published: 08/02/2018

The LLC owns an office building. This LLC has 1 individual founder. face. This founder is a retiree. Due to the fact that the cadastral value has been increased 10 times, the founder wants to find a way to reduce the real estate tax, which is paid on the cadastral value. LLCs apply the normal tax system.

It is necessary to offer options for reducing taxes, if such options exist in principle. The client’s lawyer provided advice, from which it follows that an individual entrepreneur using the simplified tax system should not pay property tax. It is necessary to evaluate the validity of such conclusions.

What are the advantages for the founder when registering as an individual entrepreneur or registering real estate in his own name, as an individual? face?

Payers of property tax are organizations that have property recognized as an object of taxation (clause 1 of Article 373 of the Tax Code of the Russian Federation). Real estate of Russian and foreign organizations is subject to property tax on the basis of Art. 374 of the Tax Code of the Russian Federation, clause 5 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

You may be interested in: Preparation of a legal opinion on tax issues.

How to reduce real estate taxes?

There are actually two ways to reduce your property taxes when owning an office building

- Removing an object from the list;

- Challenging the cadastral value of an object.

Most likely, the first method will not work, since there are no grounds for excluding the object from the list (the object is commercial real estate and has all the necessary criteria for inclusion in such a list).

When implementing the first method, you can count on a positive decision if the type of permitted use of the land plot does not involve the placement of commercial real estate and in fact this building is not used for the specified purposes.

The second method can be successfully implemented only if the cadastral value significantly exceeds the market value of the property. At the moment, the market value of the building is determined in the amount of 1,056,120,150 rubles based on the results of the assessment dated January 1, 2016. Accordingly, the cadastral value of a part of the building is determined in proportion to the area that such part occupies in relation to the entire building.

The cadastral value must first be challenged in pre-trial proceedings, and if the result of the challenge is negative, in court. For pre-trial challenge, you must contact the commission for resolving disputes about the results of determining the cadastral value. Along with the application, title documents for real estate, a market valuation report, and an extract from the Unified State Register are submitted to the commission. The application review period is 30 days.

You may be interested in: Reducing the cadastral value of real estate.

Reducing property taxes is hidden in the law: what does every entrepreneur need to know?

First steps in reducing property taxes

Leaders of companies and enterprises always keep their finger on the pulse of taxation and care about its fairness. In particular, this applies to taxes on real estate and land: buildings, structures, structures, premises and land plots used by businesses in their activities. In this column we will look at the taxes paid by businesses on real estate: corporate property tax (Chapter 30 of the Tax Code of the Russian Federation) and land tax (Chapter 31 of the Tax Code of the Russian Federation).

To begin the process of reducing property taxes, an entrepreneur must understand the tax glossary - we will help with this.

- The main components of the tax calculation formula:

- objects of taxation;

- cadastral value of real estate;

- tax rates;

- tax benefits.

Speaking about the definition of the above concepts, we must understand their territorial legislative division. And if the rules for determining cadastral value are the same for all real estate throughout the country, then, for example, the property tax of organizations is regional, and land tax is a local tax. Hence the difference in rates and benefits. They can be established both at the federal level and at the regional and (or) municipal level.

Objects of taxation

You can write a dissertation about taxation objects. There are many exceptions from taxation objects for both property tax and land tax. To simplify the task, in this column we consider only those properties that are not exempt from taxes and have a cadastral value as a taxable base.

Cadastral value of real estate, and how it reduces taxes

To reduce taxes, you first need to pay attention to the cadastral value of real estate.

At the moment, most real estate objects are taxed based on their cadastral value. And reading between the lines of the Federal Law of July 3, 2021 No. 237-FZ “On State Cadastral Valuation” (hereinafter referred to as the Law on State Bonds), we can say that from 2024 we will completely move to taxation of real estate based on its cadastral value.

The legislation provides for ways to reduce the cadastral value. One of them is to set it at the market rate.

