Is it possible to pay off a mortgage early?

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

According to Federal Law 284 of October 19, 2011, the borrower is allowed to close the mortgage early, unless another condition is specified in the agreement. The bank must be notified in advance of the decision, otherwise the payment made will not be counted and will be posted next month.

According to Art. 810 clause 2 of the Civil Code of the Russian Federation, the client is obliged to fill out an application with a credit consultant one month before the payment date according to the schedule (unless otherwise specified in the agreement).

Borrowers say that in practice it is quite difficult to repay a loan ahead of schedule, given that the procedure is unprofitable for the bank due to the loss of income from lost interest. For this reason, many people have a question about how to repay their mortgage early with Sberbank.

Is it profitable to pay off your mortgage early?

Credit institutions have a negative attitude towards early repayment, as they lose part of the profit they planned to receive. But for a mortgagee, the question of whether early repayment of a mortgage at Sberbank is possible and profitable is controversial and depends on the specific situation and the length of the lending period.

Consequences of early closure of a loan agreement for a bank

The credit institution operates according to the following scheme:

- Acquires assets on certain terms (at interest).

- Issues loans to the population at high interest rates.

- Receives profit in the form of the difference between interest received and interest paid.

Therefore, when the client returns the amount borrowed at interest, this money ceases to generate income for the bank, and he continues to pay interest on his assets.

Long-term mortgage loans are one of the main sources of income for credit institutions. The bank spends money and time resources on processing and issuing a mortgage. Therefore, if the loan is closed ahead of schedule, the invested efforts and funds, as well as plans for obtaining financial profit, are not justified.

Consequences of early closure of a loan agreement for a client

Federal Law Federal Law No. 284, adopted on October 19, 2011 and regulating the introduction of amendments to the above articles of the Civil Code of the Russian Federation, prohibits credit institutions from interfering with the early repayment of loans by the population.

Important! Even if the loan agreement contains a clause imposing penalties for early repayment, this provision has no legal or enforceable force.

The only negative consequence for the client when repaying the loan ahead of time is the likelihood that the credit history will be damaged.

Is it profitable to close a loan early?

Having the financial resources to pay off your mortgage will make anyone happy. But don’t rush to take them to the bank. It is necessary to carefully analyze the situation, since sometimes it is unprofitable to repay a loan early:

- The most convenient time to fully or partially repay your mortgage ahead of schedule is the first third of the loan term. Lenders prefer to work with the public on annuity payments. This means that at first you only repay interest, and the body of the loan remains unchanged. For example, if you took out a mortgage for 10 years, it makes sense and is beneficial for you to pay it off early, provided that you pay the loan for no more than 3-4 years.

- It is not profitable to fully repay a mortgage loan after half the loan term has passed. If you have been paying off a 10-year mortgage for 5 years or more, do not rush to close it early, as there is no point in doing so now. You have paid the interest, now only the body of the loan remains. In this situation, it is more expedient to attract the available financial resources to generate additional income.

- It is also not advisable to repay the mortgage at the end of the loan term. You won’t get any benefits from this, and your credit history will be damaged.

- Partial repayment ahead of time is beneficial if you are shortening the loan term. The lender will insist on recalculating interest and reducing the size of monthly payments, because this is beneficial to him and disadvantageous to you. You can agree to this option if you urgently need to reduce the size of your monthly payment.

Possible restrictions on early repayment by the bank

Each credit institution determines its own rules for early repayment of a mortgage:

- Banks set minimum payment amounts. For clients repaying a loan from Sberbank, it is equal to 15,000 rubles.

- In many institutions, a written application is considered mandatory. It must be submitted 30 days before the payment date.

- The mortgage agreement must specify the amount of the penalty that must be paid upon full repayment of the loan. Sberbank allows customers paying off their mortgage to pay it off ahead of schedule without imposing a penalty.

Will it happen automatically?

Recalculation of a mortgage on refinancing does not occur automatically. To be eligible for refinancing, the borrower must be proactive and submit an application. This can be done in person, through the bank’s website or Sberbank online.

No guarantors are required. If the applicant does not receive a salary on a Sberbank card, a certificate of income will be required. You also need a passport, first mortgage agreement, and real estate documents.

The bank has the right to approve or refuse the received application. He can offer several ways out of the current situation, including a lower interest rate, thereby softening lending conditions.

Types of mortgage payments

Before making monthly payments and the amount for early repayment, you should clarify what type of payment is specified in the agreement. There are annuity and differentiated payments. More often than not, the mortgage is paid off using the first method.

Annuity payments

The annuity option monthly payment is equal to the amount of the loan and interest divided by the loan term. The borrower makes equal payments each month.

