What is mortgage restructuring?

Mortgage restructuring refers to making changes to the loan agreement regarding repayment terms. This most often involves a reduction in monthly payments and an increase in the loan term, which greatly simplifies the repayment of borrowed funds. In addition, so-called credit holidays can be provided.

During the credit holiday, which lasts on average six months, it is allowed to repay only the principal debt without interest or not make payments at all. Please note that each case is individual, is considered by the bank and a decision is made on how to improve the conditions for a specific loan. In some cases, the bank is even ready not to collect fines for late payments.

To take advantage of mortgage loan restructuring, you need very compelling reasons:

- dismissal of the borrower from his place of work for reasons beyond his control (reduction of staff, liquidation of the enterprise);

- significant salary reduction or retirement;

- the onset of disability or another situation when the state of health does not allow one to receive income at the previous level.

If such circumstances arise, it is better to notify the bank immediately, without waiting for a long delay on the loan. If you have developed a good credit history in the past, then the chances of a positive decision by the bank are much higher.

Banks note that the mortgage restructuring program, which has been operating over the past year, has worked well. It is better for them to find a mutually beneficial compromise than to get involved in litigation.

Types of restructuring:

- prolongation of the contract allows you to increase the amount of each individual payment. As a minus, we can indicate an increase in the total amount of payments;

- credit holidays. The positive side is that the borrower is given the opportunity to pay only interest on the loan for a certain period of time and not repay the debt directly. The downside is the resulting increase in the total amount of payments;

- cancellation of penalties. Banks impose large penalties on late payments, which has a direct impact on the growth of the total amount of payments. The abolition of fines allows you to reduce the total debt and, along with it, monthly payments;

- Currency conversion today is one of the most profitable options for the debtor, which is due to constant fluctuations in exchange rates. As part of this type of mortgage restructuring, the debt is recalculated in domestic currency, which allows the borrower to pay the loan in rubles and not depend on exchange rate fluctuations.

Mortgage restructuring conditions

According to the latest changes in force in 2021, the following citizens can count on mortgage restructuring with the help of the state:

- families with one or more minor children, as well as with children under 24 years of age studying full-time and not working (if there is one child, then both parents must be no older than 35 years);

- disabled people and parents of disabled children;

- combat veterans;

- employees of budgetary institutions with at least 1 year of experience.

Applicants must be citizens of the Russian Federation.

Another condition for participation in the program is confirmation of income level. If it does not exceed two subsistence minimums for each family member, then there is a chance to receive support from the state.

There are also certain requirements for residential real estate:

- Located on the territory of the Russian Federation;

- It must be the only mortgage for the family and it was purchased for its purchase no more than a year ago, which is confirmed by the loan agreement;

- The cost of housing should not be higher than 60% of the average market price;

- Apartment area:

- for a one-room apartment - no more than 45 sq.m.;

- for a two-room apartment - 65 sq.m.;

- for a three-room apartment - 85 sq.m.;

- exception - restrictions do not apply only to a large family living in an apartment;

The borrower is also allowed to have a share in other residential real estate, but the total share of the entire family in it should not exceed 50%.

Housing (purchase, construction, major repairs) taken out before January 1, 2015 can apply for mortgage restructuring. The delay in payments must be at least 30 and no more than 120 days as of the date of application.

If all conditions are met, you can begin to compile a package of documents.

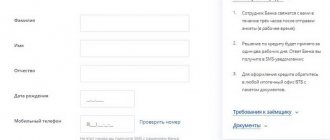

In the picture below, answer the questions and find out if you can receive help from the state.

State-assisted restructuring

On April 20, 2015, a new decree on restructuring mortgages with the help of the state came into force. Changes were made, thanks to which the amount of state assistance for the borrower was increased three times. 4.5 billion rubles have been allocated. In general, the program to support mortgage borrowers has been successfully applied in Russia since the beginning of 2009.

Based on the results of the work, overdue debt on foreign currency loans was halved, and on ruble loans there is also a steady downward trend. Assistance was provided to 9.5 thousand borrowers out of 14 thousand who applied, and at least 22 thousand are planned. You may be one of them, but you need to remember that the program’s duration is limited.

Mortgage restructuring in 2021 is possible mainly only for foreign currency borrowers. Although ruble mortgages are formally also subject to restructuring, banks do not give permission for it and block the transfer of documents to AHML and the interdepartmental commission.

