What documents are needed for a mortgage?

To apply for a mortgage, the borrower will need:

- Passport. Don’t forget the co-borrower’s passport if you plan to pay the mortgage together with someone.

- Documents that confirm solvency. For example, a 2-NDFL certificate or an extract from a salary account.

- Documents that confirm the right to an apartment. This could be an extract from the Unified State Register of Real Estate, a purchase and sale agreement, or a certificate of ownership.

- The act of acceptance and transfer. You will only need it if you purchased an apartment in a new building.

- Technical passport and floor plan of the house.

- Collateral assessment. Banks take into account the assessment only of organizations accredited by them. Find out which appraisers the bank cooperates with before ordering a report.

Some banks may request other documents. Check the complete list with your manager or on the bank’s website.

Types of mortgage payments

Before making monthly payments and the amount for early repayment, you should clarify what type of payment is specified in the agreement. There are annuity and differentiated payments. More often than not, the mortgage is paid off using the first method.

Annuity payments

The annuity option monthly payment is equal to the amount of the loan and interest divided by the loan term. The borrower makes equal payments each month.

Most of the annuity payment is used to pay off interest, the rest is used to close part of the debt. The first payment is 90% interest.

Differentiated payments

A differentiated mortgage payment at Sberbank implies priority coverage of the principal debt, and then interest. In the first quarter of the term, the borrower needs to make large payments. After the specified period, the amount of monthly payments will begin to decrease.

It is profitable to pay off a mortgage with differentiated payments; the scheme involves a smaller amount of overpayment. When depositing funds in excess of the required amount, the excess is counted towards future payments.

Example:

The monthly mortgage payment is RUB 36,370. (16,666 rubles of principal debt and 19,704 rubles of interest. The client, having deposited 100 thousand, exempts himself from paying the principal debt for 5 months. Despite this, it is impossible to repay the mortgage ahead of schedule without interest, otherwise the banks will go bankrupt.

What does a mortgage on an apartment look like?

The law does not stipulate what a mortgage should look like. Banks themselves choose the appearance of this document. However, it must include certain information, for example:

- information about the bank, including TIN and OGRN;

- the name of the first mortgage holder;

- information about the loan agreement;

- information about the borrower;

- debt amount and interest rate;

- mortgage payment terms;

- description of the mortgaged apartment and an estimate of its value.

Before signing a mortgage note, carefully study it and check it with the loan agreement. If the lending terms are different, the courts will only take into account the contents of the mortgage.

Document registration procedure

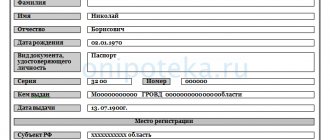

When filling out a mortgage, you must take into account that the data displayed here must correspond to reality. The necessary documents for a Sberbank mortgage in a new building are available for review when visiting the banking website. Here's what a sample mortgage looks like:

- Date of registration and number of this document.

- It is required to provide information about the person who provided the apartment as collateral. Required: last name, first name, patronymic, residential address, passport details. When the borrower is a legal entity, then you need to enter its details: name, codes (TIN, OGRN, others), legal and actual addresses, current account information.

- The lien holder must have a special license. Its name and basic details must be reflected, as well as the number of the permit and indicate who issued it and when.

- The pledgee provides his information.

- Information is placed here that allows you to uniquely identify the property in question. The information must be accurate and sufficiently complete. It is necessary to record the address of the apartment, describe its location in detail and, if necessary, other data. If there are other encumbrances on the apartment, this fact must be noted in the document.

- It is necessary to provide details of the loan agreement providing for collateral. Here it is enough to indicate its name, number and date.

- To use an apartment as collateral, its value must be assessed. The document indicates its result (you need to write the price in the loan currency), as well as information about who made this assessment.

- The mortgage note details the terms of the loan. The data should include the amount, interest, as well as the frequency of payments, the amount of contributions paid, and the date when the final repayment of the debt occurs.

- At the end you need to subscribe.

When filling out a mortgage, it is important to carefully monitor the data used in it and sign, making sure that it is correct.

How a mortgage can be used by a bank

If the bank needs money before the end of the mortgage term, it can:

- Sell the entire mortgage. To do this, he does not need the borrower's permission. After the sale, the new owner of the mortgage will receive payments on the mortgage, but he will not be able to change the terms of the loan.

