Procedure for returning a security secured by a mortgage loan after payment

A mortgage confirms the right of its owner to the property taken under the mortgage. It is issued by the bank during the signing of the mortgage agreement. The mortgage note must be registered with government authorities within the prescribed period, otherwise it becomes fictitious.

The document contains information about the mortgagor and mortgagee, about the loan agreement and about the property. It can be used to force the sale of an apartment if the borrower does not pay the funds. A credit institution may transfer the rights to a mortgage to another person, but the new owner does not have the right to change the terms of the mortgage agreement unilaterally.

In accordance with Article 17 of the Law “On Mortgage”, after repayment of the payment, the bank is obliged to issue the borrower a mortgage with a note that all obligations have been fulfilled. The original document is issued.

How does the return work?

- The borrower submits an application for a mortgage. The application is submitted to the bank where the loan was issued. The application includes the following items:

- Bank and borrower information.

- Title of the document.

- Loan agreement data.

- Property registration information.

- Amount of debt.

- A mention that loan obligations have been fulfilled.

- Please issue a mortgage.

- Date and signature.

- The bank accepts the client's request. The client is informed of the location of the mortgage (if it has been transferred to another person). The return period is also specified. The application is assigned a number by which its status can be tracked.

- An act of acceptance of the transfer of the mortgage is drawn up. The act includes the following points:

- Title of the document.

- Information about the parties.

- Information about the loan agreement.

- The fact of transfer of the mortgage.

- Mention that the parties have no claims against each other.

- Number of copies.

- Signatures of the parties.

- At the appointed time, the borrower receives the mortgage. It must bear a note about the repayment of the loan, the stamp and signature of an official. To receive the document, you must come to the bank with your passport.

How to get a mortgage for an apartment

A mortgage on an apartment is taken by the person who is most interested in it - usually the initiative belongs to the bank.

The borrower's participation is limited to providing documents, filling out a form and paying a commission, which rarely exceeds 1 thousand rubles.

When you need to draw up a mortgage for an apartment, be sure to pay attention to the coincidence of all clauses of the contract and the mortgage. Specifying conflicting information in these two documents results in the priority of the mortgage - when making a decision, the court will rely on the terms specified in it, and not in the mortgage agreement. Therefore, before signing, be sure to compare the documents and make sure that the mortgage note from the bank contains information certified by the seal and signature of the registrar about:

- registration of the loan agreement by government agencies with their full name;

- place of registration and serial number of the mortgage;

- date of issue of the security to the creditor.

When is a mortgage issued for an apartment?

A mortgage on an apartment is drawn up at the same time as the loan agreement itself. Its entry into legal force may take some time until the mortgage is entered into Rosreestr and assigned a serial number, which will allow tracking the status of the security. If you forgot to specify the serial number of the mortgage immediately, you can see it on the notification form about regular payments.

Where to register and receive a mortgage for an apartment

The disruptions occurring in the system of government agencies lead to the fact that the question of where to take out a mortgage for an apartment requires annual clarification. In 2021, the mortgage agreement, documents confirming ownership of the apartment and the completed mortgage form are submitted to the Registration Chamber at the borrower’s place of residence or the location of the property.

After assigning a number and making marks, information about:

- registrar of encumbrances;

- place of registration of the loan agreement;

- the date of issuance of an already executed mortgage to the lender's representative.

Until it is entered into the Rosreestr database, the mortgage has no legal force and does not entail any legal consequences. The borrower should not think about where to receive the document - this document is issued only to an authorized representative of the bank. The debtor receives a certificate of ownership of the property, which contains information about the encumbrance and the conditions for its removal.

What does a mortgage on an apartment look like?

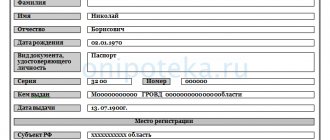

The color, type and sequence of items on the mortgage form may vary significantly. The exact type of document can be found directly at a bank branch or on the website of a financial institution. However, the amount of information remains unchanged - the form contains information about:

- pledgor (passport details, contact phone number, details and other information);

- full name of the mortgagee and information about his license;

- description of the property, its estimated value, information about the expert and details of the document that confirms the rights of the owner;

- additional encumbrances in favor of third parties;

- basic lending conditions;

- date of execution and serial number of the mortgage.

