Mortgage loans are classified as complex banking products in the field of lending to individuals. It involves the purchase of real estate and the subsequent registration of a mortgage. The procedure for processing and issuing mortgage funds is directly related to the marital status of the applicant. It is much easier for two family members to get a mortgage. One of the spouses will act as a co-borrower. Applying for a mortgage for one person without a co-borrower will be accompanied by some difficulties.

Surety and bank guarantee for mortgage

First you need to understand why banks need guarantors? A guarantee is a way to ensure the return of funds that were issued by a financial institution. As you understand, a loan without guarantors is associated with high risks of non-repayment, so not every bank is ready to do this.

A mortgage loan is characterized not only by an impressive loan size, but also by a long term – on average it is up to 30 years. But at the same time, no one can guarantee that over such a long period the borrower will be solvent, will have a job and receive a stable remuneration for it in order to make the obligatory payment once a month. Moreover, without causing harm to your family.

[offerIp]

What if someone in the household becomes seriously ill and urgently needs to find a large sum for treatment? Anything can happen in life, and no one knows what can happen tomorrow or in a couple of years, not to mention thirty years from now. It's no secret that the purpose of banks is to make a profit, and no one will engage in charity by taking on such risks.

Of course, financial organizations that do not require a guarantee as security for loan repayment insure themselves in other ways, establishing more categorical and strict limits than in cases where there is a guarantor.

It is for these reasons that before taking out a mortgage without a guarantor from a bank, you need to study in detail all the conditions of the chosen program, weigh its pros and cons, and also realistically assess your financial capabilities.

Small banks do not always provide such a service as issuing mortgages without a guarantee, but large credit institutions have been working according to this scheme for a long time. Among such banks are Sberbank, AlfaBank, VTB24 and other leaders in the banking sector.

What kind of mortgage can I get without a guarantor?

We have already found out that the need to attract a guarantor from Sberbank arises only when the potential borrower looks in the eyes of the lender as an insufficiently trustworthy client or is going to apply for a loan for an object that does not exist at the time of the loan (housing under construction). Now let’s look at the current mortgage programs without guarantors from Sberbank.

So, if the client is solvent, suitable in age, has a good credit history and meets other requirements of the lender, he can count on the following mortgage lending options:

- Mortgage for the purchase of finished housing with a credit limit of up to 15,000,000 rubles for a period of up to 30 years and a down payment of 15%.

- Mortgage for a new building with the possibility of obtaining a credit limit of up to 85% of the value of the property for a period not exceeding 30 years with a down payment of at least 15%.

- A mortgage for the construction of your own home, provided that the credit limit is limited to 75% of the value of the collateral, the loan period does not exceed 30 years, and the down payment is at least 25%.

- Mortgage for the purchase of a country house with a credit limit not exceeding 75% of the value of the collateral, a repayment period of up to 30 years and a down payment of 25%.

- Non-targeted loan with the pledge of the borrower’s existing real estate, a credit limit of up to 60% and a lending period not exceeding 20 years.

In addition to general ones, special lending programs are available to potential clients, when choosing which you can do without a guarantor. These are military and family mortgages, mortgages for the purchase of a garage or parking space, as well as refinancing of an existing mortgage.

Interest rates for each type of mortgage loan will vary depending on the following facts:

- the degree of client compliance with the lender’s requirements;

- the amount of the requested amount and the loan term;

- holding promotions and applying discounts by a credit institution;

- the borrower's use of state support funds.

At the same time, the lowest rate will be set for mortgage products for the purchase of housing in new buildings (especially from Sberbank partners), and the maximum for non-targeted loans and loans issued for the purchase of non-standard real estate, for example, for the purchase of a house or garage.

It might be interesting!

Who can be a mortgage guarantor and who is he?

Mortgage guarantor and collateral

These two concepts are regulated according to:

- General rules that are enshrined in the Civil Code of the Russian Federation. In particular, the provisions of § 5 of Chapter 23 of the Civil Code apply to the guarantee, and § 3 of a similar chapter to the mortgage agreement.