- Partially sell the mortgage. Such a transaction is also carried out without the participation of the borrower. Typically, after the sale, the payee does not change: the bank itself transfers part of your payment to another person.

- Exchange mortgages. If the loan amounts differ, the bank will receive an additional payment or will have to reimburse the difference itself.

- Prepare issue papers. The bank can divide the mortgage amount into parts and issue its securities on them. Such securities can be sold or exchanged, and even an individual can buy them.

Where is the mortgage deposit kept?

There is only one copy of this document. It is not handed over to the owner of the property. It will be useful to provide yourself with a copy of it. The mortgage remains with the bank that issued the loan. Where the mortgage note is stored, the borrower cannot review it, so it is advisable that he receive a copy.

The mortgage note is held by the bank that issued the loan.

What to do with the mortgage after paying off the mortgage

To obtain a mortgage, the borrower must write an application to the bank. This application must be accompanied by a certificate of loan repayment. The bank has one calendar month to issue a mortgage, but usually the document is received within a few days.

After receiving the mortgage, you need to remove the encumbrance from the apartment. This can be done in person at the MFC and online: in special services or on the Rosreestr portal.

To remove the encumbrance at the MFC:

- Write a special application, attach to it a mortgage note or a certificate of loan repayment.

- Hand over the package of documents to the MFC employee.

Rosreestr usually considers the application within five working days. If the borrower bought an apartment in a building under construction, this period may extend up to seven working days.

To remove the encumbrance online through the Rosreestr portal:

- Log in to your personal account on the portal. To log in, use the password and login of your State Services portal account.

- Fill out the electronic application and attach a scan of the mortgage document.

- Sign the application with an electronic signature. Please note that to work on the site you need a special signature - with an extension for working on the portal.

Algorithm of actions for obtaining a mortgage from Sberbank

If an individual, when applying for a mortgage program, transferred a mortgage on the purchased property to a financial institution, then after making the last payment, the lender must return the security to him. In the original document, Sberbank puts a mark indicating that the client has fully fulfilled his obligations. The corresponding inscription is made on the reverse side of the mortgage. The lender must also write that he does not have any claims against the borrower, indicating the exact amount and date of the last payment.

The procedure for obtaining a mortgage at Sberbank involves a certain sequence of actions:

- An individual must contact a branch of a financial institution to clarify the balance of the mortgage debt. After identifying him, a Sberbank employee will announce the amount of the last payment. You can obtain information through your personal account registered on the lender’s official website and on the hotline.

- The borrower makes a payment to fully repay the debt.

- A few days later, the client again contacts the Sberbank office with a request to issue a certificate indicating the absence of mortgage debt. He should check that the document contains a record of the absence of claims against the individual by the creditor.

- The borrower is issued the original mortgage note according to a special acceptance certificate. In it, the parties put signatures, thus indicating the transfer and acceptance of the security. On the back of the mortgage there must be the full name with a transcript and the signature of the official who issued it.

READ Sberbank Online: purchasing VKontakte votes, detailed instructions

After receiving the security, an individual must collect a package of documents and contact Rosreestr. It can be submitted to the Registration Chamber through the MFC, by mail (registered letter with notification and inventory), through an official representative in whose name a notarized power of attorney has been issued. If a mortgage was not issued when applying for a mortgage program, then in this case, after repaying the loan, the client and Sberbank submit a joint application to Rosreestr, on the basis of which the restriction on the property is lifted.

We repay the loan in full

When drawing up a mortgage agreement, an individual is given a schedule of mandatory payments that he will have to make every month on a specified date.

If a differentiated methodology was used when calculating their amount, then the client can pay larger amounts, thereby saving on interest. If there is a desire to close the mortgage agreement ahead of schedule, an individual must contact Sberbank and notify of his intentions by writing an application. In a branch, personal account or hotline, the client will be able to find out the exact amount of the loan balance. The payment must be made on the same day, since the next day the amount will change due to accrued interest. The borrower can carry out a financial transaction in any way convenient for him:

- deposit cash through the cash register;

- by using a self-service device;

- making online payment, etc.

