Co-borrower is an individual attracted by the borrower to increase the total income on the mortgage loan and increase loyalty to Sberbank. According to the law, he fulfills the same obligations as the main payer. If a difficult financial situation arises, responsibility for payments passes in full to the co-borrower, unless otherwise specified in the additional agreement.

You can attract additional participants to the transaction for all lending options, except for the “Military Mortgage” and “Mortgage with State Support” programs.

The information presented is required reading for all potential borrowers and co-borrowers.

Is there a difference between a co-borrower and a guarantor?

| Mortgage debt, rub. | Monthly savings, rub. | Refinancing costs | ||

| — 1% | — 2% | — 3% | ||

| 1 million | 500 | 1000 | 1500 | 15500 |

| 1.5 million | 800 | 1600 | 2400 | 21000 |

| 2 million | 1050 | 1600 | 3100 | 26500 |

| 3 million | 1600 | 3200 | 4600 | 37500 |

| 4 million | 2150 | 4250 | 6300 | 48500 |

| 5 million | 2825 | 5560 | 8250 | 59500 |

| 6 million | 3500 | 6870 | 10200 | 70500 |

Often the guarantor is confused with the title co-borrower, who becomes an individual who registers the living space as common property and accompanies all stages of lending. In most cases, this will be the borrower's spouse.

Responsibilities of a co-borrower under a mortgage

Both parties to the transaction have equal responsibilities under the mortgage agreement. The co-borrower cannot refuse to repay the borrower's debt. Their main responsibility is to timely transfer funds through mobile online banking to a loan account or self-service terminal.

Responsibility for payments is specified in the loan agreement. If the borrower is unable to pay his financial obligations, the co-borrower is obliged to help him.

Rights of a co-borrower under a mortgage at Sberbank

If the loan agreement states that the co-borrower is entitled to a share of the apartment, then it is determined jointly with all parties to the transaction. If this right is not specified, then the participant in the procedure must go to court, providing receipts for the payment of mortgage payments.

Is it dangerous to become a co-borrower on a mortgage?

If the borrower finds himself in a difficult financial situation and can no longer make mortgage payments, all responsibility passes to the co-borrower. Therefore, before signing the contract, the latter needs to assess his own financial situation.

If the co-borrower is unable to fulfill payment obligations, then he will need to transfer his share of the real estate to Sberbank. The money received from the sale will be used to pay off the loan debt. If this is not enough, the bank may also require the client to sell personal property, close deposits or withdraw funds from securities.

Criminal schemes in which the co-borrower acts as a victim are also possible. The fraudster offers a fairly large sum for signing a mortgage agreement, and after receiving the loan, disappears in an unknown direction. In this case, payment obligations are transferred to the co-borrower.

Undoubtedly, acting in this role is a huge risk, which can result in not just a fine, but also arrest. By agreeing to help his relative, a citizen may lose not only his share in the mortgaged apartment, but also lose his personal property.

Before signing the agreement, it is important to study the clause with the rights and obligations of co-borrowers under the Sberbank mortgage, especially paying attention to the distribution of shares.

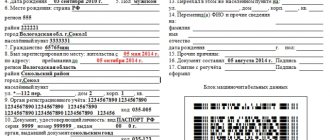

Co-borrower questionnaire

The co-borrower must fill out a loan application form in the same way as the borrower . In addition to personal information, the relationship with the borrower, information about employment, qualifications, income, family composition, ownership of property, etc. is indicated.

When preparing documents at a company representative office, the co-borrower can fill it out independently or through a bank employee; he only needs to check the information and endorse the document with his own hand.

Where can I download?

You can download it from the link: https://www.sberbank.ru/common/img/uploaded/files/pdf/person/SB_ank_obrazec_home.pdf Pros and cons of being a co-borrower on a mortgage with a bank

The main advantage of being a co-borrower is providing the opportunity for a loved one to obtain the required loan amount. Usually, co-borrowers do not act for the sake of a share in the apartment, however, this right is also an advantage of the transaction, since a long period of lending can change a lot in the relationship.

The disadvantages of participating in the transaction are the following points:

- The co-borrower is jointly and severally liable with the borrower for timely repayment of the loan, should circumstances arise. If the borrower fails to make payments, the lender will have every right to file a collection claim against the co-borrower;

- The likelihood that he will be able to get a mortgage (or other large loan) on himself is reduced , since the amount of monthly payments will be part of the client’s mandatory expenses and his income may not be enough to receive a large amount;

- If there is no agreement on the distribution of shares, you will have to prove your right to property through the court.

