A certificate of cadastral value of an object will not be issued from 2021. Instead, through Rosreestr or the MFC, you can obtain an extract from the Unified State Register of Real Estate, which will indicate information about the object and the current cadastral value. From the contents of the document you can find out what cadastral value was determined based on the results of the latest state assessment of real estate. The form of the cadastral certificate is approved by Order of the Ministry of Economic Development No. 566.

Get an estimate of the cost of this service using our price calculator - here

Read the article about when and who needs a certificate of cadastral value, where to get this document, how much a USRN extract costs when received through the MFC, Rosreestr or State Services.

Sample cadastral value

The cadastral value is determined for each property - a private or apartment building, non-residential building, land plot, structure. For this purpose, a state assessment of real estate is carried out. The results of the assessment activities are posted in the Unified State Register of Real Estate after the report is approved by the authority of the constituent entity of the Russian Federation. You can request USRN information about the cadastral value through Rosreestr or MFC, through the State Services website. You can also find out this data for free through a special online service on the Rosreestr website - Public Cadastral Map.

The form of the certificate of cadastral value is approved by Order of the Ministry of Economic Development No. 566 (). An example of a cadastral certificate in electronic form and printed in paper form:

Dear Clients!

The information in this article contains general information, but each case is unique. You can get a free consultation from our engineers using one of our telephone numbers - call:

8 Moscow (our address)

8 St. Petersburg (our address)

All consultations are free.

Three ways to find out the square footage of an apartment

You can find out or check the area of a future purchase in different ways:

- get an extract from the Unified State Register of Real Estate - the downside is that the service will be paid and not fast. Even if you access the State Services website, you will have to wait at least three days;

- use a public service – cadastral map;

- contact EGRN.Reestr and get an extract quickly from 200 rubles.

The second and third options are most often used.

Public cadastral map. This service contains data on all real estate objects. To find the necessary information you need:

- go to the service website;

- find search function;

- Enter the cadastral number of the apartment.

Based on the selection results, the service will provide publicly available information, including the area of housing.

On the website of the Unified State Register of Real Estate. Here you can get extended data on the housing you are interested in. To do this, you will need to fill in the address of the apartment you are interested in in the address bar.

Important! Until 2007, apartments were assigned conditional identification numbers, which are also stored in the Rosreest database. If such a number is known, you can use it when searching.

Why do you need a Certificate of Cadastral Value?

A certificate of cadastral value is required for everyone who owns a property. Although it is of an informational (reference) nature, the results of a state real estate assessment may be required:

- to check calculations for property tax, land tax;

- for filing declarations and paying property and land taxes (enterprises are required to do this independently);

- to obtain a bank loan secured by real estate;

- for the sale of real estate, if the parties decided to determine the price of the property based on the cadastral value;

- to challenge the cadastral value of a house, apartment, plot or other object;

- to receive tax deductions and other benefits from the state;

- to calculate the state duty when entering into an inheritance after the death of the owner.

This is not a complete list of situations when it may be necessary to request information about the cadastral value of objects. Please note that the state assessment of real estate is carried out regularly, so the cadastral value may change.

Expert commentary. From the certificate of cadastral value you can find out how much the property is worth from the point of view of state appraisers. However, this indicator may differ significantly from the market price. Therefore, a certificate most often needs to be taken to challenge the cadastral value through the Commission under Rosreestr, or in court. Experts from ]Smart Way[/anchor] will provide assistance in challenging the cadastral value.

Certificate of cadastral value. Questions to the expert

Konstantin M.

Expert in the field of cadastre, real estate and design. Higher legal education, more than 10 years of work experience.

Ask a Question

Question to the expert

What is the validity period of the cadastral value certificate? if you do not submit a cost review on time. Do I need to get a certificate again?

The law does not establish the validity period of the cadastral value certificate. But it is better to take it immediately before submitting an application to the Rosreestr Commission or to the court. Otherwise, this data may become outdated.

Hello! Is the market valuation report done only by the appraiser? Our company cannot independently produce such a report?

According to Law No. 127-FZ, only professional specialists (appraisers) can engage in appraisal activities. Only in this case will the report be accepted as evidence in court, by the Commission under Rosreestr.

How often can a cadastral value be challenged?

Usually, it is enough to achieve a reduction in the cadastral value once, since this data will subsequently be taken into account during the state assessment of real estate. But if the state assessment again inflates the value of the property, you can resubmit the application.

