How to properly repay a mortgage early: features and difficulties of the procedure

The first thing you should know about early repayment is that it is not profitable for banks. By concluding an agreement with a client, financial institutions expect to receive a certain amount of income in the form of interest. Repaying a loan before the due date reduces the size of the debt, and therefore the interest. Some banks indicate in the agreement that early repayment is impossible, but due to great competition, an absolute ban is becoming increasingly rare.

Credit institutions are trying to attract customers by advertising favorable lending conditions and the absence of commissions for early repayment.

Early repayment of a loan is any amount deposited into the account in addition to the obligatory monthly payment. This will certainly entail a reconsideration of the payment schedule. Financial institutions offer the client to reduce either the loan term or the amount of monthly payments. The borrower can make this choice himself, or the bank will inform him of the only possible solution. If you have a choice, financial experts recommend paying off the term, since the amount with interest decreases with the term.

Early payment will not be accepted without specific application and clearing of all outstanding debts. These rules apply to all banks. Some financial institutions impose penalties on customers who submit an application but fail to make a payment.

Banks try to compensate for their losses by imposing certain restrictions on early repayment: they set a limit on the amount below which payment will not be accepted, introduce additional formalities, a moratorium, etc. You should pay attention to the moratorium before signing the loan agreement. This is a certain period of time during which it is impossible to repay the loan ahead of schedule. At this stage, you should make a choice: take a mortgage with a large moratorium, but lower interest rates, or with a small moratorium at a high interest rate. The choice towards the latter should be made by those borrowers who are firmly confident in career growth, and whose salary will increase over time.

The agreement specifies the presence or absence of penalties and fees for early repayment. By law, commissions cannot be charged. A customer may file a complaint if he is forced to pay an early repayment fee. The court will take the borrower's side if the bank has not taken additional measures. Fines may apply to late payments, and fees may be charged in connection with paperwork.

When to start paying off your mortgage early?

Start paying off your mortgage early as early as possible - preferably right from the first years of the loan. This way you can pay the bank faster and save much more on interest payments.

There is a myth that interest is calculated initially and there is no way to reduce the overpayment, but this is not true. They are accrued every month on the balance of the principal debt

and for annuity payments are calculated by banks using the formula:

P - amount of accrued interest;

OOD - balance of the principal debt;

r is the interest rate on the loan;

KDM - number of days in a month;

KDG - number of days in a year.

In the first year of the mortgage, the interest overpayment will be the highest due to the large amount of the principal debt. The closer the end of mortgage payments is, the lower the debt and interest - which means the benefit from early repayment also decreases. It turns out that the sooner we start reducing the principal debt, the more we will save.

All this is easy to prove with an example - let’s calculate a loan of 4 million rubles for an apartment in a new building. Let's assume we took out a preferential mortgage at 6.5% per annum for 12 years with annuity payments.

Option 1. We will deposit 400,000 rubles ahead of schedule. in the first year of the mortgage

The loan term in this case was reduced by 1 year 8 months. Savings on overpayments of interest to the bank amounted to RUB 417,013.71.

Now imagine that at the beginning of the mortgage we did not deposit 400,000 rubles, but put it on deposit at 4.5% per annum (average rate in 2020). Over 10 years, taking into account capitalization, the amount should increase to 611,313 rubles.

Option 2. We will deposit the accumulated 611,313 rubles. with interest in the last year of the mortgage

The mortgage term was reduced by 1 year 4 months. Savings on interest payments to the bank were practically zero and amounted to only 28,580.79 rubles. This was due to the fact that at the end of the payments the principal debt was almost repaid.

| When we make an early payment | How much has the mortgage term been reduced? | Saving on overpayments (interest to the bank) |

| In the first year of the mortgage (RUB 400,000) | for 1 year 8 months | RUB 417,013.71 |

| In the last year of the mortgage (RUB 611,313 with interest) | for 1 year 4 months | RUB 28,580.79 |

Having paid 400,000 rubles ahead of schedule. at the beginning of the mortgage payment, we would have paid the bank 4 months earlier and saved 417,013.71 - 28,580.79 = 388,432.92 rubles. more. Even taking into account the interest accumulated on the deposit, early repayment in the last year turned out to be less profitable.