You can act as a co-borrower only with trusted, very close people, if possible securing your rights in a written agreement.

In what cases is a co-borrower needed for a mortgage?

The more participants in the mortgage agreement, the higher the confidence of the lender. The bank believes that the presence of co-borrowers is a guarantee of timely repayment of funds.

They are attracted to increase monthly income. The maximum loan amount is calculated based on the financial capabilities of the borrower. By attracting a co-borrower, the bank's confidence increases and the mortgage grows.

For example, Nikolai’s salary is 40 thousand rubles, his income is not enough to approve the requested amount. He attracts his wife with a salary of 27 thousand rubles as a co-borrower. The total family income is 67 thousand. So Nikolai’s wife helped him get an additional 200,000 rubles on credit.

Important! Before applying for a mortgage, you must calculate your preliminary monthly payment. On the DomClick website, the required salary level is indicated for each calculation. Based on the data provided, you can determine in advance whether the applicant needs a co-borrower.

Why are co-borrowers needed?

According to the requirements of the credit institution, up to 3 people can act as a co-borrower under a mortgage agreement.

Their involvement guarantees receipt of the maximum possible loan amount, since the incomes of all co-borrowers are summed up and, accordingly, the applicant’s solvency increases.

For the bank, the presence of co-borrowers reduces the risk of the transaction; if the main borrower is unable to make payments, the lender can turn to the co-borrower to demand repayment of the debt. Therefore, the conditions for issuing a loan will be more favorable.

Under what Sberbank mortgage programs can you add a co-borrower?

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

A co-borrower can be involved in all mortgage loans, except for “Military Mortgage” and “Mortgage with State Support”. This opportunity is also provided under the “Young Family” program, but on the condition that a title co-borrower with whom the borrower is married is involved.

It will be easier to buy an apartment in a new building or on the secondary market if the mortgage is taken out jointly with loved ones and relatives.

How to become a co-borrower on a mortgage at Sberbank

To act as a co-borrower, you must fill out the appropriate section of the application form when applying for a loan. Before submitting an application, it is important to check that the person involved meets all Sberbank requirements.

Requirements

In practice, the applicant’s relatives, in particular spouses, parents, children, brothers and sisters, become co-borrowers. Sberbank allows you to attract up to three people. While in an official marriage, the wife or husband becomes the title co-borrower, unless otherwise specified in the marriage contract.

Basic requirements for a co-borrower on a mortgage at Sberbank:

- Availability of citizenship and registration in the Russian Federation.

- The age of the co-borrower on a mortgage with Sberbank is from 21 years to 75 years at the time of the last payment.

- Work experience – more than six months at the current place of work. Total work experience – 12 months over the last 5 years.

- Mandatory proof of income and employment. The lender requires a certificate in the form of a bank or 2-NDFL. You must also provide a certified copy of your work record.

A mandatory requirement of the bank is confirmation of the legal capacity of the person involved. Recently, cases of fraud have become more frequent: citizens without a fixed place of residence who are addicted to alcohol or drugs act as co-borrowers.

If at least one of the conditions , the co-borrower's candidacy will be rejected.

Package of documents

At the stage of completing a mortgage application, it is necessary to present documentation not only of the borrower, but also of the co-borrower. If you apply online, attach high-quality scans to the appropriate section of the web form.

List of documents for a mortgage co-borrower:

- Passport with registration mark.

- Second document (TIN, VU, SNILS).

- Certificate of marriage and birth of children.

- Certificate in the bank form or 2-NDFL for the last six months.

- A copy of the work record provided and certified by the employer.

Requirements for a co-borrower: list of documents, ways to confirm income

The list of documents and requirements for this person will differ in different institutions. As an example, let’s look at the conditions that apply at Sberbank.

At the time of loan application, the age of the mortgage co-borrower is at least 21 years. At the date of final repayment of the debt, the age does not exceed 75 years. If a housing loan is issued without confirmation of official employment or income, then the maximum age of the co-borrower at the time of making the last payment will be 65 years.

The co-borrower must work at the current place of work for at least 6 months. Over the past 5 years, his total work experience is at least 1 year.

The borrower can attract no more than 5 individuals as co-borrowers. The size of the loan issued is determined by the total amount of confirmed income of the main payer and all co-borrowers. The spouse of the main borrower must become a co-borrower, regardless of her or his employment, creditworthiness and age at the time of receiving the loan.

The spouse of the main payer automatically becomes the second owner of the purchased apartment if two conditions are met:

- husband and wife run a joint household;

- a marriage contract has not been drawn up between the spouses, which spells out the property rights of each of them.

