The validity and reliability of assessment results largely depends on the correct choice of purpose and assessment methods. The result of the assessment is the final value of the value of the object being assessed. The result of the assessment can be used when the parties determine the price for completing a transaction or other actions with the object of assessment, including when making purchase and sale transactions, leasing or collateral, insurance, lending, contributing to the authorized (share) capital, for tax purposes, when preparing financial (accounting) statements, reorganizing and privatizing enterprises, resolving property disputes, making management decisions and other cases.

The assessment may be mandatory in accordance with the current legislation of the Russian Federation, or it may be optional, but necessary for the completion of certain transactions.

The most common types of independent assessment include the following:

- Assessment of machinery, equipment and vehicles;

- Assessment of the value of real estate (buildings, structures, land, etc.);

- Valuation of shares and other securities;

- Valuation of intangible assets and intellectual property;

- Estimation of the value of an enterprise (business);

- Damage cost assessment;

- Valuation for IFRS purposes.

The assessment is made on the basis of standards established by the state or professional community, reflects the fair value of the object and is independent.

The assessment for IFRS purposes is also carried out taking into account the requirements of International Financial Reporting Standards.

Valuation of machinery, equipment and vehicles

Object of assessment

Various movable property - from machines to furniture, household items, vehicles and other objects.

What affects the cost of assessment services?

Estimating the cost of equipment depends on a number of factors:

- Technological features;

- Inflation;

- Costs of analogues;

- Income from the property being assessed or from its sale.

Timing of the assessment work

The assessment takes from 3 to 14 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

III. Approaches to assessment

13. The income approach is a set of methods for estimating the value of the valuation object, based on determining the expected income from the use of the valuation object.

14. The comparative approach is a set of methods for estimating the value of an appraised object, based on a comparison of the appraised object with objects that are analogues of the appraised object, for which price information is available. An object - an analogue of a valuation object for valuation purposes is an object that is similar to the valuation object in terms of the main economic, material, technical and other characteristics that determine its value.

15. The cost approach is a set of methods for estimating the value of an appraised object, based on determining the costs necessary to reproduce or replace the appraised object, taking into account wear and tear and obsolescence. The costs of reproducing the valuation object are the costs necessary to create an exact copy of the valuation object using the materials and technologies used to create the valuation object. The costs of replacing a valuation object are the costs required to create a similar object using materials and technologies used at the valuation date.

Real estate valuation

Object of assessment

real estate is physical objects with a fixed location in space and everything that is inseparably connected with them both below and above the surface of the earth or everything that is a service item, as well as the rights, interests and benefits arising from the ownership of objects. Physical objects are understood as inextricably linked land plots and buildings located on them.

What affects the cost of assessment services?

Estimating the value of a particular property depends on a number of factors:

- Purpose of using the assessment results;

- Type of value determined;

- The nature of the real estate rights being valued;

- Type of object being assessed;

- Completeness of real estate assessment;

- Date of assessment, etc.

Time frame for the assessment work:

The assessment takes from 3 to 14 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

II. General concepts of assessment

3. The objects of assessment include objects of civil rights in respect of which the legislation of the Russian Federation establishes the possibility of their participation in civil circulation.

4. Price is the amount of money requested, offered or paid by participants as a result of a completed or proposed transaction.

5. The value of the valuation object is the most probable estimated value determined as of the valuation date in accordance with the selected type of value in accordance with the requirements of the Federal Valuation Standard “Purpose of Valuation and Types of Value (FSO No. 2)”.

6. The final value of the value is the value of the valuation object, calculated using approaches to valuation and agreement (generalization) of the results obtained through the use of various approaches to valuation, justified by the appraiser.

7. An assessment approach is a set of assessment methods united by a common methodology. A method for assessing a valuation object is a sequence of procedures that allows, on the basis of information essential to this method, to determine the value of the valuation object within the framework of one of the valuation approaches.

8. The date of determining the value of the valuation object (date of assessment, valuation date) is the date as of which the value of the valuation object was determined. Information about events that occurred after the valuation date can be used to determine the value of the subject property only to confirm trends existing at the valuation date, if such information corresponds to prevailing market expectations at the valuation date.

9. Assumption - an assumption accepted as true and concerning facts, conditions or circumstances associated with the object of assessment or approaches to assessment that do not require verification by the appraiser during the assessment process.

