Successors

To enter into a dacha inheritance, you must adhere to the legal regulations established in Federal Law No. 146 of November 26, 2001. According to the current provisions, a legal successor is a citizen or group of persons who has the right to register real estate, provided that the former owner has died.

In this case, relatives are divided into several queues:

- The first includes close family members - mother, father, son and/or daughter, spouse of the deceased;

- In the second place they include a brother, sister, grandmother, grandson, etc.;

- The third and subsequent lines include distant relatives.

Order of succession by law

However, in addition to these citizens, persons who are dependent on the deceased person can claim the inheritance mass. Their inclusion in the registration process is mandatory - no matter the procedure under a will or law.

Civil Code of the Russian Federation (Part Three) dated November 26, 2001 No. 146-FZ

Conditions for inheriting a dacha

To register a dacha, you need to enter into an inheritance after the death of the testator or testator. This is done in one of two ways:

- According to the law, the property mass is distributed among successors according to priority;

- According to a testamentary document, property is alienated to the citizens specified in the act of last will.

To initiate an inheritance case you need:

- personal visit to a notary at the residence address of the deceased;

- filing an application;

- collection and provision of documents.

An application to a notary organization must be made no later than six months from the date of death of the testator.

The procedure for inheriting a land plot in SNT

Russian legislation provides two options for inheriting a dacha after the death of the owner.

Formally

Formal entry into ownership occurs after the death of a relative when applying to a notary.

The period is 6 months. When visiting a notary, a citizen draws up a statement indicating his consent to accept the property estate. Additionally, the necessary papers are provided. After the check, the employee of the notary office will issue a certificate stating that the person has the right to inheritance. Read also: Post-mortem psychological and psychiatric examination

In fact

The successor is such until otherwise is challenged through the court, in the event of a number of actions indicating a challenge to the rights of the heir.

The actual acceptance of an inheritance means:

- systematic deduction of contributions for land allotment;

- repayment of debt for the plot;

- receiving money or paying debts to third parties or organizations;

- use of property for protection and improvement purposes.

In the future, a person has the right to file a petition, providing evidence of the actual entry into ownership of the land. Based on the court verdict, the citizen will receive a certificate.

What to do if the summer cottage plot has not been privatized?

If the testator did not take care to register ownership of the dacha during his lifetime, his heirs may have problems obtaining it.

But despite all the difficulties, inheriting an unregistered dacha is possible.

When there is a house on the site

If a house is built on a non-privatized dacha plot, and this house is registered as the property of the testator, then the heir can file a claim with a request to include the plot itself in the inheritance estate.

However, you need to take into account that unauthorized buildings will not be included. But you can try to arrange them too. To do this, the claim must ask to recognize the deceased’s right of ownership of these buildings, and then the right of the heir.

If you didn’t manage to privatize

There are cases when the privatization process was already underway when the testator died. In this case, the law determines the right of the heir to complete such a process.

When a realtor was involved in privatization, he may not even know about the death of the client and complete the privatization. In this case, it is also recognized as legal.

According to the dacha amnesty through the court

The dacha amnesty is valid until 2021. These are amendments to the legislation that allow inheritance of an unregistered dacha. More precisely, it can be registered in the name of the heir.

Such cases are often heard in court. In this case, you should present:

- An archival extract for the land, which will be proof of the absence of owners of this land.

- Documents on the indefinite or lifelong right to use this land by the testator.

- Extracts from the business book about expenses for maintaining the site.

That is, in any case, when receiving a non-privatized plot, you need to go to court and often have to resort to the help of lawyers.

Nuances of registering a dacha received as an inheritance

After the death of a loved one or relative, you must contact a notary at the last address of residence of the deceased. This is necessary to obtain information about the existence of a will. Otherwise, the entry and registration of a dacha and land by inheritance is carried out within the framework of the law. To do this, the successor writes a statement of consent to accept the property, but before doing this, the following information about the property should be clarified.

If there is a house on the site

A registered dacha by inheritance and by will, provided that it is located in SNT or a gardening partnership, is carried out in the manner established in legal acts.

At the same time, current laws should not contradict Article 1170 of the Civil Code of Russia, but are used as additional information to clarify certain points. Please note: after 30 days after sending the application, the citizen receives an extract from the Unified State Register of Real Estate, confirming the right to own, dispose and use real estate.