The procedure is simple: the owner of the property orders a similar report from the appraiser and then confirms it with the defense in court or a special commission.

However, you need to know some negative nuances with this method of reducing the cadastral value.

First. According to the requirements of the new legislation on state cadastral valuation, the replacement of cadastral value with market value will last only until the next state cadastral valuation, which will now be carried out every 2 years in federal cities or every 4 years in other constituent entities of the Russian Federation. The fact is that, according to Art. 12 of the Law on State Bonds, for state budgetary institutions conducting assessments, previous court decisions or decisions of commissions on establishing market value instead of cadastral value play only the role of a source of information about the objects being valued, but are not mandatory. The owner will spend time, money and nerves, but the effect will last only until the next assessment.

Second. According to Rosreestr statistics, in recent years, a tendency has developed towards stagnation in the satisfaction of demands for correction of cadastral value in commissions (see Fig. 1).

The judicial system so far often takes the side of the applicants and sets the market value instead of the cadastral value. It should be taken into account that the decisions of commissions and courts mentioned in the statistics relate to a greater extent to challenging the cadastral value of real estate, which was determined according to the previously effective legislation. According to the Law on State Bonds, not all subjects of the Russian Federation have yet carried out a cadastral assessment - statistics on contestation can only be analyzed in a couple of years.

Rice. 1. Number of decisions regarding applications considered for the period from January to October 2021

Third. The cadastral value established as a result of the state cadastral valuation is valid throughout the entire period: for cities of federal significance - two years, for other regions - at least four years. But at the same time, the start of the market value period is the beginning of the year in which the market valuation was carried out, and the owner can return taxes only for the current year. That is, the state cadastral valuation is not taken into account during the entire period of validity.

Fourth. It takes about a month to prepare a market value report. Also, you need to submit a package of documents to the commission to challenge the assessment or to the court, which takes from 3 to 6 months.

The review period will take another month, and there is no guarantee that the decision will be made quickly and will be made in favor of the owner of the property. So here too there is a danger of wasting time and nerves.

Fifth. The state budgetary institution that conducts the state cadastral valuation can independently replace the cadastral value with the market value based on the report provided by the owner, but this decision can be overturned by the court in favor of the authorities if it is proven that their interests are being infringed, including in the field of taxation.

There are a number of other nuances. Thus, according to the law, only the owner of the property can replace the cadastral value with the market value. This plays a role in the privatization of state or municipal real estate, since the purchase price is often determined based on the cadastral value. If potential buyers try to replace the cadastral value with the market value, the State Budgetary Institution will refuse to reduce it, since the buyer does not yet have ownership of the property.

You need to understand that if the owner tries to establish the market value instead of the cadastral value, and according to the report it is lower than the cadastral value, then most likely this market value was calculated “not entirely correctly” with obvious consideration for the interests of the owner of the property. At best, such a report on market value will not pass either the commission or the court. At worst, it can result in criminal prosecution. In addition, precedents have already emerged for bringing market appraisers to criminal liability for establishing market value instead of cadastral value. The Moscow authorities saw fraud in this action (Decision of the Moscow City Court dated September 11, 2021 in case No. 3a-2241/2018). Summarizing the above, we can confidently state the fact that with the introduction of new legislative norms, the previously existing method of replacing the cadastral value with the market value ceases to work.

What to do? The law has a mechanism for using a method to correct errors made during the state cadastral valuation. This method is more effective in establishing a fair cadastral value, and, as a consequence, fair taxation. We will tell you more about the error correction method next time.

Tax rate reduction

Maximum base rates established by the Tax Code of the Russian Federation: Art. 380 – on corporate property tax and Art. 394 – for land tax. At the same time, regional or local authorities can differentiate rates. And here, in practice, there is often a human factor - when the taxpayer organization does not pay attention or simply does not know about possible local reduced rates, and they take the officially established federal ones.

