State duty for an extract from the Unified State Register of Real Estate – description, amount, procedure for depositing funds

- Residential redevelopment

- Property deduction - sample declaration

- Rent an apartment with pets

- Neighbors flooded: step-by-step instructions

- Citizenship

- Property relations

- Pension provision

- Family

- Labor and employment

- Social Security

- Taxes and fees

- Production and trade

- Healthcare

- Culture and media

- Law and order and security

- UEC and digital signature

- Archive

Lorem ipsum dolor sit amet...

Consectetur adipiscing elit. Cras lorem urna, mattis in ornare at, lacinia eleifend eros. Vestibulum quis dignissim nisi.NULLam a nunc nisi. NULLa eu odio nec urna posuere lobortis quis venenatis magna. Fusce nunc eros, pellentesque commodo nunc eleifend, imperdiet convallis orci.

Fusce non elit ut nunc posuere blandit. Vestibulum at erat quis elit hendrerit ornare vel et ante. Pellentesque id leo suscipit, condimentum quam laoreet, congue lorem. Duis congue eros non posuere varius.NULLam a nunc nisi. NULLa eu odio nec urna posuere lobortis quis venenatis magna. Fusce nunc eros, pellentesque commodo nunc eleifend, imperdiet convallis orci.

State fees for mortgage registration

Registration of a mortgage under an agreement

- if the contract is concluded by individuals - 1000 rubles (in total);

- between legal entities - 4000 rubles (in total);

- and individuals and legal entities, with the exception of an agreement giving rise to a mortgage on the basis of the law - 1000 rubles in the amount (clause 28.1 of Article 333.33 of the Tax Code of the Russian Federation).

Mortgages are not subject to state duty by force of law.

Expert opinion

Lawyer Alexander Vasiliev comments

A mortgage on the basis of the law arises without concluding a separate mortgage agreement, when the buyer has not paid the price of the real estate before contacting Rosreestr. Based on clause 5 of Art. 488 of the Civil Code, the property will by default be pledged to the seller until the price is paid in full. The mortgage will be registered by force of law without paying state duty in accordance with Part 2 of Article 20 of the Federal Law.

The seller and buyer may not establish a mortgage by operation of law. To do this, it is necessary to directly indicate in the contract that paragraph 5 of Article 488 of the Civil Code does not apply, and the property will not be pledged to the seller.

Registration of changes in the Unified State Register of Real Estate when changing or terminating a mortgage agreement

- if the agreement is concluded by individuals - 200 rubles (in total);

- if the agreement is concluded by legal entities - 600 rubles (in total);

- if the agreement is between an individual and a legal entity - 200 rubles in the amount as for individuals (clause 28.1 of Article 333.33 of the Tax Code of the Russian Federation).

There is no state fee for registering changes to the agreement under which the mortgage arose by force of law.

When making other changes and additions to the mortgage registration record that are not related to the change or termination of the agreement, the state duty will be 350 rubles.

Registration of a change of mortgagee - creditor under a mortgage agreement upon assignment of rights under an obligation secured by a mortgage is subject to a state duty in the amount of 1,600 rubles.

State registration of a change in the owner of a mortgage, including the assignment of rights of claim, is subject to a state duty of 350 rubles.

RECEIPT for payment of state duty

The abbreviation EGRP stands for Unified State Register of Rights. Currently, the Unified State Register of Real Estate is in operation, combining two registers - the State Property Committee and the Unified State Register of Real Estate on the basis of the Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” that came into force in January 2021. Now this register is a constantly updated single electronic repository of information about any real estate: apartments, private houses or land plots. The register is replenished by registering legally important information by an official of Rosreestr.

This registry contains several sections following one after another:

- Information about land plots;

- Information about real estate objects located on these sites;

- Information about apartments and other premises included in the above-mentioned object.