You should not rely on profit from deposits when repaying loans early. Historically, mortgage interest rates in our country are higher than deposit rates. Even the most profitable deposit will leave the borrower in the red.

What is the best way to pay off your mortgage early: amount or term

Early repayment needs to be carefully considered and all options considered. The longer the period of time until the end of payments, the more profitable early repayment is. You need to weigh your needs. It may happen that the client deposits all the funds into the loan account, and then there is an urgent need for money, and he will have to take out a new loan.

If possible, you should strive to repay the loan term, but in some cases it is beneficial to repay the amount. Let's consider all possible options.

- A mortgage for a young family has its own characteristics. There is a certain family budget, children, monthly expenses. In this case, the monthly payment can be burdensome. The family may consider reducing payments. You need to proceed from the personal preferences of each individual family. Some want to quickly get rid of the collateral, others want to have a free amount of money every month for personal needs.

- It is recommended to reduce the term for borrowers with a decent salary and a reliable, stable job. The bank client must be sure that he will meet the monthly payments and will not lose his job.

- Borrowers who have a stable but not too high salary are recommended to make early payments periodically, reduce the term, and then the amount.

- Monthly payments can be quite burdensome. Some bank clients do not want to pay off the due date immediately, but want to save up funds for a car or a summer house. In this case, the amount is first reduced, and then, if possible, the term.

- Unstable or irregular income complicates the situation. First, you need to reduce the amount to reduce the financial burden, then reduce the term.

- There are situations when a borrower loses his job, earnings become random and unstable. In this case, it is recommended to reduce the amount.

How to pay off your mortgage early: pitfalls

The bank always strives to protect its income and protect itself from financial losses. For this reason, credit institutions are taking various steps to make it more difficult for the borrower to repay the loan early. Every year it becomes more difficult for him to stay ahead of schedule. This does not mean that early repayment is unprofitable or impossible, but it is necessary to carefully re-read the loan agreement and all clauses related to repayment.

- Fixed amount. The Bank reserves the right to name the minimum amount of payment considered as early repayment. To make the payment, the borrower has to save funds.

- Fines and commissions. They must be specified in the contract. In this case, it is not profitable for the borrower to deposit small amounts several times; there will be no benefit due to constant fines. You need to save up one large amount and invest it at a time. The fine can be fixed, the commission is a certain percentage of the amount. If the agreement does not mention penalties, the bank does not have the right to demand payments in excess of the repayment amount.

- Additional formalities. There are a number of formal procedures that at first glance seem harmless, but they complicate the matter with time costs. To write an application for early repayment, bring additional permission, the bank client must take time off from work or spend personal time, come to the bank branch, stand in line, and then come again with the money. Credit organizations require that the application be written a certain amount of time before depositing the amount.

Is it worth paying off your mortgage early – all the pros and cons

Is it possible to pay off a mortgage early and how profitable is it?

Advantages:

- the opportunity to reduce mortgage debt and reduce the financial burden on the family budget;

- interest accrued will decrease because the principal debt will become smaller;

- overpayment to the bank will decrease.

Flaws:

- it is necessary to warn the bank in advance about the DPI, otherwise the payment will not be counted;

- DPI is not beneficial to the credit institution, so banks may impose restrictions;

- the benefit is obvious only if early repayment is made in the first three to five years from the start of the loan agreement.

Photo: https://www.flickr.com/photos/investmentzen/29303116852/

If you want to profitably repay your loan debt, then:

- Try to pay your monthly payments on time. Avoid delays for which you will have to pay a fee or fine;

- When applying for a mortgage, pay special attention to the conditions for processing partial early repayment;

- make sure that the restrictions proposed by the bank do not make the process more expensive;

- After partial repayment, continue to pay the original monthly installments. This will reduce the overall mortgage term;

- do not forget to notify the bank in writing each time about making additional funds to pay off the debt;

- The sooner you start early repayment, the less overpayment you will pay to the bank. It is not profitable to save money and pay off debt with a large amount;

- Realistically assess your strengths and have a “financial cushion” in case your financial situation worsens.

Full early repayment

Repayment of the loan can be partial or full, when the entire balance is paid with interest. This is a more complex and lengthy procedure.

