Important features and nuances of selling an apartment with a Sberbank mortgage

If the housing was purchased with government support, including the use of maternal capital (especially if the owners include minor children), or a military mortgage, then the sale will have a lot of restrictions. Let's look at how to sell an apartment with a mortgage in the indicated cases.

Sale of an apartment purchased with a military mortgage

A military serviceman who is a participant in a preferential lending program with funds allocated from the state budget can sell an apartment secured by Sberbank in the following way:

- An application is written to Rosvoenipoteka explaining the situation and asking to remove the mark of encumbrance from the apartment purchased with the help of budget funds.

- At the same time, an application is submitted for re-participation in the NIS (if age and length of service allow, then this is done in order not to lose your right to receive a preferential mortgage).

- Sberbank notifies Rosvoenipoteka about the balance of the debt (with a payment schedule and account statement attached).

- The balance of the debt is repaid by the borrower from his own savings, and the budget money received by Sberbank from Rosvoenipoteka is returned and credited to the serviceman’s individual account.

- The encumbrance is removed from the object.

If the serviceman does not have enough money or does not have enough money, then it is possible to re-issue a military mortgage in another bank.

An alternative to the described algorithm of actions could be an assignment of rights or assignment, for example, to another NIS participant.

If maternity capital was used

It is extremely difficult to obtain permission from any Russian bank, including Sberbank, to sell a mortgaged apartment with maternal capital. This is due to the following nuances:

- obtaining permission from the guardianship and trusteeship authorities (given only after verifying the facts that the rights of children will not be infringed in the future);

- selling only for certain purposes: selling and buying new; exchange; to build your own house or place the proceeds on a deposit in the names of children;

- allocating mandatory shares to all family members, including minor children.

The most common situation is the sale of an encumbered living space and the purchase of a new one, usually more spacious.

Procedure for selling a mortgaged Sberbank apartment with maternal capital:

- Obtaining permission from OOiP (provided in written format) and Sberbank.

- Searching for a seller who will agree to buy an encumbered apartment.

- Concluding PrEP with him.

- Repayment of the outstanding balance based on the current loan account statement.

- Removal of encumbrance.

- Searching for a new property and purchasing it.

IMPORTANT! If the trusteeship authorities refused to sell a mortgaged apartment with capital capital, there is no way to bypass this decision, since all such transactions are monitored and controlled. Read more about how to sell an apartment purchased with maternity capital here.

If there are minors

If an apartment that was purchased with a mortgage through Sberbank belongs to minors along with adult family members, then, by analogy with the previous paragraph, the sale of real estate will require official permission from the guardianship and trusteeship authorities.

Their main task is to monitor compliance with children's rights, as well as study future living conditions. Specialists must ensure that sanitary and hygienic standards will be maintained or improved and that the share will not be lost or reduced.

In most cases, POiP go to the site and then draw up an independent report on the feasibility of the planned transaction for the sale of the current apartment.

A transaction for the sale of real estate with minors is fraught with risks for the seller, since through the court in the future it is quite easy to prove the nullity of the transaction and non-compliance with the rights of children (especially at a young age). Read more about how to sell an apartment with minor children.

Receipt of funds and terms of loan repayment

The loan is provided to citizens of the Russian Federation at Sberbank branches:

- at the place of registration of the borrower or one of the co-borrowers;

- at the borrower’s place of work;

- at the location of the loaned property.

Repayment of the borrowed amount is carried out in equal payments on the specified date.

In case of late payment, a penalty will be charged, which is equal to the credit rate at the time of the loan. The penalty is accrued for the period from the day following the date of the calendar payment until the date of repayment of the debt under the mortgage agreement. The client has the right to early repayment of the borrowed amount. To do this, a corresponding application is drawn up, which contains the amount and date of early payment, as well as the account from which the money transfer will take place. The repayment date must fall on a business day only.

For more information, you can go to the official Sberbank page.

Features of a mortgage for the purchase of finished housing

A mortgage for the purchase of housing from the secondary market has its own conditions, compliance with which will help you get the required amount. This loan, unlike a mortgage for housing under construction, is issued only for the purchase of a house, residential premises or apartment. The list includes any property that has the status of finished housing. General conditions for the mortgage program for finished housing:

- interest rate of 7.3% per annum

- minimum amount - from 300 thousand rubles

; - the maximum amount should not exceed 85%

of the contractual or estimated value of the purchased housing; - term - up to 30 years

; - the minimum down payment is at least 15%

;

Important!

Sberbank can issue a mortgage even if the borrower does not provide documentary evidence of income and employment levels.

Requirements for the borrower:

- Citizenship of the Russian Federation;

- Availability of a permanent place of registration;

- Borrower's age is from 21 to 75 years;

- Having at least 1 year of work experience over the last 5 years.

If the client does not provide proof of employment and income, the age at the time of loan repayment is 65 years.

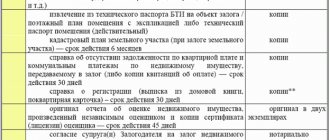

Documents for obtaining a mortgage

The list of documents established by Sberbank may vary for clients falling under the salary project, as well as for clients who have documented proof of employment.