Each of these sections contains the following subsections:

- General description of the property;

- Records of ownership and other rights;

- Property Restrictions Records:

- Rental records

- Mortgage records

- Easement records

- Records of transactions that result in restrictions on rights

- Records of the seizure of the property;

- Records of other restrictions on rights;

- Records of free use of a forest plot.

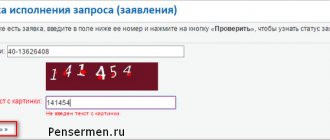

You no longer need to look for a receipt form and tax details to pay the state fee for an urgent extract. The Federal Tax Service for payment of state duties will help you in generating a receipt for payment of the state fee for an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs. We print it out and pay without commission at any bank (fee for the urgent provision of information and documents from the Unified State Register of Legal Entities). We attach the paid receipt to the top edge of the application with a stapler. Using this service, you can also pay the state duty online through one of the partner banks of the Federal Tax Service of Russia.

To receive an urgent extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the stamp of the tax office, you must submit an application for an urgent extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs in free form, to which a document confirming payment must be attached.

On our website we now have the ability to generate a receipt for payment of state duty. Now you don’t need to delve into various KBK codes, check the correctness and relevance of the details, because in case of an error, it will be very difficult to return an incorrectly made payment. As a rule, payers find out that they made a payment using incorrect details only at the tax office when the tax inspector does not accept your documents.

The final stage of registering a company as a newly created legal entity is making a record of this event in the Unified State Register of Legal Entities. For an enterprise, especially if it carries out multilateral activities, an extract from the Unified State Register of Legal Entities is often necessary. Usually it complements the package of vital documents of the company (constituent, statutory main provisions of the company), so you should request it by paying a fee, which is the legally established state duty for issuing an extract from the Unified State Register of Legal Entities. The features of the procedure for obtaining a certificate and the amount of payment for services for its preparation will be discussed in the article.

How long does it take to prepare an extract from the Unified State Register of Real Estate and how long is it valid?

Information contained in the Unified State Register must be provided within no more than three working days from the date of receipt of the request. If you submitted a request to and plan to receive information there, then the entire procedure will take 5 days. Data are considered current at the time of their issuance by the Rosreestr department or.

The day of providing information in the form of a paper document in person is considered to be the date of signing of such a document, indicated as its details, in the form of an electronic document - the date of sending by the registration authority of the rights of an electronic document or a link to such a document. If the document is sent by post, the day the information is provided is considered the day when the document was transferred to the postal service organization.

Sources

- https://rosreester.net/info/gosposhlina-za-vypisku-iz-egrn-ndash-opisanie-razmer-poryadok-vneseniy

- https://egrnreestr.ru/articles/gosposhlina-za-vypisku-iz-egrn

- https://www.mos.ru/otvet-dokumenti/kak-poluchit-svedeniya-iz-egrn/

- https://EGRNka.ru/info/gosposhlina-za-vypisku-iz-egrn/

- https://advokatymurmanska.ru/zhile/gosposhlina-za-vypisku-iz-egrn.html

- https://rosreestor.info/razmer-gosposhliny

- https://egrn365.ru/articles/plata_za_predostavlenie_svedenij_iz_egrn_-_gosposhlina/

State duty for extract from the Unified State Register for individuals in 2021

Details for paying the cost of the extract can be found by entering the phrase “Federal Tax Service payment of state duty” into any search engine. The first link will show you the page of the official website of the Federal Tax Service, on which you should click on the item “Fee for providing information from the Unified State Register of Legal Entities”, and then select the type of extract you are interested in (urgent or not).

By force of habit, we call any fee in favor of the state a state duty. However, according to the above Resolution No. 462, for issuing an extract from the Unified State Register of Legal Entities, not a fee, but a fee is charged. The state duty is fixed exclusively in Chapter 25.3 of the Tax Code of the Russian Federation, and the fee for issuing extracts from the Unified State Register of Legal Entities is not given in this chapter. For simplicity, in this article we equate these concepts.

