When residential properties are purchased with a mortgage, an encumbrance is automatically placed on them. Housing acts as collateral for mortgage lending. Clients of a financial institution cannot conduct certain types of transactions with its participation, among which are the following:

- Sale of real estate without notification to the banking organization;

- Registration of third parties in the apartment;

- Renting out housing.

After purchasing a residential property with a loan from Sberbank, an encumbrance will be placed on it, which will also be reflected when registering the property in Rosreestr. In order for it to be canceled, a specialized procedure for removing the mortgage encumbrance will be required.

Real estate encumbrance - what is it?

An encumbrance on a mortgage issued by a financial institution means restrictions imposed on the collateral. This means that the buyer, until the debt is fully repaid, will not become the full owner of the property with the right to carry out any transactions (sale, donation, exchange, etc.). Actions of this kind must be agreed upon with the mortgagee and officially approved.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

Restrictions are regulated by the Civil Code of the Russian Federation, Federal Law No. 102 “On Mortgages” and the conditions specified in the banking agreement.

The lender places an encumbrance on the loan funds after the borrower purchases the living space. The basis is a mortgage agreement. According to it, the purchased housing acts as collateral for Sberbank (another institution) and serves as security for the client’s financial obligations.

The bank transmits information that the apartment is encumbered to Rosreestr. This occurs as a result of registering a transaction. The procedure is carried out on the day the mortgage agreement is signed.

What are the types of encumbrances?

The peculiarity of the encumbrance is that it is of two types: voluntary and forced. An example of the first option is that the owner leaves his property as collateral in order to receive a certain amount, the second is seizure by the court.

Types of restrictions on property rights:

- Pledge. The owner pledges valuable property and receives a certain amount of money in return. When the debt is repaid, the encumbrance will be removed.

- Mortgage. The situation is similar to the previous one. The only collateral is the real estate purchased with borrowed funds (apartment, house). It will be at the disposal of the bank until the loan is fully repaid.

- Arrest. An encumbrance is imposed on the basis of a court decision due to non-fulfillment of debt obligations of any kind. Any transactions with seized real estate are prohibited.

- Trust management. The property is managed by a certain trustee without the right to transfer ownership. Moreover, the actions of this person should not contradict the interests of the owner. The agreement is concluded in writing.

- An annuity, or life support with dependents. A method of obtaining personal housing under an agreement with the real owner, who receives in return a certain amount or full maintenance for the rest of his life.

- Rent. The essence is to transfer a property for use on a temporary basis for a fee. The lease agreement is signed by both parties. Failure to comply with at least one of the prescribed conditions entails the recognition of the agreements as invalid.

- A ban on performing any actions with objects that are designated as historical and cultural monuments.

- Availability of guardianship. We are talking about a situation where minor citizens live in an apartment or it was purchased with the participation of maternity capital. For alienation, official permission from the trustee authorities is required.

- Easement. Restrictions are not imposed on the entire plot of land or apartment (house), but partially. The bottom line is that the owner of the object has the right to use it not to its full extent. If we are talking about land, then we mean laying out travel routes, which is important in cases where it is impossible to get to a significant object (for example, a water source) in another way.

The basis for imposing an encumbrance may be a law of the Russian Federation, a court ruling, an agreement, a transaction or an act of government agencies.

There are restrictions that are not legally considered an encumbrance. Thus, you cannot make any transactions with an apartment located in emergency housing.

What is an encumbrance and why remove the encumbrance on a mortgage?

Encumbrance means restrictions imposed on the use of real estate. Encumbrance implies that, in addition to the legal owners, a third party has certain rights to the living space. With a mortgage, the third party is the credit institution that provided its funds to the borrower.

An encumbrance on real estate is imposed in the case of a mortgage, life annuity agreement, or rental of premises.