Most of the annuity payment is used to pay off interest, the rest is used to close part of the debt. The first payment is 90% interest.

Differentiated payments

A differentiated mortgage payment at Sberbank implies priority coverage of the principal debt, and then interest. In the first quarter of the term, the borrower needs to make large payments. After the specified period, the amount of monthly payments will begin to decrease.

It is profitable to pay off a mortgage with differentiated payments; the scheme involves a smaller amount of overpayment. When depositing funds in excess of the required amount, the excess is counted towards future payments.

Example:

The monthly mortgage payment is RUB 36,370. (16,666 rubles of principal debt and 19,704 rubles of interest. The client, having deposited 100 thousand, exempts himself from paying the principal debt for 5 months. Despite this, it is impossible to repay the mortgage ahead of schedule without interest, otherwise the banks will go bankrupt.

When is it profitable to pay off your mortgage early?

It is most profitable to repay your mortgage early in the first quarter of the borrowing term. During this period, most of the interest on the loan is written off from the debtor. However, given the terms and size of the mortgage, significant savings can be made at any stage of the payment.

If the borrower wants to pay off the mortgage faster, the option of reducing the term is suitable for him.

If the client decides to pay less for the mortgage, he will be offered partial early repayment with a reduction in the monthly payment.

Is it possible to repay a loan from Sberbank early?

Today, Sberbank of Russia offers citizens many loan programs - these are:

- consumer loans for any purpose;

- non-targeted loans secured by real estate;

- mortgage loans for the purchase of housing of various classifications (in new buildings, on the secondary market, etc.).

All mortgage lending programs at Sberbank provide for early repayment of debt.

However, it is important to understand that this can be done no earlier than the established minimum period for using the funds. Typically, this period is 3 months for personal loans and 1 year for mortgages.

Mortgage loan early repayment schemes

You can close your mortgage early at the time of full settlement with the bank. And according to the NDP, there are two ways of repayment: with a decrease in the monthly installment or the payment period.

Reducing the monthly payment amount

When making partial early repayment with a reduction in the monthly payment, the borrower reduces the loan load. The payment amount changes, but the number of days on the loan remains unchanged.

You can apply for a reduction in your monthly mortgage payment at a bank branch or online. The new schedule will appear in your personal account and mobile application.

Reducing the loan term

By making a partial early repayment with a reduction in the term of the mortgage loan, the borrower receives the maximum benefit with a minimum overpayment. The client maintains the current payment specified in the loan agreement.

You can order the service at a bank branch upon an official application, and deposit funds into your account online or through an ATM.

Partial repayment: how profitable it is

Most often, there are two options when people resort to partial early repayment: making a one-time large amount or an unauthorized increase in the size of monthly payments (when possible). When writing an application, you must indicate your wishes:

- reduction in the amount of monthly payments;

- reduction of loan term.

Practice shows that the second option for annuity payments is more profitable (if the amount of current monthly payments does not burden you).

Example of benefit calculations

A mortgage was issued in the amount of 2 million rubles (the presence of a down payment is not important) for 15 years at an interest rate of 12% per annum. The loan was repaid regularly for 3 years, then the family decided to use maternity capital for partial early repayment. The amount is 465 thousand rubles. The overpayment on the loan if paid according to the schedule will be RUB 2,320,000. With partial early repayment, the reduction in the amount of overpayment is obvious:

- when choosing an option with a reduction in the loan term (decreased to 10 years), the overpayment will be 1,384,000 rubles, which is less than the original overpayment amount by 935 thousand rubles;

- if you choose the option with a reduction in the monthly payment amount, the overpayment will be 1,927,000 rubles, which is less than the original overpayment amount by 393,000 rubles.

The difference in the amount of overpayments for the two early repayment options is noticeable and amounts to RUB 542,000.

Therefore, if the opportunity arises for partial early repayment of a mortgage at Sberbank, it is better to reduce the loan term and agree to reduce the monthly payment amount only in cases where the load is really unbearable for you. In the above example, the monthly payment was 24,000 rubles. per month. When depositing the amount for early repayment with a decrease in the size of regular payments, the amount decreased to 18,000 rubles. per month. Thus, there are no obstacles to full or partial repayment of the mortgage. The only question is how profitable it is. Each case is individual, and the appropriateness of action depends on the situation. Someone simply wants to relieve themselves of debt obligations and breathe easy, someone pays off a loan to remove the encumbrance on real estate for further manipulations, someone receives unexpected financial assistance and wants to reduce debt obligations, etc. For some people, the priority is the financial side of the issue (savings), for others, the moral side (not feeling like a debtor). Paying off your mortgage early will not be difficult if you have the money and the opportunity.

