How to reduce your mortgage payment at Sberbank

Over the past 2 years, an increasingly pressing issue for many Russian citizens who have taken out mortgage lending has become the question of the possibility of reducing the interest rate or even: how to reduce the mortgage payment at Sberbank.

Of course, in the past, credit specialists most often refused such applications, because clients consciously signed documents and understood all the possible risks. But thanks to government support from the population, and a reduction in the interest rate by 3-4 points from the previously established one, many decided to use the service of refinancing or reducing the size of the mortgage loan payment at Sberbank.

Grounds for loan restructuring

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

Mortgage debt restructuring is not always carried out at Sberbank. The Bank considers each situation individually and reserves the right to refuse or make a positive decision.

Reasons for carrying out:

- job loss;

- decrease in income;

- loss of ability to work;

- conscription into the army;

- maternity leave.

If you have difficulties with repayment, in any case, you must contact the bank to resolve the issue before a delay occurs.

Mortgage restructuring at Sberbank allows you to solve debt repayment problems peacefully.

Who can benefit from a mortgage payment reduction?

Almost every borrower may encounter a situation where he no longer has the opportunity to repay a previously taken loan on the same terms. There can be a lot of reasons for this, from loss of ability to work to dismissal from a previous job. But this is not a reason to panic; there are many ways to influence the size of the monthly mortgage payment at Sberbank of Russia:

- become a client of Sberbank and receive a salary or pension on its card, or simply store your own money in accounts;

- be a reliable borrower who pays their obligations on time.

There are several really good reasons:

- the appearance of a baby in the family - banks undertake to issue a deferment for young families up to 3 years, with the possibility of partial payment only of the interest amount, the main part of the debt is temporarily frozen;

- if it is possible to pay a significant amount at once, you can apply to revise the terms of the loan and reduce the monthly payment accordingly;

- providing evidence of deterioration in financial situation ;

- providing additional collateral.

Who can't reduce their mortgage rate?

It should be noted right away that programs to reduce the size of the monthly mortgage payment are not available to everyone. There are categories of citizens to whom the bank may not make concessions. Conditions under which you are most likely to be denied a mortgage loan restructuring:

- presence of delays in monthly payments;

- the total amount of debt is at least 500,000 (five hundred thousand) rubles;

- the review procedure is available only after 1 year has passed from the loan issuance;

- repeated restructuring is not possible.

Pros and cons of restructuring

Benefits for the borrower:

- possibility of payment reduction;

- no delays or penalties;

- credit history does not deteriorate;

- the ability to pay off your mortgage even if your solvency decreases.

For the bank, this is an opportunity to resolve the problem without going to court, the absence of risks associated with the occurrence of delays, and increased customer loyalty.

Restructuring a mortgage loan from Sberbank to an individual also has a drawback - most options imply an increase in overpayment on the loan. Another disadvantage is that the bank does not always cooperate, only if there are confirmed objective reasons.

How is payment determined?

One of the important aspects of forming a monthly payment is determining the method of payment for the loan. There are 2 repayment schemes:

Annuity payments - this type of payment is used in almost 80 lending cases. It involves repaying the loan amount in equal payments throughout the entire loan term.

Differentiated payments - this type of lending is very rare, because with it the amount of the monthly payment gradually decreases, and interest is charged on the remaining amount. With this method of debt repayment, you are more likely to save money when making a larger payment. However, banks understand this benefit for customers and rarely offer this method of repaying debts.

Payment reduction methods

If you consider that when applying for a loan, you must think through all the nuances and choose the most convenient conditions for yourself that will allow you to pay off the debt under any circumstances, then here is a short list of ways to immediately get a lower monthly payment.

