All owners who own real estate are required to pay taxes on it. Buildings, houses, structures, garages, premises, residential and non-residential apartments, rooms are subject to tax. Co-owners who have a share in the apartment are also not exempt from paying tax. However, this applies exclusively to those cases where the property was received after 2009. Until this year, there was no corresponding legislative amendment.

What tax and to whom to pay for an existing apartment is determined by Russian legislation. The total cost of the immovable property is taken into account based on the tax base information. Tax rates are set by city authorities, citing legislative acts. The location of the apartment is also taken into account. So, for example, the tax within the city is less than for real estate outside it.

The collection percentage will also depend on the cost of the apartment. The lower the amount, the lower the percentage. It can range from 0.1 to 2 or more. If taxes are not paid on time and correctly, the owner will have trouble, including a fine.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

Preferential categories

However, even these categories are not completely exempt from the obligation to pay tax. The exception is for people who own an apartment with an area of less than fifty square meters, regardless of whether they are beneficiaries or not.

Payment of the tax is imposed on all owners of housing with an area of fifty square meters or more, as well as owners of non-residential premises. For evading their duties, the violator may face not only a fine, but also imprisonment.

How much to pay?

Each real estate property implies an individual tax amount that must be paid to the state. Citizens who have an apartment should calculate the amount of the fee themselves. To do this, you need to know the current cadastral value of your property. You can get this information without leaving your home using the Internet. To do this, you need to leave an application electronically on the state official portal of Rosreestr.

Since the system is relatively new and has not yet been properly debugged, the completed certificate of cost will need to be picked up in person at the local office. Next, the calculation itself is carried out.

It's fast and free!

Or call us by phone (24/7).

It is better to do this in advance, at least a week in advance, so that there is no delay in payment. And even if the tax was calculated incorrectly, you could have time to contact the tax office and make an adjustment.

Who should pay property tax?

According to the legislation, property that is subject to the tax in question can be represented by: - residential buildings; - apartments, rooms; - garages; — parking spaces; — other buildings, structures, structures, including those related to unfinished construction projects.

When owning the specified types of property, individuals must pay the tax in question, regardless of their age, social status, as well as the fact of using the relevant property. If the taxpayer is a minor citizen, then his parents are responsible for paying for the property he owns.

At the same time, the payment documents reflect the fact that the payment is made on behalf of the owner of the property. Owners of these types of real estate are required to pay property tax, regardless of their citizenship, as well as their place of permanent residence.

When is property tax due? The obligation to pay the tax in question arises for a citizen as soon as he formalizes ownership of any of the real estate objects listed at the beginning of the article. The fact of transfer of real estate into the ownership of a person is certified by its state registration in the manner prescribed by law.

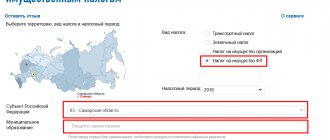

How and where to pay property tax

If the notification has arrived, then we take it and go to Sberbank, and they will tell you how to make a payment through an ATM. If you haven’t received a notification, then you should go to the tax office and connect to the “taxpayer’s personal account” service. This service displays all taxes, deductions, etc. You can also pay online or print a receipt from your personal account.

When is property tax due?

The obligation to pay the tax in question arises for a citizen as soon as he formalizes ownership of any of the real estate objects listed at the beginning of the article. The fact of transfer of real estate into the ownership of a person is certified by its state registration in the manner prescribed by law.

If a person bought real estate under a shared construction agreement, then he will be the payer of the tax in question, again, only upon the fact of state registration of ownership of the purchased housing.

With a mortgage, despite the fact that the property will be pledged to the bank, the person who has issued the corresponding loan becomes a full payer of the tax in question from the moment of state registration of the property. The owner of the apartment, one way or another, is the person who took out the mortgage on it.

Property tax benefits

The legislation of the Russian Federation establishes a fairly wide range of categories of citizens who have benefits in paying real estate taxes. A complete list of these categories is defined in Article 407 of the Tax Code of the Russian Federation. In general, the benefit provides for the complete release of a citizen from the obligation to pay property tax.

Certain benefits - for example, expanding the lists of citizens specified in Article 407 of the Tax Code of the Russian Federation - may be established by regional legislation. To apply the benefit, a person must contact the Tax Inspectorate (FTS) with documents confirming the right to use the relevant privileges.

