Mortgage loans are extremely popular because they provide an opportunity for every family or individual to become the owner of their own residential property without having the required amount of cash. The fact is that a loan is taken out from a bank, as a result of which borrowed funds are used for the purchase.

Before applying for such a loan, it is important to make sure that the borrower will be able to cope with fairly high monthly payments. If he has financial problems, he will have troubles with the bank, and his credit history will deteriorate. Therefore, a rather popular question is how to refuse a mortgage.

What are the consequences of refusing to make mortgage payments?

Don’t count on the fact that you will just take it and not repay the bank every month for the due mortgage payments. The loan has already been taken and will not simply disappear until it is fully repaid. You have taken out a mortgage and the bank, having given you money for living space, has fulfilled all contractual conditions. So you, in turn, are now obliged to reimburse him for the interest and the principal amount of the loan.

Peculiarity! Banks operate on interest from customers. The larger the loan amount, the more interest the banking institution will receive. And if the loan is long-term, then the profit will continue to flow for a long time.

When you realize after a short period of time that you are not able to pay, the bank will ask you a lot of questions and prepare a lot of difficulties. I advise you not to joke and take reasonable measures to refuse the mortgage, and a simple rebellion against monthly payments in addition to the growing debt due to late fees and penalties will significantly damage your credit history. Also, a long period of non-payment gives the bank a free hand and a claim will be filed against you. In this case, Themis is not on your side and your collateral housing may be taken away.

I will give you several unpleasant outcomes in the situation of missing payments and refusing them altogether:

- unpleasant credit history;

- loan growth when penalties are accrued;

- You will never be given even a minimal loan from this bank again, and difficulties will arise in others;

- You will have to deal with debt collectors;

- Through the court, all your accounts and other valuables in the form of movable and immovable property will be seized;

- Your mortgage will be taken away;

- Traveling abroad will be prohibited for you.

Next, I decided to give you legal ways to refuse a mortgage.

Is it possible to return the apartment to the bank?

The mortgage loan agreement does not provide for the possibility of returning the apartment to the bank and canceling the transaction. Even when debt arises, the creditor usually meets the client halfway and is in no hurry to break off the relationship. Going to court is a last resort.

If a decision is made in favor of the bank, the borrower is obliged to repay the debt. To achieve this, the mortgaged property may be forcibly put up for sale. Since the lender is interested in a quick sale, the asking price may be set below the market value.

The court decision contains the final amount of the debt, taking into account all fines, penalties, and so on. From the moment the decision is made, interest on the use of funds ceases to accrue. Bailiffs are hired to sell the debtor's property. What will happen to the money already paid? They are not included in the debt calculation, meaning you won’t have to pay twice.

If an apartment or other type of real estate is sold for a price that does not cover the amount of debt, the issue is not closed. The banking organization may file a claim again. Other property of the defendant may be used to pay off the obligations.

It might be interesting!

Is it possible to get a mortgage in another city in 2021?

Legal ways to refuse a mortgage

Method No. 1 - Selling mortgaged housing

The most effective way to relieve yourself of the debt burden is to sell the property and use the money received to fully pay off the bank. Only after this the contract can be closed, however, before the purchase and sale transaction, do not forget to notify the lender about this and obtain his approval.

Attention! Be prepared for the fact that due to the desire to speed up the process, the sale price of the apartment may be significantly lower than the market price. The deposit itself scares away potential buyers, which directly affects the price.

When you pay off a mortgage loan with maternity capital money, the bank regards this as your personal funds, they will not be returned to you, and the home sale transaction is complicated by the presence of minor children.

Method No. 2 - Settlement agreement

The bank can meet you halfway in your difficult life situation. There are cases when borrowers managed to reach an amicable agreement with the bank. At a very early stage, everything is much simpler. Money has been transferred to your account, and you are looking for housing, but have not yet spent the funds and, therefore, did not have time to sign the loan agreement. It is logical that you have not used the money yet and the agreement has not entered into force, so the funds are simply transferred back.