In what situations is it advisable to choose a reduction in monthly payment?

The option with a reduction in the payment amount is suitable for everyone who wants to reduce their loan burden in the future by reducing the amount of the monthly payment. In all other cases, repaying a loan early in this way is unprofitable, since it does not reduce the amount of overpayment on the loan.

Example: a client took out a loan for 2.3 million rubles at an interest rate of 10.2% for 15 years. The monthly payment was 24,998 rubles. After two years, he draws up a private equity loan for 400 thousand rubles with a reduction in the EP in order to further reduce the loan burden. After recalculation, the payment according to the new schedule amounted to 20,361 rubles, and the term remained unchanged.

However, the client has the opportunity to pay amounts every month according to the old payment schedule. In this case, you can close the loan earlier, with the least overpayments.

In what situations is it better to choose a shorter loan term?

The option of reducing the term is suitable for everyone who wants to reduce not only the calculation period, but also the amount of overpayment on the mortgage. The monthly payment remains the same, but the loan term will decrease in proportion to the amount paid.

An illustrative example:

The borrower took out a mortgage in the amount of 2.3 million rubles at 10.2% per annum for 10 years. The monthly payment will be 30,650 rubles, and the overpayment for the entire term will be 1.38 million. Two years later, the client made a partial early repayment in the amount of 900 thousand:

- With a reduction in time. The overpayment amounted to 663 thousand, the period was 68 months.

- With a reduced monthly fee. Payment for the second year will be 16.9 thousand, overpayment 959 thousand.

For those who decide to pay off their mortgage faster and more profitably, the first option is suitable. This procedure is only available at a bank branch.

Is it profitable to recalculate a mortgage at Sberbank?

Any client under the burden of a long-term loan is interested in its early repayment. And, of course, in the revision of current rates downwards. After all, this procedure significantly softens the mortgage burden and improves the family budget. Financial analysts strongly recommend renegotiating the interest on your current mortgage. If in 2014 this indicator was marked by a sharp increase (by almost 7-7.5 points), now there is a record decrease in the current interest rate - about 7.75% .

Conditions for early repayment of mortgage

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

You can pay off your mortgage early at any stage of payment by notifying the lender of your decision in writing or electronically. The bank sets certain deadlines: the application must be submitted 30 days before the date of the planned emergency period.

Mandatory conditions for early repayment of a mortgage at Sberbank:

- Only the borrower can submit an application.

- You can submit an application online or at the Sberbank branch where the loan was issued.

- The minimum payment must be observed: 15,000 rubles.

- After interest is recalculated, the borrower must review and sign the new payment schedule.

The nuances of early repayment for a military mortgage

Early repayment of a military mortgage occurs without an application to the bank. The borrower needs to deposit the desired amount into the Rosvoenipoteka account. On the settlement date, funds will be debited in full.

With partial early repayment, you can only shorten the term; it is impossible to change the amount of payments.

Basic bank conditions for recalculation

It is worth knowing that recalculation of a mortgage at Sberbank when the interest rate decreases is not available to every mortgage client. The banking organization may not give approval for the procedure for revising the conditions. An obstacle to obtaining more acceptable interest is some of the requirements put forward by the bank to the client .

A downward revision of the mortgage interest rate is possible only if the borrower meets the established banking requirements.

There are not many conditions that mortgage borrowers applying for a review of interest rates must meet. These are the following requirements:

- absence of debts on the existing mortgage (Sberbank may approve a review if there are delays caused by program failures within up to 3 days);

- the term of the current loan from the moment of signing the banking agreement is more than a year (if the duration is shorter, the bank will refuse);

- the cost of the mortgage loan should not be less than RUB 500,000;

- the borrower's lack of restructuring of current debt;

- The loan rate has already been revised, and not a year has passed since its change.

Methods for early repayment of a mortgage loan

To properly repay a mortgage, you need to study all stages of the procedure.

Rules for early partial repayment

Partial early repayment of a mortgage at Sberbank is possible only at the branch where the loan was issued. The credit institution allows the possibility of submitting an application online, through the borrower’s personal account.

Procedure steps:

- Deposit the monthly payment and the desired amount for partial repayment into the credit account; its amount must exceed the agreed limit of 15 thousand rubles.

- Fill out an application at the bank or submit a request through the borrower’s personal account. Check the specified details.

- Confirm the entered data with an SMS code, and in the case of a written application, with the signature of the borrower.

- After partial early repayment, the bank will recalculate and approve a new payment schedule.

