Features of the electronic mortgage

An electronic mortgage gives the bank and the borrower the same rights and obligations as a paper mortgage. So, if the borrower does not pay the mortgage on time, the bank will be able to repossess and sell the apartment to get their money back.

The main difference between a paper and electronic mortgage is in their form. The electronic mortgage does not need to be printed. It is filled out and stored as a file on your computer. Such a document can only be signed with an electronic signature (ES).

Also, electronic mortgages can only be stored in a depository. Let us remind you that the bank can store paper mortgages on its own. Sometimes mortgages are sent to two depositories. The first takes into account where the document is located and who owns it, and the second stores it. Also, the owner of a mortgage can change the depository in which it is stored.

Mortgage AHML

Mortgage AHML. To support and develop housing construction in the Russian Federation, the Government in 1997 created the Agency for Housing Mortgage Lending (“House of the Russian Federation” since March 2021), which assists citizens purchasing housing. It offers family, preferential, social programs for purchasing housing with a mortgage to Russians, regardless of social status, income level, marital status. The agency monitors the state of the country's mortgage market, develops proposals for improvement, and cooperates with credit organizations. It offers new forms of attracting investment in housing construction, promotes the growth of liquidity and stability of this market.

Activities

What should an electronic mortgage contain?

The electronic mortgage must include the same information as the paper mortgage, for example:

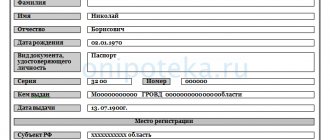

- Full name of the borrower;

- passport details of the borrower, as well as SNILS number;

- information about the loan agreement;

- the amount of the mortgage loan and interest;

- description of the apartment being pledged;

- assessment of the market value of the apartment.

But additional information must be indicated in the electronic document:

- the name of the depository that holds the mortgage;

- e-mail of the depositary, by which Rosreestr can contact him;

- The escrow account of the first owner of the mortgage.

However, mortgage writers may include other information. For example, stipulate that the bank can receive a mortgaged apartment without going to court. Or indicate the methods and procedure for selling an apartment by a bank in case of non-payment of debt.

Features and conditions of a military mortgage in 2019

- 3.1 Required documents

Military mortgage is a targeted housing loan, that is, a synonym for free housing for Russian military personnel. Anyone related to the RF Armed Forces can take out a housing loan without paying a penny of their own money. The down payment in the form of a state subsidy is allocated from the country's budget and transferred to a special military account, and then monthly mortgage payments are also made from state funds. The loan term coincides with the time that a military man must serve - 20 years. While a citizen repays his debt to his homeland, his personal debt to the bank is repaid. In case of early dismissal, you will have to pay off the remaining debt yourself.

What are the requirements for the borrower?

Every serviceman can become a participant in a special savings system (NIS) (Resolution of the Government of the Russian Federation dated N 89 (as amended) “On approval of the Rules for the formation and maintenance of the register of participants in the savings and mortgage system of housing provision for military personnel by the Ministry of Defense of the Russian Federation, federal executive authorities and federal state bodies in which military service is provided for by federal law,” Order of the Russian Guard dated N 79 (ed. from ) “On approval of the Procedure for the implementation of the savings and mortgage system of housing support for military personnel of the National Guard of the Russian Federation” (Registered with the Ministry of Justice of Russia N 46384)). But in order to get the required amount of money to purchase housing, the army man will have to go to a financial institution, where the requirements for borrowers may be as follows:

- Age limit - most often the minimum threshold is set at the age of 22-25 years, and the maximum is 45 years.

- The duration of participation in the NIS program is at least 3 years.

- Citizenship of the Russian Federation.

- Availability of permanent registration in the region of operation of the banking institution.

- The borrower has a positive or complete lack of credit history.

- Previously submitted and approved Report for inclusion in the register of participants in the savings and mortgage housing system for military personnel of the Armed Forces of the Russian Federation.

- Consent to the implementation of life and health insurance is a guarantee for the family of a serviceman that in the event of a serious injury or illness, the mortgage loan will be repaid in full.

An example of calculating a military mortgage. Calculator

Calculating the monthly payment for a military mortgage is simple. It is enough to know a few important parameters:

- the total amount of savings in the personal account of a military personnel, NIS participant;

- the cost of the apartment or house chosen for purchase;

- the interest rate provided by the bank;

- desired loan term.

Almost every bank on its official website provides customers with an online loan calculator service. This program, after analyzing all entered data, determines the amount of the monthly payment. Let's check the calculator's performance based on military mortgage standards:

- Housing costs - the state sets a limit on the amount of a military mortgage. In 2021 it was 1.9 million rubles.

- Amount of savings – in calculations we will proceed from the minimum period of savings of 3 years (for 2014-2016). During this time, the serviceman’s account will accumulate 724,860 rubles.

- The interest rate on military mortgages in most banks is set at 10% (Sberbank, VTB 24, etc.).

- The loan term is at least 20 years.

Read more in the article: Military mortgage calculator

When you enter the above data into any loan calculator, the result will be 11,340 rubles as a monthly payment. It will be paid by the state until full repayment or the moment when the serviceman leaves the ranks of the RF Armed Forces ahead of schedule.

How to apply for an electronic mortgage note

Create a mortgage

The bank and the borrower fill out an electronic document and indicate all the necessary information in it. This can be done on the Rosreestr portal or in special services. The parties to the contract must sign the finished document with a qualified electronic signature (CES).

Register a mortgage in Rosreestr

The bank sends the signed mortgage to Rosreestr. He attaches an application for a mortgage to it.

Rosreestr will check whether the information in the document complies with the terms of the mortgage agreement. If department employees find errors, they will suspend the registration of the mortgage or refuse to register the electronic mortgage.