If you belong to any category of federal beneficiaries, then you can safely apply for help from the state in restructuring your mortgage. This program is administered by a government agency - the Agency for the Restructuring of Housing Mortgage Loans (ARHML).

How it works

If your application is considered positively, your debt may be reduced by a decent amount. To be precise, the principal can be written off all at once or spread over many payments. As a result, the reduction in mortgage debt will be 20%, but not more than 600 thousand rubles. If you have two children, then you can receive a write-off of 30% up to 1,500,000 rubles. Credit holidays can be up to 1.5 years. The annual rate can be reduced to 12%. Foreign currency is converted into rubles at the Central Bank exchange rate or lower. All costs associated with mortgage restructuring are borne by the state.

The family of our readers from Novosibirsk has already received 438,000 from the state to pay off the principal debt. This is 20% of its balance. The review took only 2 weeks. Mortgage in Sberbank. Everything is real!

Taking into account the conditions of restructuring, all banks are happy to offer assistance under this program and independently submit the application to ARHML. Of course, after you collect the necessary documents and fill out an application for restructuring your mortgage debt. By the way, more than 100 credit institutions, which make up almost 97% of the lending market, take part in the borrower assistance program. Therefore, there is a high probability that your bank is accredited by ARHML and the restructuring of your mortgage will be approved. The main thing is that you and the lending object comply with state requirements.

Terms and requirements

- Parents or guardians of minor children, military veterans, disabled people and parents of disabled children can participate in the program.

- There is also an income requirement. After paying off the mortgage, it should not exceed two subsistence minimums for each family member.

- In 2021, in addition to traditional beneficiaries, families with adult children studying full-time in educational institutions were added to the state restructuring program.

- There are also requirements for the object of collateral. The home must be the only one for the family and purchased at least 12 months before the restructuring. It is allowed for one of the family members to own another property, but not more than 50% of it.

- If the borrower is not a large family, then there are restrictions on the size and cost of the apartment or house. The area of a one-room apartment is no more than 45 square meters. m., two-room apartment no more than 65 sq. m., three-room apartment no more than 85 sq. m. m.

- The cost of the apartment should not exceed the market average by more than 60%.

If you meet all the specified restructuring conditions, collect a package of documents.

Documentation

You will need the following documents: Russian Federation passport, loan agreement, payment repayment scheme, extract from the Unified State Register for the collateral value, a certificate - an extract from the Unified State Register about the generalized rights of an individual, certificate of income for the last 3 months.

If you have lost your job, then prepare the original work book with a dismissal stamp and a certificate from the employment center indicating the amount of benefits.

If necessary, the bank may request additional documents. The application for restructuring is filled out at the branch of the bank where the mortgage was issued. Review of the application will take 10 days.

We discussed a more detailed list of documents for restructuring a mortgage with state support in the previous article “Program of assistance to mortgage borrowers with state assistance.”

Step-by-step instruction

So, if you decide to reduce your debt and get a restructured loan, I suggest you the following course of action.

- The first thing you need to do is contact the bank and find out which branch you can go to for advice on this program.

- During the consultation, clarify all additional documents that are needed specifically in your case.

- We order an extract from the Unified State Register of Mortgaged Real Estate from the district multifunctional center (MFC). There we also order an extract from the Unified State Register of Generalized Rights. The second certificate stating that you and your family members have no other housing. Shares in other real estate are allowed, but in total no more than 50%. Production time 7 days.

- We fill out an application for restructuring of mortgage debt. You can fill it out at a bank branch. We provide a complete package of documents to the manager.

- We are waiting for AHML's decision up to 30 days (actually 10 working days).

- You will be notified of the result by call. Then they will invite you to the bank to restructure your loan and sign new loan documentation.

- Within a month, the mortgage will arrive from the archives to the bank. Next, you will need to go to the justice department with a complete package of mortgage documents and register changes in the mortgage.

Important point. The loan will be recalculated from the date of filing the application for restructuring. It may be a pleasant surprise for you that this month you will have to pay the mortgage amount significantly less than according to schedule. In our example, a family from Novosibirsk had a mortgage payment of 24,148, after restructuring 19,478, and in the current month only 660 rubles. Use our mortgage calculator to find out what your mortgage payment will be once your application is approved.