Peculiarity! When money has been in the account for some time, you are required to pay interest for that period. It doesn’t matter whether you used them or they were just sitting on your account. When the interest is paid in full, the property is released from the pledge and the encumbrance is removed.

Method No. 3 - Restructuring

It is also not profitable for banks to drive you into a dead end. They understand that by such actions they will not achieve any repayment. They can help you by restructuring the loan and thus increasing your ability to make payments and not lose the collateral. They will meet you halfway and simplify credit conditions. I propose to consider the available concessions in the table according to the text.

| Item no. | Mitigation option | Characteristic |

| 1 | Writing off penalties and fines | Banks independently have the right to make a decision to cancel the penalties calculated on your mortgage, but this can also be awarded by the court |

| 2 | Credit holidays | During this time, you will only have to transfer interest to the Bank, and will not pay off the balance itself. |

| 3 | Defer monthly payment | They may meet you halfway in revising the payment schedule, but know that by doing so you are increasing the loan term and, accordingly, the amount of overpayment for you will also become larger |

The bank may apply some option based on your documentary evidence that you can no longer and are not able to pay the loan for existing reasons.

Method number 4 - Refinancing

The essence of this concept is that you will be given a new loan to pay off the existing one. Apply for a new loan to another institution and cover your debt with this money. What is the beauty, you say? Pay off one loan and immediately take on another! But there is still a meaning. You are looking for more favorable conditions for yourself in a new loan. There may be a lower interest rate; if you took the money in a foreign currency, and the exchange rate is growing steadily, then it makes sense to change the currency. It is also possible to borrow money for a longer period in order to reduce the monthly amount. Many programs have a down payment and you should be aware of this.

Method No. 5 - Providing living space for rent

This method will help you at least partially cover the mortgage payment and you will not need to terminate the mortgage or resort to the more unpleasant cases I described above.

Attention! Before you rent out an apartment to people, read the mortgage agreement. Suddenly it contains a clause about mandatory notification to the bank that you have decided to do this. The apartment is still under security. In order to avoid troubles, I advise you to study this point.

I consider it useful for you to know that there is such a thing as a civilized lease, under its terms you re-transfer the mortgage to a third person and rent an apartment from him. Then he will deal with the bank, and you will pay him the cost of rent.

This is interesting: Social mortgage for a young family

Method number 6 - Go to court

I think this is the last option for both parties when terminating the existing mortgage agreement. If you decide to do this, you will have to justify your reasons for refusing to pay to the court. The reason may also be a defect in the purchase or other flaws.

If there are signed papers, but there is no fact of concluding a transaction, the agreement to purchase the apartment is canceled, the seller is obliged to return the money to the buyer. These funds are used to repay a bank loan earlier than the established period, which was taken out for the purchase of living space

Method number 7 - Do nothing

When you are absolutely sure that the troubles will soon pass and you will be able to financially repay the loan as before, it may make sense to do nothing until the situation changes. You just have to work hard so as not to miss the repayment schedule. Find extra income or seek understanding from family and friends.

What to do if the mortgage is not signed?

Life changes at lightning speed and today you come to the bank for a mortgage, and tomorrow you no longer need it. If you change your mind before concluding a loan agreement, tell the bank about it. You are not required to give reasons and circumstances that arose. You will not be charged with a fine either by a bank decision or by a court. You probably know about the existence of the Credit History Bureau and all the information on loan manipulations, including abrupt refusals, is collected here. This may have negative consequences when obtaining new loans.

What leads to such refusals is that a person may no longer need an apartment, and even as collateral, or he has found another way to improve his living conditions. The nuances of the topic under consideration are clearly presented in the video at the link

Military mortgage

Before refusing a mortgage to a military man, you should think a thousand times. Money was taken from the state budget on credit, and monthly payments are also compensated to the military. As a result, termination of the mortgage will entail a lot of litigation and the loss of all available benefits.

The reason for refusal to pay a loan may be the death of a military man, his dismissal from the military ranks, or going missing. If there is a personal desire of the employee to return the mortgage, this can only be done in court.