Encumbrance implies a number of restrictions on the use of living space:

- The borrower cannot sell the mortgaged property without the knowledge of the bank. Such transactions are considered illegal and can lead to many unpleasant moments for the seller and buyer. The loan agreement does not indicate that the borrower does not have the right to sell the apartment. If necessary, he can sell it, having previously notified the credit institution and agreed on the sale amount, as well as the return of interest and the balance of the debt.

- The borrower does not have the right to register other people in the apartment without the approval of the bank. The borrower and co-borrower, as well as the borrower’s minor children, are registered in the apartment. The homeowner should not register other persons in the apartment without the bank’s permission, since the living space is pledged to the credit institution. In case of non-payment, selling real estate with registered third parties will be problematic. Before registering other people and relatives in the apartment, the borrower must remove the encumbrance from the apartment after closing the mortgage.

- The borrower has no right to rent out the premises without the permission of the bank. The homeowner can dispose of his property, but some transactions require the written consent of the bank. If the loan agreement does not specify restrictions related to rental housing, the borrower can rent out the apartment.

A borrower who is unable to pay interest and debt to the bank can sell the apartment. The buyer is informed of the existence of an encumbrance. The credit institution is interested in returning money from insolvent clients, so a ban on sales is rarely imposed. The buyer pays the entire balance of the debt to the bank and the remaining amount to the seller. After this, a purchase and sale agreement is concluded and the encumbrance is removed.

How to remove an encumbrance from real estate

It is possible to remove a mortgage encumbrance under the following circumstances:

- the mortgage at Sberbank (another financial and credit institution) has been fully repaid;

- there are grounds for early termination of the agreement with the bank;

- complete destruction of the mortgaged object;

- selling an apartment to pay off a mortgage loan.

To remove the encumbrance on a house or apartment, you need to contact Rosreestr with an application from the mortgagee and the borrower-owner, as well as the necessary package of documents. If there is a mortgage note, then it is also attached (it must contain a note from the bank indicating full repayment of the debt).

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The mortgage agreement must specify who is responsible for sending the application to the Unified State Register of Real Estate (Article 25 of Federal Law No. 102 of July 16, 1998 “On Mortgages”).

Thus, Sberbank removes the encumbrance through DomClick independently immediately after the client pays off the mortgage. To do this, you do not need to write an application or personally contact a bank branch or the registry office - the process starts automatically.

How is the procedure for removing the encumbrance on a Sberbank mortgage in 2020-2021:

- After paying the last installment, the client receives an SMS notification within 24 hours about the start of the procedure for lifting restrictions. If the telephone number has been changed during the mortgage installment period, you must notify the bank in advance.

- Sberbank is conducting an inspection, during which it may request additional documents from the borrower. They can be delivered in person or online.

- A month later (this is how long the process of removing the encumbrance lasts) the citizen receives an SMS about the completion of the procedure.

When can you start the procedure for removing the mortgage from an apartment?

It is possible to remove the encumbrance from an apartment from Sberbank or another lender only if there are no financial claims against the client. This means that the procedure can be started after the mortgage has been paid in full and with interest. In this case, the last payment can be made ahead of schedule.

The very next day after making the final payment, the bank submits documents to Rosreestr. There they make a corresponding entry about the lifting of restrictions on the mortgaged property.

What documents will be needed

Necessary documents to remove the encumbrance:

- certificate of absence of debt obligations (it is prepared by the bank within a month);

- written confirmation from the bank that there are no financial claims against the client under the loan agreement (the document is sent to Rosreestr);

- statement of credit account;

- a statement signed by both parties and certified by the creditor;

- mortgage agreement + its photocopy;

- passports of all participants in the transaction;

- extract from the Unified State Register of Real Estate on the ownership of the apartment (house);

- receipt of payment of state duty;

- judicial act (if the mortgage is terminated on its basis).

Sometimes other documents may be required, which must be clarified directly at the bank branch.

Sample application

Since in Sberbank the procedure for removing the encumbrance from a collateral object is launched automatically, the client is not required to write an application. But you will have to wait the required 30 days to complete the process. Those who want to get results faster can take action on their own. To do this, you need to submit a corresponding application and the necessary documents to Rosreestr.