Tax authorities, in response to this request, usually recalculate property taxes. If a citizen’s right to a benefit arises in a certain month, then starting from the next month property tax is not charged. A complete recalculation of tax taking into account the benefit is possible for 3 years preceding the year in which the citizen applied to the Federal Tax Service regarding the application of the benefit.

If it turns out that the tax should not have been paid or was overpaid - that is, according to the benefit, its value should have been less, then the citizen can return the amount of the corresponding overpayment from the budget. To carry out the procedure for returning this overpayment, the taxpayer must submit an application to the Federal Tax Service in the prescribed form.

Innovations in tax legislation have excited many property owners. Now, starting from 2015, property tax for individuals will be calculated taking into account its cadastral value. Not all regions of the country have yet switched to the new calculation; by 2021 the entire Russian Federation will switch to it.

When is property tax calculated and what is the payment deadline for individuals?

Last update 2018-11-23 at 13:11

In order to pay your tax obligations on time, you need to know not only the amounts due, but also the deadlines - when letters are sent and the last day for the transaction arrives. After all, timely payment is one of the key parameters monitored by tax authorities.

When is personal property tax calculated?

The exact deadline for calculating property tax for individuals is not provided for by tax legislation. In accordance with Article 408 of the Tax Code of the Russian Federation, citizens are exempt from independently calculating this payment - they do not need to calculate the tax base, monitor changes in coefficients and look for rates in local legislation, the Federal Tax Service will do all this for them.

Inspections calculate property taxes for citizens from the beginning of the new tax period until November 1. For example, if you acquired taxable property in 2017, then in the period from January 1 to November 1, 2018, the tax office will charge property tax for individuals for payment on any day convenient for it.

But the Tax Code of the Russian Federation strictly stipulates the deadline for sending real estate taxes: the deadline for sending notifications is 30 days before the deadline for paying property taxes for individuals, i.e. until November 1 of the year. If this day falls on a weekend or holiday according to the working calendar, the date is moved to the next day. There have been no such changes this year.

Real estate tax comes in the form of a single notification - the notification will indicate all the property obligations of the person: if there is land - land tax, if there is a car - transport tax. The notification is a table indicating the tax base, rate, and accrued amount.

Along with the notification, real estate tax receipts come in the form of payment notices - you can submit them to the bank and pay the amounts using the correct details.

What the notice and notification look like:

.

Important! If you have a verified account on the “Government Services” portal or have activated the “Taxpayer Personal Account”, notifications about the payment of property tax for individuals are received electronically - paper letters will not be sent to you.

https://www.youtube.com/watch?v=l5Of7eX6gCQ

As a rule, property tax for individuals is calculated in the eighth month, i.e. in August, sometimes in September. Email notifications arrive at such times, but the letter may be delayed and not arrive at all.

Important! If you have not received a letter from the Federal Tax Service before the deadline for calculating property tax for individuals, i.e. before November 1, be sure to contact the inspectorate, since the lack of notification does not relieve you of tax obligations.

When to pay property tax for individuals

The deadline for payment of property tax for individuals is established by the Tax Code of the Russian Federation and is the same for all property fiscal payments from citizens - December 1 of the following year. This year, due to this date falling on a weekend, property taxes for individuals must be paid by December 3.

Despite the fact that the property owner can independently calculate the amount to be paid using the formulas presented in the Tax Code of the Russian Federation, or through an online calculator on the Federal Tax Service website, it is necessary to wait for the notification and only after receiving it carry out a transaction based on the amounts and details specified in it. Thus, the period for paying taxes on real estate for individuals lasts from the moment they receive a letter from the Federal Tax Service until the final deadline for paying property taxes for individuals.

What happens if you don’t pay on time:

- accrual of daily penalties from the next day after the payment deadline until the debt is repaid;

- imposition of a fine in the amount of 20-40% of the debt amount and not less than 1,000 rubles;

- if the amount of debt exceeds 3,000 rubles - filing a lawsuit to force the collection of money.

How often is personal property tax paid?

Under the standard procedure, you need to pay property tax for individuals once a year - for the entire previous period, the entire amount is paid without any advance or quarterly payments.

