credituy.ru

All about finance

- home

- Instructions

August 5, 2016

44410

Sberbank is one of the largest banks in Russia. A large number of branches provide work for several tens of thousands of people. In the current crisis, many decide to try themselves as a job seeker for a vacant position. To avoid being caught off guard, people want to know in advance how to fill out a Sberbank job application.

What is a mortgage application and why is it needed?

This is a form in which applicants indicate personal data and other information, according to the lender’s “questionnaire”. It must be completed by all applicants for a housing loan.

The application is drawn up to identify the client, check his credit history and solvency. In order for a person to confirm his capabilities, relevant documents are attached to the application.

The questionnaire can be downloaded from the company’s official website or obtained from a Sberbank branch.

The form or online form consists of several sections:

- Information about the borrower (personal data, contacts, place of residence).

- Information about the applicant’s employment, financial condition, existing property.

- Loan parameters.

Each block can be divided into subcategories. During the filling process, you must be careful to avoid errors and typos.

How to fill out the organizational and legal form of Sberbank. Helpful information

First of all, it should be noted that the organizational and legal form of an enterprise is, in essence, a method of conducting business activities. Thus, this phrase refers to the goals of creating the organization in question, as well as its legal structure. In addition, the organizational and legal form of the company in question speaks about the methods of ownership and use of the property and capital available to it.

According to the current rules, the organizational and legal form is a mandatory part of the full name of any domestic organization. Based on this rule, it is quite simple to find out the organizational and legal form of the organization you are interested in. To obtain the necessary information, you just need to read the full name of the company.

It will be useful for you to know that all companies present on the domestic market belong to one of the following categories:

- Commercial companies. The peculiarity of such organizations is that the main purpose of their creation is to make a profit from conducting commercial activities.

- Non-profit companies. The peculiarity of such organizations is that the main purpose of their creation is not related to making a profit. In most cases, the purpose of creating such organizations is to represent public interests.

It will be useful for you to know that, according to the current rules, when filling out various types of papers in the branches of the described banking structure, you will need to indicate the full name (which includes the general public fund) of the enterprise in which you are currently working.

All companies operating in the modern domestic market, depending on what type of activity they are engaged in, have a certain organizational and legal form. In fact, there are a huge number of different organizational and legal forms, but at the same time, there are only four of the most common OPFs on the domestic market, including:

- Companies with different levels of responsibility. This category includes such organizational and legal forms as closed joint-stock companies, open joint-stock companies, limited liability companies, etc.

- Non-profit foundations.

- IP.

- Enterprises.

As mentioned earlier, when filling out documents for a loan, you will be required to indicate the official name of the company for which you currently work. Thus, if you are an employee of the described banking structure, then when filling out the necessary documents you must indicate that you work for the public joint-stock company Sberbank of Russia.

Application submission methods

You can apply for a mortgage online or at a bank branch. Assistance in filling out the application and consulting are included in the list of free services of Sberbank.

Online through the DomClick service

You can submit your application online through the official DomClick portal. The client must log into his personal account in any way:

- log in through Sberbank Online;

- create an account by entering your phone number and password.

After registration, you can calculate the loan terms and proceed to the online form.

In the office

The applicant needs to visit the nearest Sberbank branch and contact a mortgage expert. A potential borrower can fill out a mortgage application on his own or a bank employee.

The paper version of the application takes up six A4 pages.

General information about working at Sberbank

To become an employee of Sberbank, you must declare your intention to a branch of the credit institution. Admission there is carried out in the format of interviews, before which the applicant needs to fill out an application form for a job at Sberbank.

The most frequently appearing vacancies are the following:

- operator;

- cashier;

- manager;

- collector

To successfully pass the interview, the applicant must bring with him:

- summary;

- a completed Sberbank job application form.

Much will depend on the candidate's education, experience and skills. As a rule, this organization hires talkative, sociable people who can easily find contact with other people, especially with bank clients.

If everything is more or less clear with the resume - it is filled out in any form independently, then a person may have difficulties and questions when filling out the questionnaire. This is largely due to the fact that the document is quite voluminous, and it contains information about almost all areas of human life.

How to fill out the online form

Stages of filling out an online application for a mortgage at Sberbank:

The applicant needs to calculate the monthly payment of the future loan. In the mortgage calculator, you should determine the loan program, amount and loan term. Particular attention should be paid to services that reduce the interest rate.

