Borrower's rights under the law

According to Law No. 284-FZ of October 19, 2011, the bank does not have the right to refuse a borrower early repayment of a mortgage. Upon official application, each client is allowed to close a mortgage loan with Sberbank earlier, without the consent of the lender. However, it is important to notify the institution of your desire in advance - no less than 30 days before the date of planned debt repayment. The specified period is specified in the mortgage agreement.

Important!

Some bank contracts specify a minimum amount for early repayment. In Sberbank it is 15 thousand rubles.

Some commercial banks provide a commission for early repayment in the amount of 3-5% of the payment made. But penalties do not apply to mortgages - according to the law, the lender does not have the right to fine the borrower for wanting to repay the loan before the end of the contractual relationship.

How to change mortgage payment terms

Paying even the minimum amount in excess of the monthly payment helps reduce the principal amount and requires recalculation of interest. Banks offer two options for early repayment:

- With the same amount of established monthly payments, but reducing the payment period;

- Or with their reduction, but maintaining the date of full repayment.

Both procedures are quite simple and do not require the collection of additional documentation or commission sanctions. You just need to clarify the amount required to repay the mortgage and fill out the RAP in the application or bank branch.

You can recalculate the term of a mortgage loan at Sberbank using a calculator.

Reducing the mortgage term

In case of partial early repayment, the client can shorten the mortgage term without changing the size of the monthly payment, unless otherwise specified in the mortgage agreement. Every borrower has the right to use the service, regardless of his income level and loan size. Early repayment of a mortgage with a shorter term is possible only at a bank branch upon an official application.

Payment reduction

You can reduce the payment on a mortgage loan at Sberbank at a bank branch or through the borrower’s personal account, unless otherwise specified in the loan agreement. After partial early repayment, a payment schedule with new payments can be obtained through the mobile application.

Reducing payments using maternity capital

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

In order for the issue of repaying the mortgage with maternity capital to be officially agreed upon, it is necessary to send a certificate to the Pension Fund of the Russian Federation about the balance of the loan debt. Once approved, the subsidy is transferred to the borrower's account to pay off interest and principal.

Penalties, penalties and fines cannot be covered with maternity capital funds.

After recalculating the loan and reducing monthly installments, a new payment schedule can be obtained at the Sberbank office or in the mobile application.

It is important to know! When using maternity capital, the total term of the mortgage does not change!

How to reduce your monthly mortgage payment using Maternity Capital?

Maternity capital is not provided in cash. This imposes certain features on the registration procedure. To use funds to close a mortgage, you must:

- Visit the financial institution where the mortgage was issued and obtain a certificate confirming the availability of the loan.

- Complete a notarial undertaking. The recipient of a mortgage using maternity capital is obliged to allocate a share in the real estate to the children and spouse. However, until the debt is repaid, it will not be possible to carry out the action. Therefore, it is necessary to draw up a notarial undertaking that the person will allocate a share in the apartment after the closure of the mortgage obligations.

- Contact the Pension Fund for the transfer of maternity capital. To complete the procedure, you must submit an application. An alternative is to use the capabilities of the MFC, the State Services portal or your personal account on the pension fund website. The application should be supplemented with a certificate for maternal capital, the borrower’s passport and SNILS, a marriage certificate, a copy of the loan agreement, a document confirming the purchase and sale of real estate, an extract from the Unified State Register of Real Estate, a notary obligation and a paper confirming the fact that the bank has paid for the purchase of housing.

- Wait for a response from the Russian Pension Fund. Review of the application takes 1 month. Then, within 5 days, the client must be informed of the decision.

- Contact the bank with an application to repay the mortgage with maternity capital. If the debt is not paid off completely, it is necessary to agree with the bank on a new repayment schedule. To ease the strain on your budget, you may need to reduce your monthly mortgage payments.

- Get a new schedule and start making payments to the bank according to the established scheme.

Reducing the mortgage term VS reducing the monthly payment

With partial early repayment, the question arises, what is more profitable, shortening the mortgage term with Sberbank or reducing the monthly payment? You can understand it with a specific example.

The borrower, on April 8, 2021, took out a mortgage for 1,500,000 rubles for 7 years, at 10.2%. If monthly payments in the amount of 25,919 rubles are made on time, according to the schedule, the overpayment will be 573,930 for the entire period of using borrowed funds.