Article 267 of the Civil Code of Russia specifies the rules for the disposal of land that is in lifelong possession with the right of transfer by inheritance. In this case, the transfer of rights to the plot after the death of the owner occurs on the basis of a will or by law. In the latter case, property is distributed among successors according to priority.

Article 1170 of the Civil Code of the Russian Federation “Compensation for the disproportion of the inherited property received with the inherited share”

Article 267 of the Civil Code of the Russian Federation “Disposition of a land plot located in lifelong inheritable possession”

Non-privatized dacha

Algorithm of actions on how to register land after entering into inheritance rights, provided that the property has not been privatized:

- Issue an extract from Rosreestr;

- Send a request to the BTI to obtain a passport of technical significance for the property;

- Order an independent examination to evaluate the dacha and plot of land;

- Submit a claim to the judicial authorities to recognize the right to own property;

- If there is a positive verdict, you should visit Rosreestr and register the property.

Dacha amnesty

Non-privatized land located in SNT can only be privatized by the legal successor. To do this, an appeal is sent to the management of the partnership to join the association. Further, it is possible to carry out the procedure for privatizing land using a simplified system within the framework of the “dacha amnesty” program.

For your information: according to Prime Minister D. Medvedev, the “dacha amnesty” has been extended until 2021.

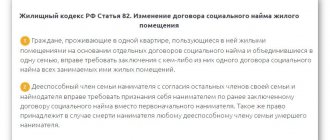

Grounds for inheriting housing

The procedure for inheriting residential premises occurs by law or by will. As mentioned above, if at the time of death the testator has not registered the apartment as his property through privatization, the heirs will not be able to receive it under the will.

After the death of the responsible tenant, all citizens registered with him at this address and having the right of residence have the opportunity to carry out privatization for themselves.

It is possible to obtain ownership of residential premises after the death of a relative only if it was already in his possession and disposal. You can learn more about the property included in the inheritance and the order of entry into inheritance rights from the article “Inheritance by Law.”

In accordance with the Law on the Privatization of Housing Stock in the Russian Federation dated July 4, 1991 No. 1541-1, it is possible to include non-privatized housing in the inheritance through the courts.

The Supreme Court of the Russian Federation takes the same position in its practice.

If there is such a statement, the court includes the residential premises in the estate and recognizes the heirs' right of ownership.

Art. 1119 of the Civil Code of the Russian Federation determines that the testator has the right to independently and at his own will dispose of the property belonging to him in the event of death. Including distributing shares in the inheritance at your own discretion. And also to deprive applicants of their inheritance by law, without explaining the reasons for such a decision.

Theoretically, the testator has the right to include municipal housing in the bequeathed property. Only these persons will be able to receive an inheritance only if at the time of death the testator carried out privatization.

It is not possible to transfer the rights to privatization by will. Read more about the procedure for drawing up a will and taking over the rights of heirs in the article “Inheritance by will.”

Persons who are not heirs of a deceased tenant in the understanding of the norms of the Civil Code of the Russian Federation cannot lay claim to his non-privatized housing.

One of the necessary conditions for inheriting such living space is the fact of cohabitation with the testator at the time of his death.

Court decisions on the issues of who the heir is if the apartment is not privatized contain a determination on the inclusion of municipal housing in the inheritance and recognition of the ownership rights of the applicants.

It is important to note that such an outcome of the dispute is only possible if there is an application for privatization submitted during the life of the employer.

Such property cannot be inherited due to its status - it is municipal property. Residents are only assigned the right to use the property (Article 7 of Law No. 1541-1 of 07/04/1991).

If the employer (tenant) has submitted an application for privatization of housing and has already begun to prepare the necessary documents, the housing can be assigned to the heirs in the event of sudden death.

Why is this allowed? It's all about timing - checking and processing documents takes at least two months, which means the procedure is delayed through no fault of the applicant (Article 8 of Law No. 1541-1).

The only basis for accepting housing as an inheritance is the submission of an appropriate application by the responsible tenant (he is the main participant in the transaction for the transfer of a municipal apartment for citizens to live in):

- If the tenant with whom the social tenancy agreement has been concluded has not begun the procedure for transferring the housing into private ownership, the relatives will not be able to inherit the apartment.

- If it turns out that the application for privatization is withdrawn by the testator, the right of inheritance for the relatives of the deceased citizen also does not arise.

We invite you to familiarize yourself with: Penalty and fine differences

Thus, a lot is connected with the actions of the testator himself - it depends on him whether the heirs will be able to register non-privatized housing as private property.

