The Internet project “Domokod.ru” invites you to order a certificate. A document with current information about the cadastral value of the property of interest can be obtained online right now. To request data on the date of the last database update, you will only need to provide the property address.

Any transactions of a property nature are formalized with a certificate of the cadastral value of the property. This document may be required to clarify the real value of the property, the tax rate or the deposit amount. In some cases, an extract must be issued at the request of an authorized government agency.

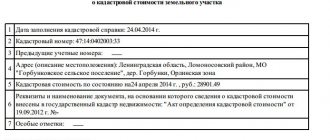

The certificate of cadastral value of the property indicates:

- physical adress;

- cadastral number;

- name and details of the institution issuing the extract;

- price established during appraisal activities.

What is a cadastral certificate of value?

Cadastral value is the price of a property determined by representatives of authorized government agencies as a result of an appropriate assessment. Evaluation procedures are carried out “massively”, strictly regulated methods and using standardized tools.

No one goes to a specific address and analyzes the quality of repairs, the technical condition of communications, the convenience of planning and other parameters of a specific facility. In this regard, it often happens that apartments adjacent to each other, similar in any characteristics important for sale, have an impressive difference in “state” value.

In the absence of the opportunity to give the state. valuation, the price of land, house or other type of object is determined taking into account market offers. The difference between market and cadastral value can be very significant.

Other important points:

- The state determines the price taking into account formal parameters: housing area, type of building, area, etc.;

- Individual features of a particular object, for example, the view from the windows, redevelopment, presence of European-quality renovation, are not taken into account;

- The price can be determined for both residential and non-residential areas and land areas;

- In 2021, the assessment is carried out by employees of budgetary institutions created in the regions specifically to solve this problem. Until 2021, valuation activities were carried out in accordance with the regulations of the Law “On Valuation Activities”. However, later it was replaced by the current law “On State Cadastral Valuation”;

You can order a certificate with financial data on our website at any time convenient for you.

Why do you need a certificate about the cost of the apartment?

Proper documentation of the true value of housing may be required in cases where a certain type of activity is carried out with real estate and property. What does this mean? During a global change in housing layout, when real estate is alienated or when an apartment is being prepared for sale.

Therefore, such a certificate is extremely necessary to perform such tasks. More precisely, without this supporting paper, execution is simply impossible. All this completely depends on the main activity carried out with housing. Therefore, a cadastral or inventory valuation of the apartment is calculated.

As for the cadastral, the following function is performed:

- When the purchase and sale of an apartment is carried out by government agencies or municipal authorities:

- Or when the exact amount of taxation on a land plot or on a citizen’s real estate is revealed.

Important! After completing such an assessment of real estate, an accurate indicator of the price category of the resident’s real estate is revealed. All initial information is entered into the cadastral passport of the apartment.

As for the inventory, we can say unequivocally that this type of apartment assessment is several times less than the previous assessment method. Why is this so?

In order to calculate an accurate inventory estimate, other factors are taken into account:

- size, or more precisely, the total area of the room;

- the location of the building in which the apartment in question is located;

- "age" of this apartment.

Therefore, the price varies and the exact amount depends on these criteria.

Nowadays, in all government agencies that are involved in the calculation of taxes and taxation, as well as accounting for citizens’ real estate, the basis is the inventory value.

Good to know! This indicator is the leading and main value for calculating tax payments for any real estate. In any case, no matter what type of calculation the citizen-owner chooses, the estimated value of his home will be reliable and performed properly, in accordance with the law of the Russian Federation.

Why is a cadastral certificate required?

Current information about the cadastral value of a property may be required in the following cases:

- Calculation of the amount of tax on a cottage, land plot, other real estate subject to taxation

Tax calculation is the most popular option for using statements. In previous years, in order to avoid paying “extra” tax fees, expensive apartments were often sold on paper for 1,000,000 rubles or less. Now it will no longer be possible to do this, because... the amount of taxes is calculated taking into account the amount of the state assessment.

We remind you that the corresponding amendments to the Tax Code of the Russian Federation were introduced in 2015. And by this year, all regions of Russia should have completed the transition to cadastral valuation from inventory value.

The amount of taxes is set by representatives of regional authorities. At their discretion, they can determine differentiated rates depending on the amount of the cadastral value of the property.

The standard top tax rate is 0.1%. However, for “luxury objects” they can be tripled by decision of local authorities. For example, in the capital of the Russian Federation, with the “state” price of a cottage up to 10,000,000 rubles, the tax rate will be 0.1%. If the cadastral value of the house is more than 50,000,000 rubles, the rate will be 0.3%.

- Participation in legal proceedings

The document has legal force and is taken into account by the court and any other government authorities.

- Payment for notary services when conducting real estate transactions

For any transactions with apartments, lands and cottages, provided that a notary is involved in them, it is necessary to pay the so-called notary fee. The fee is calculated taking into account the state service of object assessment.

- Payment of tax when receiving real estate as a gift

A gift of real estate without the need to further pay taxes on it can only be given to immediate relatives:

- Brothers and sisters (including if related only by mother or father);

- Grandsons and granddaughters;

- Grandparents;

- Children and parents;

- Spouses.

