In addition to the cost values established at the federal level, certain types of prices can be established as a result of consideration of individual cases in disputes initiated by plot owners.

How often does it change?

Cadastral value indicators have different values for individual categories of land, mainly differing in their purpose or useful quality .

From time to time, prices for certain categories of plots are revised. This is often due to the fact that key indicators change over time, which have a significant impact on its value.

In general, the revaluation procedure is determined by Federal laws, and the terms themselves are established by the State Real Estate Cadastre.

There are time frames within which the cadastral value revaluation procedure is carried out.

Thus, the maximum period is limited to 5 years , and the minimum is 2 years - in this case, the main factor on which they rely when revising prices is the region in which the site is registered.

In some cases, the revision of the cadastral value may be initiated ahead of schedule .

In particular, such cases may be:

- Changing the area of a plot of land towards decreasing or increasing;

- Carrying out land surveying;

- Changing the purpose of areas. For example, the conversion from land for growing crops to plots for individual residential construction automatically increases the price;

- Commissioning of a facility built on a specific plot of land. As a rule, such actions significantly increase the price of the plot;

- With significant development of infrastructure around the land plot, since the presence of hospitals, schools, kindergartens and other facilities in close proximity to them significantly increases its value;

- Changes in indicators at current market prices.

Revaluation of land for previous years

A massive revaluation of land was carried out back in 2014 , and the result was such that in some regions the calculated figure significantly exceeded the market value of the plots.

This situation led to the fact that the owners of many plots, who did not agree with this fact, considered the increase to be unjustified, and initiated a large number of legal proceedings to challenge the value established at the state level.

An equally significant change in the cadastral value was the amendments to the laws introduced in December 2016 , when there was a significant increase in indicators for all categories of land plots.

Forecast

According to the adopted Federal Law No. 360 dated July 3, 2016, with amendments currently in force in all regions, the growth of cadastral value has been suspended for some time - it will not be revised until January 1, 2021 .

At the end of this period, the price for plots will be revised, but in accordance with Federal Law No. 237 “On State Cadastral Valuation”, this process will be carried out by independent public sector institutions under the supervision of Rosreestr.

What does the adjustment affect?

The value of the cadastral value has a significant impact on the following points :

- Calculation of payment for land lease under certain conditions;

- The amount of land tax, which is determined as a percentage of the cadastral value.

The most significant in this case is the impact on tax calculation, since almost every owner of a land plot, with rare exceptions of preferential groups, is obligated to make such transfers to the country’s budget.

It is on the basis of the cadastral value of one square meter of land that the total price of the plot is determined by multiplying the land area by a unit of indicator.

The tax is also calculated on the basis of a percentage determined for each individual category of land, while the average rate is at the level of 0.3% and can fluctuate significantly both up and down.

Why is it necessary to reassess the cadastral value?

“This needs to be done because in 2021 a state revaluation was carried out in the Pskov region, which was done by specialists from St. Petersburg,” explains Anastasia Garbuzova, an employee of the assessment department of the Pskov Stock Company. - They didn’t go anywhere, didn’t look at anything and calculated all the plots the same, at the price of one square meter in the city of Pskov - that is, 300 rubles. This price is the same throughout the region, regardless of whether it is a swamp, a forest, or whether there is a road or electricity. People have large plots, and, accordingly, sometimes they cost 12 million, and his red price is 500 thousand. In this regard, large taxes come, which are calculated based on the cadastral value.

Therefore, it turns out that previously landowners paid 2 thousand rubles, but now they receive receipts for both 20 and 50 thousand! According to the experience of the Pskov Stock Company, in the region the real price of land in settlements and private household plots ranges from 1 to 60-80 rubles per square meter, depending on the area and location. If this is an industrial (commercial) facility, the price there is also too high, it can be reduced by at least 50%, and sometimes more. The formula is simple: the value is disputed - the tax is reduced.

How to change if rights are violated

If prices are significantly inflated, each owner of a land plot has the opportunity to challenge the established value .

To challenge the price, you must first have grounds for such action.

It is worth understanding that the determination of cadastral value is carried out on the basis of specific indicators - location, characteristics of real estate, purpose of the plot, changes in the market.

If the cadastral value of a land plot has changed, and any factors were not taken into account or the data is distorted, the land owner has the right to challenge it.