- Special legislative acts, among which the main one is Federal Law-102 of July 16, 1998 “On Mortgage”.

A guarantee is a legal relationship where, in addition to the two main participants in the transaction (debtor and creditor), there is one more participant - this is a guarantor who “enters the scene” only when the borrower cannot fulfill his obligations under the contract. In simple terms, the guarantor takes on the debts of the borrower, as if “replacing” him before the bank.

A mortgage is a kind of the same collateral, but the concept of a mortgage without guarantors is applied to those legal relations in which only real estate acts as collateral, and the ownership of it will belong to the bank for the entire term of the agreement, until the borrower repays everything your debts.

In civil law, surety and pledge are separate types of security for the fulfillment of contractual obligations, hence we conclude that they can be used both together when concluding a transaction, and separately.

Of course, financial institutions strive to use a guarantee and collateral at the same time, and this is done in order to guarantee a high probability of the borrower fulfilling its obligations. But the debtor cannot always fulfill both of these conditions.

Finding a guarantor is not so easy, and only a small number of citizens manage to do this. Even for the sake of a close relative, not everyone is ready to act as a guarantor and voluntarily drag themselves into credit bondage. In addition, if the guarantor is required to repay the entire amount of the debt, this does not mean that he will receive ownership of the real estate that he “paid for.” Keep in mind that the bank carefully selects the candidate who can be assigned a guarantee.

Why is it harder for one person to get a mortgage?

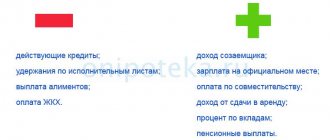

When considering an application for processing and issuing a mortgage loan, a banking institution assesses the monthly income of the potential borrower. A stable financial position serves as a certain guarantee of responsible repayment of obligations under a housing loan agreement.

The bank does not care about a certain number of co-borrowers participating in a mortgage lending transaction. In the first place in this case is the size of the monthly income of the applicant for mortgage funds.

On average, a citizen with a salary of at least 30 thousand per month can count on approval of a loan application in the amount of one million rubles. If the loan amount is larger, then the monthly income should not be lower than 35-45 thousand per month. In such a situation, the banking organization will make a positive decision for one borrower.

When considering a mortgage application, credit institutions are guided by several rules:

- the total family income is more than that of one person;

- in the event of the loss of work or illness of one spouse, the salary of the second spouse may be used to pay off the monthly mortgage payment;

- after the death of one spouse, mortgage payments will be made by the second spouse, since mortgage housing is often the only option for living.

Important! According to statistics, family people are more responsible about repaying the mortgage agreement and allow minimal delays in payments.

The presence of co-borrowers in the mortgage agreement automatically expands the circle of persons for the bank to collect mortgage debt.

What is a mortgage without a guarantee?

For those who were unable to find a guarantor to obtain a mortgage, there is still a way out - banks offer to use a more complex scheme, and the conditions for obtaining will be less attractive:

- The loan amount, as well as the repayment period, will be shorter, but the interest rate will be higher. It is possible that the amount of loan insurance that the borrower must pay will be higher.

- The verification of the borrower will be detailed and fraught with some difficulties. Moreover, not only the debtor will be checked, but also the object of sale. For example, if an apartment is purchased with a mortgage without guarantors, the bank may require not only title documents for the property and a preliminary purchase and sale agreement, but other documents at its discretion. This could be a certificate stating that there is no debt on housing utilities. The history of the apartment will also be checked, so the bank has the right to request additional information about those who owned the property until now. The bank does this in order to avoid fraud with real estate, since at different times the apartment could have been owned by unscrupulous sellers who did not have the legal right to the alienation transaction. This fact may become fundamental for challenging the transaction.

- The bank will put forward additional conditions for the payment procedure, for example, funds will not be allocated to the buyer - they will be deposited in a bank safe deposit box.

