Buying a home on credit has become easy: Sberbank’s current mortgage programs make it accessible to different categories of the population. Young families, military personnel, families with children can become owners of their own residential real estate on preferential terms. Reduced lending rates that are beneficial for people are provided as part of new state support programs. For those who want to purchase primary housing - under construction or completed, Sberbank offers discounts on loans.

By using Sberbank, without even leaving your home, you can choose the right housing and mortgage terms, calculate the monthly payment, apply for a loan and get approval, and register property rights.

First of all, you need to decide on the purpose of financing, requirements and the ability to repay the loan. There are a number of requirements that are the same for all loan programs (except for military capital):

- The borrower can be a citizen of the Russian Federation, aged from 21 years (at the time of application), to 75 years old by the time the financing expires.

- The applicant's work experience: at least 6 months in the current job and at least 12 months over the last 5 years.

Depending on the type of program, applicants may be asked for additional information.

What document requirements do Banks require can be found in the article - Requirements for documents for an online mortgage

Basic conditions of Sberbank mortgage programs

| Program | Max. amount, rub. | Down payment, rub. | % rate | Credit term | Add. conditions |

| Purchase of housing under construction or completed (primary) | Not higher than the lesser of the two: · 85% of the contract price of the purchased housing; · 85% of the estimated value of the collateral property. | From 15% From 50% (without confirmation of income, when bank funds participated in the construction of the purchased housing). | Basic: · 8.7% (over 3.8 million rubles); · 9.1% (up to 3.8 million). Subsidized: · from 6.7% (over 3.8 million rubles) · from 7.1% (up to 3.8 million rubles). | Up to 30 years old; Up to 12 years (if the rate is subsidized by the developer). | Discounts on rates are valid until 08/31/2018. |

| Purchase of finished housing | Not higher than the lesser of the two: · 85% of the contract price of the purchased housing; · 85% of the estimated value of the collateral property. | From 15% From 50% (without confirmation of income, when bank funds participated in the construction of the purchased housing). | From 9.1% | From 1 year to 30 years | |

| Refinancing mortgages and other loans | · 7,000,000 (to repay a mortgage in another bank); up to 7,000,000 rubles · 1,500,000 (for repayment of other loans); · 1,000,000 (for consumer purposes). Not higher than the smaller amount of the two: · 80% of the value of the appraised value of the property; · the sum of the balances of the principal debt and current interest on refinanced loans, including the amount requested for personal consumption. | — | From 9.5% | From 1 year to 30 years | |

| Mortgage for young families | Not higher than the lesser of the two: · 85% of the contract price of the purchased housing; · 85% of the estimated value of the collateral property. | From 15% From 50% (without confirmation of income, when bank funds participated in the construction of the purchased housing). | From 8.6% | From 1 year to 30 years | One spouse or single parent is under 35 years of age. |

| Mortgage with state support for families with children | · 8,000,000 (for the purchase of objects located in Moscow, Moscow region, St. Petersburg, Leningrad region; · 3,000,000 (for the purchase of objects in other regions of the Russian Federation) | From 20% | 6% – the first 3 years of the loan for those who had a 2nd child, or the first 5 years for those who had a 3rd child; 9.25% – remaining loan period. | From 1 year to 30 years | The loan is issued to families of Russian citizens who have a 2nd or 3rd child, a citizen of the Russian Federation, born between 01/01/2018 and 12/31/2022. |

| Construction of a residential building | Not higher than the lesser of the two: · 75% of the contract price of the loaned or other housing; · 75% of the estimated value of the loaned or other housing serving as collateral. | From 25% | From 10% | Up to 30 years old | |

| country estate | Not higher than the lesser of the two: · 75% of the contract price of the loaned or other housing; · 75% of the estimated value of the loaned or other housing serving as collateral. | From 25% | From 9.5% | Up to 30 years old | |

| Non-targeted loan secured by real estate | Not higher than the lesser of the two: · 10 000 000; · 60% of the estimated value of the collateral residential property. | — | From 12% | Up to 20 years | |

| Mortgage plus maternity capital | Not higher than the lesser of the two: · 85% of the contract price of the purchased housing; · 85% of the estimated value of the collateral property. | From 15% (covered partially or fully by maternity capital) | From 6.7% (when purchasing housing under construction or finished housing from a developer) From 8.6% (when purchasing finished secondary housing) | Up to 30 years old | Availability of documents confirming maternity capital: State certificate for maternity capital; Document from the Pension Fund of the Russian Federation on the balance of maternity capital. |

| War capital | Up to 2,330,000, but not higher than the lesser of the two: · 85% of the contract price of the purchased housing; · 85% of the estimated value of the collateral property. | — | 9,5% | Up to 20 years, not exceeding the term of the targeted housing loan. | Availability of a certificate of entitlement to receive a targeted housing loan. |

