What are the general conditions for receiving a tax deduction?

The first condition is the payment of personal income tax. After all, if a tax payment to the budget has not been made, then there is no way to get it back (for example, when giving an apartment as a gift to a close relative, you cannot receive a tax deduction, because he will not pay personal income tax to the budget).

The second condition will be the actual expenses incurred by the taxpayer. After all, it is precisely for their partial compensation that the tax deduction is intended. The cost of paying taxes in and of itself does not provide any compensation. But there is a nuance. The apartment received as a gift can be sold and a new property can be purchased with this money. After all, a property deduction is provided for the purchase of housing.

The third condition is that the amount of the deduction should in no case exceed the amount of taxes paid to the budget.

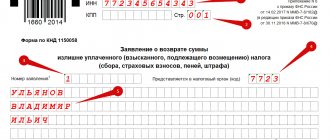

And fourth, it is necessary to submit a declaration in the prescribed form 3-NDFL within the prescribed time frame.

Only if both conditions are met is this tax benefit possible.

How to apply for a deduction

Where to go to get a tax deduction? There are two possible solutions to this issue.

Through the tax office

The most common option for obtaining a deduction is to contact the Tax Inspectorate. You need to visit the nearest Tax Office office where you are registered and write an application. A mandatory package of documents is attached to the application. If you previously paid tax under a real estate donation agreement and are counting on this amount, then you should have filed a tax return on time - before April 30 of the next year, based on the date of donation of the apartment. If all the rules are followed, then after a positive decision on your application (usually it takes up to one month), the money will be credited to your account.

Through the employer

The second option for filing a property deduction is to contact your employer. This option is suitable for those workers who bought real estate, but have not yet accumulated a certain amount of income tax for the year. Here you write an application addressed to your employer with a request to cancel deductions from his salary in the amount of 13%, that is, in fact, you will receive a tax deduction in your hands.

Thus, if you are officially employed, you can choose which method of obtaining a tax deduction is more convenient for you. With a responsible approach to collecting documents and paying personal income tax, you can take advantage of a state benefit of up to 260,000 rubles, which will be a good help for an expensive purchase. If you have difficulties collecting documents or filling them out, it is best to use the help of a specialist so as not to be refused.

What real estate can be donated to another person?

The object of taxation in this case will be the following types of real estate:

- An apartment or a share in it.

- Private home ownership along with a plot of land.

- A plot of land, if there are no buildings on it. Or the buildings do not belong to the donor. Here we must keep in mind that if the building still exists, but it is not completed and not registered in the cadastral register, then, from the point of view of the Land Code, it does not exist. You can also donate part of the land plot on which there are no buildings.

- Country house with plot.

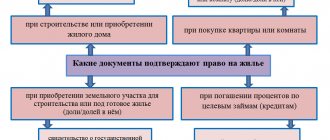

Required documents

What documents need to be prepared to take advantage of the tax deduction? The list of documents is standard and includes the following papers:

- application for a property deduction;

- passport;

- certificate of income from the official place of work, filled out in Form 2-NDFL;

- a notarized contract of purchase and sale or shared ownership of real estate;

- completed tax return in form 3-NDFL;

- extract from the Unified State Register of Real Estate;

- documents - checks, receipts, bank statements confirming the fact of payment for the apartment;

- acceptance certificate (optional for DCT);

- marriage certificate (if available);

- bank account details for depositing funds;

- loan agreement and a certificate of accrued interest on the mortgage for the year (if the property is purchased on credit).

All listed documents for obtaining a property deduction are submitted both in originals and copies. Each copy will need to be personally certified.

When the package of documents is prepared, you go to the Tax Inspectorate office at the place of your registration or apartment registration. It is very important to write the application correctly on the spot, as well as fill out the tax return. If the inspector finds errors, your application will be returned to the Tax Office. Therefore, if you doubt the correctness of drawing up documents for deduction, it is better to use the help of a specialist. Once you are done with this question, all that remains is to wait for the answer and the money. If you are in another city, then the documents can be sent by mail, but you must send the parcel in a valuable letter with an inventory included inside.

What will be the amount of tax deduction for donated real estate?

The deduction is not available to a close relative; 2021 has not changed anything in this situation. After all, all their expenses with the donor are limited to the payment of the state duty to the Federal Service for State Registration, Cadastre and Cartography for the preparation of cadastral documents and payment for notary services for the execution and registration of the deed of gift.

A non-relative will also have to pay personal income tax, so he can contrive and still receive a tax refund.

The scheme is quite complex and needs to be explained with an example.

So, citizen Vasiliev received from citizen Petrova, his lonely cousin, an apartment worth 2,600,000 rubles as a gift.

Since close relatives do not include cousins and nephews, citizen Vasiliev will be obliged to pay a tax on income received to the state treasury in the amount of 13% of the value of the gift. In total, the tax amount will be a considerable amount of 338,000 rubles.