But tax legislation regarding the procedure and timing of payment of property tax for individuals allows payment in installments under one condition - the last payment will be made before the due date.

For example, if you cannot pay the entire amount at once, you can split it up an arbitrary number of times, independently deciding how many times a year to pay, and transfer money in a convenient manner, but by December 3 of the current year you must pay off the entire accrual.

If a citizen cannot pay on time for good reasons related to difficult financial conditions, etc., then he has the right to apply for an official installment plan or postponement of the due date in accordance with Article 64 of the Tax Code of the Russian Federation.

When to start paying tax on a new apartment

When it comes to new property, you need to understand the entire tax calculation mechanism.

Where does the Federal Tax Service get information about the origin of your real estate and its value? All information is sent to her by Rosreestr - each branch of Rosreestr generates special forms with information about newly emerged real estate objects registered in the Unified State Register of Real Estate, and sends them to the inspectorates to which these objects belong geographically.

In the case of an apartment in a new building, you need to pay tax from the date of registration of ownership - as soon as you receive an extract from the Unified State Register of Real Estate that an entry about your ownership has been made in the register, you become a taxpayer for this object. Until this moment, the previous owner, the developer, pays the tax.

How to find out the cadastral value of your home?

Today you can find out the exact cadastral value of your property on the Internet if you know the cadastral number and even if you don’t know (at the address):

- If you do not know the cadastral number

, then go to the Rosreestr website in the section “Reference information on real estate objects online”, enter the address of the apartment, then copy the received GKN (state cadastral number). - If you know the cadastral number

, go to the tax service website, where you indicate the State Tax Code, click “next” and see the cost. If you want to know the property tax due and whether it is calculated based on the cadastral or inventory value, click “next”.

Other options to find out the cost on the official website of Rosreestr:

- section “Obtaining information from the State Tax Committee” - order an extract, which will have to wait 5 working days. Remember the order number, because it can be used to track execution;

- section “Public cadastral map” - search by cadastre number, the information obtained can be used as reference information, it has no legal force;

- section “Reference information on real estate objects” - can be found out by one of three conditions: cadastre number, conditional number or address of the property;

- section “Obtaining information from the state cadastral valuation data fund” - search by cadastral number.

If the unified database contains information about the cadastral value of your property, then such information must be provided free of charge within five days from the date of contacting Rosreestr or the MFC directly.

When Do Tax Notices Arrive In 2021?

If the total amount of taxes calculated by the tax authority is less than 100 rubles, a tax notice is not sent to the taxpayer by mail. However, a notification with a tax amount of less than 100 rubles. in any case, they will be sent in the year after which the tax authority loses the right to send it (three previous years).

- But provided that the citizen received the receipts on time, he is obliged to pay the specified amount no later than within one month after receiving the notification, from the date of delivery in person.

- The main ways to find out the debt Every person who has arrears in paying taxes can find out the calculated amount, and there are 4 main ways to do this:

- Communication with a tax specialist in person.

- Receipt by mail.

- On the official portal of the tax service.

- Call the tax office at your place of residence.

How is the tax calculated in the new way?

The following table will help you determine the tax rate for your property:

The exact amount of property tax does not need to be calculated independently - it will be indicated in the notice, which is usually sent to all taxpayers. However, due to general concern, our fellow citizens are striving today to know how much they will have to pay for their property.

To make the transition to the new calculation smoother, a reduction factor is provided, which will gradually increase (for 2015 it is 0.2

). The formula by which you can calculate the amount of property tax in 2021:

| H = (H1*SK – H2*SI) *K + H2*SI, where |

- N – the amount of tax to be paid.

- N1 - cadastral value of real estate.

- H2 - inventory value of real estate.

- K – coefficient (depending on the type of property).

- SI – tax rate based on inventory value.

- SC – tax rate based on cadastral value

The reduction factor does not apply to administrative and commercial buildings, public catering and consumer services facilities. For those who don’t want to bother themselves with long calculations, an online calculator can help you find out the property tax for individuals starting in 2021.

When will property tax notices arrive in 2021?