If a person serves less than ten years, he will have to return the entire amount of funds. But when he wants to continue living in the mortgaged apartment, the mortgage will be reissued on standard non-privileged terms and the state will no longer help him pay. If you have 10 years of service, you will not have to return your savings, but you will need to pay the interest yourself.

Peculiarity! If a serviceman wishes to independently refuse to participate in the program, his decision will be considered not only by the court, but also by his immediate superiors.

You will have to weigh everything especially carefully and carefully, since many military personnel refuse preferential mortgages in favor of obtaining a subsidy. With its funds, people look for the right living space and buy apartments without being burdened with a mortgage.

Mortgage cancellation at Sberbank: termination of payments and sale of collateral

A housing loan is secured by collateral (apartment, house, land, surety from an individual, etc.). If the client’s financial situation deteriorates sharply, he should contact a credit manager. The debt will be repaid using funds received from the sale of the collateral. If the money received from the sale of the apartment is not enough to pay off the debt, then the client will have to pay the balance of the debt on his own.

Citizens who do not make contact with Sberbank will be forced to pay a fine. Its size depends on the current value of the key rate, which is determined by the Bank of Russia. Reluctance to resolve debt issues will lead to the borrower’s credit history being damaged. The debtor will no longer be able to obtain a mortgage again.

Early repayment of a mortgage at Sberbank

How to refuse a mortgage from Sberbank if a person has enough money to repay the loan? Most loan agreements contain a provision allowing for early repayment of the loan. Sberbank does not charge a penalty for unscheduled return of funds. The client needs to sign the application, bring it to the bank or carry out the corresponding operation in the Sberbank Online system.

The application must indicate:

- Full name of the applicant;

- Sberbank branch number and full name of the manager;

- Contract number;

- Account details.

After reviewing the application, the bank will provide a document calculating the remaining payment. If the client does not agree with the amount of the debt, then he must document his doubts. When a consensus with the bank is reached, the client needs to transfer money to the account and pay off debt obligations. Next, you should terminate the loan agreement, close the account and remove the encumbrance from the property.

The documents may contain clauses that do not allow you to repay the debt ahead of schedule. Such agreements contain a clause allowing unscheduled payments thirty days after the conclusion of the mortgage agreement. This requirement can be challenged in court.

Mortgage holidays

Unfortunately, sometimes people simply cannot afford to pay their mortgage: legislation will tell you what to do in this situation. Starting from 2021, any citizen can contact the bank with a request to provide them with a mortgage holiday for a period of up to six months. It is expected that during this time he will sort out the problems that have arisen and resume payments. There are three vacation options:

- Payments are suspended, but interest is charged on the debt amount;

- The borrower pays only interest without repaying the principal;

- Payments are made in an arbitrary amount agreed with the bank.

During the holidays, loan payments are not written off or reset. Obtaining a deferment simply extends the term of the mortgage agreement by the appropriate number of months. In the same time:

- Vacations are provided once, but you can apply for them at any time during the contract period;

- The borrower himself determines the duration of the deferment within six months. However, it cannot be changed later;

- A citizen can choose whether he can not pay the mortgage now, or go on vacation on any date convenient for him;

- During the holidays, you can make a one-time deposit of arbitrary amounts to pay off your debt. But if you start paying regularly, the benefits are canceled.

The law applies to all Russian banks, so holidays are provided on an application basis, without any restrictions. However, there are still certain requirements to obtain them:

- The citizen has not previously applied for vacation;

- The loan amount is within 15 million rubles;

- The mortgage was issued for the applicant’s only residence.

The client has a document proving his difficult situation:

- Obtaining unemployed status;

- Assignment of a disability category by the commission;

- Staying on sick leave for more than two months;

- Reduction in monthly income by more than 30%;

- An increase in the number of dependents in the family and a simultaneous decrease in income by at least 20% if the amount of payments exceeds 40% of the family budget.