- if possible, choose a differentiated method of loan repayment;

- choose a longer loan term;

- take care of insurance without involving a bank;

- take out a personal insurance policy;

- contact the tax office to apply for a tax deduction (it is due to all citizens receiving loans under housing programs);

- if possible, you can use maternity capital;

- apply subsidies;

- do not choose the payment amount too large, there may be unforeseen circumstances, leave a reserve for your own budget;

- try to find money to repay in excess of the norm;

- control the interest rates, because you may have a chance to refinance at lower interest rates.

How to apply for a reduction in mortgage payment at Sberbank

So, you have decided that you have a real opportunity to reduce your own workload and reduce the size of your monthly payment, then you need to thoroughly prepare.

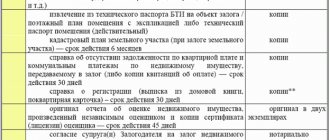

What is required for re-registration:

- passport of a citizen of the Russian Federation;

- certificate in form 2NDFL from all family members;

- certificate or employment certificate confirming the borrower’s loss of employment;

- an extract from the medical record or a medical examination report on the deterioration of the borrower’s health;

- birth certificates of young children;

- statement of the remaining amount of debt;

- a certificate from the Unified State Register of Real Estate to confirm ownership of the property if it is pledged.

The step-by-step actions will be as follows:

- Contact the bank branch with the specified list of documents;

- Draw up an application in the bank’s form indicating the reasons for reducing the payment amount;

- Also register a copy of the application (this will guarantee that the application will reach its destination);

- The bank reviews the application within 1 month;

- If the decision is positive, the contract is renegotiated and a new debt repayment schedule is formed.

Registration procedure

If the borrower finds himself in a difficult situation and cannot, as before, fulfill his obligations on mortgage payments, it is possible to use a special program. The procedure for restructuring a Sberbank mortgage in 2021 is quite simple, and it will also allow you to preserve your credit history. You can reduce the size of the regular payment, get a deferment, or change the currency of the contract.

The main thing is that the new terms of cooperation suit both parties. As a result of the agreement, changes are made to the terms of the primary agreement, and the consequences of non-compliance with the new terms of the loan for the debtor are stipulated. Borrowers contact the bank with an application and documents confirming the need for these changes. The bank agrees on the terms and the parties sign an additional agreement.

The procedure for completing a transaction is as follows:

- The client personally submits to the bank and submits the required package of documents. It is also possible to submit documents online by logging into the Sberbank website and filling out all fields of the electronic application, attaching all document files. A personal visit to the department is the preferable option; it takes time, but employees can help with filling out applications and will check the correctness of all applications.

- The bank reviews the application and analyzes the possibility of providing refinancing for a specific mortgage case. The period for consideration of applications is up to 10 days.

- A decision is made, about which the client is informed - in person at the branch or through an online service, SMS message and email.

- If the decision is positive, the borrower comes to the branch and signs an additional agreement and other related documents.

- Additionally, a new loan payment schedule is being formed.

There are a number of nuances for individuals. For example, if there is a delay, refinancing may be denied. You can also take advantage of preferential restructuring options with the involvement of government resources and funds.

It is also possible for legal entities to revise the terms of the mortgage agreement and apply an individual restructuring scheme. To do this, they conduct a comprehensive analysis of the state of the business, predict the development of the project and its prospects. The debt can be partially written off, or the loan can be repaid using shares.

Recommended article: How to buy a summer house with a mortgage

Pros and cons of reducing mortgage payments at Sberbank

If we take into account that the client independently decides to reduce the monthly payment, then well-founded advantages immediately appear:

- the burden on the family budget is reduced;

- it is possible to revise the interest rate, which will greatly reduce the overall cost of the loan;

But there are also disadvantages:

- the term of loan obligations will be seriously extended;

- Extending the term increases the period for interest payments.

That is, the benefit is immediately obvious, the load is reduced, but at the same time the repayment period is longer. In this case, if the financial situation subsequently changes for the better, it is worth increasing the monthly payment yourself in order to shorten the debt repayment period.

Is it possible to shorten the mortgage term at Sberbank?