You must understand that the tax inspectorate itself will not come to “visit” the owners with news of the possibility of lowering the rate and stating the fact of overpayment of taxes. Specialists of the Federal Tax Service of Russia are focused on collecting taxes at the maximum federal rates and are not interested in notifying owners about the possibility of lowering rates.

Therefore, business and real estate owners need to be careful in this direction, independently monitor the applied rates and draw the attention of their employees to these rates. To help business - a convenient service of the Federal Tax Service of the Russian Federation “Reference information on rates and benefits for property taxes”.

How benefits work

Benefits for corporate property tax and land tax are also provided for in federal legislation (Article 381 and Article 395 of the Tax Code of the Russian Federation), as well as in regional and local regulations. We also recommend that you carefully monitor and apply them wisely.

For example, the Law of St. Petersburg dated July 14, 1995 No. 81-11 “On Tax Benefits” gives organizations the right to reduce the amount of property tax of organizations by the amount of tax calculated in relation to real estate used by these organizations for the needs of culture and arts, education, physical culture and sports, health care and social security, calculated in proportion to the share of the area of the facility used for these needs in the total area of such facility. This is quite a significant benefit both in terms of size and the list of objects to which it can be applied. Practice shows that many property owners in St. Petersburg do not even know about this benefit.

Nice bonuses

In this article, we talked about ways to reduce property taxes that are “hidden in the law.” At the same time, professionals have completely unique cases of tax reduction, which are not directly provided for by tax legislation, but have already managed to successfully prove themselves in practice. About them next time.

Managing partner of Mitsan Consulting Dmitry Zhelnin specially for GARANT.RU.

Simplified tax system and reduction of real estate tax:

From the provided consultation it follows that taxpayers using the simplified tax system are exempt from paying property tax for individuals. At the same time, footnote <1> states that there is an exception to this rule for objects that are included in a special list. This is exactly the list mentioned above.

On page 3 of the presented consultation, the provisions of the Tax Code of the Russian Federation related to the inclusion of real estate in a special list are quoted. The inclusion of an object in this list means that the tax for this object should be determined by the cadastral value.

Thus, from this consultation, the opposite follows - the tax on an office building must be paid, since this real estate is included in a special list. If the office building were not on the list, then using the simplified tax system would allow you not to pay tax.

Thus, there is no point in using the simplified tax system. At the moment, the corporate property tax rate is 1.5% of the cadastral value of the property (in 2021 it was 1.4%).

The tax rate for individuals is 2.0% for objects whose value exceeds 300 million rubles. However, if the property is included in the list, then the rate for individuals should be 1.4% of the cadastral value of the property.

You may be interested in: Investments in real estate in Moscow.

These norms contradict each other, since, on the one hand, if the value of a property exceeds 300,000 rubles, a rate of 2.0% should be applied to it, on the other hand, this property is included in a special list, which implies the application of rate 1, 4%. These contradictions can be eliminated by contacting the mayor of Moscow for appropriate clarification, since these norms are regional legislation (Moscow Law of November 19, 2014 N 51 “On the property tax of individuals”).

Most likely, a rate of 2.0% should be applied, since the rate of 1.4% is indicated in paragraph “4)”, and the rate of 2.0 is indicated in paragraph “4.1”. Following the logic of the legislator, paragraph 4.1 has special legal regulation and should be applied, including to those objects that are included in the list.

Everything is outsourced

One of the common ways to “get rid of” property for tax saving purposes is to “outsource” it. The meaning of the operation is to transfer property from the balance sheet of an organization to the balance sheet of another company or individual entrepreneur who applies a simplified taxation system.

To minimize the costs of transferring property, it is worth doing it through a contribution to the authorized capital. In this case, you will only need to restore VAT. By the way, this option will not only save on property tax, but also regularly reduce income tax by the amount of rental payments. Thus, the total profit will be transferred to the company with a more lenient tax regime.

And the most important thing. All transactions aimed at optimizing property taxes must have a clear economic goal, supported by documentation (correspondence, etc.). In the simplified scheme, the withdrawal of property will be explained by outsourcing of business processes. A will have to rent out real estate not only to the parent company, but also to other independent tenants (of course, after negotiations with independent firms, and not at the direction of the parent company).