Since the security can be used by the bank in conducting financial transactions, it usually provides space for additional records of the transfer of the document and similar information.

Download a sample mortgage note for an apartment (Sberbank) for review: Mortgage note.

Where is the mortgage for an apartment kept?

Only the bank is able to exercise its rights with the help of it, so additional copies are not issued upon registration. The document is kept by the pledgee or transferred to third parties legally (of which the pledgor must be notified). For this reason, it is recommended to contact the bank and make a copy, which can be helpful in situations involving the loss of the original, legal proceedings and the issuance of a duplicate.

Mortgage for an apartment: documents

The list of documents that need to be collected is very short:

- Borrower's identity card;

- title documents of the apartment owner.

Mortgage for an apartment under a mortgage in a new building

has its own characteristics: the standard package of documents required for the assessment of collateral property is supplemented by an agreement for participation in shared construction and an apartment acceptance certificate.

Return and sale of a mortgage on an apartment in a mortgage

When the debt to the bank is fully repaid, the mortgage must be returned to the mortgagor automatically within 1 month.

If this simple procedure was not completed on time,

the borrower must apply to the arbitration court to remove the encumbrance

.

The returned mortgage note must contain a note indicating that payments have ceased due to full payment of the debt.

. If it was transferred to third parties during the bank’s financial transactions, it can be received either from them or at their place of residence.

Sometimes it is almost impossible to determine to whom the mortgage was transferred - in this case, the bank that has lost the “trace” is obliged to issue a duplicate paper. Refusal to issue it or incorrectness of the duplicate serves as grounds for legal proceedings.

What to do next after receiving it?

When the borrower has repaid the loan, the bank that issued the funds or the current owner of the mortgage makes a note on it that the loan has been repaid. The borrower must receive a mortgage note and a certificate of full repayment of the loan. Where to take it next? You should contact Rosreestr in order to remove the encumbrance from the property. When contacting Rosreestr, you must provide the following package of documents:

- Application for removal of encumbrance.

- Loan agreement.

- A certificate confirming that the loan has been repaid.

- Mortgage on an apartment.

- Document of ownership.

- Passport.

Read more about how to remove mortgage encumbrances in Rosreestr, MFC and State Services in this article.

The encumbrance implies that the borrower cannot dispose of the apartment without the control of the bank. So he cannot sell the apartment, rent it out, or add new tenants there. After the mortgage encumbrance is removed, the borrower becomes the full owner of the property. The record of the presence of a loan is removed from the database. Thus, the bank's right to the apartment is completely canceled.

Procedure for issuing a mortgage

A mortgage is a document, a security issued by the bank when signing a loan agreement, which confirms the pledge of your property. When registering a transaction at the MFC, the mortgage, as well as the purchase and sale agreement, is submitted for registration, but only a bank employee can receive it. And it is stored in the bank until the debt under the loan agreement is fully repaid.

The procedure for obtaining a mortgage after repaying the mortgage

:

- The client will find out the balance that must be paid if he plans to pay off the debt early. This can be done at a bank branch, by phone or via SMS, online banking. Or the last payment is made according to the payment schedule.

- To issue a mortgage after repaying the mortgage, the client contacts the bank.

We also recommend that you order a certificate confirming the absence of debt under the loan agreement. The certificate and mortgage are issued free of charge. A note is made in the mortgage about the fulfillment of the obligation in full.

Recommended article: How to get a tax deduction for an apartment for a pensioner

The certificate itself consists of the following details:

- Loan repayment date, loan agreement number;

- Date of filling out the certificate;

- Full name of the borrower and the bank employee who issued the certificate;

- Record of debt repayment.

What actions to take and where to go if the bank does not return the document after repaying the loan?

The bank may not issue a mortgage only if the loan account is not closed. This can happen if the mortgage is paid off early and the last payment was calculated incorrectly.

After depositing the remaining amount, you must contact the credit institution to obtain an account statement. Even if there is a debt of 5 rubles left, the mortgage will not be closed.

If everything is in order, and the bank does not issue the document, you need to take the following actions:

- Write a letter to the bank with reference to Article 17 of the Law “On Mortgage”. The letter can set a period of 2 weeks for receiving a written response.

- When submitting a letter to the bank, obtain the number of incoming correspondence.