Refinancing a mortgage issued at Sberbank

Mortgage interest rates are periodically revised by financial institutions. In certain situations, the borrower has the opportunity to refinance the current debt with great benefit to his budget. The loan issued by Sberbank will be repaid using a new loan. How to refuse a mortgage from Sberbank and get a new loan?

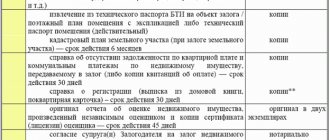

To apply for a loan, the client must provide the bank with:

- Passport of a citizen of the Russian Federation;

- A copy of the work book;

- Certificate of income;

- A copy of the insurance contract;

- Certificate of outstanding balance on the mortgage loan.

Refinancing can be especially beneficial during times of economic crisis. A sharp change in the exchange rate and the key rate of the Central Bank of the Russian Federation significantly changes the cost of a mortgage loan. The borrower should carefully study the debt restructuring programs offered by banking institutions. A Sberbank client can refuse standard loan products and use the services of a third-party financial organization.

How to avoid problems with your mortgage?

At least a third of the difficult situations when repaying a loan arise due to the borrower’s inadequate assessment of his capabilities or lack of understanding of the responsibility of such a step. To save yourself from problems when applying for a mortgage during a crisis, you should use some recommendations:

- There is no need to get a loan if the borrower does not have his own savings for a down payment of at least 25–30% of the contract value;

- You cannot give all your money as a down payment. In case of loss of income, it is better to save up funds to make three to four monthly payments;

- The total monthly payments should not exceed 40% of the total family budget. The reserve will be useful in case the situation worsens;

- It is important to understand the full scope of loan costs. The total cost of the loan is, in simple words, a combination of payments, commissions and insurance premiums;

- It is better not to refuse insurance. All life situations cannot be foreseen, and in the event of force majeure, the insurance company will pay interest on the loan.

How to refuse a military mortgage issued by Sberbank?

Most Russian military personnel are participants in the NIS (savings and mortgage system). Soldiers and officers of the Russian army are included in a special electronic database.

A serviceman is excluded from the register in the following cases:

- Dismissal from the Armed Forces;

- Death;

- Missing.

How to refuse a mortgage from Sberbank and exit NIS? Soldiers and officers who signed a contract with the state before 2005 can refuse a mortgage. To formalize the refusal, the serviceman must submit a report addressed to the commander. In some situations, an NIS participant may be excluded from the mortgage register by decision of the judicial authorities.

This is interesting: State assistance in repaying mortgages

Mortgage waiver in case of divorce

Up to 60% of marriages in Russia break up. According to the terms of the loan agreement, the spouses are co-borrowers on the housing loan. In the event of a divorce, one of them can refuse the mortgage. The contract is renewed, and the co-borrower who refuses the loan loses ownership of the residential premises.

The second option for solving the mortgage problem is to sell the property at auction. This event must be completed before the divorce process. The mortgage loan is repaid using funds received from the sale of the collateral property, and the remaining funds are returned to the former spouses.

The pledged property may be divided into shares by court decision. In this case, each spouse will have to repay the loan in proportion to the area of the share.

Termination of a mortgage agreement

Is it possible to refuse after signing the contract?

All mortgage loan documents are signed on the same day (purchase and sale, loan agreement, collateral agreement). On the same day, the client is given funds that are placed in a safe deposit box or transferred to a special account for subsequent transfer to the seller (after registering the transaction). Thus, the bank provided the client with a loan. And from this moment on, the right to refuse a mortgage loan is lost.

In this case, it is possible to terminate mortgage obligations using one of the following methods:

- Early repayment. The principal amount is repaid in full plus any interest due. If you don’t have the full amount on hand, you can use the refinancing service - take out another loan at a more favorable interest rate to repay the previous one.

- Sale of collateral property. There are several options here: Obtain the bank's consent for an independent sale with the transfer of borrower responsibilities to the buyer. But banks rarely give such consent, and it is unlikely that such a buyer will be found.

