What types of matrimonial property regimes exist?

A marriage officially registered with the registry office presupposes the establishment of property relations between husband and wife. The RF IC has determined that such relations are regulated by special legal standards - legal or contractual regime. The effect of the legal regime is discretionary and depends on the will of the persons entering into or already in a marriage union.

Under the legal regime, joint ownership, use and disposal of all property acquired during marriage is established; under the contractual regime, an agreement concluded by the spouses determines special rights to use such property. To the question of whether the legal regime of the property of spouses can be changed by a marriage contract, the legislator gives a positive answer, defining in Art. 33 of the RF IC, that the legal regime is valid only if the marriage contract does not provide otherwise.

The essence of the marriage contract

An agreement on the delimitation of property rights and responsibilities during marriage and after its termination is rarely concluded between spouses. The text of the agreement contains postulates that explain what property regime and in relation to what property the husband and wife wish to establish.

Find out in more detail what a marriage contract is.

Legislation on marriage contracts

Article 42 of the RF IC contains comprehensive data on what provisions must be included in the marriage contract and how the legal regulation of property relations between spouses is carried out. The law determines the possibility of establishing a regime of separate property, joint or shared, and regulates what exactly the agreement may concern - existing or future property.

The agreement may deal with all property in its entirety, or certain types of it, as well as specific units of property owned by each spouse.

By whom and when is a marriage contract drawn up?

A marriage contract can be concluded both by people intending to get married and by spouses at any time during their marriage. In the first case, until the official registration of the relationship, the agreement does not have legal force.

Find out more about how to draw up a marriage contract.

The meaning of a marriage contract

A prenuptial agreement changes the legal regime to a contractual one. By virtue of the IC, by default, all property belongs to the spouses jointly without allocating shares to each - that is, the husband and wife act as if they were one legal entity. They make decisions regarding purchased items in consultation, and compliance with pre-emptive rights, as with shared ownership, is not required.

However, Article 40 of the Family Code provides the right to conclude a marriage contract and change the “default” regime to any convenient regime. For example, the contract may provide:

- in what shares the already acquired property is distributed to the spouses;

- how the future property will be registered - all, only specific or certain types (for example, apartments or cars);

- distribute income and income in advance - who pays for what.

The law provides greater freedom in choosing a convenient legal regime. After the conclusion of the agreement, the regime established automatically by the insurance company will no longer apply to this married couple.

What is the form of a prenuptial agreement for an apartment purchased during marriage?

When concluding a contract for purchased real estate, in order for it to be legitimate and legal, two conditions must be met:

- the document must be in writing;

- Mandatory notarization of the contract is required.

You can conclude a marriage contract after purchasing an apartment or before completing a transaction to purchase it. It may contain an explanation of all situations that are in one way or another related to the acquired real estate and are not prohibited by law, and also do not violate the legal rights and interests of each spouse. Otherwise, the contract will be declared invalid.

Despite the fact that the document is drawn up according to general rules, it is important to correctly indicate the subject of the agreement, as well as the obligations and rights of the parties both during marriage and after its dissolution.

Drawing up a prenuptial agreement for real estate purchased during marriage

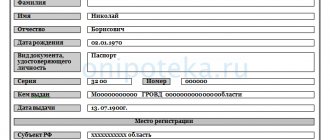

The standard procedure for spouses to draw up a housing contract assumes that after determining the subject of the contract and preparing the necessary documents, a visit to a notary follows. The latter will prepare the text, after which the document will be signed and certified.

The agreement specifies the location, address, cadastral number, area and other significant characteristics of the housing. The main issues reflected in the contract are the division of housing after a divorce and its principles: in what shares and who will own the apartment if it is decided that it remains for one of the spouses, etc.

It is important to know how to correctly draw up a prenuptial agreement for a mortgaged apartment. If a mortgage loan is used to purchase real estate, the agreement must include a section containing a definition of the conditions and to whom the loans will be issued, and how the loan debt will be repaid.

Is it necessary to enter into a prenuptial agreement for an apartment with a mortgage?

Formally, the bank cannot require the mandatory conclusion of a prenuptial agreement for a mortgage. The situations when its presence is desirable are listed above. But there are still a number of points that it is advisable to discuss in advance, so as not to waste months and years on court hearings.

The apartment was purchased before marriage

If an apartment was purchased before family ties were established, then the husband/wife becomes neither its owners nor co-owners. Problems arise if the debt is repaid from the general budget.

In a prenuptial agreement with a mortgage before marriage, the spouses determine whether the other half will receive the right to a certain number of square meters if they spend their salary or other income on bank payments. If not, the issue of payment of compensation is resolved if family life turns out to be short.

If a mortgage is obtained without a prenuptial agreement, the spouse who is not the owner of the apartment will have to collect receipts, checks, payment documents to prove his right to part of the property or a refund. Don’t forget about the statute of limitations (). It does not apply to the moment of closing the loan agreement, but to each individual payment. If 3 (three) years have passed, it will not be possible to recover anything from the ex-spouse.

Whether a prenuptial agreement is required for a mortgage in such a situation is up to the spouses to decide.

Other property

A prenuptial agreement may concern not only an apartment purchased with borrowed money, but also any other property, for example, transferred to a bank as collateral. Spouses have the right to sign an agreement at any time and resolve issues regarding the ownership of movable and immovable property.

How to correctly draw up a marriage contract for an apartment with a mortgage

How to draw up a prenuptial agreement for a mortgage? To sign it, it is important that both spouses are legally capable, are not under treatment, and are not taking potent drugs, including psychotropic drugs. Otherwise, challenges and demands to invalidate the agreement are possible. Signatures on the document are placed only in the presence of a notary.