Advantages of the apartments

An important feature of the apartments is comfort. The luxury class may include services for careful care of the surrounding area and maintaining the environment in proper condition. It is pleasant to observe the clean, well-groomed walls of the corridors, enjoy living plants in the halls, and move in a modern, clean elevator to unobtrusive music. Economy class often offers cleaning of living quarters.

The decision to purchase an apartment is influenced by the area where the living space is located. Not all plots in the city are suitable for residential development. For those wishing to purchase a comfortable place to live close to work, a new offer on the real estate market will help solve the problem. The proximity of the building to your home office will allow you not to waste extra time on the road, using the saved hours for productive work. Time is money; minutes saved increase your income, allowing you to pay off your home purchased on credit sooner.

Purchase of finished (secondary) housing

As part of lending, you can buy finished residential real estate (apartment, house or other) second hand. Interest rate discounts are provided for participants in state regional and federal programs for the development of the housing sector.

How to buy a house with a Sberbank mortgage - read the article.

Step-by-step instructions on buying an apartment with a mortgage on the secondary market are in the next article.

Reviews from real borrowers

Sberbank collects a lot of feedback from real borrowers. It should be noted that the bank staff promptly responds to reviews and tries to solve problems that arise.

Among the advantages, borrowers note fast and convenient mortgage processing, intuitive and trustworthy digital services. The downsides are staff errors and human errors. As a rule, similar disadvantages are identified in the work of other banks.

Refinancing of mortgage and other loans

Sberbank makes it possible to transfer existing financing from another bank to a mortgage with more favorable conditions. It is also possible to combine several loans into one and reduce the interest rate on them. 1 mortgage loan is subject to refinancing; up to 5 different loans: for consumer needs, car loans, credit cards.

A mandatory condition of the mortgage program is that the refinanced loan meets the following requirements:

- No overdue debt at the moment.

- Loan payments must be made on time according to the payment schedule for the last 12 months.

- The term of the refinanced loan must be more than 180 months by the time of application to Sberbank.

- The period until the end of the contract is from 90 days.

- No restructuring was carried out on the refinanced loan.

Secure payment service

Another product from Sberbank designed to increase the comfort of transaction participants:

- The parties to the agreement open a special account to which the buyer’s money is transferred.

- Documents are submitted for registration.

- The bank requests information from Rosreestr about the registration progress.

- After registration, the bank transfers the money to the seller.

Calculations are carried out without the participation of the parties. Compared to escrow, for example, the seller does not need to present ownership documents to the bank. Unlike a safe deposit box (2,000 rubles), the bank is responsible for the safety of funds in the account, plus it independently prepares all the documents. The cost of the service is 3,400 rubles.

Quickly jump to sections

Mortgage under the state program for families with children

Mortgage lending is provided as part of the state program of assistance to families who had a 2nd or 3rd child between 01/01/2018 and 31/12/2022. Families of citizens of the Russian Federation, or a single parent, can buy primary housing under construction or completed housing from a developer company. A preferential interest rate is provided under the loan agreement for a period of 3 years (at the birth of the 2nd child), 5 years (at the birth of the 3rd child). If a family with a 2nd child in the process of paying off the loan in the period from 01/01/2018 to 12/31/2022 has a 3rd child, then it is possible to extend the grace period.

Read more about mortgages with state support in another article: Mortgages with state support at 6% for families with children: answers to frequently asked questions

Non-targeted loan secured by real estate

If you need funds for personal purposes, you can receive financing without confirming the intended purpose. This loan can also be an alternative to a mortgage when there is no money for a down payment. Own real estate serves as collateral. This program does not provide online review. A package of documents must be submitted to the bank office.

About non-targeted lending in detail in another article: Mortgage secured by existing real estate

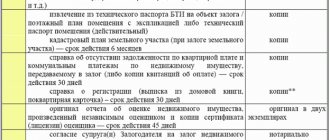

What documents does the bank need?

To obtain a mortgage for an apartment, you must provide a standard package of documents:

- Identity document.