Citizen Vasiliev sells this apartment and buys a house worth 2,300,000. According to tax legislation, he has the right to deduct up to 2,000,000 rubles. Accordingly, the amount of funds to be refunded will be 260,000 rubles.

By way of offset, citizen Vasiliev will pay 78,000 rubles to the budget instead of the initially due 338,000.

Those. The tax reduction option is only possible when using another tax deduction. The procedure for offsetting income tax and property deduction for the purchase of real estate will be outlined below.

Deduction amount

The size of the tax deduction depends on several factors. Let us turn to the Tax Code for clarification:

- the value of the property you purchased or want to purchase;

- the amount of accumulated income tax.

The maximum deduction amount for a refund from the cost of the apartment can be no more than 13%, but subject to the available limit of 2,000,000 rubles. In practice, it looks like this: the cost of real estate is 3,000,000 rubles, but since the state has set a deduction limit of 2,000,000, the maximum return amount will be: 2 million * 0.13 = 260,000 rubles. Thus, you can get back and save up to 260,000 rubles on an apartment, provided that you have a tax reserve and you work officially.

A limit of 2,000,000 rubles is set for apartments that are purchased with your own funds, and if you buy housing on credit, then the property deduction is 3,000,000 rubles, based on which the maximum amount to be returned is 390,000 rubles.

Thanks to changes in Tax legislation that came into force on January 1, 2014, the maximum deduction amount of 2,000,000 rubles is calculated not for a specific property, but for an individual. This option is convenient if the apartment is purchased by spouses on the basis of common shared ownership and, accordingly, you can receive a deduction twice as large.

In one year, a taxpayer cannot return more than he paid in taxes to the state treasury. If the buyer has accumulated a significant tax base over several years, then he can count on a one-time deduction for no more than three years. An application for a property deduction to recalculate 13% for the previous year is written in the next reporting period. Every year you need to write an application for a tax deduction until you have spent the entire amount allocated by the state - 260,000 rubles.

Who is exempt from personal income tax when donating real estate?

- spouses;

- children and parents. Adopted children and adoptive parents are equal to natural children and parents;

- full, half-blooded and half-brothers and sisters;

- grandparents and grandchildren

The list is exhaustive. Transfer as a gift to a non-relative gives rise to the latter's obligation to pay tax.

A tax deduction after donating an apartment can be issued under certain circumstances. However, the transfer or receipt of living space under a deed of gift does not automatically give rise to the right to a personal income tax deduction. The donor does not have any costs (compared to the home buyer). The donee has income from which tax will need to be transferred (unless, of course, he is a close relative of the donor). Meanwhile, other transactions that preceded or followed the donation may allow the parties to legally obtain personal income tax compensation.

What can the donor expect?

What, in turn, rights and obligations may arise for the donor of the apartment?

In general, the fact of a person donating real estate does not imply the emergence of any special rights and obligations, at least from the point of view of tax legislation. But this rule has an exception: if the donor previously bought an apartment donated to another at his own expense, then his right to receive a property deduction for this apartment does not disappear.

It is worth noting that, in principle, it does not matter through what mechanism the donor freed himself from ownership of the apartment - he sold it or, as in the scenario under consideration, donated it. It does not matter whether the recipient was a close relative.

The right to a property deduction is given to a person once the expenses for the purchase of a property are made. This right is not canceled in subsequent transactions with the apartment.

When applying for a deduction for a donated apartment, the donor will, however, need to take time to collect documents that certify the fact that:

- he bought the corresponding apartment at his own expense;

- he was the full owner of this apartment.

Otherwise, the documents for registration of the deduction, in principle, do not differ from those that characterize the process of using the corresponding privilege in the event that the citizen has valid ownership of housing.

Can the donor of an apartment count on a tax deduction?

The donor of the apartment cannot count on receiving a tax deduction. The same goes for real estate sellers.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The only exception is the subsequent purchase of an apartment at your own expense. In this case, the citizen will be able to contact the tax office to obtain a deduction in the manner prescribed by law.

For this purpose, he needs to prove the fact of acquisition of real estate, as well as provide an estimate of its market value. The ownership of the apartment must be registered.

If it has passed into the hands of several owners, each of them will be able to exercise the right to obtain a tax deduction.

A tax deduction is an amount by which the tax base can be reduced. That is, any working person who is officially employed and pays 13% income tax can count on a refund under certain circumstances.

Most often, tax deductions are used in real estate purchase and sale transactions. Is it possible to take advantage of a tax deduction in accordance with current legislation when receiving real estate as a gift? If you are faced with a similar situation, then familiarize yourself with the specifics of the transaction.

Deduction to the donor - is it due or not?

A donor is a person who transfers his own apartment to another person without any financial benefit for himself, i.e., as a gift. Since donation does not imply the receipt of money, such a citizen will not have to pay the state 13% of the cost of housing. Consequently, he has nothing to receive a deduction for.