The procedure for applicants is the same as when inheriting non-privatized housing under a will. The only difference is the absence of an order that determines the range of applicants. When inheriting by law, the primary heirs are children, parents, and living spouse.

Order and procedure

The heirs of the deceased citizen need to visit a notary and submit an application. If the property is not privatized, the heirs will be denied a certificate. After this, you can begin to prepare papers for the court.

The procedure for entering into inheritance according to the law:

- Collect documents confirming the fact of relationship with the deceased.

- Visit a notary, write an application.

- If you refuse, prepare for the trial (file a claim, collect documents, pay the state fee).

- Attendance at court hearings, receiving the final court decision.

- Repeated application to the notary for the issuance of a certificate.

Statement of claim

When going to court, you need to briefly outline the circumstances of the case. One of the points of the claim is a description of the fact of filing an application with a notary office. The claim will need to be accompanied by a reasoned refusal from the notary. Additionally, you need to refer to Resolution of the Plenum of the Supreme Council No. 8. The Supreme Court has already considered similar issues. Also, do not forget to display the value of the disputed object. Based on this, the amount of state duty is calculated.

The successors of a non-privatized apartment are determined only conditionally, since a thing that is not registered as personal property is not subject to inheritance.

By will

The circle of potential successors to a non-privatized apartment under a will is not limited to a certain category of persons. The future owner of the property has the right to dispose of it freely, at his own discretion, appointing heirs, testamentary refusal, or simply depriving the heirs of the rights to housing by law.

In other words, the heirs of non-privatized real estate under a will can be:

- individuals, regardless of citizenship, age and relationship;

- legal entities existing at the time of opening of the inheritance;

- Russian Federation, its territorial units, foreign state;

- international organizations.

All of the above applies only to the preparation of a will. That is, you can bequeath a non-privatized apartment, but you cannot receive it through succession. How this is applied in practice can be seen in the following example.

Example. Citizen Samsonov V.I. was the tenant of a state two-room apartment. In the near future, he planned to privatize the living space, but decided not to wait for it to become a property and bequeath it to his grandson now. To do this, he went to a notary and certified his posthumous orders for the transfer of the apartment by inheritance. Next, he privatized the housing and after his death it passed to the heir appointed by him in the order of universal succession.

The outcome could have been completely different if the testator had not managed to complete the privatization of the apartment. In this case, after his death, the will loses legal force due to the absence of inherited property (in fact, non-privatized living space is not an inheritance).

Potential heirs by law are determined by Ch. 63 Civil Code of the Russian Federation.

They could be:

- first of all - parents, children, spouse, grandchildren by right of representation;

- in the second - grandfathers, grandmothers, brothers, sisters, nephews by right of representation;

- in the third - aunts and uncles, cousins by right of representation;

- in the fourth - great-grandparents;

- in the fifth - children of nephews, great-aunts and grandfathers;

- in the sixth - cousins, great-grandchildren, nephews, uncles and aunts;

- in the seventh - stepsons, stepdaughters, stepfather, stepmother.

But the inheritance rights of legitimate applicants are relevant only in relation to a temporarily non-privatized apartment, which will subsequently be registered by the testator as the property. As already mentioned, non-privatized real estate cannot be inherited for any of the possible reasons.

Example. The tenant of the municipal housing space had two legal heirs - a brother and a sister. They lived separately and were not mentioned in the rental agreement. After the death of the tenant, it turned out that the apartment was never privatized, and therefore the successors by law could not receive it. The tenancy agreement was terminated due to the death of the only tenant.

If the tenant died without registering the living space in his own name, then the law established by Section V of the Civil Code of the Russian Federation is invalid. The composition and rights of the group of possible heirs are determined by Art. 69 and 70 Housing Code of the Russian Federation

According to these resolutions, the category of future owners of a non-privatized apartment can include persons moved in by the tenant and members of his family. They have equal rights to use and subsequent privatization of housing.

However, such a circumstance has legal significance only if there is an appropriate entry in the lease agreement. Making a record of the move-in of new persons (to give them the right to a share of the apartment after privatization) is made on the basis of written permission from:

- already registered family members - to move in father, mother, spouse, adult children;

- family members and the landlord - to include other relatives and dependents in the family;

- courts - to enter into the contract records of the residence of other citizens.