- The bank may put forward the following requirement for the acquired real estate object: it must be not only built, and not just put into operation, but ownership must be registered for it. In unfinished construction, it is possible to buy an apartment with a mortgage in isolated cases due to the fact that there is a high risk of the developer delaying the delivery of the project. No one can rule out the possibility that the developer will completely freeze construction for an indefinite period. Of course, it is not possible to sell such a property, and this will involve new costs. The borrower will stop repaying the loan, and the bank will be left with an illiquid asset, and no one will guarantee that construction will resume after a while. Or it may be that such “frozen” real estate will become a completely unsuccessful investment, which not only will not bring profit, but will also become unprofitable.

- A condition may be prescribed that makes it impossible to carry out alternative transactions, in other words, the property acquired through a mortgage must be vacant and can be moved into at any time. In reality, it looks like this: the seller receives only cash, but does not have the right to buy a new one instead of the property being sold.

We would like to point out that with a mortgage, banks consider as collateral not only the real estate for which borrowed funds are issued, but also other housing, which can be equivalent security.

Methods for completing an application without taking into account a spouse

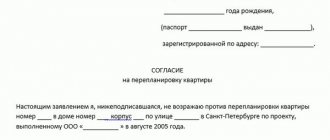

Answering the question - is it possible to take out a mortgage without the knowledge of the spouse, we give an unequivocal answer in the negative. Even though one spouse is excluded as a co-borrower, his or her participation will still be required.

To take out a mortgage without a spouse, you need to contact a notary and register your consent to the purchase of real estate by the second spouse. The document contains data on the property and the consent itself.

The notary certifies the identity of the spouse and records this consent. This document has a default term of 3 years, like most notarized documents. Such consent will be required to register the transaction, that is, when registering ownership of the apartment.

Recommended article: Can a mortgage be denied after approval?

However, the apartment will still be joint property, to which the non-participating spouse has the right to claim. And debt obligations also apply to both spouses.

Mortgage co-borrower and his rights

The borrower's co-borrower can act as an additional guarantor of mortgage repayment for the financial institution. If you look deeper, then he, in fact, is entrusted with the role of a guarantor, but at the same time these concepts cannot be considered equivalent. Co-borrowers are citizens who share responsibilities under the loan agreement with the debtor.

Co-borrowers have a significant difference from guarantors - in addition to responsibilities, they also share rights. That is, they receive the right to a share in the purchased real estate. For the most part, co-borrowers are needed when the main borrower does not have enough income, in which case the income of the co-borrower will be taken into account in the aggregate (several persons can be involved, then the income of all of them is added).

When the borrower is in an officially registered relationship, the second spouse automatically becomes a co-borrower, since all property acquired during marriage belongs to both spouses under the right of joint ownership.

In addition, the funds used to pay off the mortgage also belong to the husband and wife as joint property.

If one of the spouses does not want to take part in the mortgage, and the second has expressed a desire to independently own the property purchased on credit, then you need to sign a prenuptial agreement in advance, which will clearly indicate the division of income of the spouses and the division of their property.

In addition to “other halves,” acquaintances, relatives and organizations (even an employer) can become co-borrowers, but keep in mind that each bank has its own rules. The number of co-borrowers is limited, and in most cases banks allow no more than three persons to be involved to share the responsibility of the debtor.

As a rule, all co-borrowers bear equal responsibility under the mortgage agreement, unless other terms are specified in it. We focus on the fact that the bank has the right to grant the right to exclude a co-borrower from the mortgage agreement. For example, such a development of events will be relevant if the spouses are divorcing, but such options will be considered strictly individually.

Documents for obtaining a mortgage without guarantors

Each financial institution has the right to establish its own set of documents for the future borrower.

But there is a certain list of papers that will be required by almost every bank to which you have submitted an application to issue the funds necessary to purchase an apartment without having a guarantor.

This:

- Identification document – passport. Some banks require an additional document that can confirm your identity - a foreign passport, pension certificate, military ID, military ID, etc.

- An application filled out in a form established by a specific bank.

- Employment contract.

- Valuation documents for real estate on which a mortgage is taken.

- Papers that officially confirm your financial status.

- Legal documents.

- Documents for real estate serving as collateral. Among them:

- Evaluation report.

- Certificate of ownership.

- Technical certificate.

- The document providing the basis for the emergence of proprietary rights.

- Cadastral passport.