The maximum rate is limited to the following limits: In Moscow, St. Petersburg and Sevastopol, the tax rate of 0.1% can be either reduced to zero or increased to 0.3%, depending on the type, cost and location of the taxable item. The citizen owns half of the apartment with an area of 80 square meters. meters, which has a cadastral value of 6 million rubles and is taxed at a rate of 0.1%.

- you didn’t get it - and this is the worst situation

- you received a tax notice and it’s even better if it comes in compliance with federal regulations (that is, 30 days before the deadline for paying the debt)

We recommend reading: Minimum pension in Ulyanovsk in 2021

When should I start paying housing taxes in a new way?

As a general rule, property owners will have to start paying a new property tax in 2021 for the reporting period from 01/01/2015. Before the fall, each taxpayer will receive a notification and a receipt by mail, which will need to be paid by October 1 of the current year.

The procedure is traditional, only the amount of tax will change.

Not all regions have yet assessed the entire stock of real estate; the list below shows only those 22 entities (the list will be updated by 2021), whose residents will have to pay a new property tax in 2021.

Question:

How will the tax be calculated if the property was purchased in August 2015?

Answer:

the tax will be calculated based on the cadastral value only from August, that is, when you actually purchased the property. For the previous period, a notification from the tax office will be sent to the seller, who will have to pay the tax from January 1 until August inclusive.

When does the car tax arrive?

Let us remind you that the absence of notification does not relieve the payer from the obligation to pay taxes to the budget on a timely basis. To avoid penalties, care should be taken to obtain an estimate of the amount due in advance. An unscrupulous car owner may face the following measures:

Important! Tax services have become more active in connecting citizens to the taxpayer’s personal account. This allows them to send notifications electronically and eliminate the paper option. Therefore, you should check your account on the Federal Tax Service website from around the end of August. Access to it is also possible through the Unified Self-identification Account.

How much will you have to pay for housing now? Why the panic?

The fact is that the cadastral value is significantly higher than the inventory value, which was used to calculate the tax before. The cost according to the cadastre is almost similar to the market value - it takes into account the location of the property, the year of construction and its area, the type of property and other important aspects.

Since the cadastral value of housing is close to the market value (in some regions it is only 10-15% lower than the market value), for some homeowners the new tax calculation will be significantly higher than the inventory value. But for some categories, on the contrary, it is more profitable. According to the law, the cadastral value will be reviewed in the regions once every five years

. Therefore, deviations in the discrepancy between market and cadastral values will be eliminated in the coming years.

Does a pensioner need to pay tax when buying an apartment?

The result of the assessment by the Cadastral Chamber is taken as of the beginning of the year in which the transaction is made. The law exempts from paying tax for real estate transactions worth up to one million rubles. If the cadastral valuation of the housing does not exceed the specified value, then the seller does not need to pay anything to the treasury.

“Owners of “new” real estate put into operation since 2013, who previously did not pay property tax for individuals due to the lack of a tax base for them (the inventory value of real estate has not been determined since 2013), will now begin to pay tax, and thereby the tax conditions for all property owners will be equalized,” the release said.

The new law will relieve residents of St. Petersburg who have purchased or are planning to purchase housing in new buildings that were commissioned in 2015-2019 from the tax burden. At the same time, only those real estate objects whose ownership was registered from April 1 to December 31, 2021 are subject to the regulation.

Taxes on the acquisition of real estate. Photo No. 1

According to tax legislation, all persons receiving income must pay income tax (NDFL). When purchasing a home, a person does not receive money, but actually loses it. Therefore, he has no profit or income, and therefore no need to pay personal income tax.

According to the logic of the legislator, a person buys an apartment with legally earned money. This means that personal income tax has already been withheld from the funds he earned. And Russian laws prohibit double taxation. Therefore, it is the seller’s responsibility to pay the required thirteen percent to the state.

However, after purchasing an apartment, its new owner not only receives rights, but also must bear the burden of maintaining it. Therefore, you will have to pay the state a certain amount for the existing property.

On the other hand, having spent money on the purchase of a long-awaited apartment, you can exercise your right to receive a tax deduction. In essence, this is a refund of part of the personal income tax paid earlier. Accordingly, those who have official earnings from which deductions of the specified tax were made can count on it.

Thus, when purchasing an apartment, buyers do not need to pay personal income tax. Moreover, they can return part of the tax previously paid if certain conditions are met. However, everyone must pay taxes to the state annually to own real estate.

