Transactions on the secondary market: main points

In comparison with the purchase of new buildings through transactions with secondary residential real estate, some features can be highlighted. Each apartment offered on the secondary market has its own history - short or long. We are talking, first of all, about a series of owners and a number of transactions for the alienation of real estate; each of these transactions can present its own surprises to the current owner, in most cases not very pleasant ones.

Even if the house is completely new, but at least one certificate of ownership has already been issued for the apartment, the housing is considered secondary.

An ideal option for a buyer, although not the cheapest, is housing that a year or two ago was in the status of a new building, and now the owners are selling it.

It is clear that there cannot be many previous owners, and with a high probability such a purchase will not be fraught with violation of the rights of third parties, which is most often the subject of litigation. In cases with apartments in buildings built a long time ago, the history can be long and confusing: several changes of owners, donation, inheritance, rental intricacies, and so on.

In addition, it is necessary to carefully evaluate not only the “legal cleanliness”, but also the living space itself , the surfaces of the walls, floors, ceilings, and utility networks for wear and tear.

The same can be said regarding regional communications.

For many, the characteristics of their neighbors, their habits and characteristics are of great importance, since, one way or another, the new owner will have to fit into a certain established way of life.

Which apartment to choose

How profitable the purchase of housing will be depends not on the market (primary or secondary), but on the characteristics of the apartment or house itself:

- When purchasing a home from a developer, you should check how reputable he is on the market and whether he has any frozen properties.

- A resale apartment should be checked in the State Register, where the real owners and other data are indicated.

- The choice of real estate should be based on such characteristics as area, location in the city, number of floors, materials for constructing walls, and transport support for the area.

It is worth considering several options in order to be able to compare certain features and make an informed choice.

Advantages of “resale”: established infrastructure, lack of construction sites

However, the obvious positive aspects of transactions with secondary housing include the opportunity to purchase residential space in areas where new construction is practically excluded. But a high-quality social infrastructure has already been created, and with transport accessibility everything is more or less clear. All these parameters can be assessed immediately, already at the stage of choosing a suitable apartment, without relying on a long-term plan for the development of the territory or the assurances of the developer, when compared with buying housing on the primary market.

By the way, the range of apartments on the secondary market is significantly wider than in new neighborhoods.

Another advantage is that the right to own an apartment can be obtained immediately during the conclusion of the transaction, and one can immediately move to a new place of residence, without waiting for the completion of the construction of the house, as is the case with new buildings. True, if the secondary apartment turns out to be part of a chain of alternatives, everything turns out to be very difficult, and you may have to wait for “comprehensive” paperwork.

Many of those who prefer to buy second-hand apartments indicate that the apartments are already fully lived-in. That is, most of the nuances - from the view from the windows to the quality of heating and sound insulation - will no longer be subject to changes and all this can be checked immediately.

In addition, there is always a chance based on some discovered deficiencies (if desired, they can be found in almost every apartment)

negotiate with the seller about a discount, changes in some nuances of the contract, distribution of costs for completing the transaction.

In other words, housing on the secondary market is a commissioned object that, like any physical product, can be viewed “in all its glory.” But at the same time, of course, you need to understand that the inability to completely eliminate legal risks and ensure absolute security of the transaction in this regard can negate all the advantages of secondary real estate. There are risks, there are many of them, and they must be taken into account, which will be discussed further.

Primary housing and its difference from secondary housing

A primary real estate property is a residential premises, the ownership of which is registered for the first time.

Typically these are new buildings sold by developers, construction companies through intermediaries or their own sales offices.

An apartment in a newly built building can be a secondary property. This happens when it is not sold by the developer, but by the owner of the share, who has documented the rights. At the same time, the living space may not yet have been used for its intended purpose.

Advantages of primary real estate

New buildings are sold in different ways: through a mortgage, in installments, leasing . You can save up to 30% if you invest during the construction phase.

The “primary” building was built to a higher quality; modern materials and technologies were used during the construction process. Maintenance of the facility costs less, since there is less heat loss and there are no costs for maintaining communications. New housing is usually legally clean.

The difference between “primary” and “secondary”

The cost of primary in one area is 20% higher than secondary . New buildings are usually located on the outskirts with poor infrastructure.

With shared participation, there is a risk that the documents for the site and construction are drawn up incorrectly. Because of these errors, difficulties arise when putting the facility into operation. This cannot happen with a secondary one.

Where is it better to buy housing - on the primary or secondary market?