Having chosen the best option, you need to create a personal account by connecting through Sberbank Online or registering by phone number.

Go to fill out the form. When logging in using the first method, some fields will already be filled in automatically.

Enter the requested personal data.

Indicate your income and choose a convenient method to confirm your solvency. Be sure to disclose information about additional income (if any), this increases the chances of approval.

Be sure to fill out all fields in the employment section.

Take photos or scan documents and upload them to the website for verification. The data should not be covered with fingers or cover. The applicant must attach to the application a certificate in the form of a bank or 2-NDFL and a copy of the work record book.

If there is a co-borrower, fill out the block of the same name in accordance with reality, indicating his personal data, income and place of work.

Choose the nearest bank office where it is more convenient to sign mortgage documents.

Send an application for consideration to Sberbank.

The response to the questionnaire will be received within 1-5 days. In rare cases, the bank may delay the verification for objective reasons.

Application form for work at Sberbank: content and features of filling out

I would like to immediately note that you can fill out an application form for a job at Sberbank online. To do this you need it first. To avoid unnecessary misunderstandings or questions, you can fill out all the fields and send the document to the employer through the website’s online system or to the email address specified in the vacancy.

The questionnaire is filled out on a special form with the organization’s logo, and all the necessary information about it is also indicated there. The document must contain a photograph of the applicant; it is pasted on the first page of the application.

general information

First comes the standard information: full name, gender, age, citizenship, date and place of birth. The place of registration and residence of the applicant is also indicated (in detail, not just the city, but the exact address), all kinds of telephone numbers - home, mobile, work (if the applicant is still employed elsewhere). A separate column contains passport data that fits into the line.

At the end of the first page of the application form, the person indicates what position he is applying for and where he learned about the availability of such a vacancy (this could be a printed publication, an Internet portal, an official website). If one of the Sberbank employees recommended this job, then his full name is indicated.

Education, professional skills

The second page contains information about education. If a person has several seniors, then he must enter information about all of them. When taking any courses, seminars, PDAs, you also need to write about them in the application form. In this case, document numbers, course names, dates of completion, and sometimes academic hours are indicated.

Since Sberbank is one of the largest banks, this leads to frequent servicing of foreigners. That is why the questionnaire contains a separate question about language knowledge. As a rule, people are interested in the following languages and their level of proficiency:

- English;

- German;

- French;

- Spanish.

Sberbank is a modern institution, where working requires knowledge of computer and other specialized programs. The scope of required skills largely depends on what position the applicant is applying for. The main requirement for working in an office is the ability to work with Microsoft products (including Word, Excel, Access, mail), and the Internet.

Sberbank is also interested in the applicant’s attitude towards military service, availability of a driver’s license, and marital status.

A separate column contains information about immediate relatives. In principle, such information is standard for any questionnaire. The data is subsequently used to fill out a personal T-2 card.

It is very important to fill out information about your work experience as accurately and reliably as possible. It is better to copy the data from the work book . If necessary, you can take a copy from your current place of work.

It is necessary to tell in detail not only about previous places of work, but also describe in detail what skills were acquired during this activity. Here you can be guided by job responsibilities from your previous job. The reasons for dismissal/desire to change occupation are also indicated.

Separate columns show the amount of wages at the previous place of work and the amount that a person wants to receive from Sberbank.

To assess a person’s readiness for training, the questionnaire includes questions about whether he is ready for business trips, if so, for how long, and what skills he would like to acquire.

If the applicant has people (former employers) who can characterize him from a positive point of view, you need to indicate their full name and contact information so that Sberbank employees can contact him and clarify information about the employee.

other information

Sberbank is socially oriented, so it takes care of the proper leisure of its employees. The applicant is encouraged to have useful hobbies in the form of sports. Having a rank will only be a plus when applying for a job.

If desired, a person can indicate some additional information about himself in the column provided for this.

At the end, consent to the processing of the received data by Sberbank specialists, the date and signature of the author of the questionnaire are indicated.

To increase your chance of getting the coveted position, you must answer all questions as accurately and honestly as possible. This will characterize the applicant as a responsible and honest employee.

If you have any questions or difficulties, you can always contact a bank specialist. He will help you fill out the form and provide a sample. In general, the document is compiled according to the same type as in other organizations. On its basis, data is entered into the personal T-2 card.