- Conclude an agreement on the sale of property out of court. The apartment is sold at auction, and the proceeds cover the existing debt. But if there is not enough money from the sale, the borrower will have to pay the remaining balance.

Is it possible to refuse a mortgage: conditions, methods

Mortgage loan from Otkritie Bank with a rate of 9.3% →

Mortgage: offers from banks

| Bank | % and amount | Application |

| Bank Otkritie mortgage | from 9.3% Up to 150 million rubles. | Direct application |

| Sberbank of Russia mortgage loan | from 8.2% to 70 million rubles. | More details |

| VTB 24 mortgage loan | from 9.2% to 60 million rubles. | More details |

| GAZPROMBANK mortgage | from 9.5% to 42.5 million rubles. | More details |

A home loan is a thoughtful and responsible step. But in case of life changes, you may need to solve such a problem as giving up a mortgage on your own square meters and getting your money back.

Mortgage loan from Otkritie Bank from 9.3% → Apply

Someone loses a good job, someone is going on maternity leave, someone gets divorced from their spouse - all these and other situations lead to the fact that repaying a loan becomes much more difficult. In this article we will present some ways on how to refuse a mortgage with the least loss for yourself.

Can I just stop paying?

It should be understood that you cannot simply refuse a loan, much less return the money spent on it. If you already have a signed agreement and the bank has fulfilled its obligations, i.e. transferred funds to your account, then you are also obliged to fulfill your part of the obligations, i.e. Pay monthly debt payments + interest on time and in full.

It is through interest that banking organizations make their profits. By giving you large sums of money, the company expects to receive high income through long-term debt repayment. And if you immediately refuse this, then be prepared to face difficulties.

Of course, situations are different, but you can’t just stop paying. Not only are you increasing your debt through daily penalties and fines, but you are also damaging your credit history due to late payments.

And when the delay becomes long, the bank has the right to go to court and, through bailiffs, take away your mortgaged property, which is pledged.

That is, if you simply stop paying, then the consequences will be as follows:

- increase in debt due to fines and penalties,

- damaged credit history,

- getting on the stop list of this bank and its subsidiaries, if any,

- if the delay is large, they can go to court. If the court sides with the bank, then the bailiffs will be able to seize your accounts, real estate, valuable property, and seize the collateral, i.e. mortgage housing, block travel abroad,

Is it possible to cancel your current mortgage and simply not pay monthly payments?

You cannot simply refuse a mortgage without good reason and without notifying the bank.

Otherwise, the borrower will face the following negative consequences:

- the bank will begin to charge penalties and interest on it, which will ultimately lead to an increase in the final cost of the loan;

- the borrower will be blacklisted, his credit history will be damaged and in the future, if he wants to take out a loan or mortgage, banks will be forced to refuse him;

- if the delay is large, the bank may transfer the borrower’s debts to a collection agency. Knowing how employees of such agencies work (blackmail, hacking, intimidation), it is better not to bring the situation to this stage;

- the bank may go to court and demand compensation for losses it incurs if the borrower fails to pay the mortgage and interest on it. In such a situation, the court will be on the bank’s side and can forcibly take away the borrower’s collateral property in favor of the bank.

What options are there?

What can you do? Here are some tips we can give you.

- If you have nothing to pay

Contact your bank and let them know that you are having financial problems. In this case, the client must support his words with documents, i.e. provide a certificate of reduction in income or an extract from the work book about dismissal, reduction, etc. The bank changes the terms or offers deferred payments.

Lenders often make concessions to borrowers, not wanting to get involved in litigation. The bank may reduce the interest rate, provide a credit holiday for 6-12 months (only interest will be repaid), or offer to extend the term.

If life problems arise, contact the bank immediately; perhaps you can easily reach an agreement. This procedure is called debt restructuring in banks; you will get more information about it from this article.

- You simply stop making monthly payments.

What does this threaten: as we wrote above, in a situation where the borrower does not pay his loan for a long time, the bank goes to court, in most cases wins, takes the home and sells it. Proceeds from the sale go to pay off debt.