- Wait for the bank's response. The response will be received at the postal address specified in the letter.

- If the bank refuses to issue a mortgage, you can go to court with all the evidence. The bank's written response can also be attached to the statement of claim.

Because the bank may transfer the mortgage to other persons, the document may simply be lost. If the mortgage is lost, the bank is obliged to issue a duplicate .

When receiving a duplicate, it is important to make sure that it matches the previous document. To do this, it is important to promptly request a copy of the mortgage from the bank so that you have something to compare with. The issued document must have a mark indicating that it is a duplicate.

Registration of a mortgage with Rosreestr requires the expenditure of funds. The credit institution may charge the borrower with the costs of preparing the duplicate. However, you should not agree to this if such an obligation is not specified in the contract.

Our experts have prepared articles about the basic rules and important nuances of removing the encumbrance from an apartment after paying off the mortgage from banks:

- VTB 24;

- Sberbank.

Legislation and mortgage

In accordance with current legislation in Russia, there are 2 types of mortgages:

- Mortgage by law; arises when a citizen has entered into a corresponding loan agreement in one of the banking institutions. This type of mortgage is regulated by the Mortgage Law.

- Mortgage under contract. This occurs when a separate mortgage agreement is concluded, in which it is possible to negotiate some additional conditions.

It is noteworthy that the mortgage agreement must be registered with the relevant government authorities, otherwise it is considered void. It is for this reason that all calculations should be carried out exclusively after the procedure for registering the purchase and sale agreement and the mortgage agreement has been completed.

The mortgage agreement must be registered with the relevant government authorities, otherwise it is considered void.

Bank mortgage lending programs are mostly focused on contracts of the first type, because this is the simplest option. It is important to remember that some additions will have to be made to the standard loan agreement.

For example, the owner is fully responsible for the integrity and safety of the property purchased with a mortgage. One of the important conditions is that the premises must be used for their intended purpose. If the owner of the property wants to carry out redevelopment, or transfer residential premises to non-residential ones, this will not be possible to do without the appropriate permission from the bank, since certain changes in the layout of the property can significantly affect its estimated value, which is not beneficial for the financial institution.

What if the encumbrance is registered in a different way?

Not all banks accept mortgages. Large banks may take the risk of issuing a loan without formalizing it. If the document has not been drawn up, then repayment of the mortgage record occurs on the basis of a joint application of the borrower and the bank representative.

The mortgage gives the bank the opportunity to get its money back if the borrower defaults on the loan. The bank has its own rights to the property and without its consent you cannot perform any actions with the property. The issuance of a mortgage implies that the client has fulfilled his obligations. After the encumbrance is removed, the borrower can dispose of his home without obtaining consent from the bank.

If you find an error, please select a piece of text and press Ctrl+Enter.

Why do you need a mortgage?

A mortgage is a security that allows a bank to record collateral for a mortgage loan.

It also certifies the lender’s right to receive mortgage payments from the borrower. The mortgage can be documentary and electronic. Typically, a mortgage note is prepared by the bank and signed by the borrower when the loan is issued. The document is registered in Rosreestr. After the loan is repaid, the mortgage on the property is removed by the registration authorities. Mortgages are also used in refinancing transactions. If a client takes out a loan from one bank to pay off a mortgage debt from another, the mortgage is transferred to the new lender.

Is it possible to have a mortgage without a mortgage?

According to the law in force on the territory of the Russian Federation, a mortgage can be issued without registering a mortgage note, however, as practice shows, most banks, when concluding a mortgage agreement, simultaneously issue a mortgage note. Quite large banking institutions that have large cash reserves can afford to issue a mortgage loan without a mortgage on real estate. Such banks include institutions with state participation, since they receive the pension savings of the population. Also, foreign banks can provide a mortgage without a mortgage, because they have the opportunity to attract borrowed funds at low interest rates.

Quite large banking institutions that have large cash reserves can afford to issue a mortgage loan without a mortgage on real estate.

There is also a mortgage by virtue of a court decision, but this type of lending is not spelled out in sufficient detail in the legislation.

When concluding this type of mortgage, you can do without registering not only a mortgage, but also a lending agreement, since all the details of the relationship that arises between the lender and the borrower are regulated by a court decision. When using this article, be sure to use a direct link to the site