How an apartment purchased with maternity capital is divided during a divorce

Matkapital is assistance from the state, intended primarily for children, and not for parents. It is now issued after the birth of even the first baby, and is also often used to purchase real estate, but at the same time, some part of the living space is necessarily registered in the name of minors.

When purchasing a home, parents draw up a written obligation, certified by a notary, if a mortgage is issued. When purchasing real estate for cash, the property is immediately registered in the name of all family members.

Sometimes parents even decide to transfer the apartment only to their children. During a divorce, such an object is not divided, since it is not represented by the joint property of the spouses. In other cases, division is made only on equal terms, for which the share of minors is taken into account.

To divide a disputed apartment, different methods are used:

- Sale of real estate , after which the money received is divided among all family members based on their share. But such an apartment can be sold only after receiving approval from the guardianship authorities. In this case, the operation must be carried out in such a way that the rights of minors are not violated. Parents must have property for their children to live in.

- Payment of compensation to one spouse . If it is impossible to sell the apartment because citizens do not have other real estate, then one of the spouses can pay the other compensation for the existing share. It is allowed to give compensation even in material assets, for example, a car, equipment or jewelry can be provided.

- Allocation of shares in kind . But this process is considered too complicated, since ex-spouses rarely want to live in the same apartment, so they try to resolve the issue in other ways.

The division of property is carried out voluntarily or through judicial proceedings. In the first case, citizens sign a peace agreement, which indicates who gets this or that property. If people cannot reach a compromise, they go to court. Usually, the issue regarding the place of residence of the children, the division of valuables and the assignment of alimony is immediately resolved.

The procedure for dividing an apartment through the court is divided into successive stages:

- Initially, a real estate assessment is carried out to determine its market value, and this indicator will be needed if compensation is to be paid;

- documentation for the trial is prepared, and a statement of claim is formed;

- a fee is paid;

- court hearings are attended, at which the judge analyzes the relationship between the spouses and the possibility of dividing the apartment for the purchase of which maternal capital was used;

- After the decision is made, property is divided or compensation is paid.

Citizens are required to strictly follow all orders issued by the judge. If one spouse evades fulfilling his obligations, the second participant in the process may apply to the court or to the executive authorities to bring the violator to justice. Based on a court decision, property is re-registered, for which the shares determined by the judge are taken into account.

Attention! If any spouse does not agree with the decision, he can file an appeal, but if he deliberately refuses obligations, then forced registration is allowed.

It is also useful to read: How to register maternity capital

Division of an apartment in maternity capital in court

In order to legally divide an apartment purchased with maternity capital, the applicant must do the following:

- Determine jurisdiction - in accordance with Art. 24 of the Code of Civil Procedure of the Russian Federation, the claim is filed in a district or city court.

- Assessing an apartment is a particularly important step. Depending on the cadastral price of the property, the duty and the share of maternity capital in the total cost of living space are calculated.

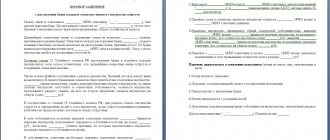

- Prepare a statement of claim for the division of an apartment in the family capital according to the rules established by Art. 131 Code of Civil Procedure of the Russian Federation.

- Collect attachments to the claim in accordance with Art. 132 Code of Civil Procedure of the Russian Federation.

- Pay the state fee and attach the receipt.

- Send the collected papers to the court through the office or the State Automated System “Justice” portal.

- Within 5 days from the date of filing the claim, it is necessary to obtain a ruling on the acceptance of the claim for proceedings, as determined by Art. 133 Code of Civil Procedure of the Russian Federation.

- At the appointed time, you need to appear in the courtroom, provide all the information, state your demands, and attach evidence.

- At the end of the trial, the judge will make a decision, which will come into force in a month. During this period, one of the parties has the right to appeal the adopted judicial act through the appellate procedure, as established by Art. 321 Code of Civil Procedure of the Russian Federation.