Although everyone must pay taxes, the law provides for some exceptions. This list is directly prescribed by Article 407 of the Tax Code of the Russian Federation and cannot be arbitrarily supplemented. The benefit may be provided, inter alia, to the following persons:

- disabled people of the first, second groups, as well as childhood;

- Heroes of the USSR and the Russian Federation;

- participants in hostilities;

- pensioners;

- military personnel.

In addition, this benefit can be provided only in relation to one piece of real estate, with the exception of unfinished construction and real estate complexes. Real estate that is used by an entrepreneur to carry out his activities is also not covered.

In order to take advantage of the benefit, you must submit a corresponding application to the tax office before November 1 of the current year. In this case, it is necessary to indicate in relation to which object it is provided. Otherwise, the tax inspectors themselves will do it. If there are several owners, then the tax amount is divided between them. For minor property owners, parents or other representatives are required to pay.

It is necessary to immediately make a reservation that the purchase and sale transaction is not subject to tax on the part of the buyer. When it is completed, such an obligation arises only on the seller. But here there are two options for the development of events.

First option

Tax obligations, in this case, depend on the date of acquisition of the property and its value according to the agreement between the parties.

The situation with apartments purchased before 01/01/2016 is as follows: a citizen who has owned it for more than 3 years is exempt from paying tax if it is sold. The situation is completely different with residential real estate, which the owner has owned for less than 3 years and its value is less than one million rubles.

The situation with apartments purchased after this date is somewhat different. The law exempts the seller from paying tax on the income of those owners who have owned the property for at least five years.

Some time ago, the Federal Tax Service determined the cost of housing (and, accordingly, the cost of tax) on the basis of a concluded sale and purchase agreement.

We invite you to read: When an employee’s working period is shifted

According to current legislation, the cost of housing is determined in two ways:

- The result of the cadastral valuation;

- 70% of market value.

The tax authority independently chooses the method in which the cost is maximized.

Let's look at this situation using an example. A citizen purchased a home for 750 thousand rubles in 2021 and sold it the next year for 200 thousand more.

It is more profitable for him to take advantage of the tax deduction for exemption from paying income tax (950 thousand - less than one million).

Otherwise, he will be charged income tax, which will be 13% of the difference in purchase and sale prices. In this case, the citizen would be required to pay 26 thousand rubles to the state treasury. In this situation, citizens independently make a choice which way to go.

Persons who received housing by inheritance, under a rental agreement or as a gift from a close relative more than three years ago are exempt from paying personal income tax. The period is counted from the date of sale of the property.

The legislation of the Russian Federation exempts purchasers of apartments from paying taxes. This responsibility is shifted to the shoulders of the home seller.

Until recently, the purchaser of real estate had to prove that the funds for these purposes were obtained legally.

Currently, the tax for the completed transaction is paid by the seller. The logic is that he becomes the owner of a large sum and receives a certain benefit from the transaction.

There is one exception to this statement. The new owner is obliged to pay part of the cost of the property to the state if the latter was donated to him.

Donation of an apartment

Real estate received as a gift is subject to income tax. It is paid by the beneficiary, in this case, the donee citizen. The amount that must be paid to the treasury is determined as follows: the estimated value of the apartment is multiplied by a factor of 0.13.

How to calculate the estimated value?

To do this, subtract one million rubles from the cadastral value.

The algorithm for calculating the tax amount is as follows:

- Find out the market value of housing and the cadastral value as of the beginning of the year the property was received;

- Take the larger of these values;

- Subtract one million rubles from it;

- Multiply the result by a factor of 0.13.

If the result turns out to be negative, therefore, you do not owe the state anything for this transaction. Housing worth up to one million rubles is not taxed upon purchase, sale or gift.

Gifts from close relatives (even if it is an apartment in a high-rise building) are not taxed. But if it is received from other persons, then a contribution to the state treasury may be required. Inherited property is also not considered income and taxes are not paid on it.

The laws of the country oblige sellers of real estate to pay personal income tax. One of the main conditions that the transaction must satisfy is that he must own the apartment for less than three years. If this is not the case, then the state does not need to pay anything.