10. Analogue object - an object similar to the object of assessment in terms of the main economic, material, technical and other characteristics that determine its value.

Valuation of shares and other securities

Object of assessment

security - a document certifying, in compliance with the established form and required details, property rights, the exercise and transfer of which are possible only upon presentation.

What affects the cost of assessment services?

For shares:

- Availability of quotes on the stock market;

For bonds:

- Availability of information on the discount rate;

For a bill:

- Availability of information about the drawer;

- Bill amount;

- The due date for the bill of exchange;

- Endorsers of a bill;

- Availability.

Timing of the assessment work

The assessment takes from 3 to 14 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

Valuation of intangible assets and intellectual property

Object of assessment

The objects of assessment include:

1) Intellectual property objects (exclusive right to the results of intellectual activity):

- The exclusive right of the patent holder to an invention, industrial design, utility model;

- Exclusive copyright for computer programs, databases;

- The property right of the author or other copyright holder to the topology of integrated circuits;

- The exclusive right of the owner to a trademark and service mark, the name of the place of origin of goods;

- The exclusive right of the patent holder to selection achievements.

2) The business reputation of an organization is part of the value of an operating enterprise, determined by its good name, business connections, reputation, fame of a company name, trademark, suppression of unfair competition.

What affects the cost of assessment services?

Estimating the value of an intangible asset depends on a number of factors:

- Intangible, unique nature of the object of evaluation;

- Current use of the intellectual property;

- Possible industries of use, the most likely capacity and market share, costs of production and sales of products manufactured using an intellectual property object, the volume and time structure of investments required for the development and use of an intellectual property object in a particular industry;

- Risks of development and use of intellectual property in various industries, including risks of failure to achieve technical, economic, operational and environmental characteristics, risks of unfair competition and others;

- Stages of development and industrial development of an intellectual property object;

- Possibility and degree of legal protection;

- The scope of transferred rights and other terms of agreements on the creation and use of intellectual property;

- Method of payment of remuneration for the use of intellectual property;

- Useful life of the object.

Timing of the assessment work

The assessment takes from 3 to 14 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

On the date of assessment and the date of preparation of the report, which should not differ by more than three months

- To the President of the All-Russian public organization “Russian Society of Appraisers” S.A. Tabakova 107078, Moscow, st. Novaya Basmannaya, 21-1

On the date of assessment on No. 38/454 of June 17, 2009.

Dear Svetlana Alekseevna!

The Corporate Governance Department of the Ministry of Economic Development of the Russian Federation (hereinafter referred to as the Department) has considered the issues raised in your appeal and reports.

In accordance with paragraph 18 of the Federal Assessment Standard “General concepts of assessment, approaches to assessment and requirements for assessment (FSO No. 1)”, approved by Order of the Ministry of Economic Development of Russia dated July 20, 2007 No. 256 (hereinafter referred to as FSO No. 1). The appraiser collects and analyzes the information necessary to conduct an assessment of the object being assessed. The appraiser studies the quantitative and qualitative characteristics of the valuation object, collects information essential for determining the value of the valuation object using the approaches and methods that, based on the judgment of the appraiser, should be applied when conducting the valuation, including information about the valuation object, including accounting and reporting data related to the valuation object, as well as other information essential for determining the value of the valuation object.

Based on the foregoing, when conducting an assessment, the appraiser is not limited in the choice of information used that is essential for determining the value of the appraisal object. In addition, it is necessary to take into account that according to the Regulation on accounting skills “Accounting statements of an organization (PBU 4/99)”, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n, the organization must prepare interim financial statements for the month, quarter on an accrual basis from the beginning reporting year, unless otherwise established by the legislation of the Russian Federation. The organization must prepare interim financial statements no later than 30 days at the end of the reporting period, unless otherwise provided by the legislation of the Russian Federation. In this regard, in the opinion of the Department, when conducting an assessment, the appraiser has the right to use, among other things, the interim reporting of the organization. Regarding the determination of the COST of an appraisal as of the date preceding the appraisal, the following should be noted.

In the opinion of the Department, the date of assessment always precedes the date of drawing up the assessment report, and in cases where, in accordance with the legislation of the Russian Federation, an assessment is mandatory, then no more than three months should pass from the date of assessment to the date of drawing up the assessment report, unless when the legislation of the Russian Federation establishes otherwise.