However, if the right to deduction arose before the donation of housing, then it is not lost after the transaction.

Example. Starovoitov bought an apartment worth RUB 1,650,000 in 2021. In 2021, he gave it to his grandson. After the transaction, Starovoitov remained entitled to receive a deduction for the purchase of housing in the amount of: 1,650,000 * 13% = 214,500 rubles. If part of the deduction had already been received before the donation transaction, then the remaining amount will be carried forward to subsequent periods without a time limit.

Deduction to the donee for donated real estate: when can you get it?

The donee has or may have the following tax consequences associated with the donation of living space:

- Tax obligations arising from the acceptance of this gift.

- Personal income tax obligations with the possibility of registering a property deduction when selling donated housing.

- He also has the right to receive an income tax refund after purchasing a new home using the proceeds from the sale of the donated apartment.

If a citizen accepted an apartment as a gift, he must pay personal income tax on its value, since this situation is considered to be receiving income.

If the donor is a close relative (family member) of the recipient, there is no need to pay income tax on the value of the gift received. Such conclusions follow from the content of paragraph 18.1 of Article 217 of the Tax Code. In this case, the person who received the gift will have to remit income tax on the full cost of the apartment, since he is not entitled to tax refunds.

If a citizen wants to sell living space previously received as a gift, he will have to pay income tax on its sale under the following circumstances:

- the apartment is sold before the expiration of the three-year period of legal ownership if it was donated by a close relative;

- the apartment is sold before the completion of the five-year period of legal possession, if the donee (seller) is not a close relative of the donor.

In this case, the donee can apply a personal income tax deduction upon the sale of the donated premises. In other words, he has the right to reduce taxable income by 1,000,000 rubles, which will lead to a reduction in the amount of this tax. A reduction in the tax base by the amount of costs is excluded, since the sold housing was received by an individual as a gift.

If the donee sold the apartment he received and used the proceeds to buy a new living space, he will be able to apply for a deduction, since he is the buyer under the housing purchase and sale agreement. An additional condition is that he must be an income tax payer (13%).

In this case, he will be able to return the personal income tax paid. The amount of such a refund is a maximum of 260,000 rubles (for costs of purchasing housing). In addition, he can return another 390,000 rubles (maximum) from repaid loan interest if a mortgage was taken out to purchase a new home.

It should be clarified, however, that the fact of using the proceeds from the sale of donated housing to purchase a new apartment does not have legal significance when registering the deduction in question. The only thing that matters is the fact of purchasing the living space. However, this benefit should not be exhausted by the individual applicant.

If you have any questions, you can ask them free of charge to the company’s lawyers in the form provided below. An answer from a competent specialist will help you make the right decision.

Buying your own home is always a serious expense, which can be reduced with tax deductions. Some people don’t have to look for their own money – for example, if their parents donate an apartment. This is a great chance for anyone to get housing. But the question arises: is it possible to get a tax deduction when donating an apartment? We'll talk about this today.

Deduction when donating a share in an apartment

You can also receive an income tax refund when donating not the entire home, but a share in the apartment. Just as the donor can issue a personal income tax refund, the recipient can take advantage of this benefit to reduce the size of his tax liability. When donating a share in an apartment to a close relative, there is no benefit.

According to Art. 246 of the Civil Code of the Russian Federation, the donor in this case is not obliged to notify the other owners of this apartment about the transaction. The main difference between donating a share in an apartment and donating the entire property is that if you want to donate your share, the transaction must be certified by a notary.

Personal income tax deduction to the donor for a donated apartment: when can it be issued?

Acting as a donor, an individual transfers his home free of charge to the new owner (donee), which is accompanied by the re-registration of property. Thus, the donor citizen is the former (previous) owner of the donated living space. This fact does not automatically give rise to any tax obligations and rights associated with the donated real estate:

- The accrual of annual property tax stops (from the moment the deed of gift is issued).

- For a gift transaction, it is not necessary to determine and transfer personal income tax (13%).

- The fact of transferring real estate as a gift is not a direct basis for issuing a personal income tax deduction.

The purchase of real estate that precedes the gift allows the donor to receive a refund of income taxes paid. He can recover 260,000 (in terms of purchase costs) and 390,000 (in terms of repaid mortgage interest).

In 2021, a citizen purchased residential premises for 2,500,000 rubles, but did not declare his right to preference. However, next year in 2021, he transferred this living space to his own son through a deed of gift. By transferring a real estate asset to a close relative in this way, the donor can receive an income tax refund.

The basis for such a preference is the purchase and sale agreement for this premises, concluded by the applicant last 2018. Under such circumstances, a citizen who has given his property to another person for free has the right to apply for a personal income tax deduction through an employer or a department of the Federal Tax Service.