Is it possible to make a copy or screenshot of a public cadastral map and have it certified by a notary for filing in court?

No. is impossible, since such copies will not be a document equivalent to a certificate of cadastral value. Through the PPK you can generate a request for an extract from the Unified State Register.

Good afternoon How long does it take to challenge the cadastral value?

Review of applications by the Commission at Rosreestr takes up to 30 days. Court procedures last up to two months.

What is included in the living area of the apartment? Should I count the balcony?

More than half of apartment owners are not satisfied with the layout of their property. In this regard, citizens often engage in reconstruction, allowing them to change the arrangement of rooms and increase or decrease the size of the living space of the room. Before carrying out repair and construction work, the owner must obtain permission to remodel the room.

This is important to know: Types of use of real estate

If a technical passport has not yet been issued, the owner of the premises first needs to call a technical engineer who will carry out the necessary measurements. If changes have occurred in the apartment (for example, remodeling a room), you should also call a specialist again to enter new information into the housing registration certificate.

Contents of the Certificate of Cadastral Value

The certificate of cadastral value consists of certain sections approved by Order No. 566. This regulatory act is applied when issuing written and electronic certificates that have the same legal force. The contents of the document include:

Get an estimate of the cost of this service using our price calculator - here

- Date of filling out the cadastral certificate:

- Cadastral number:

- Previous cadastral numbers (if archival information is available);

- The cadastral value contained as of the date of the last assessment procedure (the cost is written in rubles for the entire object);

- Date as of which the cadastral value was determined (date of determination of the cadastral value);

- Details of the regulatory act on approval of the cadastral value;

- Date of approval of the cadastral value;

- Date of entering information about the cadastral value into the state real estate register;

- Special marks;

- Authorized person of the cadastral registration authority

The certificate form must comply with the regulatory act. The document in electronic form is certified with an electronic digital signature (EDS) and sent as a file. The written form can be picked up at Rosreestr or the MFC, or it will be sent by letter.

The EGRN extract contains information about the cadastral value of the property as of the date of the last assessment.

What other data can be obtained by knowing the address of the apartment?

By determining the area of an apartment by address using public services, you can obtain additional information about the property, which can significantly influence the decision to purchase it. These include:

- type of premises - residential or non-residential;

- cadastral value – the date of its determination and revision. If you wish, you can find out the tax amount immediately by following the link to the Federal Tax Service website;

- form of ownership of the apartment - municipal or private;

- imposed burdens and restrictions.

Text: Svetlana Kuryleva

Online cadastral value certificate

Reference information on the cadastral value can be obtained through the public cadastral map. If you need an official form with a stamp or digital signature from Rosreestr, you need to submit a request to provide USRN information. You can submit a request electronically through the State Services website, or through the online service of Rosreestr. You can receive the document at ]Smart Way[/anchor] as soon as possible. Our specialists have access to cadastral information from the Unified State Register of Real Estate and can generate a form within a few hours.

How is property tax calculated based on cadastral value?

In connection with the adoption of a new law on taxation of property of individuals based on cadastral value, the tax will be calculated according to the following rules:

- the Tax Code of the Russian Federation defines the maximum possible tax rates based on cadastral value (for example, for apartments and residential buildings 0.1-03% of the cadastral value);

- exact rates are approved annually by municipal authorities, including using decreasing or increasing coefficients (they are determined by orders and letters from the Federal Tax Service);

- from 2021, the tax amount is calculated using the formula 100% of the tax on the cadastral value (on the day the payment is calculated).

If the cadastral value of a house, building, premises or plot does not correspond to the market price, the tax amount will be overestimated. Therefore, challenging the cadastral value is allowed. To do this, you need to take a certificate of cadastral value, order a report on the market price, and then submit an application to the Commission under Rosreestr or to the court. The challenge procedure through the Commission is free of charge. When filing a claim in court, you need to pay a state fee of 300 rubles. (citizens) or 6000 rub. (organizations).

The content of regulations that are used to calculate cadastral value can be found below.

| No. | Regulatory acts for calculating cadastral and market values | Description |

| 1 | Federal Law No. 237-FZ () | Contains the procedure for state assessment of real estate, rules for approving and publishing cadastral value, making changes to the Unified State Register of Real Estate after it has been challenged |

| 2 | Federal Law No. 135-FZ () | Contains rules for assessing real estate, requirements for appraisers, and the procedure for preparing a report on the market price |

| 3 | Order of the MER No. 226 () | Contains guidelines for conducting state assessment of real estate |

| 4 | Order of the Ministry of Economic Development No. 378 () | Contains forms of USRN extracts, including for obtaining information on cadastral value |

On the Public Cadastral Map you can find out the value indicator and the date of the last state assessment of the property.