Send the registered mortgage to the depository

It is Rosreestr that sends the electronic mortgage to the depository. If the department employee does not find errors in the document, he enters information about the mortgage in the mortgage record. After that, he signs the mortgage with an electronic signature and transfers it to the depository chosen by the bank.

If you issued a paper mortgage when receiving a mortgage, you can replace it with an electronic one. To do this, the bank and the borrower must write a special application to Rosreestr. The department will cancel the paper mortgage and send the electronic one to the depository. However, it will not be possible to replace an electronic mortgage with a paper one.

Last payment

The debt under the mortgage agreement is repaid in accordance with the payment schedule.

The client has the right to strictly follow it in terms of amount and terms (pay according to schedule), and to pay ahead of schedule in larger amounts (in this case, the debt is recalculated in favor of the borrower). The bank must be notified that you plan to close your mortgage early. This can be done directly at a bank branch by writing a corresponding application (a sample application must be requested from the bank), by calling the call center or carrying out an early cancellation operation in the bank’s personal account online. This operation is necessary for the bank to recalculate the payment schedule.

To make the final payment on the loan, you must request information from the lender about the amount of the remaining debt. They can be obtained by contacting the bank in person orally or in the form of a statement, as well as by telephone. The designated amount is paid by the borrower in a way convenient for him.

Immediately after such payment, it is recommended to issue a certificate of absence of debt from the bank. It can be either paid or free. Such a certificate is an official document and is certified by the signatures of authorized persons on the part of the creditor. If necessary, it can be presented at the place of request.

Help contains the following information:

- the date of full repayment of the debt under a specific loan agreement (indicate its number and date of conclusion);

- FULL NAME. borrower;

- date of issue of the certificate;

- position and full name the person who signed the document;

- a phrase about the absence of claims on the part of the bank to the client.

In most banks, after the last mortgage payment has been made, the loan account is closed automatically. However, if such a service is not available, the client must independently write a statement demanding that the account be closed due to the fulfillment of obligations on its part. To do this, you need to have your passport, a mortgage agreement with a payment schedule and payment receipts (just in case).

If the borrower plans to repay the entire mortgage debt ahead of schedule, then the date of such repayment is agreed upon with the bank and the amount is specified. It is highly not recommended to carry out such operations without approval from the lender, since the amount of the final payment may be calculated incorrectly (either up or down).

For your own peace of mind, you can additionally make a request to the Credit History Bureau about the quality of fulfillment of your obligations. The information received contains all the information about the mortgage, the nature of payments and the assumption or absence of delays. Due to the human factor, as well as the features of the program, data may arrive with some delay, which requires clarification.

Advantages of an electronic mortgage

Processing speed

Generating an electronic mortgage is faster than a paper one. Banks fill out a ready-made document form. To register a mortgage, you do not need to go to the MFC. The borrower and the bank representative do not need to wait for an appointment at the multifunctional center, waste time traveling and waiting in line. You can submit documents to Rosreestr remotely.

Receipt speed

Receive an electronic mortgage faster than a paper one. So, the document may be needed when refinancing a loan. Most often, banks store paper mortgages themselves and delay issuing them. Sometimes borrowers have to wait up to one month.

Rosreestr is responsible for issuing electronic mortgages. It promptly sends the document online.

Safety

A paper mortgage can be lost or intentionally destroyed. It can burn in a fire, and restoring the document will take a lot of time and effort. This will not happen with an electronic mortgage. It is stored in a depository on secure servers, and Rosreestr monitors its every movement.

Allocation of shares to children after closing a mortgage in case of using maternity capital funds

I have paid off the mortgage - what to do next{q} To remove the encumbrance from the apartment, you need to get a certificate of debt repayment from a financial institution. To do this, the borrower must write an application for a certificate of closure of the contract.

After paying off the mortgage

, what documents need to be obtained from the bank{q} When the bank verifies all the data on the loan, a

We suggest you read: How is salary calculated when combining positions?

apartment mortgage

and a certificate stating that the loan has been repaid in full and there are no claims against the borrower. All certificates, statements, receipts and other loan documentation must be retained for 3 years.

Parents with 2 or more children have the legal right to use maternal (family) capital to pay off part of the mortgage loan or pay the down payment. According to 256-FZ “On additional measures of state support for families with children,” when purchasing housing at the expense of maternal capital, the ownership of it is registered in a share ratio for each child and parent by agreement.

At the same time, the concluded agreement provides for the possibility of reducing/redistributing shares in the event of the birth of children in the future. The minimum share value is not determined or regulated by law. Here we should start from the current standards of living space per person in the constituent entities of the federation. Now it is 12 square meters. m. per person.

It is possible to register shares for each participant in common property in accordance with the law within six months from the date of full repayment of the mortgage and removal of the encumbrance on the property.

Allocation of shares to children after repayment of the mortgage is possible in the following ways:

- through the parties entering into an agreement or a gift agreement;

- through the court (if disputes arise between parents about the size of each share).

The agreement and the deed of gift must be notarized.

Registration of shared ownership is also carried out in Rosreestr. After the decision is made, each participant will receive their own certificate indicating the ownership share.

Disadvantages of electronic mortgage

The need for an electronic signature

An electronic mortgage can only be signed by a CEP. If banks usually have such a signature, then borrowers will have to obtain it additionally. This can only be done at certification centers accredited by the Ministry of Telecom and Mass Communications. Such a signature is issued for a certain period, usually no more than a year, and costs about 1000 rubles.

Receive an electronic signature without leaving home. Submit an application on the website of the Contour Certification Center. Documents for issue can be submitted online. Order delivery of the signature, and the courier will bring it to any convenient location.