This is not the best way to solve the problem, since the lender will not be interested in a profitable sale. He only needs to cover your debt, the price of the apartment will be significantly reduced.

If you take the case to court, your credit history will be ruined. Subsequently, it will be very difficult to even take out a consumer loan. That is, this method is suitable only as a last resort.

However, even with a bad credit history you can get a loan, but to do this you first need to try to improve your financial record. Read about how to do this here.

- You are looking for a buyer and selling him your living space.

The money received is used to pay off the debt. This method allows you to solve the problem, but it is worth considering that today it is not so easy to find a person who wants to purchase a home with a mortgage.

Therefore, the seller should think about reducing the price of his home, and this risks the fact that the amount received will not be enough to fully pay off the debt. It should be remembered that for the entire duration of the loan agreement, the purchased property does not belong to you, its owner is the bank.

It is for this reason that you need, first of all, to contact the bank branch and find out whether it is possible to change the borrower, on what grounds, what documents will need to be prepared? More details about the sale of an apartment with an encumbrance are described at this link.

- Mortgage refinancing service

The client decides to use the refinancing service, which allows him to reduce the monthly loan burden due to a more attractive interest rate, increasing the loan term, changing the currency, etc.

It is better to refinance with your own bank, but if its terms do not suit you, then the programs of other lenders are also suitable. You will find a list of the best offers for re-issuing a home loan here.

Please note that in this situation, you will need to incur additional costs to re-evaluate your home as well as insure it. The mortgage will be transferred to the new bank. The re-registration process is not quick, it can take up to a month, and if you have at least one delay, you will be denied.

If you have not yet made a single payment after your application has been approved , then it is quite possible to refuse a mortgage loan. If the agreement has not yet been signed, you simply inform the bank employee that you will not apply for a loan. Refusal of your application or even termination of the contract does not entail penalties and does not affect your credit history in any way.

Return of funds to the borrower upon cancellation of the mortgage is possible only upon sale of the property, after which the bank recalculates the loan and negotiates the amount of the debt. The refund amount will be equal to the difference between the amount received after sale and the balance of the principal debt.

If the mortgage was taken out a long time ago, then if you cancel it and sell the apartment, you will get a decent amount of money back, given the stable and strong growth in real estate prices recently. More information about housing prices is presented in this article.

Mortgage restructuring

Absolute insolvency is relatively rare. Typically, the borrower retains some income and the ability to make small payments: in this case, it is advisable for him to contact the bank with a request to restructure the mortgage due to the crisis. Such a procedure may involve:

- Extension of the contract term, but not more than 35 years. As a result, the average monthly payment decreases, although the total overpayment increases;

- Transfer from annuity to differentiated types of payments. If more than 50% of the debt has already been repaid, the monthly payment amount will be less;

- Changing the loan currency to domestic. A relevant way to reduce the mortgage burden during the 2021 crisis, when the ruble exchange rate fell by almost 15%.

It is quite difficult to achieve restructuring: the manifestation of dishonesty among borrowers forces banks to be careful when providing benefits. In order for the client’s request to be granted, he will need compelling reasons:

- Salary reduction or layoff;

- Serious illness or assignment of disabled status;

- Conscription for military service;

- The onset of an emergency, fire, flood;

- Registration of maternity and child care leave;

- Imposition of punishment in the form of imprisonment.

Different banks may provide restructuring services based on a number of additional requirements for applicants. First of all, we are talking about a positive credit history, which proves the client’s reliability. Other rules include:

- The borrower has documentary evidence of the difficult situation;

- The applicant has not reached retirement age;

- The mortgage is issued for the citizen’s only home;

- The contract expires in at least three months;

- The borrower has regularly paid contributions for at least a year;

- The loan has not previously been subject to restructuring.

When can you get out of your mortgage?

The question of whether it is possible to refuse a mortgage does not have a clear answer. Exiting a mortgage can be done at different stages of its registration and implementation, and depending on this, the procedure differs.

- At the stage of consideration of the application, before signing the contract, there are still no legal obligations, and the process of obtaining a mortgage simply stops.