IMPORTANT

After the final decision on dividing the apartment in maternity capital is made, it is necessary to register the ownership rights in the Rosreestr branch. This is a mandatory stage, because the composition of the owners changes and the sizes of shares are also redistributed.

What to do if maternity capital acted as a down payment for a mortgage

It is allowed to use funds from the certificate not only to purchase housing for cash, but also when applying for a mortgage loan. Often a large amount is used as an initial investment.

Even when applying for a loan, the basic rule is taken into account, which is that after repayment of the debt, housing should be registered not only in the name of the parents, but also in the name of minors. Therefore, each family member has equal rights to living space.

If spouses decide to divorce, then when dividing housing the following features are taken into account:

- mother and father have equal obligations on the mortgage, although their shares may differ;

- It is quite difficult to sell an apartment before the loan is repaid, since you will have to enlist the support of representatives of a banking institution and guardianship workers, and the sale price will be much lower than the market value;

- the sale of mortgaged housing is permitted only if the mother has other real estate in which the children will be registered, and the guardianship authorities ensure that the living conditions of minors do not worsen;

- one of the spouses can simply refuse their obligations for housing, so he is excluded from the number of borrowers, receiving some compensation, the amount of which depends on the part of the debt that has already been repaid.

Important! Sometimes citizens decide to jointly repay the mortgage, although the woman and children remain in the home, and after repaying the debt, they decide to sell the property and distribute the money.

State duty and deadlines

The size of the state duty is clearly regulated by the norms of the Tax Code of the Russian Federation. In order to apply for the division of an apartment in maternity capital to a district or city court, you must pay a state fee. The size depends on the value of the property:

- If the price of the property does not exceed 100,000 rubles, the fee will be 800 rubles + 3% of the amount exceeding 20,000 rubles.

- In the case when the cost of the apartment does not exceed 200,000 rubles. – 3,200 + 2% of the figure exceeding RUB 100,000.

- Provided that the apartment costs up to 1 million rubles. – 5,200 rub. + 1% of the amount over 200,000 rubles.

- Everything above 1 million – 13,200 rubles. + 0.5% of the amount exceeding 1 million.

The maximum fee is 60,000 rubles. These indicators are regulated by paragraph 1 of Art. 333.19 Tax Code of the Russian Federation.

Speaking about the timing of consideration of the case of dividing an apartment in maternity capital, it is necessary to refer to Art. 154 Code of Civil Procedure of the Russian Federation. Clause 1 of this norm indicates that from the moment the claim is filed in court, claims are resolved within 2 months. In exceptional cases, if difficulties arise during the proceedings, the deadlines are extended by 1 month.

Is the maternity capital itself divided?

If, before the divorce, citizens did not exercise their right to maternity capital, then they still have a certificate issued in the name of their mother. During a divorce, the document remains with the woman, since she is its owner. In the future, the money may be used to increase her pension, purchase rehabilitation equipment for a disabled child, or purchase housing.

The division of this amount is not allowed. A man will be able to claim maternity capital only after the death of his mother or deprivation of her parental rights. In this case, the woman loses the right to government assistance, so the certificate is issued to the father of the children. The same applies to a situation where the mother has committed any crime against her offspring.

Division of an apartment purchased with a mortgage using maternity capital

If an apartment in maternity capital was purchased with a mortgage, then it is best to repay the loan before the divorce, so that there are no difficulties in legal proceedings. In this case, the collateral will be removed and debt obligations to credit institutions will be terminated. However, practice shows that in most cases the encumbrance is not removed, the mortgage is partially paid, so the following must be done:

- Ask the bank for the size of the loan balance so that the judge has an idea of the size of the debt obligations.

- File a claim in court, and demand not only the division of the apartment in maternity capital, but also the mortgage debt.

- In accordance with paragraph 3 of Art. 39 of the RF IC and clause 5 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. dated 04/13/2016, total debts are distributed in proportion to the shares awarded to the spouses by the judge. As a general rule, shares are recognized as equal, but the court can change the size based on the interests of minors. Thus, the judge sets limits on the shares of each spouse. Depending on this, the mortgage debt is divided.