The borrower has a deposit in the same bank in the amount of 800 thousand rubles, but its validity period ends on April 1, 2021. It turns out that in exactly one year he will contribute 800 thousand as partial early repayment.

Option 1. Reducing the term of the Sberbank mortgage.

If all the money is deposited, the final payment date will be postponed to 03/08/2021, i.e. will be reduced by 49 months. At the same time, the full overpayment will be 201,213 ₽. and will decrease by 372,717 ₽.

Option 2: How to reduce your monthly fee.

The borrower can also reduce the loan burden and reduce monthly payments. As a result, in 7 years he will replenish the bank’s capital by 317,037 rubles, the savings for the debtor will be 256,893 rubles.

Analyzing the examples given, reducing the loan term is much more profitable. But the second option also has its advantages: if you continue to pay according to the old payment schedule, making partial early repayment every month, the mortgage payment period will be reduced along with the overpayment.

Pros and cons of reducing mortgage payments at Sberbank

The main advantages of early repayment with a reduction in monthly amounts:

- The borrower's financial situation improves.

- There is an opportunity to use the saved funds for personal purposes.

- The borrower can open a deposit and use the interest received to pay off the mortgage.

- By reducing the loan burden, the client will increase his chances of receiving approval from another bank.

The only drawback : when making partial early repayment with a reduction in the mortgage term, the borrower will save a larger amount of money than by reducing monthly payments.

Mortgage refinancing

If you have already taken out a mortgage from Sberbank, how can you reduce the interest rate on it? When the bank does not want to revise the rate in any way, the client has the right to apply to another credit institution for refinancing. Such programs are available almost everywhere; you just need to adequately assess the profitability of debt transfer.

We advise you to familiarize yourself with the conditions and requirements for the borrower to refinance a mortgage at Sberbank. Information can be found on the bank's website or.

If you carefully study the conditions of transferring to another bank, you can reduce the interest rate on your existing mortgage at Sberbank. Pay attention to the new interest rate, repayment period, amount of overpayment, the need for encumbrance and associated expenses. As a result of a well-calculated refinancing, it is possible to save tens and even hundreds of thousands of rubles. Especially if the initial bid was high enough.

Refinancing involves reviewing a loan application, as when applying for a previous mortgage. You need to collect documents about employment and income, fill out a form and provide a complete package of documents for collateral (if it is under the terms of the new loan).

Is the interest rate on mortgages at Sberbank reduced under the state refinancing program by 5-6%? Yes, this is provided, but the available loan must meet the following conditions:

- a second or subsequent child was born in the borrower’s family in the period 2018-2022;

- the loan amount should be no more than 6 million rubles, but in the capital and St. Petersburg - up to 12 million rubles;

- down payment – from 20%;

- The purpose of the loan is the purchase of a new building at the stage of construction of a house or a ready-made apartment from the developer.

The essence of the state program () is to subsidize the interest rate on mortgages at 5-6%. If the client has a financial protection policy, his payment schedule is recalculated at 5%; if not, at 6%. The difference between this value and the base interest is paid by the state.

Recommended article: Uralsib Bank Mortgage: programs, conditions, documents

The client will need to submit an application to Sberbank to reduce the mortgage interest rate. It should be accompanied by the child's birth certificate. These documents are submitted to the bank for review, after which it notifies the borrower of a revision of the schedule.

Conditions for early repayment under a mortgage agreement

Each borrower, having received a loan from Sberbank, has the right to arrange partial or full early repayment, if this does not contradict the terms of the loan.

It is important to clarify in advance the type of payments that the borrower makes each month. This is necessary in order to decide on a profitable option for early repayment.

When making an annuity payment

When applying for partial early repayment for a loan with annuity payments, the borrower can independently decide whether to reduce the monthly mortgage payment or shorten its payment period.

Partial early repayment of the loan is carried out:

- on the Sberbank Online website;

- at the regional office.

In the first case, there are restrictions:

- it is impossible to shorten the payment period online; to do this, you will need to contact the bank office with an official application;

- The minimum amount for NDP is not less than 99% of the amount of the next monthly payment.

In case of partial early repayment, additional payments are not required.

With differentiated payment

Partially early payment of the mortgage is credited to the loan account, repaying the debt of future periods, canceling the borrower's obligation to pay it at that time. The client will be able to temporarily reduce the mortgage payment, easing the financial burden.

