Create a repayment plan

First, you need to find out whether it is even possible to pay off your mortgage early. Probably yes. Most banks issue loans with the possibility of early repayment even the next day. Another thing is that restrictions may be introduced that may impose significant obstacles to the implementation of this action.

For example, minimum repayment amounts may be specified or, for example, you will first need to agree on a repayment date with the bank.

When all the obstacles are removed, think about what is more profitable for you to reduce: the term or the payment. Mathematics suggests that the term is more profitable, since the number of overpayments is reduced, and therefore the volume of overpayment is reduced.

But I recommend reducing the monthly payment for the following reasons:

- it’s psychologically easier this way: you see success from your actions;

- expenses are reduced, and you can improve the quality of your life and make a long-awaited renovation or buy a much-needed wall-to-wall TV;

- you free up funds and can use them to quickly pay off your mortgage, increasing your monthly payment by the amount saved;

- in case of a critical situation, your expenses are lower than usual, and you do not incur additional debt.

In general, see for yourself which is more profitable. If you have a stable income that will not be interrupted under any circumstances, then you can choose to shorten the term. If your income is not constant or you want to have a financial cushion, then it is better to reduce your payment.

And now for specific advice.

Procedure

To pay off your mortgage faster and more profitably, you need to use one of the methods of early debt repayment. Sberbank has a simple algorithm of actions in this regard, understandable to everyone. You need to deposit money into your account, write an application, and the funds will be debited on the date of your next monthly payment. You can pay off your debts faster only if you deposit large sums of money more often. So the overpayment will be significantly reduced. The amount paid ahead of schedule will not have a negative impact on the client’s credit history; you don’t even have to worry about it.

Cut expenses

A rather hackneyed recommendation, but you can’t do without it. If you want to pay off your mortgage faster, save more money. Use all your savings for early repayment. There are no secrets here. Even 500 rubles a month is a victory. Think about what you can save on:

- transport – it may be worth buying a travel card or taking a bus;

- clothes and shoes - avoid buying branded items and don’t be fooled by sales;

- groceries - switch to meaningful nutrition, try to purchase at a time to get discounts and big cashback;

- alcohol - give it up completely;

- gym - instead of jogging through the forest;

- TV – do you need a zombie box;

- Internet and cellular communications - find the best tariff and the best operator.

I do not urge you to save every penny and buy milk in the conventional “Pyaterochka” 1 km from your house, because it is 2 rubles cheaper than in the conventional “Magnit” in the house opposite. Count your time - it is more valuable than all the money in the world.

I once wrote about how to actually save without losing your quality of life. I recommend reading this article.

And one more note - saving should not be to your detriment. If a cup of latte in the morning puts you in the mood for work, and if you can’t get to work on time without a car, of course, you can’t refuse it. Be smart with your savings.

And here’s another interesting article: Conditions for refinancing a loan in Uralsib: how to get a rate of 11.9%

And one more thing - use cashback cards and special programs to find profitable purchases and save on them. At least a little, but saving.

Procedure for early repayment of a mortgage at Sberbank

The procedure for early repayment of a mortgage at Sberbank does not depend on whether you want to pay off the debt in part or in full. You need to submit a payment request ahead of schedule. This can be done in two ways: through a specialist in the credit department or independently through Internet banking.

How does early repayment of a mortgage occur in Sberbank Online:

- Go to the client’s personal account in the usual way.

- Select the loan you want to pay.

- Click the button to pay early, then select partial or full repayment option.

- Next, you need to select the account from which the money will be debited. Specify a payment date of the same day or the next.

- Write the amount if you do not plan to fully repay your mortgage with Sberbank ahead of schedule. When the loan is closed completely, the system itself calculates the final payment.

- Application for early repayment must be confirmed with a code from an SMS message.

- Deposit the required amount into the account to be debited. This must be done before 21:00 Moscow time.

- After writing off, check the size of the next payment if you are repaying the loan partially. Once you have paid in full, wait until your mortgage closes. This will happen within a couple of days following the debiting of the money.

- In the future, you will be able to view the history of early repayments in Sberbank Online by going to the detailed information about the loan.

If you are going to close the loan tomorrow, you will have to calculate the amount of interest yourself or contact the bank’s hotline. The fact is that the online service makes calculations only for today’s date.

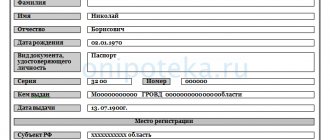

To apply for early repayment through a mortgage manager, you need to go to a bank branch with a passport. You can do this in the region where you took out the loan. What is the procedure for repaying a mortgage at Sberbank early in this case:

- Take the application form from the employee or fill it out in advance. You need to indicate the details of the bank agreement, the amount to be written off and the planned date of early payment. If you don’t remember the details of the loan document, ask a specialist to clarify them in the program.