I.V. Oskolkov Director of the Corporate Governance Department

Estimation of enterprise (business) value

Object of assessment

When assessing a business, a company is assessed as a property complex that provides profit to its owner.

Thus, when valuing a business, the value of the following assets is calculated:

- Real estate;

- Machinery and equipment;

- Warehouse stocks;

- Financial investments;

- Intangible assets;

- Company performance;

- The company's past, present and future earnings;

- Development prospects and competitive environment in this market.

Based on such a comprehensive analysis, the company being assessed is compared with similar enterprises and a fair assessment of the business is given.

What affects the cost of assessment services?

- The scope of the company's activities;

- Level of publicity and transparency of activities;

- Introduction of modern management and IT systems.

Timing of the assessment work

The assessment takes from 3 to 20 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

Estimating the cost of damage

Object of assessment

when assessing damage, an assessment is made of lost profits or direct damage caused by the actions or inactions of third parties.

What affects the cost of assessment services?

Each assessment case is specific.

Timing of the assessment work

The assessment takes from 3 to 20 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

Procedure and timing of personnel assessment:

3.1. Every year, in the last week of October, the company will issue an order announcing the composition of the commissions and the timing of the assessment. The approximate dates for personnel assessment are November-December each year.

3.2. Level I certification commissions are created to certify department heads and employees who are especially valuable to the company.

The level I certification commission includes:

- CEO

— Representatives of an independent company conducting the initial assessment

— Company Psychologist

3.3. A level II evaluation commission is created to evaluate deputy heads of departments, as well as persons equivalent to them. Level II commissions include:

- head of the HR department (or HR specialist

- employee's immediate supervisor

- head/heads of related departments.

3.4. A Level III Evaluation Commission is created to evaluate ordinary employees of the Company. It consists of:

— Immediate supervisor

— HR representative

— Heads of related services

3.5. Frequency of personnel assessment:

— Newly hired employees - upon completion of the probationary period.

- Newly appointed employees - after 2 months from the date of issuance of the appointment order.

— For permanent employees, once a year.

3.5.1. During the year, evaluation commissions meet to evaluate specialists who have passed the probationary period. Heads of departments are required to notify the chairman of the commission about the end date of the probationary period two weeks before the end of the probationary period of employees.

Valuation for IFRS purposes

Object of assessment

- The objects of assessment include:

- First adoption of IFRS (IFRS 1 First Adoption). Valuation for IFRS purposes is carried out to reflect the fair value of property, plant and equipment, construction in progress and sometimes intangible assets;

- Business combinations (IFRS 3 Business Combinations). Valuation for IFRS is carried out in order to properly reflect the value of acquired assets on the balance sheet. The objects under consideration are the company’s tangible assets and liabilities, as well as intangible assets, the work on which is the most important stage in the work of our specialists;

- Impairment of assets (IFRS 36 Impairment of Assets). The assessment of fixed assets according to IFRS is carried out with the aim of depreciation of assets. As a rule, it is carried out in case of deterioration of economic conditions;

- Fixed Assets (IFRS 16 Fixed Assets). If the fair value accounting model is applied, IFRS requires an annual revaluation of the enterprise's fixed assets with the involvement of an independent expert;

- Intangible assets. If the fair value accounting model is applied, IFRS requires an annual revaluation of an enterprise's intangible assets with the involvement of an independent expert;

- Financial instruments (IFRS 32, IFRS 39, IFRS 7). If the fair value accounting model is applied, IFRS in some cases requires an annual revaluation of financial investments;

- Investment property (IFRS 40 Investment Property). Carrying out an annual revaluation of investment real estate in the case of applying the fair value valuation model.

Documents required for the valuation of various types of property

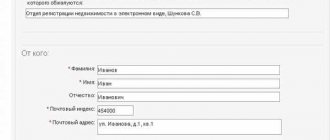

To evaluate residential premises (apartments, rooms):

- Copies of title documents (Certificate of state registration of rights, investment agreement, purchase and sale agreement, etc.);

- Copies of BTI documents (cadastral/technical passport with floor plan and explication);

- Other information affecting the quantitative and qualitative characteristics of the object (information about major repairs, information about the presence/absence of encumbrances, etc.);

- Certificate of book value of the object (if the object belongs to a legal entity);

- Information about the customer of the assessment (for individuals - passport data, for legal entities - company details).