Any borrower who has taken out a mortgage loan strives to pay the lender faster and reduce the amount of overpayment. Clients with unstable incomes and a high credit load, on the contrary, apply to increase the loan term and, accordingly, reduce the current payment. Most borrowers are interested in whether it is possible to change the mortgage term at Sberbank downward after concluding a loan agreement?

At Sberbank, recently, it has become possible to reduce not only the amount of the monthly payment for early repayment of the mortgage, but also the term.

Important point! If you decide to shorten the mortgage term due to early repayment, this can only be done at a bank branch. This form of early repayment is not possible through Sberbank online. In this case, the payment amount must necessarily be greater than the payment according to the schedule!

Current legislation allows early repayment of debt at any time after concluding a loan agreement with the bank without any penalties or additional payments. It is quite logical that for Sberbank early settlement is extremely unprofitable, since it will not receive its interest. However, according to the law, the creditor has no right to refuse the client’s desire to repay the debt or part of it before the specified period.

You can deposit an amount, the amount of which should be greater than the monthly payment amount in the approved payment schedule, according to a pre-drafted application addressed to the bank management. The document can only be submitted offline (usually at the branch where the loan was issued) if you plan to shorten the mortgage term and possibly online if you want to reduce the monthly payment.

Features of early payment in Sberbank:

- the application is accepted no later than 1 working day before the next payment is due;

- money is debited on the day of payment according to the schedule;

- interest is accrued for the days of actual use of the loan;

- the application is drawn up and signed personally by the borrower (no oral agreements are valid).

At the request of the borrower, the bank is obliged to provide a new payment schedule under the loan agreement, taking into account payments made ahead of schedule.

IMPORTANT! If the borrower plans to repay the balance of the mortgage in full, then you will need to contact Sberbank in advance and request the exact amount for payment, including accrued interest, on the planned payment date. This is done to avoid underpayment or overpayment.

Let's consider whether it is possible to shorten the mortgage term at Sberbank for annuity and differentiated payments, as well as in the case of using maternal capital.

When making an annuity payment

The annuity scheme provides for debt repayment in equal installments over the entire loan term. Since in the first half of the term the main part of the payment is interest to the bank with a minority of the loan amount, early repayment will be beneficial and relevant only until the middle of this term.

Experts recommend early payment in this case in the first year after the conclusion of the contract. This could then become a loss-making business. In any case, the necessary calculations should be made to determine the potential benefits.

It is possible to submit a request for early payment through Sberbank.Online. To do this, on the special tab “Early repayment” in the personal account, the client must click the “Partially repay the loan” button and indicate the write-off account, the account and the date of crediting the indicated amount. The completed application will be automatically sent to the bank, and the money will be debited on the specified date.

With differentiated payment

This scheme, on the contrary, provides for a gradual reduction in the amount of monthly payment. In case of early repayment, the system will automatically recalculate the remaining debt on the Sberbank mortgage and, accordingly, accrued interest.

Differentiated payment in this matter will be more profitable than annuity payment. However, at Sberbank, all mortgage loans today are issued only using equal payments.

When repaying with maternity capital

Owners of a maternity capital certificate have the opportunity to repay their Sberbank mortgage debt using the available amount of government assistance. All issues regarding the disposal of this measure of state support are resolved by agreement with the Pension Fund of Russia.

In order to use maternal capital, the client initially orders from Sberbank an official certificate about the status of the current loan debt and the name of the details of the mortgage agreement, which is then presented to the Pension Fund.

At the same time, the borrower applies to the Pension Fund of the Russian Federation with an application to transfer the available amount of capital to repay the mortgage at Sberbank and provides the required package of documents (under the signature of a specialist).

If the outcome of the case is positive, the required amount will be credited to the client’s loan account at Sberbank in a non-cash manner. The balance of the debt will be recalculated in favor of the borrower.

