The article was prepared by Mortgage Live. If you need help with your mortgage, please contact us. You can also take a quick test to assess your chances of getting a mortgage. Thank you, useful reading.

Submit your application

Some clients take out loans to purchase two apartments. With the help of two loans for the purchase of apartments, you can solve the housing problem of children and parents, as well as profitably invest your savings. How to take out two mortgages at the same time? You need to prove your worth to the bank. We will tell you further what awaits the person who chooses this path.

Is there a chance of getting a second home loan?

Taking out a second home loan is much more difficult if the first one is not fully paid off. Many banks are trying to reduce the risk of losing their money. Therefore, a thorough check is carried out on each client wishing to receive a loan. You must prove to lenders that you are able to make two property purchases using the loan.

Typically, mortgages are issued for a long period. During this time, a person’s life circumstances may change, which may require a second home of their own. This is why it often becomes necessary to apply for a second mortgage at Sberbank or another financial institution without paying off the loan already taken in full.

In most Russian banks, lenders put forward criteria that clients must meet to receive a second home loan. If you meet all the requirements, then a second mortgage is practically in your pocket.

What does the law say?

Mortgage lending is regulated by 2 regulatory documents - Federal Law No. 102 and the Civil Code of the Russian Federation . Having studied these sources, we can come to the conclusion that the bank cannot refuse a client to receive a loan to purchase a home only for the reason that he is already paying off a similar loan.

If a citizen has a high income and meets the basic requirements of a financial institution, obtaining a second mortgage is possible. However, in this case, the borrower may face rather strict conditions and restrictions.

Bank criteria

If the borrower can immediately pay the down payment after the application is approved, then there will be no problems with purchasing another home on credit. You should also remember that there should be no delays in payments on the first mortgage. The higher the family's monthly income, the greater the chance of getting your application approved.

The evaluation criteria are as follows:

- Solvency. It must be confirmed by providing a 2NDFL income certificate. Statements from savings accounts, deposits, as well as other documents that reflect cash receipts will not be superfluous. Their amount should be enough to regularly repay two obligations at once.

- Good credit history. Lenders often provide favorable conditions to conscientious borrowers, which allows them to take out a second mortgage while repaying the first with a minimum interest rate.

- Family size. The calculation of the monthly minimum subsistence level, which is calculated from total income, depends on the number of family members. The smaller the family and the higher the salary, the higher the chances.

- The remaining balance on the first mortgage. If the primary housing loan is repaid by 65-75% of the total amount, then the chances of receiving a loan increase.

- Subject of collateral. It must meet all conditions of the mortgage. Don't forget about compulsory insurance.

When considering an application, the bank pays attention to these points. If the borrower meets all the criteria put forward, then his application is likely to be approved.

What else does the bank want to see?

When a client applies for a second mortgage loan, the bank also imposes additional requirements. They are standard - no different from the first application for a mortgage:

- citizenship of the Russian Federation;

- age ranging from 21 to 65 years;

- stable income;

- permanent residence in a given city;

- Work experience in the last place for at least six months.

Sberbank considers Russian citizenship and permanent residence registration to be the most important conditions for approving an application. Correct age assessment is also important. It is important for the bank that the client is able to pay off the debt, and for this it is important that he must be of working age during the entire payment period.

How to get a second mortgage

Now, let's figure out how to get a second mortgage from Sberbank. To get your application approved, you need to maximize your chances. First of all, the client’s age should not exceed 40 years - according to the bank, it is during this period that the borrower is most active, has not only his main place of work, but also the possibility of part-time work.

The procedure for obtaining a home loan is no different from obtaining the first one. The client will need to collect all the necessary documents and submit them to the bank branch.

The following copies of documents must be included in the package of documents:

- Application for a mortgage loan.

- Passport of a citizen of the Russian Federation.

- Insurance policy.

- Military ID.

- Certificates of completion from all educational institutions.

- Marriage certificate, birth certificate of children.

- Employment history.

- Certificates of official monthly income.