For example

The loan payment is 20,000 + accrued interest on the remaining debt. This month, the borrower contributed 100,000 rubles, completing a partial early repayment. Therefore, over the next 4 months he only needs to pay interest on the loan. On the fifth month, the borrower will again have to pay 20,000 + interest for the period.

Is it possible to shorten the term of a mortgage loan?

The rules for processing and changing mortgage loans indicate 2 ways to change the deadlines for paying off loan debts:

- reduction of regular payments

- term of the loan.

In Sberbank, only the first option is valid, and this is specified in the rules of the credit institution, therefore, if the client decides to pay the debt amount earlier than the period specified in the agreement, he will have to apply for additional payments, which will accelerate the total payment period to 2 years.

An application for early payment must be submitted no later than 1 business day before the next payment is due. Reducing the deadline for submitting an application makes early payments at Sberbank more convenient compared to credit institutions that require submitting such an application no later than a month before the planned payment date.

In the application for early payment, you must indicate the credit agreement number, the date and amount of payment, as well as the details of the bank card from which the specified amount will be debited.

It should be remembered that applications for early payments are submitted to the same bank branch where the mortgage agreement was drawn up, and the payment amount should not be less than 15 thousand rubles.

Other additional conditions for over-time payments at Sberbank are:

- additional mortgage payments are tied to the payment schedule specified in the agreement;

- mortgage debt is paid off with a smaller portion of the deposited funds, which are used to repay the main loan;

- along with a positive decision on the application for additional payments, a new mortgage payment schedule is provided;

- Early payments are not subject to fines or fees.

The client can reduce the term of the mortgage loan if he pays the entire amount one time and ahead of schedule. Partial repayment of the loan reduces the amount of monthly payments, but does not reduce its term.

Under some bank programs, there are restrictions on additional mortgage payments, which can be found on the lender’s website.

You can ask questions by calling the Sberbank hotline

The nuances of early repayment on a military mortgage

Partial early repayment is also possible for a military mortgage, but to obtain it you do not need to submit an application in advance. The borrower can deposit any amount into the Rosvoenipoteka account, and it will be written off in full. The new payment schedule will appear in your personal account the next day.

Under the program for military personnel, only a reduction in the mortgage payment period is allowed. For this category of borrowers, this is quite profitable, because you can quickly remove the encumbrance and register ownership of the property.

How to reduce your mortgage term

Is it possible to reduce mortgage debt? Of course you can. To do this, you must deposit part of the funds and partially pay the debt ahead of schedule. Another method is to repay the loan in larger installments than required, and the loan period will change automatically. You can reduce the mortgage term at any Sberbank office or in your personal account in the Sberbank-Online system.

Through Sberbank Online

Log in to your online banking system and select a valid loan product. Next, go to the full or partial repayment section. Enter the data in the fields provided and secure the operation with an SMS code. Select the account from which the money will be transferred. Determine a convenient date for debiting the money. Select the payment amount and submit your request.

At the bank office

You can submit a request for early repayment of a loan at any branch of this organization. The main thing is that it should be in the same locality in which the loan was issued. If the client has changed his place of residence to another city or region, the debt must be linked to the last place of residence. Take your passport with you, fill out the application, and on the date the next payment is written off, your debt will be reduced by the selected amount.

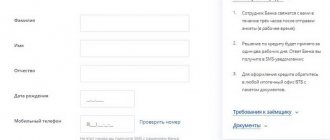

Submitting an application for early repayment of a mortgage

There are two ways to apply for early repayment of a mortgage: through Sberbank Online or at a branch.

Closing a mortgage through Sberbank Online

Early repayment through your personal account is another online service available to every Sberbank client.

In your personal account, select a mortgage and go to the partial or full repayment section. After filling out all the fields, you must confirm the application for early repayment using an SMS code.

Partial repayment

You must adhere to the following algorithm:

- Go to the “Partially repay the loan” section.

- We select the card from which funds will be transferred to the credit account.

- We decide on the repayment date. You can choose any day, even the one on which the application is submitted.

- We indicate the amount.

- Click “Submit an application”, check the application parameters and confirm the actions via SMS.

A new schedule with a reduced monthly payment can be obtained in your personal account or bank branch.

