The acquisition of their own square meters by young people with the help of a mortgage for students for an apartment in Sberbank on favorable terms is one of the options for resolving the issue. Often, final year students get a permanent job and start a family, which requires further development of an independent life.

Buying real estate with your own funds is not available to everyone. Therefore, a bank loan is often the only chance to get a roof over your head. Rental payments for residential space increase annually depending on inflation. Its amount is not much higher than the monthly mortgage payment. Therefore, more and more young people are turning to the bank for help in purchasing housing.

Features of a student mortgage

University applicants, especially those studying in another city, are in dire need of living space. Not everyone is given a room in a dormitory, and the allocated living space often does not meet all the student’s requirements. The option of taking out a loan and buying an apartment or house is a good alternative to renting a living space; in addition, the amount of monthly rent payments can be equal to mortgage payments.

There are no special mortgage programs for students. The exception is a few regional programs. These programs are carried out in the Rostov region and Krasnodar region. Today, students there can receive preferential loans or reduce the unit cost of one square meter of housing, receive an installment plan, book a specific apartment, and receive a reduced interest rate.

Attention! The remaining constituent entities of the Russian Federation offer mortgages for young people aged 18-21 on standard terms.

Student mortgages have their own characteristics and pitfalls. So, to take out a loan, a young person must be 18-21 years old. In addition, he needs to attract a co-borrower with a guarantor (the bank minimizes as much as possible its risks from non-repayment or failure to make payments under the mortgage agreement). The student must also confirm his income, stable employment, bring a 2-NDFL certificate and a tax return required by the bank, and pay a deposit. The housing purchased on credit serves as collateral.

Important! Despite the fact that you can take out a mortgage from the age of 18, many banks that provide student loans have one prerequisite for concluding a mortgage agreement - at least one year of work experience. This is almost impossible for a young man. The exception is Rosevrobank. He does not set such conditions. There are also good options: Deltacredit and Uralsib. In recent credit institutions, the length of service requirement is at least 6 months.

If the student is a research fellow

It is much easier to become an apartment owner if the student is a young scientist. The state provides them with assistance in solving the housing problem in the form of social benefits. The payment, if prices for apartments in the region are affordable, can be used in full for the purchase of housing, or it can also be used to purchase an apartment with a mortgage.

The right of a young scientist to receive money from the state is confirmed by a personal certificate - a state housing certificate.

The certificate is valid for seven months from the date of its issue. A young scientist can become a participant in the subprogram and apply for a certificate provided that:

- he is no more than 35 years old;

- his total work experience as a research assistant is at least five years;

- the scientific organization recognized him as in need of receiving social benefits on the grounds established by Article 51 of the Housing Code of the Russian Federation.

The size of the social payment to a young scientist is determined as the product of the total living area (33 sq.m.) and the average cost of one square meter in the region, approved by the Ministry of Construction and Housing and Communal Services for the constituent entity of the Russian Federation on the territory of which the scientific organization in which the young scientist works is located .

For example, in the Stavropol Territory, the payment amount for the 2nd quarter of 2018 is 964,887 rubles.

Which banks provide student loans?

The student mortgage programs listed above in the south of Russia are implemented with the help of Kuban Credit. You can get a mortgage from this institution at 8.8% per annum for 30 years with a zero down payment. The maximum loan amount is up to 7 million rubles. You can take out a loan for any accredited project from construction companies.

The specific interest rate, loan amount and repayment period are determined individually after the lender reviews all documents. The bank is considered loyal to potential borrowers, especially in social programs.

In addition to Kuban Credit, mortgages are provided to students by Sberbank, Bank Vozrozhdenie, Bank St. Petersburg, Ak Bars, Bank Center-Invest, FC Otkritie, Globex Bank, Moscow Credit Bank. At the same time, in the listed banking institutions the requirements for work experience are acceptable - from 6 months. The interest rate varies from 9.1 to 12.75%.

Interestingly, all banks give a discount on the interest rate of 0.5% for salary earners. Since the age of 21, such large banks as Gazprombank, Absalut, SMP Bank, VTB-24, Rosselkhozbank, Raiffeisenbank and others have been issuing loans. Rosselkhozbank actively engages students with families and gives discounts.