Attention! An extract from the Unified State Register of Legal Entities is provided via the Internet without a tax stamp in electronic form, is not legally significant and is for informational purposes only. A legally significant extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs with a seal can only be obtained from the tax office.

State duty is not subject to commission. Attention! In accordance with Article 45 of the Tax Code of the Russian Federation, the taxpayer is obliged to fulfill the obligation to pay tax independently, that is, on his own behalf and at his own expense.

The legal entity receiving the extract transfers to the authorized person the right to represent interests. The power of attorney is issued in any order with the obligatory indication of the rights to submit an application and receive an extract.

Attention!

In accordance with Article 45 of the Tax Code of the Russian Federation, the taxpayer is obliged to fulfill the obligation to pay tax independently, that is, on his own behalf and at his own expense. When funds are written off from your bank account to pay taxes and fees for other individuals, their obligation will not be considered fulfilled.

- On the main page, in the “Electronic services” section, find the “Pay taxes” item.

- Select "Payment of duties".

- Check the box next to the fee for providing information.

- Click "Next".

- In the window that appears, fill in information about the payer. Required items to be filled out: TIN, first and last name, region of receipt of the service and payer’s residential address. Select "Next".

- Check the data again and click the “Pay” button.

- In the window that appears, select the payment method: cash or card. In the first option, the “Generate payment document” button will appear. A receipt with the index and details will appear. When choosing the second method, options for banks and electronic systems will appear through which you can pay the fee. Having selected a logo, you go to the credit institution’s page, where you will need to make a transfer.

If an interested person needs to make amendments to the Unified State Register of Legal Entities, he only needs to fill out an application on form P14001 and provide a set of documents confirming the fact of the changes made. In this case, you do not need to pay a fee - the service is provided free of charge.

Fees for providing information contained in the Unified State Register of Real Estate

The state duty is the fee for providing information from the Unified State Register of Real Estate. The obligatory payment is paid by the person who requests the necessary information. The amount of state duty is the same for different regions and is established by law. Benefits and discounts are not provided during the deposit process.

The amount of the state fee for an extract from the Unified State Register depends on a number of criteria, including:

- status of the user who sent the request (legal entity, individual);

- complexity of the information that interests the applicant;

- the form in which the document will be issued.

Without going into details, it is worth noting that the cost of an extract from the Unified State Register for individuals will be cheaper than for an enterprise, and the price of a paper certificate will be higher than an electronic one.

Many users are interested in information about when the fee must be paid for providing information from the Unified State Register; the state duty is paid before submitting the request or after receiving the information. Although there is no clear information in the legislation, in practice the following procedure has developed:

- When an extract is issued through the MFC, a regional division of the Unified Register, it is recommended to make payment in advance. Failure to pay according to Rosreestr details may result in denial of service during a personal visit to a government agency.

- When ordering government services through online services, the request is generated automatically. One of the stages of the procedure is payment of the state duty, without which the operation cannot be completed.

Thus, planning to personally go to the state. institution, it is worth paying the fee for an extract from the Unified State Register in advance, and presenting the receipt of payment to the employee. When choosing online cooperation, money will need to be transferred during the process of forming a request.

The tariff for obtaining information from the register is established by law. The cost of services depends on various factors. Below is a range of state duty

for providing information from the Unified State Register of Real Estate 2021 for individuals:

- A certificate with a description of the property will cost about 400 rubles.

- The extended version will cost up to 750 rubles.

- Receive a record with a note about the legal capacity of the owner - up to 950 rubles.

- Providing information about title documents will cost up to 600 rubles.

If you need to obtain information from the Unified State Register for legal entities, you will need to pay an order of magnitude more:

- extract with a description of the property - up to 1100 rubles;

- extended form - up to 2200 rubles.

As noted above, when paying the state fee for issuing an extract from the Unified State Register, no benefits are applied. You can obtain information from the State Register for free only when preparing title documents. In all other situations you will have to pay.