Objects in the primary and secondary markets are parts of a single market, which allows solving the housing problem in different ways. This table, which lists the main characteristics of the two housing formats, will help you make your choice:

| Characteristics | Primary housing | Secondary housing |

| Price | Higher, depends on cost | Below, depends on offers |

| Layout | More modern. There are no walk-through rooms. The ceilings are higher. | Outdated. The ceilings are lower. Combined bathrooms. Passage rooms. Small kitchens. |

| Finishing | Rent with rough finishing. Turnkey options are also offered. There is no need to dismantle the old finish. | Repairs are not necessary. You can buy and live right away. |

| Quality | Complies with GOST standards. | Does not comply with GOST standards. |

| Infrastructure | Developing. | Already quite developed. |

| Purchase Features | Purchased with 100% prepayment, in installments, on credit, with an overpayment of 10%. | Not sold in installments. You can get a mortgage, but with an overpayment. |

Myths about the “resale”: budget housing with a high degree of wear and tear

When the concept of “secondary housing” is mentioned, a picture of “killed” living space in an old “panel” is immediately drawn before the eyes of ignorant people, which does not even approximately fit into the idea of a comfortable living space. Of course, there are many such options on active sale, but the range of offers is far from limited to them.

Since years have already passed since the commissioning of some modern new buildings with new planning solutions, more and more quality apartments are appearing on the secondary market. Therefore, excellent housing that fully complies with all existing standards becomes available to buyers. People purchased such real estate most often at the foundation pit stage, equipped it, even lived or rented it out for some time, and then circumstances changed and the apartments ended up being sold.

In addition, secondary real estate is not necessarily economy class housing. There are many very high-quality apartments and secondary housing belonging to the comfort and business class on the market.

It should be noted that secondary housing, with the exception of “low-budget” options, is not necessarily cheaper than living space in a new building, which, moreover, can be purchased at any stage of the construction of the house.

Many buyers prefer to buy a new apartment with ready renovation in order to be guaranteed to protect themselves from problems with worn-out infrastructure and “history” that cannot be thoroughly verified. Although this does not mean that there are no risks in the primary market, they exist, and evidence of this is the defrauded shareholders who come out to rallies almost every year.

Secondary storeys

When purchasing secondary living space, pay attention to the floor where it is located. There are certain pros and cons everywhere. For example, the absence of neighbors above will be a clear advantage of the last floor. But there is a risk that the ceilings may leak.

If the property you choose is on the top floor, check whether an attic or technical floor is provided. Make sure the roof is strong and secure. Preference should be given to a gable roof, since, thanks to its shape, it better protects your ceiling from leaks and freezing.

When purchasing premises on the ground floor, you should also be careful and careful. Possible risks here are high humidity, mold, noise outside the window. Dampness and an unpleasant odor may spread from the basement. In addition, criminal elements often enter the first floors, so it is worth taking care of the presence of security.

Tangible risks of “resale”: dubious history, illegal redevelopment

Unfortunately, the secondary real estate market is a favorable area for the implementation of multidirectional fraudulent schemes, which means that the buyer has to be especially vigilant.

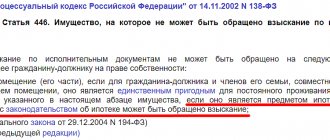

The main risks are related to the fact that in each of the transactions for the transfer of ownership, the rights of third parties (children, relatives, spouses)

or the owner himself, who, for example, may be recognized as incompetent and not be aware of his actions at the time of signing the contract.

It is impossible to guarantee the complete absence of such problems; the legislation does not offer appropriate mechanisms. If the seller manages to prove that such violations have occurred, the court will declare the transaction illegal. As a result, the buyer will have to return the home and make lengthy attempts to get their money back. What most likely cannot be done, scammers skillfully take advantage of gaps in the legislation.

The main thing that you should not save time, effort or money on when buying a secondary home is checking the legal cleanliness of the apartment.

The ideal solution is to entrust this work to real estate lawyers, who, if necessary, can ask all the questions if it seems that there are controversial areas in the documents presented. In addition, experienced professionals will notice possible pitfalls that a person who is not a specialist may simply not pay attention to.

If you purchase apartments in old buildings, the imperfection of planning and architectural solutions, their technological backwardness is something that you will have to come to terms with. However, many owners, trying to add comfort to such housing, carry out redevelopment on their own, transforming the apartments beyond recognition. Before purchasing, you need to make sure that the redevelopment was carried out legally, and that there is all the necessary confirmation.

Otherwise, having already become the owner of a new home, you may encounter serious problems, which, at best, will result in large costs for putting the documentation in order. One way or another, buying an apartment with illegal redevelopment is a reason to talk about a significant discount.

