What determines the term of the mortgage?

In general, the requirements of different banks do not differ too much in terms of mortgage lending. The minimum payment period is 1 year, the maximum is 30 years.

The term of a mortgage loan is influenced by several factors:

- the cost of the apartment - the more expensive the property, the longer it will take to repay the debt;

- down payment - the larger the advance payment, the less the remaining amount, so you can pay off your debts faster;

- the borrower's income - it is logical to assume that a person with a higher income will be able to pay off the mortgage faster than a debtor with a small salary;

- banking conditions - not all lenders can afford to set long mortgage lending terms.

Sberbank offers a mortgage for a term of up to 30 years, while some other financial organizations provide it only for 7 years.

The influence of the borrower's age on the mortgage term

When determining how many years a mortgage is given, 3 main criteria are taken as a guide: income, credit history and age of the borrower. Moreover, the last factor is no less significant.

The lender must be confident that its client will be able to repay the debt consistently throughout the mortgage period. Therefore, the age limit is set within the range of 21-65 years (depending on individual requirements, they can shift in one direction or another). It is believed that a person over the age of 21 already has a more stable financial situation, he is old enough and therefore is aware of his actions. As for old age, the restrictions are quite understandable and are associated with a high probability of death. If an elderly person is approved for a mortgage, it will most likely be small and for a short period.

Factors influencing the term of a mortgage loan

Mortgage repayment terms are determined individually for each financial institution client. The conditions set by banks for lending periods may be affected by several circumstances.

The term of the mortgage loan set by the financial institution may, for some reasons, be either increased or decreased. Let’s look at what bank requirements the loanee must meet in order:

Depending on the age of the loan recipient

It should be understood that the bank, when issuing a large cash loan, takes a significant risk. Therefore, age differences are determined by which the period of the mortgage loan is determined.

Let’s say for a twenty-year-old borrower, when his working life has just begun, these terms may be the maximum. In this case, the borrower of retirement age can only count on the minimum period for issuing a mortgage.

Most often, banks also set a lending threshold. It usually ranges from 21 to 65 years. However, some financial organizations, like Sberbank, raise this bar to 75 years and, conversely (Otkritie Bank) lower it until adulthood.

Borrower's ability to bear the loan burden

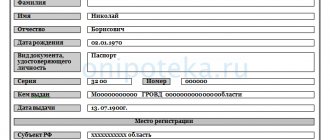

The financial institution must carefully examine the potential borrower’s documents confirming his regular income. Depending on the amount of this income, conditions will be selected for the long-term or, conversely, short-term duration of the mortgage issued.

If the recipient of the loan is married and the spouse also has a regular income, the bank’s confidence in this case increases, which affects the profitability of the loan terms.

Price of purchased property

As you know, a mortgage is repaid monthly in equal or differentiated payments. Accordingly, these contributions directly depend on the price of the property. Based on the calculation of monthly payments, the optimal loan repayment period will be selected.

The fact is that the monthly payment should not exceed a certain percentage of the borrower’s income. Therefore, the compatibility of the lending period with monthly payments should be selected optimally according to the financial strength of the loan recipient.

If the borrowed person falls under the state support program

In this case, based on the category of the program, part of the debt and interest obligations are assumed by the state. This significantly affects the revision of the terms of the mortgage by the bank.

However, other reasons may also influence the increase or decrease in loan terms under state programs. For example, the ratio of federal funds to the personal financial strength of the borrower. And, what is more significant, for some state support programs the boundaries of the time periods for which mortgage loans will be issued have already been determined in advance.

Availability of iron-clad guarantees

One of these guarantees is the presence of a guarantor or co-borrower, the other is a pledge of other real estate. This significantly affects the increase in mortgage terms and the cost of the banking product.

A positive credit history of the borrower is also important. If there are outstanding overdue loans in violation of the agreement with the financial institution, the bank has the right to refuse, citing the unreliability of the person being loaned.

Terms of mortgage lending at Sberbank

Today, Sberbank offers several mortgage lending programs. They differ in conditions, amount of down payment, interest rates, terms, etc. Thus, Sberbank tries to satisfy the requests and needs of borrowers belonging to different categories (military, young families and others).

Regardless of mortgage lending programs, the loan is issued for at least 1 year. Moreover, the shorter the payment period, the lower the interest rates. And all because, at the same time as the mortgage term decreases, the risks for the bank are reduced. It is worth noting that the conditions may become more favorable with an increase in the size of the down payment, which is also associated with minimizing risks.

For how many years do they give a mortgage at Sberbank, according to the maximum terms? No more than 30 years. Borrowers aged 27 to 35 are more likely to get a long-term mortgage.

What mortgage lending conditions are most beneficial for the borrower? The payment period is up to 10 years and upon making a down payment of 50%.

How to profitably take out a mortgage for an apartment: examples with calculations

Even taking into account the fact that concluding a mortgage agreement for a minimum term saves money, borrowers prefer long-term loans. The main reasons for this decision are the ability to stretch the total amount over a longer period and thereby reduce the size of the monthly payment.

To understand how it is more profitable to take out a mortgage for an apartment, let’s look at examples of two lending options and compare them with each other:

- Registration of a mortgage for 30 years. The cost of housing is 2 million rubles. The borrower makes a down payment of 20%, the bank sets a rate of 12.5%.

- The mortgage is issued for a period of 10 years, the interest rate is 12%. The remaining parameters are similar to the previous option (advance payment 20%, apartment price - 2 million rubles).

In the first option, the monthly payment will be 21,345 rubles, and the overpayment will reach 5,684,238 rubles.

In the second option, you will have to pay 28,694 rubles every month, and the amount of the overpayment will be 1,443,302 rubles.