How to pay the state fee for an extract from the Unified State Register

Officially approved prices for obtaining a document from the Unified State Register (USRE) through the Multifunctional Center or Rosreestr:

- information about property: paper version - 400 rubles, electronic - 250 rubles;

- extended version of the extract; paper - 700 rubles, digital - 300 rubles;

- data on incapacity: paper - 950 rubles, electronic file - 400 rubles;

- information about the change of owners of a property: paper certificate - 400 rubles, digital - 250 rubles;

- information about title documents: paper - 600 rubles, electronic format - 400 rubles.

Certificates containing information from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs have a higher cost:

- a regular certificate with characteristics will cost 1,100 rubles. (on paper) and 700 rub. on digital;

- an extended version of the document will cost 2200 rubles. (paper) and 600 rub. (electronic version).

The provided data on payment of the state duty for an extract from the Unified State Register was taken from the official website of Rosreestr.

A certificate from the Unified State Register can be obtained free of charge only once - when registering property rights. All subsequent times, extracts are issued by Rosreestr only after payment of a fee.

You can pay the state fee in different ways:

- through the cash desk of a banking institution;

- in the Personal Account of any bank (Internet banking);

- from electronic wallets (YaD, Qiwi, WebMoney, etc.);

- from terminals (regular and located in the MFC);

- using services for issuing statements (only when ordering services for them).

You must pay:

- Before applying for a certificate. A receipt for payment of the state fee must be provided to an employee of the MFC or Rosreestr when ordering a service from these government agencies.

- After submitting your application. This method is used when ordering certificates through special services. The service is paid only after the customer verifies that the property is actually included in the real estate registry database.

Before depositing money in any way (except for ordering on special services), you need to clarify the recipient’s details. Otherwise, you won’t be able to pay for the service or the money will go in the wrong direction. To return them, you will have to write a statement and send a request to Rosreestr.

You can find out the details of Rosreestr for paying the state duty for an extract from the Unified State Register on the official website of Rosreestr or from its employees. They are also provided at the MFC. Each region has its own details.

The details contain a lot of numbers, so you need to enter them very carefully when paying.

- a request for legal entities or an application for individuals, which can be filled out in any form, as well as using a sample for filling out a request (application)

- a document confirming payment of the state duty for the provision of information from the Unified State Register (except for cases of its payment through the ERIP system), or a document confirming the right to exemption from payment of the state duty, in cases provided for by legislative acts

In order to pay the state fee for providing information from the Unified State Register via ERIP using the Internet banking system, a legal entity will need to use a corporate bank payment card.

When paying the state fee for providing the information you are interested in, it is important not only to fill out the details correctly, but also to accurately indicate the purpose of the payment in the payment order or receipt. It is also important to understand that the details will differ in different regions. How to do everything right?

State registration of property rights requires confirmation by an appropriate document. You can get it only by paying the legally established amount of the state duty - a kind of tax paid for making the corresponding entry in the Unified State Register of Rights. The topic of this article is the state duty for registration of property rights 2021, details required for transfer, and payment features.

In the past, in order to pay the state duty, you had to go to the tax office, take a receipt form there, fill it out according to the sample at the stand, where, of course, there was always a crowd of the same sufferers, go to the bank, then return with a receipt confirming the payment.

Subject of the Russian Federation - here is a selection of subjects. Instead of twisting and turning this gigantic list, immediately enter your region number and everything will be found automatically. For example, we enter 16 - Tatarstan is located.

Making a payment

Payment Methods:

- Using Internet banking.

- Cash at a banking institution.

- Through payment terminals.

- On the official portal of government services.

Citizens provide a receipt, which is prepared by a bank specialist.

Legal entities draw up a payment document and make payments with the help of a specialist working with corporate clients.

When making a payment, a bank mark is placed on the payment order.

The receipt is provided to the registration service official as confirmation of payment for the services of providing an extract from the Unified State Register of Real Estate.