We would like to note that in some cases the bank may refuse. The reason for this may be inaccurate information in the application or incorrectly completed documents. Don't despair. You should find out the reason for the refusal from the bank manager and apply again.

In 2021, this program is no longer valid. Along with this, there are mortgage holidays.

What documents are required?

The number of documents that must be collected to participate in the mortgage restructuring program with the help of the state is quite large. Let's list everything:

- application for revision of the terms of the contract;

- passports and birth certificates of all family members of the borrower;

- marriage certificate, if available;

- certificate of family composition;

- if there are adopted or warded children, then a decision of the guardianship authorities or a court order;

- a certificate from the educational institution confirming the fact of full-time education of a child under 24 years of age, and a certificate from the Pension Fund confirming the absence of a place of work;

- a copy of the work book;

- salary certificate in form 2-NDFL for the last three months;

- ID card of a combat participant (if available);

- documents confirming disability;

- extract from the Unified State Register of Real Estate for an apartment that is pledged.

Other documents may also be provided: a certificate of registration with the Employment Service.

Mortgage: how to get it on preferential terms and pay it off faster?

For many Russian families, a mortgage is the only way to purchase their own home. Having taken on debt obligations, you want to pay off the loan faster. There are several ways to quickly pay off your mortgage. In particular, you can try to collect a good down payment, find out about benefits and government support, taking advantage of all suitable programs, or use your income tax refund to pay off your mortgage.

Down payment when applying for a mortgage

Despite the fact that today banks offer various mortgage programs, including those without a down payment, the starting amount for purchasing real estate will reduce the debt burden and pay off the loan faster. Almost all preferential programs that allow you to buy an apartment with state support provide for a down payment of at least 20% of the amount paid. You can save a lot on overpayments if the down payment is less than the amount taken out for a mortgage.

Mortgages without a down payment are usually used by citizens whose purchased housing is of low cost or who additionally pledge other real estate of the borrower as collateral.

If desired, the mortgage loan can be repaid ahead of schedule: in whole or in part. Partially – that is, increase the amount of the next contribution. For this purpose, an application is drawn up, and the bank determines the terms and conditions of debt repayment.

Refund of income tax (NDFL) from a mortgage

The mortgage provides a refund of income tax to borrowers, provided that they have official income from their work activities. This situation, of course, helps improve the family budget.

When buying an apartment with a mortgage, a citizen has the right not only to a tax deduction in the amount of 13% of the cost of the apartment, but also to an additional deduction for mortgage interest. This applies to all types of mortgage loans: for housing under construction, when buying an apartment, for a plot of land for housing under construction, etc. If both spouses are the owners of the apartment, each of them can apply to the tax office for an income tax refund and receive a deduction. The maximum amount of real estate for which a tax deduction is calculated for each owner is 2 million rubles, and the maximum amount of an apartment with mortgage interest for a tax deduction is limited to 3 million rubles.

Benefits for young families

At the moment, the state program “Young Family” is in effect. The basis for participation in the program is: age under 35 years and non-compliance of living conditions with living standards. Young families can receive a subsidy and use it to pay off their mortgage. The amount of the family benefit reaches 35% of the cost of the apartment or house (if the living space meets the conditions of the state program).

Also, young families can take advantage of a mortgage with a preferential rate of 6% for the entire period of debt repayment. For residents of the Far East, the rate is set at 5% if the contract was concluded from March 1, 2019. The main condition for receiving a preferential loan is the birth of the 2nd and subsequent child during the period from January 1, 2021. The down payment is 20% of the cost of the housing purchased on the primary market. The apartment must be purchased directly from the developer.

Maternal capital

As another state support program, the state provides maternity capital for families where a second child is born. Its size is 453,026 rubles. As you know, the certificate is sent only for certain purposes. It is important that the mortgage allows it to be used immediately after the birth of the child. According to the law, maternity capital can be divided into shares, and only one of them can be used for a loan.

In 2021, the law on state support for large families came into force. For the 3rd and subsequent children, they are given a one-time allowance in the amount of 450 thousand rubles, which can only be spent to pay off the mortgage issued for an apartment from the developer. The condition for receiving a preferential subsidy is the birth of a child from January 1, 2021. It is provided to either the father or mother of the child. Any family can receive compensation, regardless of their income and the age of the spouses. At the same time, you can use maternity capital to pay off the mortgage.