How to pay off your mortgage loan in full early

Full early repayment of the mortgage is possible 6 months after the start of the mortgage agreement. This is a rather complex procedure that requires maximum client responsibility.

How to repay a mortgage loan early:

- Call the hotline number (8(800) 555-55-50) to find out the exact amount of the remaining debt

- Deposit it into your credit account in full.

- Arrange for early repayment.

- After full payment, order a loan closure certificate.

Is it worth doing?

Costs. You can recalculate in two ways:

- By reducing the time limit. For example, repayment of the loan provided is calculated for 5 years, and after partial early repayment, the repayment period is reduced to 3 years.

- Through a reduction in the payment amount. For example, before it was reduced, it was necessary to deposit 20,000 rubles monthly, and after – 5,000 rubles.

Vasyukovich Artem

Mortgage expert. In lending since 2005. Editor-in-Chief IPOTEKAVED.RU

Ask a Question

The method of early repayment available to the borrower is usually specified in the contract. Given a choice, he can independently calculate the first and second amounts, compare the amount of the remaining debt and choose a more profitable, economical option. Both options are available at Sberbank, with the exception of repaying the mortgage with maternity capital. In this case, only the monthly payment is reduced.

Mortgage early repayment scheme

Procedure for early repayment of a mortgage:

- the borrower signs an application for private equity or PD;

- the creditor approves the completed request;

- the client makes the agreed amount and monthly payment;

- in case of partial early repayment, it is necessary to obtain a new payment schedule, and in case of full repayment, a certificate of closure of the court.

Calculation of benefits of early repayment

The benefit for partial early repayment is calculated based on the existing payment plan.

Let's look at an example:

The borrower took out a mortgage for 1.25 million at a rate of 11.6% for 120 months. After 3 years, he decides to contribute an additional 200 thousand rubles.

Annuity payment:

| Monthly payment | Overpayment | Benefit | |

| Before the emergency period | RUB 17,646 | RUB 868,935 | — |

| After NPV with a decrease in EP | RUB 14,163 | RUB 775,580 | RUB 93,355 |

| After the emergency period with a reduced period | RUB 17,646 | RUR 665,379 | RUB 203,556 |

After partial early repayment with a reduction in the loan term, the number of payments was reduced from 120 to 98, that is, the borrower will pay off the mortgage earlier, paying several times less.

Differentiated payment:

| Monthly payment (before NPV) | Overpayment | Benefit | |

| Before the emergency period | RUB 18,295 | RUB 731,498 | — |

| After NPV with a decrease in EP | RUB 14,685 | RUB 649,259 | RUB 82,239 |

| After the emergency period with a reduced period | RUB 17,066 | RUB 586,611 | RUB 144,887 |

Under the second partial early repayment scheme, the payment period is reduced to 101 months.

Thus, shortening the payment period is the most advantageous strategy to minimize overpayment.

How to calculate benefits and early payment using a mortgage calculator

The borrower must enter all available mortgage data into the calculator. In the “Schedule early repayment” field, indicate the expected amount and payment date. Click “Calculate amount”.

A new graph will appear at the bottom, created taking into account the interest paid. Not only the mortgage payment will be automatically recalculated, but also the amount of the overpayment.

Submitting an application

The borrower must write a corresponding application for early repayment at least one day in advance, otherwise the deposited funds will be credited next month. You can apply for it in your personal account or at a bank office.

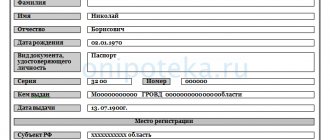

The application contains all the details of the loan product, starting with the interest rate and ending with the personal data of the borrower.

In the office

The client can go to a bank branch and submit an application only in the city in which the loan was issued to him. For registration you only need a passport.

Through Sberbank Online

Partial early repayment of a mortgage through Sberbank Online:

- Log in to your personal account and go to the current mortgage section.

- Click “Partially repay the loan.”

- Having indicated the write-off account and payment date, the client needs to decide on the amount to be repaid. The minimum contribution is not less than 99% of the size of the next EP.

- Click on the “Fill out an application” button and, after checking the entered data, confirm the action via SMS.

Important! This scheme only involves reducing the size of payments; a reduction in the payment period can be ordered at a bank branch.

Full early repayment of a mortgage in Sberbank Online:

- Check in advance with the support service operator at number 900 for the amount to close the loan.

- Select the “Repay the loan in full” tab.

- If the DAP is carried out on the day of registration, then only the specified amount should be indicated. If on a different day, the borrower will need to independently calculate the interest for all days of use.

- Confirm the entered data with an SMS code and complete the application.