In this case, the buyer is not required to pay anything to the country's budget. This is logical, since he has already paid a lot of money for the apartment. There are situations when one of the conditions of the transaction on the part of the seller is the payment of income tax for him.

The buyer can agree to this condition only if he is extremely interested in the seller’s offer and feels that he will benefit from the transaction. Organizations acting as a buyer will never take such a step.

Additional costs can only be covered by the benefits of the transaction, a good discount, as well as excellent characteristics of the property purchased under the purchase and sale agreement.

Taxes after purchasing an apartment

A citizen who bought housing in an apartment building and registered ownership of it is now required to pay property tax.

In 2015, a new scheme for calculating it came into effect. Now the basis is the result of the cadastral valuation, which is carried out once every five years. The tax rate is now 0.1%.

The cadastral valuation is slightly lower than the market value, which helps reduce the tax payment. If you take, for example, a 2-room apartment, you will have to pay about 2 thousand rubles a year for it.

The answer to the question depends on the duration of ownership of the property until the day the purchase and sale agreement is concluded.

If this period is more than three years, then it does not incur any tax consequences for the seller. There is no need to declare this operation. If he owned the home for a shorter period of time, then 13% of its cost must be transferred to the budget.

Some pensioners do not see the difference between property tax and personal income tax. Due to the absence of a tax on real estate ownership, they believe that there will be no tax on income from the sale of residential premises. However, pensioners pay income tax on the same basis as other categories of citizens. The only income that is not taxed for seniors is pension payments.

Real estate transactions are subject to declaration to the tax authorities. Penalties are provided for violation of this procedure. The tax return must be filed by April 30 of the year following the year of purchase.

The state is making accommodations for homeowners – tax deduction

To reduce the tax amount, a deduction is provided:

- for apartments – 20 sq. m.;

- for houses - 50 sq. m.;

- for rooms - 10 sq. m.

We are talking about square meters that must be subtracted from the total area of your property. These meters will not be taxed.

We remind you: there is no need to make independent calculations. The tax notice will detail the deductions and the final amount to be paid.

Question:

How will the benefit for an apartment or house be taken into account?

Example 1: the property owns an apartment with a total area of 30 square meters. m. Taking into account the tax deduction, we get 30 – 20 = 10 sq. m. Thus, the owner will need to pay tax for only 10 sq. m. m.

Example 2: the property owns a house with a total area of 40 square meters. m. Taking into account the tax deduction, we get 40 – 50 = -10. If the value is negative, the tax rate is zero and no tax needs to be paid.

When will tax notices arrive in 2021?

Also, objects of taxation are unified real estate complexes, various buildings, structures, structures and objects of unfinished construction. For land plots, another tax is paid - land, and for cars - transport. Changes in the tax notice form will allow you to immediately display the recalculation of the tax and the amount to be paid additionally or decrease.

Land tax for three months of 2021 in this case will be equal to: 1,801 rubles. x 0.3 / 100 x 0.25), where 0.25 is the coefficient of time of ownership of a land plot (3 months. The tax rate for this land plot is provided in the amount of 0.3%. Land tax in this case will be equal to: 7 RUB 172 If erroneous data is found in the notification, you must write an application to the tax service (the application form is sent along with the notification).

We recommend reading: Laws for Single Mothers 2021

How is the deduction applied for shared ownership of an apartment?

According to tax legislation, each owner will pay tax only in proportion to his share in the right. However, the deduction is not provided to each owner, but for the entire property.

Question:

Apartment with a total area of 50 sq.m. is in shared ownership of two owners of 1/2 each, how will the deduction be distributed?

Answer:

One owner will need to deduct only 10 sq.m. (20 m2/2) as a tax deduction. Thus, he will pay for 25 – 10 = 15 sq. m. A similar calculation will be for the second owner. The cadastral value of housing is 2 million rubles, the area is 44 m2, everyone will have to pay (44 m2/2 - 10 m2) per 12 m2. And 1 m2 costs 45,455 rubles (2 million/44), then the tax will be (12 m2 * 45,455 rubles) * 0.1% = 545 rubles. This is the maximum amount, i.e. in those years when the reduction factor is in effect, the tax will be even less.

If there are three or more owners, then the deduction will be divided among the appropriate number of persons, according to their shares.

How much money will be returned?

