Currently, there are a considerable number of borrowers who, after submitting an application for mortgage lending and after reviewing it, think about how long mortgage approval at Sberbank branches is valid. Today, this is the most reliable financial institution where it is possible to take advantage of mortgage lending on acceptable terms. A mortgage from Sberbank is becoming an attractive solution for many clients for a number of reasons:

- Low interest rates on loans to purchase housing;

- Flexible lending terms;

- A large selection of programs for obtaining a loan for any period.

In order to take out a mortgage from Sberbank, the borrower will first need to contact the branch to submit an application. But today this opportunity is also available online. The form in which it is submitted will not affect the review time frame in any way. Once approved, you can proceed to further stages of obtaining a mortgage.

How long does it take to process a client’s mortgage application?

The official Internet portal of Sberbank states that mortgage applications are checked and considered within a period of 8 days. However, this period of time may vary depending on numerous circumstances. Consideration of the application submitted by the borrower may continue for two weeks. This difference arises due to the fact that Sberbank does not take into account weekends or holidays on its official website.

Also, when submitting an application for a mortgage at Sberbank, the processing time is also affected by the fact that the client may not provide all the necessary information in the application. The banking organization may request insufficient data separately. Only after this the mortgage application will be considered further. After which the procedure for approving the mortgage at Sberbank or its rejection will be carried out.

Refusal and its reasons

Although banks participate in various government mortgage programs and demonstrate in every possible way their readiness to issue them, however, refusal of a mortgage is not such a rare phenomenon. Therefore, many citizens are interested in the reasons why they are denied a mortgage at Sberbank.

Let us note that the bank itself often does not explain the reason for the refusal at all, and at the same time remains within its rights, because issuing a loan is the right of banks, and not their obligation. This means that refusal does not have to be accompanied by motivation. To prevent you from becoming one of those who were denied simply because of inaccuracies in filling out documents or similar trifles, let’s look at the reasons for refusing a mortgage, which is why Sberbank most often refuses.

As with any large loan, when a mortgage is taken out, all factors play a role, from income level and the presence of a stable job to age and dependents in the family. A mortgage is issued for a long term - up to thirty years, and you need to take into account that during this time a lot of important events can happen. This means that the bank’s mortgage risks are very high. This is why Sberbank’s refusal rate for all declarations of assistance in improving the housing situation in the country is quite high, amounting to approximately 30%. You need to take into account all the factors when applying, and then the bank will undoubtedly give you a loan.

Let's move on to the reasons for refusal.

Non-compliance with basic requirements

These requirements are:

- The age at the time of application must be at least 21 years old, at the time of loan repayment - no more than 75 years.

- At least six months of experience at your current place of work.

If you do not meet these two key requirements, obtaining any large loan will hardly be possible, because if you do not meet them, you should not be surprised that Sberbank refused you a mortgage.

Low solvency

The monthly payment is usually 15-35 thousand rubles, and not every applicant will be able to pay - here is another answer to the question why they don’t give a mortgage at Sberbank.

When calculating, the applicant’s salary is taken, and the cost of living for himself, as well as all dependents in the family, is subtracted from it - the balance must be more than the monthly payment, and preferably significantly more.

If you have a borderline situation, then you can try to increase the down payment, thereby reducing subsequent monthly payments, and meet this criterion.

Bad credit history

If there were previously problems with payments on time and the applicant has damaged his credit history, then the application may be refused for this very reason. In this case, you will have to correct it with the help of smaller loans, which now, most importantly, must be repaid on time.

Problems with documents

All certificates are carefully checked and if at least one of them turns out to be suspicious and there are doubts about its authenticity, the applicant may be refused. Inaccurate data specified in the application form can also serve as a reason for refusal, as well as the absence of a mark on the military ID - documentation should be approached very carefully.

How borrowers can find out Sberbank’s decision

If you decide to apply for a mortgage at Sberbank, then you need to be prepared for the fact that this is a complex and lengthy procedure. First, you will need to go through the application approval process. Bank representatives carefully study the application to clients and then make their decision on a mortgage from Sberbank. Clients have several methods by which they can find out whether the loan department has approved an application or not:

- SMS notification from a banking organization. It will not indicate the amount of the mortgage from Sberbank, but it is possible to clarify it with mortgage loan specialists;

- A call from a mortgage specialist. He will contact the client a few hours after the application is approved. He will also tell you what amount is approved and what actions need to be taken to further obtain a mortgage from Sberbank;

- Call a mortgage broker. This method works if the application for a mortgage at Sberbank was submitted through a developer or an accredited real estate agency.