The form to fill out can be taken directly from a bank branch or registry office, after which it is certified by the financial institution. If the apartment is owned by several people, everyone must write a statement. If there is a mortgage, it serves as the basis in Rosreestr for canceling the entry on restrictions on real estate.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The document must have the bank's seal and a note that the mortgage has been fully repaid.

In other financial institutions, a borrower who has made the last payment on a mortgage loan must first submit an application for removal of the encumbrance directly to the bank.

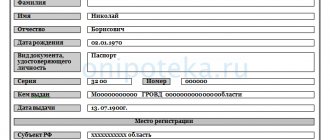

Sample:

The application sent to the Unified State Register of Real Estate indicates:

- your initials;

- passport details;

- residential address and contact information (phone number, e-mail);

- the reason for removing the encumbrance (fulfillment of debt obligations in full);

- date and number of the document on the basis of which the restrictions will be cancelled;

- type of object (apartment, house, land plot or other);

- characteristics of real estate;

- number and signature.

Sample application to the Unified State Register of Real Estate:

How are documents submitted?

There are several ways to submit an application to Rosreestr:

- through a bank branch;

- personal appeal to the MFC or the Registration Chamber;

- via the Internet (Gos website).

Filing via Companies House

The borrower can apply to remove the encumbrance immediately to Rosreestr (in person or remotely).

Procedure for the applicant:

- Receives a mortgage from the bank or certifies the application with a seal.

- Collects the necessary package of documents.

- Submits papers to Rosreestr.

You will not need to visit the registration office again after the restrictions are lifted.

Registration at the MFC

The sequence of steps will be the same as when applying to the Unified State Register of Real Estate. When visiting the MFC, the owner saves significant time, since he will not have to stand in line. While filling out the application, you can get help from a center specialist. The period for removing the encumbrance in this case will increase to 5 days.

Online - via the Internet

If you have an electronic digital signature, you can remove the restriction on the USRN website through “Government Services”. How to proceed when removing an encumbrance online on the State Services portal:

- Log in to the site using your login and code combination.

- Go to the “Authorities” section and click on the “Rosreestr” item.

- Go to the section “State cadastral registration or... and transactions with it.”

- Then select “State registration of residential mortgages”. Here you can familiarize yourself with the list of required documents, the duration of the service, and possible reasons for refusal. If there is no “Get a service” button, then in this region it is not provided in electronic form - you must personally contact the registration authority or the MFC.

- If the service is available, a link to the official Rosreestr portal will be posted nearby.

- You will not need to register again on the Registration Chamber website - you can log in using the input data from the EPGU website.

- Enter the section on registration of rights and click on “State registration of termination of restriction of rights.”

- Indicate the object and enter its main characteristics (cadastral number, address), as well as information about yourself. Attach scans of documents.

- Sign the application with an electronic signature. You can get it at the MFC.

If the client has his own account on the DomClick online platform, an application for removal of the encumbrance can be submitted through it.

Then all you have to do is wait for the procedure to complete – an SMS message will be sent to the borrower’s mobile phone.

Amount of state duty, when and how to pay it

There is no state duty for removing restrictions on real estate. If you need an extract from the Unified State Register on paper to verify that the encumbrance has been lifted, then you need to pay 400 rubles. A document in electronic form costs less – 250 rubles.

Features of the procedure at Sberbank

Removing an encumbrance on a Sberbank mortgage is standard, but the procedure can be somewhat simplified with a free service for some regions. A client of Sberbank of Russia must contact a bank branch to fill out an application to remove the encumbrance from the pledged property. A note will be made in the mortgage note regarding the repayment of the debt on the mortgage loan; the application will be prepared by bank specialists. After which the application must be signed by both parties.

After visiting the bank, the owner must wait for an invitation from a bank employee to visit the multifunctional center.