In all other cases, the “gift” is legally taxable income. If there is no market price in the gift agreement, current information on the cadastral value is required to calculate the amount of tax collection.

The tax rate will be 13% or 30% depending on whether the recipient is a tax resident of the Russian Federation (the presence/absence of Russian citizenship in this case does not matter).

- Property For Sale

Taxes are levied on almost any income Russians receive. The sale of housing and land also falls under the “profit” category. The legislation clearly states in which cases after the sale of real estate it is necessary to pay personal income tax and in which not.

And if you still need to pay, use the help of our website: you can order a certificate immediately. Current data will allow you to understand from what amount to calculate the amount of the fee:

- If the value of residential/non-residential space under the purchase and sale agreement is 70% higher than the state assessment amount, you will need to pay tax on it;

- If the amount under the contract is less than that determined by the state, then the tax will need to be calculated from 70% of the cadastral price.

For reference: the state property deduction (1,000,000 rubles) can be used for any resulting amount.

How and where to get a certificate of the cadastral value of an apartment?

Such a certificate is issued only if the apartment is already registered in the real estate cadastre. Otherwise, the first step is to register the property.

Below are the options for obtaining a certificate of the value of an apartment based on the results of a cadastral valuation:

- in the Unified State Register office;

- in the Cadastral Chamber;

- on the Rosreestr web resource (https://rosreestr.ru/wps/portal/cc_gkn_form_new).

To issue this certificate, the owner of the residential premises or his representative must prepare the necessary package of papers listed below:

- application of the established form (forms are issued by government agency employees);

- title documents for housing;

- passport;

- a receipt with the paid fee for the provision of services;

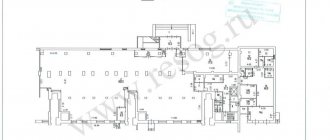

- registration certificate for the premises (required when applying to the Cadastral Chamber, must contain an explanation and floor plan, issued by the BTI).

Instead of a technical passport, it is possible to provide a floor plan and explication as separate documents; these papers are issued to the BTI within 10 days upon submission of the appropriate application, title documents, a form with a paid fee (the size differs depending on the region) and an identity card.

Regardless of the chosen method of application, to obtain a certificate of the cost of an apartment, a citizen must provide a complete package of documentation to a civil service employee and receive from him a receipt indicating the date when the document will be ready.

Processing takes about 10 working days. To pick up the certificate on the specified day, the citizen needs to present the employee with his identification card and a receipt (power of attorney, if necessary).

Other methods for determining cadastral value

Typically, information about the cadastral value of a property (apartment, land, etc.) is freely available. In addition to issuing a certificate containing this information, there are several other ways to determine this value:

- through the online help desk on the Unified State Register website (https://rosreestr.ru/wps/portal/p/cc_ib_portal_services/cc_ib_ais_fdgko) (you need to know the cadastral number or address);

- using a public cadastral map (https://maps.rosreestr.ru/PortalOnline/) (information should be contained in the information panel that appears when you click on a specific area on the map);

- by filling out a request on the Unified State Register website (https://rosreestr.ru/wps/portal/cc_gkn_form_new) for the issuance of a cadastral extract for a specific property or a cadastral passport.

Interesting material: Obtaining a technical passport for an apartment.

How often is the state cadastral valuation carried out?

The results of the state assessment are not established forever. Data is updated once every three to five years. Once every two years, a revision of financial information is permissible only in the case of St. Petersburg, Moscow, Sevastopol and a number of other cities of the Russian Federation that have federal significance.

An unscheduled assessment can only be performed in special situations. Let’s assume that a Russian entity was able to successfully challenge the price determined by the state for at least 30% of all real estate properties.

Is it possible to challenge the cadastral value?

You can answer the question correctly if you know how the assessment is carried out:

- Representatives of the executive body of the regional government will agree on the need for assessment.

- Members of a special budget institution collect and analyze data and formulate results.

- Preliminary assessment reports are posted on the official RosReestr portal. They will be freely available to everyone for the next two months after publication.

During these 60 days, comments are accepted from Internet users who identify errors in the reports (if there are any inaccuracies). Error statements are reviewed and, if accepted, the reports are amended (reporting information is updated once every five days).

After the 60-day period, the assessment results are officially approved. New and final financial data are valid from January 1 of the following year.

Exceptions: On January 1, 2019, amendments to the Tax Code of the Russian Federation came into force, according to which the conditions for property taxation were changed. Now, if the “state” price of the property has changed throughout the year, suppose, in connection with the combination of several apartments or complex redevelopment, the tax amount should be revised from the day on which the adjusted value of the property was established, and not from January 1 of the next year

Vector Prava +7(499) 502-55-87, +7-926-983-00-55

Offices in Moscow and the Moscow region: Directions

- Estimation of the cost of the apartment.

- Market and inventory value of the apartment.

- Conducting an assessment.

- Criteria for assessing the cost of an apartment.