In addition, payment can be made using payment terminals. However, this method is only allowed if the service has entered into an agreement with this service.

Many banks have remote banking technologies and access to current accounts and transactions that allow you to make payments without leaving your home.

In this case, the transfer of funds is carried out in the shortest possible time - in a few minutes.

Extract from the Unified State Register urgent details 2021

In other cases, the territorial body of Rosreestr is indicated. For example, for Moscow this is the Federal Criminal Code of the Russian Federation for the city of Moscow (Office of Rosreestr for Moscow). At the same time, the BCC of the state duty will depend on whether the application is submitted to the office of Rosreestr or the MFC.

We will provide the details for paying the state duty to Rosreestr for Moscow organizations. To do this, we will provide for downloading payment orders required when submitting applications directly to Rosreestr or through the MFC.

Receipt for payment of data Form of receipt for receiving data in the form of a cadastral extract. Order of the Ministry of Economic Development dated 9. Application for registration of a real estate property with the state cadastral register. Application form. Application for state cadastral registration of changes in real estate Application form.

Application for state registration of rights to real estate Application form for individuals. Request for information Request form for data from the state real estate cadastre. Receipt for payment of data Form of receipt for receiving data in the form of a cadastral passport.

3.4. Purpose of payment: Payment by a legal entity for information about it when applying to the registration authority for the re-issuance of a document confirming the fact of making an entry in the Unified State Register of Legal Entities

, as well as when applying for urgent provision of information about him in the form of an extract from the Unified State Register of Legal Entities.

Often, many recipients of government services - individuals and legal entities - are faced with the problem of finding details to which funds should be transferred for the ordered services.

Extracts from the Unified State Register are provided in all public service centers in St. Petersburg for real estate located throughout the Russian Federation. An extract can be obtained on an extraterritorial basis, regardless of the applicant’s area of registration. Based on the results of consideration of requests from the Rosreestr information system, specialists themselves certify and issue extracts from the Unified State Register. Due to electronic document management, the period for providing services for facilities located in St. Petersburg has been reduced to 5 working days.

Obtaining an extract from the Unified State Register of Real Estate consists of the following stages:

| Submitting a request to the MFC | or territorial branch of the Federal Service for State Registration, Cadastre and Cartography |

| Payment of the state fee by the applicant | The receipt must be presented to the MFC specialist |

| A copy of the passport of the citizen who orders the extract is attached to the application | when ordering through a proxy - a copy of the representative’s passport and a copy of the notarized power of attorney |

| Issuance of a receipt by an MFC employee who accepted a set of documents from the applicant | which contains the details of this person, the list of documents submitted and the date of acceptance of the application |

| Receive information from the register within 3-5 working days | The applicant’s representative can also obtain a certificate |

Is it possible to save money when receiving an extract?

All kinds of actions of citizens are subject to taxes and state duties. It is logical that everyone wants to pay less but get the full range of services. Although there are no statutory benefits or discounts, you can save money without resorting to illegal options.

Both individuals and entrepreneurs can use the services of specialized online services. Their advantages are

difficult to overestimate:

- available around the clock;

- do not rest during holidays and weekends;

- you don’t need to devote a lot of time to visiting them or stand in huge queues.

The main difference between their work and real departments is the issuance of documents in electronic form, and less often, the sending of a paper statement via Russian Post. However, data on such a resource is processed for a maximum of two to three days, and in most cases the user receives the necessary information within a few hours after payment.

As noted, the cost of an electronic statement is slightly cheaper than its paper counterpart:

- a regular, detailed certificate costs about 250 rubles;

- data on the history of transfer of ownership rights - 250 rubles.

The received document is not just for reference purposes, but has all the legally significant powers of a paper extract. Despite the fact that there are no wet stamps on the printed copy, any authorized person will be able to follow the link provided by Rosreestr to verify the compliance of the information. The electronic statement is certified by an enhanced electronic signature, which is sufficient protection of the document from forgery.