The scope of the marriage contract concerns only property and money. It can write who pays what amount to pay for their children’s education, but it cannot indicate who is obliged to take them to school or kindergarten. The marriage contract does not regulate issues of cleaning, cooking, intimate relationships, etc. No court will consider such clauses legally significant.

It is necessary to separately say what kind of marriage contract is needed for a mortgage or division of property. In the second case, we are talking about the property that has already been acquired. For an apartment or car, specific characteristics are indicated that allow the object to be uniquely identified. If an apartment is divided, you can indicate how many meters each person will receive.

Why do you need a prenuptial agreement for a mortgage? It regulates ownership rights even to those things, houses, apartments, vehicles that have not yet been purchased, only those indicated in the plans (Clause 1 of Article 42 of the RF IC). The validity period of the document can be fixed. It is possible to make adjustments and new items.

Formally, the document can be filled out at home by downloading a sample prenuptial agreement for a mortgage from the link here. If there are nuances that deserve special attention, it is better to contact a professional lawyer. This will help avoid incorrect formulations and problems in the future.

Recommended article: Tax deduction for mortgage interest

How much does it cost to draw up a marriage contract for an apartment?

The legal nihilism of modern society and the reluctance to provide for various options for the development of events after marriage and the purchase of living space often do not even bring spouses (future or existing) closer to asking themselves the very important question of whether a marriage contract is needed when buying an apartment.

Responsible and rational couples today are increasingly inclined to enter into a property agreement, and they are faced with a natural question about the cost of registration services. It may be different for each notary, since pricing is not limited by anything.

The cost of drawing up a contract, as a rule, includes consultation with specialists, the use of technical means, answers to questions and clarification of points that are unclear to the client, and adjustments to previously agreed upon clauses in the contract for real estate purchased during marriage.

The price of notarization of a document is legally regulated by the uniform amount of the state duty valid throughout the country, which for certification of this type of contract is 500 rubles (Tax Code of the Russian Federation, Article 333.24).

Is it possible to terminate a marriage contract?

In the vast majority of cases, a prenuptial agreement can be dissolved. However, if the subject of such a contract is housing purchased with a mortgage loan, and the spouses have obligations to repay it, termination of the contract can become very problematic. In other cases, termination of the contract is provided in the following ways:

- by mutual agreement of the parties;

- based on a court decision that has entered into force.

In the first case, the procedure is quite simple - the document ceases to be valid after registration of its termination and notarization of this fact, which is carried out on the basis of an agreement signed by the parties. The latter is compiled indicating the necessary data in any order, since its form is not fixed by law.

To make a court decision, compelling reasons will be required (gross repeated violation of the terms of the contract by one of the spouses, etc.).

Find out more about terminating a marriage contract.

Does a marriage contract cancel an agreement on the division of property?

Upon divorce, former spouses seek to divide the property acquired during their cohabitation. They can decide who will own what after the divorce by agreeing among themselves and without involving official bodies in resolving property issues.

However, if the spouses concluded a marriage contract and determined the property regime both in the marriage relationship and after its termination, then in the event of discrepancies regarding certain types of property, it is possible to cancel the agreement on the division of property by the marriage contract.

In the case when this type of document establishes the procedure for the disposal, possession and use of property not only during the marriage, but also after its end, often no additional agreements are required regulating the rights and obligations of spouses who have dissolved their marriage.

Why do you need a prenuptial agreement for a mortgage?

In Russia, few people know what a prenuptial agreement for a mortgage looks like. Citizens of the country lack minimal knowledge in the field of jurisprudence. In most Western countries, this document is mandatory. It regulates the financial and material obligations of spouses to each other.

Current legislation provides that spouses are jointly obliged to pay the bank for the received mortgage loan ( and ). Who is the title borrower and who is the co-borrower does not matter. There are two exceptions:

- the husband or wife are not citizens of Russia;

- there is a valid marriage contract that provides for a special procedure for owning real estate or other property.

It is important to note that spouses can sign the agreement before submitting an application to the registry office and after, but before the divorce. The document must be endorsed by a notary.

There are many reasons to enter into a prenuptial agreement before taking out a mortgage. Let's pay attention to the main ones:

- the husband or wife does not want to either buy real estate or go to the bank. A prenuptial agreement for a mortgage for one spouse allows you to purchase an apartment and protect it from the claims of the other half;

- money to pay the down payment is taken from pre-marital savings or donated (borrowed) by parents. And this spouse expects that he will own more square meters;

- The credit history of the husband or wife is not impeccable, or there is a criminal record. Without delineation of responsibilities, the bank will refuse to issue money. Credit institutions prefer not to deal with such clients;

- the spouses decided in advance who would receive what property in the event of a divorce;

- an apartment is purchased for parents, children from a previous marriage, office location, etc. The buyer becomes the sole owner and cannot require the other half to bear the costs associated with servicing the loan.

For what reason the marriage contract was signed when applying for a mortgage does not matter. It must be presented to the bank manager when submitting an application. Then the income of the spouse who does not claim ownership of the purchased real estate will not be taken into account as part of the total income.

Banks treat prenuptial agreements differently. The situation is being clarified regarding who will pay and from whom the penalty will be collected in case of delays. There is an understanding that spouses take finances seriously and are not inclined to make hasty decisions.

At the same time, if there is no solvent co-borrower, the bank has the right to refuse to issue a mortgage loan. A spouse who wants to purchase an apartment will have to look for another co-borrower, which is quite difficult to do. Few people want to take on other people's responsibilities. In addition, a credit institution can significantly reduce the loan amount if it calculates it based on the income of only one person.

It is impossible to cancel or change the marriage contract after receiving a mortgage without the knowledge of the bank. This will be considered a violation of the loan agreement. The inevitable consequence is a requirement to return the entire amount ahead of schedule.

Recommended article: Apartment mortgage insurance - how to choose an insurance company