Depositing the amount

Unfortunately, Sberbank no longer accepts cash for mortgage payments, so the client is offered to use any convenient method:

- depositing funds through an ATM or terminal;

- replenishment of the balance through the bank operator;

- transfer of amounts via online transfer from cards of other banks.

After enrollment, an early payment must be made to the loan account. The next day after the repayment date, you need to make sure that there is no debt through the bank’s online portal.

results

In case of partial early repayment, it is necessary to obtain a new schedule, which will reflect the information after recalculation of interest. If the settlement was complete, the borrower should order a certificate of paid mortgage.

How to pay a mortgage through Sberbank Online?

Payment of a mortgage through Sberbank Online is carried out according to the following algorithm:

- Go to the Sberbank Online website and log in using your username and password. They can be obtained from one of Sberbank’s ATMs or by completing an independent registration procedure in the system. You can also get access by contacting a bank branch. In any case, the client must already have the mobile banking service activated. After entering your login and password, confirmation via SMS is also required. When a message with a code arrives on your phone, you will need to enter it in the field provided for this.

- The service’s personal account will open the main page, where all the client’s deposits, loans and accounts will be displayed. Here you need to select the loan to be repaid, click the “Operations” tab and select “Transfer funds between my accounts” in the drop-down menu.

- On the page that appears, you need to indicate the account from which the funds will be debited and the loan to which they will be transferred. You can pay a loan through Sberbank Online using only a bank card. Payment by credit card will not be accepted. Here you will need to indicate the amount of the payment being made and click “Confirm”.

- A password confirmation of the funds transfer will be sent to your phone. It must be entered in the field provided for this and click “Confirm” again.

- A receipt with the stamp “Completed” will appear on the screen. Also, the system will prompt the user to add a payment template to their Sberbank Online personal account or enter loan repayment into autopayments.

After saving, the template will be located in the special “My Templates” menu.

- Also, Sberbank Online allows you to pay someone else’s loan. To do this you need:

- Log in to your Sberbank Online personal account using your login and password.

- Select the “Payments and transfers” tab and then “Banking operations: transfers/loans from another bank.”

- Find the desired bank by name or BIC number in the search bar and select it.

- You can continue the operation by filling out all the necessary fields: loan agreement number, insurance agreement number (if there was no insurance agreement, you do not need to indicate it).

- Next, indicate the payment amount and the account for debiting the funds. Online payment is only possible when using a bank card.

- After completing these actions, the payment is confirmed by a one-time password received via SMS, and the co-borrower pays the loan to another bank. In this case, it is possible to charge a certain commission percentage (depending on the bank in whose favor the payment is made).

You can pay off someone else’s loan at Sberbank only if the loan agreement initially indicated the possibility of making payment by third parties. Otherwise, the payment will be blocked by the recipient bank.

State assistance

State policy is aimed at supporting the country's citizens during an unstable economy. The government helps not only to obtain a loan for real estate at a favorable rate, but also to pay off the mortgage faster. There are several targeted programs for borrowers.

Registration of a tax deduction

Tax deduction on real estate and mortgages - an opportunity to return part of the cost of the purchased apartment and the issued loan. The maximum tax base is 2 million rubles, and for mortgage interest - 3 million rubles. The borrower can return up to 260 thousand rubles from the purchase of a home and 390 thousand from a mortgage loan.

Important! In accordance with the provisions of paragraph 3 of Art. 210 of the Tax Code, the amount of the refund depends on the official income of the taxpayer.

Calculation example:

The client took out a mortgage on real estate worth 2.35 million rubles for 15 years, having an official income of 96 thousand. The overpayment will be 1.808 million. Over the entire term of the mortgage, he will be able to return about 540 thousand, but in a year no more than 149 thousand

The borrower can independently calculate the approximate amount of the tax deduction using an online calculator.

Maternal capital

Maternity capital funds can be used not only for the down payment, but also to pay accrued interest. It is important to know that you cannot use money to pay off penalties and fines.

To repay a mortgage early with funds from maternity capital, borrowers must provide the Russian Pension Fund with a certificate of the balance of the loan debt. After this, the subsidy will be transferred to your bank account.

In 2021, the amount of maternity capital is 453,026 rubles.

State support programs for mortgage lending

You can pay off your mortgage with government subsidies:

- "Young Family" program. If all state requirements are met, a family can receive a subsidy in the amount of 35% to 100% of the cost of housing.

- Governor's (regional) capital. Assistance to families who, after the start of the maternity capital program, had a third/subsequent child. The payment amount is not more than 100 thousand.