How much does the mortgage approval period depend on the submission of documents?

The answer to the question of how long it takes to approve a mortgage at Sberbank will largely depend on the correctness of the documents submitted to the bank. To speed up this stage of the procedure, it is worth having documents with you when you first visit the bank.

These include:

- passport of a citizen of the Russian Federation or temporary registration document (if there is no passport);

- application for a mortgage: filled out during the interview on Sberbank letterhead;

- marriage certificate;

- children's birth certificates;

- documents that would confirm your financial status - certificates in form 2NDFL or certificates similar to Sberbank. Pensioners submit pension certificates. If there are additional sources of income (from renting out an apartment, help from relatives from abroad), it will also be good if you provide documentary evidence of each source of income;

- a document from the main place of work, which will confirm the availability of work and work experience at this place;

- a copy of the work book, certified by the seal and signature of the employer;

- work contract or employment contract.

If guarantors are involved in obtaining a mortgage loan, they will also have to collect a similar package of documents.

Spouses automatically become co-borrowers. If both spouses have stable jobs and good earnings, this will be a positive factor for the bank.

In what cases can they refuse?

A mortgage from a Sberbank may be denied for a number of reasons. The main ones are the following:

- The presence of a large number of outstanding existing loans from the borrower;

- Bad credit history;

- Low income;

- Providing false documents to Sberbank;

- Writing false information in the application;

- There is no confirmation of official employment from the employer;

- Mortgage Expert Solution;

- Hunter denial.

These are the main reasons why a client may be denied a mortgage. However, this is not a reason to give up your dream of owning your own home. After a certain amount of time, which reaches 2 months, borrowers have the opportunity to re-apply for a mortgage.

Main reasons

A variety of factors can lead to a bank refusing a mortgage after approval. And sometimes even borrowers with sufficient income and a good credit history face this situation. Among the main factors that help ensure that you are not denied a mortgage after approval are:

- working age – from 21 to 75 years;

- work experience of at least six months;

- total work experience from one year.

Recommended article: How to get a mortgage for a single woman with a child

Methods for assessing the creditworthiness of a mortgage borrower

If these conditions are met, you can safely consider a number of lending programs.

Can a mortgage be denied after approval?

Absolutely yes. This may be due to the borrower’s negative credit history, even if it had been improved by the time of the application. To correct it, they usually take out a small loan and repay it on time. But you shouldn't pay off your debt early. The bank may regard such manipulations as a deliberate increase in the rating. This will also contribute to the refusal of a mortgage loan.

The second most common aspect for refusal may be errors made in the documentation. As a rule, they arise due to the inattention of the borrower himself or a bank employee when filling out the questionnaire.

Important! A typo in a document is equivalent to providing false information, which leads to a refusal to issue a mortgage loan.

Requirements for online mortgage documents

Often, borrowers provide the bank with income certificates in free form, indicating a higher salary. But bank employees can call your employer and check your earnings level. People who receive salaries in envelopes are least likely to take out a mortgage.

If Sberbank refused a mortgage after approval, then it is likely that one of the above factors contributed to this. The reason for refusal of mortgage lending may also be:

- uncertain behavior of the applicant, who cannot immediately provide reliable information about the income received or the place of work;

- having a criminal record;

- identification of debts for taxes, housing and communal services, fines;

- unreliability of the employer - the organization is also checked for litigation;

- providing false documentation;

- an attempt to inflate the cost of housing;

- applying for a personal loan for a down payment;

- lack of approved housing if the apartment chosen by the borrower does not meet the requirements of the financial institution;

- presence of outstanding consumer loans;

- change of credit program.

Important! They may also refuse if bank employees fail to verify the information provided by the client, do not get through to the employer, etc.

Important to know: Reasons for refusal of a mortgage: what should borrowers take into account?

Recommended article: How to get a mortgage of 6.5 percent (new mortgage 6-5) - conditions, documents, refinancing

How long does a positively approved application last?