APARTMENT VALUE ASSESSMENT

Buying and selling an apartment in Moscow has a number of features, the most important of which is the price of the apartment. The importance of price, as an essential term of the contract, is felt when assessing the value. Residents often cannot determine exactly how much their own property is worth. It is also important for sellers to have a good understanding of the Moscow housing market and its work in order to determine the selling price. Often people independently place an advertisement for the sale of an apartment through the media and friends. In practice, it is usually not enough to simply submit an ad. The best way is to contact a special real estate agency, where professional appraisers will issue you a document on the market value of the residential premises. On the issue of appraising an apartment, you can first consult with the law firm MGK “Vector Prava”.

The contract for the purchase and sale of an apartment, in accordance with the current Civil Code, is concluded in writing with mandatory state registration. At the stage of the purchase and sale of the transaction, it is necessary to obtain a certificate in form 11a about the cost of the apartment in one of the divisions of the Moscow City BTI. This document indicates the cost of the apartment only taking into account its area, and other indicators are not taken into account. The validity period of such a certificate is 1 month.

A certificate in form 11a (on the inventory value of home ownership) is issued after the presentation of identification documents, an application and the availability of title documents for the property.

MARKET AND INVENTORY VALUE OF THE APARTMENT

When assessing the value of an apartment, its market value

and inventory value.

The market value of an apartment involves taking into account the cost of the building and land in the given territory. The criteria for assessing property are established in the Federal Law “On Valuation Activities in the Russian Federation” and are specified in Decree of the Government of the Russian Federation No. 519 of July 6, 2001. In this case, the market price will be recognized as the most probable price at which property is alienated in a competitive market. The inventory value

of real estate includes only the cost of the construction of the object, without taking into account the cost of the land plot, and is calculated on the basis of the cost of construction of the real estate according to existing standards and coefficients.

CONDUCTING THE ASSESSMENT

Based on the results of the inspection by the appraiser of the value of the apartment, an “Appraisal Report” is issued. 3 methods are used to estimate the cost of an apartment

– comparative, profitable and costly. It is carried out on the basis of an assessment agreement concluded with the client. The appraiser must photograph the building and premises and obtain copies of documents. The specified documents are a certificate of ownership or a purchase and sale agreement (with a registration mark), a cadastral passport of the apartment or an explication and floor plan of the BTI, a death certificate (in the case of an assessment for registration of an inheritance).

CRITERIA FOR ASSESSING THE PRICE OF AN APARTMENT

1) The determining indicator of the value of real estate is LOCATION

. What is important is the distance from the center, the prestige of the area in which the apartment is located, and how convenient it is to get to it. If the apartments are economy class, then one of the decisive factors is proximity to the metro, but when selling an elite apartment, on the contrary, proximity to the metro is not significant - then the presence of a good road and parking lot is considered valuable. Apartments near which traffic jams often occur lose value.

2) Infrastructure. Lack of shops, shopping centers, schools, kindergartens, etc. nearby. significantly reduces the cost of the apartment.

3) General environmental situation in the area. It is known that the areas in the south and southeast of the capital are considered the most environmentally unfavorable in Moscow. Therefore, apartment prices in these areas are the lowest in the city. The most prestigious areas at the moment are Leninsky Prospekt and Sokol. Therefore, apartment prices in these areas are the highest on the market. Neighborhood to an industrial zone, railway, plant, factory, etc. reduces the cost of the apartment. Green areas of Moscow (parks, recreation areas, etc.) - increase the price when buying and selling an apartment.

4) The building material of the building and its category (it can be a panel, brick, monoblock house, or even a house made of wood). The floor, the size of the kitchen, the presence of an elevator and a telephone line are also taken into account.

5) General condition of the apartment. The wear and tear of plumbing, the condition of the windows, the evenness of the walls and the absence of cracks and cavities in them, whether the floor and ceiling are damaged - this is important when determining the price of an apartment for sale. Repairing an apartment when selling it is important only when selling luxury real estate, since in an ordinary apartment the owners will most likely carry out the repairs themselves.

6) Of course, one of the criteria will be the view from the windows of the apartment. Apartments with views of nature are more expensive than those with views of buildings, cars and roads.

Other criteria, such as the presence or absence of neighbors in the house, the convenience of the location of the premises in the apartment, whether a garbage disposal is installed in the building and others, are not taken into account by the appraiser, but become only an important wish for the apartment being sold or purchased.

See also:

State registration authorities for the sale and purchase agreement of an apartment in Moscow

Donation agreement

Installment payment under an apartment purchase and sale agreement in Moscow

Features of the purchase and sale agreement for an apartment in Moscow

Contacting the BTI when registering a contract for the sale and purchase of an apartment in Moscow

Apartment exchange

Responsibility of the parties under the apartment purchase and sale agreement

Buying and selling an apartment by proxy

Invalidity of the apartment purchase and sale agreement

Purchase and sale of a share in an apartment

Payment for services for state registration of an apartment purchase and sale agreement in Moscow

Documents for state registration of a purchase and sale agreement in Moscow

Specialists of the subscriber legal department in the Moscow office of the Interregional Group of Companies “Vector Rights” are ready to help you. Our phones:

+7(499) 502-55-87,, +7(925) 703-74-70