Full repayment

Full early repayment procedure:

- Go to the “Repay the loan in full” section and select the write-off account.

- In the case of DAP, on the day of application you need to indicate the amount that is written in the window that appears.

- If you choose to repay the next day, you must independently calculate the interest for the additional day.

Restrictions when completing an online application

Design features:

- The minimum payment for partial early repayment in your personal account must be no less than 99% of the next monthly installment. To deposit a smaller amount, you must contact the bank office.

- In case of partial early repayment through a personal account, the borrower has the right only to reduce the amount of the monthly payment.

- Funds must be transferred before 21:00 to avoid additional interest charges.

At the Sberbank office

You can submit an application for early repayment at any bank branch, but only in the city in which the agreement was signed. If the borrower has moved, it is necessary to transfer the mortgage to the bank at the new place of registration.

Package of documents for mortgage repayment

When filling out an online application, the system does not need all the documents collected to obtain a mortgage for an apartment. But when contacting a bank office, a passport is required.

If the borrower transfers a mortgage from another city, then you will also need to present a loan agreement.

In order to find out the amount required for early repayment through the hotline, you should tell the operator the contract number and passport details.

In some cases, full early repayment allows you to return part of the cost of unused insurance. In this case, you will need to come to the bank with a complete set of mortgage documents.

Useful tips for borrowers

Now that you have an idea of the main ways to change the mortgage payment schedule, let’s consider particular situations that Sberbank clients often encounter in practice:

- Unprofitable savings . When receiving a large sum of money, many people strive to quickly pay off their debts. However, this decision is not always economically correct. Often banks and other financial organizations offer the public short-term deposits with attractive interest rates and conditions. Perhaps by investing in one of these programs, you will get more than you will save by repaying the loan early. Therefore, before reducing the payment period, consider all possible options and make sure that you will not lose.

- Wrongful refusal. Above we have described the current methods for changing the terms of a mortgage loan. However, in practice, people continue to face refusals when trying to repay their mortgage early through a bank. This is due to Sberbank’s unspoken internal system of fines and incentives. Taking advantage of the client’s legal illiteracy, employees must impose unclaimed services on him and dissuade him from decisions that are unfavorable to the bank. However, such actions are illegal, so if you are faced with a refusal in 2021, proceed according to the following scheme:

- Indicate to the bank employee with whom you are working that the mortgage is a loan for “personal use,” which means, according to Federal Law No. 284 of October 19, 2011, you have every right to repay it early.

- Open the Sberbank website on your mobile device and show the consultant the section on early loan repayment.

- If your mortgage agreement has an early repayment clause, you can refer to it as well.

- Positive impression. The right to early repayment of a mortgage is enshrined in law. As the period increases, the situation is different. If the client wants to change the payment schedule, he will have to convince the bank that financial difficulties are temporary and his solvency will soon be restored. Will help with this:

- The borrower has a good credit history.

- No current loans from another financial institution.

- Availability of material resources (deposits in Sberbank, owned housing, etc.).

As a rule, this is enough for careless employees to back down . If this does not help, leave a complaint using any of the methods suggested in the link, and then pay off your mortgage through Sberbank Online.

This concludes this topic. If you still have questions about whether it is possible to change the term of your mortgage at Sberbank after signing the agreement, ask them in the comments and we’ll discuss it.

Advice for Sberbank mortgage holders

Recommendations for future and current Sberbank borrowers:

- Please fill out the loan application carefully. Most refusals occur due to incorrect data being entered.

- If you decide to take out a mortgage with no down payment, be prepared for a more thorough check of your credit history. Similar loans are issued at high interest rates.

- The approval period for a mortgage at Sberbank is 3-5 days, during which time you should soberly assess your own financial capabilities in order to pay off the mortgage without problems.

- When applying for partial early repayment, shorten the loan repayment period if you can afford the monthly payment.

- When conducting any transactions with a credit account, be sure to check all the specified details.

- After repaying your mortgage from Sberbank, be sure to take a certificate of closure of the loan, so that if a controversial situation arises, you can use official confirmation.

See also: several useful life hacks for early loan repayment from Channel One journalists.

Non-standard ways to pay off a mortgage early

You can pay off your mortgage early or partially by applying for a tax deduction or receiving interest on the deposit.