The deadlines for transferring tax deductions are specified in paragraph 2 of Article 88 of the Tax Code of the Russian Federation. The Federal Tax Service has three months from the date of submission of documents for a desk audit. After the end of the desk audit, the tax service is obliged to make its decision: to approve the tax refund or refuse. The taxpayer must be notified in writing of the results of the audit. Let's look at how to track your tax deduction below.

If the Federal Tax Service makes a positive decision, the citizen additionally submits an application for a refund of 13%. It contains his personal account and bank details. The tax office has one month to transfer the money. Thus, the maximum time for checking and transferring a refund takes four calendar months.

How to find out when the tax deduction will arrive? The easiest and most convenient way is to open a personal taxpayer account. To do this, you need to contact the nearest tax office with your original passport and TIN. It is not necessary to come to your place of registration; you can open a personal account at any tax office.

You won’t be able to get your income tax back for purchasing an apartment if:

- You purchased an apartment before January 1, 2014 and have already exercised your right to deduction;

- If you purchased real estate after January 1, 2014, but have reached your limit (more on this below);

- If you purchased real estate from a close relative (mother, father, daughter, son, brother, sister);

- If you are not officially employed (and accordingly do not pay income tax);

- If your employer took part in the purchase of the apartment (for example, the company you work for paid for some part of the housing you purchased);

- If, when purchasing an apartment, you took advantage of some government programs or subsidies, for example, maternity capital.

Your maximum limit for income tax refund from the purchase of an apartment is 2,000,000 rubles (for your entire life). You can return 13% of this amount, i.e. 260,000 rubles and nothing more.

For each calendar year, you can return an amount equal to your income tax, which your employer pays to the state for you (13 percent) for the reporting year, while the balance of the funds due to you does not expire, and in subsequent years you will also be able to issue a refund until don't reach your limit.

But you have the right to submit income declarations to the tax office only for the current year or for a maximum of three previous years, but more on that a little later. First, let's finally figure out the amount of tax compensation you can count on when buying an apartment. To make everything completely and completely clear, let’s look at two specific examples.

You can submit documents for a property tax refund when purchasing an apartment, starting from the moment you have fully paid for the purchased housing and received the documents for the right to own real estate:

- Certificate of registration of ownership - in case of purchasing square meters under a sales contract;

- An act of transfer of ownership of an apartment – if the property was purchased in a house under construction under an equity participation agreement.

We suggest you familiarize yourself with: The procedure for discharging a person from an apartment without his presence and consent - who can be discharged from the apartment, how the process goes

You must also have in your hands all payment documents confirming your expenses for the purchased housing.

As a rule, submission of documents for a refund occurs at the beginning of each calendar year. It is best to contact the tax office in the second half of January (immediately after the New Year holidays).

In addition, if you purchased an apartment several years ago, you can also receive a tax deduction for it, and you have the right to file an income tax return for the three previous years. Those. for example, you bought an apartment in 2021 and forgot to exercise your right to a tax refund. Five years later, in 2021, you came to your senses and contacted the tax office with a corresponding application.

All these five years you worked honestly and had an official income, but you will only be able to use your contributions to the treasury in just three years preceding the moment you applied for the deduction. In this case it is 2021, 2021 and 2021. If during this time your total income tax was less than the refund amount due to you (see the item “How much money will be returned?”), then you can easily receive the rest of the amount in subsequent years.

Will I have to pay more for housing?

In fact, the biggest blow will be to the wallets of owners of large and expensive apartments, houses, shopping centers or public catering establishments. For luxury real estate, the value of which according to the cadastre is over 300 million rubles, owners are required to pay 2% property tax.

Owners of more modest housing need not worry - the tax amount will be calculated within 0.1% of the cadastral value. By the way, in many rare cases, the amount of tax may become even less than it was before, before 2015.

Example:

there is an apartment with a total area of 50 sq.m. Previously, the inventory value was 186,000 rubles, the cadastral value became 196,000 rubles. The tax rate was 0.1% in both options. Cost of 1 sq.m. at cadastral value = 196,000: 50 = 3,920 rubles. The tax deduction for an apartment is 20 sq.m., which in our case will be 3,920 x 20 = 78,400 rubles. Minus the deduction, we get a taxable amount of 196,000 – 78,400 = 117,600 rubles. Thus, the tax on an apartment with an area of 50 sq.m. will be 117,600 x 0.1% = 117 rubles 60 kopecks. For example, previously the owner paid 186 rubles (186,000 x 0.1%) for the inventory value.