A family member of the tenant retains the right to use a non-privatized apartment even after the termination of relations with him, for example, after the divorce, subject to continued residence in this living space.

The reasons for disagreement with the move-in of new residents by already registered persons may be recognized by the court as insignificant. The court can also challenge the landlord's ban. It should be taken into account that the outcome of a court decision to challenge or establish the fact of moving into a non-privatized apartment as a family member will depend on the following factors:

- Joint management of the household with the employer (the presence of a common budget, property, expenses for the purchase of food).

- Time spent in the living space.

- Availability of rights to other housing.

- The content of the expression of will of the remaining family members in this regard.

The consent of the landlord and other citizens living in the apartment is not required when moving in a minor child of any of the residents.

Registration procedure

To register a dacha plot by inheritance, you will need to write an application to a notary for its acceptance. In situations where the testator did not include some items or real estate in the will, the successors must independently carry out this procedure.

Read also: Inheritance to parents after the death of a son

After checking the documentation, the notary employee initiates the case and provides participants with recommendations on further actions. Following the procedure, legal successors receive a certificate.

Documentation

To inherit a dacha, you need the following documents:

- certificate of death of a relative;

- a certificate or extract from the house register about the last address of residence;

- personal passport of the legal successor;

- papers indicating family ties - if inheritance is carried out within the framework of the law, or a will.

Deadlines

The period for accepting the property estate left by a deceased citizen is 6 months from the date of initiation of the case by a notary (Article 1154 of the Civil Code of Russia).

In addition, the date may be the day of death or the entry into force of a court decision. Note: reinstatement of deadlines is allowed if the absence was due to extenuating circumstances and there is documentary evidence. The procedure is carried out by filing a claim in court.

Article 1154 of the Civil Code of the Russian Federation “Term of acceptance of inheritance”

Real estate valuation

Carrying out assessment activities in relation to the site requires the involvement of an independent accredited organization. After the relevant activities have been carried out, a report is issued, which is subsequently transferred to the notary. The cost of country property depends on various factors, the main one of which is location.

It is almost impossible to independently assess the value of property. In addition, the information received cannot be attached to the case.

The procedure for distributing shares between heirs

When distributing shares among legal successors, the dacha plot is first provided to the heir of the first category.

If this group includes several persons, then a redistribution of property will occur, i.e., shared ownership will take place. It is noteworthy that adopted children of the deceased and persons dependent on him for at least 12 months can also apply and challenge the procedure. This is due to the fact that the current laws indicate the need to allocate a share in the property mass in relation to disabled citizens, as well as dependents.

The share is allocated even if there is a will executed in favor of relatives of one of the categories or third parties, i.e., in any case, a number of citizens must receive part of the inheritance. As a rule, it is 50% and if the residual property is not enough to cover it, then the missing property is allocated from the shares of the main successors.

Procedure for state registration of property rights

In the question of how to inherit a dacha for a person, the main factor is obtaining a certificate of ownership of the plot. Such a certificate is issued by a notary and subsequently it must be registered with the cartographic authorities, cadastral institution and Rosreestr.

At the time of application, the applicant will need to submit the following documents:

- successor's passport;

- certificate of ownership of a dacha;

- inheritance certificate;

- an application drawn up according to the sample;

- a receipt confirming payment of the state fee for the registration of rights.

Amount of state duty and tax obligations

In accordance with the Decree of the Government of Russia dated January 1, 2006, the tax burden on the inheritance procedure was abolished. There is no tax in 2021 , but the successor will need to prepare for financial costs.

Read also: Taxes when selling an apartment received by inheritance

This is due to the fact that the procedure is additionally burdened with a state duty for notary services. The tariff is set at the state level, and you will not be able to get a discount or benefit on it. The price of a notary's work depends on the value of the dacha indicated in the appraisal report. At the same time, an independent examination also costs money and is paid for by the relatives of the deceased.

Further, the amount of state duty is calculated depending on the family ties of the successor to the testator. For example:

- The first stage, whose representatives are a child, husband or wife, as well as father and/or mother, are required to pay 0.3% of the cost of the dacha plot. The collection limit is 100,000 rubles;

- If the receiver belongs to the third and subsequent categories, then the amount of encumbrance will be 0.6%. The limit on the obligation is RUB 1,000,000.

In a situation where there are several legal successors, payment of the state fee is distributed among the participants in accordance with the share received from the property mass.