- Assistance program in the event of force majeure. You can receive up to 10% of the total value of the remaining mortgage debt if the borrower's regular income does not exceed 30% of the last year's earnings.

Reducing the rate on an already concluded contract

The essence of the product is the allocation of funds by Sberbank to fully repay the debt on the existing mortgage. A new agreement is signed, under the terms of which the terms, interest, and amount of payments on the mortgage loan change. The borrower becomes the owner of the following benefits:

- Sberbank recalculates rates and interest on any loans, except plastic cards. All debt obligations are repaid in one payment.

- The rate is reduced regardless of the terms of the previous contract. Overpayments on interest become minimal, housing costs are cheaper.

- If previously the repayment was made in foreign currency, then Sberbank recalculates rates and interest in Russian rubles.

- The amount of the mandatory payment is fixed and does not depend on exchange rates, inflation rates and other crisis manifestations.

- Early repayment is allowed. The period is determined individually. All mortgage parameters (interest, rate, period) are agreed upon with the applicant.

- Recalculation of the mortgage interest rate from Sberbank in 2019 is available to all categories of citizens, regardless of status and creditor bank.

- It becomes possible to use all Sberbank products, including obtaining new loans at favorable rates.

- When it becomes difficult to repay interest and the loan balance, Sberbank provides credit holidays (other banks do not have such a function).

It doesn't matter who issued the loan. This could be Sberbank or any other banking structure of the Russian Federation. The location of the housing is also unimportant, as is its type. Apartments, country houses, cottages, dachas, garages, parking spaces, land plots - a loan taken for any real estate is recalculated at a favorable interest rate. But in order for the rate to be minimal, it is necessary to meet the requirements of Sberbank.

Where to get money for early repayment of a mortgage loan

If a client does not meet the conditions of government programs, but wants to quickly repay a loan from Sberbank, experts offer him the following options:

Savings

You can repay the loan with your own savings. Often, debtors close their mortgage with funds from their personal savings account.

Consumer loan

Unfortunately, consumer loan rates compared to mortgage loans are completely unprofitable, so this option can only be used in case of emergency.

Borrow money

If the borrower decides to save on interest, he can borrow money from friends and acquaintances. You can find out the balance of the debt in order to completely close the mortgage at a bank branch.

What is more profitable: shorten the term or reduce the payment?

An example of a situation: in 2021, a family entered into a mortgage deal with Sberbank in the amount of one million rubles for a five-year period at a minimum rate of 7.2%. If payment is made according to the calculated schedule of 19.9 thousand rubles monthly, then for the entire period about 194 thousand rubles of overpayment to the bank will be paid.

The family also has a deposit of 600,000 rubles, which can only be closed at the end of the year. In January 2021, the family can make an early payment of 600 thousand rubles.

We reduce the period

The same family decided to close the loan in the shortest possible time. Next, loan payments will be required at the end of 2021, which is 2.5 years earlier than expected. The bank will receive an overpayment of interest in the amount of 88 thousand, which saves 105.5 thousand rubles.

We reduce the payment

The benefit is a reduction in the loan term. The bank allows the debt to be closed using the following option: a payment reduction is selected, but the monthly payment continues in the same amount as at the beginning. At the beginning of cooperation with Sberbank, the family pays 19.9 thousand rubles monthly, and not 7.6 according to the updated schedule.

To regularly deposit a larger amount, a larger amount of money must be transferred to the credit account. The money will still be debited according to the schedule. It is necessary to submit an application for early repayment of the mortgage every month. This option has the following advantages:

- Closing a loan before the deadline set by the lender. The debt balance decreases much faster.

- The interest rate does not decrease, as well as when the period is reduced.

- Personal peace of mind thanks to reduced financial burden. If there is a sharp drop in income, the amount is paid according to an updated schedule.

But the benefit depends on the period when the debt is paid.

If a military mortgage

If the client cooperates with the bank under the military mortgage program, the reduction occurs for the terms in case of premature closure of the debt. Payment is made by the military treasury, so there is no reduction in payments. The client receives a benefit in repayment: the encumbrance is removed and the apartment is registered as ownership.

Look at the same topic: Mortgage in Svyaz-Bank [y] year: conditions and documents for registration

Alternative ways to pay off a mortgage in a difficult life situation

If the borrower is in a difficult financial situation and cannot fulfill his debt obligations in full, Sberbank offers additional support programs.

Mortgage refinancing

Refinancing is a procedure for obtaining a new mortgage loan to pay off an existing one, but on more favorable terms. It is important to know that Sberbank does not refinance its own mortgage loans!