The requirements for mortgage documents are discussed in a separate article.

If necessary, the lender may request additional paperwork to review your application. All papers are submitted along with the originals. The application form can be obtained from a bank employee.

The following will help increase your solvency and chances of taking out a second mortgage without paying off the first:

- Receiving additional regular payments, such as: salary for part-time work, pension.

- Availability of valuable real estate or property: car, apartment, premises, garage, dacha.

- Availability of a co-borrower.

Please note that payments such as alimony and child benefits are not counted as additional income.

Information on all official income is provided in writing. In addition, all payments made on an outstanding loan must also be confirmed. There is an option to take out a second mortgage using maternity capital. To do this, you will need to submit additional certificates about the child and the subsidy itself.

Recommended article: Family mortgage from Gazprombank at 4.9 percent per annum

After the application and package of papers are submitted to the bank, all that remains is to wait for the creditor’s decision. On average, one application is considered from 5 to 20 working days. If questions arise, the bank may request additional documents.

A second mortgage is an opportunity to expand your living space and improve your living conditions. If you need another loan, but the first one has not yet been repaid, do not be upset. There is a chance to get a second mortgage. The main thing is to approach the procedure responsibly and prepare as many papers as possible. In addition, if your first home loan is almost paid off and there are no arrears, there is a high probability that the bank will approve your application.

Ways to increase your likelihood of getting 2 mortgages

Despite the difficulties, it is possible to get a second mortgage. The following circumstances can increase the chances of simultaneously issuing a second home loan:

- a relatively young age of up to 35 years, but not less than 25 years, when the borrower is not yet responsible enough for his obligations;

- stable work in a reliable company;

- registration of guarantors, co-borrowers who will share responsibility for the mortgage debt;

- in addition to 2-NDFL, provide evidence of additional income;

- offer additional collateral - real estate or other valuables;

- purchasing personal insurance.

It is allowed to take out 2 mortgages from the same credit institution (for example, Sberbank), or consider lending options from different banks. The easiest way is to take out a mortgage again from a salary bank, since you will need a minimum set of papers to complete the transaction. However, you should not forget about other financial programs if they promise lower interest overpayments.

If the bank does not allow you to take out a mortgage a second time, it is recommended to consider the option of refinancing the mortgage with an amount greater than the remaining debt. The first mortgage is paid off, and the borrower pays off the debt at a lower interest rate, using the remainder of the borrowed funds for a new home.

Is it possible to take out a second mortgage while paying off the first?

This option is possible if the borrower repays the loan without delays or delays. Any bank is interested in issuing another loan to a client with a good history, if he strictly complies with financial obligations. Each issued loan brings profit to the organization, and a mortgage is also a loan with minimal risk, since it guarantees the repayment of the loan amount at the expense of the owner’s collateral obligations.

Many clients are worried whether a second mortgage will be approved if the first loan is not closed. The bank's decision will depend on the borrower's income. The organization will ask you to provide official confirmation of income - a 2NDFL certificate, a declaration or documents in the prescribed form.

On a note. The amount of mortgage payments should not exceed a third of the family's monthly income. In some situations, payments of up to 50% are allowed, but such a load creates a high risk of non-payment and the bank may raise the interest rate on the housing loan.

Is it possible to take out a second mortgage from the same bank?

In the first quarter of 2021, demand for mortgage loans decreased. The reason is simple: according to unofficial data, the incomes of Russians continue to decline for the 6th year in a row. Competition among banks for each solvent client is growing, since hundreds of thousands of able-bodied Russians have already purchased an apartment with a mortgage.

Trying to attract customers, banks come up with new programs, reduce rates, and offer refinancing. Organizations provide discounts when filling out a remote application, as Sberbank does, or reduce the tariff when the borrower decides to purchase an apartment with an area of more than 60 meters, as at VTB Bank.

To increase your chances of approval, you can apply for a second mortgage before repaying the first one at the same bank where you continue to repay the loan. The institution will check the history of payments, evaluate the amount of wages to the level of financial burden and announce its decision. If there is enough income to obtain a loan, the bank will offer a minimum loan rate.