What kind of housing cannot be inherited?

The use of residential premises without privatization occurs on the basis of social rent. Legal regulation of the relationship between the tenant and the homeowner is carried out by the Housing Code of the Russian Federation. The owner in the agreement is the state or local government through authorized persons or bodies.

One of the features of this agreement is that it does not set a validity period. The text of the document is compiled according to a standard form approved by the Government of the Russian Federation. The legislator also established requirements for the tenant of the premises.

Housing is provided to low-income citizens who are recognized in accordance with the established procedure as in need of housing or improved living conditions. A prerequisite is Russian citizenship.

It happens that not only members of his family are registered and live with the employer, but also persons who are not family members. Lawyers are often asked whether it is possible to inherit a non-privatized apartment if it is not claimed by a family member.

For example, a husband and wife lived in a non-privatized apartment, the tenant of which was the wife's father. The husband was registered in this apartment. After the couple divorced, the husband left, but remained registered. In such a situation, if he did not pay utilities and did not actually live, he can be discharged in court.

We suggest you read: What documents are needed to check out of an apartment?

Otherwise, after the death of his father, he will be able to claim the right to privatize housing on an equal basis with his ex-wife.

Relatives of the deceased tenant who remain living in the municipal apartment have the right to continue to use the property. A citizen can be deprived of the right to occupy residential premises only through a judicial proceeding. Therefore, if one of the relatives does not want to share the right of residence in the apartment, he needs to file a reasoned claim in court.

You can figure out who will get a municipal apartment after the death of the tenant based on the current norms of the Housing Code of the Russian Federation.

Yes, Art. 69 of the Housing Code of the Russian Federation determines who are members of the employer’s family:

- spouse;

- children;

- parents;

- other relatives, if they were moved into the housing on his initiative and maintain a common household with the tenant;

- persons recognized as family members in court.

The contract must mention all members of the tenant's family, despite the fact that he is a party. Therefore, the re-registration of a municipal apartment after the death of the owner occurs by concluding a social tenancy agreement with one of his family members.

If there is a dispute between relatives as to who will become the employer, it is subject to judicial resolution.

To re-register a social tenancy agreement, you must contact the authorized body - the Housing Policy Department. It makes sense to contact the specified authority if written consent has been received from other relatives registered in this apartment.

Signatures on the document stating that they are not against re-issuing the contract must be certified by a notary or passport officer.

To communicate your will and draw up a contract, you need to write an application to the Housing Policy Department. The application must be signed by all family members of the deceased tenant living in the apartment.

The text of the application indicates the need to amend the social tenancy agreement in connection with the death of the tenant of this housing.

Along with the application to the authorized body, you must provide a package of documents:

- extract from the house register;

- copy of personal account;

- social tenancy agreement, which is subject to renewal;

- copies of passports of all registered and living family members of the employer;

- death certificate of the employer (copy).

In some cases, you may need documents confirming your relationship with the deceased tenant.

The Privatization Law gives the employer the perpetual right to register real estate as his own through privatization. This right can only be used once.

Heirs who entered into use of an apartment under a social tenancy agreement after the death of a relative also have this right. If the applicant for privatization has already implemented it in relation to another apartment, he will not be able to apply it a second time.

You cannot privatize housing that is in disrepair, that is, unsuitable for habitation. The legislator does not allow the registration of ownership through privatization for living rooms in dormitories and military camps.

There is a ban on privatizing official departmental housing.

An agreement for the transfer of ownership of premises, drawn up in violation of the law, may subsequently be declared invalid or void.

If the responsible tenant has submitted an application for privatization of the apartment, then he can decide who will get the apartment on social rent after death. This can be done by making a will.

According to the law, in order to register an apartment, heirs need to resolve the issue of to whom the social tenancy agreement is reissued. After which the new tenant submits an application of the established form to the body authorized to dispose of the property.

The application must confirm that:

- the applicant for the property has not previously used the right of one-time free privatization;

- the apartment is not under arrest and there are no other encumbrances on it;

- The privatization procedure has been agreed upon with all those prescribed.

In addition to the application, it is necessary to submit to the body authorized to dispose of the property:

- passports and birth certificates of the applicant and his family members;

- social tenancy agreement (if no warrant was issued);

- documents that confirm citizenship;

- an extract from the house register;

- personal account information;

- information about previously issued passports of privatization participants.