We contact the bank with an application

After repaying the mortgage debt, an individual must personally contact the Sberbank office with an application. In the document, he must indicate his intention to obtain a mortgage on the basis of full repayment of the loan debt. You should also indicate the area, type of property (apartment, house, plot of land), floor, and your contact phone number.

In parallel, the individual must ask Sberbank to issue a certificate of no debt. It should reflect the following information:

- Client's full name;

- date of full repayment of the debt;

- Full name, position of the employee of the financial institution that issued the document;

- date of preparation of the certificate;

- a phrase that the lender has no claims against the borrower.

As soon as the last payment is made by Sberbank, the client’s credit account should be automatically closed. If this service is not provided by the mortgage program, then the client must write a statement addressed to the management of the financial institution with a request to close the account based on full repayment of the debt.

READ The procedure for disabling Mobile Banking through a Sberbank ATM

We receive a mortgage

An individual needs the following documents to obtain a mortgage:

- Civil passport for personal identification.

- Mortgage agreement.

- Schedule of mandatory payments.

- Receipts, if you have them, but you must take the last payment with you.

- Statement.

When should the withdrawal procedure begin?

The procedure for closing a mortgage agreement can last up to one and a half months, so before submitting a package of documents, bank specialists recommend waiting two months.

The legislation does not provide for any penalties for delay in removing the encumbrance from the collateralized property. However, it is not recommended to delay the procedure. Firstly, until the procedure is completed, the owner has no right to violate the imposed restrictions, even if the debt to the bank is fully repaid.

Secondly, during withdrawal it is necessary to collect a large number of documents, certificates and letters. After some time, collecting papers will be more difficult and longer, in addition, various force majeure circumstances are possible, so it is recommended to close the transaction in a timely manner and contact Rosreestr.

Features of selling housing with encumbrances

The situation may develop in such a way that the borrower may need to sell the encumbered home before the mortgage loan is repaid. Typically, such a need may arise if the borrower’s financial condition has deteriorated and he cannot pay his installments on time.

If the borrower does not take any action, the property will become the property of the credit institution and will be sold. In this case, part of the funds will be returned to the borrower. At the same time, the borrower has the right to try to independently sell the collateral property in order to pay off the credit institution. This option is more preferable for the borrower, since credit institutions usually sell collateral at a lower price.

It is important to understand that selling encumbered real estate on your own is quite difficult. This is due to the fact that potential buyers are quite suspicious of such housing. If you do manage to find a potential buyer, you will be able to sell the property only after receiving permission from the credit institution.

If the credit institution agrees to the sale of housing with encumbrances, then to transfer ownership rights to it you will have to contact the registering organization. You need to be prepared for the fact that the procedure for transferring ownership of such real estate takes quite a long time - up to two months.

It is important to note that the process of selling housing and transferring ownership rights is carried out under the careful supervision of a credit institution.

How long does it take to remove an encumbrance on real estate?

You should remember the fact that the encumbrance is practically lifted at the moment when the employees issue you a specialized certificate. This is due to the fact that after this event you only need to take it to the registering institution to amend the documents.

As mentioned earlier, the certificate must be requested approximately one month before the final mortgage payment is due. This is due to the fact that this period is quite enough for the employees of the credit institution to prepare the requested certificate for you.

As soon as you are issued a certificate, you should hand it over to an employee of the registering organization. Based on this certificate, the necessary changes will be made to the documents for your residential property. In most cases, it takes no more than three days to make the necessary amendments.

It is important to remember that you do not have to spend personal time getting a certificate from a credit institution, or visiting the registering organization. If you do not do this, the encumbrance on the property will be automatically removed according to the scheme established by law without your direct participation. At the same time, you must be aware of the fact that it will take much more time to remove the encumbrance without your participation. Typically, the encumbrance is removed 45 days after the completion of the mortgage agreement. You should be prepared for the fact that in some cases it may take more than 90 days to complete this procedure.

Experts advise that it is mandatory to save documents confirming payments made on a mortgage loan for at least three years after the end of the loan term. This is due to the fact that the statute of limitations is exactly three years. For this reason, if the lending institution has any questions for you during this period, you will need documentary evidence that you have repaid the entire loan in full.

After the registering organization makes all the necessary amendments, you can receive new papers for real estate. These papers will not contain any marks from the credit institution. It is important to be aware of the fact that in order to obtain new documents for real estate you will have to pay a fee to the state.