Example of tax calculation based on cadastral value

The apartment costs 1,000,000 rubles.

Cadastral – 900,000 rubles.

Property tax in 2021: (cadastral value * 0.0015) 1350 rubles.

Currently there are marginal tax rates for a certain value of real estate:

- Up to 300 million – 0.1%

- From 300 to 500 million – 0.1 – 0.3%

- From 500 million rubles. – from 0.3 to 2%

Expert commentary. Tax deductions can be used to calculate taxes. For example, a certain area of an apartment or land plot will be excluded from the tax base. For more information on the procedure for applying tax deductions, you can consult the experts of ]Smart Way[/anchor].

Dear Clients!

The information in this article contains general information, but each case is unique. You can get a free consultation from our engineers using one of our telephone numbers - call:

8 Moscow (our address)

8 St. Petersburg (our address)

All consultations are free.

To challenge the cadastral value, a report on the market price of the property must be taken.

How to find out?

There are several ways to find out how many square meters a property has.:

- Order an extract from the Unified State Register of Real Estate, which will indicate all publicly available information about the object, including its area.

- Use a public cadastral map. It provides only minimal data, but this also includes the number of square meters.

- Use the online service of Rosreestr.

The first method is inconvenient because it requires payment: an ordinary citizen has no right to receive a free extract from the Unified State Register of Real Estate. In addition, here it is necessary to take into account the deadlines for providing information established by the Federal Law “On State Registration of Real Estate”.

Even if you order online through the Gosuslugi portal or the Rosreestr website, you will not be able to receive an electronic document immediately - you will need to wait up to three working days. Therefore, the easiest way is to use the remaining two options.

Search by map

A public cadastral map is a special online resource that provides information about real estate properties . It is convenient because with its help you can not only obtain information, but also see with your own eyes how a specific plot, building or other real estate registered in the Unified State Register is tied to the area.

The maintenance of the map (as well as the Unified State Register of Real Estate itself) is carried out by a special registration body - Rosreestr, which records both legal, cadastral and cartographic information about objects.

You can find a property using a map and cadastral number as follows::

- Follow the link https://pkk5.ru/.

- Select the search function (magnifying glass icon).

- Enter a known number in the line that opens and press “Enter” or the left mouse button.

- A window will open with known data about the apartment, which, among other things, will include its area.

Via the Rosreestr website

Another option for obtaining information is to use the online services of the official website of Rosreestr. This is done as follows:

- Follow the link https://rosreestr.ru/site/.

- Select the “Electronic Services” section on the main page.

- In the section, click on the link “Online Help”.

- A search form will open. In it you can indicate any known information about the apartment, including its cadastral number.

- After entering the information, you need to click the “Generate request” button.

- A new window will open with a link to specific information.

- By clicking on the link, you can find out the area of the apartment online.

If the number is not specified in its entirety, the site may provide several links to objects whose cadastral numbers begin with the same numbers.

In addition, instead of the cadastral number, you can enter a conditional number assigned before 2007 .

How to find out the cadastral value?

You can find out the cadastral value through Rosreestr, MFC or the State Services website. After approval of the assessment report, the relevant data is entered into the Unified State Register. Therefore, the USRN extract or certificate will indicate the details of the regulatory act and the date of the assessment. To calculate the cadastral value, special methods are used that take into account the position of the property, its profitability and other parameters that affect its price.

How to obtain information through the State Services portal

To obtain detailed information about the property, including the area of individual premises, you must order an extract from the Unified State Register of Real Estate. To do this, you need to register on the State Services portal and confirm your account at one of the confirmation centers in your city. This can be done at the post office or at the MFC. The procedure takes no more than 3 minutes and is free.

After this, you need to log into your personal account on the Rosreestr website. Entrance there will be made through the State Services portal. This scheme identifies the user. After this, from your personal account you can order any extract from the Unified State Register of Real Estate that interests you. If you want to know the area of the apartment, then you will need its extended version with a cadastral plan.