- An extract from the state register confirming that there are no encumbrances.

- Consent of the spouse to transfer the object as collateral - this document must be executed by a notary.

- Other documents at the discretion of the bank.

- If the borrower attracts co-borrowers, then it is necessary to bring their passports, documents that confirm their financial condition and official employment.

- If you have a down payment, you need to provide documents that confirm this point. Do not forget that there are banks that are ready to accept maternity capital as a down payment.

Do you need a guarantor for a mortgage?

Before issuing loans, banks carefully check the borrower and his solvency. Although the transaction involves the provision of the purchased property as collateral, lenders try to reduce risks by requiring a guarantee as additional collateral.

Who is a guarantor in a mortgage? This is a person who takes on certain responsibilities. In case of improper fulfillment of obligations by the borrower, the bank has the right to demand repayment of the debt from him.

A guarantee is also used if the borrower’s income is not enough to obtain the required amount to purchase an apartment. Although the guarantor’s income is not taken into account when calculating the maximum loan, its presence reduces risks and increases the likelihood of receiving a positive decision.

Difficulties in obtaining a mortgage loan without guarantors

There are situations when getting a mortgage without involving guarantors is associated with a number of difficulties that may be impossible to solve:

- A citizen who has not reached the age of 25 wants to take out a mortgage loan. If a person has not celebrated his or her 21st birthday, then you should not count on getting a mortgage - the bank will not issue it.

- Young university graduates receive low wages, so banks are reluctant to provide mortgages to this category of borrowers.

- The chances of getting a mortgage for a man who is of military age are practically zero due to the fact that if he is drafted, who will have to pay the bills.

- If funds are needed to purchase real estate in a house under construction, especially if construction readiness has not reached 50%. The risks facing the bank are obvious, and we talked about them earlier.

- The borrower wants to purchase a plot of land with money received from the bank. Today, it is quite possible to borrow money not only to buy an apartment, but also to buy land. But registering ownership rights to a plot when selling it will take a long time, and during the procedure itself, significant difficulties may arise, due to which it will not be possible to formalize the transaction.

In conclusion, it should be said that the situation in the credit market today is that a number of financial institutions are removing guarantees from their requirements when offering mortgage programs. Despite the increasing risks, they insure their income in other ways - by increasing the interest rate, reducing loan terms and limiting the loan amount.

Of course, the consumer needs to choose the program that is suitable for his case from the huge number of banking offers on the market. And to do this, it is necessary to carefully analyze the proposals of several banks, soberly comparing them with your financial capabilities.

Tips for Borrowers

These recommendations will help increase the likelihood of getting a mortgage approved without a co-borrower:

- Before applying to a credit institution for a mortgage lending service, it is recommended to deposit funds intended for a down payment into the account in advance. This will have a positive impact on the bank’s final decision when considering the application, as the degree of confidence in the applicant will increase. In this case, funds can be gradually accumulated in a bank account, and upon reaching the required amount, submit an application to the bank for registration and issuance of a mortgage.

- At the stage of preparation for applying to a credit institution for a mortgage, it is recommended to repay all existing loans, as well as debts on taxes and utility bills. You should know that at the stage of consideration of accepted applications, banking organizations make a request not only to the BKI, but also to the bailiff service. If there is legal proceedings for unpaid alimony, fines, fees and taxes, the bank will refuse mortgage lending services.

- You should know that married persons cannot act as one borrower. In this case, the participation of the spouse as a co-borrower, as well as the consent of the other half to obtain a mortgage, is mandatory.

- Involving a guarantor in the transaction will help increase the chance of approval when one borrower approaches the bank. With this scheme, the guarantor’s income is not taken into account when considering the application. However, the participation of a third party in the transaction increases the loyalty of the credit institution.

- It is necessary to consider available preferential bank mortgage programs. For example, you can use special programs for public sector workers or military mortgages.

In case of refusal, it makes sense to contact another credit institution that practices a more loyal approach to potential clients. You can also attract a co-borrower or a reliable guarantor. Borrowers are advised to consider an installment plan from the development company or select a more budget-friendly residential property.