Mortgage loan restructuring

Sberbank offers restructuring services to its clients who find themselves in difficult financial situations. By agreement with the lender, the borrower can change the loan currency, increase the total loan term, or issue a temporary deferment of payment.

What you need to do after paying off your mortgage

After repaying the loan, you need to obtain a certificate from the bank indicating that there is no mortgage debt. You can request it after the last payment at a Sberbank branch. We advise you to order an extract from the BKI to verify that the loan has been closed.

The next step is to revoke the mortgage. Until the mortgage is fully repaid, the purchased property is encumbered by the bank, so it is prohibited to carry out any actions with it. After repaying the mortgage, the apartment owner must visit the MFC to remove the encumbrance.

If the mortgage was paid off early, the borrower has the right to return a portion of the insurance for the unused period. To do this, you need to visit the company that issued the policy and write an application for a refund.

When can restructuring be carried out?

Sberbank is restructuring loans issued earlier, when income was higher and it was easy to pay. In the current situation, many find themselves in a position where the family budget cannot withstand the load due to the depreciation of the ruble and rising prices for food and consumer goods. Some were left without work or began to receive less wages. If this happens, then it’s time to contact Sberbank, write an application for recalculation of the rate, and draw up a new agreement with a minimum percentage.

If the loan is overdue at the time of application, the bank will refuse. Therefore, pay off all current payments before submitting your application. At least 20% of the housing price must be paid. The minimum debt balance is RUB 300,000. The maximum is negotiated individually. There are programs in which the mortgage involves paying 10, or even 12 million. These values differ in different regions. So, if in Moscow you can get 10 million rubles. then in another city, say, only 8 will be available.

There are no other restrictions on applying. Are you experiencing financial difficulties? Don't want to pay the inflated rate anymore? Do you want to review the terms of using credit funds? Contact any Sberbank branch, bring documents for a mortgage, write an application. Requirements for applicants are standard. The decision, of course, is up to the bank, but if the reason is objective and significant, you will receive approval.

Improving the financial situation of the borrower

People going through a difficult period and in need of financial support turn to Sberbank and receive help. Just a few years ago, paying off mortgage debt was easy. But over time, anything could happen, and if events lead to a decrease in the standard of living, it is necessary to recalculate the interest in order to reduce the rate. In this case, the overpayment will be less, and mortgage repayment will become more affordable.

Sberbank accepts any arguments. The birth of a child, deterioration of the borrower’s health, and other preconditions that caused the deterioration of the situation are taken into account. Having a salary card increases the chances of hearing consent. If you have a deposit account, but have not taken out a mortgage with Sberbank, you can count on recalculation of rates and interest. As a result, the size of the monthly payment is reduced, the terms are revised, and the mortgage rate becomes meager. The remaining funds can be spent on yourself and your family.

Decrease in client income

Recent years have shown how unstable the country's economy can be. Employers are not able to pay as they used to. Many companies closed and people found themselves without wages. When profits have decreased, but the mortgage remains, there is nothing to pay the interest, everything ends in arrears. Recalculation of the interest rate allows you to eliminate this risk if you contact a financial institution in a timely manner. The fact is that the apartment or house is pledged to the bank, and if the situation gets too bad, you could end up homeless.

There is no need to describe in the application for recalculation what exactly happened and why there was a need to recalculate the rate with interest. The application form for recalculation of interest requires the indication of key aspects, excluding the “lyrics”. When applying for an online loan, you don’t have to explain anything. It is enough to fill out the required fields of the recalculation form, provide additional information and wait for pre-approval. Collect documentation and come to the Sberbank office on the appointed day. Sign a new agreement, restructure the mortgage at a new interest rate.

Restructuring options

Sberbank restructures mortgage debt if there are no delays, fines, or penalties. Overdue debts and penalties are not included in the scope of the service provided. Recalculation involves a change in rate. At the same time, there is a choice of which path to take when recalculation is needed, as well as new rates and a minimum percentage. The decisive factor is circumstances. The interest rate reduction occurs as part of the restructuring. But this is not the only option available to the borrower.

You can review the terms of the mortgage and perform a recalculation upon an application submitted at a Sberbank branch. Another way is to go through court. The resolution will contain a clause on rate reduction. In this case, the percentage is subject to mandatory revision. All methods are available and legal. To take advantage of one of them, it is necessary to evaluate the feasibility of each mechanism for reducing mortgage rates. The decision is yours to make. First study what the listed procedures entail.

Tips for Mortgage Borrowers

Recommendations for borrowers:

- It is important to study the loan agreement. Pay special attention to the clause with penalties for late payment and early repayment. You need to sign a contract only if you fully agree with all the terms.