To evaluate country real estate (dachas, cottages):

- Copies of title documents (Certificate of state registration of rights, investment agreement, purchase and sale agreement, etc.);

- Copies of BTI documents (cadastral/technical passport with floor plan and explication);

- Copies of title documents for the land plot (Certificate of state registration of rights, lease agreement, purchase and sale agreement, etc.);

- Cadastral passport of the land plot;

- Other information affecting the quantitative and qualitative characteristics of the object (information about major repairs, information about the presence/absence of encumbrances, etc.);

- Certificate of book value of the object (if the object belongs to a legal entity);

- Information about the customer of the assessment (for individuals - passport data, for legal entities - company details).

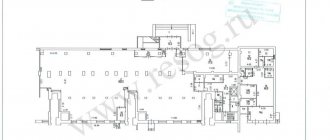

To evaluate non-residential premises and buildings (offices, shops):

- Copies of title documents (Certificate of state registration of rights, investment agreement, purchase and sale agreement, etc.);

- Copies of BTI documents (cadastral/technical passport with floor plan and explication);

- Copies of title documents for the land plot (Certificate of state registration of rights, lease agreement, purchase and sale agreement, etc.) – if available;

- Cadastral passport of the land plot - if available;

- Data on operating costs for the facility (if necessary);

- Other information affecting the quantitative and qualitative characteristics of the object (information about major repairs, information about the presence/absence of encumbrances, etc.);

- Certificate of book value of the object (if the object belongs to a legal entity);

- Information about the customer of the assessment (for individuals - passport data, for legal entities - company details).

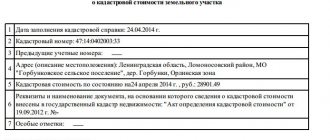

To evaluate land plots:

- Copies of title documents for the land plot (Certificate of state registration of rights, lease agreement, purchase and sale agreement, etc.);

- Cadastral passport of the land plot;

- Other information affecting the quantitative and qualitative characteristics of the object (presence of improvements to the land plot, information on the presence/absence of encumbrances, etc.);

- Certificate of book value of the object (if the object belongs to a legal entity);

- Information about the customer of the assessment (for individuals - passport data, for legal entities - company details).

To evaluate vehicles:

- A copy of the vehicle's passport;

- A copy of the vehicle registration certificate;

- Certificate of book value of the object (if the object belongs to a legal entity);

- Information about the customer of the assessment (for individuals - passport data, for legal entities - company details).

To evaluate equipment (furniture, office equipment, etc.):

- Basic technical data on the equipment being evaluated (brand, model, year of manufacture, year of commissioning, main technical parameters, etc.);

- Certificate of book value of the object (if the object belongs to a legal entity);

- Information about the customer of the assessment (for individuals - passport data, for legal entities - company details).

To assess intangible assets and business:

- Copies of constituent documents (Charter, certificates, orders, etc.);

- Copies of accounting documents (Form 1 and Form 2 for the last five years, etc.);

- Deciphering the organization's fixed assets;

- Description of the company, its activities, development plan, etc.

- Other documents necessary to determine the quantitative and qualitative characteristics of the appraisal object, at the request of the appraiser.

Due to the individuality of the assessed object, it is possible to request additional documentation.

What affects the cost of assessment services?

Factors influencing value are specific to each type of asset.

Timing of the assessment work

The assessment takes from 3 to 20 days.

The result of our work

- Appraiser's report in accordance with the requirements of Russian legislation;

- Appraiser's report in accordance with international valuation standards;

- Protection of interests in court;

- An appraiser's report made in accordance with the requirements of a specific customer (Bank, Association of Banks, etc.).

Property rights to the subject of valuation

When drawing up an assignment for a cadastral valuation, the customer is required to provide documents confirming ownership of the site being assessed. Such documents may include a certificate of ownership, a lease agreement, etc. The documents must provide comprehensive information about the types and scope of rights to the property being assessed. The customer provides copies of documents to the appraiser, after which an acceptance certificate for this documentation is drawn up. In cases where the order to carry out appraisal activities is not given by the owner of the property, he must justify the fact why he carries out this order.