Such an important characteristic of a property, such as its area, is of great interest to the buyer. To quickly analyze several apartments using this parameter, it is enough to know their addresses. You can get information about the area of the entire house and the rooms in it in different ways, but all of them do not require much effort, since everything can be done online.

Cadastral value assessment

To assess the cadastral value, specialists from budgetary institutions authorized by the authorities of the constituent entity of the Russian Federation are involved. The algorithm of actions when determining the cadastral value is as follows:

- a normative act on conducting an assessment is adopted;

- specialists of a budgetary institution request information from the Unified State Register of Real Estate, letters and reference information from state and municipal bodies, archival data (if available);

- property owners can transfer their data and documents for an objective assessment;

- market prices for real estate, location and year of construction of objects, and other data are studied;

- a report is generated based on the results of the state assessment;

- after the report is approved by the authorities, it is published on the official portal of the constituent entity of the Russian Federation;

- information about the new cadastral value and details of the regulatory act are sent to Rosreestr for inclusion in the Unified State Register of Real Estate.

The assessment results do not take into account the individual characteristics of the property. For example, the cadastral value of housing is calculated based on average indicators, although each apartment may have significantly different improvement parameters. For this reason, the cadastral value almost always exceeds market values, which leads to an overestimation of tax payments.

Expert commentary . When inheriting after the death of the owner, you need to pay a state fee to the notary. To calculate the duty, it is allowed to take not only the cadastral value, but also the inventory or market price. To save on payments when entering into an inheritance, it is worth first assessing which indicator the fee will be lower. By default, the notary will take the cadastral value as a basis.

Specific cadastral value

UPKS - specific indicators of the cadastral value of real estate objects are used when determining the cadastral value of new objects. UPKS are approved for a specific territorial block in which the facility is located. A typical example of the use of UPKS when conducting an assessment is the assessment of the value of a land plot transferred from one permitted use to another or when the purpose of land is changed. This indicator is not indicated in the USRN extract. It is also not used to calculate tax payments.

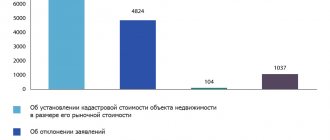

Challenging the cadastral value

If you find out the cadastral value of an object that belongs to you, but do not agree with the results of the assessment, the state allows you to challenge the result of the cadastral assessment. A specially created Commission under Rosreestr considers applications for disagreement with the cadastral value of housing, plots or other objects. The procedure for its formation and functioning was approved by Order of the Ministry of Economic Development No. 263 dated May 4, 2012 (download here). Here are the most important rules for challenging the cadastral value in 2020:

- citizens can submit an application to the Commission or directly to the court;

- legal entities are obliged to apply to the Commission, and after its refusal have the right to file a claim in court;

- the period for consideration of applications by the Commission does not exceed 30 days;

- if the cadastral value is equal to the market price, the corresponding data will be included in the Unified State Register of Real Estate.

In order to apply to the Commission or the court, you must submit an application, attach title documents to the property, an extract from the Unified State Register of Real Estate on the cadastral value, a report on the market price of the property, and other documents confirming the unreliability of the cadastral information about the price of the property. A report on the market price of real estate can be ordered from a company or from a specialist who is a member of the SRO of appraisal activities. The certificate and report must be requested at the time of application. As a result of the Commission's consideration of a request to challenge the cadastral value, a Decision is made, according to which the complaint of the interested person is either satisfied or the change in the cadastral value is denied.

Expert commentary . To avoid problems when challenging the cadastral value, use the services of Smart Way specialists. We ourselves will prepare all the necessary documents and evidence, which will confirm the discrepancy between the cadastral value and the market price of the property.

Get an estimate of the cost of this service using our price calculator - here

Change in cadastral value

The cost approved in the Unified State Register can be changed. This scenario is possible if the applicant disputes the cost, if the object has been changed, or if a technical error was identified when assessing the object. We talked about challenging the cost above. As for the change in the object, it can be expressed in different ways. All changes in characteristics that were registered in the Unified State Register of Real Estate may affect the increase or decrease in the value of the object.

Cadastral value of land plots

The cadastral value of land plots is determined in accordance with the type of permitted use of the object and the category of land to which it is assigned. A special procedure for cadastral valuation has also been established when entering information about an object that was previously included in the cadastre, about newly formed plots, or when transferring land from one category to another. The procedure for determining the cadastral value of real estate is approved by Law No. 237-FZ (). When determining the cadastral value of land plots, the registration of acts for each cadastral quarter is used, where the intermediate results of the assessment will be indicated.

