Given the difficult economic situation in Russia, borrowers are increasingly asking themselves the following pressing question: how to reduce a mortgage taken out from a banking organization. What to do if you no longer have the opportunity to pay the same monthly amounts as before (due to life and other objective circumstances). We'll talk about this in more detail later in our article. First, let's talk about what influences the formation of the monthly contribution amount (what factors and circumstances).

Paying off a mortgage is a difficult task for many borrowers.

Ways to reduce interest rates

There can be various reasons for refinancing a mortgage loan. Firstly, currency exchange rate fluctuations negatively affect the solvency of the population, and therefore the weight of monthly payments changes. Secondly, the bank may reduce the interest rate on a similar loan. All these events push the borrower to lower the mortgage rate.

In order to reduce interest payments, you can use one of three options:

- Close the loan with money received from another bank;

- Change the parameters of the current loan agreement;

- Go to court with a claim for illegally charging a high interest rate.

A reduction in interest may be considered in the event of a reduction in the terms of repayment of the principal debt. Loan restructuring also occurs when part of the loan is repaid early. In this situation, contractual obligations may change not only in terms of monetary amounts and terms of return, but also in terms of collateral. For example, additional types of real estate can be provided in the form of a security guarantee, or reliable guarantors can be invited.

The loyalty of banking conditions directly depends on the financial risks of the credit institution. If the mortgage agreement stipulates the opportunity to reduce the mortgage rate, then this can be used at any time.

Don't overpay for convenient payments

Often, due to lack of time or laziness, a person repays his mortgage not through the cash desk of the bank that issued the loan, but through Sberbank-online, with a 1% commission for transferring money.

If monthly payments are 40 thousand rubles, then easy and convenient payment will cost the borrower 400 rubles.

A small amount will not hurt your wallet with a one-time payment. But if you regularly pay in this way, then in five years the client will simply give the bank 24 thousand rubles. It would be more appropriate to use this amount for partial early repayment of the loan.

Loan refinancing

Refinancing a loan is the most preferable option, since it is the easiest way to reduce the mortgage interest rate. But this method has its own nuances that need to be realistically assessed. To refinance a loan, you will have to go through the entire procedure of collecting documents in a new way.

Regardless of where the client reissues the loan, in his own or another bank, the loan application is considered according to the same rules. As a result of the procedure, the client has a real opportunity not only to reduce the interest rate, but also to repay part of the loan ahead of schedule.

In what cases is it necessary to go to court?

Quite often in judicial practice it is necessary to consider cases related to a bank’s violation of regulatory documents. Control over compliance with contractual obligations and changes in the refinancing rate is a good opportunity to reduce the amount of payments.

The regulations of the Central Bank (No. 39 of June 26, 1998) set out the procedure for calculating interest. Violation of such a regulatory act may cause a change in loan obligations. For example, a bank can be held liable if interest on the balance of the principal debt was accrued at the wrong time.

Also, if the contract contains a direct relationship between the cost of the loan and the refinancing rate, the lender can himself verify the correctness of the accruals, and if discrepancies are detected, seek help from the judicial authorities.

In what cases is refinancing most profitable?

Depending on how monthly payments are calculated, you can calculate the greatest benefit of refinancing the loan. You need to do this as early as possible, since it is more profitable to reduce your mortgage payment with annuity calculation at the very beginning of the term.

Additionally, there are other factors to consider when refinancing. The expediency of actions will be justified only if:

- the difference between lending rates will be at least 1-2 percent;

- there will be no restriction on early repayment of the loan in the new agreement;

- the benefit received from reducing the mortgage interest rate will be greater than the costs incurred for re-registration;

- with annuity calculation after refinancing, a greater effect will be noticeable at the initial stage of payments, and with a differentiated effect throughout the entire period.

If, after analyzing the situation, none of the conditions are met, then there is no point in refinancing the mortgage loan. A nominal rate reduction will not lead to a reduction in costs and payments.

What is better to reduce – term or payment?

The age-old question is, what will be more profitable – reducing the monthly mortgage payment or the total loan term? In general, shortening the term is more profitable, as the amount of overpayment is reduced.

But if you reduce the size of your monthly payment, then every month you will have more free funds that you can use for early repayment.

For example, your payment is 14 thousand rubles, but every month you pay 20 thousand. You reduce the payment amount, and for the next month it is 13,800 rubles. You again deposit 20 thousand, and it will take 200 rubles more to pay off the mortgage body early. It seems like a small thing, but on a scale of several years it is very profitable.

And here’s another interesting article: Where can you get a mortgage without an income certificate, guarantors and SMS?