A bank specialist will accompany the owner and supervise the entire process until the transaction is completely closed and the encumbrance on the collateral property is removed. If such a service is not provided, the borrower independently continues the procedure for legal registration of removal of the encumbrance.

How to get a mortgage and send documents yourself

If you filled out a mortgage at a bank (a document pledging the property being purchased), then you can order it directly from the lender. The document will be ready within 10 working days. There is no need to pay for this service.

At Sberbank, a request can be made by calling the hotline 8 800 770-99-99 or by visiting the office in person to write an application. When the mortgage is ready, the client will be notified via SMS. They receive the document at the mortgage department after presenting their passport.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The collected papers, including the mortgage note, are sent to Rosreestr through the MFC.

Statement

According to the requirements, in addition to the mandatory documentation, in order to remove the encumbrance from the apartment after repaying the mortgage, you must write an application to Sberbank. It is drawn up independently and signed personally. Despite the free form, the document must contain the following points:

- personal information of the borrower’s passport (number, series, date of issue and name of the authorized body);

- place of registration;

- name of the credit institution and its address;

- information from the loan agreement: date of issue, repayment, full cost of the mortgage, as well as the date and number of the agreement;

- information from the certificate of no debt;

- the main point in which the borrower indicates the requirement to remove the encumbrance from the apartment in order to carry out further actions on it in connection with the fulfillment of obligations under the contract.

How long does the removal procedure take?

Removing restrictions from a property after paying off the mortgage is a quick process if you initiate it yourself. According to Art. 25 Federal Law No. 102 “On Mortgage”, the encumbrance is removed within 3 working days from the date of submission of all necessary documents. If the client used the services of the MFC, the process will take 2 days (the time required to send the documentation).

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

At Sberbank, the process of canceling a mortgage record lasts 30 days. The institution carries out this procedure independently; the participation of the borrower is not required.

What needs to be done to remove the burden?

If the mortgage agreement was drawn up at Sberbank, withdrawal occurs automatically within a month after full payment of the debt. The owner does not have to visit the bank office, Rosreestr or MFC and fill out an application. All that remains is to observe the process.

In 2021, changes in legislation came into force allowing banks to carry out withdrawals without the participation of the property owner unilaterally.

A client registered in the DomClick service will receive a message on their phone within two business days about the start of the process of removing the encumbrance. The message will also contain a link to the list of ordered services, where you can monitor the status of the procedure.

Notifications are sent to the number linked to the mortgage agreement. If the client has changed his phone number, he needs to contact the manager and ask to update the data.

If you have not registered in the system before, do so now.

How to make sure that the encumbrance has been lifted

After the mortgage record is cancelled, the information is updated on the Rosreestr website within a week. The easiest way to check whether the encumbrance on an apartment has been removed is to order a new extract from the Unified State Register from the MFC or on the website in the public services section.

On the Rosreestr portal you can check the status of a real estate property in the following ways:

- Go to the website. In the form presented, find the desired object (apartment, house, etc.) using specific data: cadastral or conditional number, address. Create a request and wait for an extract. There must be a dash in the “Rights and Restrictions” column.

- In your “Personal Account”, go to the “My Objects” section (you can log in using your login and password from “Government Services”). On the page that opens you will see information about all your real estate. If there is no encumbrance, then there will be a dash in the line “Information about restrictions/encumbrances of the right.”

We check whether the encumbrance has been removed from the object through the DomClick portal (relevant for Sberbank clients):

- Go to the official website and log in to your personal account.

- Open the “Mortgage/Removal of Encumbrance” item.

- We fill out the application and send it for consideration.

- Employees of the creditor bank, after reviewing the application, start the procedure manually. And you can track the status of the service on the corresponding page.

What to do if you haven’t received an SMS from someone other than the bank?

Cancellation of encumbrances is a lengthy process that continues for at least one month. And when it starts, the bank must notify the client about it by sending SMS messages. However, there are a considerable number of situations when notifications are not delivered. This leads to the fact that the citizen remains unaware that the financial institution will soon remove the collateral status from the apartment.