Document requirements

To become a co-borrower, you must have Russian citizenship, fill out and submit an application for a housing loan. This is a special form that must be filled out by all participants in the transaction - the main payer, each of the co-borrowers, the mortgagor and the guarantor (if any). The application contains the following information:

- the role of the citizen in the upcoming transaction;

- client’s personal data (full name, date of birth);

- information about monthly income and expenses;

- contact information for communicating with the applicant;

- information about the employer, position held, length of service;

- permanent registration address and place of actual residence;

- data on the number of family members and minor children who are dependent on the citizen;

- information about real estate and vehicles owned by the client.

The package of documents for a mortgage co-borrower must include a passport with a registration stamp. You must also provide a second document used to confirm your identity. The applicant independently decides which additional document to present to bank employees. You can bring a driver's license, foreign passport, military ID, pension insurance certificate or other document.

Who will be refused?

The bank will not approve a mortgage loan if at least one participant in the transaction, including the co-borrower, is:

- member of a farm;

- individual entrepreneur;

- manager or chief accountant of a small enterprise employing less than 30 people;

- the owner of the enterprise in the case when his share of ownership, as a participant, exceeds 5%.

It is important for the co-borrower to provide papers that confirm his stable financial situation and employment. Bank employees will verify the client’s official employment if he provides a certified copy of the work book or an extract from it indicating information about previous places of work. To ensure the client’s stable financial situation, specialists need to familiarize themselves with a certificate of the citizen’s income received over the past six months.

The more co-borrowers agree to participate in a housing transaction, the greater the amount the financial institution will approve for the main borrower. Each of the co-borrowers will provide financial insurance. All loan repayment obligations will be distributed evenly among all parties to the transaction. There is a limit on the maximum number of co-borrowers. Typically, a financial institution allows you to connect no more than 5 participants with this status.

Important! Unlike mortgage guarantors, co-borrowers may have property rights to the property being purchased, that is, receive a certain benefit from the transaction.

If an object is acquired in common ownership with the title borrower, then the co-borrowers, along with the main borrower, are endowed with the same property rights. Being a guarantor is unprofitable and risky; this decision is not always justified . He bears financial responsibility for failure to comply with the conditions in the contract and cannot claim the apartment.

Recommended article: How not to lose your home with a mortgage in a civil marriage

FAQ

Our legal agency often receives requests from readers who want advice on mortgages. Now we will answer 2 popular questions:

First question. Can a pensioner be a co-borrower on a mortgage?

Answer: Yes, some banks allow this option. But solvent pensioners who are officially employed and not just receiving pension payments from the state can play this role. There is also an age limit - it should not exceed 65 years for most banks. Sberbank allows a pensioner under 75 years of age to be a co-borrower, subject to confirmation of official employment and salary.

Second question. If the co-borrowers on the mortgage are parents who are not the owners of the property purchased on credit, can the bank require them to repay the housing loan?

Answer: Yes, the financial institution imposes equal obligations to repay the home loan on each participant. Representatives of the institution will definitely require parents to make monthly payments if the title payer does not fulfill loan obligations.

Important! If financial problems arise with the main borrower, not only the parents, but also the other co-borrowers listed in the bank agreement will be forced to pay the mortgage.

The procedure for drawing up a questionnaire for the bank

A separate application is not submitted for the co-borrower. All data is entered into the borrower’s application form on the official DomClick website or at a bank branch, together with an employee.

In the online version of the application, the paragraph with information about the co-borrower is final. After filling out all the fields and attaching the required documents, the applicant can submit the application for review.

After registering the application, the document will be reflected in your Sberbank Online account. Each applicant will be able to track the status of their application here.

Points of the application form

To obtain a housing loan from Sberbank, fill out an application on 6 pages. The borrower needs to fill in the following information:

- The client indicates who acts in this procedure: borrower, co-borrower, guarantor, mortgagor.

- Enter your last name, first name, patronymic and date of birth.

- Contact information fields are filled in, including email.

- Information about registration and actual place of residence is provided.

- The index must be entered.

- The bank requests information about close relatives.

- A large section is devoted to detailed information about the place of work.

- An important point is also questions about income and expenses.

- The borrower is obliged to register all movable and immovable property registered in his name.

- A large block is devoted to the mortgage product: loan size, type of housing, some of its characteristics.

- Other information, including about previously refinanced loans.

All listed sections have several subcategories. It is extremely important to be careful and correctly fill out all the information about yourself.

When filling out a document at home, you must use blue ink pen. A sample application form will be a great help when filling out the application. You can also download it from the official website of the banking institution or request it at one of its branches.