So I think that reducing the monthly payment, provided that you regularly make early payments, is more profitable and psychologically calmer (you can clearly see the result of your work).

But if you decide to reduce the period, you will need to notify the bank in advance. By default, early investments reduce your monthly payments. Therefore, before reducing the mortgage term, fill out the appropriate application.

Reducing the loan term

Quite often, when receiving a mortgage loan, people try to extend the repayment period as much as possible. This gives them the opportunity to allocate a monthly amount to pay off the debt in the least painful way. But at the same time, as the term increases, the amount of accrued interest on the loan increases. Therefore, in order to reduce them, you will have to choose the optimally short term, during which the borrower will have the opportunity to transfer the required amount without compromising the budget.

When looking for a “golden mean”, you should take into account such phenomena as inflation, reliability of the source of income and possible needs for additional money.

State assistance to young families

Under the state support program for young and large families, many individuals can significantly reduce their mortgage interest rates. Young families have the right to take advantage of a free subsidy, which amounts to 30% of the cost of housing. If the family already has children, then each child receives an additional subsidy of 5%.

To receive assistance, a young family must contact the Housing Department with the established package of documents. According to the regulations, the application will be considered within 10 days. The grant certificate can be used as a down payment or to pay off other mortgage debt.

Participate in preferential lending programs

Participation in preferential lending programs allows you to:

- make a first contribution at the expense of the state free of charge;

- get a mortgage at a lower rate.

Today, military personnel, large families, young professionals (teachers, doctors) permanently residing in rural areas can take advantage of government assistance. The list of such programs and their participants is constantly expanding; you can familiarize yourself with it on specialized Internet resources.

Use of maternity capital

When deciding how to reduce the accrued interest on a mortgage, many families can use a maternity capital certificate. To implement this type of government support, it is proposed to use funds as follows:

- provide a certificate in the form of a down payment of a mortgage loan;

- transfer a sum of money to pay interest or principal.

You can take advantage of this opportunity immediately after the birth of your second child; in this case, you will not need to wait three years. You can reduce your payment on an existing mortgage at any time, regardless of the date the loan was issued. Many banks, in the interests of citizens who have a certificate, are developing the most acceptable lending programs.

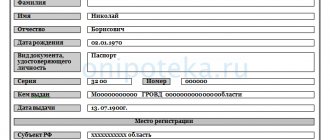

To pay with maternity capital for a mortgage received before the birth of a child, it is necessary to go through several stages. From the bank you need to obtain a certificate of debt on interest and principal; to do this, it will be enough to present your passport and provide the agreement number. And then submit an application to the Pension Fund for the disposal of public funds.

Early repayment procedure

It is not enough to simply deposit a large amount into your mortgage account to make an early repayment. You must inform the bank in the application form that you intend to make an additional payment.

You can fill out the form:

Mortgage according to two documents of BZhF Bank

Apply now

- Remotely in:

- personal online banking account;

- mobile application.

- By visiting a bank branch office in person.

The application must indicate:

- amount of additional payment;

- write-off date;

- the chosen option for early repayment of the mortgage.

After the amount indicated in the application is debited from the account, the bank, recalculating the loan, will provide a new adjusted payment schedule.

Preferential mortgage interest rates for large families

The mortgage lending program for large families began operating relatively recently. Currently, many banks are fighting for the right to provide such loans by lowering interest rates.

The first to offer such a program was Sberbank. He significantly extended the terms of mortgage lending, reduced the down payment as much as possible and lowered the interest rate. For large families of 5-8 people, the absence of a large down payment is an important fact, since such program participants usually buy housing with a large area.

In the near future, a program will be developed under which part of the interest will be repaid from the state budget.

Social mortgage loan for pensioners and state employees

In order to become a participant in the social program, you must be a public sector employee for the entire term of the mortgage. If this condition is met, the interest rate on the property loan is set on preferential terms, and the bank receives the difference from the state budget.

For pensioners, special programs with a shortened loan period are provided. It makes no sense to issue a mortgage to a person of retirement age for 30 years, therefore, as part of government support, banks offer such citizens loans with a small down payment and preferential interest.

What is the best way to pay off your mortgage early?

How to get a mortgage without a down payment at Sberbank

Repaying a Sberbank mortgage through Sberbank Online

Monitor promotions

You should study the offers of developers for the sale of housing in new buildings. Quite often in the summer during the “low season” they announce discounts and you can buy a good apartment at a price 5-15% below the market price.

It is worth paying attention to joint programs of banks and developers. As a rule, mortgages offered through a partnership are approved by lending institutions at a reduced rate.