Important!

The list of documents listed below is subject to change.

To clarify information, you can contact the Contact Center at 8 800 555 55 50

.

List of basic documents without proof of employment and income:

- Mortgage application from the borrower;

- Russian passport with registration information;

- Identity document (military ID, driver's license, international passport).

Upon confirmation of employment:

- Mortgage application from the borrower/co-borrower;

- Russian passport of the borrower/co-borrower with registration information;

- Documents confirming the employment of the borrower/co-borrower.

- Document confirming registration at the place of stay;

- Documents on the provided collateral.

All mortgage lending programs at Sberbank

| The name of the program | Rate, year | Loan terms | Amount, from | An initial fee |

| Purchase of housing under construction | from 0.9% | up to 30 years old | from 300 thousand rubles | from 15% (from 50% without confirmation of income) |

| Purchase of finished housing | from 7.3% | up to 30 years old | from 300 thousand rubles | from 15% |

| Refinancing mortgages and other loans | from 7.9% | up to 30 years old | from 300 thousand rubles | — |

| Mortgage with state support for families with children | from 0.1% | up to 30 years old | from 300 thousand - up to 12 million rubles | from 20% |

| Construction of a residential building | from 8.8% | up to 30 years old | from 300 thousand rubles | from 25% |

| Non-targeted loan secured by real estate | from 10.4% | up to 20 years | from 300 thousand - up to 10 million rubles | — |

| country estate | from 8.0% | up to 30 years old | from 300 thousand rubles | from 25% |

| Mortgage plus maternity capital | from 4.1% | up to 30 years old | from 300 thousand rubles | from 15% |

| Mortgage under the program for the purchase of finished housing | from 7.9% | up to 30 years old | from 300 thousand rubles | from 15% |

| Military mortgage | from 7.9% | up to 20 years | from 300 thousand - up to 3.251 million rubles | — |

| Garage or parking space | from 8.5% | up to 30 years old | from 300 thousand rubles | from 25% |

| Loan restructuring | — | — | — | — |

Interest rates on a mortgage loan at Sberbank

The interest rate on a mortgage for the purchase of finished housing does not have a fixed rate, which depends on premiums and promotions. The rates below apply to borrowers who receive a salary from Sberbank, or if the purchased property was built with the participation of bank loan funds. Additional interest will be charged if:

- I have a Sberbank salary card - 0.5%.

- the borrower activates the life and health insurance program - 1%.

Clients who do not provide proof of income and employment can obtain a mortgage using 2 documents.

The following interest rates apply:

The mortgage program under 2 documents includes real estate built with partial participation of borrowed funds from Sberbank (subject to an initial payment of 50%).

You can use a loan calculator to pre-calculate the interest and amount.

Requirements for mortgage housing

The requirements of Sberbank of Russia for real estate registered under a mortgage program are based on its liquidity.

Even without knowing the exact parameters, it is enough to adhere to the following rule: the easier it is to sell a home profitably, the more suitable it is for the bank. Whether a property complies with this rule depends on a number of factors.

Location of the house

Housing that has a good chance of being approved by the bank:

- located on the territory of the Russian Federation,

- located within the city or in the nearest suburbs;

- there is developed infrastructure around the property;

- located in an environmentally favorable location.

Many banks do not lend to apartments in dormitories and hotel-type premises, as well as those located on the first or last floors. For applying for a mortgage at Sberbank, these facts are not a reason for refusal.

The main thing is that an apartment building must comply with sanitary and technical standards.

Age of the building

Apartments in new buildings are easily approved by a financial institution, but are not a prerequisite for lending.

If you choose living space in a house under construction, then, according to the bank’s terms, the construction stage must be completed by more than 10%.

A house selected on the secondary market will be approved if it meets the following conditions:

- not subject to demolition;

- has less than 50% wear and is not in line for major repairs;

- built no earlier than 1970.

Borrowers rarely pay off their mortgage in a few years, so the bank needs confidence that the building will last for decades.

Design features

The selected house must meet a number of design features. Sberbank has the following requirements for mortgage housing:

- availability of central sewerage and heating;

- the foundation of the house is stone, concrete or reinforced concrete;

- houses built from fragile and flammable materials, for example, buildings with wooden floors between floors, are rarely financed by Sberbank;

- Heating maintenance in the house is performed by city companies with which existing contracts have been concluded;

- The building structure must be intact, without cracks or screeds.

Internal equipment of the apartment

In order to avoid problems with mortgage approval, it is important to take into account the condition of the future home. The location of windows and doorways must comply with technical documentation. Each room must have radiators installed, fully glazed windows, and functioning doors. The mandatory conditions of Sberbank are the following: the presence of at least cold water in the house, a bathroom, and ventilation in the kitchen.

Before approving the selected object, it is necessary to invite a licensed appraiser who will document information about the condition of the apartment and its value and provide the data to the bank. Based on them, the loan will be approved or denied.

Based on this information, you can be confident in the chosen housing option. Sberbank clients rarely complain about the difficulty of obtaining loans; this bank’s requirements for a mortgage property are softer than others, so the choice of housing is much wider.