Apartments in “ancient” buildings may have hidden flaws that are difficult to notice the first time.

An expert assessment when purchasing such a home is expensive, but very often it is worth it. This service allows you to save even more money that would have to be spent, for example, on replacing engineering infrastructure or external insulation.

Thus, a certain number of risks associated with the secondary market can be controlled. But if during the analysis it becomes clear that there are “blank spots” in the history of the property, and the condition of the apartment is not ideal, perhaps such real estate should be abandoned. Fortunately, none of the apartments were in jeopardy; there are almost always good offers on the market, you just need to look hard.

Risks when buying a secondary home

One of the main risks is purchasing an apartment under a secondary power of attorney. Everyone knows that there are black realtors on the market. Choosing weak and irresponsible citizens as their victims, they re-register documents as dummies and sell the apartment. The first sign of such an offer will be a reduced price of housing, as scammers are in a hurry to complete the deal. You should also beware of tracking by proxy, as serious problems can arise with this.

To sell an apartment, the consent of all its owners is required. If the owners have minor children, then the consent of the guardianship and trusteeship authorities is required. If someone claims their rights after the transaction has been completed, it will be declared invalid. It is necessary to trace the entire history of the apartment, how many times it was sold, how it got to the owner. The transaction will be invalid if one of the relatives about whom it was not known declares their rights to the inheritance.

There are many features of selling an object if this apartment is a “resale” apartment. What does it mean? You need to carefully check all the information, understand the situation in the housing market and think through all the possible issues that will bother you in the future.

If you find an error, please select a piece of text and press Ctrl+Enter.

What influences the price of resale?

The price range for secondary housing is very wide, and the cost depends not only on the prestige, area and quality of housing. Apartment prices fluctuate significantly depending on the area, the location of the house, the demand for housing in this area, and the availability and quality of infrastructure.

Proximity to the center affects the cost, but in many cases it is not decisive. A well-equipped one-room apartment in a house with an improved layout, located in a good area on the outskirts, can turn out to be much more expensive than a modest “destroyed” apartment in the center. Of course, the condition of the premises themselves and utility networks plays a significant role.

There are also many other nuances associated with the characteristics of individual apartments. The main thing that should alert the buyer is the price, which is much lower than the average market value. When purchasing such an apartment, the history, circumstances of the sale and technical condition must be assessed with particular care.

What is more profitable and better for the borrower?

It is difficult to answer this question unequivocally, because everything depends on the goal pursued by the borrower.

- The borrower wants to sell the apartment for a higher price in the future.

- A person fundamentally wants to live only in a new home, where there were no previous owners, and where he can do everything “for himself.”

- Client does not want to pay high insurance (personal and property only, no title)

- A person cares about the quality of a home, which is checked over the years.

- I don’t want to invest in finishing and new renovations.

- You can choose the most convenient location (in the center, near work, etc.).

- You need to move in quickly and live without investment.

- I don’t want to bother with unnecessary documents and depend on the developer.

The eternal question facing future property owners is to buy a primary or secondary property? This is by no means a choice between good and bad, because there are a lot of worthy offers in both markets. To understand which way to look, you need to understand how the secondary differs from the primary, and in this article we will try to reveal all the nuances of this issue.

Secondary mortgage: opportunities and problems

The state and the developers themselves are trying in every possible way to stimulate and advertise the possibilities of mortgage lending for the purchase of housing in new buildings. Financial institutions are quite willing to provide loans for the purchase of secondary goods, and banks have their own reasons for this:

Firstly,

You can’t earn much on new buildings alone, since the market is still not updating as quickly as the bankers’ appetites are growing. The secondary market presents an abundance of options in different price categories.

Secondly,

apartments that exist only in the project are objects associated with certain risks not only for end buyers, but also for banks. Therefore, not every developer’s properties are suitable for a bank mortgage.

However, the requirements for the secondary are also very serious,

which, in general, is not surprising, since the apartment becomes collateral for the entire period while the borrower pays off the mortgage loan. If suddenly it turns out to be insolvent, the collateral will have to be sold, and it is important for the bank to sell the apartment quickly and without problems. An indispensable condition is the presence of a complete set of communications and a satisfactory level of wear and tear of the house. Thus, it is almost impossible to obtain a mortgage for the purchase of real estate in a house built before the sixties of the last century.

The legal history of the apartment is also under the close attention of banks, which will definitely not be suitable for housing that has at least some encumbrances. Third parties cannot be registered on the premises, and the presence of collateral agreements with other organizations is also excluded. In addition, experts from financial institutions will certainly check the title documents. This approach also reduces risks for homeowners - if the bank has approved the mortgage, the risks are significantly reduced.