The borrower's solvency will be assessed using the following parameters:

- Level of solvency. The credit expert will evaluate the income of both spouses, since the second automatically becomes a co-borrower, and will calculate the percentage of the monthly payment.

- Credit rating. The institution will send a request to the credit history database, where it will check how regularly the client makes payments and whether he has been in arrears.

- First payment. If the borrower decides to use maternity capital, it will not be possible to get by with just a subsidy - you will have to withdraw 5-10% of the cost of housing from family savings to deposit into a bank account.

- Object of purchase. Bank representatives will carefully check the purchased property and only after that will inform the final decision on the transaction.

Recommended article: How to calculate a mortgage with maternity capital using an online calculator

If the bank where you pay the loan has refused your application, this is a reason to think about it. It’s quite possible that you can’t afford a mortgage for a second home right now; you need to increase the down payment or improve your credit history.

This is interesting: How and where to buy a repossessed apartment for debts

Is it possible to get a mortgage for another person?

Is it possible to give an apartment with a mortgage to a relative or co-borrower?

How to make money on a mortgage without investment

What are the borrower requirements and approval criteria?

Organizations try to create different offers to attract more customers. However, most banks have a number of standard requirements that future borrowers must meet. This is due to risk factors.

| Type of requirement | Description |

| Financial receipts | Official salary, rental payments - if a person rents out a property, deposit payments. Income received over the year is considered. All regular earnings of a citizen. The total amount should cover both payments, plus there will be enough money left later, for the life of the family 60% . This will show that having a loan will not change the level of people’s well-being; they will continue to lead normal lives. Separately, employees will study the down payment . It will be good if a person can deposit more than the specified minimum. |

| Credit history | The main indicator of a citizen's trustworthiness. The case of each borrower is reflected in the BKI. The number of loans taken and repaid by him, the size of payments, their regularity, the presence of delays, fines and accrued penalties. If there have been no misfires before, it’s easier to visit a familiar bank, where you can get approval faster. |

| Liquidity of collateral | It is studied along with the amount of the down payment. After all, the lender receives the collateral if the person stops repaying the debt. When applying for 2 mortgages, you need to set aside two amounts that will serve as a contribution. If, according to the first, a person is ready to pay 35% of the cost of the purchased housing, according to the second - 40%, he will show himself to be solvent. A personal advance covers the risks of the institution. |

| Insurance | There will be double expenses, in particular, payment of both insurance contracts , without which it is impossible to obtain a mortgage. A client who is ready to follow all the rules of the institution is always valued more. |

There are ways to increase your chances. You need to follow a few simple steps:

1) Provide evidence of additional income (a lease agreement will do). For example, a person has other real estate that he rents out to tenants. It doesn’t matter whether it’s a home or a garage. The main thing is that people pay a certain amount for this every month.

2) Attract more guarantors and co-borrowers. The lender will evaluate everyone's income and add it up. However, the requirements for co-borrowers are similar to the main payer. They must have a decent income and be age appropriate.

3) Accumulate a decent amount of work experience, preferably continuous, without layoffs. Unofficial employment is not considered.

4) Be within the financially stable age of 25-35 years.

5) Have additional property - another apartment, garage, house, land or car.

6) Have unspent maternity capital - the law allows the money to be used as a down payment or a regular payment.

7) Distribute existing debts to the maximum.

Take out insurance – life, health, and also the purchased object.

Take out insurance – life, health, and also the purchased object.

9) Transfer more money for the down payment

Experts also advise concluding an agreement for the maximum possible period. Let time be your ally. And try to pay as quickly as possible.

How to apply for a second mortgage at Rosselkhozbank?

This bank offers affordable conditions for obtaining a second mortgage if the first loan is unpaid. The borrower will be able to borrow a large amount for a period of up to 30 years with an overpayment of 10% per annum. Special conditions await salary borrowers, public sector employees and reliable clients who previously took out a loan from Rosselkhozbank and successfully repaid it.