Is one of the spouses an automatic co-borrower?

The spouse who is officially married to the applicant automatically becomes the title co-borrower. The requirement is valid only in the absence of a marriage contract.

When filling out an application, the spouse’s details are automatically entered in the “Co-borrower” column.

If a marriage contract has been drawn up

If the marriage contract states that the spouses do not claim each other’s property, then the status of co-borrower is not automatically awarded. The conditions specified in the document are officially certified by a notary, therefore they are not subject to appeal in court.

What to consider when making a decision

Before becoming a co-borrower on a mortgage, you need to ask the question: “Am I ready to repay the loan in full for a friend/brother/godfather/matchmaker?” By signing the agreement, the borrower agrees to be responsible for someone else's debt. Therefore, it is important to study each clause of the contract, discuss with the borrower the details of payment and the circumstances under which responsibility passes to the co-borrower. The agreement can be made in writing and notarized.

Taking out insurance as a way to reduce risks

For their own protection, the co-borrower and the borrower must take out a life insurance policy. It is concluded in case of death, illness and loss of ability to work.

For the main borrower, this is an opportunity not to spoil their own credit history and trusting relationships with the involved parties to the transaction. Similar to an insurance company.

Registration procedure:

- Inform the bank employee of your desire to issue an insurance contract.

- Study the documentation provided and decide on the tariff plan.

- Pay the insurance premium.

Insurance cases and tariffs:

- Death, deterioration of health and involuntary loss of work - 3.6% per year.

- Death and health problems - 2.4% per year, when choosing additional parameters - 2.6% per year.

Who can be a co-borrower at Sberbank?

The co-borrower in the transaction must be the spouse of the main borrower, regardless of solvency. They both bear joint responsibility for quality debt servicing. There are no age restrictions applicable to other parties to the transaction.

An exception is if the spouse of the title borrower does not have Russian citizenship or when a marriage contract is submitted to the bank, which determines the existence of separate ownership of real estate acquired during marriage.

Additional co-borrowers on a mortgage are individuals whose income is taken into account when calculating the borrower’s solvency. Usually they are close relatives of the main borrowers, but it is also possible to involve third parties who want to help the borrower obtain a larger loan amount.

How to get a co-borrower out of a mortgage at Sberbank

To remove a co-borrower from the list of participants in the agreement, the main payer must submit an application to change the terms of the loan according to the bank's model, indicating an objective, compelling reason for such a decision. With his departure, the trust of the credit institution also decreases, so it is necessary to attract a new one to increase the creditor’s loyalty.

The following must be attached to the form:

- Original and copies of the passport of the borrower, co-borrower and the person involved.

- Certificates of marriage, divorce, birth of children or death of all parties to the transaction.

- Marriage agreement for all participants (if any).

- Income certificates (for the borrower and the introduced co-borrower).

Up to 10 working days are allotted for consideration of the application. If the answer is positive, you must visit the bank branch for re-registration.

Sample application for exit

To change the composition of participants in a mortgage loan, you must fill out an application for their withdrawal.

Removal from debtors upon divorce of spouses

Upon divorce, it is possible to remove the former spouse from the list of debtors only if the following conditions are met:

- the form of ownership of a mortgaged apartment is determined by the court, a notarial agreement, or a marriage contract;

- after the withdrawal of the co-borrower, the total income of all participants in the transaction meets the bank’s requirements.

If the lender decides that the procedure will negatively affect the repayment of the home loan, it may require the introduction of a new co-borrower.

List of documents

Required documents to apply for a mortgage:

- A document confirming the identity of the borrower - a passport with a mark on Russian citizenship.

- Photograph.

- Details of the account to which the salary is received.

- Copies of all necessary pages of the work book with the obligatory signature of the manager and seal.

- Certificate of income in form 2-NDFL for the last 6 months.

- Driver's license (if available).

- Military ID (applies only to those under 27 years of age).

- Foreign passport (if available).

- Marriage certificate, birth certificate of children.

- Tax return and state registration document (if you have your own individual entrepreneur).

conclusions

Co-borrower is an individual engaged to increase Sberbank’s loyalty when applying for a mortgage loan. Up to three participants can be included in the loan agreement, provided that they meet all the requirements of the banking institution.

The co-borrower’s salary is added to the borrower’s income, thereby increasing the credit limit for the purchase of an apartment. Attracting additional participants is an optional condition of the bank.

Sberbank also allows its clients to change and remove participants from the loan agreement. To do this, you must fill out an application at a bank branch, indicating the objective reasons for this decision.