What can be concluded? The total savings are 4,240,936 rubles. And the monthly payment amount in the second option is only 7 thousand rubles higher. It is clear that the answer to how long it is more profitable to take out a mortgage for an apartment is obvious.

The best mortgage offers for 2019

According to data for 2021, the best mortgage offers are recognized:

- “Loan for an apartment or share” from Delta Credit Bank. The down payment is 15%. The payment period is 25 years. The interest rate is 9.5%.

- "Ready housing" from "TKB". The mortgage term is up to 25 years. The interest rate is 10.2%. Down payment - 20%.

- "Resale housing" from "VTB". Down payment - from 10%, for a period of up to 30 years, interest rate - 10.1%.

- “Purchase of housing under construction” from Sberbank. Valid for up to 12 years. Rate from 8.5%. Down payment - 15%.

- “Residential complex “Balaklava” from National Standard Bank.” Interest rate from 8.8%. Any down payment amount.

What to do if the mortgage is still too expensive

The optimal mortgage payment is considered to be 40% of confirmed earnings. Ivan’s payment of 36 thousand rubles is 4 thousand more than the norm. It seems that this is not much, but per year it is already 48 thousand rubles.

There are several ways out of this situation.

Find extra money for a down payment

Suppose Ivan has a dacha somewhere in the Ivanovo region that he does not need. Meanwhile, you can get 500 thousand rubles from the sale of a plot and a house.

If Ivan manages to sell his country property before November 1, 2021 and makes this money as a down payment, this will help him reduce his monthly payment to 31 thousand rubles.

By the way, the terms of the preferential mortgage do not prohibit the use of maternity capital certificates to pay for the loan. Since January 2020 of that year, a payment of 466,617 rubles is due at the birth of the first child, and at the birth of the second, another 150,000 rubles are paid in addition to the maternity capital.

But remember, if maternity capital is used when paying for an apartment, the buyer automatically loses the right to a 13% property tax deduction for the amount paid using maternity capital funds. The maximum tax deduction payment, taking into account mortgage interest, is 650 thousand rubles.

Increase the mortgage term

Then the payment will decrease, but the overpayment will increase. For example, Ivan can increase the term of the preferential mortgage to 20 years - then he will pay 30 thousand rubles per month, but the overpayment will increase by 391 thousand rubles.

This is what Ivan’s mortgage calculations look like for various periods:

| Amount of credit | 4.1 million rubles | ||||||

| Credit term | 5 years | 10 years | 15 years | 20 years | 25 years | 30 years | |

| Mortgage at a weighted average rate of 8.69% | Monthly payment, thousand rubles. | 84,39 | 51,14 | 40,71 | 35,94 | 33,40 | 31,93 |

| Overpayment on loan, million rubles. | 0,96 | 2,03 | 3,22 | 4,52 | 5,92 | 7,39 | |

| Mortgage under the “State Program 2020” with a rate of 6.5% | Monthly payment, thousand rubles. | 80,22 | 46,55 | 35,71 | 30,56 | 27,68 | 25,91 |

| Overpayment on loan, million rubles. | 0,71 | 1,48 | 2,32 | 3,23 | 4,20 | 5,22 | |

| Benefit, million rubles. | 0,25 | 0,55 | 0,90 | 1,29 | 1,71 | 2,16 | |

You can calculate a mortgage on your own terms online using a mortgage calculator.

The term of the preferential mortgage under the “State Support 2020” program can be increased to a maximum of 30 years, some banks are introducing restrictions up to 20 years.

Find a bank with a reduced preferential rate

Many large banks are ready to further reduce the interest rate on preferential mortgages - by an average of 0.4-0.6% per annum. Such conditions may apply for the entire loan term or the first few years, it all depends on the specific bank. From time to time, promotions appear when purchasing an apartment on a preferential mortgage, under the terms of which developers agree to fully or partially pay the interest on the mortgage for a certain period of time - usually the first six months to a year.

As a result, Ivan’s application for a preferential mortgage at 6.3% per annum was approved.

How to shorten the mortgage term for an apartment?

Ways to shorten the mortgage period:

- mortgage refinancing - partial or full coverage of the existing mortgage with a new loan (it is advisable to apply after several years of debt repayment;

- investment of maternity capital against debt;

- using a tax deduction to pay off part of the mortgage;

- mortgage loan restructuring - writing off up to 30% of the debt on good grounds (the borrower must provide evidence that he cannot repay the debt).

Many banks provide the possibility of early repayment of a mortgage. If you wish, you can pay off the debt in one amount, paying it off without interest.

Related Posts

- Up to what age can a mortgage be granted? Each bank has its own requirements. And one of them is the age limit, which is provided...

- Take out an apartment on a mortgage and rent it out At first glance, it may seem that you can take out a mortgage on an apartment and rent it out, paying…

- State duty for a gift for an apartment When receiving such an expensive gift as real estate, you will have to go through a certain procedure provided for by law in order to formalize…

- How to revoke a will for an apartment by the testator himself? If a person has made a will, and after some time decides to revoke it, the law allows him...

Mortgage for 10 years

If the loan term is not 5, but 10 years, the payment will be significantly reduced, and the amount of overpayment will more than double:

- monthly payment - 29,862 rubles.

- overpayment amount - RUB 1,583,066.

- total amount of payments - 3,583,066 rubles.

During the year it will be necessary to repay the loan 358,344 rubles.

How to choose a mortgage bank? More details at the link

Is it worth taking out a mortgage at all? Review after 4 years of mortgage using the link

How to buy an apartment with a mortgage: procedure

![Mortgage for civil servants and other public sector employees in Sberbank in [year]](https://2440453.ru/wp-content/uploads/ipoteka-dlya-gossluzhashchih-i-drugih-byudzhetnikov-v-sberbanke-v-year4-330x140.jpg)