Where to contact?

At the moment, there are two possible ways to change the cadastral value privately.

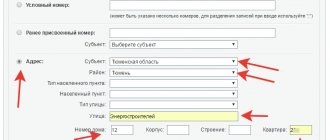

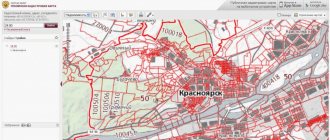

- Administrative method . In this case, an application is sent to Rosreestr from the direct owner of the land plot.

- Judicial . Going to court is possible only after a pre-trial settlement of the issue has taken place and Rosreestr has refused such an action.

When applying both administratively and judicially, the owner of the plot must have real grounds for reducing the cadastral value , which can be confirmed either by existing documents or by conducting an additional examination.

What documents are needed to revise the value?

When applying for the need to revise the cadastral value, the list of documentation is as follows:

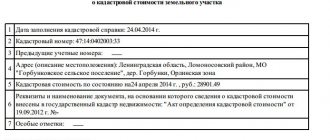

- Cadastral passport of a plot of land;

- Report on the market price of land;

- Certificate of ownership of land;

- A separate expert opinion in the event that the market price differs from the cadastral price.

By whom and on what basis is the recount carried out?

In any case, a written statement from an authorized person or organization is required to re-evaluate or change the cadastral value of the land plot. These include the owner of the property (individual or legal entity), municipality or territorial executive authorities.

The municipality can make relevant claims only if the land plot is in its ownership.

According to Art. 9 of the Law the grounds are:

- agreement between the appraiser and the individual or legal entity that owns the land plot;

- determination of a district, arbitration or arbitration court;

- resolution of territorial executive authorities.

It is possible to initiate a revaluation or change in value if the property undergoes a planned revaluation by the State Cadastre, land surveying is established or the boundaries of the territory are changed, the type of permitted use or category of land changes.

The owner has the right to submit a corresponding petition in connection with other circumstances that objectively affect the assessment (decrease or increase in soil fertility, natural disasters, cadastral and audit errors).

Not only full owners, but also persons with the right of indefinite residence, inheritable ownership and tenants (with the consent of the owner, if the housing is not social) have the right to apply for a revaluation or change in the cadastral value.

Is there a tax increase planned?

The issue of increasing taxes on land plots and increasing the cadastral value of land is inextricably linked and currently worries both ordinary citizens and individuals and legal entities, since for many of them the amount of the annual contribution to the budget becomes a fairly large expense.

Over the past few years, there has been a trend towards selling properties that are not profitable and become a burden on their owners who do not have enough income to pay the full tax.

It is worth noting that the new principle of calculating tax based on cadastral value began to be applied not so long ago - even before 2015 it was calculated based on the book price of land.

At the moment, a gradual transition is being made to calculations based on cadastral value , and therefore the amount of taxes is increasing and this trend will continue in the near future.

In general, the increase in taxation is carried out in stages - from 2015 to 2021, the rate increases gradually (by 20% annually) and, in connection with this, the amounts payable for the property also become larger.

On the one hand, according to experts, increasing the amount of revenue to the country’s budget is a necessary measure that will help raise funds for infrastructure development and financing the modernization of various facilities.

However, on the other hand, each individual owner of a land plot cannot always allocate such an amount of funds.

Entrepreneurs belonging to small and medium-sized businesses are most concerned about the significant increase in costs, especially those engaged in activities in the agricultural sector - it is for these categories that the cadastral value has increased the most recently.

Support of revaluation and contestation of cadastral value

“Of course, we accompany clients, we can go with the client to Rosreestr itself to submit documents,” says Anastasia Garbuzova. — We will fill out an application for the client to submit documents to the dispute resolution commission. If the client is from out of town (and there are a lot of St. Petersburg residents who have local sites), then you can send us all the documents by e-mail, and send the originals by regular mail. A notarized power of attorney is issued, for example, for our employee, and we ourselves submit all the documents to the commission - the client does not need to come. What happens next? We have submitted documents to Rosreestr, a commission date is set, and both we and clients are notified about this. The client himself may not come to this commission. We go to the commission, if the commission has any comments, we correct them free of charge and resubmit the application. We also have experience in successfully challenging cadastral values in the courts.