Additionally, you can request from Sberbank an account statement or a certificate confirming the receipt of money from the Pension Fund of the Russian Federation.

Under what conditions are additional payments made?

You need to know that according to the rules of the banking structure described, you will need to fill out a specialized application before making additional payments towards the repayment of a mortgage loan. You must submit this application at least one day before the due date for the next installment to repay the loan. It should be noted that Sberbank treats clients wishing to repay a loan early as loyally as possible, since most domestic banking institutions require that the said application be completed a month before the next payment is due.

In this application, you will need to enter information such as the mortgage loan agreement number, as well as the account into which the money will be received, and the amount of money you plan to make as an additional payment. If you plan to make additional payments to repay the debt to the described banking structure, then you need to remember a number of additional rules:

- You must submit an application that you plan to make an additional payment in person at a branch of the banking structure. The application itself must be completed at the branch where you received the mortgage loan.

- There are restrictions on the minimum amount of additional payment, which cannot be less than 15 thousand rubles.

- The additional payment is made to the credit account, from which they will subsequently be debited when the next payment date arrives in accordance with the established schedule.

- In accordance with current rules, most of the additional payment made will be used to repay the loan body.

- The maximum amount of additional contributions is not limited by the current rules of the described banking structure.

- As soon as you make an additional payment, employees of the banking structure will draw up a new contribution schedule for you, which will include changes in their amount.

- The current rules of the described banking structure do not provide for any penalties for making additional payments. In addition, no commission is deducted from such contributions.

It should be very clear to you that the only possible option for reducing the term of a mortgage loan is to repay it in full. For this reason, the additional payments you make will not affect the loan term in any way, but will allow you to reduce the size of your monthly payments.

Some of the mortgage programs from the range of the described banking structure have certain restrictions on the full or partial repayment of received mortgage loans. To find out about these restrictions, before applying for a loan, you can read its terms and conditions on the website of the described banking structure.

How to correctly make partial early repayment of a mortgage at Sberbank

Partial repayment of mortgage debt is carried out only upon application and prior notification of Sberbank. The document is drawn up in free form, but must necessarily contain the following information:

- details of the loan agreement and loan account number (number, date of conclusion and availability of additional agreements);

- FULL NAME. and the position of an authorized employee of Sberbank, in whose name the application is being drawn up;

- Name of the bank;

- FULL NAME. applicant + his passport details;

- the amount and date of the upcoming payment.

The application is written in duplicate in the format of a request to repay part of the debt under a specific loan agreement, indicating the exact amount.

IMPORTANT! Sberbank indicates the deadline for submitting such a document - no later than 1 business day before the date of debiting money from the loan account, but it is recommended to make the transfer at least 3-5 business days, since possible force majeure or other circumstances beyond the control of the client may lead to delays and incorrect calculation of debt.

An example application for partial early repayment can be downloaded here.

Can Sberbank extend a mortgage application?

After a person submits the necessary documents to obtain a mortgage loan, he must find a suitable collateral within 3 months. Not all potential counterparties of Sberbank meet this deadline. Can Sberbank extend a mortgage application? You should contact your credit manager with this question. In most cases, the financial institution accommodates its clients halfway and allows them to extend the application period.

What does it look like in reality?

Extending a mortgage is more of a special case than a practice that not all bank clients can take advantage of. As a rule, people can count on it when their family’s financial situation becomes difficult. The quality of the credit history and the absence of overdue payments are taken into account.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

As a result, bankers may approve:

- Deferred payment of the loan principal for a period of 6 months. up to 2 years. The client will only have to pay interest.

- Extension of the loan from 3 to 10 years, if possible according to the standards of the mortgage program. Maximum – up to 35 years.

- Payment holidays, when a person does not repay anything for 3-6 months, until the financial situation stabilizes.

In any case, an additional agreement to the current contract will be signed, which will indicate the new period and nature of payment. Naturally, they will also recalculate the repayment schedule.

