Pros and cons of mortgage refinancing

Resolving all issues relating to the family’s main asset – real estate – requires an extremely balanced approach. There are no trifles in this matter. Significant funds are spent over a long period of time; each percentage and even its share during repayment is expressed as a substantial amount.

In addition to the obvious benefits of lowering the annual rate, there are disadvantages hidden from the uninitiated. There are also arguments in favor of the decision to “leave everything as is”. People are inert by nature, and the ideas instilled from childhood about the obligation to fulfill one’s obligations interfere with the desire for benefit. And will she?

This is the main reason for doubt. It's common knowledge that refinancing a mortgage can be costly and hassle-free. In essence, it is similar to obtaining a new loan secured by purchased real estate and is even more complicated. When changing banks, you must not only provide financial security, but also “take away” the mortgage from the previous lender. What if he objects and interferes?

The second point: how justified are the costs? And they will happen, and not just one-time ones. Property, health and life insurance must be paid annually. And time is also wasted, and it has a monetary value. If all the savings for 12 months are equal to a week's earnings, then why fence the garden?

These arguments are correct. But economics does not tolerate emotions, give it numbers and calculations.

When does mortgage refinancing really benefit?

On-lending can be internal or external. The procedure is simplified if the issue is resolved on the spot. The client has the right to express a wish to improve the terms of loan repayment in his own mortgage bank. Third-party clients, whose solvency still needs to be verified in practice, receive loans at a lower rate, and a person who regularly fulfills his obligations is forced to pay more.

Perhaps the bank will make concessions. When entering into commercial relations, each participant strives to respect their interests. It is possible that the interest rate that will be offered is not the lowest, taking into account the inevitable costs that refinancing mortgage loans from other banks entails. If mutual agreement can be reached, the issue can be considered closed. Otherwise, the client starts looking for better deals, and usually finds them.

The goal is to evaluate the profitability of mortgage refinancing. It is determined by the formula :

Where:

- VIR – benefit from refinancing;

- SZ – amount of remaining debt;

- C1 – mortgage refinancing rate;

- C2 – rate of the current mortgage agreement;

- N – number of months constituting the remaining loan term;

- SPK – the amount of the repaid part of the loan;

- ST1 – the amount of annual insurance under current conditions;

- ST2 – the amount of annual insurance in the new bank;

- SI – the sum of associated costs;

- Sp – an increased rate in effect during the period of re-registration of the collateral.

The formula requires some explanation. First, insurance costs are determined by the number of calendar years the mortgage is paid off. Even if full repayment of obligations occurs in January, it will still have to be paid for the entire year.

Secondly, the number “4”, which probably raised the question, means the number of “transition” months when the mortgage on the collateral property has not yet been transferred to the new creditor bank. All this time, the loan is treated as unsecured, and therefore it is subject to an increased rate (usually 2-3% higher than promised). It may be possible to re-register the collateral faster, but for preliminary calculations it is better to use a pessimistic period.

Thirdly, insurance under the new conditions may be more expensive, and then the amount of savings will decrease.

Dividing by 100% converts the percentage of rates into fractions of one, which is necessary for calculations.

Now about one-time costs, which significantly determine how profitable it is to refinance a mortgage at a bank offering these conditions. They are represented by the following expense items for an average two-room apartment from a developer:

- Expert independent assessment of the property – 3.5 thousand rubles.

- Certificates and notarization – 1.5 thousand rubles.

- State duty - 1 thousand rubles.

- Additional unforeseen costs - 1 thousand rubles.

The total value of associated costs (in the formula - SI) can be approximately replaced by seven.

The complexity of determining the profitability of mortgage refinancing can be reduced if you use a loan calculator. It calculates the entire left side of the formula, and the user can only independently subtract the difference in insurance costs, associated costs and losses during the period of the increased rate, which should be treated as inevitable.

The formula takes on a simplified form:

Where:

- VIR – benefit from on-lending;

- A – the benefit received as a result of calculations on the refinancing calculator;

- SI – the sum of associated costs;

- SZ – amount of remaining debt;

- SP – increased rate in effect during the period of re-registration of the collateral;

- C2 – rate of the current mortgage agreement;

- N is the number of months that make up the remaining loan term.

To enter the refinancing rate for a new mortgage loan in the field, you should check it with the bank manager.

Why do banks that issued loans agree to refinance?

Lending programs are structured in such a way that bank interest is paid unevenly throughout the entire term. The peak of their payments occurs in the first years. Then the borrower gradually repays the loan amount.

Important! Be sure to check whether early repayment is allowed under the terms of your loan agreement.

When can you apply for mortgage refinancing: profitable 50/50 formula

It is unlikely that the lender will agree to refinance if less than six months have passed since the loan was issued. In this case, he will not have time to assess your reliability as a payer. It is also almost impossible to achieve agreement if there are less than 180 days left before the end of payments (only in Sberbank this period is 90 days). The most beneficial formula for both parties is: 50/50. That is, it is profitable to apply for refinancing after half the term has passed.