Mortgage at VTB Bank

The financial institution VTB offers clients to take advantage of a mortgage lending program called “Victory over formalities.” The loan amount can range from 600 thousand to 30 million rubles. A mandatory down payment of 20% of the value of the purchased property is required.

The final annual interest rate depends on many indicators. The main thing is the availability of comprehensive insurance. The lowest rate of 7.4% is assigned in case of making a down payment of 50%. Also, the final annual interest rate is influenced by the square footage of the purchased property.

To obtain a mortgage loan using two documents from VTB, you will need to perform the following steps:

- Send the application form to the financial institution. It will be reviewed within 24 hours;

- Wait for mortgage approval;

- Personally provide a passport of a citizen of the Russian Federation and SNILS to the nearest branch of the banking company;

- Start searching for suitable real estate. At the same time, the company’s specialists will provide assistance in choosing if the residential premises will be purchased from partner organizations of the bank;

- Prepare the required package of documentation for the purchased property;

- A purchase and sale agreement is drawn up and a mortgage loan agreement is concluded.

Mortgage terms

| Bank | Interest rate | An initial fee | Work experience (months) | Age, years |

| Sberbank | 9,1% | 15% | 6 | 21-75 |

| VTB 24 and Bank of Moscow | 9,1% | 15% | 3 | 21-65 |

| Raiffeisenbank | 10,99% | 15% | 3 | 21-65 |

| Gazprombank | 10% | 20% | 6 | 21-60 |

| Deltacredit | 12% | 15% | 2 | 20-65 |

| Rosselkhozbank | 10,25% | 15% | 6 | 21-65 |

| Absolut Bank | 11% | 15% | 3 | 21-65 |

| Bank "Revival | 11,75% | 15% | 6 | 18-65 |

| Bank "Saint-Petersburg | 12,25% | 15% | 4 | 18-70 |

| Promsvyazbank | 11,75% | 20% | 4 | 21-65 |

| Russian capital | 11,75% | 15% | 3 | 21-65 |

| Uralsib | 11% | 10% | 3 | 18-65 |

| AK Bars | 12,3% | 10% | 3 | 18-70 |

| Transcapitalbank | 12,25% | 20% | 3 | 21-75 |

| Bank Center-Invest | 10% | 10% | 6 | 18-65 |

| FC Otkritie | 10% | 15% | 3 | 18-65 |

| Svyaz-bank | 11,5% | 15% | 4 | 21-65 |

| Zapsibcombank | 11,75% | 10% | 6 | 21-65 |

| Zhilfinance | 11% | 20% | 6 | 21-65 |

| Credit Bank of Moscow | 13,4% | 15% | 6 | 18-65 |

| Globex Bank | 12% | 20% | 4 | 18-65 |

| Metallinvestbank | 12,75% | 10% | 4 | 18-65 |

| Bank Zenit | 13,75% | 15% | 4 | 21-65 |

| Rosevrobank | 11,25% | 15% | 4 | 23-65 |

| Binbank | 10,75% | 20% | 6 | 21-65 |

| SMP Bank | 11,9% | 15% | 6 | 21-65 |

| AHML | 11% | 20% | 6 | 21-65 |

| Eurasian Bank | 11,75% | 15% | 1 | 21-65 |

| UniCredit Bank | 12,15% | 20% | 6 | 21-65 |

| Alfa Bank | 11,75% | 15% | 6 | 20-64 |

Nuances

The nuances of purchasing housing under the “Apartment for Students” program

If you are planning to join a student housing program, there are some features you should consider.

The important point is to reach the specified age, confirm employment, and have income. Moreover, at the time of purchase, the student may not even have the amount necessary for a down payment.

The main thing is that the bank is convinced that it is possible to collect this amount and pay it within the terms established by the agreement.

It should be borne in mind that not just any housing is purchased under the program, but those specifically determined by developers and lending institutions.