After all the necessary documents and application have been duly completed and submitted, a decision is made within 2 months to conclude a property transfer agreement.

The Civil and Housing Codes do not mention such a possibility, but quite the opposite - they clearly indicate the legality of inheriting exclusively personal property. While non-privatized is the property of the state (municipal entity or other territorial unit of the Russian Federation).

After the death of the employer, the social tenancy agreement requires re-conclusion. This right is transferred to one of the family members of the deceased with the consent of the remaining residents. If a general agreement has not been reached, all family members will act as co-tenants.

Procedure

To re-register a non-privatized apartment, the future tenant:

- Obtains the consent of the other residents of the apartment.

- Contact the territorial department of the Department of Housing Policy and Housing Fund.

- Concludes a social rental agreement.

The tenant is chosen unanimously by all registered residents of the non-privatized living space. Their consent must be official and expressed in the form of:

- Signatures under the application for concluding a rental agreement, delivered during a personal visit to the housing stock.

- A notarized application that can be submitted to the authorized body in the absence of residents.

In case of disagreement between the persons registered in the housing space, the re-registration agreement is concluded between all of them, as a result of which the residents become co-tenants.

To renew the contract, the new tenant (co-tenants) must come to the housing fund with a corresponding application and a list of documents. Based on this, with the help of an authorized specialist of the body, the re-registration of municipal living space is carried out.

In the rental agreement, the employer will need to provide the following information:

- your last name, first name and patronymic;

- series and number of the passport of a citizen of the Russian Federation;

- residential address;

- the number of rooms in the apartment, their total footage and living space.

After the renegotiation, the new tenant will need to come to the housing maintenance department with a copy of the agreement to change the data in their personal accounts.

Statement

An application for concluding a social tenancy agreement for another tenant (tenants) of a non-privatized apartment is submitted via a PC or by hand. When choosing the latter option, it is important to ensure that the document is readable (write in neat, legible handwriting, avoid corrections and blots).

The content of the application must include the following information:

- Name of the authorized body (local government body, housing department department).

- Full name, address, telephone number of the applicant.

- Apartment address.

- An indication of the previous contract and the reason for its re-conclusion (death of the employer).

- A list of persons registered in this living space, indicating their full name, date of birth and the presence of family ties with the applicant.

- List of documents attached to the application.

Sample application for re-registration of a non-privatized apartment

Documentation

To renew a contract by a local government body or housing fund, the following documents are required:

- Passports of all family members registered in this living space.

- Tenancy agreement with the deceased tenant and his death certificate.

- Extract from the house register.

- Certificate of deregistration of the deceased.

All new family members must participate in the re-registration procedure. If for any reason this is not possible, they are allowed to give written consent certified by a notary.

Procedure

To receive an inheritance, the successor under the will must complete the following action plan:

- Obtain a death certificate of the testator.

- Find the will.

- Prepare other necessary documents.

- Appear before the notary.

- Write an application for acceptance of inheritance.

You can accept inherited living space without going to a notary - in fact. This method of succession involves performing the usual actions for the owner of an apartment: living in it, maintaining it at his own expense, caring for it, paying off debts on utility bills, protecting it from attacks by third parties.

We suggest you read: How to protect yourself from fraud when renting apartments

However, the actual heir will not be able to register ownership rights to real estate - to carry out state registration, you need a certificate of the right to inheritance, which is issued exclusively by a notary.

The Supreme Court granted citizens the right to inherit real estate that is in the process of registration (Resolution of the Plenum of the Supreme Court No. 8). The main criterion is the presence of documentary evidence of the citizen’s will regarding the privatization of the object.

If a citizen has submitted an application and entered into an agreement on privatization, his relatives (heirs) can inherit.

Statement of claim

Selling a dacha after taking ownership

At the legislative level, there are no restrictions on the sale of property received as a result of entering into inheritance law.

However, there is a nuance - if a citizen has owned real estate for less than 5 years, then for the sale of such property it is necessary to pay a tax of 13%, i.e. a tax on the income of individuals. The inheritance of a summer cottage is subject to strict registration regulations, which are prescribed in Russian legislation. Violating the procedure or ignoring the provisions of the Civil Code of the Russian Federation when drawing up a testamentary document can bring many problems to legal successors.

Therefore, you cannot do without the help of a lawyer in the question of how to register ownership of a house according to law or will. This is due to the fact that it is necessary to prepare documents, correctly distribute shares, and also carry out land surveying.