using maternity capital to pay. The difficulty lies in the fact that money is credited to the credit account not by the debtor, but by government bodies that control the management of maternity capital. That is, it is almost impossible to name the exact date of enrollment in advance, so it is worthwhile to promptly seek help from Sberbank employees and follow their recommendations and instructions.

Situations where debtors cannot fulfill their obligations to contribute an additional amount deserve special attention. In such cases, you need to submit a second application, with a message about the withdrawal of the first and refusal of early repayment.

What are the terms of early repayment at Sberbank?

We have already discussed the importance of submitting an application with notification of the desire to increase the payment or make an additional contribution. It must be sent 15 days before payment. You can withdraw your application at any time before the day the account is replenished.

The method of submitting an application deserves special attention. Borrowers can submit either a written application or simply call the contact center. But the first option is preferable, since it guarantees that the application will not be lost and will be received by the manager.

To what has been said, it must be added that the bank cannot reject the application.

Recalculation of interest in Sberbank

There are 2 main ways to calculate interest:

- reduction in the amount of monthly contributions;

- reduction of debt closure period.

For annuity payments, the second option is more profitable, since it allows you to reduce the amount of overpayment. Interest for the last months is deducted from the total debt amount. But it is important to emphasize that sometimes this option is prohibited by the terms of the loan agreement, so you should read the text of the agreement in advance so as not to encounter unpleasant surprises later.

With differentiated payments, the benefit is achieved by reducing the amount of debt, so there will be no fundamental difference between each recalculation method.

Minimum payment

There are no restrictions on the amount of payment. Borrowers can make either a small payment or a significant contribution that can completely cover the debt. But it is important to take into account that submitting an application and notifying the bank about your intentions makes small payments pointless, since the difficulties with payment turn out to be more than the benefits.

But it may be convenient to round the next payment according to the schedule to a round value (up to a thousand or 500 rubles). This will simplify the calculations and eliminate the need to change money if the payment is made in cash through an ATM.