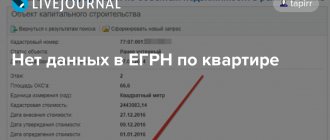

When planning to obtain information from the Unified Register, it is worth noting that the task is quite complex. There are constant queues in departments of government agencies, and not everyone can afford to take time off from their boss to resolve personal matters. In the process of independently requesting information via the Internet, you should be extremely careful, since inaccuracies and errors when filling out the form can lead to the fact that the statement comes empty, and you will have to pay for a new request again. By turning to professionals, you can avoid such risks and obtain information promptly, without unnecessary problems.

State duty for the official extract of the Unified State Register from Rosreestr

The amount of the state fee depends on the status of the applicant (citizen or legal entity), the amount of information provided and the type of document (the electronic form costs approximately half the price of a paper document)

The cost of the fee for carrying out registration actions is established by Chapter 25.3 of the Tax Code of the Russian Federation.

The procedure for paying the fee was approved by order of the Ministry of Economic Development of the Russian Federation dated December 23, 2015 No. 968, with amendments made on the basis of order of the Ministry of Economic Development of the Russian Federation dated June 20, 2016 No. 378.

State duty is paid for inclusion in the unified register:

| Right | for real estate, including apartments and private houses |

| Encumbrances imposed on real estate, i.e. rights to it of other persons | For example, a bank pledge may be issued on the property. |

Any transactions undergo a mandatory registration procedure if their validity period exceeds 1 year and their object is real estate.

The following agreements are subject to registration:

- Rentals.

- Agreement on shared participation in construction.

- Indefinite free use

- Other transactions.

Below is the cost for registration services for various rights :

| Ownership rights that arose before January 1, 1999. With the exception of rights to plots of land | for individuals - 2,000 rubles (clause 22, clause 1, article 333. 33 of the Tax Code of the Russian Federation), for legal entities - 22,000 rubles |

| Encumbrances arising before January 1, 1999, with the exception of land plots | for physical individuals - 1,000 rubles, for organizations - 4,000 rubles |

| Common joint property rights | for physical persons - 350-2,000 rubles. regardless of the number of owners using the instructions of the Tax Code of the Russian Federation |

| Shares in common property | for individuals - 350-2,000 rubles. multiplied by the size of the share, for organizations - 22,000 rubles, which is multiplied by the size of the share |

The cost of other registration actions can be found in Art. 333. 33 of the Tax Code of the Russian Federation or on the website of the Rosreestr service.

Tax legislation establishes that state duty payers are citizens and legal entities that are parties to the agreement on the basis of which property rights are transferred.

Typically, the registration fee is paid by the seller, as the party to the transaction selling the property.

For example, during the registration of a purchase and sale agreement, the state duty is paid by the seller, unless otherwise specified in the agreement.

Where can I get an extract from the register, and what methods of application does the law provide for?

Federal Law No. 218-FZ regulates the following options for obtaining this official form:

- directly at the territorial office of Rosreestr;

- through the system of Multifunctional Centers;

- through the electronic resource of the government services portal .

In any case, the document will be processed in Rosreestr; for this purpose, MFC employees will transmit the request through interdepartmental exchange channels. When issuing a certificate via the Internet, the applicant will receive a document in electronic form with an electronic digital signature of an official of Rosreestr.

Regardless of the method of appeal, the extract received will have equal legal force and can be accepted in any field of activity.

The legal basis for issuing an extract will be the completed request form. A sample application is issued upon personal application to the Rosreestr service or the Multifunctional Center. If using the public services portal, a sample application is available on the Rosreestr department page.

You can also view the application form here.

Instructions for filling out the request form can be found on the official website of Rosreestr, or at information stands at the place of contact of interested parties.

A simplified extract form allows you to obtain a certificate of basic information about real estate, as well as copyright holders. In this case, the request is made according to the general rules, but the applicant does not indicate additional information.

