Since 2007, our country has had a maternity capital program, which implies that families with a second child have the right to receive material support from the state.

At the same time, the funds that make up the maternity capital are not issued in cash to the certificate holders. The program is targeted, and families can exercise their right to state support only within the framework established by law.

Thus, among other things, the most popular area for spending MK funds is improving housing conditions. It should be noted that transactions aimed at purchasing real estate using public money have some features. In particular, the law obliges the allocation of mandatory shares to children. The features of this procedure will be discussed further.

Allocation of shares in an apartment after purchasing real estate using maternity capital

Maternity capital is a form of state support for families with children. According to statistics, the majority of holders of the relevant certificates decide to use maternal capital to purchase real estate.

Reference! In 2021, the amount of maternity capital is 466,617 rubles.

From the point of view of legislation, MK funds belong not only to its owner, but also to all family members. In this regard, the housing rights of each of them must be ensured when making a transaction using state support funds.

In other words, we are talking about the allocation of shares in the right to real estate. This is required by law.

The simplest way to allocate shares to children is to directly indicate this in the purchase and sale agreement . However, this is only possible in cases where housing is purchased using maternal capital using one’s own funds and savings.

In cases where a family takes out a loan to purchase real estate, it is not always possible to immediately allocate shares to children and this must be done after repaying the mortgage. The same applies to the purchase of housing in an apartment building under construction.

In this case, a written obligation must be drawn up, according to which the owner of the capital undertakes to allocate shares after the removal of the encumbrance or upon acquisition of ownership rights.

The presence of documents confirming the allocation of shares to children, or a corresponding obligation, is necessary for a positive decision by the Pension Fund in terms of satisfying the application for the disposal of MK funds.

It is also useful to read: Indexation of maternity capital by year

Background to the question: how much does it cost to divide a notary?

It is easy to implement this provision of the law if the family purchases housing only using its own savings and government subsidies. Then the purchase and sale agreement indicates the share of each family member, including children. The state does not make any recommendations on the size of shares - the division is carried out on a voluntary basis.

But the situation becomes more complicated when housing is purchased not only with maternity capital, but also with a mortgage. In this case, banks prefer that one of the spouses be the borrower, and the other a co-borrower. If part of the loan is supposed to be repaid with family capital, they insist that the borrower and the manager of the capital capital be the same person.

Housing purchased during marriage becomes the common joint property of the spouses, as the Family Code says (). From the point of view of family and mortgage law, spouses are jointly and severally liable to the creditor. Children, especially minors, are not responsible for the obligations of their parents and cannot be co-borrowers.

Recommended article: Certificate of maternity capital for a mortgage - ways to obtain it

There are some contradictions between the requirements of Federal Law-256, the Family Code and mortgage legislation. To “smooth out” them, it is envisaged to provide the Pension Fund with an obligation to divide shares in the property in the future. At the same time, the PF demanded that a simple written form of the obligation be certified by a notary, arguing that notarization gives the document “weight” and imposes responsibility on the manager of the family capital.

In fact, notarization resulted in additional and significant expenses for the family. Since the mortgage was issued and the property right was registered or planned to be registered in the name of one of the spouses, the notaries interpreted the transaction as one-sided and carried it out as a certification of other agreements, the subject of which is subject to evaluation.

As a result, in addition to notary services, it was necessary to pay:

- state fee for certification of the obligation, in the amount of 0.5% of the value of the property or 10-20 thousand rubles, depending on the region;

- state duty in the amount of 2000 rubles. to enter the division of shares into Rosreestr in the future ();

Repeated appeals from lawyers defending the rights of families with children were heard and the notarial obligation for mat capital was cancelled.

Who should allocate shares

As a general rule, the allocation of shares in real estate that was purchased with maternity capital should be handled by the owner of the certificate. In the vast majority of cases, this is a woman who has given birth to a second child.

In addition to children, the spouse also has the right to housing under the MK. However, it should be noted that he loses the corresponding right in the event of divorce before the disposal of the maternity capital.