Requirements for students

The banks considered have requirements for students that are standard for all clients. So a potential borrower must have:

- Russian passport and citizenship;

- Age from 18 years;

- The total work experience in an official position is at least 6 months;

- Sufficient solvency (upon request with the approval of the bank, when calculating the loan and issuing it, the income of the parents can be taken into account to become co-borrowers);

- Good credit history, if available (no late payments with serious violations of contracts);

- A sufficient amount to pay the down payment on an apartment or house;

- Registration in a place close to the region where the bank is located.

In addition, guarantors may be required in some cases. For example, if there is no high income and places of work often change. Co-borrowers and guarantors must also meet the above requirements, including having a permanent place of employment. They are required for the student to obtain a mortgage.

How can students get a mortgage without work experience?

Students often face the question of what to do if it is not possible to confirm their work experience or it is not enough according to the lender’s criteria. In this situation there are two options:

- The first method involves taking out a mortgage loan for one of the parents.

- The second method is to draw up a mortgage agreement using two documents.

Accordingly, in the first option, all responsibility falls on the parents. Next, we will consider the proposals of banking companies to provide mortgages based on two documents.

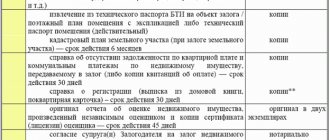

Documentation

Students, like other potential borrowers, have a standard package of documents. They must have:

- General passport of the Russian Federation with a registration mark close to the location of the bank;

- Documents that directly confirm a person’s work and stable income (the lender may require a copy of the work record book, an agreement with the employer, a certificate of income, an account statement, etc.);

- Completed application form to obtain a mortgage;

- Student card for lending at Kuban Credit;

- Documents for collateral;

- SNILS.

The above is a list that can be supplemented by the lender on an individual basis. The co-borrower and the guarantor bring exactly the same documentary kit.

Conditions for participation in the program

The main criterion for participation in the program, in addition to having a student card, is the borrower’s solvency, which can be confirmed by the presence of a constant income from working outside of school hours or other means of earning , confirmed by an income statement or other available means.

Tripartite relationships between the student, developers and commercial bank Kuban Credit are feasible for any available combination of capabilities and needs of the borrower, in particular:

- if it is possible to purchase an apartment entirely at your own expense;

- in the presence of an amount corresponding to the size of the down payment and the presence or absence of the possibility of mortgage lending;

- if there is insufficient funds to pay the initial payment.

Registration process

To get a mortgage for a student, he needs to go through the same path as other borrowers. It looks like this:

- Researching available banking offers on the Russian financial market and searching for a suitable lender with a program (it is imperative to familiarize yourself with the loan terms and use a mortgage calculator).

- Collecting the necessary documentation to attach to the mortgage application with a full set of papers.

- Submitting an application (you can submit it in advance through the online service of the selected bank or through a personal application to the lender’s branch).

- Consideration of the submitted application with all documents (the bank makes a decision on issuing or refusing a loan from 1 to 10 days; the number of days of consideration depends on the complexity of the situation).

- Signing of all mortgage documentation, if the bank has made a positive decision (bank employees call the borrower and announce the decision, a day is set for signing the documents, and then the person buys the property and registers it with a special registration authority).

- Registration of a transaction by signing papers and agreeing on actions.

- Payment of the down payment on the loan from personal funds.

- Issuing a loan to the account of the real estate seller, since a mortgage is a targeted loan and in most cases the amount is sent immediately for the purchase of an apartment, house or plot.

In cases where secondary housing is purchased, the property may additionally be assessed by an appraiser. It is prepared by the relevant company that cooperates with the bank.

Mortgage loan for students

Sberbank can also issue a mortgage loan for students to purchase an apartment. This is a long-term targeted loan, where the purchased housing serves as collateral for the loan. The collateral can be real estate owned by the borrower. To get a mortgage loan, you must first find out what the requirements are for obtaining a loan from the bank you choose. To increase your chances of getting a loan, you can make several sets of documents at once and send them to different banks. Moreover, you need to do this at the same time, this will save your time, nerves and energy. After all, if you are rejected by one bank, you will have to re-assemble the package of documents for another bank, and this will be even more difficult. In addition, having received the first refusal, you can become completely disappointed in the idea of getting a loan, and not achieve your goal, give up. It is important to choose the right bank that will issue you a loan. You should not be tied to any particular bank. Don't try to save on mortgage interest, e.g. find a bank with lower interest rates. It is better to pay attention to the following criteria:

- The presence of advertising containing information about the issuance of a loan.