How to fill out a form to submit in the office

The application is processed by a credit consultant or the client’s personal manager. Procedure for applying for a mortgage:

- Visit the nearest bank office and contact the mortgage lending department.

- Together with the employee, calculate the parameters of the housing loan, taking into account possible benefits and concessions.

- Together with your manager, fill out an application form for a mortgage at Sberbank.

- In the first section, indicate the purpose of the loan, the selected program, repayment period, requested amount, form of payment and down payment. When choosing between annuity and differentiated payments, you need to take into account your financial condition. The first option is the most popular because contributions do not change throughout the entire term. The second option involves priority payment of the loan body, so payments at first will be high.

- The second section is devoted to the personal data of the borrower, co-borrower and guarantor. Provide only reliable information, otherwise the lender reserves the right to refuse to issue a loan.

- The third section reflects the applicant’s solvency and level of income. The borrower should indicate all sources of income to increase their chances of approval.

- The fourth section is devoted to the debt obligations of the creditor. It is necessary to list all payments on existing loans.

- The last section is devoted to indicating the characteristics of the property being purchased.

Application form

You can download the mortgage application form on the official website of the credit institution. The form is filled out independently in an online form and printed.

You can get a sample application form for a mortgage from Sberbank at any branch.

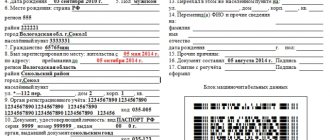

Example of filling out a form

A sample of a completed application form for a mortgage at Sberbank can be downloaded and studied on the website of the Security Council of the Russian Federation. It looks like this:

When designing, special attention should be paid to the last sections. It is necessary to indicate the bank account number and your card, this will increase the chances of approval, and with a constant flow of funds, the client will establish himself as a solvent borrower.

You can get an example of filling out a mortgage application form during a visit to a bank branch.

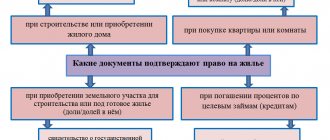

What documents must be attached when completing the application form?

List of documents for completing an application for mortgage lending:

- Passport of a citizen of the Russian Federation (copies of all pages).

- Photo. A digital photograph taken on a phone will be suitable for the questionnaire.

- Salary account details (if available).

- A certified copy of the work record.

- Certificate in the bank form or 2-NDFL for the last six months.

- Military ID (for persons under 27 years old).

- Driver's license.

- International passport.

- Tax return (for individual entrepreneurs).

- Certificate of state registration of individual entrepreneurs (if available).

- Certificates of marriage and birth of children.

How to fill out an application to increase your chances of approval

Recommendations for potential borrowers:

- Enter only reliable information into the mortgage application form. All information will be verified by the assessment department.

- Fill out all fields of the application. Half-empty forms are rejected at the scoring stage.

- Be sure to double-check the information entered. If mistakes are made, the likelihood of receiving a negative decision increases.

- When specifying the loan amount, it should be slightly overestimated. Sberbank, like any credit institutions, can limit the borrower’s limit.

- When choosing a co-borrower, it is necessary to take into account not only the level of his income, but also his expenses. The number of dependents must also be taken into account. The ideal co-borrower is the spouse.

- It is important to indicate all sources of income, even unofficial ones.

- If you do not have a landline telephone, it is forbidden to come up with “left” numbers; this may cause refusal.

Special cases

Questions often arise when specifying the OPF of some government agencies. For example, when for Sberbank you need to indicate the organizational and legal form of the Ministry of Internal Affairs of Russia. According to the classifier, this Ministry belongs to the “Federal State Treasury Institutions”. When you need to indicate the form of an economic entity, this is what they write - the Ministry of Internal Affairs of Russia. If you need more specific information about the police department, it is better to get clarification from the personnel department.

The “Federal Treasury Institutions” also include the Ministry of Emergency Situations and the Armed Forces. For example, for the Ministry of Emergency Situations, the form will be indicated as follows: FKU Data Center FPS State Fire Service EMERCOM of Russia.

!['Sberbank's requirements for an apartment with a mortgage in [year]: reasons for the "tough](https://2440453.ru/wp-content/uploads/trebovaniya-sberbanka-k-kvartire-po-ipoteke-v-year-godu-prichiny-330x140.jpg)