The entire procedure will receive the status of a restructured loan. If financial problems arise, you should not wait, but should immediately notify the bank.

Contents of the mortgage application

Applying for a mortgage loan begins with filling out a special questionnaire. It contains the following points:

- The role of the person in the proposed transaction;

- Full name of the Sberbank client;

- Passport data (number, series, etc.);

- Data on change of name (if available);

- Contacts (phone number and email address);

- Address of the actual residence;

- Education;

- Family status;

- Information about co-borrowers;

- The name of the organization and the position occupied by the potential loan recipient.

In addition to the listed items, the questionnaire contains fields in which you need to provide information about your financial situation. The applicant must estimate the approximate income and expenses of the family budget. If a citizen is the owner of large property, then he must write about this in the questionnaire. The applicant must select a loan program and check the appropriate box. It is mandatory to indicate the account details to which the Sberbank client will transfer mortgage payments.

The application contains a separate block dedicated to the current debt load of the applicant. This section provides the following information:

- Loan currency;

- Name of the financial institution that provided the funds;

- Date of conclusion of the loan agreement;

- The end date of the mortgage agreement;

- Loan size and outstanding balance.

The questionnaire must be filled out in accordance with the sample provided by a Sberbank employee. A large number of corrections and unclear handwriting may cause your application to be rejected. Can Sberbank extend a mortgage application? A potential borrower may complete the application several times. Sberbank does not limit this process in any way. A person can always extend the period for consideration of an application. An application for a mortgage can be submitted electronically (the necessary form can be found on the Sberbank website).

Algorithm for obtaining a mortgage at Sberbank

To obtain a mortgage loan, a person must follow the following algorithm:

- Calculate the total cost of the mortgage;

- Submit an application and other necessary documentation to Sberbank;

- Find a collateral apartment in a new building or on the secondary housing market;

- Conclude a preliminary agreement for the purchase and sale of an apartment;

- Collect a set of papers on the loaned object and take it to the bank;

- Assess the collateral property and conclude an insurance contract;

- Sign a loan agreement and receive funds;

- Transfer money to the apartment seller;

- Pay off the mortgage and register ownership of the living space with Rosreestr.

At each stage of the transaction, it is necessary to consult with lawyers, realtors and banking specialists. Some borrowers make the mistake of starting the mortgage process by looking for collateral. They enter into a preliminary agreement for the purchase and sale of housing and transfer the deposit to the seller of the property. After this, they apply for a mortgage, which is rejected by Sberbank. The potential borrower loses the deposit and is temporarily deprived of the opportunity to solve his housing problems.

Can Sberbank extend a mortgage application? The application can be resubmitted by agreement with the personal manager. The counterparty may refer to force majeure circumstances that prevented the collection of all documents on time (the contract contains a provision allowing an extension of the application period).

Customer reviews about mortgage restructuring at Sberbank

Feedback from borrowers suggests that restructuring helps solve problems with mortgage repayment. But you need to apply before the loan becomes overdue, otherwise you will be refused. Six months or a year is usually enough to restore your financial situation. If you formalize the restructuring, the bank will not apply penalties.

Natalya Karaseva, Director of the Retail Lending Department of Sberbank: “The lender needs to report any difficulties that have arisen immediately”

What documents do I need to collect to apply for a mortgage?

Sberbank considers loan applications only if they have a complete set of necessary documents. If a potential borrower does not provide all the certificates, he will have to submit the application again. Can Sberbank extend a mortgage application? The credit manager can accommodate the counterparty halfway and extend the deadline for submitting documents.

In order to avoid wasting time, you must prepare the following papers in advance:

- Passport of a citizen of the Russian Federation;

- SNILS;

- Documents confirming the employment of the counterparty;

- Certificate of salary;

- Documents on the loaned object;

- Receipts confirming the down payment.

If a young mother plans to use maternity capital to pay off debt, then she should be provided with a state certificate and a certificate from the Pension Fund.