If you have not been notified that work has begun to cancel the lien, then most likely the message was sent to an old phone number. If it is not at hand, it is recommended to wait for the process to complete or find out about its status through the Domclick service. In this case, you will not need to write any application. All information of interest to the borrower will be provided in the personal account.

If you still want to know about each stage of the encumbrance work, then you can write a statement in the Domlik system so that specialists will report such information through the system when Sberbank cancels the collateral.

How to find out that the apartment is at the complete disposal of the owner without restrictions

During the validity of the mortgage, the apartment is at the disposal of the owners, but Sberbank imposes restrictions on some manipulations with it. After paying off the debt, she changes her status with the registration authorities. New documents are drawn up for it, and a note appears indicating that the procedure for removing encumbrances has been carried out. Re-registration of all documents by Sberbank is carried out automatically. And clients can find out the details through the Domklik system.

In order for the borrower to ensure that the housing has been re-registered, the following methods are used:

- Visit the Internet portal of Rosreestr and open the reference section. It must indicate the exact address of the property, as well as the number registered in the cadastral passport. In the category of restrictions and rights there will be no information about restrictions. All information is available free of charge;

- It is also possible to find out information about real estate purchased with a mortgage using the public services service. This method is optimal for those citizens who have a personal account on this portal. The site has a section called “My objects”. It contains information regarding all real estate owned by a citizen. In the category of restriction of rights there should not be any information about property;

- Using an extract from the Unified State Register of Real Estate. It is not provided free of charge. It will indicate that the object is not registered. The document can be ordered from Rosreestr.

It should be remembered that the check should be done only a week after Sberbank sent a message that the cancellation of the pledge was successful. This is due to the fact that Rosreestr updates data on real estate objects every week.

What needs to be done after removing the encumbrance

Having received an SMS from the bank stating that the encumbrance has been cancelled, there is no need to do anything further. Now in the Unified State Register of Real Estate information about your property has been updated, and the note about restrictions has disappeared.

If you need to make sure the procedure was successful, order an extract. You just have to pay a state fee for it. The document is valid for only 1 month. Therefore, it makes no sense to order it if no manipulations with the living space are planned in the near future (for example, buying and selling).

Is it possible to sell an apartment with an encumbrance?

Real estate sales transactions with restricted rights are possible in some cases:

- Re-issuance of a loan agreement with a change in the collateral.

- The agreement with the buyer is as follows: the mortgage is closed with the money paid as an advance payment. The restriction is lifted and the purchase and sale transaction is completed.

- If the buyer takes out borrowed funds from Sberbank, they can cover the balance of the seller’s debt. After completing the transaction, he receives the difference between the sale amount and the balance of outstanding loan funds.

All of the above operations must be approved by the bank.

Didn't find the answer to your question? To get advice, help with documents or find out the conditions for reducing the interest rate, write to a specialist in the online chat . All requests are accepted and processed around the clock!

Why may they refuse to remove the encumbrance?

For what reasons may the encumbrance not be lifted:

- incompleteness of the submitted documents or errors in some (for example, the details of the mortgage agreement were incorrectly indicated in the mortgage note);

- the lender has financial claims against the borrower due to the remaining debt (the encumbrance can be removed after repaying the mortgage in full, so you must keep all receipts to confirm the proper fulfillment of your obligations);

- the application was submitted not by the owner of the mortgaged property, but by a third party without a power of attorney (if it is not possible to visit the MFC or registration office yourself, you must issue a power of attorney from a notary for another person);

- the creditor bank ceased its activities;

- A ban has been imposed by the bailiff service on carrying out any actions with real estate.

There are restrictions from the FSSP

Bailiffs can temporarily prohibit a borrower from carrying out any transactions with property due to unpaid other loans. So, until the client pays off all debts, he will not be able to remove the encumbrance. You can try to challenge this decision in court.