- Certificate of temporary registration at the place of actual residence (if any).

- Documents about the amount of income and employment (a copy of the work record book, a certificate from the tax office and from the employer, a certificate about the amount of the accrued pension). Documents on financial status do not need to be presented if the client receives a salary through Sberbank.

- Documents about marital status.

- Confirmation of availability of funds for the down payment (account statement).

- Real estate documents:

- if one’s own real estate is pledged as collateral: the primary document according to which the real estate was transferred into ownership (agreement, certificate of inheritance, etc.);

- extract from the Unified State Register of Real Estate;

- registration certificate;

- the consent of the spouse to transfer the property as collateral, or a notarized statement that at the time of receipt of the property the borrower was not married;

- certificate of registered persons;

- grade;

- insurance policy.

Since apartments can only be purchased from accredited developers, all other documents are already available in the bank (statutory documents of a legal entity, construction permits).

Mortgage plus maternity capital

Owners of maternity capital can apply for mortgage lending for the purchase of housing under construction (primary) or finished housing (secondary). It is possible to use maternity capital as full or partial coverage of the down payment. If one of the spouses or a single parent in the family has not reached the age of 35, then the borrower can additionally take advantage of lending benefits for young families under the state support program.

You can learn more about how to use maternity capital in the article - Mortgages and maternity capital.

Interest reduction options

In reducing the possible overpayment on a mortgage at Sberbank, some conditions can play a significant role:

- mortgage for secondary housing in Dom Click from Sberbank;

- receiving earnings through this bank;

- life insurance offered by the lender;

- apartment registration through Sberbank;

- eligibility for benefits under the program for young families.

Applying for a mortgage in Sberbank online

Currently, the procedures for obtaining a mortgage loan at Sberbank have been significantly simplified. Now there is no need to visit a bank office until signing a loan agreement. All steps to submit an application, submit a package of documents and obtain loan approval can be done online.

After familiarizing yourself with the bank's current programs and deciding on the terms of the mortgage, you need to calculate the amount of the monthly payment. This can be done on the official website of Sberbank using. Depending on the loan term, the monthly installment varies - the longer the term, the lower the payment. However, in this case, the total amount of interest paid will be higher.

After completing the registration procedure in your personal account on the bank’s website, you can submit an application online, attaching the necessary documents. The application is reviewed within 2 days. The bank will inform you of the result by sending an SMS and calling a bank representative.

If Sberbank refuses a mortgage, you can re-apply after 2 months. The reason for the refusal, of course, will not be announced, but read the article - Reasons for refusal of a mortgage: what should borrowers take into account? - and analyze your situation.

The approval of the selected residential property takes place within 3 to 5 days if the loan is approved. The loan transaction is concluded at the Sberbank mortgage lending center. You can also register ownership of real estate online. When registering housing rights electronically, a discount is provided at an interest rate of 0.1%.

What pitfalls to pay attention to in a purchase and sale agreement, read the article - Sale and purchase agreement with a mortgage - important points for the seller and the buyer.

If the seller insists on lowering the price in the purchase and sale agreement, then read the article first - Mortgage with underfinancing (lower price) - should you agree to such a deal?

You can familiarize yourself with the terms of the loan agreement by downloading the document - Conditions for providing a mortgage by Sberbank

Thus, by using one of Sberbank’s mortgage programs, you can become the owner of a long-awaited home or an investor in your own real estate in a short time and on favorable terms.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publicationJuly 10, 2018December 21, 2018

Electronic registration service

Classically, real estate registration takes place through the MFC, which accepts documents from the seller, buyer and bank. Based on the results of registration, ownership is transferred to the borrower, and the encumbrance is registered to the bank. After the mortgage is repaid, the encumbrance is also removed through the MFC.

Sberbank decided to simplify the registration procedure by introducing a special electronic service. Clients do not have to visit the MFC - everything can be done through the bank.

Sberbank service offers:

- payment of state duty (2000 rubles);

- issuance of UKEP for all participants in the transaction (signature on a flash drive, analogous to a handwritten signature);

- sending documents to Rosreestr electronically;

- control of registration by the bank.

All actions will be performed by the bank manager, and the finished policy and statement will be sent by email. Legally, this is completely legal and is in no way inferior in strength to the paper version of registration.

Attention! The price of electronic registration is from 8 to 11 thousand rubles. In small towns there is no point in spending money on this service; it is easier to contact the MFC in person.