What to do if Sberbank rejected your mortgage application?

A mortgage application may be rejected without explanation. Sberbank employees are not required to explain to applicants why their application was rejected. Typical reasons for refusal are:

- Bad credit history and open enforcement proceedings;

- High debt load;

- Having an outstanding criminal record;

- Illiquid collateral;

- Low level of official income;

- Inappropriate or aggressive behavior during a credit interview;

- Short work experience and frequent changes of employers;

- Lack of solvent co-borrowers.

All information collected about the borrower is processed by special software. Based on the processed data, each borrower receives an individual scoring score. Applicants with a low rating will not be able to extend the processing time of their application and receive a mortgage.

Some citizens try to deceive bank employees by providing false information and false certificates. The frauds are quickly uncovered by the Sberbank security service. The applicant's application is rejected with the wording “false data”. Can Sberbank extend the mortgage application in this situation? If fraudulent activities are detected, Sberbank blacklists the businessman and submits an application to law enforcement agencies.

Nuances associated with extending mortgage approval

If you intend to contact the bank with a request to extend the approval of your mortgage application, then remember that the following options are possible:

- Refusal to provide a loan. This is a rare case; in most cases, banks give a positive decision. Refusal is possible in the presence of serious circumstances - in particular, a change in the client’s life circumstances for the worse. These include loss of a job, sudden and serious health problems, deterioration of credit history, etc. Also, refusal may result from a change in the bank’s credit policy.

- Receiving a smaller amount. In this case, the client receives a mortgage - but it is possible that the funds provided will not be enough for him to purchase the selected property. This will lead to the need to search for additional sources of financing.

- Increase in interest rate. The bank may assign it not in the same amount, but in accordance with the tariffs in force at the time of renewal, or increase it for other reasons.

It should be borne in mind that any bank working with mortgages is a commercial financial and credit organization that seeks to get the maximum benefit not only from each transaction, but also from any other circumstances, including those related to the extension of mortgage approval.

How to pay off your mortgage early

First, let's talk about whether it is possible to reduce the mortgage term at Sberbank. To get a clear answer, let’s turn to the provisions stated on the website of the financial regulator itself.

The bank offers us two options:

- Pay off your mortgage at a bank branch

- Take advantage of the capabilities of Sberbank Online.

With the first option, everything is clear, just come to the bank and write a corresponding application. Therefore, we will dwell in detail on how to reduce the term of mortgage lending via the Internet.

The scheme is simple:

- Log in to your Sberbank Online personal account.

- Go to the “Transfers and Payments” section.

- Click on the item “Loan repayment at Sberbank”.

- We fill out the specified form.

- We are freed from credit “bondage”.

Note! If you decide to repay the loan partially, wanting to reduce the payment period, you need to personally (or by proxy) contact a bank branch and write a corresponding application.

If a partial payment is made through Sberbank Online, the system will automatically reduce the amount of the remaining payments, but the time period will remain the same.

Features of term extension

It is possible to extend the period of consent to receive a mortgage loan. To do this, you need to submit an application to the bank and wait for the results of its consideration. The loan manager can extend the mortgage approval period with some tricks:

- Increase in loan interest rate;

- Reduction of the approved amount;

- Refusal to provide a housing loan.

A client who does not take advantage of the extension of the mortgage period may face an initial refusal. After resubmitting your application, it is usually approved.

Important!

If unforeseen difficulties arise, a person must contact a bank employee for permission. If the manager cannot help the client, the latter must call the bank’s hotline.

The reasons for refusal to provide a housing loan must be clarified. It is quite possible that they can be easily eliminated. Also, the bank can provide a loan on the terms in force at the time of re-application.