There are errors or typos in the documents

Often, when preparing documentation, the borrower or lender makes mistakes (typos). Because of this, Rosreestr may refuse to remove the encumbrance. Therefore, you need to be as careful as possible with the papers when applying for a mortgage loan and submitting an application.

The lender has ceased operations

If a credit institution is liquidated, it is necessary to find a successor company. Then apply there with a request to sign a certificate of repayment of mortgage debt obligations and jointly draw up an application to the MFC or Rossreestr.

If you cannot find a credit institution, you must go to court.

Definition of encumbrance (collateral)

Removing restrictions on housing is an important aspect of the acquired property. In order to carry out the process in accordance with the law, it is necessary to clearly understand the essence of the pledge, the purpose of its existence and also the grounds for imposing an encumbrance on the mortgaged housing.

Important! Based on regulations, encumbrance is defined as a partial restriction of property rights to housing, when purchased through a housing loan, in the case of using an apartment for rent or through an easement, as well as rent or trust management.

The limitation is established in the following circumstances:

- When selling an apartment that is pledged, the bank's permission is required.

- When purchasing an apartment through a mortgage, the borrower registers only a narrow circle of people (co-borrowers, family members). You cannot register others.

- Renting is also prohibited, so this option requires the approval of a credit institution.

Despite the established prohibitions, it is possible to sell an apartment with collateral. To do this, the buyer who agrees to this type of transaction transfers part of the money to the bank to pay off the mortgage, and the rest to the borrower’s account.

Understanding the concepts

First of all, we are interested in the possibility of filing

Applications by the mortgagor with the simultaneous provision of a Mortgage Note containing a note from the mortgage owner regarding the fulfillment of the obligation secured by the mortgage in full

The mortgagor is you, the owner of the apartment, who pledged the apartment to the Bank; A mortgage is a security that is kept in the custody of the Owner of the Mortgage (you signed it when you received the loan) and which the owner of the Mortgage must return to you after repaying the loan; The owner of the Mortgage is the organization to which you owed money and registered the Apartment as collateral. Initially, it was the Bank that issued you a loan. If your loan has not been transferred anywhere (and you must be notified of this in writing), then the Bank will remain the owner of the Mortgage. But your debt could be sold (refinanced) to another organization, for example, to AHML (Federal Agency for Housing Mortgage Lending) if you received a loan under government programs. Then the owner will be the secondary creditor, i.e. the organization that bought the right to demand repayment of the loan from you (you should have been notified of this in writing). Fulfillment of the obligation secured by the mortgage in full - full repayment of the loan, arrears, penalties and other things (if any). Thus, to submit documents to remove the encumbrance (i.e., submit an application to the registration authorities so that your apartment is no longer pledged to the Bank) after repaying the loan, the participation of the Bank or any intermediaries is not required.

Sale of property

Sometimes there is a need to sell an apartment with an existing mortgage encumbrance. It happens that the borrower does not have enough money to repay the debts. As a result, according to the Federal Law, the real estate is transferred to the banking institution. Often it is sold in order to settle payments with the client. In this case, the client can try and independently sell land or an apartment encumbered with a mortgage. However, it will be very difficult.

After all, one of the main conditions that real estate buyers usually follow is the absence of any restrictions, arrests, etc. Of course, if this succeeds, then the encumbered apartment can be alienated only with the permission of the banking institution itself.

A buyer who has decided on such a transaction should obtain a special certificate indicating the amount of debt. It is taken from Rosreestr. According to the document, it will be clear exactly how many payments remain to be made.

As practice shows, the transfer of ownership of the property being sold is not carried out very quickly and takes about two months. But these terms can be extended, although this rarely happens. In general, buying an apartment with an encumbrance, as well as removing it, is not so difficult. But the client must remember that before starting any action in this direction, it is imperative to notify the banking institution. Otherwise, he may face serious fines. In turn, the purchase of an apartment with a mortgage encumbrance should also be under the control of the bank. The buyer must make sure of this, otherwise he risks losing money and real estate, since the transaction may be declared invalid.