Before writing an application, the borrower must request a certificate from the bank about the balance of the debt. After determining the exact amount, you need to write a statement indicating both the amount and the date of payment. The application is submitted no later than a certain period before the amount is paid. On the specified day, the amount is paid through the cash register.

The mortgage repayment procedure does not end there. It is necessary to close the mortgage loan, obtain an official document confirming that the debt has been repaid and the bank has no claims against the client.

The borrower receives a conclusion about the absence of debts and draws up an application to close the account into which monthly payments were received. The account will be closed after 45 days. All documents received during the closing of a mortgage must be kept for three years.

After receiving the documents, the borrower notifies the insurance company about the termination of the loan and receives the balance of the money paid for the current insurance period.

It is worth considering full early repayment several times and calculating all the options. A sufficiently large amount can be deposited in the bank at interest and make a profit.

How to get back overpaid mortgage interest

Since the economy is unstable, the state has created several targeted programs to support borrowers.

Tax refund

Property tax deduction is an opportunity to return part of the funds spent on purchasing real estate with a mortgage. The amount of the refund directly depends on the official income of the borrower.

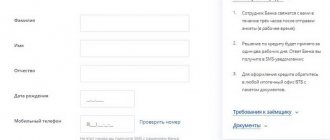

To preliminary calculate the tax deduction, you can use the online calculator on the websites by filling out a simple form. For an accurate calculation, you must contact the tax office at your place of residence.

If you submit your tax return at the beginning of the year, the deduction will be transferred earlier - it can be used to apply for partial early repayment of the mortgage.

Maternal capital

With the help of a certificate, you can improve your family’s living conditions. Maternity capital makes it possible to:

- pay the down payment when applying for a mortgage;

- repay principal and interest early.

To arrange early repayment of a mortgage, you must contact the Pension Fund and provide documents confirming the conclusion of the mortgage and information about the balance of the debt. After checking the documentation, the funds will be transferred to the bank account.

Maternity capital allows you to reduce only the required monthly contribution, but not the mortgage term. Payment arrears, penalties and fines cannot be paid using a certificate.

Government subsidies

There are several programs to support borrowers who have taken out a mortgage.

- “Young family – affordable housing.” If the age of the spouses does not exceed 35 years, and the family is officially recognized as in need of housing, then a subsidy in the amount of 35% of the value of the property can be issued.

- Regional capital. If a third or subsequent child is born in the family, you can receive financial assistance from the governor. The amount of assistance is no more than 100,000 rubles.

Is it possible to pay off a mortgage early at Sberbank?

Sberbank is loyal to its clients. You need to find out how to repay a mortgage loan from Sberbank early before signing the contract. The early repayment procedure has been simplified to the maximum. The application must be submitted one day before depositing the amount.

Sberbank stipulates that it is impossible to reduce the loan term. In case of early repayment, only monthly payments are reduced. The amount cannot be lower than 15 thousand rubles. There are no commissions or penalties.

Before repaying your mortgage at Sberbank early, you need to write an application at the bank branch where the loan was issued. The amount specified in the application is deposited into the account through the bank's cash desk or through a terminal. It will remain in the account until the day the monthly payment is made and will be written off along with it.

Most of the deposited amount will go towards repaying the principal rather than interest.

After the amount is written off, the borrower receives an updated payment schedule and signs it. No further steps need to be taken.

To repay the mortgage, you can use both personal accumulated funds and maternity capital. In the second case, money is transferred from account to account after receiving permission from the Pension Fund. Most of the funds will be used to reduce the loan amount.

Reducing the payment term

This method is applied equally to both differentiated and annuity methods of mortgage repayment. It consists of reducing the term of the mortgage loan. Let's return to the original data from the example above. If you deposit 250 thousand rubles, then with monthly fees of 25 thousand rubles. The mortgage term will be reduced by 10 payment periods. Therefore, the loan will actually be issued not for 5 years, but for 4 years and 2 months. The amount of monthly payments will remain the same.

Look at the same topic: Review of mortgages at JSC Koshelev-Bank

You can refund your mortgage insurance for the unused term of the contract (from the example above - 10 months).

Recalculation for the differentiated method of early repayment of a mortgage loan is carried out in the same way. But due to the fact that the monthly volume of payments decreases, you can pay for a larger number of payment periods with the same amount.