Cadastral value for taxes

The main application of establishing the cadastral value of real estate in the Russian Federation is the calculation of the tax base for paying property taxes for legal entities and individuals. Since 2021, all regions have switched to using cadastral value when calculating taxes. As the state assessment is carried out, the cadastral value of real estate increases. For this reason, contributions to the budget increase annually. If the owner himself does not challenge the cadastral value indicators, he will pay tax at inflated rates.

The payment receipt will indicate that the tax is calculated based on the cadastral value. Using these data, you can check the validity of the calculation.

Is the area of the balcony included in the area of the apartment? Balcony area in the total area of the apartment according to BTI

Regarding the issue of heating, a personal consideration of each room is required. When radiators are installed on a balcony or loggia and it is possible to spend time there during the cold season, they belong to the total heated area of the apartment. These meters will be included in the payment receipt, since the law provides for payment for each square meter. According to the legislation of the Russian Federation, the size of unheated loggias, balconies and terraces is not included in the total area, but in practice the situation is different. Most developers “forget” what is included in the total area of an apartment and calculate its cost using established coefficients.

This is important to know: What is the total project area of the apartment

List of useful documents

Documents for download:

| No. | Links | Description |

| 1 | Sample terms of reference for market valuation of an object | |

| 2 | Sample USRN extract with cadastral value | |

| 3 | Sample application to the Commission under Rosreestr | |

| 4 | Sample claim for reduction of cadastral value | |

| 5 | Application form for the provision of an extract from the Unified State Register of Real Estate | |

| 6 | Request form for clarification of cadastral value | |

| 7 | Application to the Commission under Rosreestr for revision of cadastral value | |

| 8 | Application for revision of cadastral value due to unreliable information |

Tax return for property tax

When paying real estate taxes, you must comply with the rules and reporting requirements of government agencies for their registration. The document by which an organization covers its obligations to pay real estate taxes is a declaration. Now declarations are filled out in accordance with the Order of the Federal Tax Service dated November 5, 2013 No. ММВ-7-11/ (When filling out documents (declarations), special requirements must be observed, including indicating the deadline for calculating the tax, the current cadastral value.

How is the area of the apartment indicated in the cadastral passport of the premises determined?

The cadastral passport of the premises displays information about the premises, including the area of the premises , contained in the state real estate cadastre (hereinafter referred to as the State Real Estate Cadastre). In the case of creating a new premises (in particular, when creating an apartment building), as well as in the event of changes in information about the premises (for example, in connection with the redevelopment of the premises), information about this premises is entered into the State Property Committee on the basis of an application and a technical plan of the premises prepared by a cadastral engineer . The technical plan of the premises is prepared taking into account the requirements for the preparation of the technical plan of the premises, approved by Order of the Ministry of Economic Development of Russia dated November 29, 2010 No. 583 (hereinafter referred to as the Requirements for the technical plan of the premises). One of the characteristics of the room, the information of which is contained in the technical plan, is the area of the room .

area of a premises is understood as the sum of the area of all parts of such a premises, including the area of auxiliary premises intended to satisfy citizens' household and other needs related to their residence in residential premises, with the exception of balconies, loggias, verandas and terraces. The area of auxiliary premises includes the area of kitchens, corridors, baths, toilets, built-in closets, storage rooms, as well as the area occupied by the internal staircase. The measurement of distances used to determine the total area of a residential premises, a residential building, is carried out along the entire perimeter of the walls at a height of 1.1 - 1.3 meters from the floor (Order of the Ministry of Economic Development of Russia dated September 30, 2011 No. 531 “On approval of the Requirements for determining the area buildings, premises”, hereinafter – Requirements).

Thus, in the case of state cadastral registration of a premises or state cadastral registration of changes to a premises, information on the area of the premises in the cadastral passport corresponds to the information on the area of the technical plan of the premises prepared by the cadastral engineer and is determined taking into account the Requirements.

The area of balconies and loggias in accordance with the Requirements is not included in the area of the apartment.

If information about the premises is entered into the State Property Committee as a previously registered real estate property on the basis of a title/title document (certificate of state registration of rights, purchase and sale agreement) without subsequent preparation of a technical plan and determination of the actual dimensions and area of the premises, information on the area of the cadastral premises passports will correspond to the information about the area of the premises in the title/title document.