- If you have the financial opportunity, you should arrange partial early repayment with a shorter payment period. This will help you quickly pay off your mortgage at Sberbank with the least overpayment.

- There are situations when a borrower believes that his income may soon decrease, but currently he has the opportunity to contribute large amounts. In this case, the bank advises you to arrange partial early repayment with a reduction in the monthly payment, reducing the loan burden in the future.

- If you have an additional financial reserve in the form of a deposit or investment, the bank advises using them as an additional source of income, and not as a private equity income. Thus, it protects its borrowers from difficult financial situations.

Borrower mistakes when repaying early

The most common mistakes:

- The borrower, having a fairly large amount, does not want to make early repayment. If you have the financial opportunity, it is more profitable to issue a private insurance policy and reduce the overpayment.

- Many people do not know that the partial early repayment amount does not include the monthly payment. If the borrower draws up a private equity investment for 50 thousand, then in addition to this he must also make a contribution according to the schedule.

- Some clients arrange partial early repayment only after saving a large amount of money. This is wrong, because the later the debt is repaid, the less savings will be.

- Not everyone evaluates their own financial capabilities. When making partial early repayment, it is important to take care of the “financial cushion”. This is necessary in case of dismissal, illness, etc.

Correct borrower steps for early repayment

To pay off your mortgage faster, you need the following:

- You need to choose a PPP with a shorter payment period.

- It is not necessary to save, you can make minimum amounts: 99% of the next monthly payment.

- Don't forget about tax deductions. The funds received can be used for early repayment. Tip: by submitting a tax return at the beginning of the year, the borrower will receive a deduction earlier, reducing the overpayment.

- You should agree to the offer to profitably refinance your mortgage loan.

See also: what should you pay attention to and what should you be prepared for when paying off your mortgage early? On the air of the Khabarovsk channel “Guberniya”, Dmitry Cheshulko, president of Khabarovsk channel, shares useful information, which specializes in consulting citizens on mortgage lending issues.

Recommendations for existing borrowers

Those who want to quickly pay off their mortgage at Sberbank should adhere to a number of rules:

- do not hesitate to repay the loan early, then you will be able to reduce the final overpayment;

- making early payments in the last years of payments is unprofitable, since there will be no savings on interest (most of it is paid at the beginning of the loan term);

- You can repay the loan ahead of schedule using the received tax deduction, maternity capital, additional earnings or your own savings;

- immediately start transferring small amounts rather than saving;

- when paying off part of the debt, leave some amount in reserve - for various unforeseen situations (layoffs, illnesses, etc.), so as not to experience financial difficulties later.

Borrower mistakes when repaying early

It often happens that, having a large amount at his disposal, the borrower does not want to repay the loan early. However, if there is such an opportunity, it is better to start making emergency payments earlier, thereby reducing the overpayment.

Also, most clients prefer to save up a substantial amount and then partially cover the debt. But the later this is done, the less benefit.

An equally common mistake is to think that the amount paid in excess of the norm includes the standard monthly contribution. These are different categories. So, when paying, for example, an additional 40 thousand rubles. the client will have to close the main payment on the scheduled date.

Correct borrower steps for early repayment

What to do to pay off your mortgage as quickly as possible:

- Partially repay the debt by reducing the loan term.

- Don’t save, but contribute money whenever possible. It is acceptable to transfer small amounts, but not less than 99% of the monthly contribution.

- Use the received tax deduction for early payment.

- Agree to the bank's offer to refinance the mortgage.

conclusions

To apply for early repayment at Sberbank, you must write an application at the branch or submit it through your personal account. You must notify the lender of your decision 30 days before the payment date, otherwise the funds will be taken into account the following month.

The bank offers two options for paying off your mortgage early: with a shorter repayment period or a lower monthly payment. The first option is more profitable for all borrowers, however, if the client decides to ease the loan burden, it is better to choose the second scheme. It is more convenient to arrange early repayment in the first quarter of the payment term, when the monthly payment consists of 90% of accrued interest.

Recalculation of interest

The loan is recalculated if this option is indicated in the contract document. Regardless of Sberbank’s mortgage products, debts are repaid ahead of schedule when interest is recalculated. If the client has made a partial payment at a Sberbank branch, he is entitled to receive a printed copy of the new schedule. If you deposit the amount ahead of schedule through your personal account, the updated payment schedule will be available on the screen in the loan information section.

The interest rate for the use of early repayment will not be recalculated in all cases, since contractual clauses must be specifically stated. When a new schedule is indicated in the calculation points, the interest is transferred to the new debt and the payment will be reduced.

See the same topic: Federal Law 117 on military mortgages with latest changes %%current_year%%