- Deposit the amount of payment required for payment into the account. You can do this immediately or use your personal account on the website.

- After the target date, check the debit via Internet banking or go to a Sberbank branch in person. If you have paid off the debt only partially, check the size of the next loan payment. The bank will print out a new schedule for you, but if you have access to your personal account, it is no longer so necessary. Just go to the service and see the recommended amount.

The right to spend MK on a housing loan is enshrined in. What is the procedure for early partial repayment of a mortgage at Sberbank with maternal capital? This is different from the procedure described above. You need to collect all the documents on the completed credit transaction and submit an application to the Pension Fund to pay the mortgage debt (the procedure for considering the application is indicated in). This can be done at the regional Pension Fund department or through the MFC. You will have to fill out, after which the specialist will send it for review.

The answer regarding the disposal of maternity capital funds will come within a month. After this, the Pension Fund will use the money to pay off your home loan. Immediately after the early repayment of the mortgage with maternity capital, Sberbank will reduce the payment amount due to a reduction in debt. The certificate amount is distributed against the body of the debt and current accrued interest.

Keep in mind that you can apply to shorten the loan term only at a Sberbank branch and through your personal account on the website. This feature is not yet available in the smartphone application, but the bank is working on an update.

Find additional sources of income

However, no matter how much you save, you won’t jump over your head. And to really be able to close a mortgage, you need to not only save, but also earn money. The higher the income, the greater the opportunity to profitably repay the mortgage in the shortest possible time. What can I recommend:

- take up freelancing: write texts, draw illustrations, design landing pages - there are a lot of options;

- monetize your hobby - if you bake cakes well, make them to order (or, for example, sew to order);

- find a part-time job according to your profile - an accountant friend of mine fills out tax returns (she has a place where a girl sits and collects applications from people), and another lawyer I know advises people via the Internet;

- increase the number of shifts (hours) at work;

- find a second job - for example, on weekends or in the evening, maybe even part-time;

- create an information site or write a useful application (okay, okay, you can’t do without special knowledge, but it’s also an option, you’ll agree!);

- make people laugh - become a toastmaster or join a concert group;

- run a Zen channel.

Just please - do not get involved in various financial adventures and do not play lotteries. Apart from disappointment and loss of money, you will gain nothing.

And on the topic - useful articles: first and second.

Alternative ways to pay off a mortgage in a difficult life situation

If the borrower is in a difficult financial situation and cannot fulfill his debt obligations in full, Sberbank offers additional support programs.

Mortgage refinancing

Refinancing is a procedure for obtaining a new mortgage loan to pay off an existing one, but on more favorable terms. It is important to know that Sberbank does not refinance its own mortgage loans!

Mortgage loan restructuring

Sberbank offers restructuring services to its clients who find themselves in difficult financial situations. By agreement with the lender, the borrower can change the loan currency, increase the total loan term, or issue a temporary deferment of payment.

Sell unnecessary things

Look through your balcony or wardrobe - and you will be stunned to discover how many unnecessary things are lying around there. If you need to pay off your mortgage quickly, sell everything on Avito or through a local newspaper ad (if anyone reads it).

If you don’t find unnecessary things in the indicated places, look on the cabinets and in closets, in the country house, in the garage.

You can also have a garage sale or take things to a flea market. There they will give less for them, but that is also money.

The most important thing is that you should use the funds received from the sale to pay off the mortgage, and not on an extra carton of milk or a liter of gasoline. Your actions must make economic sense.

By the way, I sold a lot of clothes, leftover building materials (I was renovating the kitchen) and several books. It came out to 5 thousand. A trifle, but still.

Tips for Mortgage Borrowers

Recommendations for borrowers:

- It is important to study the loan agreement. Pay special attention to the clause with penalties for late payment and early repayment. You need to sign a contract only if you fully agree with all the terms.

- If you have the financial opportunity, you should arrange partial early repayment with a shorter payment period. This will help you quickly pay off your mortgage at Sberbank with the least overpayment.

- There are situations when a borrower believes that his income may soon decrease, but currently he has the opportunity to contribute large amounts. In this case, the bank advises you to arrange partial early repayment with a reduction in the monthly payment, reducing the loan burden in the future.

- If you have an additional financial reserve in the form of a deposit or investment, the bank advises using them as an additional source of income, and not as a private equity income. Thus, it protects its borrowers from difficult financial situations.