- Search the Internet for information about the number of loans issued by this bank.

- Use the advice of brokers and bank employees when choosing.

Choose a bank when you are sure that it does not make excessive demands on customers. Some banks offer mortgages for students without a start-up fee. You can get a loan for the amount of the entry fee.

Student mortgage from Sberbank

Today, in order to get a mortgage for a student at Sberbank, you need to apply for a standard package, since no other social programs have been created. For this period, there are offers to purchase housing under construction or ready-made, buy a house or apartment using maternity capital as a down payment, take out a loan to build a residential building or buy country real estate.

The minimum amount that can be borrowed from Sberbank for a person over 21 years old is 300 thousand rubles. The maximum amount is calculated based on the papers provided to the bank. The loan term is up to 30 years.

The interest rate is from 9.1%, depending on income, credit history and other indicators. The presence of guarantors, co-borrowers and the classification of the student into another category of borrowers also influences. For example, the mortgage rate is lower if a person has a family at a young age.

Specific terms of the mortgage are approved on an individual basis, taking into account the specifics of his case, the price of the purchased living space, the person’s status, solvency and history of issuing loans.

It is not difficult to obtain a mortgage for a student today at Sberbank, as well as at any other credit institution. To do this, he needs to have a suitable age, a stable income with a job, and no written complaints from other banks.

How to Apply Online for a Mortgage

You can submit your application online and receive a preliminary decision without visiting the bank. All you have to do is fill out a short form on his website.

For example, in the Gazprombank application you must indicate:

- FULL NAME;

- contacts (phone, email);

- series, number, date of issue of the passport;

- residential address;

- the city where you plan to purchase real estate;

- city where the mortgage was issued;

- desired loan parameters (term, amount);

- information about the availability of a bank salary card.

conclusions

Despite the existing disadvantages and strict requirements for participation in the student program, buying an apartment is still profitable.

It provides several options for purchasing housing, a good list of discounts and benefits. If a student (other person) meets all its requirements, he can become the happy owner of his own apartment.

You can learn more about the target program “Apartment for Students” by watching the video:

See also Phone numbers for consultation June 22, 2021 kasjanenko 798

Share this post

Discussion: 7 comments

- Irina says:

04/21/2018 at 14:28It is great that there are such programs to help students purchase housing. I just don’t understand why such a program is not valid throughout Russia, but only in its South? It would be nice to think about other students, not just southerners. As I understand it, it’s not the state that needs to be thanked for this, but the banks and developers.

Answer

- Elena says:

08/30/2018 at 03:26

I agree with Irina, my daughter is also a student and she needs housing, but we do not live in the South, so unfortunately we cannot participate in the program. In general, the idea is quite interesting and allows families to form and not think about the housing issue.

Answer

- Ivan says:

12/29/2018 at 19:02

Probably, if a student or his parents have money for an apartment for him, then such programs can be very useful. But most often this money is not available, which is quite logical, because students study and do not work, and it is difficult to earn a lot of money with the help of part-time jobs.

Answer

- Peter says:

04/26/2019 at 13:36

This is not a program for students, but actually for parents of students. The student is naked like a falcon and hungry like a wolf, what can you take from him? But parents may be concerned that their child does not wander around the dorms.

Answer

- Elena says:

10/15/2019 at 15:58

You can clarify whether this program “An apartment for a student is a target program for the south of Russia” applies to North Ossetia-Alania, Vladikavkaz, we are also in the south. Where and who can I turn to for advice? Which banks?

Answer

- Vitaly says:

04.11.2019 at 05:08

I don’t know for sure whether Moscow is joining this program or not, but recently all the media reported that they began specially building housing with a total area of eleven square meters. Of course, this is a very small capacity. But, as a temporary option, one might say, a starting one, it is available not only to students, but also to young families.

Answer

- Sergey Petrovich says:

12/26/2020 at 09:31

It seems to me that the program, although it was good, did not justify itself at all. It implies too many components. Whether it's a preferential mortgage supported by the state.

Answer