In addition, if a woman gets married after receiving the use of MK funds, then her husband also cannot claim a share in the real estate.

In practice, the situation with the distribution of shares is more complex. So, if an MK pays for a mortgage that was issued to a spouse, then it is he who makes the allocation.

Most often, shares are allocated by spouses jointly under a distribution agreement. This applies to cases of purchasing housing with a mortgage, where they act as a borrower and co-borrower, as well as purchasing real estate with their own funds using maternity capital.

Allocation of shares: how they will check

Legislative changes that abolished the notarial obligation to allocate shares in maternity capital, left in force the actual need to allocate a share to each family member. Moreover, this is the responsibility of the manager of family capital established by law.

The division of shares and the introduction of changes about the owners in the state register of real estate objects must be made by the manager within six months, from the moment of the occurrence of one of the following events:

- full payment of the mortgage and removal of the encumbrance;

- commissioning of housing and registration of ownership;

- transfer of ownership of the facility being built according to the DDU.

Recommended article: Mortgage with maternity capital in Rosselkhozbank

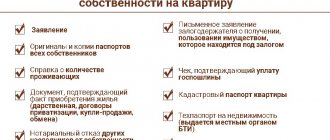

To register changes, the manager submits to the MFC:

- application for registration;

- personal documents of co-owners;

- title document for a residential property purchased with funds from maternal capital;

- share sharing agreement.

A sample agreement for the allocation of shares is in the article: Allocation of shares in maternity capital without a notary

And since the notarial obligation for maternity capital has been cancelled, for registration with Rosreestr you will only need to pay a state fee in the amount of 2 thousand rubles. Thus, the financial burden on the family is reduced significantly.

Monitor compliance with legal requirements:

- branch of the Pension Fund that issued the Certificate. The institution will also monitor changes in the composition of the manager’s family - this information is supplied to the Pension Fund from the Civil Registry Office departments;

- department of guardianship and trusteeship of local authorities.

General supervision over the implementation of legislation is carried out by the prosecutor's office.

If, as a result of the inspection, it is determined that the allocation of shares in residential real estate purchased with capital capital has not been registered, the Pension Fund may file claims in court for:

- forced allocation of shares in common property;

- return of maternity capital.

Currently, much attention is also paid to the targeted use of state support funds and to preventing the cashing out of maternity capital.

Please note that the appearance of another child in the family before the first children are allocated shares will entail a revision of the shares of the co-owners. Changes must be submitted again to Rosreestr.

What share is allocated to children?

Today, the current legislation does not establish the size of the minimum share that must be allocated in the right to real estate when purchasing it with capital. Accordingly, it is set by the parents themselves.

However, it should be understood that maternity capital belongs to each family member. Accordingly, 466,617/4 = 116,654.25.

Thus, if the cost of an apartment or house is 1 million 116 rubles, then each child can claim a 1/10 share in the ownership. This calculation was given as an example in order to develop an understanding of the distribution principle.

Undoubtedly, family members have the right to independently determine its order and size of shares. However, experts do not recommend allocating too large portions to children. This is due, first of all, to the fact that in the future certain difficulties may arise when selling such real estate.

It has been determined that in transactions involving the alienation of housing owned by minors, the consent of the guardianship authorities is required. An important condition for this is to provide children with a volume of rights that is equal to or greater than those available in the real estate being sold.

In addition, a small share in the future cannot be allocated in kind, which significantly reduces the property risks of the remaining family members.

Elimination of encumbrance on housing

This is possible after full repayment of the loan . After termination of settlements with the bank, you need to obtain a mortgage from them. Next, they write an application to remove the encumbrance to the registration chamber of Rosreestr with the following documents attached:

- Sales and purchase agreements;

- Document of ownership;

- Mortgage.

The Registration Chamber issues an Extract from the register of rights to real estate. After receiving this document, the owners can officially divide the property or gift it (in whole or in part) to their children. An application for this procedure is sent to the MFC , and payment of a state fee is not provided.