Some time ago, borrowers had about a couple of months to begin further mortgage stages after their application was approved. In 2021, the validity period of the positive decision was extended. Now it is three months. This time should be used to find a suitable option for residential real estate, evaluate it, register ownership of the property, register the apartment with Rosreestr, and provide the necessary documents to Sberbank.

This three month period must be respected upon approval. But if the borrower failed to prepare all the documents to the credit institution on time, then the stages of obtaining a mortgage loan will need to start all over again. You will have to fill out the application again and submit it to the bank. Then wait for a decision until it is approved.

The validity period of a positive bank decision on a mortgage application begins to count immediately after the bank has completed its approval. Many clients mistakenly believe that the countdown starts after submitting an application.

How does a mortgage transaction work?

The classic scenario for a bank client’s actions is as follows: first, he contacts the bank, fills out a ready-made application form, then prepares the necessary set of documents, waits for a response from bank employees, looks for the housing option he likes and prepares the documents that will be required to conclude the transaction. If the credit committee makes a positive verdict, its approval is valid for 3 months (90 calendar days). It is worth noting here that the period during which the bank’s approval is valid begins from the moment a positive decision was received, and not from the day you submitted the application to the bank.

Within 90 calendar days

, which are given to the borrower after approval of the application for a mortgage loan, he must have time to choose the housing he likes. First, he needs to approach the credit manager and clarify all the nuances of the chosen mortgage program, as well as find out what documents will be required to sign an agreement with the bank.

Please note that each mortgage program has its own nuances, so the terms and conditions may vary.

In order to have all the necessary documents on hand at the time of the transaction, be sure to consult with a bank employee! Preparation for the transaction takes place in several stages:

- Selection of real estate, obtaining information regarding the nuances of purchase and sale, discussion of the final transaction amount.

- Collection and transmission of documents to a bank employee, as well as an insurance company;

- Real estate valuation;

- Transfer of funds against the insurance contract. Today, banks require the borrower to sign a comprehensive agreement, which must specify the conditions for three key points: life and disability, risks associated with the property itself, as well as the title to the right to own the property. As a rule, a list of insurance companies with which the bank has partnership agreements can be obtained from the credit manager. In the case of Sberbank of Russia, the main insurance agent is Sberbank Insurance LLC.

- After all documents are approved, the bank starts the mortgage lending process and also sets the date and time for concluding the transaction.

To get a preliminary estimate for the mortgage loan you are about to take out, use the online calculator provided at the link.

What to do after a positive verdict from a banking organization

For any citizen, an approved application for a mortgage loan is a great joy, as he becomes one step closer to his cherished goal. But now everything depends on the borrower’s further actions. He has to do a huge amount of work, which includes not only the pleasant moment of choosing the appropriate apartment option, but also contacting various structures in order to prepare documents within the established time frame.

It is important to understand that after your loan application is approved, the first thing you should do is choose an apartment. And it is better to do this with the help of a specialist. This way you can spend less time searching. A client of a credit institution needs to remember that the outcome of the transaction will depend on the choice of residential property.

The procedure for obtaining a mortgage at Sberbank

In order to understand how long to wait for approval of an apartment in Sberbank or other real estate, you need to understand how the issue of granting a loan is considered.

This happens in several stages:

- Collection of documents. These are the papers that a potential borrower must submit to the bank. This includes documents confirming a person’s identity, as well as his registration in Russia (passport), papers that give the right to receive information about the financial status of the client and his family (income certificates, account statements), a work book or a certificate of business activities (confirm the person’s employment and length of service).

- Submitting the necessary documents to Sberbank. All of the above papers must be taken to a Sberbank branch and the loan officer must be informed that the person wishes to obtain a mortgage loan. The specialist also needs to tell what amount the future client is expecting, and be sure to indicate it in the application.

- The next stage is information processing by the bank. Today, bankers have software products that, based on the information provided by the client, issue recommendations on the advisability of issuing a cash mortgage loan. The bank's security service also checks the potential borrower, whose employees check the information provided with the database of loan defaulters.

- After preliminary approval of the application, loan and mortgage agreements are drawn up and the transaction is finalized.

In some cases, bank employees may require additional documents, a list of which they will indicate, and may also ask to reduce the required amount in order for the application to be successful.

Registration of a mortgage occurs according to a certain algorithm

Features of a military mortgage

In cases of lending to military personnel (under a special program), they must provide a certificate stating that the house where the apartment is purchased is not dilapidated or in disrepair. This paper is given by the municipal authorities, and you need to wait several weeks for it.