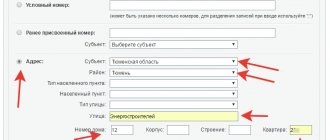

Use the tax calculator

There is a special calculator on the page of the official website of the tax service www.nalog.ru. To obtain a preliminary tax amount, you need to know the cadastral value of the property. It can be found on the Rosreestr website www.rosreestr.ru. If your property is not on the Rosreestr website, then it is not assessed, and the inventory value is used when calculating the tax. Also, in some cases, tax authorities use a special form taking into account how much you paid last year based on inventory value. Do not forget to double-check the tax calculation . But since the calculator calculates only the preliminary tax amount, it is safer to double-check the correctness of the calculation with the tax office by making an official request. After all, a lot depends on other circumstances (for example, whether you have other real estate, whether there were purchases or sales of an apartment during the billing period), so you can only do an accurate check together with a tax officer. There have been cases when, after applying, errors were discovered and people could pay less.

How are land taxes calculated?

The tax goes to local governments. They are an economic entity that is responsible for the territory of a certain region. That is why all payments are made to the local treasury.

Taxes must be paid in the following cases:

- If there is a plot of land in the property.

- There is a right of unlimited use.

- Lifetime inheritable ownership.

All persons who fall into this list must pay 0.3% every year. Citizens who rent land are exempt from paying. A receipt with accrued tax always arrives at your place of registration.

Who will face a double tax on land in 2021?

Where can you order a certificate of cadastral value?

For information, please contact your local cartography and cadastre office. At the request of the population, certificates are issued stating the cost of the plot and the cadastral value.

If you order a certificate from Rosreestr, it will take about three business days to receive it. Sometimes there are delays. The certificate can be ordered online, its cost is 250 rubles, delivery time is up to one day.

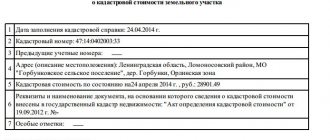

You can also find out the cost by the number of the land plot or get the required data from the cadastral passport - they are on line 12, and the unit cost is listed on line 13.

Tax rate

The rate is set by each subject of the federation and each administrative unit independently.

But tax legislation establishes average values for this taxation:

- 0.1% of the price of real estate in the form of residential premises, property under construction, garage structures, parking spaces, utility buildings with an area of no more than 50 square meters and other buildings on private plots that do not have a commercial purpose;

- 2% of the price for objects of administrative, business or commercial significance, as well as for any other real estate whose price is above 300 million rubles;

- 0.5% for any other real estate.

Municipalities have the right to decide for themselves who to exempt from the tax. The local administration has the right to completely cancel such obligations of citizens, reducing their rate to zero. At the same time, they are authorized to independently increase the rate, but not more than three times the average value established by federal legislation. The federal government also limited the rights of regional administrations to increase taxes to 20% per year.

For example, in Moscow the rate is completely tied to the price of the objects and is slightly different for different categories of real estate.

So:

- 0.1% is charged on objects whose price at the time of assessment was less than 10 million rubles;

- 0.15% is charged for properties that cost between 10 and 20 million;

- 0.2% is charged for objects with a cost of 20 to 50 million rubles;

- 0.3% for real estate that costs from 50 to 300 million rubles;

- 2% for commercial objects worth more than 300 million;

- 0.5% for other categories of real estate.

In case of owning residential premises, an automatic benefit applies.

For residential premises, when calculating the size, the following are not taken into account:

- 20 square meters from the apartment;

- 10 square meters from living rooms;

- 50 square meters from a residential building.

To some extent, tax breaks are given to every property owner.

However, if you do not pay the accrued obligations for the apartment or if part of the obligations is not paid, then the taxpayer will be fined. For this reason, taxes must be paid on time and in full.