To obtain pre-approval, simply submit an application online and indicate:

- bank branch where the client’s application for a second mortgage will be considered;

- Full name, date of birth, phone number, email of the borrower;

- the amount needed to make a purchase;

- maturity date of the debt to the bank.

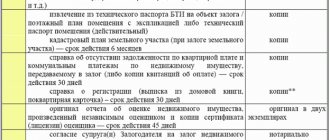

Documents for a second mortgage at Rosselkhozbank:

Certificate of income in the form of Rosselkhozbank

- Rosselkhozbank mortgage application form

- Certificate of income in the form of Rosselkhozbank

There is no way to hide the fact that your first mortgage is unpaid. When the organization begins to establish a credit history, the bureau will provide information about existing loans, monthly payments and balances.

Two mortgages, but in one banking institution

It's simpler, and at the same time more profitable. Experts advise visiting an organization that you have previously applied to. The citizen’s data is saved, his credit history with a schedule of previously made payments is visible. And the requirements will be common for both loans. Theoretically, it is not difficult for a wealthy person to apply for two loans. The main thing is to meet the criteria set for borrowers.

“Taking marbles from one common basket” is easier for the borrower:

· there is no need to study two different loan agreements;

· run to take the loan to institutions, everything happens in one cash desk per day;

· less money and time (often such clients are given a discount, in particular by notaries);

· relations with the lender will be more trusting.

If any problems arise in the future, it is easier to discuss everything with one manager than to run to two.

Is it possible to take out a second military mortgage?

A military mortgage is issued a second time only after the first loan is closed. Military personnel under 42 years of age who have signed a long-term service contract retain the right to receive assistance from the Ministry of Defense.

To obtain NIS approval for a second apartment on a military mortgage, it is necessary to remove the encumbrance from the previously purchased housing. If government assistance is not enough, you can pay off the debt on a bank loan from your own funds, as well as with the help of regional or federal certificates, for example, maternity capital.

As soon as the debt is closed, the owner needs to contact the bank and, together with its representative, visit Rosreestr, where they will remove the mark on the former encumbrance of the property. After this, you can re-apply for a mortgage loan.

Recommended articles on our website: Removing mortgage encumbrances - instructions

What to do with the mortgage after paying off the mortgage

Is it possible to get a tax deduction for a second apartment with a mortgage?

All citizens who regularly deduct tax payments from their salaries can return part of the money paid to the budget. But is it possible to apply for a property deduction for a second mortgage if part of the money has already been received for the first loan?

Sample of filling out the 3-NDFL declaration for tax deduction

If before 2014 it was possible to receive payment only for one apartment, today a tax refund is allowed for a second mortgage if the amount of 2 million rubles was not selected earlier. For the Federal Tax Service, it does not matter how many real estate properties the taxpayer bought - you can receive a payment before using the entire deduction amount. In this case, it is important to comply with the only condition - the purchase and sale transaction must be executed after January 1, 2014.

Documentation:

- Instructions for filling out 3NDFL

- Agreement on the distribution of costs for the purchase of an apartment

But you won’t be able to get a tax deduction on a mortgage a second time if you apply for interest compensation . The law allows the return of tax contributions only on one single property. However, if you have not applied for such a deduction before, you can claim the entire amount of up to 3 million rubles in interest for another recently purchased apartment. Receiving such a deduction is allowed gradually as tax contributions are paid.

About the tax deduction for mortgage interest - in a separate article.

For a client who regularly pays off his mortgage and earns good money, getting a second home loan will not be difficult . You can use the services of Sberbank, submit an online application to Rosselkhozbank or contact the nearest VTB office, even if the debt has not yet been repaid. But the payer of a military mortgage, on the contrary, needs to close the first loan, and only then improve living conditions.

If you have any questions, ask them in the comments below, under the article.

Rate this article by giving it a star. Share the article on social networks.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication March 7, 2019 July 20, 2019