Renting out a mortgaged apartment

Clause 4.1.3 of the Sberbank loan agreement states that renting out a mortgaged apartment is prohibited. Only in rare cases does the bank allow this possibility:

- when the borrower is laid off or fired from work;

- in case of loss of part of income;

- with temporary disability.

You can legally register a mortgaged property for rent only with the permission of Sberbank. In all other cases, penalties and legal proceedings are provided.

Tax deduction for the purchase of an apartment

The maximum tax base for calculating the tax deduction for the purchase of an apartment is 2 million rubles. At the same time, if you have an official salary, you can return up to 260 thousand rubles. The amount of the refund directly depends on the taxpayer’s income level.

A good example: the borrower took out a mortgage on an apartment worth 2.7 million rubles. His salary is 70 thousand. Monthly income tax to the state budget is 9,100 rubles, and per year - 109,200 rubles. Therefore, he will be able to receive a tax deduction for 3 years:

- in the first two years - 218,400 rubles;

- last year - 41,600 rubles.

You can independently calculate the approximate amount of tax deduction for the year using an online calculator.

Tax deduction for mortgage

Maximum tax base for mortgage deduction:

- real estate purchased before 2021 - 1 million rubles;

- the transaction was completed before 2014 - 2 million rubles;

- the apartment was decorated after 2014 - 3 million rubles.

It turns out that when applying for a mortgage loan after 2014, the borrower has the right to reimburse up to 390 thousand rubles for the entire loan term.

Example: the borrower took out a mortgage on an apartment in the amount of 2.1 million rubles, the overpayment on interest amounted to 1.259 million. Having a salary of 60 thousand rubles, he will receive a tax deduction:

- for real estate - 260,000 rubles;

- for a mortgage - 163,670 rubles.

When purchasing an apartment after January 1, 2014, each spouse can apply for a tax deduction, even if only one is the borrower. Pensioners can also receive the paid 13% if no more than three years have passed since their retirement.

Deposit

With good financial capabilities, the borrower can open a bank deposit or a debit card with interest on the balance, the rate should be higher than for a mortgage. The income received at the end of the term can be used to repay the loan. If the rate is lower, then it is better to use available funds for early repayment.

Pros and cons of early mortgage repayment

Main advantages:

- the client saves significantly on interest;

- removal of encumbrances on real estate;

- After paying off the mortgage, free funds will appear;

- after full repayment, you can rent out the apartment and receive additional income;

- the client can become the sole owner of the apartment by receiving an extract of ownership.

Flaws:

- by paying off the mortgage early, the borrower loses the opportunity to receive a tax deduction in full;

- if the debtor planned to purchase a car in the coming years, then it is better to save up funds and buy it in cash rather than arrange partial early repayment of the mortgage and apply for a car loan.

By choosing the option of reducing the monthly payment for partial early repayment, the borrower can independently reduce the terms of the mortgage payment. In this case, you need to make payments every month not according to the new payment schedule, but according to the old one, thereby reducing the overpayment.

If we consider the issue from the other side, then the borrower will come to the aid of restructuring or refinancing in another bank.

In the first option, the lender can increase the length of the mortgage term to ease the financial burden of the borrower. Such an increase will reduce the client's monthly payment.

In the case of refinancing, you can not only increase the term of the mortgage, but also reduce the interest rate on the loan.

Is it possible to shorten the term without early repayment of the loan? Solutions

The first option is eliminated, since in this case the borrower receives only a temporary respite while maintaining the original parameters of the agreement.

The second option involves refinancing the borrower on new terms. In this case, you can shorten the period, as well as change the percentage and amount of the down payment. However, the credit burden is unlikely to decrease as the old mortgage is replaced by a new loan. And besides, Sberbank does not honor the procedure for refinancing its own mortgage borrowers, therefore, this method is also eliminated.

There remains a third method, which involves changing the terms of the agreement in terms of reducing the monthly payment, lowering the interest rate on the loan, changing the currency or extending the loan period. It is one of these options that the largest bank in the country offers when it comes to the impossibility of further fulfilling mortgage obligations. At the same time, with this method it is almost impossible to reduce the loan repayment period.

Summarizing the above, we can draw the following conclusion: it is possible to reduce the mortgage term in Sberbank, as well as in any other bank, provided that the borrower can increase the expense ratio associated with the fulfillment of the loan obligation.