Civil liability insurance – what is it?

What types of insurance are there? Let's understand this concept in detail. Today you can insure anything - personal property, a car, an apartment, health, even individual parts of the body. When an insured event occurs, specified as damage in the insurance contract, the insured person receives monetary compensation.

...But there are situations when we can unexpectedly cause this very damage to someone else’s property.

Case of civil liability

A fire, flood or other disaster in an apartment can harm not only the owner’s property, but also the apartments in the neighborhood. Not only the emergency itself, but also the means used to eliminate it can cause property damage. Fire extinguishing agents may also affect nearby apartments. Communication problems can also spread to neighbors.

If the situation described above occurs, the owner of a burnt apartment must not only restore his own property, but also compensate for the damage to injured third parties. It is this moment that is considered the onset of civil liability. It is difficult to imagine how many thousands of compensation a fire or flooding of lower-level apartments could result in. If the owner is a client of an insurance company, and all risks are specified in the contract, then the insurer undertakes to compensate the damage to the client and all victims.

Insurance risks

The client receives protection for damage caused to third parties. The minimum civil liability insurance contract includes the risks of fire and flood. It can be supplemented with risk insurance from the list below:

- Fire and fire damage to the property of third parties.

- Flood and associated costs to the apartments below.

- Domestic gas leak and explosion.

- Damage caused to third parties during housing redevelopment, during repair work, etc.

- Damage caused to neighbors' property due to problems with communication networks: sewerage, heating.

If the client owns an apartment and not a private house, then this type of civil insurance will protect against lawsuits from neighbors. By the way, in this case there is a special type of insurance - against legal costs. But provided that you clearly state all the risks in the contract, and the case is recognized as insured, the case most likely will not go to court.

When can you not do without SGO?

When making cosmetic repairs, whether to conclude a civil liability agreement or not is a matter for the owner, but even in this case, experts advise not to neglect the civil liability contract. But in case of redevelopment, insurance may be required.

Demolition and construction of walls, relocation of heating equipment, plumbing, expansion of windows and doors, addition of a balcony, etc. — such actions must be coordinated with licensing authorities. In some cases, approval alone may not be enough. The interdepartmental commission has the right to demand either written consent from all neighbors in the house to carry out reconstruction during renovation, or a civil defense contract.

If it is easier to obtain the consent of all neighbors in a small house, then in a large high-rise building this will pose serious problems. Let's assume that this was done, but where is the guarantee that material damage will not be caused to neighbors as a result of the reconstruction? For example, due to the regular operation of hammer drills, cracks may appear on the ceiling of a neighbor below. If in the best case it will be possible to cover the damage with money from your own pocket, then in the worst case you will have to go to court to compensate for moral damages and legal costs.

Is liability insurance required?

Insurance as a concept is divided into compulsory and voluntary. For example, car insurance in Russia is mandatory. Its voluntary subtype includes all other cases: fire, sweat, shorted wiring, etc. In this case, of course, the client himself must assess whether there are potential risks that could cause harm to third parties.

Unfortunately, finding a stand-alone liability insurance package is not that easy. Due to low demand for the service, insurance companies are in no hurry to develop insurance cases that are convenient and useful for citizens. On the other hand, it is easy to include additional risks in any basic package.

Example! You insure your apartment, and additional options include the risk of flooding your neighbors or a fire in the apartment. Yes, the cost of payment will increase, but you will be comprehensively protected on all fronts.

Where can you profitably insure civil liability - review of the TOP 5 insurance companies

The huge number of tempting offers makes the average citizen's eyes widen. To make your choice easier, we present the five most reliable and trusted insurance companies in the Russian Federation that provide insurance for various types of civil liability.

1) Ingosstrakh

There are few insurance companies in Russia with a history of more than half a century. Ingosstrakh is one of them. The organization has been operating on the market since 1947. Among the undoubted advantages of the company are high professionalism, reliability, and speed of action in the event of an insured incident.

Anyone can insure civil and professional liability here. The civil defense insurance market for corporate clients is especially widely represented. Programs are available for all areas of business - hotel and restaurant, medical, transport.

2) RESO-Garantiya

A universal insurance company with 25 years of experience in the market. It has a license for more than a hundred current and affordable products for corporate clients and individuals. Civil insurance programs include risk protection for property owners, motorists, businessmen, and law firms.

RESO operates through an agent network - the company has more than 20,000 professional agents providing services in 850 branches throughout Russia. Reliability rating A from the independent agency "Expert".

