Financial obligations of one of the parties in relation to the other require guarantees of their fulfillment. A transaction in which the transfer of an agreed amount of money is carried out according to a receipt from the borrower is legally protected and is a procedure provided for by civil law. The practice of using this document as evidence of the transfer of values is widespread in economic transactions and in relationships between individuals.

The legislation does not directly regulate the procedure for issuing a receipt and does not indicate the grounds on which it is drawn up, however, Article 808 of the Civil Code of the Russian Federation (Part 2) stipulates that a receipt can serve as confirmation of an agreement on a loan and its terms.

Knowledge of the basic rules and features of obtaining written evidence of a debt will allow you to protect yourself in situations involving non-repayment or untimely return of funds.

Important features of transferring money

If you are unwilling or unable to use the services of a bank, transferring a certain amount of money on completely legal grounds is permissible in various ways. Under any circumstances, the important features of the transfer of funds are:

· the need to document the fact of actions taken with finances in order to ensure guarantees of their full and timely return;

· Carrying out a transaction directly with the person with whom the agreement was drawn up, or with his principal having powers certified by a notary.

All terms of the transaction, responsibilities and obligations of the parties to each other can be stipulated in detail in a full-fledged loan agreement. The need to conclude it for an amount of more than 10,000 rubles is prescribed in the Civil Code of the Russian Federation (Article 808).

However, the absence of an agreement does not limit the lender’s rights to legally demand the return of his money. The Civil Code of the Russian Federation (Article 163) deprives the parties of the opportunity to rely on the testimony of witnesses in the absence of a written agreement, but allows the presentation of written and other evidence. A correctly written receipt can serve as such a written confirmation of a monetary transaction.

It is problematic to prove, in the event of a legal dispute, the fact of transfer of money if a loan agreement was not concluded and there is no receipt. But the final decision is made by the court taking into account the assessment of the totality of all available arguments, including indirect ones.

Other evidence of the transfer of funds may include correspondence on the issue of debt via email, on social networks, via SMS messages, as well as the presence of audio or video recordings.

A separate nuance in the agreement related to a cash loan is the issue of calculating interest on the debt. If the agreement does not stipulate the condition of an interest-free loan and does not set interest, then the calculation is carried out at the refinancing rate. It is also possible to collect interest for the use of other people's financial assets, calculating them on the basis of the average bank interest rates on deposits for a given period (Clause 1 of Article 395 of the Civil Code of the Russian Federation).

The procedure for transferring money by receipt

Transfer of funds to the borrower can be carried out in various ways.

Cash

Handing over cash is the most common method in financial relationships between individuals, but it is also the most vulnerable to the actions of fraudsters who are exposed to the risks of making sham transactions and using counterfeit banknotes.

Through a safe deposit box

Participants in the transaction rent a small safe from the bank. Additional agreements to the contract stipulate the conditions for receiving funds from it, possibly with the participation of a bank representative. When renting a safe deposit box, the key is given to the lender in exchange for a document confirming the fact of the loan. The disadvantage of this method is the need for additional costs for renting a locker, paying an insurance premium and, possibly, a deposit in case of loss of the key.

Conclusion of a letter of credit

With this method, the bank assumes the obligation to transfer money on behalf of the payer. The borrower and the lender enter into a letter of credit agreement, which specifies all the conditions (payment procedure, details of the parties, etc.). The funds are transferred by the bank, upon receipt of all necessary documents from the lender, to a special account opened by the borrower.

This option is considered the most secure, but is not used so often due to its apparent complexity and the need to pay a commission.

Notary deposit

The funds are transferred by the lender to a special notary account. The notary certifying the transaction, after fulfilling its conditions, transfers the money to the borrower. This procedure is the safest.

Via ATM

When transferring funds non-cash through an ATM, transferring them to the borrower’s card, the loan document must indicate the details of the receipt (cheque) and attach a payment document to it.

For all types of transactions, a receipt for the transfer of any amount of money is an important document that insures the lender against possible risks. It must be stored in a safe place to prevent damage, fading of ink, etc.

Settlements using a notary's deposit

A much more secure way of transferring money as part of a purchase and sale transaction is to use a notary deposit.

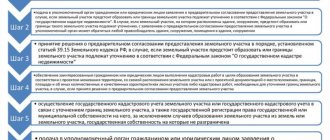

The procedure for settlements between the seller and the buyer in this case is defined in Article 87. 457-FZ. The buyer can deposit funds in either cash or non-cash form. The advantages of this method include:

- lower cost than payment through a cell or letter of credit;

- notarized purchase and sale transactions are registered with Rosreestr in an accelerated manner (maximum - 3 days instead of 7);

- high security.

The procedure for settlements through a notary deposit is as follows:

- The parties sign a contract for the purchase and sale of an apartment at a notary, including a clause on settlements through a deposit.

- The rental cost of the deposit is paid.

- The buyer pays the amount required under the contract.

- After re-registration of ownership in favor of the buyer, the seller gains access to the money.

If the transaction does not reach a logical conclusion, the buyer will receive his money back.

When they write and give a receipt

The loan agreement acquires legal force from the moment of the actual transfer of funds from the lender to the borrower, therefore the receipt for the transfer of money serves as a fixing role for the transaction.

The need to write a receipt for receiving money may be due to the following situations:

- Cash loan.

- Transaction of purchase and sale of goods, cars, real estate, etc.

- Payment for services provided or rent.

The procedure and time for providing a cash receipt for a loan or goods is determined by the parties, but the most optimal option is that it is issued after the actual transfer of money and the signing of the agreement by the parties.

With the payment of the debt, a document confirming the fulfillment of obligations is returned by the lender to the borrower.