How to extend the payment period

Now let's talk about whether it is possible to increase the term of the mortgage at Sberbank. It is necessary to understand that the bank is not a charitable organization, and when making a decision on this issue, it will try to extract the maximum benefit for itself. In practice, three scenarios are possible:

The client’s mortgage term is extended, reducing monthly payments proportionately

This process is called restructuring and is aimed at facilitating debt servicing. The bank can leave the interest rate unchanged or reduce it at its discretion.

The client must provide compelling reasons for extending the mortgage and, importantly, document them.

Most of the bank’s positive decisions occur in cases where:

- The borrower is fired from his job and is actively looking for a new one. The reasons for dismissal (downsizing or the borrower’s own professional unsuitability) play a significant role.

- Force majeure circumstances occur (flood, earthquake, fire) that significantly worsen the financial situation or health of the borrower.

- The borrower loses his ability to work for a long period of time or begins to care for a seriously ill relative, provided that this happened after the mortgage was issued.

- The borrower's employer delays payment of wages.

- A close relative of the borrower or one of his co-borrowers dies.

Is it possible to extend the mortgage term?

It is possible to increase the mortgage term with a commensurate reduction in monthly payments. This process is called loan restructuring and is aimed at reducing the financial burden on the borrower. A mortgage extension can only be carried out at the bank where the loan was issued and only if there are compelling reasons supported by documents. Only those who really need it can use the restructuring service.

Situations in which the bank can approve an increase in the term of the mortgage loan:

- Dismissal of the borrower from work due to a planned reduction in staff or due to the liquidation of the enterprise.

- Force majeure situations that significantly affected the financial position or health of the borrower.

- Loss of ability to work due to illness of the borrower himself or the need to care for a seriously ill relative.

- Delay of wages.

- Going on parental leave.

Citizens who participated in hostilities, disabled people and guardians of disabled minors can also increase the mortgage term.

To extend the mortgage, the borrower must contact the bank with an application to change the loan term and provide documents confirming the fact of a difficult financial situation. Depending on the situation, this may be a certificate of illness, a child’s birth certificate, a certificate from the employment center, etc. Each case is considered by the bank on an individual basis. Recalculation of the amount of payments in accordance with the changed terms of the loan is carried out from the moment the application is submitted to the bank.

Mortgage borrowers who find themselves in a difficult financial situation and having problems repaying their loans have the right to take advantage of mortgage holidays - suspend payments completely or reduce their size. Vacations can be taken out at any time during the term of the loan agreement in the following cases:

- Job loss.

- Receiving 1 or 2 disability groups.

- Increasing the number of persons who are dependent on the borrower.

- Decrease in total income by 30% over the last 2 months.

- Incapacity for work for more than 2 months in a row.

During the mortgage holiday, the borrower may not make monthly payments at all or pay an amount that is comfortable for him, the amount of which he determines independently. In any of the options, payments are postponed to the end of the payment schedule, and the lending period is extended for the duration of the mortgage holiday.

There are several types of mortgage holidays:

- Full deferment. The borrower does not pay the loan, the total mortgage term is extended for the deferment period.

- Interest repayment. The borrower pays only the interest amount.

- Increasing the mortgage term. The bank extends the loan term and recalculates the amount of payments.

- Changing the amount of payments. The borrower pays only part of the previously established monthly payment. The unpaid balance is carried forward to subsequent payments.

The client has the right to independently choose the payment option that suits him. This will not affect your credit score in any way.

To apply for a mortgage holiday, you must notify the bank about your difficult life situation and provide the necessary documents.

The lender will review the application and make a decision. The bank cannot refuse to provide a grace period if all conditions are met. Comment Expert's answer

Useful tips for borrowers

Now that you have an idea of the main ways to change the mortgage payment schedule, let’s consider particular situations that Sberbank clients often encounter in practice:

- Indicate to the bank employee with whom you are working that the mortgage is a loan for “personal use,” which means, according to Federal Law No. 284 of October 19, 2011, you have every right to repay it early.

Open the Sberbank website on your mobile device and show the consultant the section on early loan repayment.