Recommended article: Conditions for refinancing a mortgage at Sberbank

When is mortgage refinancing beneficial?

Banking tricks

The interests of the borrower and the lender are mutually contradictory. For this reason, banks often include clauses in the text of the agreement that seem harmless, but in fact can lead to a reduction in the debtor’s benefits. You need to know these techniques:

- An attractive offer for ideal clients. The point is that the offer indicates a very low rate in large numbers. The client is not “bought” by it, but at the bank he learns that in order to obtain such conditions, he must be a salary client with an impeccable credit history, and better yet, “with a halo over his head.” And if something goes wrong, then here’s another rate, a couple of percent more. In addition, the announcement was about a promotion, but it was long over.

- Promise of preferential interest rates for special cases. For example, refinancing of new buildings is carried out at a reduced rate. Below in small letters it is added that the benefit is valid until the house is put into operation. Then the object ceases to be a new building, and the rate turns into a regular one.

- Insurance. A policy for the collateral object must be issued. But some banks that own subsidiaries of insurance companies successfully supplement their budgets by imposing the service on applicants. At their expense, of course.

- Earnings on registration. Banks that refinance mortgages offer many additional services. They, of course, are paid, but can facilitate and speed up the refinancing procedure. You should not agree without studying the prices. There are also fees for servicing special cards that are not directly related to the mortgage, SMS alerts, etc., the benefits of which are very doubtful.

- Penalties for early repayment of debt. Individuals who receive loans and refinance them cannot by law be subject to such sanctions. A client who decides to pay the bank a debt earlier must notify the bank of this intention one month in advance. If the contract contains a clause regarding a penalty for early repayment, it can be challenged in court.

The general rule is that the client should read everything he signs carefully. If something is not clear, you need to ask again. The answer is also not entirely clear - then consult a lawyer for advice. Don't be afraid of being considered a bore. It will be worse if you have to count your losses later.

Procedure

To get an affirmative answer from the bank to the question of whether it is possible to re-issue a mortgage to another person, you must:

- notify the lender of your desire to renew the mortgage;

- prove to him the solvency of the new borrower;

- conclude a preliminary transaction in the amount of the remaining amount of the mortgage debt;

If the mortgage loan is not issued at the mortgagee bank, this algorithm includes the receipt of a document confirming the repayment of the debt, an extract and removal of the encumbrance on the property, the transfer and execution of a new loan agreement.

Is it possible to refinance a mortgage using two documents?

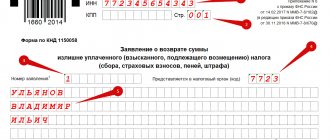

The documents attached to the application form for mortgage refinancing are almost the same as for a regular loan secured by real estate:

- passport;

- income certificate (most often 2-NDFL);

- a copy of the work book;

- TIN;

- SNILS;

- a valid loan agreement and other mortgage documents.

Citizens who, for some reason, are unable to confirm their employment and income can present a simplified package in the form of two documents - a passport and another one from the proposed list. The only thing you should remember is that the payment for the bank’s lack of awareness will be an increased rate.

Step-by-step refinancing process

This is not a quick procedure. Still, we are talking about a mortgage, which is accompanied by collateral and compulsory insurance. This simple loan is covered in a couple of days. A housing loan is a more complex loan, so everything will take a couple of months.

Please note that in addition to the standard package of documents for the borrower, you also need papers for the mortgage loan that will be overlapped. A loan agreement, a payment schedule, and a certificate of no debt must be provided. In addition, Sberbank will ask for a certificate from the previous bank about the balance of the loan debt - this will be the amount for which a new loan is issued.

If, in addition to the mortgage, other loans are covered, a set of documents must also be provided for them.

Borrower's procedure:

- First contact Sberbank by calling its hotline 900 and tell them that you want to refinance your mortgage. You need to obtain information about the exact package of documents that should be collected.

- Collect all the necessary papers and submit your application. This can be done at the bank branch where mortgage borrowers are serviced, or through the Sberbank Domklik service, that is, online. When you apply online, you will be offered three design options.

- If you have access to Sberbank Online, you can go to this system, you can also upload personal data from your account on State Services or start registration on Domklik by uploading a passport photo. A form to fill out will open here:

- Fill out the main form, indicating all information about yourself. You will need to enter information about income, place of work, information about marital status, education, etc. Here the client uploads a loan agreement for an existing mortgage.

- Selecting an office where mortgage transactions are carried out. The system will display current branches in your city on the map. All that remains is to submit the application for consideration and wait for a call from a Sberbank representative.

A decision on the application is made within 2-4 working days. If approval is given, the bank announces what package of documents needs to be collected for the property. When refinancing, the mortgage holder changes, so you will have to collect paperwork for the property again and conduct an expert assessment of it.

A positive refinancing decision is valid for 90 days. During this period, the client needs to collect papers and submit them to the bank to complete the registration.

Real estate documents are analyzed within 4-5 days. If there are no complaints, then the borrower is invited to sign a loan agreement. The process also involves a change of mortgagee and changes in insurance.