- After the issue of distribution of shares is resolved in court proceedings, the judge begins to consider the claims regarding the apartment purchased with a mortgage using maternity capital.

- In accordance with paragraph 1 of Art. 46 of the RF IC, spouses must notify the creditor, that is, the credit institution, of the divorce. Based on this, employees can change the payment schedule or divide the debt between the parties.

- Based on the decision made, the mortgage repayment schedule at the bank changes.

Is maternity capital considered jointly acquired property?

According to the law, maternity capital is not the joint property of spouses. Therefore, after a divorce from her husband, this amount is not divided. She remains at the disposal of her mother or father. The husband has the right to maternity capital if he was initially involved in obtaining the certificate , since the woman has lost her right to state support.

In the event of a divorce, only the apartment for the purchase of which the maternal capital was allocated can be divided, but additional funds from the general budget of citizens were used. Therefore, the man has the right to some share in this property.

It’s also useful to read: Is maternity capital given for twins?

Agreement on the division of an apartment in maternity capital

The most convenient and rational way to divide an apartment in maternity capital during a divorce is to conclude a voluntary agreement between the spouses. This right is provided for in paragraph 2 of Art. 38 RF IC. The document must be certified by a notary; this is the only requirement established by law. There are no separate rules regarding the form and structure of the agreement, so you can freely establish a draft agreement, which is subsequently signed by a notary.

For your information

As part of a voluntary agreement, the parties must sit down at the negotiating table and discuss the option of dividing an apartment purchased with public funds, the procedure and amount of compensation. After this, both need to go to a notary and have the document certified in the prescribed manner. Specialist services are subject to a tariff fee, the amounts of which are reflected in Art. 22.1 Federal Law “Fundamentals of legislation on notaries”.

The tariff amount depends on the subject of the transaction:

- If property worth up to 1 million rubles inclusive is transferred – 3,000 rubles. + 0.4% of the transaction amount.

- If the price is more than 1 million rubles – 7,000 rubles + 0.2% of the amount exceeding 1 million.

- When the amount exceeds 10 million rubles – 25,000 rubles + 0.1 of the amount exceeding 10 million rubles.

The maximum cost of the tariff when dividing an apartment in maternity capital cannot exceed 100,000 rubles.

If not distributed

Allocation of the due shares to children is a mandatory condition, failure to comply with which is punishable by law. And although there is not yet a clear system for monitoring the fulfillment of such an obligation, there are already known cases when parents were prosecuted for fraud, and this is how manipulation with a certificate is interpreted. Unfortunately, manipulations with the receipt of funds, and in particular with their cashing out, can lead to imprisonment for up to two years to five years.

Consequences of refusing to distribute shares to children:

- A court ruling to cancel transactions involving the purchase and sale of housing;

- Forced allocation of shares to minors through the court.

It is also worth keeping in mind that some regions of Russia have launched special responsible commissions, whose activities are aimed at monitoring the fulfillment of obligations (whether maternity capital funds were actually spent on residential real estate).

Arbitrage practice

Court cases related to the division of an apartment purchased with maternity capital funds are complex. There are no direct legislative instructions, so judges have to rely on decisions of higher courts. The following cases can be cited as examples:

- The couple jointly purchased an apartment using family capital for themselves and their three children. The share of each owner was 1/5. During the divorce, the judge decided that the allocation of housing in kind was impossible, which means that the spouse must be compensated for the size of his share. The division of real estate is impossible due to the fact that maternity capital funds were used. The Ryazan Regional Court left the decision unchanged on appeal.

- Citizens M. and N. bought an apartment with the help of maternity capital and registered ownership of M.’s wife and joint son. Each share was 50%. When going to court, the man explained that he did not give notarized consent to register the apartment as the property of his wife and son. The district court decided to divide the apartment purchased with public funds. The Moscow City Court upheld the act on appeal.

These examples clearly illustrate that each situation regarding the division of apartments purchased with family capital is individual and without a qualified assessment by a professional lawyer it is impossible to give an unambiguous answer.