- After signing the contract, but before transferring funds. An application is sent to the state register to delete the mortgage record. The process takes three days.

- After the conclusion of the contract and the transfer of funds, the money has not yet been spent. The easiest way out is to pay off your mortgage early. You need to write an application to the bank and deposit the required amount, taking into account interest for even a short period of use of the funds.

- If part of the funds transferred by the bank has already been spent, the process becomes more complicated. Options for how to refuse a mortgage in this case are discussed further.

In principle, getting out of a mortgage is always possible. The only difference is the complexity of the procedure and the costs incurred.

How to justify refusal during registration?

Undoubtedly, the client has the right to refuse life insurance immediately when applying for a mortgage.

In this case, the bank offers the borrower a different lending program, which contains more stringent conditions for issuing borrowed funds. As a rule, they are associated with an increase in mortgage rates.

In addition, the borrower

has the opportunity to refuse life and health insurance immediately after purchasing a home using a mortgage.

This can be done during the so-called “cooling off period”, which lasts 14 days from the date of conclusion of the contract.

In this case, the policyholder will be fully (if the insurance contract has not entered into force) or partially (if the insurance has entered into force) refunded the amount of the insurance premium.

If the policyholder decides to refuse life insurance a significant time (1 year or more) after the conclusion of the contract, this can have very negative consequences.

But, we must take into account that the bank may significantly increase the mortgage lending rate or even require repayment of the loan ahead of schedule.

Features of military mortgage insurance ►►

Causes

It should be noted that the borrower is not at all obliged to indicate the reasons for refusing life and health insurance under the mortgage, since the acquisition of this type of policy is carried out on a voluntary basis. No one has the right to force a client to take out such insurance.

In most banks, in the application form for refusal of life and disability insurance, there is no column at all in which it is necessary to indicate the reason for reluctance to take out insurance.

Legislation to help

At the legislative level, the borrower is not required to provide life and health insurance when applying for a mortgage.

This procedure is entirely voluntary.

In accordance with paragraph 2 of Article 31 of the Federal Law of the Russian Federation “On mortgage (mortgage of real estate)”, the borrower must insure only the mortgaged property itself , that is, the mortgaged property.

Terms and conditions of the mortgage insurance contract ►►

Therefore, if the bank forcibly insists on issuing a life and disability insurance policy, the borrower has every right to write a complaint to the appropriate authorities, where he argues for the right to refuse mortgage insurance.

How to get out of your current mortgage

If a bank client has already started using mortgage funds, but due to various life situations cannot or does not want to continue paying the debt, there are several ways to refuse the mortgage.

Refusal due to financial difficulties

If the only reason for refusing a mortgage is difficulties with funds, there are different options for solving the problem. How to refuse a mortgage if you have nothing to pay:

- The client simply stops making contributions and does not contact the bank. After some time, he will receive a summons to appear in court. The result of the litigation will be the closure of the mortgage. But at the same time, property is confiscated. Both money and housing will be lost. Plus, your credit history will become hopelessly damaged, and you won’t be able to get a loan even from another bank. If there are small children in the family, the court may allow you to stay in the apartment for a year to look for another accommodation option.

- If the client is determined to keep the home, the bank may offer restructuring or refinancing of the loan. Restructuring is a change in the terms of mortgage lending, for example, extending the term or reducing the rate. Refinancing is the issuance of a new loan to pay off the old one. These measures allow you to reduce the size of your monthly payment. In some situations, such measures are enough to avoid giving up your mortgage. Plus, you can try to take a credit holiday - and pay only interest to the bank for a year. To qualify for such relief, you must have documentary evidence of insolvency.

- Another way to refuse a mortgage is to switch to the civilized rental program. The apartment is transferred into ownership to a third party, who continues to pay the mortgage, and the client lives in the living space, renting it at a reduced price. Officially, the borrower is guaranteed to live under such conditions for up to five years. After their expiration, the issue of housing will become open.