Currently, military mortgages prohibit the purchase of apartments in dilapidated and dilapidated buildings.

You need to remember that if a future client had problems paying off loans, but he repaid them in full, then before contacting the bank you need to check yourself to see if you are on the “black list”. All violators of credit discipline are entered into a special database, where you can write a written request for information on a specific person.

How long does it take for approval to take place?

Now let's move on to the loan application approval period. In practice, two terms are distinguished:

- the first concerns the total time required to collect all documents, submit them to the bank, verify the client with the bank, and issue the necessary loan. In total, these actions take from one week to one month.

- A separate place is occupied by the period during which the client and his solvency are verified. As mentioned above, first a person is checked by a special program, which, based on his entered data (work experience, presence of children, salary and other income), assigns him a coefficient.

The higher it is, the greater the chance of getting a loan. After verification by the program, the data is rechecked by the security service. Based on official information received from bank employees and feedback from people, it takes from 5 days to one month to approve the application (from the moment it is accepted by the loan specialist).

The approved mortgage must be issued within a month

How long does an approved application last?

After Sberbank has pre-approved the application for a mortgage loan, the client must collect all the remaining documents that will be needed to sign the loan and mortgage agreement.

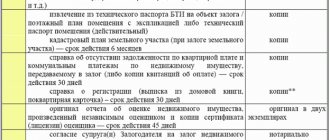

These are the following documents:

- a preliminary agreement of intent to carry out a purchase and sale transaction of real estate (must be notarized);

- assessment of the future property (done by a licensed appraiser who indicates the real value of the property);

- an extract from the registers stating that housing or other real estate is not under arrest or other encumbrance;

- documents confirming the seller’s ownership, and a technical passport for a house or apartment (cadastral documentation for a land plot).

In order for the future borrower to have time to prepare these documents, bank employees set a certain time period (period) during which the application will be valid and will not be cancelled.

According to information from Sberbank employees, as well as reviews from people who have used mortgage lending, the approved application is valid for one month.

If the borrower does not have time to collect all the documents, and some are already ready, he has the right to contact the bank with a written request to extend the period allotted for collecting documents. Such a statement must be supported by copies of the collected documents. Usually banks accommodate such persons halfway.

Based on this, the validity period of approval ranges from one to several months.

If the review period is delayed and the client is not informed of the decision, there is no need to wait. It’s better to call or visit the bank employee who accepted the application and remind yourself. Situations often occur when an application is approved, but the manager forgets to inform his client about this.

For certain categories of citizens, consideration of the application may be expedited

Collection of documents

While a positive bank decision on mortgage lending is in effect, the borrower will need to collect a package of documents to submit to the bank’s lending department. If a specialist was involved in choosing an apartment to buy with a mortgage, then he can easily help with paperwork for the selected property. In order for the transaction to be approved by the bank, a certificate from the unified state register, ownership of housing, and others will be required.

You will also need to spend time assessing your future home. It is carried out by organizations that are accredited by Sberbank. This type of document is provided exclusively in situations where the client purchases a finished home or land plot using a mortgage loan. If real estate is purchased in an apartment building under construction, then this type of document is issued only after completion of construction work.

What documents need to be collected?

To approve a loan application, you must prepare the following documents:

- Application (a sample is available on the bank’s corporate portal);

- Document confirming employment;

- Salary certificate;

- Passport of a citizen of the Russian Federation;

- Marriage certificate;

- Documents confirming the income of co-borrowers.

The provided certificates must contain reliable information about the financial situation of the applicant. To register real estate as collateral, you must present the following documentation:

- Certificate of state registration of ownership rights to living space;

- Papers on the basis of which the ownership of housing arose;

- Housing assessment report (prepared by a company accredited by the bank);

- Statement of absence of encumbrances (issued in Rosreestr);

- Technical plan of the premises;

- Consent of the spouse to carry out transactions with real estate (notarization of the paper is required);

- Permission from guardianship authorities (if available);

- An extract confirming the absence of registration of unauthorized persons in the apartment.

If the pledgor is a legal entity, then its representatives are required to provide:

- The current charter of the company;

- An extract from the Unified State Register of Legal Entities with a limitation period of no more than 30 days;

- Protocol on the election of governing bodies of a commercial organization;

- Documents confirming the authority of a third party who acts on behalf of the company.