Social mortgage for low-income citizens

There is a mortgage for the poor.

Social loans are used by people living in:

- houses in disrepair;

- small premises;

- those standing in line to improve their living conditions;

- living with seriously ill and disabled people.

With the support of the state through a mortgage, they can purchase real estate below market value, receive a subsidy, or take out a loan with low interest.

Mortgage restructuring program

Mortgages help many citizens solve their housing problems. But due to emerging financial difficulties, it can be very difficult to pay off the debt. In order to improve the financial situation, a mortgage restructuring program was adopted, that is, a change in the terms of the loan.

Under the program, a credit institution can go:

- to reduce the interest rate and, accordingly, increase the debt repayment period;

- defer the main payment. In this case, only mortgage interest will need to be paid;

- according to the law of May 1, 2021, you can completely stop payments for up to 6 months, but this requires the consent of the bank;

- write off part of the debt if there is an overdue debt. Subject to payment by the borrower of some part of the overdue amount.

Reasons for restructuring a mortgage may be:

- dismissal from work, including due to illness;

- salary reduction;

- divorce, etc.

In any case, you should contact the bank with a request in time.

When setting the goal of getting a mortgage loan, you need to familiarize yourself with the lending conditions of different banks. After submitting the application, the organization will accept it for consideration and only then give an answer: to grant or refuse a mortgage. It is better to apply to several banks to find a suitable option and not waste time.

How does mortgage restructuring work in 2021?

You should contact the bank that issued the mortgage with an application for government assistance. If the bank accepts your arguments and makes a positive decision, then the debt under the loan agreement can be significantly reduced:

- Maximum support amount. The bank can write off the amount to pay off the debt immediately or reduce payments for several months. In percentage terms, the reduction may be 30% of the amount of the remaining outstanding loan, but not more than 1,500,000 rubles . These funds are allocated by the state and credited to the bank account.

- A good idea was the possibility of providing the debtor with a credit holiday. Their term can be up to 1.5 years, during which it is planned that a person can find a job with sufficient wages, recover a little and again become solvent on the mortgage.

- The bank may also offer a reduction in the interest rate to 11.5% per annum.

Many banks are participating in the mortgage restructuring program with government support and are making accommodations for borrowers who find themselves in difficult life situations. After a person collects all the documents and submits an application, the bank itself transfers them to Dom.rf (formerly AHML).

Most banks have been accredited by Dom.rf; all that remains is to clarify whether the borrower and the loan facility meet all the requirements set by the state for participation in the program.

Step-by-step instruction

Let us briefly outline the action plan.

- Contact a bank representative to obtain advice on participation in the restructuring program.

- Find out the list of documents required in a particular case.

- Fill out an application for restructuring and attach a complete package of documents.

- Wait for the result of the application review.

After the response is received and a positive decision is made, the borrower will be invited to the bank branch to sign a new loan agreement with a new payment schedule. Then you need to request a mortgage from the archive and make changes in Rosreestr.

Mortgage refinancing concept

Refinancing is taking out one loan in order to fully or partially repay another. This service involves concluding a new agreement with the same bank where the mortgage was issued, or another financial institution. In this case, the borrower does not receive cash in hand - when the refinancing application is approved, the funds are transferred to the loan account.

Refinancing a mortgage loan allows the borrower to:

- reduce the interest rate on the loan, resulting in a reduction in the amount of monthly payments;

- increase the loan amount - request from the lender an amount greater than necessary to cover the mortgage loan;

- debt consolidation is a relatively new service that involves merging existing loans into one.

In other words, refinancing a mortgage is refinancing. It will be relevant to use this service if the client is not satisfied with the quality of service or the terms of the lender’s agreement, the rate on the current loan exceeds the market average, the debt to the bank is growing despite making payments, the amount of the monthly payment has become a burden to the borrower.

Recommended article: Refinancing a military mortgage with 2 children - conditions and banks

Recently, the demand for refinancing services has been growing. However, there is a negative trend - banks refuse to refinance mortgage loans. If the client wishes to move to another financial institution, banks refuse to issue permission for the next mortgage. This is legal, but not ethical manipulation on the part of the lender.