A typical example of a simplified form of an extract is a certificate of the presence or absence of encumbrances registered in relation to the property.

When submitting a request in electronic form, you can not only reduce the waiting period for a document, but also significantly save on costs.

Producing an electronic statement for citizens will cost only 200 rubles , while a written standard form will cost 400 rubles .

Payment for the tariff can be made through electronic payment systems; Rosreestr institutions are required to independently verify the information.

Read about how to order an urgent extract from the Unified State Register of Real Estate here.

The fees for the production of USRN extracts vary significantly for individuals and enterprises.

The cost of an extract from the Unified State Register at the MFC will not differ from the standard tariff; citizens will pay a state fee in the same amount as when applying to Rosreestr institutions.

The cost of all government services for legal entities will be significantly higher than for ordinary citizens.

It should be noted that the indicated amounts of state duty apply only to one piece of real estate. If an enterprise requests information on several objects at once, the price of an extract from the Unified State Register will include payment of a fee for each object of interest.

- during divorce proceedings with division of property;

- if you purchase real estate using credit funds (mortgage);

- if you are purchasing real estate with collateral;

- if you are entering into an inheritance;

- if you receive a loan against real estate you own;

- when registering on a waiting list for improved housing conditions.

On January 1, 2021, the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” comes into force, which provides for the creation of a Unified Register of Real Estate and a unified accounting and registration system. The Unified Register of Real Estate will include information currently contained in the real estate cadastre and the register of rights.

State fee for registration of property rights

Fee for providing information from the Unified State Register of Real Estate (state duty)

State duty for extract from the Unified State Register of Legal Entities 2017

State duty in case of bankruptcy

State duty to the Supreme Court

State registration of property rights requires confirmation by an appropriate document. You can get it only by paying the legally established amount of the state duty - a kind of tax paid for making the corresponding entry in the Unified State Register of Rights. The topic of this article is the state duty for registration of property rights 2021, details required for transfer, and payment features.

The fee collected from the potential owner represents a monetary contribution to the country's budget and is mandatory. Its dimensions are established by Art. 333 of the Tax Code of the Russian Federation, you can find out about them and payment options on the state website, and the details of the state duty for registering property rights are provided by specialists from Rosreestr and the Federal Tax Service.

The official website of Rosreestr posts the information necessary for payment of the duty. Not only the owner of the property, but also his authorized representative (who has a power of attorney to represent the interests of the applicant) can pay for the service of preparing registration documents, using the form of non-cash transfers from a bank account or payment in cash, which is the most commonly used method. A receipt for the state fee for registration of property rights is a document confirming the fact of payment, and is an important component in the package of necessary documentation submitted by the payer to the government agency.

Please note that the mandatory submission of a document confirming payment of the state duty is not provided for, since the Law of July 27, 2010 No. 210-FZ “On the organization of the provision of state and municipal services” allows it to be submitted exclusively at the initiative of the applicant (information about payment is promptly sent to the state information system). In addition, it is allowed to issue a form for paying the state fee for registering property rights after the documents have been submitted to the registration authorities. However, this is not very convenient from the point of view of completeness of the set of documents, and will also delay the completion of registration actions. Therefore, the presence of a paid receipt is a guarantee of immediate acceptance of documents for processing, since the date of payment of the state fee is considered the day the application for registration is accepted. Failure to confirm payment (or pay only part of the fee) within ten days after receiving the documents is a reason for returning the package to the applicant.

You can pay the fee at Sberbank or the MFC cash desk. There, employees of these institutions will issue a receipt, fill out the necessary details for paying the state fee for registering property rights and make the transfer. You can also issue a receipt yourself by downloading the form on the website of Rosreestr or the Federal Tax Service, and then enter the necessary information, print the receipt and pay for it at the nearest Sberbank branch.

State duty USRN – description

What is the state duty for an extract from the Unified State Register? This is the name given to the mandatory payment made by the customer of information from the real estate register.