An international level insurer with the highest solvency index and a developed branch network. Maintains a focus on constantly improving the quality of customer service. Most services are available online with prompt execution of the contract and free delivery.

Each user can receive free consultations by phone and online chat. Civil damage insurance is available to individuals (MTPL, Good Neighbors, Even the Flood) and companies (liability protection for small, medium and large businesses).

4) Ingvar

Experience since 1993. Professionalism, quick conclusion of a contract with a minimum number of documents, prompt payments in insurance situations. The priority area of activity is the protection of property interests of legal entities.

The company insures all types of property, as well as civil and professional liability of clients. Provides financial protection to companies in the event of harm to third parties during production, economic and administrative activities.

5) Rosgosstrakh

The oldest insurance office in the Russian Federation. Legal successor of the Gosstrakh organization. It has more than 3,000 divisions and a staff of tens of thousands of professional agents. The total number of clients of the company is about 45 million people.

Practices all types of liability protection - insurance of hazardous industries, carriers, civil liability of industrial and commercial enterprises, persons providing professional services, property and transport owners.

Civil liability insurance to third parties can be taken out by:

- vehicle owners;

- owners of real estate (apartments, houses, commercial real estate);

- trade organizations;

- construction companies, etc.

The contract process

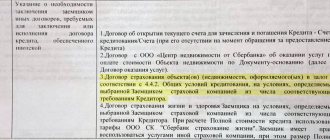

Since this type of insurance is not mandatory within the Russian Federation, insurance companies therefore offer clients favorable and transparent conditions. To start the process of obtaining a policy, the client must provide a document confirming the identity of the citizen and papers on the ownership of residential property. In practice, a minimum package of documents is required, since the property of a civilian is insured, and his liability is insured. The requirements for concluding a contract are given below:

- The insurance company provides a range of payment amounts, and the policyholder chooses the appropriate option based on his needs. The higher the potential amount of compensation, the higher the mandatory payment.

- An insurance contract can be concluded without a client’s application.

- The obligatory payment can be made in any convenient way: cash deposit, bank transfer and even installments.

- When concluding a contract, it is not necessary to evaluate the condition of the apartment or house.

- The policy can be obtained in absolutely any city in the Russian Federation. If you have chosen a non-resident insurance company, a copy of the contract will be sent to you by registered mail.

After the preparatory work has been completed and the policy has been fully issued, the policyholder receives the insurance rules and a memo on the procedure for applying in the event of an insured event. It is important to comply with the terms of the first application specified in the contract. As a rule, we are talking about 3-4 days. You can request compensation from the organization after presenting the following documents:

- The original insurance contract, which is kept by the client.

- A receipt confirming that the insurance fee has been paid.

- Documents or acts confirming the occurrence of an insured event.

- Conclusion of the expert commission on the incident.

- List of damaged property with photos.

Unlike the stage of concluding a contract, when requesting compensation, you need to write a statement. It must accurately indicate the location and time of the incident, and also list the damaged third party property. All facts must first be verified by insurance specialists. If (according to the contract) the case is recognized as insured, then an act of payment of compensation is concluded.

Upon the occurrence of an insured event, the Insurance Company undertakes to:

- Consider the written request for compensation for harm/damage received from the client, whose civil liability was insured, and the injured person and the documents submitted to confirm the event that occurred and the liability of the insured person.

- Conduct an examination of the claims made by the injured person, incl. conduct an inspection of the damaged property, involve independent expert organizations in assessing the harm/damage.

- Recognize the fact of the occurrence of an insured event, calculate the amount of insurance compensation, or send to the Policyholder and/or the Person whose liability is insured and the injured person a written refusal to satisfy the claim for payment of insurance compensation within 18 working days, counting from the date of receipt of all necessary documents.

- Pay the amount of insurance compensation specified in the insurance act no later than 5 working days following the day of approval of the insurance act.

Cost and amount of compensation

The insurance company's savings are used to pay compensation to clients upon the occurrence of an insured event. The amount of compensation is calculated individually in each individual situation. It depends on the estimated value of the property and the conditions specified in the contract.

Important! The amount of insurance payment cannot exceed the value of the insured object.