What benefits are provided?

List of benefits for property tax for individuals

However, the legislator took into account the desire of our citizens to transfer all their real estate to close relatives who have benefits, in order to be exempt from tax. Now one owner is exempt from tax on only one property. In other words, if a pensioner with a benefit owns two or more apartments, then he is exempt from tax on only one of them. And for the second and others, you will have to pay in full.

To receive such a deduction, you should write an application to the Federal Tax Service (), and also attach to it “Notification of selected tax objects in respect of which a tax benefit for personal property tax is provided” ().

How to pay?

You can pay a receipt for property tax for individuals in cash or by bank transfer. The receipt can be printed through the website of the Federal Tax Service or government services. The electronic resource “Yandex Money” is also available, as well as the websites of partner banks.

Methods

To make payments through the Federal Tax Service website, you must create a personal account. The login login is the payer’s TIN number, and the password is issued upon application to the tax office.

To clarify the amount of property tax you will need:

- log in to the site;

- select the “Individuals” section;

- log into your personal account;

- To find out the tax amount, you need to enter the “Overpayment/Debt” section, where you can print a receipt or pay on the website via a bank card.

Payment is also possible through the government services website. To do this, you need to authenticate with EGAIS and get an account on the website.

Next, you should fill out an application for receiving a receipt and indicate the method of notification:

- in your personal account;

- via email;

- via SMS message.

Tax payment is possible with VISA, MasterCard, Mir bank cards. Payment is available through the WebMoney resource.

Sberbank clients can pay through the Sberbank Online system. To do this, you will need to enter the section “Transfers and Payments” - Federal Tax Service - “Search and Pay Taxes”. Next, you should enter the TIN number, by which the system will find the taxes billed for payment. You can pay the tax for yourself or for another taxpayer. The main condition is to indicate the Taxpayer Identification Number (if you pay, you may not use your own), the details of the tax office and transfer the payment. Other banks have a similar function.

The ability to pay taxes remotely is provided in the Yandex Money system. The tax billed for payment can be found by the payer’s TIN. Payment is also possible not only by the payer himself, but also by another interested party (for example, the legal representative of a minor citizen).

As before, payment is possible through a bank cash desk or through an ATM of the selected bank. If you pay taxes on the Federal Tax Service website or through the government services portal, the applicant does not pay a commission.

Read about the property tax rate for legal entities. How to calculate property tax penalties? Information here.

Is there a property tax for a minor child? Details in this article.

Is it possible to reduce the cadastral value?

Example:

The cadastral value of home ownership was 12,000,000 rubles. The owner considered this amount to be clearly too high, since the house was not completed and there were no funds to complete the construction, the toilet was located on the street, the water supply was a well, and the sewage system was a septic tank. From the central networks there is only electricity. Independent accredited appraisers were invited, who indicated in the assessment conclusions the cadastral value of the house in the amount of 3,500,000 rubles. You can go to court with the results obtained.

What to do if the tax notice of accrued tax has not been received?

Beginning in 2015, property and vehicle owners must report to the Internal Revenue Service if they have not received tax notices.

Before asking your question, please carefully read the article again and the comments to it, they cover many questions. Duplicate questions that are answered in the article or comments will be ignored.

If you have questions about the topic of the article, please do not hesitate to ask them in the comments. We will definitely answer all your questions within a few days. However, carefully read all the questions and answers to the article; if there is a detailed answer to such a question, then your question will not be published.

About tax notices in 2021

For users of the “Taxpayer’s Personal Account”, a tax notice is posted in the “Taxpayer’s Personal Account” and is not duplicated by mail, except in cases where the user of the “Taxpayer’s Personal Account” receives a notification about the need to receive documents on paper.

We recommend reading: One-time Payment from Maternity Capital 2021

— Tax notices to owners of taxable objects are sent by tax authorities (posted in the taxpayer’s personal account) no later than 30 days before the tax payment deadline: no later than December 1 of the year following the expired tax period for which taxes are paid.