- Sale of mortgaged housing and early repayment of debt from the funds received. The procedure is carried out exclusively with the permission of the bank. The attractiveness of this method is that the credit history remains clean, and after repaying the mortgage, some of the funds will remain on hand.

In order to avoid disputes during a divorce, it is recommended to conclude a prenuptial agreement for housing purchased with a mortgage.

As you can see, there are different options for getting out of a mortgage in case of financial difficulties. The choice of the preferred one is determined by the characteristics of a particular situation.

How to deal with a mortgage during divorce

A frequently asked question is how to get rid of a mortgage during a divorce. The divorce process itself is frightening with legal difficulties, and the presence of a mortgage aggravates the matter. There are also different ways to solve the problem.

If the marriage is civil, then the mortgage and apartment remain with the spouse for whom it was registered. It is up to this spouse to decide how to refuse the mortgage. All the previously mentioned options are possible.

If a marriage contract was concluded, then all the subtleties are stipulated in it.

If the mortgage was taken out after marriage and the spouses are co-borrowers, you can go in different ways:

- Continue to pay the mortgage jointly, in half, and after repayment, sell the apartment and divide the funds;

- One of the spouses gives the apartment along with the mortgage to the second;

- Sell the apartment, pay off the mortgage and divide the remaining funds;

If one of the spouses stops paying their share, they go to court, and depending on the decision, they either lose their share in the housing and the mortgage is paid off by the other party, or the apartment is sold and the debt is paid off. There is a difference in special programs, for example, military mortgages - in this case, only the military spouse is considered both the owner and the debtor.

If you have nothing to pay for your home loan, then with the bank’s permission it is permissible to sell your home and pay off the debt

The main goals and objectives of getting rid of a mortgage loan

Not everyone understands, but getting rid of the mortgage burden is often much easier than getting rid of a consumer loan. However, everything is determined primarily by the goals and objectives that the borrower seeks to achieve.

Most often, mortgage borrowers set the following goals for themselves:

- Preserve the collateral in the property, but at the same time achieve changes to the terms of the mortgage agreement. This will help reduce the credit burden and service the loan on more favorable terms.

- Maintain ownership of real estate or land and independently achieve a reduction in your loan burden. This can be achieved by refinancing your mortgage.

- Pay off your mortgage as quickly as possible. In this case, it does not matter to the borrower whether the collateral remains in his ownership.

At its core, a mortgage is a rather complex form of lending. Such a loan includes two types of legal relations: regarding the collateral and directly regarding the loan. These two parts are interconnected, so the goals that the borrower sets in relation to them when deciding to get rid of the mortgage also depend on each other.

In most cases, you have to choose whether or not to retain ownership of the collateral. The decision made determines what measures to take in the current situation.

The easiest way to get rid of a mortgage loan is if the borrower is ready to lose the collateral. In this case, it is the property that will be able to ensure the fulfillment of obligations.

If it is important to maintain ownership of real estate or land, the situation becomes more complicated. You will have to independently find a source to pay off the mortgage, refinance it, or try to negotiate with the bank.

Before you begin choosing a method for releasing your credit obligations, you should pay attention to the possibility of resolving this issue with the help of insurance . Most borrowers take out a life and health insurance policy. Moreover, some of them take out liability insurance, including in situations of job loss or reduction in income.

Insurance payments can help the borrower pay off all or at least part of the mortgage. If the policy has not been issued, or the debtor’s situation is not an insured event, you will have to look for another way to solve the problem.

Legal ways to get rid of a mortgage

Is it possible to return money from Sberbank

Many people have probably wondered how to cancel their mortgage and get their money back. It’s a shame to lose both your home and the funds that have been invested in it for years. Even if a home is sold, the bank often sells it at a minimum price to speed up the process, and the proceeds do not always cover the size of the mortgage. So there is no way to stay in the black by giving up a mortgage.

Otherwise, it is not profitable for banks to lend funds for use. When deciding how to refuse a mortgage from Sberbank or any other bank, you need to understand that this is in any case a no-win situation.