Registration of a notarial obligation

The undertaking is a written document according to which the owner of the certificate and his spouse undertake the responsibility to allocate shares in the acquired property to their minor children.

The obligation must be certified by a notary. At the same time, it can be issued both at the place of residence and at the location of the property.

Important! A written document must be sent to the pension fund when submitting an application for disposal of maternity capital funds.

It is also useful to read: Is tax paid for receiving maternity capital?

Is commitment always required?

The obligation is drawn up in cases where the allocation of shares is impossible at the time of conclusion of the transaction, and serves as confirmation and guarantee of the parents’ compliance with the requirements of the current legislation.

In particular, this applies to situations:

- Payment of a mortgage loan due to the presence of encumbrances (if the mortgage was issued to one spouse or jointly);

- participation in shared construction;

- reconstruction of a residential building.

In those cases where the shares of children are determined initially in the purchase and sale agreement, there is no need to prepare additional documents.

When is the obligation to allocate a share realized?

The procedure is performed in several stages, after:

- Repayment of mortgage debt;

- Removal of encumbrance;

- Completion of settlements with the housing seller (if the apartment is purchased under the Sale and Purchase Certificate);

- Payment of the last payment (in case of purchasing housing in installments);

- Approval of the document on the transfer of premises (with participation in shared construction);

- Putting the construction project into operation (if this procedure is carried out by a contractor);

- Obtaining a cadastral passport (when the construction of the facility is carried out on its own);

- Transfers of funds for a house being reconstructed;

- Final payment of the share in the housing cooperative.

Terms of allocation of shares

The law determines that the obligation must be fulfilled within 6 months after the restrictions related to the impossibility of allocating shares are lifted. Let's look at these nuances in more detail.

- Mortgage. For the entire period of its validity, real estate purchased using maternal capital is under an encumbrance, that is, pledged to the bank. After fulfillment of obligations under the contract, upon application, the encumbrance is also removed. Accordingly, six months after the date of its withdrawal the shares should be allocated.

- According to DDU. The six-month period begins to run from the moment the house is handed over and ownership rights arise.

- In case of reconstruction of a residential building. Reconstruction can be considered completed from the moment a new cadastral passport is received. The same applies to the construction of a new individual residential building.

If the housing was purchased without borrowing funds under the DCT, then the allocation of the share must be carried out within six months after the funds are transferred to the seller and the corresponding encumbrance is removed.

How to select shares - methods

After the circumstances preventing the allocation of shares have ceased to apply, parents need to attend to this procedure directly. It can be done either by drawing up an appropriate agreement or in the form of concluding gift agreements.

Drawing up an agreement to determine shares

The agreement is a written document according to which the spouses determine the amount of allocated shares for their children. It is submitted to the registration authority and is the basis for making changes to the Unified State Register. There is no strictly established, unified form of such an agreement.

Sample agreement:

Donation agreement

A donation is a transaction as a result of which the property or property rights of one person are transferred to another person free of charge. In relation to the situation discussed in the article, the execution of a deed of gift is the optimal option for fulfilling obligations.

It should be noted that a separate agreement must be drawn up for each child, sent to the registration authority for making the appropriate entries in the Unified State Register of Real Estate.

What consequences could there be if shares are not allocated to children?

If parents have not fulfilled their obligation within the required period, then certain sanctions may be applied to them. They are expressed in the fact that, at the initiative of the authorities, the amount of maternity capital can be recovered from citizens in court back to the pension fund.

Criminal prosecution under Art. 159 of the Criminal Code of the Russian Federation, which is written about on many thematic websites, is unlikely in this case unless there are signs of another crime. In particular, these include actions aimed at cashing out maternity capital funds.

Current legislation determines that when purchasing housing using MK funds, it is necessary to allocate shares to children. This can be done both at the moment of concluding the transaction, and after a certain time. In the latter case, a notarial obligation is drawn up.