What about the legal purity of housing?

Banks also impose requirements on the legal history of the apartment - no encumbrances are allowed. Registration of third parties on the premises, as well as the presence of arrests or collateral agreements with other credit institutions are not permitted. In addition, the bank will require all title documents and check them for errors and inaccuracies. This will also benefit future owners - they will receive a quality-tested apartment in which no unpleasant moments will be discovered over time.

Quality guarantees for new homes

In new buildings, requirements are met to ensure the safety of residents: there is a guarantee for utilities, walls, windows and ceilings. If apartment owners encounter problems during the first five years of operation, they have the right to demand compensation and free elimination of defects.

Pros and cons of secondary housing

If you are still hesitating in choosing, consider the advantages of the second type of housing:

- you can move into the apartment immediately after purchase;

- availability of repairs, furniture, utilities;

- there is infrastructure: schools, shops, kindergartens, parks;

- large selection of apartments on the market.

Flaws:

- high price;

- costs for the services of a lawyer checking the history of the apartment;

- The quality of communications and supporting structures has deteriorated over the years of operation.

However, developers can also deliver low-quality housing that requires improvements in the first year of occupancy. There are known cases when the ventilation in new apartments did not work properly, there was no electricity, there were constant interruptions in the heat supply, etc.

Assessing risks

Buying an apartment in a new building is a risky project, since the development company may go bankrupt without completing construction. In this case, the money will be lost, and it is difficult to foresee such a situation. Delayed construction time is another disadvantage of such a deal. It is extremely difficult to influence the progress of work by speeding it up.

The state is trying to mitigate the risk by obliging the developer to carry out compulsory insurance. However, the risk still remains. Practice has shown that even fines do not prevent delays. When choosing between new and secondary housing, take into account the reputation and authority of the developer: how many years has it been on the market, what is the success of its work. Weigh the pros and cons to reduce the risk of wasting money and time.

The state of the secondary real estate market in Russia

So, you have some savings and want to buy real estate. Secondary housing is the best option for investing money. In Russia, most apartments are sold directly by the owners, and not through intermediaries, as is the case in Western countries, so the cost of square meters does not include a realtor’s commission. But in some cases, owners inflate the cost of apartments too much without any reason. This is due to the fact that calculating the real cost of living space, which will correspond to current market conditions, requires certain knowledge and experience that most people do not have.

Price analysis

To compare prices, let's take the real estate market of the Russian capital.

The Moscow primary market for the most part consists of modern business-level properties, which accounts for almost 40% of the total supply. Of this amount, almost half falls on the “elite” segment, which meets all modern requirements in matters of architecture and technical equipment.

Mid-level properties occupy about 29% of the market, and “economy” – about 5%.

The secondary real estate market mainly offers economy class housing - 39%, middle class - a little more than 31%, business class - almost 29%.

Most real estate experts agree that it is impossible to compare prices without taking into account the specific quality of the housing itself.

In general, we can now safely say that new houses are definitely more expensive than resale living space. The result is that the average price per square meter on the new home market is just over 206 thousand rubles, and on the secondary market – just over 180 thousand rubles.

For example, the sale of a 2-room apartment with a “stale” renovation of about 50 square meters in a standard block house in the center of the capital will bring from 11 to 12 million rubles. This amount is quite enough to purchase a comfortable and spacious 2-room apartment in the area of the 3rd transport ring. The area of a new apartment can vary around 80 square meters. In new buildings closer to the Moscow Ring Road, it is quite possible to buy a 3-room or a modest 4-room apartment. In the Tsaritsyno residential complex, you can buy a three-room apartment of 120 square meters for an amount of 11 to 12 million rubles.

Summary

It is impossible to see, by making a generalized comparison, which is better - “primary” or “secondary”. Here it is important to compare a huge number of individual qualities of housing, to study the reputation of the developer of the new house: whether he had any downtime and delays in construction. For example, you should not blindly trust the good promises of new developers - it is unknown how the company will behave in practice.

Share link:

You may like:

- How to profitably invest in real estate: a step-by-step guide

- Investing in commercial real estate

- Budget bathroom renovation

- Procedure for purchasing an apartment in a new building

- Apartment redevelopment: list of documents, approval features

- Is it profitable and worth investing in real estate now?

- Panel, monolithic or brick house: which is better?

- Should I buy an apartment on the top floor: pros, cons

- Tax deduction when purchasing a new building in 2021