Regarding the difference between information about the area of the premises in the agreement for participation in shared construction and the cadastral passport of the premises, it is necessary to note the following:

Information about the area of the apartment contained in the agreement for participation in shared construction is indicated by the developer on the basis of the design documentation of the apartment building prepared by a design and architectural organization that has the authority to produce this documentation. The area of the apartment in the shared construction participation agreement is the design area.

However, based on the successful experience of preparing documents for state cadastral registration of an apartment building by employees of Regional Cadastral Center LLC, it should be noted that the area of the apartment upon completion of construction may differ from the designed area of the apartment by some amount. In the agreement for participation in shared construction , the developer can indicate the possible size of the discrepancy between the projected area of the apartment and the actual area and the consequences of this discrepancy for the parties to the agreement. When concluding an agreement for participation in shared construction, as well as when receiving a cadastral passport of an apartment from the developer, it is necessary to pay special attention to the area of the apartment indicated in these documents and to the clause of the agreement for participation in shared construction that stipulates the consequences of discrepancies in area.

How do discrepancies arise?

Upon completion of the construction of an apartment building, the developer turns to a cadastral engineer to prepare a technical plan for the apartment building and, based on the technical plan, obtain permission from the architecture and urban planning authorities to put the house into operation.

Cadastral work is carried out by a cadastral engineer on the basis of a contract concluded in accordance with the requirements of civil legislation and federal law of July 24, 2007 No. 221-FZ “On the State Real Estate Cadastre” (hereinafter referred to as the Cadastre Law) and a contract agreement for the performance of cadastral work, unless otherwise not established by federal law (part 1 of article 35 of the Cadastre Law).

According to the Real Estate Department, a full-scale survey of a real estate property is carried out in order to verify the compliance of the actual parameters of the real estate property with the parameters specified in the documents used to prepare the technical plan (in accordance with the letter of the Ministry of Economic Development of Russia dated November 3, 2013 No. D23i-2971).

In accordance with paragraph 31 of the Requirements for the technical plan of the premises, if during cadastral work discrepancies are identified between the area of the premises specified in the design documentation and the area of the premises determined by the cadastral engineer taking into account the Requirements, the section “Conclusion of the cadastral engineer” of the technical plan is drawn up, in which the cadastral engineer a note may be made about the presence of such discrepancies indicating the actual area of the premises (letter from the Ministry of Economic Development Letter dated November 29, 2013 No. OG-D23-15744).

Thus, information about the area of the apartment specified in the agreement for participation in shared construction may differ from the area of the apartment indicated in the cadastral passport of the premises due to the fact that information about the area of the apartment contained in the State Property Committee reflects the actual value of the area of the apartment, determined by the cadastral engineer upon completion construction of an apartment building taking into account the Requirements based on actual measurements of the lengths of the walls of the premises of the apartment building.

Cost of a certificate of cadastral value

In the table below you can find out how much a certificate (extract) of cadastral value costs, as well as a number of other documents and services that can be ordered from ]Smart Way[/anchor].

Approximate prices for services can be found below.

| No. | Service, document | Price |

| 1 | Report on the market price of the property | from 7000 rub. |

| 2 | Request for an extract from the Unified State Register of Real Estate with cadastral value | 350 rub. |

| 3 | Supporting the procedure for challenging the cadastral value in the Commission under Rosreestr | from 12,000 rub. |

| 4 | Support in the procedure for challenging the cadastral value in court | from 15,000 rub. |

| 5 | Filing a claim to challenge the cadastral value | from 3000 rub. |

How can you find out the number of residential square meters

To find out the area of an apartment by cadastral number online and receive documentary evidence of this, you will have to request an extract from the Unified State Register of Real Estate. Below are instructions for ordering a certificate.

Here using the widget

If you decide to look at some important information, we use the widget:

- We find it on the page or higher.

- Fill in the search bar.

- Use the “More details” button to find out the details of interest.

- To obtain official data, you need to order extracts. Using the “Order” button, we open the price list for review.

- All that remains is to make a choice depending on the information that you want to check.

Order an extract from the Unified State Register of Real Estate

The most detailed and up-to-date information is provided by obtaining an extract from the Unified State Register of Real Estate. It will be cheaper in electronic format. You can print it if necessary.

The need to order such a certificate is confirmed by the sad statistics of Rosreestr, which annually records about 14,000 cases of fraud in real estate transactions.