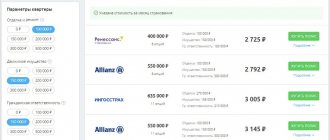

If the condition of the relationship between the amount of insurance and the value of the object is not met, the payment may be considered invalid. The analysis should be carried out by specialists in assessing the cost of insurance. Based on their conclusions, it will be possible to correctly calculate the amount of payment. Today, every insurer offers similar services. The more risks you protect against, the more expensive the insurance fee will be. Below we will consider the top 3 offers on the insurance market as of 2021.

| Organization | Amount of mandatory payment / maximum amount of compensation | Available risks | ||

| 100 thousand rubles. | 300 thousand rubles. | 500 thousand rubles. | ||

| "Alfa Insurance" | 750 rub. | — | 3000 rub. | Fire, damage to supporting structures, sweat, short circuit |

| "Reso-Garantiya" | 900 rub. | 2100 rub. | 3000 rub. | Fire, short circuit |

| "Ingosstrakh" | – | 2100 rub. | 3000 rub. | Fire, flood |

The cost of the policies given in the table is calculated for the required minimum risks in the contract. Accordingly, the extended version of the contract will cost a much larger sum. Sometimes the amount of compensation for damage becomes significant, so the assistance of the insurance company in monetary compensation will definitely not be superfluous. It is wise to think through all possible risks at the stage of concluding a contract.

Features of insurance in the Russian Federation

Under an insurance contract, it is not possible to insure risks or actions that violate the current legislation of Russia. Properly issued insurance does not immediately relieve you of liability for damage caused to third parties or their property. From a financial point of view, the victim will receive monetary compensation, but if the incident is clearly your fault, then there is a risk of criminal or administrative liability.

The contract stipulates the maximum insurance compensation. If the estimated cost of the damage you cause exceeds this figure, the client pays the difference out of his own pocket.

There are situations when a person is declared incompetent: injuries, disability, serious illness, paralysis, stroke, etc. In this case, of course, a trustee is appointed to the person, and all insurance obligations on the property are transferred to him. Regarding the topic of this article, i.e., civil liability insurance, the contract terminates from the moment the client is declared incompetent.

How does the policy pay out?

The insurance amount for any of the risks is determined by agreement of the parties - participants in the transaction. In this case, the potential amount of damage to other persons is taken into account. The contract may specify maximum amounts of compensation (for example, for each case and/or for each type of liability).

The insurance rate is determined for each client individually. To do this, the specifics of the policyholder’s activities, statistics of insured events, payment limits, etc. are taken into account. The amount of the insurance premium depends on the line of the contract, region and other factors.

Insurance compensation is paid only if the policyholder provides the insurance company with all the necessary documents confirming the circumstances of the insured event and the amount of damage incurred.

After the insurance company recognizes the event as an insured event, an insurance certificate is issued. It determines the amount of compensation. The insurer pays the policyholder compensation that is equal to the amount of damage received by a third party, but not more than the amount of compensation provided for in the contract.

Civil liability insurance to third parties is a reliable and effective method of protecting your interests or the interests of your business in the event of harm to citizens or their property.

You can register an insurance policy for different periods. Regular insurance is for a year. Periods up to 12 months are also acceptable. This condition is discussed with the insurance agent and depends on your goals.

The policy begins to be valid from 00:00 the next day after which the lump sum payment or the first installment installment was made. The end of insurance is 24:00 on the day indicated in the policy as the last day of the contract.

The insurance contract may indicate that the insurance company will pay compensation for events that occurred before the policy came into force if it is proven that the insured event occurred during the validity of the contract.

We invite you to familiarize yourself with: Sample agreement between the customer and the contractor

The same applies to events that occurred before the end of the policy, but became apparent after its completion. Such policies usually specify the period within which the company accepts applications for compensation.

A contract concluded with an insurance company may be terminated for the following reasons:

- Completion of his term;

- Early fulfillment of all obligations by the insurance company;

- The court declared the contract invalid;

- The policyholder has refused the services offered by the policy;

- The client did not pay the installment plan on time (if you neglected the obligation to make monthly payments according to the contract, then the insurance company will not pay compensation, since you did not pay for the service in fact).

If an insured event occurs, you need to contact your insurance company. This can be done by calling the hotline number indicated in the policy, or through the insurer’s website.

To receive compensation you will need:

- Draw up an application for compensation for damage (it can also be written by someone who has suffered from your actions);

- Present all documents confirming the insured event (for example, an inspection report by a specialist of a neighbor’s flooded apartment).

Within 7 working days, the insurer will inform you of a decision on whether to approve or deny payment. Based on the decision made, an act is drawn up, according to which the amount of compensation will be calculated.

Payments depend on the damage caused and are paid in the amount of:

- The cost of the object if it is completely destroyed (within the amount of coverage);

- The cost of repair (improvement and other) work based on the conclusion of an independent appraiser (in case of damage to property, harm to health or the environment);

- The cost of improving quality characteristics if the resulting damage does not require restoration work.