Requirements and rules for issuing a receipt

The law does not establish a sample receipt for the transfer of money. The basic rule for drawing up a document is to include in it the most useful information about the parties to the transaction and its conditions.

Recommendations for drawing up a receipt:

- write by hand, for more reliable, if necessary, identification of the borrower by handwriting;

- use a ballpoint (not gel) pen, the ink of which is more resistant to the external environment;

- exclude blots and corrections;

- empty spaces in a document in which you can write something, fill them with dashes.

The required details included in the form of receipt for the transfer of money are:

- Information about the borrower and lender (passport number, registration details of the parties).

- Personal information of witnesses, if they are present during the transfer of money.

- The grounds on which money is transferred, for example, an agreement.

- The transferred amount of money in numbers and words.

- Name of currency.

- Interest on the loan (if agreed upon).

- Transaction date.

- Date of drawing up the receipt for the transfer of funds

- Refund period.

- The document is drawn up in a single copy.

Established judicial practice indicates that, subject to the above requirements, the legal significance of the receipt is not affected by its format (written or printed) and grammatical errors in the text, if they do not distort the meaning of the document.

Sample receipt

An inscription on the loan agreement indicating the amount of funds received and sealed with the signatures of the parties is also equivalent to a receipt.

Cash payments: advantages and disadvantages, risks

The traditional method of settlement between the seller and the buyer is the transfer of cash “from hand to hand”. This option allows the seller to immediately use the proceeds from the sale of the apartment, which is a definite advantage. .

Transfer of money can be carried out when selling an apartment in two formats:

- before state registration of the transfer of ownership rights in Rosreestr;

- after receiving documents on re-registration of property in favor of the buyer.

The first option is characterized by increased risks for the buyer.

No one is immune from the dishonesty of the seller, who can simply ruin the deal and not show up for state registration on the appointed day.

Or the transaction may be declared invalid due to the seller’s insanity and it will be very difficult to get your money back.

The second option, on the contrary, is unfavorable for the seller, who may lose both the apartment and the money due to him due to the buyer’s refusal to pay.

In addition to these risks, cash payments also have the following disadvantages:

- A buyer may have problems getting a large amount of money to buy real estate from a bank: usually there are certain daily and monthly limits on cash advances.

- In fact, it is difficult for the seller to make sure that the entire amount has actually been received: when recalculating such a volume of cash, it is easy to make a mistake.

- There is a high risk of not noticing counterfeit money.

- There is a high probability of becoming a victim of robbers or losing cash.

Cash payments are gradually becoming a thing of the past due to their insecurity and unreliability. They are only rarely practiced between a seller and a buyer who trust each other (for example, they are in a family or friendly relationship).

But even in this case, the buyer should be careful not to forget about the need to obtain a receipt from the seller confirming that he has received the money. Such a receipt must include the full names of the seller and buyer, passport details, signatures of the parties, the amount received, a link to the purchase and sale agreement and the date.

As an alternative to cash payments, non-cash payments can be considered, when the buyer transfers money to the seller's account . With this method it is easier to prove the fact of payment, you do not need to carry a large amount of cash with you and there is no risk of receiving counterfeits. But this option also has a high risk of fraud on the part of the seller or buyer.

Tips for a safe transaction

A prerequisite for the safe conduct of a transaction involving the transfer of money is the consent of the borrower in drawing up the appropriate paper document. Any kind of attempts to get away from this serve as a signal for greater vigilance on the part of the lender.

In order to avoid becoming a victim of a dishonest or fraudulent scheme, you must take precautions and follow these recommendations:

- be sure to check the borrower’s signature with the sample in the passport if the document confirming the fact of the loan has a printed form;

- if possible, use audio or video recordings when carrying out a transaction;

- in case of a large amount, have the loan document notarized;

- It is advisable to carry out a financial transaction in the presence of at least two witnesses, which should be indicated in the loan agreement.

- approach responsibly in choosing the location of the transaction, for example, use a room equipped with CCTV cameras.

The limitation period for a loan agreement is generally 3 years. The countdown starts from the date designated as the due date for repayment of the debt on the receipt.

Video on the topic:

When do you need an act of acceptance and transfer of funds?

The document is drawn up for cash payments, when transferring cash into possession (accounting) between two entities. For non-cash payments, it is not drawn up; the transfer of money from one account to another is confirmed by the bank with a mark on the payment order or a check.

When paying in cash for goods, work or services, the seller (performer) is obliged to confirm the fact of transfer of funds to him by check or strict reporting form (Federal Law No. 54 of May 22, 2003), if he is a legal entity or individual entrepreneur. Within the framework of non-payment relations, the fact of cash transfer is confirmed by an act of acceptance and transfer (issuance of a loan). Please note: not all sellers (executors) conscientiously fulfill the obligation to use cash registers and strict reporting forms (SSR), therefore, in the absence of a check and SSR, we recommend recording the transfer of money in writing.

When obligations arise under a loan agreement between individuals, an act is drawn up, and if cash is transferred to an organization, confirmation of receipt of money will be a receipt for the cash receipt order in form No. KO-1 (approved by Resolution of the State Statistics Committee No. 88 of August 18, 1998). Along with the receipt, it is permissible to draw up a transfer document.

When making payments between individuals, a transfer document is always drawn up.

Cash is transferred from one entity to another during the operation of cash register equipment. When changing a cashier, a cash inventory report is usually drawn up in form No. INV-15 (approved by Resolution of the State Statistics Committee No. 88 of August 18, 1998), nothing additional needs to be drawn up or recorded.

ConsultantPlus experts analyzed the risks of borrowing money and gave recommendations on how to avoid them. Use these materials for free.