Borrower mistakes when repaying early

The most common mistakes:

- The borrower, having a fairly large amount, does not want to make early repayment. If you have the financial opportunity, it is more profitable to issue a private insurance policy and reduce the overpayment.

- Many people do not know that the partial early repayment amount does not include the monthly payment. If the borrower draws up a private equity investment for 50 thousand, then in addition to this he must also make a contribution according to the schedule.

- Some clients arrange partial early repayment only after saving a large amount of money. This is wrong, because the later the debt is repaid, the less savings will be.

- Not everyone evaluates their own financial capabilities. When making partial early repayment, it is important to take care of the “financial cushion”. This is necessary in case of dismissal, illness, etc.

Correct borrower steps for early repayment

To pay off your mortgage faster, you need the following:

- You need to choose a PPP with a shorter payment period.

- It is not necessary to save, you can make minimum amounts: 99% of the next monthly payment.

- Don't forget about tax deductions. The funds received can be used for early repayment. Tip: by submitting a tax return at the beginning of the year, the borrower will receive a deduction earlier, reducing the overpayment.

- You should agree to the offer to profitably refinance your mortgage loan.

See also: what should you pay attention to and what should you be prepared for when paying off your mortgage early? On the air of the Khabarovsk channel “Guberniya”, Dmitry Cheshulko, president of Khabarovsk channel, shares useful information, which specializes in consulting citizens on mortgage lending issues.

Use your tax deduction

This is the sweetest thing that a mortgage allows you to do. Many people have no idea what a tax deduction is and how to get it - and do not take advantage of this opportunity. But you can legally receive money from the state and pay off part of the mortgage without using your own funds.

So, there are two types of deductions that work for a mortgage:

- property;

- on mortgage interest.

The maximum amount for property deduction is 2 million rubles per person. 13% of this amount is returned. For example, you bought an apartment for 3 million rubles, you can return only 13% of 2 million rubles, i.e. 260 thousand rubles. If the apartment costs 1 million rubles, then you will return only 130 thousand rubles, and another 1 million rubles of deduction will remain for future purchases.

You can take advantage of the deduction only if you have taxable income, and it is taxed at the rate of 13% - i.e. Personal income tax. For example, salary. In fact, you are returning money that you yourself paid to the state treasury.

The deduction for mortgage interest is slightly higher - 3 million rubles per person. You can return 13% of this amount, i.e. maximum 390 thousand rubles. The payment, as in the previous case, is made if there is taxable income. Moreover, the maximum payment amount per year is limited by the amount of interest paid.

And here’s another interesting article: 4D for investors

Let me explain with an example. You have a salary of 25 thousand a month, and per year you paid 500 thousand rubles in interest on your mortgage. In total, you (well, as an employer) paid taxes: (25,000 * 12) * 0.13 = 39,000 rubles. Now you can return 13% of the interest paid, i.e. 0.13 * 500,000 = 65,000 rubles. But you will only receive 39 thousand, since that is exactly what you paid to the state. At the same time, the maximum possible tax deduction will decrease - and not by 500 thousand rubles, but by 300 thousand, since they were the “tax returnable” base.

A person can receive a deduction for interest only on one object. If you received less than 13% of 3 million rubles, and then the mortgage ran out, call me, you won’t get anything else. But the balance of the property deduction can be transferred to another object.

In general, this topic is complex and interesting, subscribe to updates so as not to miss the article when I write it and talk about how I return taxes myself.

How to pay off early online

In order not to visit the branch and fill out an application there, everything is allowed to be done through your personal account. It has a form for submitting your request in order to close the mortgage faster - in whole or in part. Fill it out and choose the repayment method—with a reduced payment or the entire term. Submit this online application from your account.

Sberbank will inform the client that the application has been accepted. Next, you should deposit the amount into your credit account. After its receipt, changes will be made to the payment schedule. Upon request, the client will either adjust the mortgage term or the payment itself. Everything is done online. But if the method is not suitable, then come to the department. They will accept exactly the same application, but in writing. There are no commissions, interest or fines for this service.

Use benefits and government support (and maternity capital)

A list of tips on how to pay off your mortgage the right way would be incomplete without mentioning the possibility of receiving benefits. For example, low-income people can register as those in need of improved housing conditions. And they will be paid compensation, which can be used to pay off the mortgage.

Specific conditions for registration and the amount of compensation are regulated by local legislation. Take a look at the official website of the subject of the Russian Federation and find what you need.

I’ll tell you whether it’s possible to pay off a mortgage with maternity capital. The fact is that it is easier to obtain materiel capital (aka family capital) than a subsidy from the municipality. Just need to give birth to a second child