The state duty is the same in all regions of the Russian Federation; it is established by the state. There are no benefits or discounts when transferring funds.

The fee for providing information from the Unified State Register (state duty) depends on several factors. Namely:

— the category to which the customer belongs (legal entity or individual);

— type of information required by the owner;

— type of documentation (electronic or paper version).

Individuals pay less for the service than organizations. And a paper copy of information from the State Register is more expensive than its electronic counterpart. The USRN state duty is a fee for providing information from Rosreestr, which is charged by the state in cases provided for by the law of the Russian Federation. It is paid by all taxpayers, including legal entities. Discounts are not provided for preferential categories (disabled people, pensioners, etc.). The amount of the state fee for extracting the Unified State Register depends on the following factors:

- Type of customer of the service. They are legal entities and individuals. Legal entities pay more than individuals.

- The volume of information received. There are certificates that indicate complete information about real estate, only the cadastral value, encumbrances (arrest, pledge), and the history of changes in copyright holders.

- Document type. It can be obtained in paper or electronic form. A digital file is cheaper than a paper certificate.

Both types of certificates (electronic and paper) have the same legal force. It is worth considering that through some resources you can only obtain paper statements.

Regulatory changes

Since the beginning of 2021, the procedure for registering real estate has changed slightly due to the entry into force of Federal Law No. 218, and the amount of the state duty has also increased.

Changes adopted by law regarding the provision of services:

- The Unified Register for Accounting and Registration of Real Estate now has a new abbreviation - EGRN.

- Payment for services provided is made by bank transfer on the Rosreestr website or through an ATM of Sberbank PJSC by selecting the desired category.

- An online request and payment in the form of an electronic payment does not cancel the issuance of an extract from the Unified State Register on paper, and the production time for such a document does not exceed 3 days.

State duty amount valid for 2021:

| Applicant Extract from the Unified State Register | Individual | Entity | |

| by email | on paper | by email | |

| Basic characteristics of the real estate and the presence of a registered owner | 250 rub. | 400 rub. | 700 rub. |

| Transfer of ownership of an object | 250 rub. | 400 rub. | 500 rub. |

| Information about the real estate | 300 rub. | 750 rub. | 600 rub. |

| Contents of the title deed | 400 rub. | 600 rub. | 800 rub. |

| Recognition of the owner as partially or completely incompetent | 400 rub. | 950 rub. | – |

| Registered DDU in construction | 700 rub. | 1,500 rub. | 1,400 rub. |

| Availability of other immovable objects by the person (the amount depends on the requested number of subjects of the Russian Federation) | 400-750 rub. | 650-1,800 rub. | 650-1,100 rub. |

Details in Moscow and the Moscow region

Budget classification code when requesting information from the unified register on real estate: 000 0 0000 130.

An extract from the Unified State Register is subject to mandatory payment in the prescribed amount. For branches of the Federal State Budgetary Institution "FKP Rosreestr" the following details are used:

| Region Form item | Moscow | Moscow region |

| Payee's name | Management of FC in Moscow | FC Department for the Moscow Region |

| Personal account | 20 73 6 Ts0989 0 | 20 48 6 Х7646 0 |

| TIN | 7705 40134 0 | |

| checkpoint | 7720 43 001 | 7708 43 002 |

| OGRN | 1 02 77 00 48575 7 | |

| Name of the receiving bank | Main Directorate of the Bank of Russia for the Central Federal District | |

| BIC | 04 45 25 000 | |

| Bank account | 405 01 810 8 4525 2000079 | 405 01 810 5 4525 2000104 |

| OKTMO | 45309000 | selected from the list |

In addition, on the Rosreestr website you can download the following forms and samples of how to fill them out:

- receipt for payment by an individual;

- payment order for payment by a legal entity;

- sample of filling out a receipt;

- sample of filling out a payment order;

- an individual’s application for a refund if the wrong amount was paid;

- application from a legal entity for a refund if the wrong amount was paid.