The list of documents can be expanded and supplemented at the request of the credit institution or in connection with changes in current legislation. The approved application is valid for 2 months.

Insurance documents

After a credit institution makes a positive decision on a mortgage loan, the future owner of the apartment will definitely need to take out insurance. It is available to Sberbank clients exclusively from those insurance companies that have banking accreditation. Insurance documents issued by third parties will not be accepted. This must be taken into account when you need to complete documents within the deadlines set by the bank. When contacting third-party companies, you can waste time and obtain insurance from another company that is approved by the financial institution.

Also, the client at the bank may be asked to undergo the life and health insurance procedure. This procedure is not mandatory. And you don’t have to waste your time on it. But it is important to remember that if you use this type of insurance, the rate on the loan offer will be reduced. This type of insurance has a fairly high level of cost, but to save money, clients can use the services of companies that are approved by a financial institution.

How long are documents reviewed?

Let's first note this: some citizens think that if they constantly call the bank's loan officer and inquire about how things are going, this will speed up the process, because they will not be forgotten about them or something like that. In reality, everything is completely different, and no acceleration will occur, but you can spoil the specialist’s mood. And there are chances that you will influence the results not for the better. Therefore, during the review you just need to wait.

Moreover, it won’t take so long to do this. As the bank's website suggests, the review should take 2-5 business days.

In reality, this period can be exceeded, and is often exceeded. There are factors that may cause the review period to take longer than stated. It’s one thing if the applicant is a client of Sberbank and receives wages on his card and has a positive credit history. In this case, a minimum of checks will be required during the mortgage review process. It’s different if it needs to be checked in detail. After all, a mortgage is a large-scale injection of money, and the bank cannot do it just like that.

Sometimes during the review you have to provide some other documents, or one of those that you have already submitted immediately turns out to be invalid due to expiration. Then it will take more time, up to several weeks, or even a month.

But after five days have passed, it is worth contacting the bank and asking at what stage the consideration of your application is, since it may turn out that it has already been accepted, and you simply did not receive a notification about it.

Payment of the down payment

Within three months after the bank has issued a positive verdict on the mortgage loan, you will be required to make a down payment. The banking institution is provided with confirmation of its availability in advance. To make a down payment upon approval, it is currently possible to use several methods:

- Cash. Funds can be transferred to employees of a banking organization at the branch where the mortgage loan is issued;

- Cashless method. In this case, the client transfers funds to the specified bank details from his card or bank account;

- State certificates. Currently, a borrower can take advantage of government programs to pay off a mortgage loan. In particular, you can use maternity capital as a down payment.

Conducting a transaction

One of the important stages after the bank has pleased the client with the approval of the application is the conclusion of a real estate purchase and sale transaction. In this case, borrowers will need to be extremely careful, since a large number of nuances and features are taken into account during registration.

It is also important to settle issues related to the residential property before concluding a transaction. You can also ask your loan officer.

You must be careful during the transaction. You need to read all the clauses that are stated in the contract. It may contain additions and additional conditions, to which special attention is drawn. Clients usually learn about them only during the transaction.

How long does it take for the bank to review an application?

Cooperation with Sberbank begins with filling out an application. First, the user should make sure that he meets the requirements of the financial company. You also need to prepare documents confirming the place of work, the required length of service and the amount of earnings.

There are several ways to apply for a mortgage, including visiting an office or using online banking. The completed application form can be reviewed by bank employees for up to 5-8 days.

Review of the questionnaire is necessary for the following purposes:

- to verify the accuracy of the personal information provided;

- to submit requests related to the analysis of credit history;

- to assess additional risks if the potential client’s employment is associated with activities hazardous to health;

- to analyze social status, education and standard of living;

- for the ratio of earnings and the number of family members and dependents;

- to assess the financial condition of co-borrowers;

- to check the borrower's reputation, including criminal records or participation in illegal activities.

The difference in review times depends on the way the information is processed. Sometimes the necessary data is already in the database. In other cases, manual verification is required, which significantly slows down the process.

!['Sberbank's requirements for an apartment with a mortgage in [year]: reasons for the "tough](https://2440453.ru/wp-content/uploads/trebovaniya-sberbanka-k-kvartire-po-ipoteke-v-year-godu-prichiny-330x140.jpg)